January 2025

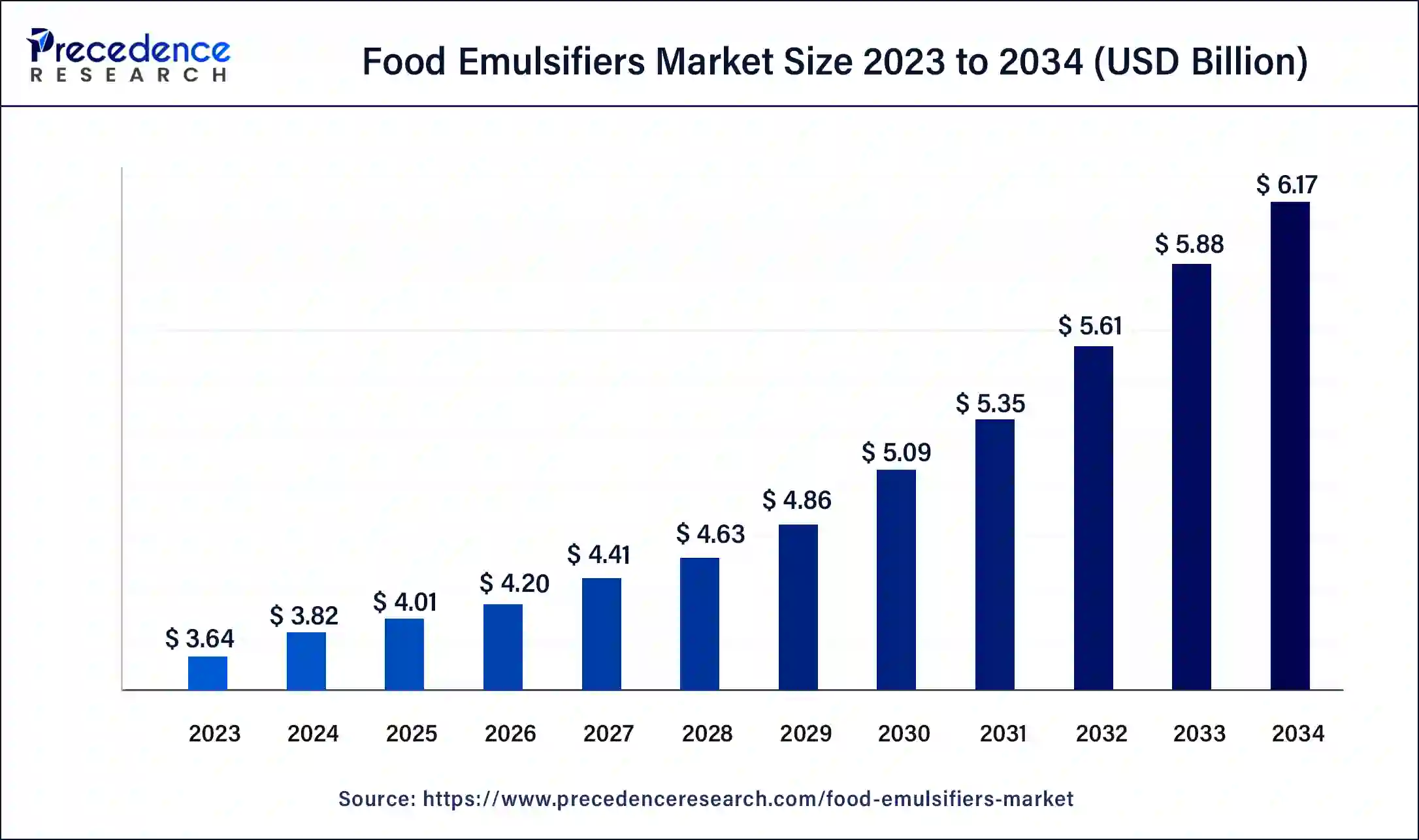

The global food emulsifiers market size was USD 3.64 billion in 2023, calculated at USD 3.82 billion in 2024 and is expected to be worth around USD 6.17 billion by 2034. The market is slated to expand at 4.92% CAGR from 2024 to 2034.

The global food emulsifiers market size is expected to be worth around USD 6.17 billion by 2034 from USD 3.82 billion in 2024, at a CAGR of 4.92% from 2024 to 2034. Food emulsifiers improve texture and flavor, prevent separation in mayonnaise-like products, preserve processed food items, and improve flavor and aroma.

