January 2025

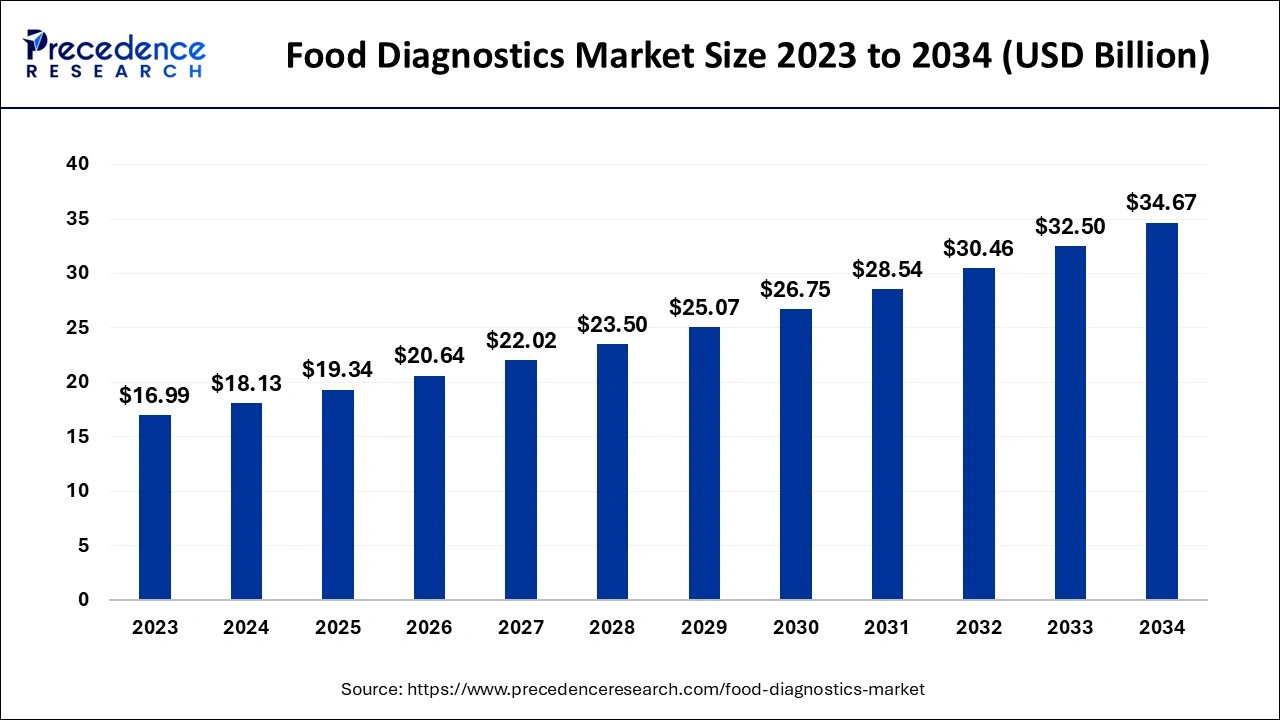

The global food diagnostics market size accounted for USD 18.13 billion in 2024, grew to USD 19.34 billion in 2025 and is predicted to surpass around USD 34.67 billion by 2034, representing a healthy CAGR of 6.70% between 2024 and 2034.

The global food diagnostics market size is accounted for USD 18.13 billion in 2024 and is anticipated to reach around USD 34.67 billion by 2034, growing at a CAGR of 6.70% from 2024 to 2034.

To ensure that the food is safe to eat, food testing and analysis are crucial components of the food safety ecosystem. This entails developing a network of laboratories for food testing, guaranteeing the standard of food testing, investing in human resources, conducting surveillance operations, and educating consumers. A food laboratory is crucial for determining whether the foods are healthy or not. Scientific research called food diagnostics uses modern techniques to find bacteria, viruses, parasites, chemicals, biotoxins, and heavy metals, at every stage of the food supply chain, from raw ingredients to finished goods. Food diagnostic testing is done to help prevent some foodborne diseases. Food diagnostics can identify microbial and other contaminations in fruits and vegetables. Food diagnostics contribute to lower healthcare expenditures and consumer health protection.

Through food diagnostics, microbial and other toxins in fruits and vegetables can be found. The demand for safety testing is anticipated to rise as a result of the increasing frequency of food recalls and the requirement to uphold customer confidence in the availability and safety of food.

Due to changing lifestyles and time restrictions, there is a growing market for food and beverages, particularly processed food. The requirements of essential food legislation and cleanliness, which dominate the processed food sector is increasing. Demand for processed food is rising as a result of urbanization and modernization. Additionally, it will boost demand in Europe and North America areas for nutrient-dense processed food.

Productivity is influenced by food quality and sanitation. Testing laboratories can aid to find these adulterants because purposeful and inadvertent adulteration have both become high-tech in recent years. Testing for adulterants, pathogens, pesticide residues, chemical pollutants such heavy metals, microbiological contaminants, non-permitted additives, colors, and antibiotics in food is the primary duty of food diagnostics laboratories. Food manufacturers and producers cannot assure that pesticides, antibiotics, heavy metals, and naturally occurring poisons, among others, are not present in their products without doing food testing. Consequently, it is crucial to assure food safety.

