August 2024

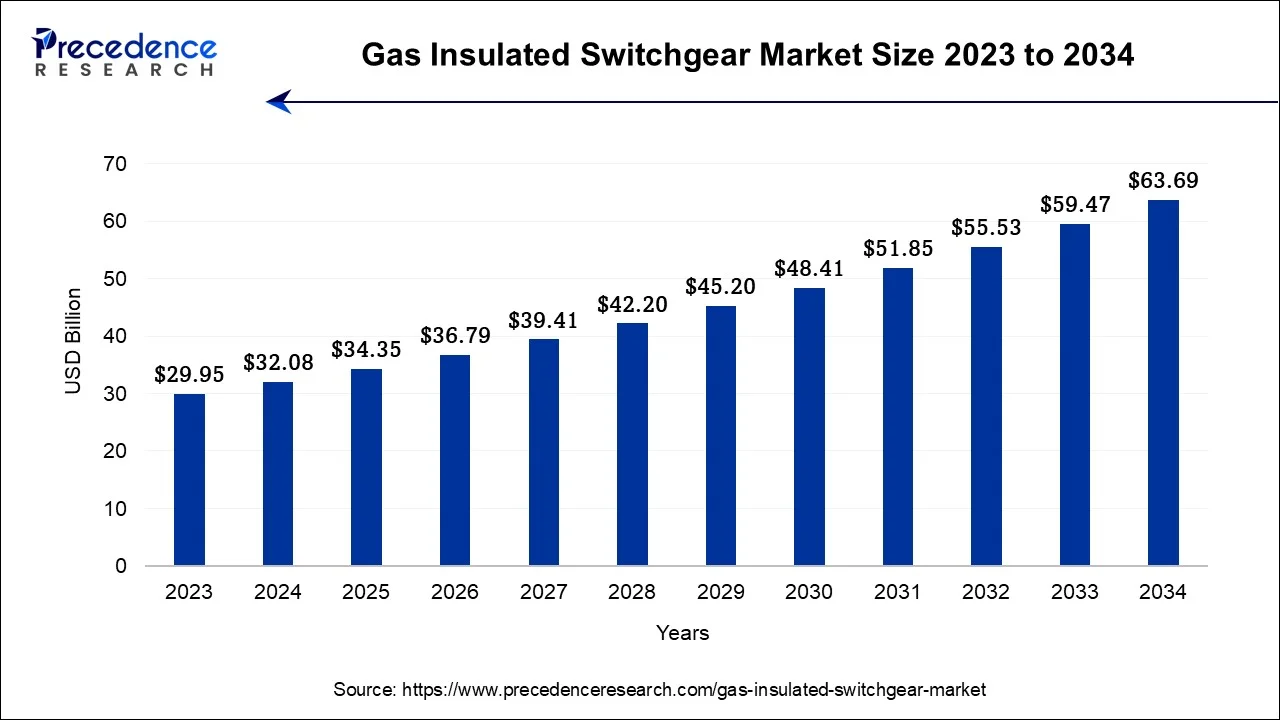

The global gas insulated switchgear market size accounted for USD 32.08 billion in 2024, grew to USD 34.35 billion in 2025 and is projected to surpass around USD 63.69 billion by 2034, representing a healthy CAGR of 7.10% between 2024 and 2034.

The global gas insulated switchgear market size is estimated at USD 32.08 billion in 2024 and is anticipated to reach around USD 63.69 billion by 2034, representing a notable CAGR of 7.10% from 2024 and 2034.

