What is the Fourth Party Logistics Market Size?

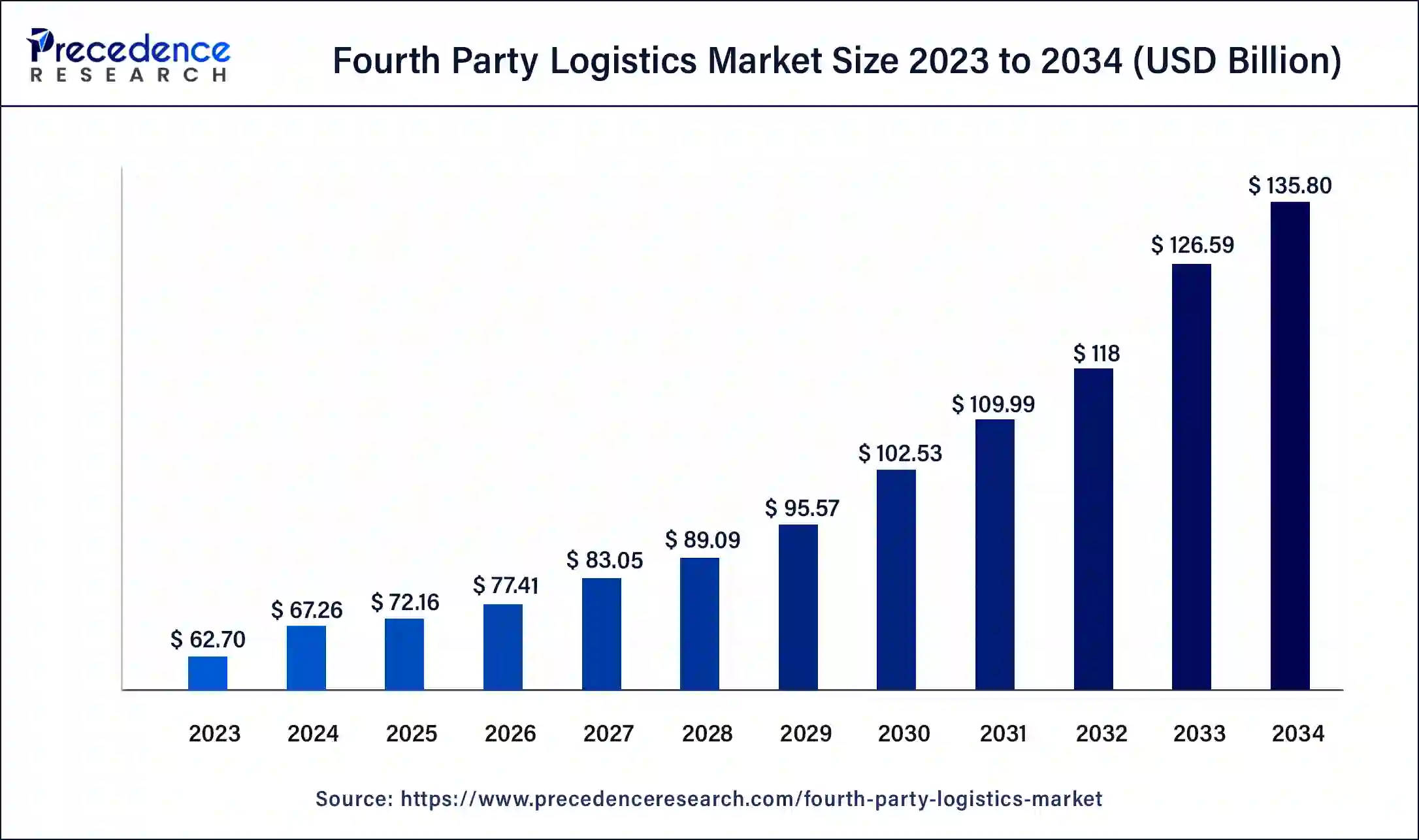

The global fourth party logistics market size is accounted at USD 72.16 billion in 2025 and predicted to increase from USD 77.41 billion in 2026 to approximately USD 135.80 billion by 2034, expanding at a CAGR of 7.28% from 2025 to 2034. Increasing complexity in the logistics sector means that the logistics sector needs to streamline its operations accurately for better outcomes and efficiency, which are the major factors driving the fourth party logistics market globally.

