February 2025

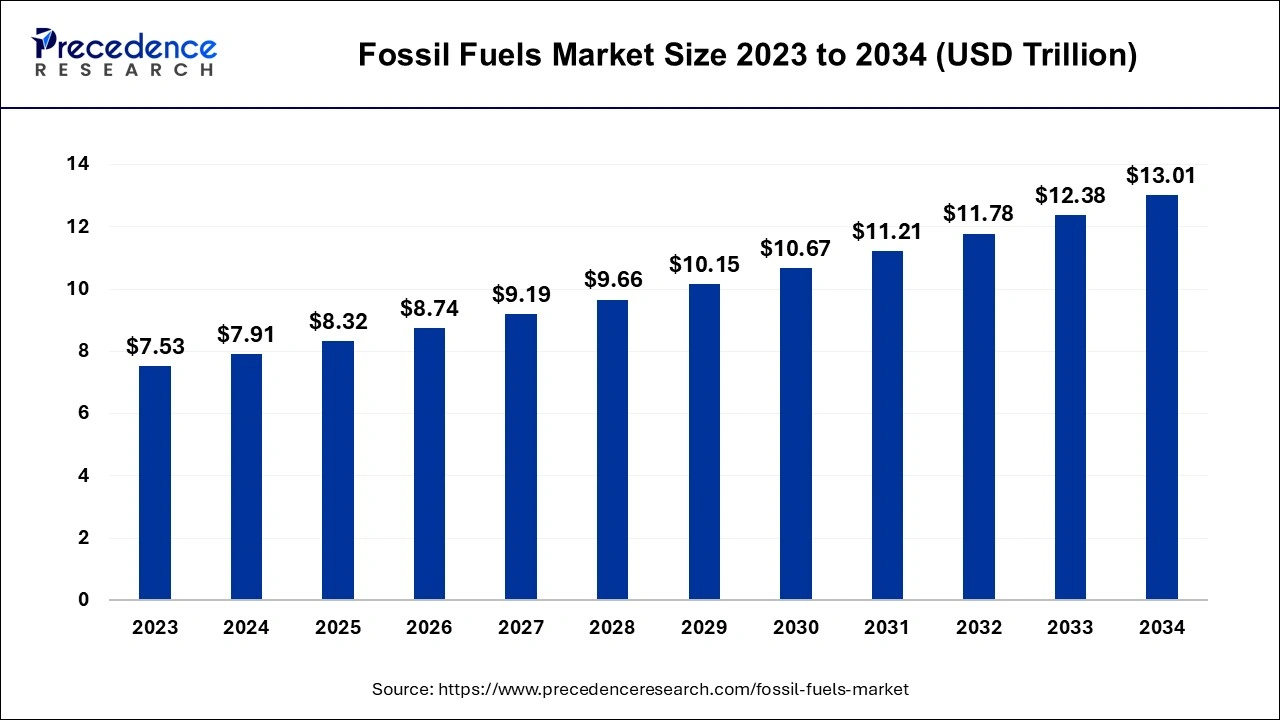

The global fossil fuels market size is calculated at USD 7.91 trillion in 2024, grew to USD 8.32 trillion in 2025 and is predicted to hit around USD 13.01 trillion by 2034, expanding at a CAGR of 5.10% between 2024 and 2034.

The global fossil fuels market size is estimated at USD 7.91 trillion in 2024 and is anticipated to reach around USD 13.01 trillion by 2034, growing at a CAGR of 5.10% between 2024 and 2034.

