January 2025

Foot and Mouth Disease Vaccine Market (By Type: Conventional Vaccines, Aluminum Hydroxide/Saponin-based Vaccines, Oil-based Vaccines, Emergency Vaccines; By Animal: Cattle, Sheep and Goat, Pigs, Others (Antelope, Deer, Bison, and Camelids); By Distribution Channel: Veterinary Clinics, Government Institutions, Other) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

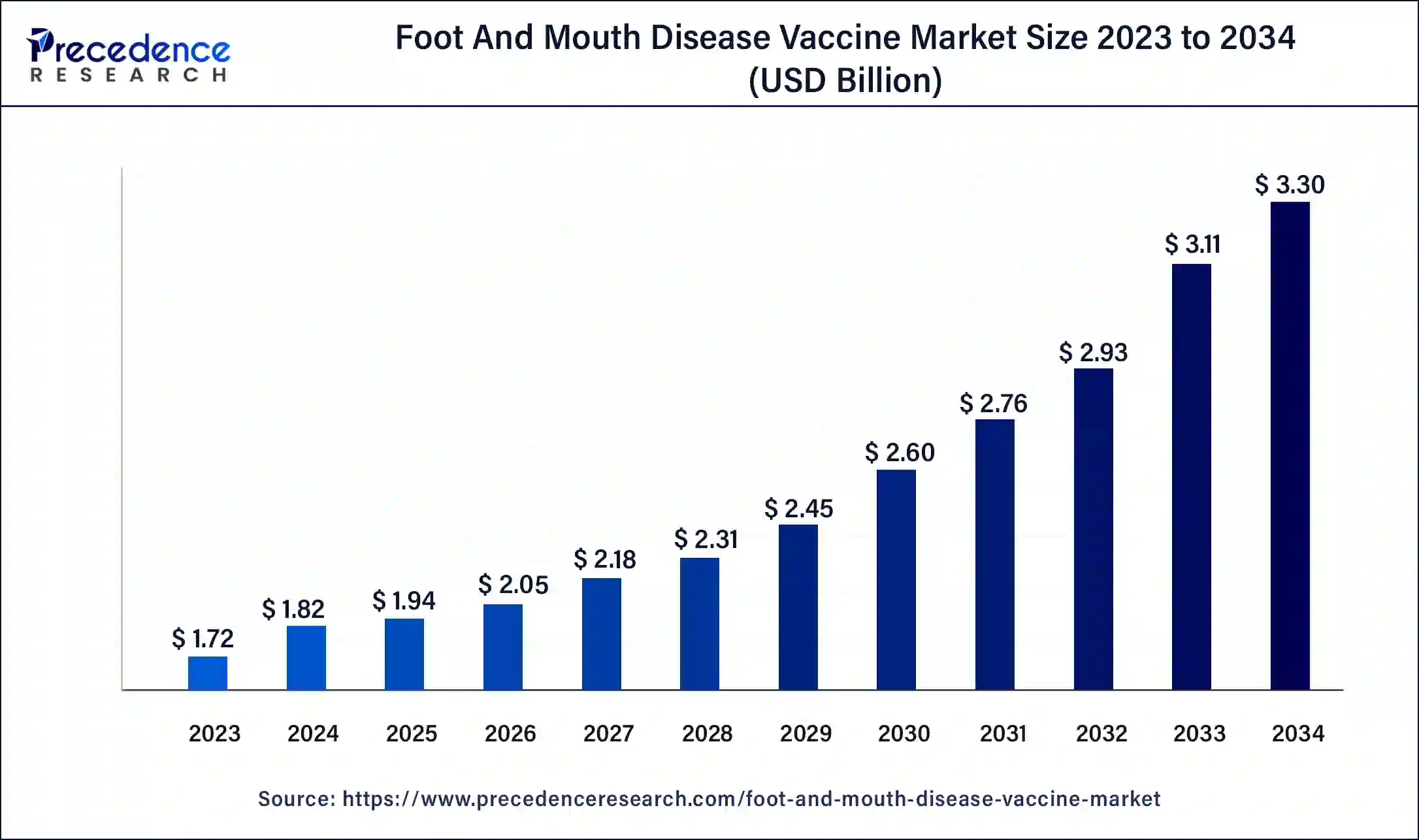

The global foot and mouth disease vaccine market size was USD 1.72 billion in 2023, accounted for USD 1.82 billion in 2024, and is expected to reach around USD 3.30 billion by 2034, expanding at a CAGR of 6.1% from 2024 to 2034. Growing livestock population and increasing demand for animal products are some of the factors contributing to the increased adoption of these vaccines globally.

Foot and mouth disease (FMD) is a highly contagious viral illness affecting livestock, including sheep, goats, swine, cattle, and other animals. It can cause severe economic losses and affects intensively reared animals more than traditional breeds. FMD results in fever and blister-like sores on the tongue, lips, mouth, teeth, and between the hooves. While most animals recover, the disease can lead to high mortality in young animals and production losses.

