January 2025

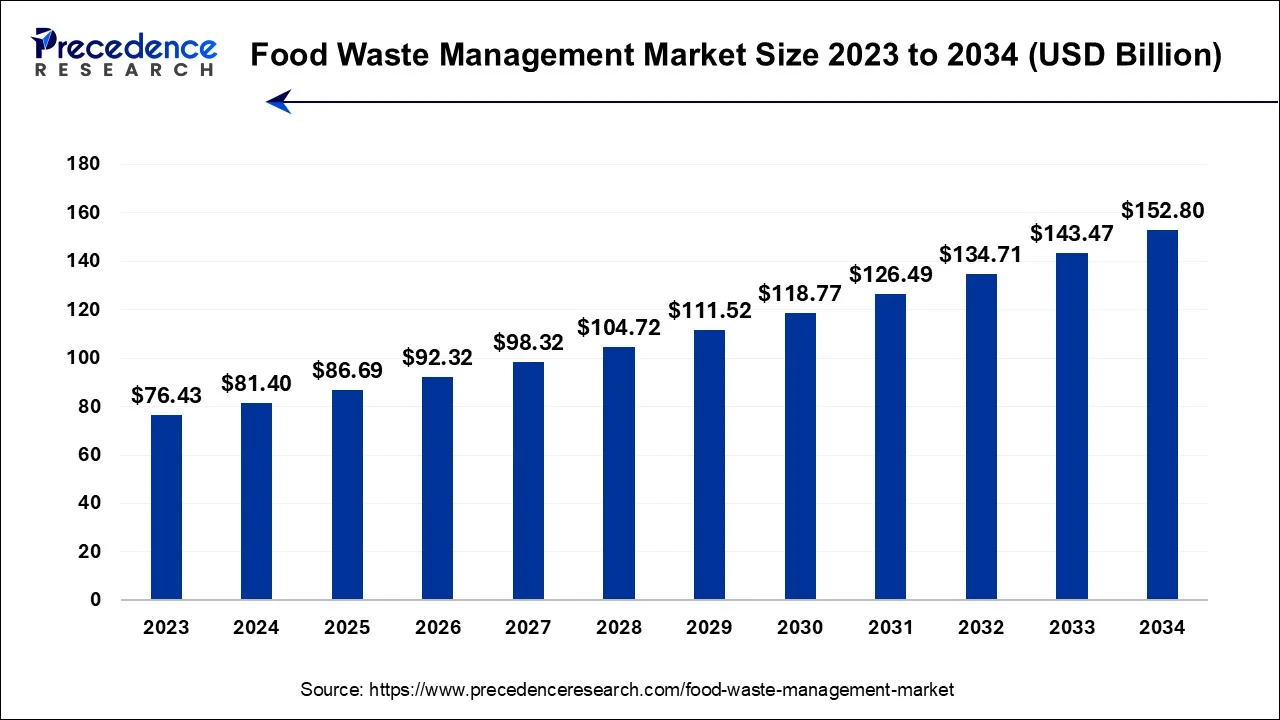

The global food waste management market size is estimated at USD 81.40 billion in 2024, grew to USD 86.69 billion in 2025 and is predicted to surpass around USD 152.80 billion by 2034, expanding at a CAGR of 6.50% between 2024 and 2034. The North America food waste management market size accounted for USD 30.93 billion in 2024 and is anticipated to grow at a fastest CAGR of 6.64% during the forecast year.

The global food waste management market size accounted for USD 81.40 billion in 2024 and is anticiipated to reach around USD 152.80 billion by 2034, expanding at a CAGR of 6.50% between 2024 and 2034.

The U.S. food waste management market size is estimated at USD 21.65 billion in 2022 and is expected to be worth USD 41.47 billion by 2032, at a CAGR of 6.64% from 2024 to 2034.

