April 2025

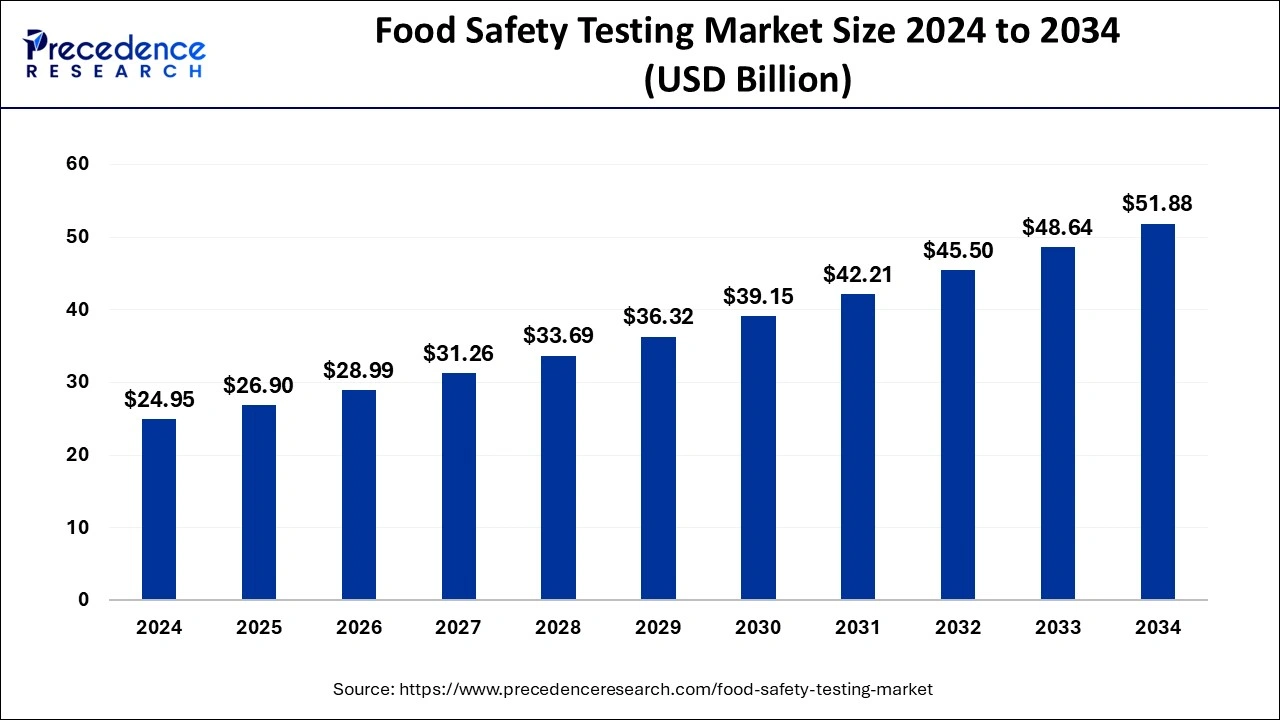

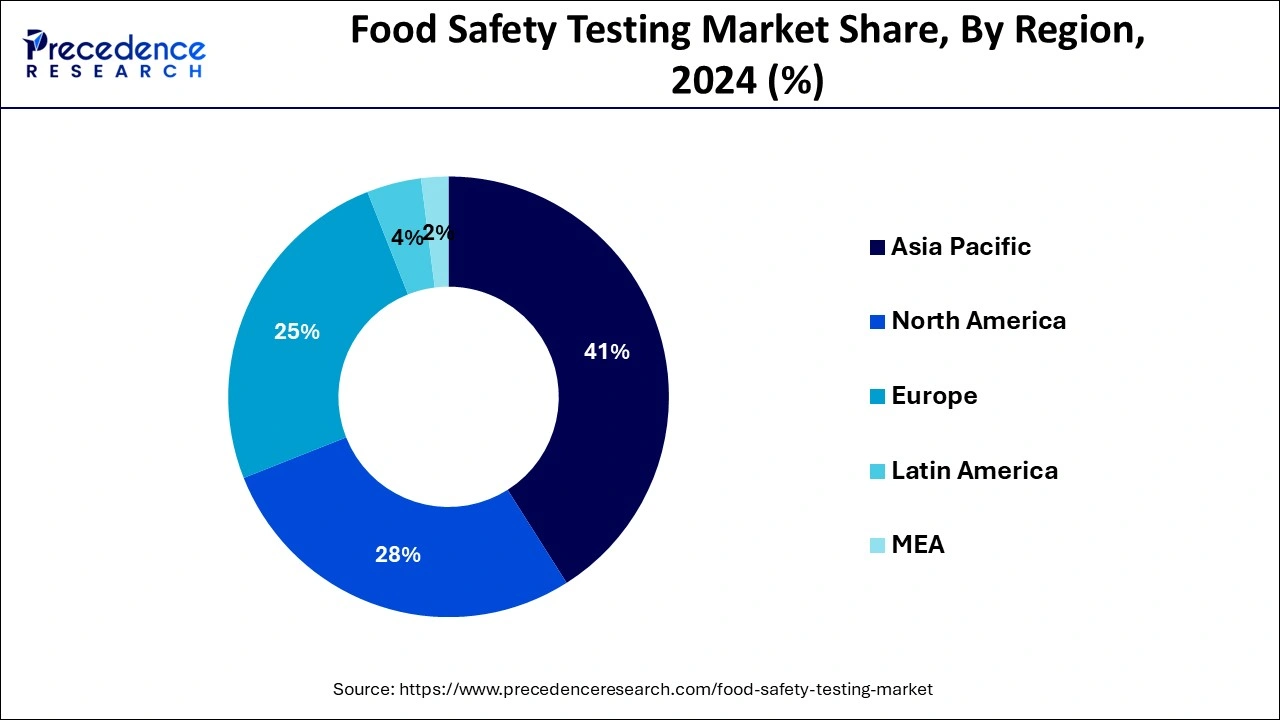

The global food safety testing market size is estimated at USD 26.90 billion in 2025 and is anticipated to reach around USD 51.88 billion by 2034, expanding at a CAGR of 7.59% from 2025 to 2034. The Asia Pacific food safety testing market size was valued at USD 11.03 billion in 2025 and is expanding at a CAGR of 8% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global food safety testing market size accounted for USD 24.95 billion in 2024 and is predicted to reach around USD 51.88 billion by 2034, growing at a CAGR of 7.59% from 2025 to 2034. The rising demand for safe food products with high quality, initiation of various policies and strategies for ensuring consumer safety, expansion of the food industry and the technological innovations are driving the growth of the food safety testing market.

The food safety testing and quality can be enhanced with the application of AI and machine learning tools which will ultimately lead to faster identification of contaminants with improved accuracy. The increased use of machine learning algorithms for predictive analytics, convolutional neural networks (CNNs) for analysing food sample images, computer vision technology providing automated assessment, Internet of Things (IoT) for environmental monitoring with enhanced traceability and natural language processing tools for improving regulatory compliance are enhancing the consumer expectance for safe and quality food while securing the standards of food products.

The Asia Pacific food safety testing market size was valued at USD 10.23 billion in 2024 and is expected to reach USD 21.27 billion by 2034, poised to grow at a CAGR of 8% from 2025 to 2034.

Europe occupied prevalent revenue share in the global food safety testing market in 2024. Over the past many years, European nations have documented several concerns associated to food safety which established stringent policies to apply complete food protection for the public. Food safety policies have been underlined by struggles from National Reference Laboratories, Control Laboratories and EU Reference Laboratories. These authorities are playing an imperative role in continuing food standards and defending user health by confirming the excellence of the food supply chain. In the UK, the Food Safety Agency takes care of food-borne diseases and regulates the phases of sicknesses triggered by diverse pathogens. Nevertheless, regulations vary region to region.