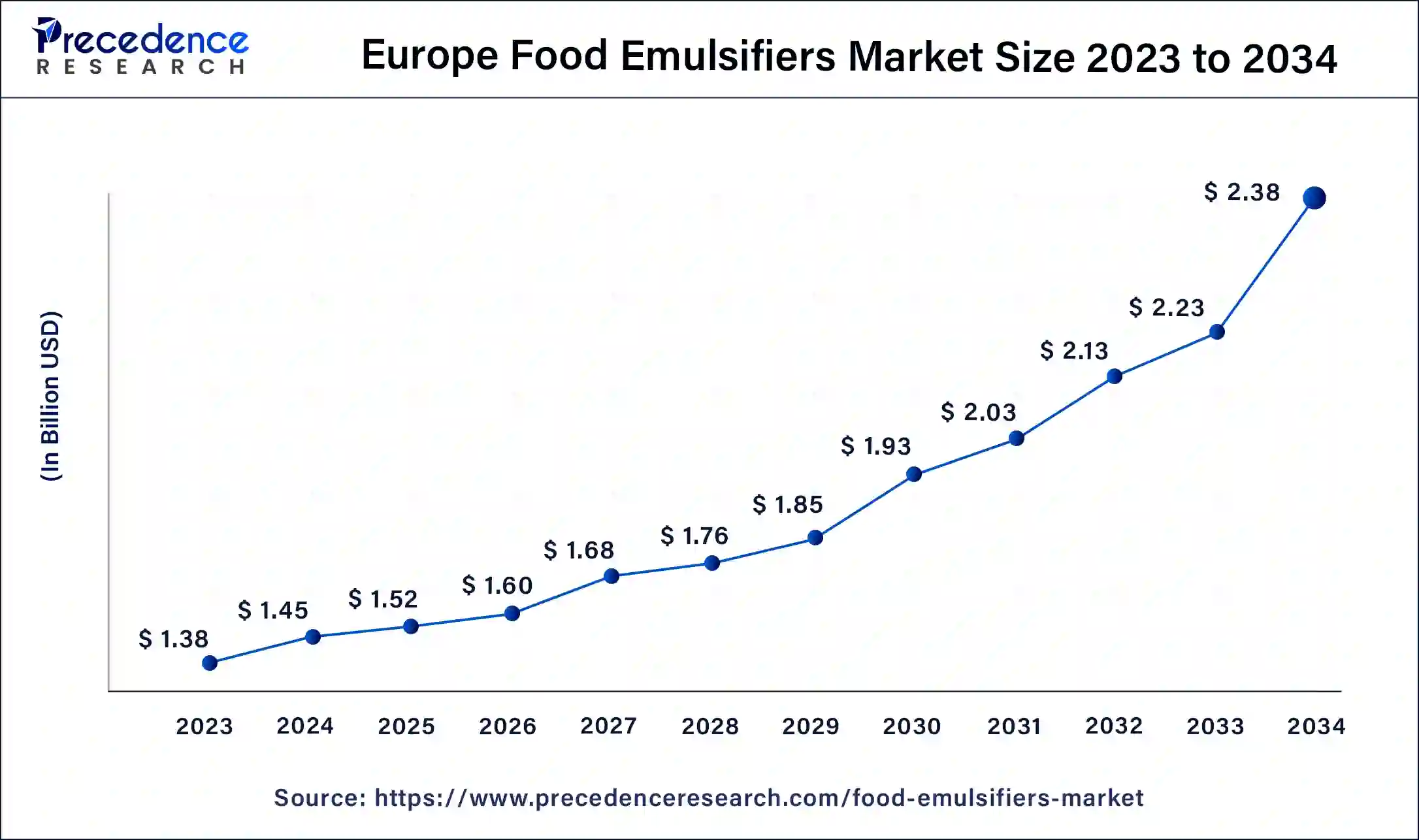

The Europe food emulsifiers market size was exhibited at USD 1.38 billion in 2023 and is projected to be worth around USD 2.38 billion by 2034, poised to grow at a CAGR of 5.07% from 2024 to 2034.