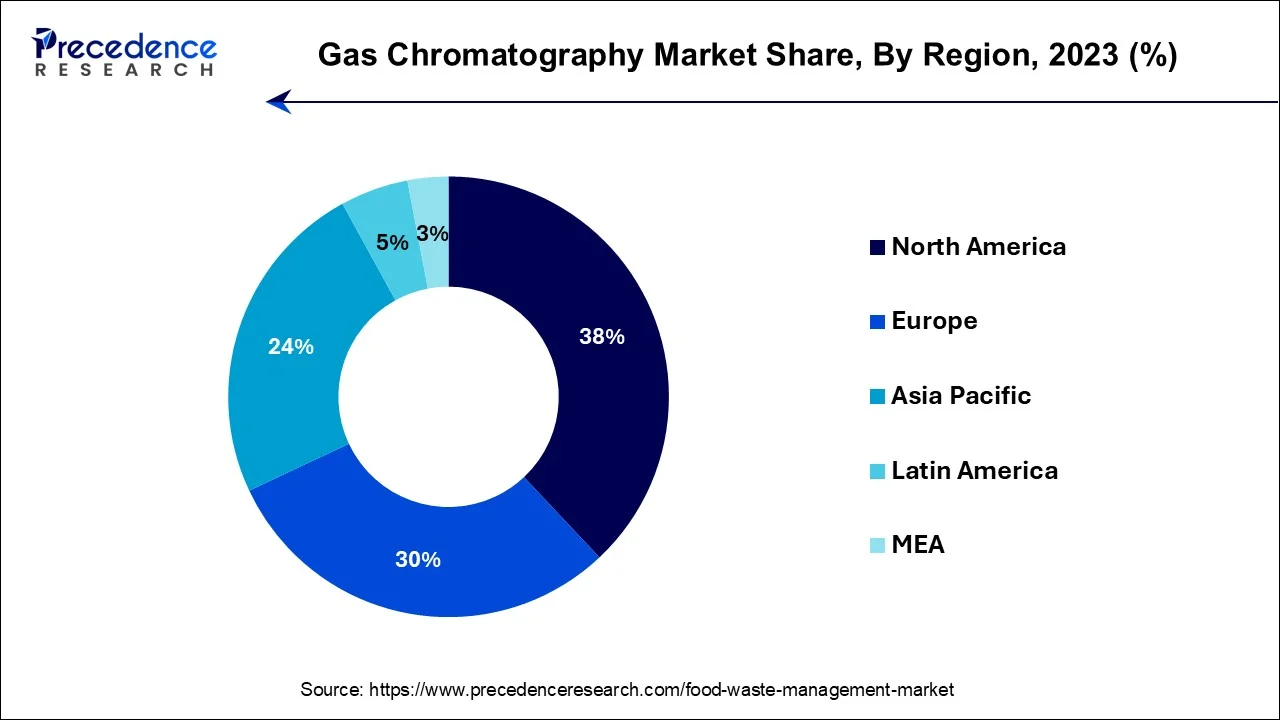

North America has held the largest revenue share 38% in 2023. In North America, the food waste management market has witnessed substantial growth due to rising awareness of environmental sustainability and stringent regulatory measures. The region has seen a surge in food waste diversion and recycling programs, with many municipalities and businesses adopting innovative technologies for waste collection and treatment. The pandemic expedited the integration of digital solutions like smart waste collection systems in North America, significantly improving food waste management efficiency. Consequently, the region is undergoing a notable transition towards more sustainable practices, resulting in reduced food waste being disposed of in landfills.

Asia Pacific is estimated to observe the fastest expansion. In this region, the food waste management market is evolving to address the growing food waste crisis driven by rapid urbanization and changing consumption patterns. Several countries are implementing waste-to-energy projects, including anaerobic digestion and biogas production, to harness the energy potential of organic waste. Furthermore, technology adoption is on the rise, with smart bins and waste-tracking systems gaining traction. Asia Pacific also faces unique challenges, such as food losses in the supply chain, making it an area of opportunity for waste reduction and sustainable food practices. Overall, the region is increasingly recognizing the importance of efficient food waste management in the context of environmental conservation and resource recovery.

In Europe, the food waste management market is thriving, driven by robust environmental consciousness and stringent waste disposal regulations. The region exhibits a strong commitment to circular economy principles, focusing on resource optimization and minimizing food waste. Several European countries have implemented advanced waste-to-energy solutions and innovative recycling practices, emphasizing the reduction of food waste and the recovery of valuable resources. Europe's food waste management sector reflects a dynamic and eco-conscious approach to sustainable waste disposal.

The food waste management market plays a pivotal role in addressing the escalating global issue of food wastage. It involves efficiently collecting, disposing, and recycling food waste generated across diverse sectors. This market's growth is fueled by several drivers, including increase in environmental awareness, stringent regulations promoting responsible waste disposal, and the need to reduce greenhouse gas emissions associated with food decomposition. Moreover, the shift towards a circular economy and the focus on resource conservation are driving forces behind this industry's expansion.

