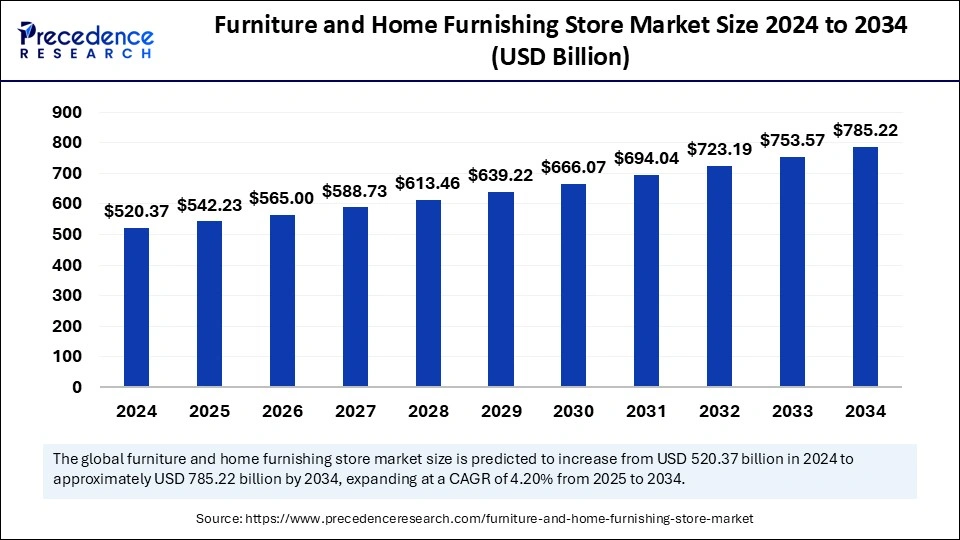

Furniture and Home Furnishing Store Market Size and Forecast 2025 to 2034

The global furniture and home furnishing store market size accounted for USD 520.37 billion in 2024 and is predicted to increase from USD 542.23 billion in 2025 to approximately USD 785.22 billion by 2034, expanding at a CAGR of 4.20% from 2025 to 2034. The market is experiencing steady growth, driven by rising demand for stylish, functional, and affordable home furnishings. Consumers are increasingly investing in home improvement and renovation projects, fueling sales in both furniture and building materials. The growing popularity of online shopping and omnichannel retail strategies is also reshaping how customers purchase furniture and home improvement products.

Furniture and Home Furnishing Store Market Key Takeaways

- Asia Pacific led the furniture and home furnishing store market by holding the largest share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the furniture stores segment held the largest market share in 2024.

- By type, the home furnishing stores segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By ownership, the retail chains segment held the major market share in 2024.

- By ownership, the independent stores segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By store type, the exclusive/retail showrooms segment contributed the biggest market share in 2024.

- By store type, the inclusive retailers/dealer stores segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

How Artificial Intelligence (AI) Elevates Customer Experience?

Artificial intelligence is significantly reshaping the furniture and home furnishing store market by enhancing both product offerings and customer service. AI-powered design tools enable consumer to visualize furniture in their spaces using augmented reality, making the shopping experience more interactive and personalized. Smart algorithms are also improving inventory management and supply chain efficiency, ensuring faster delivery and reducing stock shortages.

Additionally, predictive analytics helps retailers anticipate design trends and customers' needs, allowing for more targeted product development and marketing strategies. Recent developments include the use of AI in 3D printing furniture components, promoting sustainable and customized manufacturing solutions. On the services front, AI-driven chatbots and virtual assistants provide instant customer support, guiding buyers through product selections based on personal preferences and purchase history.

- IEKA launched its AI-driven interior design app, which helps customers visualize furniture in their homes using augmented reality. The app uses AI algorithms to offer personalized product recommendations based on room size, lighting, and customer preference.

Market Overview

The furniture and home furnishing store market is experiencing a steady growth, driven by increasing urbanization, rising disposable incomes, and evolving consumer preferences for sustainable and AI-powered solutions. The demand for customized, smart, and eco-friendly furniture is shaping the industry, while e-commerce and AI-powered retail experiences are revolutionizing traditional shopping.