Fourth Party Logistics Market Key Takeaways

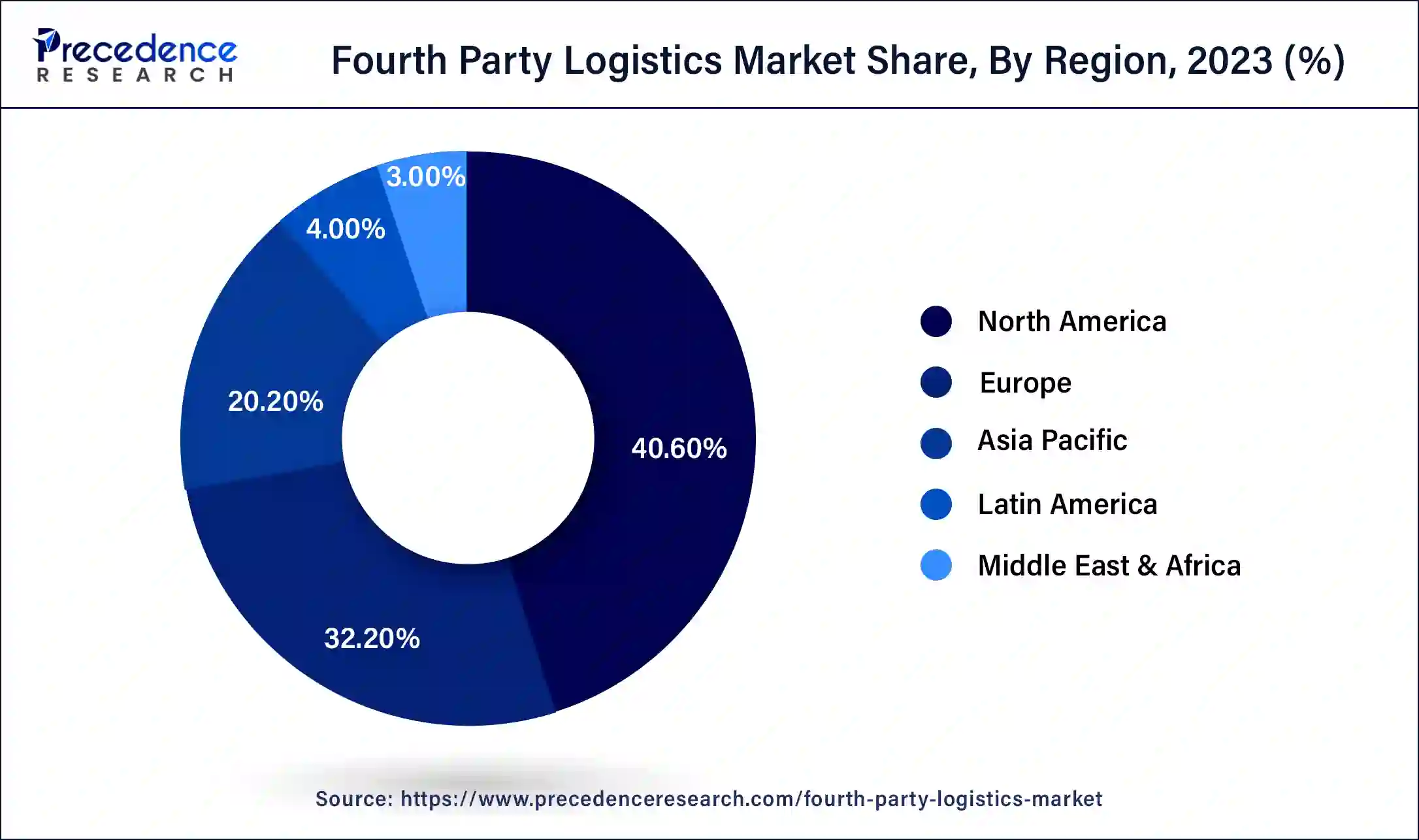

- North America has accounted market share of around 40.6% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest rate in the global market during the forecast period.