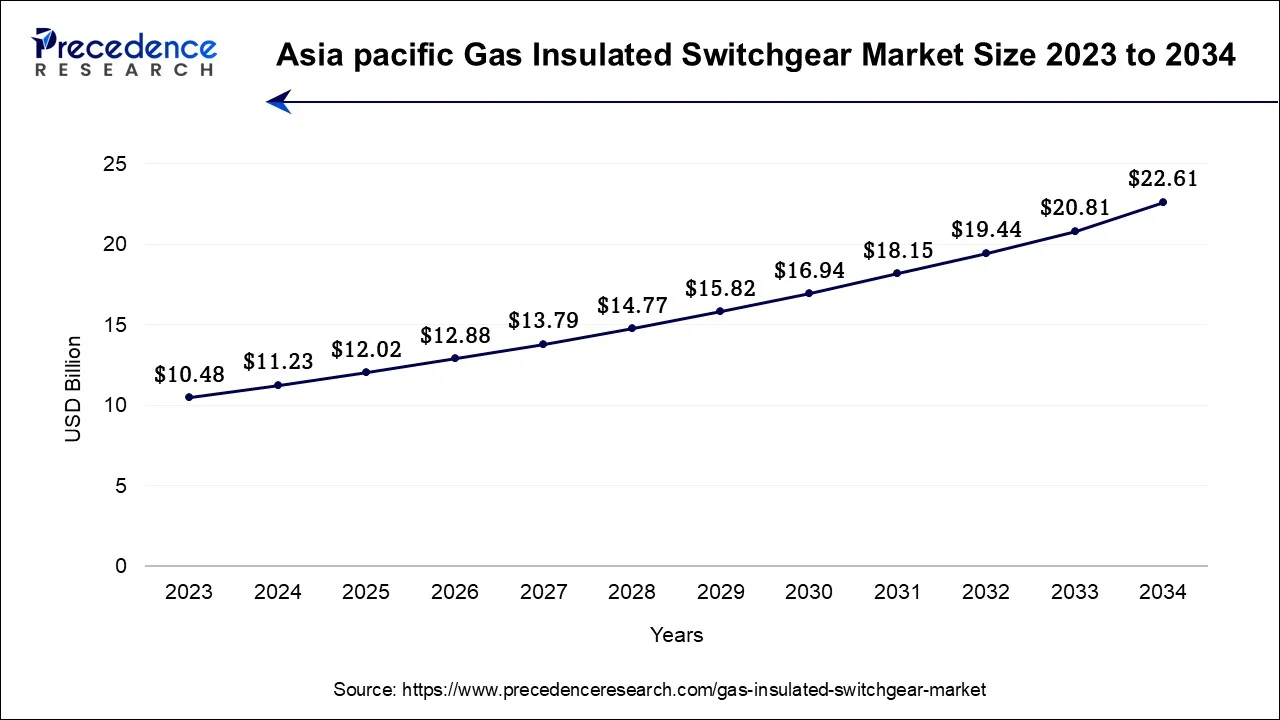

The Asia-Pacific gas insulated switchgear market size was valued at USD 11.23 billion in 2024 and is estimated to reach around USD 22.61billion by 2034, growing at a CAGR of 7.24% from 2024 to 2034.