Product Launched Around the Globe

| Country | Company | Product |

| Sweden | IKEA | Launched a new AI-powered interior design app, uses AI and AR for real-time room visualization. |

| U.S. | Wayfair's smart home collection | introduced AI-integrated furniture with built-in sensors for smart living. |

| China | Ashleys furniture | Released ai-predictive supply chains, it enhances production efficiency and demand forecasting. |

| U.S. | Lowe's smart | Launched AI-assisted in-store shopping for DIY and home improvement projects. |

| China | Tmall Home's | A customized platform enables tailored product designs based on consumer preferences. |

Furniture and Home Furnishing Store Market Growth Factors

- Smart home integration: Consumers are demanding AI-powered furniture that enhances comfort and convince.

- E-commerce and augmented reality shopping: the rise of virtual shopping experiences allows customers to visualize products before purchasing.

- Sustainability and eco-friendly materials: increasing consumer preference for recycled, non-toxic, and energy-efficient materials.

- Urbanization and compact living trends: The rise in apartment living is fueling demand for multi-functional and space-saving furniture.

- AI-powered supply chain: Retailers are leveraging AI for better inventory management, predictive analytics, and tailored recommendations.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 785.22 Billion |

| Market Size in 2025 | USD 542.23 Billion |

| Market Size in 2024 | USD 520.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.20% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Ownership, Store Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for sustainable and eco-friendly products

A major driver of the furniture and home building store market is the growing demand for sustainable and eco-friendly products. With increasing awareness about environmental conservation, consumers are opting for furniture made from recycled materials, FSC-certified wood, and low-emission manufacturing processes. Additionally, AI and smart technologies are transforming the shopping experience, offering virtual room planners, augmented reality/virtual reality for product visualization, and personalized design recommendations, making the buying process more engaging and convenient. The rise in urbanization and disposable incomes, especially in emerging economies like India and China, is further boosting the market, as people are investing in modern and compact furniture solutions tailored for urban living.

- In March 2025, IKEA announced its partnership with Adobe's AI platform to enhance its virtual design studio, allowing customers to create hyper-personalized room setups from their homes.

Restraint

High cost of premium and smart furniture

Despite these positive trends, the furniture and home furnishing store market faces challenges, particularly the high cost of premium and smart furniture. Products that incorporate AI features or sustainable materials often come with a higher price tag, limiting accessibility for middle- and lower-income consumers. Another restraint is the complexity and cost of logistics and supply chain management, especially for large or customized products. Furthermore, rising raw material costs and fluctuations in supply chains, exacerbated by geopolitical tensions, impact pricing and product availability.

- In January 2025, Wayfair launched an AI-powered furniture customization tool that uses machine learning to recommend color schemes and furniture arrangements based on customer preferences and space constraints.

Opportunity

Sustainability and eco-friendly furniture

One of the most significant opportunities in the furniture and home furnishing store market is the rising demand for sustainable and eco-friendly furniture. Consumers are becoming increasingly conscious of environmental impact, leading to a surge in preference for furniture made from recycled materials, responsibly sourced wood, and non-toxic finishes. Brands are responding by introducing carbon-neutral production processes, biodegradable materials, and energy-efficient manufacturing.

- In March 2025, Governments worldwide are promoting green certification programs and tax incentives for sustainable furniture brands, boosting investments in this sector. The second-hand and refurbished furniture market is growing rapidly, driven by circular economy initiatives and rising consumer interest in upcycled home décor.

Type Insights

The furniture stores segment held the largest furniture and home furnishing store market share in 2024, driven by the steady demand for high-quality, durable furniture across residential and commercial spaces. Consumers are increasingly investing in premium furniture, custom-made designs, and sustainable materials, reinforcing the segment's stronghold.

However, the home furnishing stores segment is anticipated to grow at a remarkable CAGR between 2025 and 2034, fueled by the rising trend of home décor, DIY aesthetics, and smart home solutions. The increasing popularity of modular and space-saving furniture, coupled with e-commerce integration, has significantly contributed to the rapid expansion of this segment.