- By type, the solution integrator model segment accounted for the largest share of 61% in 2024.

- By type, the synergy plus operating model segment is observed to grow at the fastest rate in the market during the studied years.

- By end user, the manufacturing segment registered the highest share of the market in 2024.

- By end user, the retail segment is anticipated to grow at a notable rate in the market in the upcoming period.

What is Fourth Party Logistics?

The fourth party logistics market is experiencing rapid growth driven by the increasing complexity of supply chains and demand for integrated solutions. 4PL providers offer inclusive management of logistics that includes strategy, design, and operational execution, often including advanced technologies like AI and IoT for enhancing the efficiency of operations. Major key players are making the market highly competitive, with major tech firms like XPO Logistics, DHL Logistics, and C.H. Robinson, who are leaders in the global market.

Major key sectors that driving the fourth party logistics market are E-commerce, automotive and healthcare which required sophisticated solutions for co-ordination. Furthermore, despite growth, the global market is also facing challenges, such as maintaining the quality of service while adapting to dynamic market conditions. Although these challenges continue to be experienced by the market, they are still fostering and expected to continue their growth, supported by the need for end-to-end supply chain visibility and efficiency.

What are the Growth Factors of the Fourth Party Logistics Market?

- Growing globalization and diverse sourcing have made supply chains more complex, and it is, thus, driving the need for integrated supply chain solutions.

- Adoption of cutting-edge technologies like big data analytics, IoT, and AI again helps enhance the supply chain visibility and efficiency, further boosting the demand of the global fourth party logistics market.

- The rapid growth of E-commerce requires rapid expansion of logistics management that can be delivered by 4PL providers.

- Companies aim to reduce logistics costs and improve efficiency by outsourcing.

- Businesses focus on core activities, leaving logistics management to 4PL experts, fuelling the demand of the fourth party logistics market.

- Companies having a target to reduce their carbon footprints leverage management from 4PL providers for sustainable logistics solutions.

Fourth Party Logistics Market Outlook:

- Industry Growth Overview: The fourth-party logistics industry will expand significantly from 2025 to 2030 as firms continue to navigate toward integrated, asset-light supply chain operations. Increased complexity in global trade and demand for end-to-end supply chain visibility are compelling firms, especially in Asia-Pacific and North America, to use 4PL providers for complete supply chain orchestration.

- Global Expansion: Leading 4PL providers are expanding into Southeast Asia, Eastern Europe, and LATAM to be in close proximity to manufacturing, decrease risk, and support nearshoring. Numerous companies are developing regional control towers in significant locations such as Singapore, Poland, or Mexico to further enhance speed and provide synchronized cross-border supply chain services.

- Key Investors: Private equity and strategic investors are starting to come into the 4PL market as demand surges for technology-enabled logistics, recurring contracts, and high switching costs. Investment firms are establishing greater positions in digital logistics platforms, AI-enabled control towers, and supply chain orchestration services.

- Startup Ecosystem: Logistics startups purpose-built around technology are gaining traction, especially in AI planning, predictive analytics, and automated supply chain control towers. New entrants leveraging cloud-native orchestration systems, real-time optimization engines, and sustainability-linked logistics platforms are experiencing strong VC interest as businesses advance toward fully integrated, technology-first 4PL approaches.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 135.80 Billion |

| Market Size in 2025 | USD 72.16 Billion |

| Market Size in 2026 | USD 77.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.28% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

A supply chain complexity

As businesses expand globally, supply chains become more intricate, involving multiple suppliers, manufacturers, and distributors across various regions. This complexity necessitates sophisticated logistics solutions to ensure seamless coordination and integration. Fourth-party logistics providers offer a holistic approach, managing the entire supply chain from strategy to execution. They leverage advanced technologies like AI, IoT, and big data analytics to provide real-time visibility and predictive analytics, enhancing efficiency and decision-making. This comprehensive management helps businesses navigate the challenges of global supply chains, such as varying regulations, transportation bottlenecks, and market volatility. By outsourcing to 4PL providers, companies can streamline operations, reduce risks, and focus on their core competencies. The increasing complexity of supply chains thus drives the demand for 4PL services as businesses seek to enhance efficiency and maintain a competitive edge in the global fourth party logistics market.