How is Food Testing Sector Growing in India?

The Indian food safety testing market is expected to grow significantly in this region. The growth can be attributed to the rising consumer awareness, enforcement of consumer protection policies by government, increased investments and initiatives for expanding food testing infrastructure. Furthermore, the science-based standards set by the Food Safety and Standards Authority of India (FSSAI) for food safety testing labs and the Food Safety on Wheels program by FSSAI which provides mobile units for food testing by conducting simple tests for adulterants is boosting the market growth.

North American food safety testing market is estimated to show healthy growth due to implementation of stringent food safety regulations across the region. For instance, Food Safety and Inspection Service of the US Department of Agriculture controls the safety of exported and imported food items. It is also accountable for the examination of items at borders and ports, alongside the ruling of food labeling. Furthermore, in the U.S., food processors or manufacturers subject to Consumer Product Safety Commission standards need to obey with the guidelines of the U.S. Consumer Product Safety Improvement Act and attain the essential certifications.

Germany Food Safety Testing Market Trends

Since last few years, food producers are beneath cumulative pressure to make sure the safety of the products they are offering in the market. Different rules under the Food Safety Modernization Act have amplified the need to guarantee that the products in the U.S. food supply are harmless, tested, and testing should be documented and substantiated. Augmented safety and health risks pretended by microbiological, chemical, and chemical pollutants have progressively made analytical testing approaches a cornerstone of food safety programs. The global food safety testing market is projected to record noteworthy progression account of growing occurrences of food-borne diseases that have forced to implement stringent food safety regulations across the world.