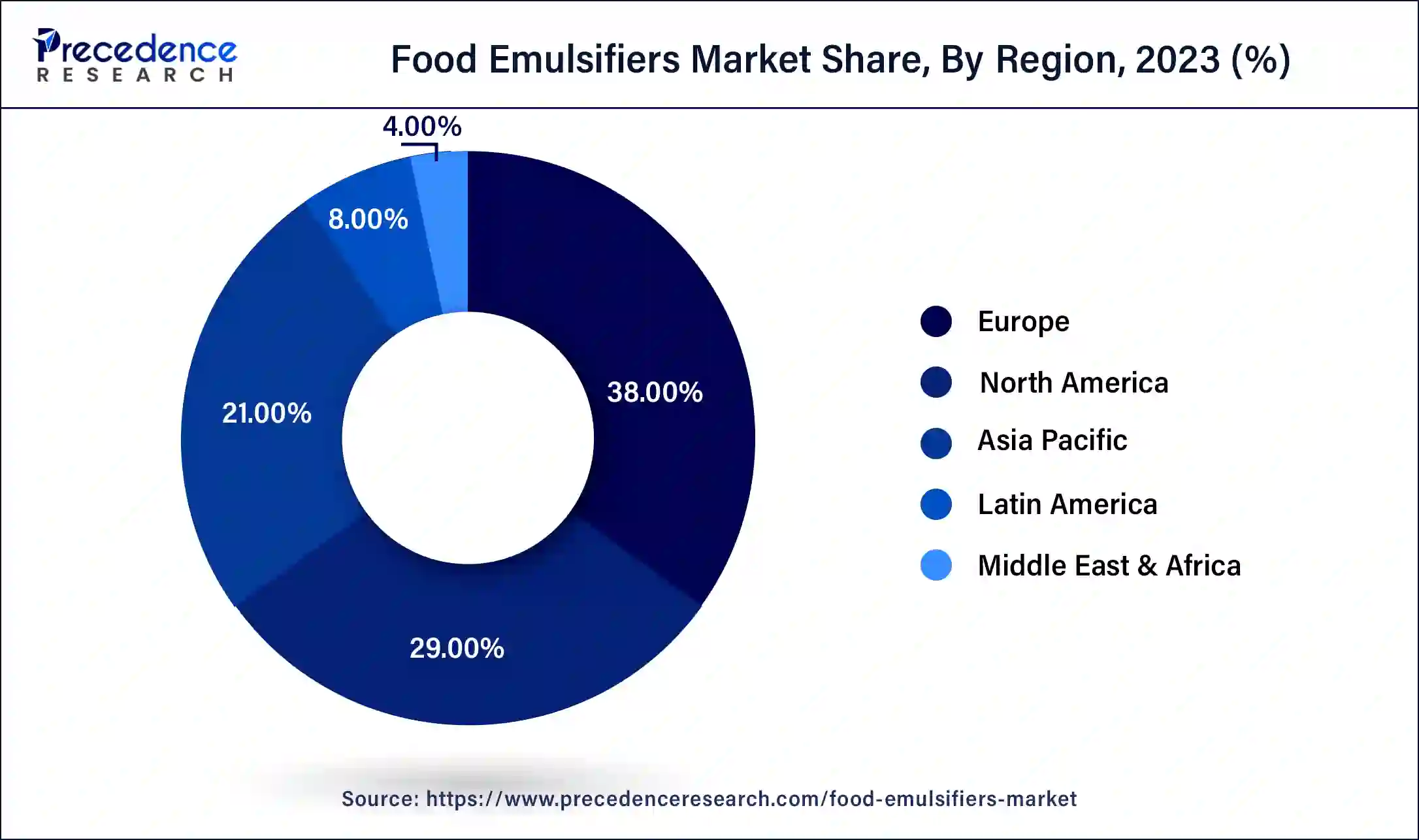

Europe dominated the food emulsifiers market in 2023. Industrial expansion in France, Germany, and Eastern European countries contribute to the growth of the market in the European region. European region people demand food emulsifying agents, including sorbitan esters and stearoyl lactylates, for dairy and bakery applications, which contribute to the growth of the market. The alcoholic beverages production sector, increasing foreign investment, and rapid expansion contribute to the growth of the market. In March 2024, according to a report, European natural products still hold a high growth potential, including foods and supplements, which help the growth of the market.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. The expanding consumer base for the food & beverage sector and rapid development contribute to the growth of the food emulsifiers market in the Asia Pacific region. China and India contribute to the growth of the market in the Asia Pacific region. The increasing popularity of veganism, rapid urbanization, and increasing demand for premium products and convenience foods contribute to the growth of the market.

The food emulsifiers market refers to food emulsifier providers that are used to food and beverages to create consistent and smooth textures in foods that may otherwise normally coagulate or separate, like ice cream or mayonnaise. The food emulsifier is a substance that helps blend 2 ingredients together that do not generally mix like water and oil. Food emulsifiers are used in processed foods to help prevent the separation of water and oil components, increase their shelf life, and give them a smooth texture. Examples of food emulsifier products include sorbitan esters, stearoyl lactylates, lecithin, mono-, di-glycerides & derivatives, etc. These factors help to the growth of the market.