The food waste management market is at the forefront of sustainability efforts, striving to reduce the environmental impact of food waste while offering potential growth avenues for companies and entrepreneurs committed to combating this critical global issue.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.5% |

| Market Size in 2024 | USD 81.40 Billion |

| Market Size by 2034 | USD 152.80 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Waste Type, Source, Service Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing environmental awareness and stringent regulatory framework

This recognition that food waste is a substantial contributor to greenhouse gas emissions and resource depletion has intensified the urgency to combat the problem. This heightened environmental consciousness is spurring the widespread adoption of food waste management solutions. Individuals, businesses, and governments alike are now taking proactive measures at every stage of the supply chain, from individual households to large food producers. This collective effort is aimed at mitigating the environmental impact of food waste and fostering more sustainable waste management practices.

Moreover, stringent regulations and policies have been enacted worldwide to curb food waste. Governments and local authorities are implementing measures that mandate responsible food waste disposal, imposing fines for non-compliance. These regulations create a legal imperative for businesses and institutions to adopt effective food waste management practices, driving the demand for innovative solutions. In this environment, the food waste management market plays a crucial role in providing the expertise and infrastructure needed to meet both environmental goals and legal requirements.

Complex waste segregation and limited infrastructure

Complex waste segregation and limited infrastructure pose significant challenges to the food waste management market. While there is a growing awareness of the need to manage food waste sustainably, the practical implementation of effective segregation remains a hurdle. Food waste can be highly heterogeneous, comprising various types of organic and inorganic materials, making it complex to separate efficiently. This complicates the sorting and recycling processes and requires advanced technologies for accurate waste characterization.

Limited infrastructure further impedes the market's growth. Many regions lack the necessary facilities for composting, anaerobic digestion, or waste-to-energy conversion, which are vital components of food waste management. Establishing these facilities demands substantial investments and time, often beyond the capacity of smaller municipalities or organizations. As a result, the potential for efficient food waste management is constrained, hindering the market's progress. Nevertheless, these challenges also present opportunities for innovation in waste sorting and recycling technologies, as well as investments in expanding the infrastructure, which can further the development of the food waste management market.

Technology advancements and waste-to-energy initiatives

Technology advancements and waste-to-energy initiatives are driving significant demand in the food waste management market. As technology evolves, innovative solutions emerge, streamlining food waste collection, segregation, and recycling processes. Advanced sensor technologies and smart waste collection systems enable more efficient sorting and disposal, reducing the environmental footprint of food waste. Additionally, data analytics and artificial intelligence help businesses and municipalities optimize waste management practices, further reducing costs and environmental impact.

Waste-to-energy initiatives, like anaerobic digestion and biogas production, provide a sustainable way to convert food waste into valuable resources. This process reduces the volume of waste sent to landfills and produces renewable energy from organic waste. It's a win-win solution, addressing waste reduction and contributing to the generation of clean, sustainable energy. This dual benefit aligns with both environmental conservation and the growing demand for alternative energy sources. As these technologies continue to advance and gain recognition for their economic and environmental advantages, the food waste management market experiences a surge in demand, addressing food waste challenges while promoting sustainability.

Impact of COVID-19

The COVID-19 pandemic significantly impacted the food waste management market. With lockdowns and restrictions, there was a sudden disruption in the food supply chain, causing food service establishments to close and events to be canceled. This led to a shift in the type and volume of food waste generated. While household food waste increased, commercial food waste declined due to reduced restaurant operations.

In response to the pandemic, many waste management practices were temporarily altered to accommodate safety protocols. Recycling programs faced challenges, and in some cases, food waste was directed to landfills instead of recycling or composting facilities. Moreover, reduced budgets and economic uncertainties affected investments in food waste management infrastructure and technology.

On a positive note, the pandemic also highlighted the importance of food waste reduction and sustainability. It encouraged consumers, businesses, and governments to reevaluate food waste practices and work towards more efficient, sustainable solutions. As the world emerges from the pandemic, the food waste management market is expected to play a crucial role in addressing both food waste challenges and broader sustainability goals.

According to the waste type, the fruit and vegetable segment has held 24% revenue share in 2023. Fruit and vegetable waste, a significant component of the food waste management market, includes discarded or spoiled produce from households, grocery stores, and restaurants. A notable trend in this segment is the increasing adoption of sustainable practices like composting and anaerobic digestion to convert fruit and vegetable waste into valuable resources such as compost or biogas. Additionally, efforts to reduce cosmetic imperfections and redistribute surplus produce to food banks have gained momentum, reducing waste at the source and promoting food rescue initiatives.