E-commerce expansion

The rapid growth of e-commerce has significantly transformed the logistics landscape, creating a heightened demand for efficient and scalable logistics solutions. E-commerce requires swift, reliable, and flexible logistics to meet consumer expectations for fast and accurate deliveries. Furthermore, the surge in online shopping, especially during peak seasons and promotional events, requires robust logistics management to handle large volumes of orders. Thus driving the fourth party logistics market.

Fourth-party logistics providers are well-equipped to handle these demands, offering integrated services that encompass warehousing, transportation, inventory management, and reverse logistics. They use advanced technologies to optimize routes, manage inventories, and ensure timely deliveries, which are critical in the e-commerce sector. By leveraging the expertise of 4PL providers, e-commerce businesses can enhance their supply chain efficiency, reduce operational costs, and improve customer satisfaction. Consequently, the expansion of e-commerce continues to be a major driver for the growth of the fourth party logistics market.

Restraint

High operational costs

One major restraint in the fourth party logistics market is the high initial investment and ongoing operational costs. Establishing a 4PL operation involves significant financial outlay for infrastructure, technology, and skilled personnel. For instance, integrating advanced technologies such as AI, IoT, and blockchain requires substantial investment in software, hardware, and continuous updates.

Additionally, implementing and maintaining a comprehensive logistics management system necessitates significant expenditure on training and retaining a skilled workforce capable of leveraging these technologies effectively. Operational costs remain high due to the complexity of managing entire supply chains. This includes expenses related to real-time tracking systems, data analytics, and maintaining global logistics networks. Moreover, 4PL providers must continuously invest in upgrading their technology and infrastructure to stay competitive, adding to the financial burden.

Hence, these high costs can deter small and medium-sized enterprises (SMEs) from adopting 4PL services, as they may lack the necessary financial resources. Consequently, the market might see slower growth in segments where businesses are more cost-sensitive. This financial barrier highlights the challenge of balancing cost-efficiency with the need to provide comprehensive, technology-driven logistics solutions, potentially limiting the fourth party logistics market's overall expansion.

Opportunities

Adoption of AI in logistics

The integration of advanced technologies such as artificial intelligence (AI), machine learning, blockchain, and the Internet of Things (IoT) presents significant opportunities for the fourth party logistics market. These technologies can enhance supply chain visibility, predict demand, optimize routes, and improve inventory management. For instance, AI can forecast demand more accurately, while IoT devices provide real-time tracking and monitoring of shipments. Blockchain ensures secure and transparent transactions. By adopting these technologies, 4PL providers can offer more efficient, reliable, and innovative solutions, thereby attracting more clients seeking to leverage technology for competitive advantage and improved operational efficiency.

Sustainability and green logistics

As environmental concerns grow, there is a significant opportunity for 4PL providers to offer sustainable and green logistics solutions. Businesses are increasingly looking to reduce their carbon footprint and meet regulatory requirements for sustainability. 4PL providers can capitalize on this trend by implementing eco-friendly practices such as optimizing transportation routes to reduce fuel consumption, using electric or hybrid vehicles, and promoting the use of recyclable packaging materials. By offering green logistics solutions, 4PL providers can attract environmentally conscious clients and gain a competitive edge in the market while contributing to global sustainability efforts.

Technological Advancement

The fourth-party logistics market is being transformed by technological innovations because of increased visibility, efficiency, and collaboration in supply chains. The real-time tracking, simplified communication, controlled data sharing, and centralised data management are available through the cloud-based platforms; hence, it augments the transparency among the entire stakeholders.