The virus responsible for foot and mouth disease belongs to the Picornaviridae family, and seven different strains are endemic in various countries worldwide. Each strain requires a specific vaccine to provide immunity to vaccinated animals. The foot and mouth disease virus (FMDV) has seven serotypes: O, A, C, SAT1, SAT2, SAT3, and Asia 1. Animals infected with this virus often show symptoms such as blisters on the lips and tongue, reduced meat and milk production, fever, excessive salivation, and loss of appetite. Various vaccines containing ingredients like aluminum hydroxide, saponin, and oil are used to protect animals from contracting FMD.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.1% |

| Global Market Size in 2023 | USD 1.72 Billion |

| Global Market Size in 2024 | USD 1.82 Billion |

| Global Market Size by 2034 | USD 3.30 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Animal, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rise in the incidence of FMD

The growth of the foot and mouth disease vaccine market is fueled by several factors, including the rise in FMD outbreaks, increasing demand for animal products, and government efforts to control the disease. With the global population growing and the demand for meat and dairy products rising, the livestock industry is expanding, leading to a greater need for FMD vaccination to prevent and manage outbreaks.

Governments worldwide are also taking steps to prevent FMD outbreaks, further driving the demand for FMD vaccinations. Organizations like the International Organization for Animal Health (OIE) and the Food and Agriculture Organization of the United Nations (FAO) have established the Global FMD Control Strategy to address this issue.

An increase in vaccine failures

There have been reports of vaccine failures in preventing and treating FMD, which may hinder growth prospects, especially in developing countries. Alleged vaccine failures could also threaten animals in Europe and North America. A research study by the Indian Council of Agricultural Research found that vaccine samples from certain companies did not meet quality standards and failed in sterility tests. This suggests that recent FMD outbreaks in India may be due to poor vaccine quality, leading to significant economic losses. Such issues could negatively impact the foot and mouth disease vaccine market.

Increasing mergers and acquisitions

The foot and mouth disease vaccine market has witnessed increased mergers and acquisitions, which will likely drive market growth. Vendors are increasingly focusing on inorganic growth strategies to expand their presence and expertise in the market. In addition, such strategies will boost their growth and profitability in the market. These strategies will benefit new companies that aim to penetrate the market quickly. These are among the leading animal health companies in the world. The vendors are also forming collaborations to expand their reach in the market. Such initiatives will likely fuel market growth.

The oil-based segment dominated the foot and mouth disease vaccine market in 2023. The conventional vaccines segment is leading due to the increasing use of oil-based vaccines, which offer longer-lasting effectiveness and higher efficacy. While other conventional vaccines effectively prevent diseases, they protect for a shorter time. This means that frequent vaccination is required for preventive measures.

The aluminum hydroxide and saponin vaccine segment is projected to experience the fastest growth during the forecast period. This is because these vaccines, containing aluminum hydroxide gel and saponin, along with oil adjuvants, are commonly used in inactivated FMD vaccines to manage the disease. On average, the expected lifespan of livestock, such as cattle, is between 18 and 22 years.

The cattle segment dominated the foot and mouth disease vaccine market share in 2023. Cattle are a primary focus for foot and mouth disease vaccination because they are highly susceptible to the disease, and many countries rely heavily on cattle sales for their economy. As the demand for higher quality and safer meat increases, there is growing awareness of diseases in cows and their potential transmission to humans (zoonosis). These factors are expected to positively impact the market in the coming years.

The sheep and goats segment is projected to experience the fastest growth during the forecast period. Although these animals are less prone to foot and mouth disease than cattle and swine, they can still contract and spread the disease. The increasing demand for products like wool and meat from sheep and goats is driving the need for foot and mouth disease vaccinations in this segment.

The government institutions segment dominated the foot and mouth disease vaccine market in 2023. This is due to the Governments around the world taking proactive measures to control and prevent foot and mouth disease outbreaks. They have introduced national vaccination programs that include regular immunization of animals and emergency vaccination during outbreaks. These initiatives have resulted in a considerable rise in demand for foot and mouth disease vaccines across all market segments.

The veterinary clinics segment held a notable share in 2023 and is expected to grow considerably during the forest period. Vaccination is acknowledged as an effective strategy to reduce the economic impacts of foot and mouth disease. By preventing and controlling the spread of the disease, vaccination is increasing awareness of its benefits.

Asia Pacific dominated the foot and mouth disease vaccine market in 2023 and is expected to maintain its position during the forecast period. This is because of the rising cases of foot and mouth disease, especially in countries like China and India, which have large animal populations. The demand for vaccines against foot and mouth disease is increasing in these countries due to higher consumer demand for meat and dairy products and a greater focus on animal welfare. Furthermore, the presence of major vaccine manufacturers like MSD Animal Health and Zoetis in the region is anticipated to boost market growth in the Asia Pacific further.

Latin America is expected to witness significant growth during the forecast period, mainly due to the development and standardization of diagnostic tests in the region. The increasing demand for animal care products and the growing livestock population are also major factors driving market growth. Governments in the region are taking initiatives to promote safe healthcare practices for livestock and optimize vaccine-based control programs. They are also raising awareness among the public about the importance of proper vaccination to combat foot and mouth disease.

Segments Covered in the Report

By Type

By Animal

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

September 2024

May 2024