The need for food testing is growing, thus manufacturers are concentrating more on it. They are also taking part in the market's new product launches, promotions, awards, certifications, and events. In the end, these choices are helping the market expand. The strict safety rules for food are anticipated to fuel market growth because the regulator must verify that the food products on the market are fit for consumption. These factors are growing the demand for food diagnostics.

| Report Coverage | Details |

| Market Size in 2024 | USD 18.13 Billion |

| Market Size by 2034 | USD 34.67 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Diagnostics System, Site, Application, Test Type, Contaminants Type, Technology Used, Geography |

Depending upon the type, the systems segment is the dominant player and is anticipated to have the biggest impact on food diagnostics market. It provides accurate test results and is simple to use. With the rising need for simple-to-use solutions, the market for food diagnostic systems is anticipated to expand further. The most preferred diagnostics tools for identifying and measuring foodborne pathogens are hybridization-based techniques. These techniques are also utilized to find the food pathogen mutations that cause persistent illnesses. The food diagnostics industry is anticipated to be a major driver in the growth of this market as a result of the advantages of hybridization-based systems in the recognition of food pollutants.

Food diagnostics are tools that test food samples' nutritional composition and look for contaminants to assist maintain the safety and quality of the food. Additionally, they contain consumables like reagents, cleaners, and test accessories that are necessary to conduct food safety and quality tests and produce precise and detailed findings.

A small number of people have severe antibiotic allergies. Even the modest amounts carry a risk of death. Others are sensitive to low drug concentrations that can result in uncomfortable, moderate responses. Testing kits are used in food diagnostics market to ensure the safety of food before intake. Product quality control and ensuring maximum safety of food is taken to healthy life.

During the projected period, the outsourcing facility segment is anticipated to be the largest in the food diagnostics market. The demand for fully integrated, autonomous, and specialized equipment for gathering and analyzing food samples will fuel the growth of outsourced food testing services. Increased international outbreaks of foodborne illnesses are expected to continue to be the main factor influencing the market for food diagnostics hence, the outsourcing segment is expected to grow.

The food sector is changing as a result of greater globalization, regulation, and customer demand, and internal food laboratories must adapt or risk falling behind. This transformation affects not just how food laboratories operate and the services they provide, but also how food firms choose whether to conduct testing in-house or with outside laboratories. The amount of testing has increased, most significantly in pathogen and allergen testing, as a result of an increase in imported and exported foods as well as new consumer trends. Rapid testing has expanded in-house testing, yet validation and accreditation requirements are driving more firms to outsource their production. Food firms must determine whether to outsource the testing because it is simpler and more affordable than investing inhouse technology and procedures to improve quality while retaining efficiencies.

During the forecast period, the segment that includes meat, poultry, and seafood is expected to hold the largest market share. In all of its forms, meat speciation testing is a standard procedure used to protect consumer interests and health, particularly from frauds like adulterations. Soymeal is frequently fed to animals along with genetically engineered soybeans. During the processing, some processed meat and meat products, including ham and sausages, are genetically altered. Numerous additives frequently found in hams and sausages are frequently made utilizing techniques employing GM microbes. The detection of species-specific proteins or DNA analysis is the food diagnostics technology that is frequently used to identify meat.

The convenience of cooking with chilled processed food and the ability to cook food quickly are two significant factors supporting the expansion of the worldwide chilled processed food market. Additionally, rising disposable incomes among consumers and an ever-growing population have raised demand for chilled processed food, which has greatly accelerated the market's expansion. In order to keep the appropriate level of food quality and standards, it offers consumer satisfaction. This is another outstanding element that is anticipated to provide new market chances for the market for processed foods globally.

The highest market share and dominant position in the food diagnostics industry belongs to Europe due to high demand for food testing. This region majorly includes UK, Germany, Spain, and others. The Europe food diagnostics market is anticipated to expand as a result of the strict food safety rules, which are necessary for the regulator to verify that the food products on the market are safe to eat. Food related diseases are getting increase due to alteration and hence, government and several agencies are concerned about the food diagnostics more in this region.

North America is considered as second largest region in the food diagnostics market during the forecast period. This region includes U.S., Canada, and Mexico. Due to changing lifestyles and time restrictions, there is a growing demand for food and beverages, particularly processed foods. The hectic lifestyle and dependence on processed foods are rising that causes a drive in the sales of such products in the market. The child and teenagers are mostly affected by the food related diseases hence, the need of food testing is driving in this region owning to more production and consumption.

Asia-Pacific is expected to grow at a steady rate as the food safety is not taken strictly in most of the countries. The illness related to food consumptions is a global issue and government and food regulatory agency are not taking proper steps to make food free from any type of viruses or threats.

By Type

By Diagnostics System

By Site

By Application

By Test Type

By Contaminants Type

By Technology Used

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025