Proactive monitoring of shipments can be conducted due to IoT devices like smart sensors, as such devices result in a better management of risks and respond quickly. Further streamlining logistics processes in warehouses is complemented by robotics and automation, which lowers the costs, as well as the mistakes in calculations. Such technological innovations give the 4PL providers the ability to offer extremely tailored, flexible, and resilient logistics solutions.

Type Insights

The solution integrator model segment accounted for the largest share of the fourth party logistics market in 2024. The solution integrator mode segment in the fourth party logistics market offers enhanced supply chain visibility, allowing businesses to track and manage all logistics activities in real time. This comprehensive oversight helps identify inefficiencies, reduce delays, and optimize operations. By integrating various logistics services under one umbrella, solution integrators can streamline processes and reduce redundancies, leading to significant cost savings.

This holistic approach enables businesses to leverage economies of scale and negotiate better rates with service providers. Solution integrators provide valuable insights and analytics, aiding in strategic decision-making. They help businesses align logistics strategies with overall corporate goals, enhancing responsiveness to market changes and improving customer satisfaction through better service.

- In November 2023, GWC signed a cooperation agreement with Qatar Development Bank (QDB) to support micro, small, and medium-sized enterprises. As part of the agreement, GWC provides preferential rates for logistics solutions to businesses affiliated with QDB. It also offers accommodation solutions, logistics consultation services, and preferential rates for UPS services to QDB staff and clients while also exploring future collaboration opportunities related to incubation and acceleration programs, forums, and events.

The synergy plus operating model segment is observed to grow at the fastest rate in the fourth party logistics market during the studied years. The synergy plus operating model segment is fast-growing in the fourth party logistics market due to its comprehensive service offering. This model combines the strengths of various logistics providers and integrates them under one management system, delivering end-to-end solutions. By fostering close collaboration between different service providers, this model enhances efficiency and operational performance. It leverages synergies to optimize supply chain processes, reduce costs, and improve service quality. Additionally, the synergy plus model offers greater flexibility and scalability, allowing businesses to adapt quickly to market changes and scale operations efficiently, meeting the diverse needs of global supply chains.

- In April 2024, Synergy Limited (CLS) launched a new subsidiary, Logistics365 (Pvt) Ltd. The launch of the new venture took place at CL Synergy's office premises amidst a gathering of staff and well-wishers. Logistics365 provides total shipping and logistics solutions to all types of cargo, specializes in international trading under the ‘Entrepot' scheme, among other niche products, and is geared to provide stable and uninterrupted service excellence.

End user Insights

The manufacturing segment registered the highest share of the fourth party logistics market in 2024. The manufacturing segment dominates the market due to its complex supply chain requirements. Manufacturers often deal with multiple suppliers, production sites, and distribution channels, necessitating sophisticated logistics management. Manufacturers constantly seek to improve efficiency and reduce costs. 4PL providers offer integrated solutions that streamline logistics operations, enhance inventory management, and optimize transportation, leading to significant cost savings and improved productivity.

With global sourcing and distribution, manufacturers require comprehensive logistics support to manage international trade, customs, and compliance. 4PL providers offer the expertise and infrastructure needed to navigate these challenges, ensuring smooth and efficient operations across borders.

The retail segment is anticipated to grow at a notable rate in the fourth party logistics market in the upcoming period. The retail segment is fast-growing in the market due to the surge in e-commerce. Retailers increasingly rely on 4PL providers to manage complex logistics, streamline order fulfillment, and ensure timely deliveries. Rising consumer expectations for fast and accurate deliveries drive demand for efficient logistics solutions. 4PL providers help retailers meet these demands by offering integrated services that enhance supply chain efficiency and responsiveness, supporting the sector's rapid expansion.