AI is transforming the food industry, including the use of food emulsifiers. The benefits of AI in the food industry include improving traceability and visibility in the supply chain and ensuring that emulsifiers are sourced and delivered effectively. It can help develop emulsifiers modified to specific dietary preferences and needs, improve the nutritional profile of food products, and perform predictive maintenance. AI algorithms can improve the mixing and formulation processes of emulsifiers, increasing production efficiency and reducing waste; AI can analyze and monitor the production process in real-time and ensure emulsifiers are constantly produced to high-quality standards. This helps in maintaining the texture and stability of food products.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.17 Billion |

| Market Size in 2023 | USD 3.64 Billion |

| Market Size in 2024 | USD 3.82 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.92% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for bakery and confectionary applications

The increasing demand for bakery and confectionary applications contributes to the growth of the market. Emulsifiers are used in a wide range of food applications, such as bakery and confectionery applications. Emulsifiers may be used to assimilate water and fat in ice cream, making a smooth texture. They can also enhance the shelf life and texture of vinegar, mix oil, and baked goods uniformly in mayonnaise and salad dressing. In lubrication, crystal modification, aerated foods like creamers and cake batters are complex emulsions. These factors help the growth of the food emulsifiers market.

Downsides of food emulsifiers

The downsides of food emulsifiers include rising gut permeability and harm to the gut microbiome called leaky gut. A leaky gut allows bacteria to proceed from the gut wall into the bloodstream. Develop widespread inflammation, change mat metabolism, developing bowel syndromes such as colitis in rats, unequal gut microbes in mice, and the source is inflammation and weight gain. Cause obesity-related conditions like liver, type-2 diabetes, and cardiovascular diseases. High costs are linked with the emulsifier extraction from natural sources. These factors can restrict the growth of the food emulsifiers market.

Increasing investment in research and development

The increasing investment in research and development contributes to the growth of the market. Moving beyond the quick sips of emulsified drinks and jumping into sustained studies. Increasing high use of natural alternatives like Pickering stabilizers which are organic-based solid particles may support emulsions, biosurfactants, proteins and polysaccharides, saponins extracted from plants that have emulsifying properties, and phospholipids natural molecules found in soybeans and egg yolks may stabilize emulsions.

The mono and di-glycerides & derivatives segment dominated the food emulsifiers market in 2023. The benefits of mono and di-glycerides & derivatives include these are generally classified as emulsifiers that enable for contribute to the overall product stability, help products to dissolve easily, keep ingredients dispersed, control crystallization, reduce stickiness, prevent separation and smooth mixing of ingredients. It is also considered a fat and lipid source.

The industrial applications include puff pastry, cake, and cream kinds of margarine. The mono and di-glycerides & derivatives create and stabilize emulsions in many food products like ice cream, margarine, salad dressings, and mayonnaise. These factors help the growth of the mono and di-glycerides & derivatives segment and contribute to the growth of the market.

The stearoyl lactylates segment is expected to grow significantly during the forecast period. Primarily, stearoyl lactylates are used to emulsify and stabilize properties in cosmetics and food. In food, stearoyl lactylates mix oil and water together and are highly used as crumb softeners and dough strengtheners in bakeries. When stearoyl lactylates are mixed with saturated and distilled mono glycerol, they are stable in food systems. These stearoyl lactylates work well for applications such as texturing and aerating low-fat foods.

Stearoyl lactylates have broad applications in pet food, mostarda di frutta, minced and diced canned meats, dietic foods, chewing gums, gravies, sauces, snack dips, dehydrated potatoes, cream liqueurs, creamers, powdered beverage mixes, sugar confectionaries, toppings, puddings, fillings, icings, desserts, instant rice, kinds of pasta, cereals, waffles, pancakes, and baked cooks. These factors help the growth of the stearoyl lactylates segment and contribute to the growth of the food emulsifiers market.

The bakery & confectionery segment dominated the food emulsifiers market in 2023. Emulsifiers like polysorbate 60, calcium stearoyl lactylates (CSL), sodium stearoyl lactylates (SSL), DATEM (Diacetyl Tartaric Acid Esters of Monoglycerides), mono- and di-glycerides, and lecithin. These are used in meat products, plant or vegetable-based artificial whipped cream, candies, and chocolate, preventing precipitation and stability of ice cream, fermented foods, etc. Food emulsifiers help to maintain the hydrophilic-lipophilic balance. These factors help to the growth of the bakery & confectionery segment and contribute to the growth of the market.

The convenience foods segment is anticipated to grow significantly during the forecast period. Emulsifiers such as vinegar and oil are used in foods to help stabilize mixtures that may generally be naturally separated. The use of food emulsifiers in the food industries provides a high range of benefits, including reduced fat content in some products, improved flavor & aroma, raised freshness & shelf life, and increased stability and texture in food products. These factors help to grow the convenience foods segment and contribute to the growth of the food emulsifiers market.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025