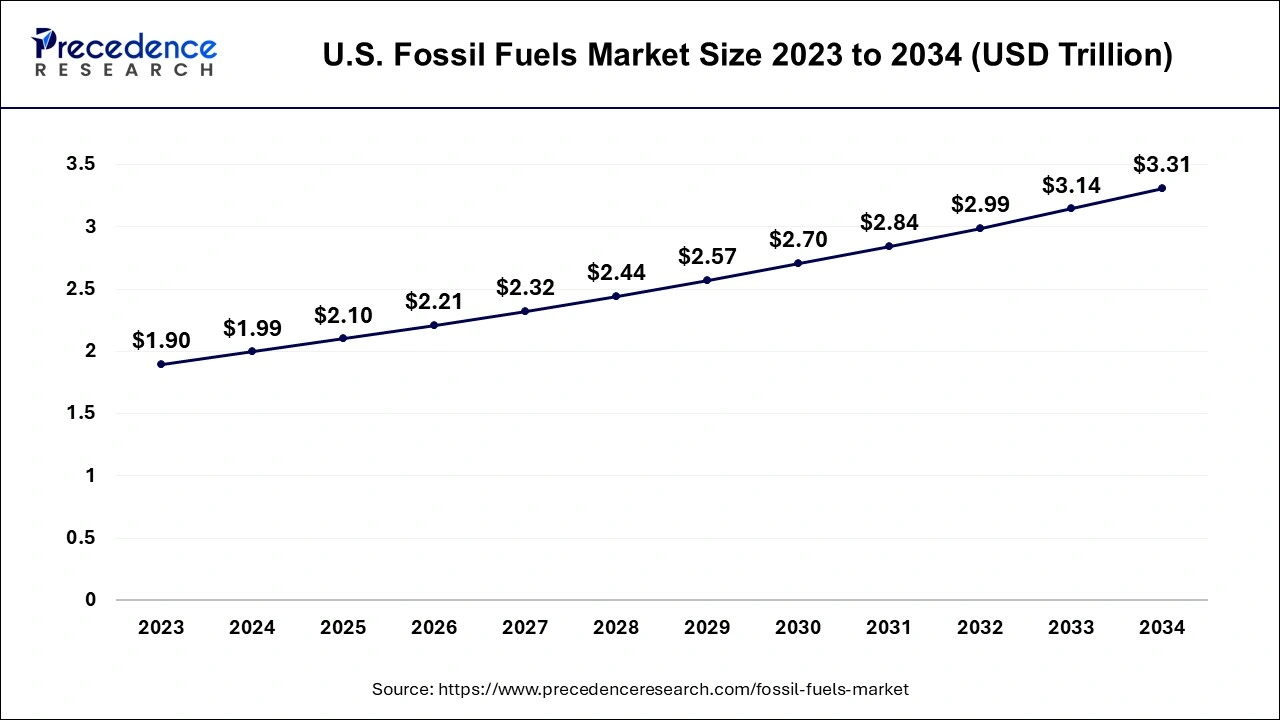

The U.S. fossil fuels market size is estimated at USD 1.99 trillion in 2024 and is expected to be worth around USD 3.31 trillion by 2034, at a CAGR of 5.18% from 2024 to 2034.