Regional Insights

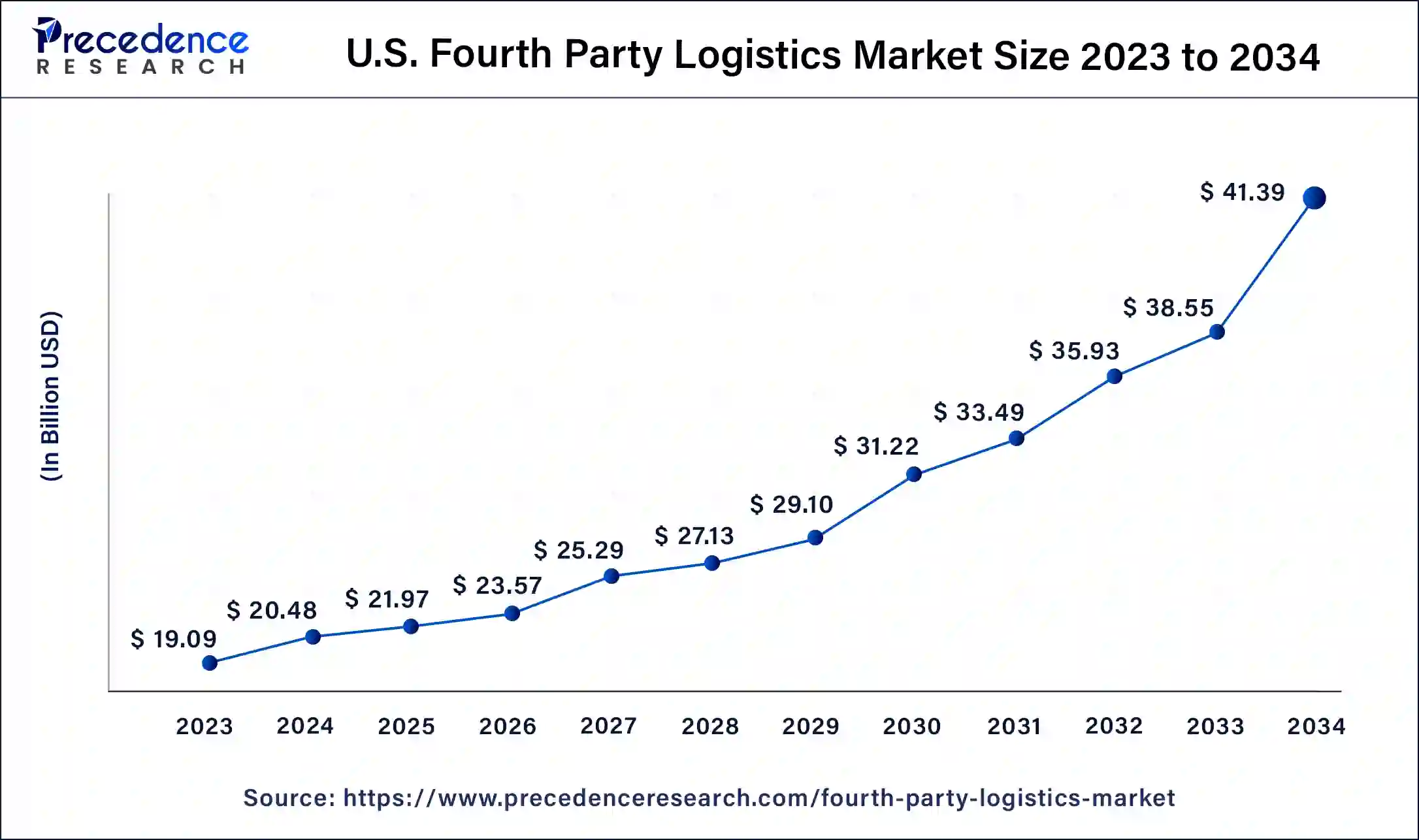

U.S. Fourth Party Logistics Market Size and Growth 2025 to 2034

The U.S. fourth party logistics market size is exhibited at USD 21.97 billion in 2025 and is projected to be worth around USD 41.68 billion by 2034, poised to grow at a CAGR of 7.36% from 2025 to 2034.