The dairy & dairy product segment is anticipated to expand at a significantly CAGR of 7.8% during the projected period. Dairy and dairy product waste encompasses unsold or expired milk, cheese, yogurt, and related items. A prominent trend in this category is the implementation of dairy waste-to-energy solutions, were anaerobic digestion and biogas production transform dairy waste into renewable energy. This not only curbs waste but also contributes to sustainable energy production. Another trend involves the optimization of supply chain management to reduce overproduction and minimize dairy product waste, aligning with the broader objectives of food waste reduction and environmental sustainability.

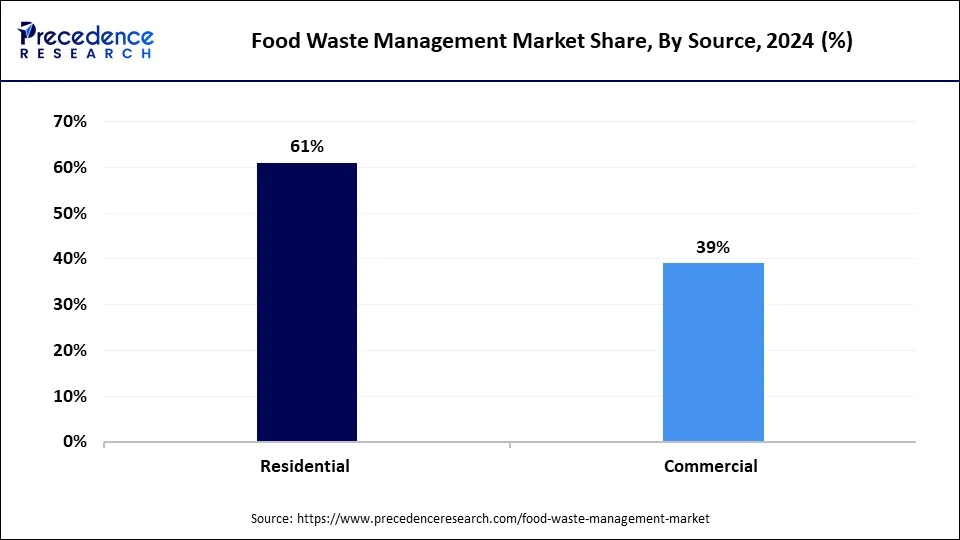

Based on the source, the residential segment held the largest market share of 61% in 2023. The residential segment of the food waste management market pertains to food waste generated by households. During the COVID-19 pandemic, there was a notable increase in residential food waste due to changes in cooking and dining habits. Many households began cooking more frequently, leading to a higher volume of food waste. The trend towards home composting and the adoption of food waste reduction apps and tools also gained traction.

On the other hand, the commercial segment is projected to grow at the fastest rate over the projected period. The commercial sector of the market covers food waste generated by restaurants, hotels, food retailers, and other businesses. With lockdowns and restrictions impacting the foodservice industry during the pandemic, commercial food waste saw a temporary decline. However, as the world reopens, businesses are increasingly focusing on sustainable waste management practices to reduce food waste and demonstrate their commitment to environmental responsibility. Technology-driven solutions for food waste tracking and recycling are becoming integral to commercial operations, aligning with the broader trend toward sustainability.

In 2023, the collection segment had the highest market share of 53% on the basis of the end user. In the food waste management market, collection services involve the efficient gathering of food waste from various sources, including households, restaurants, and businesses. The trend in food waste collection is shifting towards more streamlined and tech-enabled processes. Innovative solutions include the use of smart bins equipped with sensors to monitor waste levels and optimize collection routes, reducing costs and environmental impact. Moreover, there is a growing emphasis on source separation to improve the quality of collected food waste, making it more suitable for recycling or conversion to energy.

The disposal/recycling segment is anticipated to expand at the fastest rate over the projected period. Disposal and recycling services are vital components of the food waste management market. The trends in this segment reflect a commitment to sustainability and waste reduction. Anaerobic digestion and composting processes are increasingly popular for converting food waste into valuable resources such as biogas and nutrient-rich soil. Waste-to-energy initiatives are also on the rise, in line with the growing demand for renewable energy sources. Additionally, there's a shifting perspective on food waste, with a focus on viewing it as a resource for creating circular economies. This entails repurposing organic waste rather than simply sending it to landfills, resulting in reduced environmental impact and contributing to a more sustainable future.

Segments Covered in the Report

By Waste Type

By Source

By Service Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025