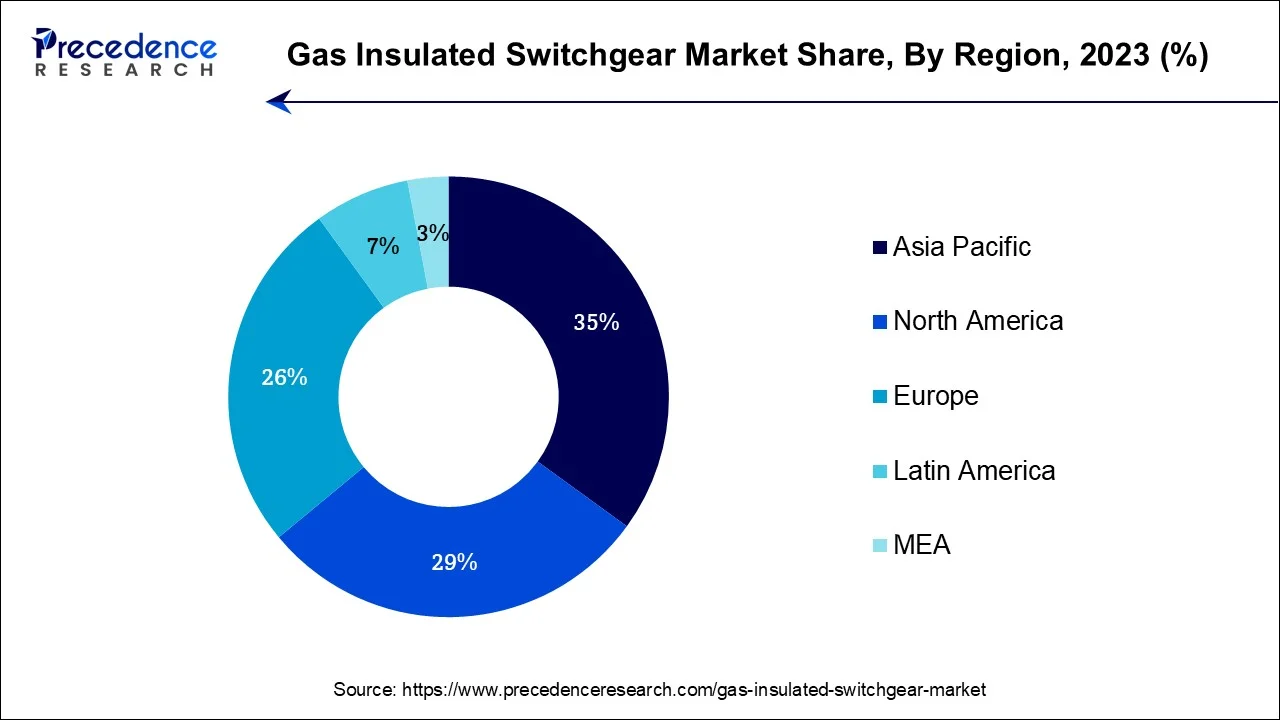

Asia-Pacific has held the largest revenue share 35% in 20223. The Asia-Pacific region commands a significant share in the gas-insulated switchgear (GIS) market due to several key factors. Rapid urbanization, industrialization, and infrastructure development in countries like China and India are driving substantial demand for reliable electrical distribution systems, where GIS technology excels. Moreover, government initiatives to enhance electricity access and grid reliability contribute to GIS market growth. The Asia-Pacific region's large population and expanding economies underscore the necessity for robust power infrastructure, making it a major contributor to the GIS market's share.

North America is estimated to observe the fastest expansion. North America holds a significant growth in the gas insulated switchgear (GIS) market due to several factors. The region has a mature and technologically advanced electrical infrastructure that necessitates regular upgrades and modernization. Additionally, stringent environmental regulations have accelerated the adoption of eco-friendly SF6 alternatives, driving demand for GIS systems. The region's focus on renewable energy integration and grid reliability further supports GIS market growth. Furthermore, the presence of major GIS manufacturers and ongoing investments in smart grid technologies contribute to North America's dominance growth in the market.

The gas insulated switchgear market encompasses a sector within the electrical power industry, specializing in the production, distribution, and maintenance of high-voltage switchgear systems that utilize sulfur hexafluoride (SF6) gas as an insulating agent. GIS systems present compact and highly efficient solutions for electrical substations and power distribution networks, resulting in reduced space requirements and a diminished environmental footprint. This market has experienced expansion driven by factors such as growing urbanization, heightened demand for dependable electricity supply, and a heightened focus on curbing greenhouse gas emissions. Key industry players comprise ABB, Siemens, Schneider Electric, Hitachi, and others.

The gas insulated switchgear market is a pivotal segment within the electrical power industry, responsible for the development, distribution, and maintenance of high-voltage switchgear systems that employ sulfur hexafluoride (SF6) gas as an insulating medium. These GIS systems offer compact, efficient solutions for electrical substations and power distribution networks, addressing space constraints while reducing environmental impact.

The GIS market has witnessed robust growth attributed to several key industry trends and growth drivers. Firstly, the surge in urbanization across the globe has led to a rising demand for reliable electricity supply in densely populated areas, necessitating advanced GIS solutions. Secondly, the industry's focus on reducing greenhouse gas emissions aligns perfectly with SF6 gas's lower environmental footprint, driving its adoption.

Additionally, the increasing integration of renewable energy sources into power grids has spurred the demand for GIS systems to manage fluctuating power inputs effectively. Furthermore, the need for grid modernization to enhance resilience and minimize downtime during adverse weather conditions has accelerated GIS system deployments.

Several factors contribute to the ongoing expansion of the GIS market. The compact nature of GIS systems makes them particularly appealing, as they require less physical space compared to traditional air-insulated switchgear. Moreover, their high reliability and low maintenance requirements make them an attractive option for utilities seeking cost-effective solutions. The growing emphasis on energy efficiency and the ability of GIS to minimize transmission losses further enhance their market prospects. Additionally, governments' investments in infrastructure development and the expansion of power grids in emerging economies are stimulating market growth.

Despite its growth potential, the GIS industry faces certain challenges. One significant challenge is the high initial investment required for the installation of GIS systems. Moreover, the environmental concerns associated with SF6 gas, which has a potent greenhouse effect, have prompted regulatory scrutiny and the exploration of alternative insulation gases. Businesses operating in this sector must navigate these regulatory challenges and invest in research and development to stay competitive.