North America: U.S. Fourth Party Logistics Market Trends

The U.S. market is expanding steadily as companies increasingly outsource entire supply chain orchestration rather than just discrete transport tasks. Driving this growth are surging e commerce volumes, especially in omnichannel retail, which demand real time visibility and predictive logistics. Technology is a major enabler: AI, automation, cloud platforms, and control tower models are helping 4PL providers optimize routes, manage risk, and offer smarter orchestration.

North America held a substantial share of the fourth party logistics market in 2024. North America, particularly the United States and Canada, is a dominant region in the fourth party logistics market due to its advanced technological infrastructure. The region boasts widespread adoption of cutting-edge technologies like artificial intelligence (AI), the Internet of Things (IoT), and blockchain, which are crucial for efficient and integrated supply chain management. This technological edge enables North American 4PL providers to offer innovative solutions that enhance visibility, accuracy, and efficiency across supply chains.

Additionally, North America is home to many leading 4PL providers, such as DHL Supply Chain, XPO Logistics, and C.H. Robinson, which drive market growth through extensive networks and comprehensive service offerings. These companies benefit from robust financial resources, allowing significant investments in technology and infrastructure to maintain competitive advantages.

- In July 2024, Gulf Warehousing Company, Quatar, one of the fastest-growing logistics businesses in MENA announced the launch of Al Wukair Logistics Park Directory, which coincides with the United Nations Micro, Small and Medium-Sized Enterprises (MSMEs) Day, observed on June 27th every year.

Again, the highly developed e-commerce sector in North America further fuels the demand for 4PL services. The region's consumers expect rapid and reliable deliveries, prompting e-commerce businesses to partner with 4PL providers to manage complex logistics operations efficiently. This synergy between advanced technology, leading market players, and a booming e-commerce sector solidifies North America's dominance in the fourth party logistics market.

Asia Pacific is anticipated to grow at the fastest rate in the global fourth party logistics market during the forecast period. Countries like China, India, and Southeast Asian nations are experiencing significant industrial expansion, leading to increased demand for efficient supply chain management solutions. The region's manufacturing boom necessitates advanced logistics services to handle the complexity of global supply chains. The expanding e-commerce sector is another critical driver. With a burgeoning middle class and rising internet penetration, online shopping is surging, especially in markets like China and India. This growth fuels the demand for sophisticated logistics solutions to meet consumer expectations for fast and reliable deliveries.

Asia Pacific: China Fourth Party Logistics Market Trends

Moreover, substantial investments in infrastructure and technology by both governments and private enterprises enhance logistics capabilities. Initiatives like China's Belt and Road Initiative improve connectivity and transportation networks, facilitating smoother logistics operations. Additionally, a favorable regulatory environment and government initiatives supporting logistics and transportation further bolster the fourth party logistics market's growth, making Asia Pacific a hotbed for logistics innovation and expansion.

Why did Europe grow consistently in the Fourth Party Logistics Market?

The European market for fourth-party logistics expanded consistently due to the movement towards digital transformation, sustainability regulations, and cross-border coordination. Companies engaged fourth-party logistics (4PL) service providers to help deal with complex trading relationships between EU countries and improve visibility in real time. Significant investments in green modes, automation, and data-driven technologies aided market growth.

Germany Fourth Party Logistics Market

Germany led in Europe because of its strong manufacturing base, advanced logistics infrastructure, and high level of automation. Companies in Germany often relied on 4PL providers to help manage increasingly complex industrial supply chains, especially in the automotive and machine industries. Germany's digital systems, smart warehouse facilities, and stable trade environment promoted continuous operations. Germany also invested heavily in the green transportation space as well as data tools, which kept it ahead of the game in technologically advanced supply chain management within the region today.

Why did Latin America grow rapidly in the Fourth Party Logistics Market?

Latin America performed strongly as increasing output, nearshoring, and e-commerce expansion have pushed companies to reformulate their supply chain planning. 4PL providers assisted companies in managing long transport times, inconsistent infrastructure, and customs delays. Countries invested more in logistics technology, while also increasing digital adoption. The region presented significant opportunities in retail, automotive, and consumer goods, with companies focusing on total integration and improved cost control during the planned growth in the coming years.