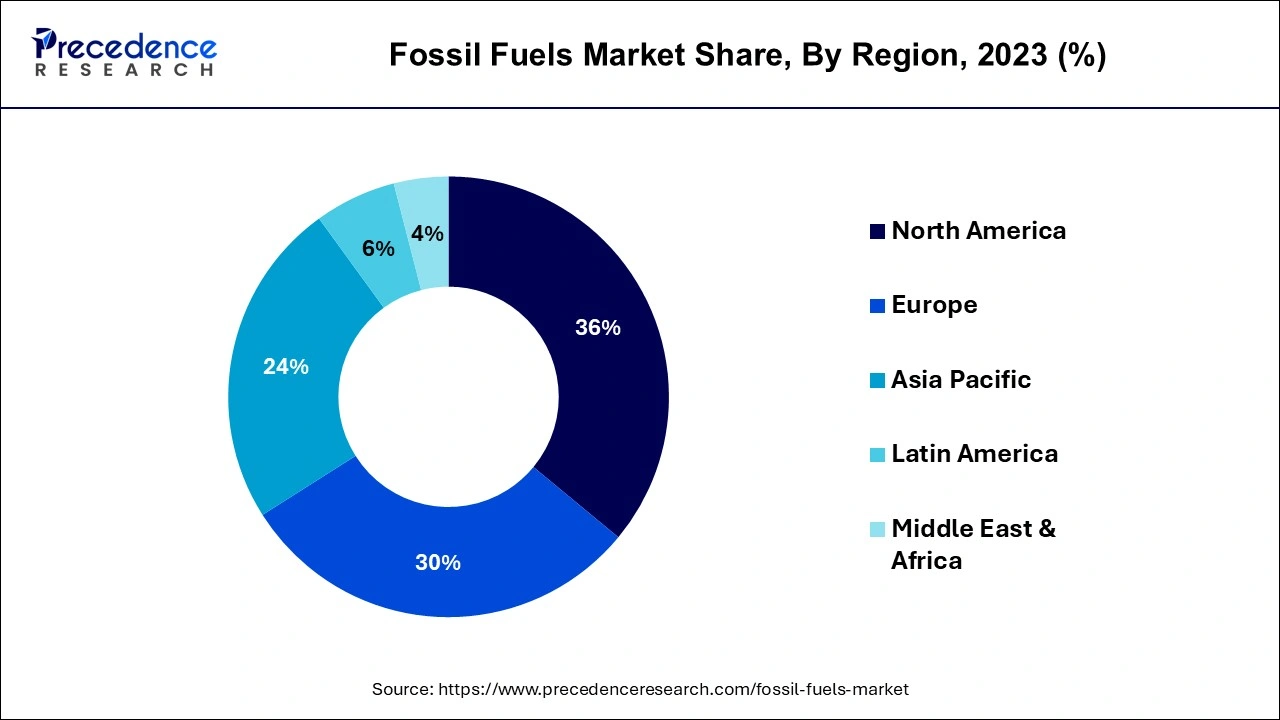

North America has held the largest revenue share of 36% in 2023. Many U.S. states are adopting ambitious renewable energy targets and gradually phasing out coal-fired power plants. This transition is motivated by dual factors, growing environmental concerns and the economic viability of renewable alternatives. In addition to this, the region is proactively directing investments into carbon capture and storage (CCS) technologies, aimed at mitigating emissions from pre-existing fossil fuel infrastructure. These initiatives underscore a collective commitment to bolster sustainability measures and reduce the environmental footprint within the North American fossil fuels industry.

Asia Pacific is estimated to observe the fastest expansion. In Asia Pacific, the fossil fuels market is undergoing a significant upswing in energy demand, driven by the robust expansion of emerging economies in the area. Although there's a rising inclination towards renewable energy sources, coal retains its dominant position as a primary energy source, notably in nations such as China and India.

The region's energy security is notably impacted by geopolitical factors, largely attributable to its reliance on energy imports. Consequently, several countries are proactively exploring energy source diversification and investing in cleaner technologies to address environmental concerns and minimize their ecological impact.

Fossil fuels encompass hydrocarbon-based energy sources originating from ancient organic materials, such as plants and microorganisms, subjected to geological processes over eons. The primary fossil fuels include coal, crude oil, and natural gas, integral for electricity generation, transportation, industrial operations, and heating. Yet, the combustion of fossil fuels emits greenhouse gases, contributing to climate change, motivating a global transition towards cleaner, sustainable energy alternatives. These fuels are linked to environmental concerns, with applications spanning electricity generation, transportation, and industry, serving a diverse range of end users from households to commercial and transportation sectors.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.91 Trillion |

| Market Size by 2034 | USD 13.01 Trillion |

| Growth Rate from 2024 to 2034 | CAGR of 5.10% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global energy demand and transportation sector

Global energy demand is a paramount driver for the fossil fuels market. With the global population expanding and economies growing, there's an ever-increasing need for energy. Fossil fuels, being highly energy-dense, are sought-after sources to fulfill this escalating demand. They power electricity generation, heating, and various industrial processes. Emerging economies rely on fossil fuels to meet their energy needs, contributing significantly to market growth.

The transportation sector is another crucial factor propelling fossil fuel demand. Gasoline and diesel fuels power the majority of the world's vehicles, from automobiles to freight trucks and airplanes. As urbanization spreads and personal mobility becomes more accessible, the transportation industry continues to expand. Moreover, maritime and aviation sectors primarily rely on fossil fuels. The continued growth of the transportation sector, especially in emerging markets, ensures a steady demand for fossil fuels, further driving the market.

Geopolitical instability and volatility in prices

Geopolitical tensions and instability can significantly hinder the fossil fuels market. Conflicts in major oil-producing regions, trade disputes, and sanctions can disrupt the supply chain, causing uncertainty in the market. Political instability in regions like the Middle East can lead to sudden supply disruptions or constraints, affecting global energy prices.

Moreover, geopolitical factors can influence energy policies and trade agreements, leading to fluctuations in supply and demand. Businesses and investors often face challenges when geopolitical events lead to uncertainty in energy markets, making long-term planning and investment in fossil fuel projects risky.

Price volatility is another critical restraint in the fossil fuels market. This inherent volatility can introduce uncertainty into energy markets, making it challenging for businesses, investors, and consumers to plan effectively and adapt to shifting economic and geopolitical conditions. Price volatility can deter investments in fossil fuel projects, making it challenging for the industry to plan for the long term and maintain stability. Additionally, as the world transitions toward cleaner energy sources, the fossil fuels market faces uncertainties in terms of future demand, which can exacerbate price instability.