Furthermore, escalating sale of processed and packaged food in developing and developed nations due to influences such as increasing popularity of quick-service restaurants and varying lifestyle is expected to push the requirement for safety testing of eatable items.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.59% |

| Market Size in 2024 | USD 24.95 Billion |

| Market Size in 2025 | USD 26.90 Billion |

| Market Size by 2034 | USD 51.88 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application Type, Technology Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing prevalence of foodborne illnesses

According to the Centers for Disease Control and Prevention CDC estimate, the burden of foodborne illness in the U.S. is one in six Americans (or 48 million people); 128000 are hospitalized, and 3000 die of foodborne diseases.

Moreover, according to WHO, Contaminated food causes an estimated 600 million people to become ill each year, resulting in 420,000 deaths and the loss of 33 million healthy life years (DALYs). This has a devastating impact not only on public health but also on productivity and medical expenses, resulting in a staggering loss of US$ 110 billion each year in low- and middle-income countries. Moreover, children under the age of five bear a disproportionate burden, accounting for 40% of all foodborne illnesses and causing 125,000 deaths each year. Addressing food safety is critical for improving public health and promoting global economic growth.

Technological advancement

The food safety testing market is being driven by several key trends that are shaping the industry's future. One of these trends is the FDA's "New Era of Smarter Food Safety" program, which focuses on developing more modern approaches to food safety, such as a technology-driven traceability system and smart tools for addressing outbreaks. This program aims to enhance predictive assessments for food safety purposes and improve responses to issues and outbreaks. Another trend is the post-pandemic approach to food service, where food businesses are finding new ways to protect their customers. This includes a stricter cleaning and sanitation schedule and a more aggressive approach to preventing cross-contamination. Sustainability is also a top trend in the food industry, with more companies pursuing sustainability as one of their main objectives in the next few years.

High cost

Food safety testing requires specialized equipment and expertise, both of which are expensive for businesses, particularly small ones. Some businesses find it difficult to implement adequate food safety measures because they lack the resources to invest in expensive testing equipment or hire trained personnel. As a result, they choose to conduct less thorough testing or none, putting consumers at risk. Furthermore, the cost of testing is passed on to consumers, leading to higher food prices. The high cost of food safety testing equipment and services limits market growth, particularly in developing countries with limited resources.

Integration of Digital Solutions to Enhance Accuracy, Efficiency, and Compliance in Food Safety Testing

Food safety is increasingly becoming digitalized in the food industry, with businesses adopting digital solutions for more accurate recording of food safety data, minimizing human error, and easing compliance. This trend is expected to continue as new software programs and automated applications help food businesses streamline their processes. Software and applications, for instance, are now linked to machines and sensors, allowing for streamlined and automated data recording without the need for human intervention. Although these digital solutions are not meant to replace human workers, they do make food safety recording faster and less prone to error, allowing the food safety testing market to grow by offering innovative and effective digital solutions to food industry businesses.

Among different application segments, meat, poultry, & seafood products dominated the global food safety testing market in 2024 by occupying major chunk of the market demand in 2023. Cumulative intake of meat and meat products around the world and great risk probability of infections in red meats are estimated to push these segments during years to come. The adulteration of poultry and meat products is frequently witnessed while packaging, processing, and storage. The food safety and Inspection Service have bordered guidelines to regulate the adulteration of poultry and meat products in processing plants and slaughter houses, depending on HACCP food safety control system. Furthermore, foremost factor that pushes the development of the seafood testing service sector is the huge sale for seafood products like shrimp, crustaceans, crabs, tuna, lobsters, swordfish, marlin and others on account of their nutritional values including existence of vital nutrient and omega fatty acids.

Different technologies involved in this market include genetically modified organism testing, allergen testing, chemical & nutritional testing, residues & contamination testing, microbiological testing, and others. Out of these, microbiological testing segment appeared as a governing market segment with sizable revenue share in 2024. It is predicted to achieve momentum as it aids to identify microorganisms in eatables with the help of biological, chemical, molecular, and biochemical techniques, offering extremely precise results regarding their composition.

Further, genetically modified organism testing segment is estimated to observe the firmest growth pace, during assessment period mostly motivated by escalating alertness with in users concerning the existence of harmful GMOs in eatable. Also, growing production of GMO eatable products is anticipated to boost the request for safety tests to safeguard finest food quality.

Growing concentration on dropping lead time, testing cost, sample utilization, and short comings connected with numerous technologies have lead different technological revolution and improvement of new technologies in chromatography and spectrometry. The food safety testing sector is undergoing technological inventions as major performers are proposing novel, fast, and more precise technologies including inductively coupled plasma-optical emission spectrometry, inductively coupled plasma mass spectrometry, near-infrared spectroscopy nuclear magnetic resonance and others for testing the safety of food products.

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2024 to 2034. This report includes market segmentation and its revenue estimation by classifying it on the basis of application, technology and region as follows:

By Food Tested

By Target Tested

By Technology

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

January 2025

October 2024