Ownership Insights

The retail chains segment held the largest furniture and home furnishing store market share in 2024, leveraging their well-established brand presence, extensive supply chains, and digital transformation strategies. Leading brands are expanding their omnichannel presence, offering both online and offline shopping experiences to cater to evolving consumer expectations.

On the other hand, the independent stores segment is anticipated to grow at a remarkable CAGR between 2025 and 2034, capitalizing on the demand for personalized shopping experiences and unique product selections. The growing preference for local craftsmanship, bespoke furniture, and community-driven businesses has propelled their expansion.

Store Type Insights

The exclusive/retail showrooms segment held the largest furniture and home furnishing store market share in 2024, attracting customers seeking premium, high-end, and customizable furniture solutions. These showrooms are integrating technology-driven experiences, such as virtual room planners and augmented reality, to enhance customer engagement.

Meanwhile, the inclusive retailers/dealer stores segment is anticipated to grow at a remarkable CAGR between 2025 and 2034, thanks to their affordability, diverse product offerings, and ability to cater to a wide range of customer preferences. The shift toward hybrid retail models, where physical stores complement online sales, has played a crucial role in driving the expansion of this segment.

Regional Insights

Is Asia Pacific Transforming Global Furniture Demand?

Asia Pacific led the furniture and home furnishing store market by holding the largest share in 2024 due to urbanization, rising disposable incomes, and expansion of the middle class, particularly in China and India. Consumers in this region are rapidly adopting modern, space-saving, and multifunctional furniture to suit compact urban living spaces. E-commerce channels are booming, making furniture more accessible, especially in tier-2 and tier-3 cities. China leads in manufacturing and consumption, with an emphasis on affordable, eco-friendly furniture.

- India's Pepperfry expanded its experience studios across major cities and partnered with local artisans to promote handcrafted wooden furniture under the “Made in India” initiative, and China's Red Star Macalline launched a virtual reality furniture showroom, enhancing customer experience.

North America: Fastest Growing Furniture Trends

North America is estimated to expand the fastest CAGR in the furniture and home furnishing store market between 2025 and 2034, driven by high consumer spending, a strong inclination toward premium and customized furniture, and the rise in eco-friendly and smart home products. The U.S. market is highly influenced by sustainability trends, with major players offering FSC-certified wood furniture and energy-efficient home solutions. United States is a key player due to a well-established retail infrastructure, growing online furniture sales, and consumer preference for modern and multifunctional furniture.

- IKEA U.S. announced an expansion of its smart furniture lines that integrate wireless charging and voice-controlled lighting features into beds and desks.

Can Europe Redefine Sustainable Furniture Solutions?

The European furniture and home furnishing store market is expected to grow at a considerable rate in the upcoming period. It is highly mature regarding sustainable furniture production and design innovation. Countries like Germany and Sweden lead in green furniture initiatives, with customers preferring products made from recycled materials and low-carbon manufacturing. Germany focused on minimalist, high-quality furniture, with strong environmental regulations driving sustainable design.

- IKEA Sweden unveiled its circular furniture program, where customers can rent or return furniture for recycling, aligning with the EU's circular economy action plan

Furniture and Home Furnishing Store Market Companies

- IKEA

- Ashley Furniture Industries Inc.

- RH (Restoration Hardware)

- Williams-Sonoma, Inc.

- La-Z-Boy Inc.

- Raymour & Flanigan

- American Signature

- Oppein Home Group Inc.

- Jason Furniture (HangZhou) Co., Ltd

- Steelcase Inc

Recent Development

- In March 2024, Five Corners Furniture & Appliances announced a refreshing approach to home furnishing where personalization meets quality. The store features renowned names like Ashley Furniture and sought-after Canadian-made brands like Stylus, known for its craftsmanship and customizability.

Segments Covered in the Report

By Type

- Furniture stores

- Home furnishing stores

By Ownership

- Retail Chains

- Independent stores

By Store type

- Exclusive/Retail Showrooms

- Inclusive Retailers/Dealers Store

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content