Brazil Fourth Party Logistics Market Trends

Brazil led the way because it was the biggest economy and had strong industrial production with a growing logistics technology ecosystem. Companies needed 4PL providers to handle long-distance transport, increasing e-commerce orders, and infrastructure challenges. The region witnessed investment in tracking technologies, upgrading warehouses, or modernizing transport to facilitate better planning as companies expanded their operations. Brazil's emphasis on resilience and sustainability had its 4PL partners delivering more seamless operations and planning across multiple business sectors in its region.

Why did the Middle East & Africa Region have a Considerable Growth Rate in the fourth-party logistics Market?

The Middle East & Africa region had considerable growth because rising trade, larger retail markets, and big infrastructure projects increased the need for structured logistics planning. Businesses employed 4PL providers to tackle long routes, fragmented networks, and border issues. Further, advancements in digital capabilities and investments in ports, free trade zones, and transport hubs fueled the growth of logistics in the region. The region continues to present strong possibilities in energy, construction, and consumer goods throughout the larger market region in the upcoming years.

The UAE Fourth Party Logistics Market Trends

The United Arab Emirates led the region, given that it has advanced ports, top-tier free-trade zones, and strong digital capabilities in logistics. Companies relied on 4PL partners to manage trade flows between Asia, Europe, and Africa. The UAE invested in smart warehousing, automation, and modern customs systems. The UAE's advantageous location, air links, and stable rules of business contributed to strengthened leadership in efficient supply chain management throughout the region today.

Fourth Party Logistics Market Companies

- Allyn International Services, Inc.

- United Parcel Service, Inc.

- GEFCO Group

- XPO Logistics, Inc.

- Deutsche Post AG

- DB Schenker

- DAMCO

- Logistics Plus Inc.

- GEODIS

- CEVA Logistics AG.

Companies Contribution

- A. P. Moller – Maersk uses its worldwide logistics footprint for delivering integrated 4PL services. Their investments in digital platforms and sustainability initiatives make their leaders' position stronger. Maersk's capability to manage complex global supply chains guarantees high customer satisfaction.

- CEVA Logistics has 4PL solutions customized for various industries. Their high capability of focusing on technology integration and strategic partnerships promotes operations efficiency. CEVA is known for its global market and innovative services, making it among the top competitors.

- Kuehne + Nagel International is an expert in integrating 4PL services into higher digital platforms. Their ability to implement data analytics and automation enhances supply chain transparence and efficiency. Their worldwide presence helps them meet different market needs.

Recent Developments

- In November 2024, C.H. Robinson trumpeted the launch of its Managed Solutions, an integrated logistics management platform that converged the TMS technology with 3PL and 4PL services to respond to the increasing need for agile and transparent logistics solutions.

- In November 2024, Redwood enhanced the logistics services and Harbison-Walker International and stressing the cost savings and offering an advanced solution on transportation management to guarantee delivery of the materials in excess of 130 million pounds of refractory products in a year.

- In April 2024, XPO teamed up with UPL and presented a 4PL solution by using the Key-PL platform. XPO now controls transport orders as a 4PL across Europe and helps UPL optimize supply flows in the supply chain.

- In January 2023, Leidos acquired 1901 Group, a provider of cybersecurity, digital modernization, managed IT services, and cloud solutions for commercial and federal customers. The acquisition added 400 IT, cloud, and cyber specialists to the Leidos team and strengthened its position in the fourth party logistics market.

- In December 2023, The National Défense Authorization Act aims to protect the national security and economic interests of the U.S. by restricting the involvement of foreign adversaries, such as China and Russia, in the supply chain of the DoD. The NDAA also supports the modernization and innovation of the defense infrastructure and capabilities by promoting the use of data centers, drones, and intelligence technologies.

Segments Covered in the Report

By Type

- Synergy Plus Operating Model

- Industry Innovator Model

- Solution Integrator Model

By End-user

- Manufacturing

- Retail

- Healthcare

- Automotive

- Other

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344