Hydrogen economy and carbon capture & storage (CCS)

The hydrogen economy and carbon capture and storage (CCS) initiatives are paradoxically surging the demand for the fossil fuels market even as the world transitions toward cleaner energy sources. Firstly, the hydrogen economy relies on various types of hydrogen, including blue and green hydrogen. Blue hydrogen is produced from natural gas using CCS technologies to capture and store carbon emissions. As this process still involves natural gas, the demand for fossil fuel remains intact.

Similarly, green hydrogen, produced through renewable energy sources, necessitates significant energy input, often from conventional power sources, including fossil fuels. This dual demand for hydrogen has created a unique synergy with fossil fuels.

Moreover, CCS technologies are critical for reducing carbon emissions from industries heavily reliant on fossil fuels, such as power generation and heavy manufacturing. As governments and industries seek to meet carbon reduction targets, CCS projects present a compelling solution, resulting in sustained demand for fossil fuels. This unique interplay between cleaner energy initiatives and the fossil fuels market highlights the complex transition to a more sustainable energy landscape.

Impact of COVID-19

According to the type, the crude oil segment has held 41% revenue share in 2023. Crude oil, a vital component of the fossil fuels market, is unrefined petroleum extracted from underground reservoirs. Despite the growing focus on renewable energy, crude oil maintains its significance. Recent trends show a shift toward cleaner extraction methods, like fracking and offshore drilling, and an increased emphasis on optimizing oil's energy efficiency. The market is also witnessing innovations in crude oil processing to reduce environmental impact and emissions, aligning with global efforts to combat climate change.

The natural gas segment is anticipated to expand at a significant CAGR of 7.4% during the projected period. Natural gas, primarily methane-based, holds a crucial role in the energy sector for its environmentally friendly combustion. Recent market trends reveal an increasing dependence on liquefied natural gas (LNG) for international trade, extending its global presence.

Additionally, natural gas applications have seen a surge, particularly in electricity generation, serving as a transitional fuel in the global transition towards cleaner and sustainable energy sources. Advancements in natural gas infrastructure and extraction methods continue to bolster its prominence in the ever-evolving fossil fuels market. Advancements in natural gas infrastructure and extraction techniques are contributing to its increasing prominence in the dynamic fossil fuels market.

Based on the application, the industrial processes segment held largest market share of 38% in 2023. In the fossil fuels market, industrial processes refer to the extensive use of these energy sources in manufacturing, chemicals, and heavy industries. These sectors rely on fossil fuels as a primary energy input, facilitating high-temperature heat generation, chemical reactions, and mechanical work. A prominent trend in industrial processes is the growing emphasis on energy efficiency and emissions reduction, pushing industries to explore cleaner technologies and sustainable practices while optimizing fossil fuel utilization.

On the other hand, the transportation segment is projected to grow at the fastest rate over the projected period. Within the fossil fuels market, the term "transportation" pertains to the application of gasoline and diesel fuels in diverse modes of conveyance, spanning automobiles, maritime vessels, and aircraft. Shift towards cleaner, more fuel-efficient vehicles, catalyzed by evolving regulations and changing consumer preferences. The adoption of electric and hybrid vehicles, in conjunction with the exploration of renewable fuels, is steadily growing. This transition presents a dual landscape for the fossil fuels industry, encompassing both challenges and opportunities as it adapts to these changing dynamics and the demand for greener alternatives.

In 2023, the Industrial segment had the highest market share of 49% on the basis of the end user. Industrial end users in the fossil fuels market comprise diverse sectors like manufacturing, chemicals, and heavy industries. They heavily depend on fossil fuels, particularly natural gas and coal, to fuel operations, provide essential heat, and facilitate various industrial processes.

A prominent trend within this category is the increasing push towards cleaner and more efficient technologies. Industries are actively investing in measures aimed at enhancing energy efficiency, with a growing exploration of solutions like combined heat and power (CHP) systems, aimed at reducing carbon emissions and operational costs.

The commercial is anticipated to expand fastest over the projected period. The commercial sector encompasses businesses and institutions that rely on fossil fuels for heating, electricity, and transportation. A notable trend within this sector revolves around a shift towards heightened energy efficiency and sustainability. Commercial establishments are progressively embracing energy-efficient technologies and strategies, incorporating high-efficiency HVAC systems and lighting. Furthermore, there is a growing emphasis on transitioning to cleaner energy sources, aiming to reduce their dependence on fossil fuels to align with environmental objectives and drive down operational expenses.

Segments Covered in the Report

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024