However, amid these challenges, numerous business opportunities abound. The development of eco-friendly, SF6-free GIS systems represents a promising avenue for innovation and market expansion. Additionally, the increasing adoption of digital technologies and smart grid solutions within the GIS sector opens doors for value-added services and enhanced system monitoring and control. As the global demand for electricity continues to witness growth, the GIS market is expected to witness steady expansion, driven by its efficiency, reliability, and adaptability to evolving energy landscapes.

In summary, the Gas Insulated Switchgear market is experiencing robust growth driven by urbanization, environmental considerations, renewable energy integration, and grid modernization efforts. While challenges like high upfront costs and environmental concerns exist, innovative solutions and regulatory compliance offer promising business opportunities for those in the GIS industry.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.10% |

| Market Size in 2024 | USD 32.08 Billion |

| Market Size by 2034 | USD 63.69 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Installation, By Voltage, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Urbanization and infrastructure development

The expansion of urbanization and the simultaneous development of infrastructure are acting as primary catalysts propelling the growth of the gas insulated switchgear (GIS) market. With an increasing global population gravitating toward urban centers, there emerges an escalating requirement for robust and dependable electrical distribution systems to cater to the burgeoning needs of these expanding cities. Urban landscapes come with inherent spatial limitations, demanding electrical infrastructure solutions that are not only efficient but also space-saving.

GIS systems emerge as the favored choice due to their streamlined design, effectively utilizing the limited urban real estate. Their compactness becomes pivotal in fulfilling the electricity demands of densely populated urban zones. Moreover, infrastructure development initiatives, encompassing the establishment of new commercial and residential structures, industrial complexes, and transportation networks, necessitate the installation of state-of-the-art electrical grids.

GIS systems shine in this regard, as they are adept at managing high-voltage power distribution in these new developmental projects, guaranteeing a stable and uninterrupted power supply. In summation, urbanization and infrastructure development are acting as potent drivers of the GIS market by creating a substantial demand for electrical distribution solutions that are not only efficient and dependable but also tailored to fit the spatial constraints inherent to rapidly growing urban environments and contemporary infrastructure endeavors.

Environmental concerns

Environmental apprehensions are acting as a substantial impediment to the expansion of the gas insulated switchgear market. The central issue revolves around the utilization of sulfur hexafluoride (SF6) gas as the insulation medium in GIS systems. SF6 is notorious for its exceptionally high global warming potential, making it thousands of times more potent than carbon dioxide. As the global community intensifies its efforts to combat climate change and curtail greenhouse gas emissions, there is a heightened focus on controlling SF6 emissions originating from GIS operations.

Rigorous environmental regulations and emissions reduction targets are exerting pressure on GIS manufacturers and users to curtail SF6 leakage and explore more ecologically responsible alternatives. This transition towards environmentally conscious practices often entails substantial retrofitting costs and technological upgrades, which can affect the economic viability of GIS solutions.

Furthermore, environmental concerns can impact the image and reputation of companies associated with SF6-based GIS systems, potentially resulting in public relations challenges and influencing decision-makers to explore greener insulation alternatives. As a result, these environmental considerations are prompting the GIS industry to innovate and pivot toward insulation technologies that are more sustainable and environmentally friendly.

SF6 alternatives development

The development of alternatives to sulfur hexafluoride (SF6) insulation gas is catalyzing substantial opportunities within the gas insulated switchgear market. Growing environmental concerns and stringent regulations regarding SF6's high global warming potential have prompted intensive research and innovation in pursuit of more eco-friendly insulation solutions. Companies investing in and successfully commercializing SF6-free alternatives, such as dry air, fluoronitrile-based gases, or solid-state technologies, are poised to capture a significant market share by offering environmentally responsible GIS systems.

These alternatives not only address environmental apprehensions but also position manufacturers to align with evolving sustainability goals and compliance requirements. As the demand for greener and more sustainable energy solutions escalates, GIS manufacturers embracing SF6 alternatives are well-positioned to meet market needs, gain a competitive edge, and contribute to the transition towards cleaner and more environmentally responsible power infrastructure.

Impact of COVID-19

The COVID-19 pandemic disrupted the gas insulated switchgear (GIS) market in several ways. Supply chain disruptions, factory closures, and logistical challenges led to delays in production and project implementations. Additionally, reduced economic activity and uncertainty in many regions temporarily slowed down investments in electrical infrastructure projects. However, the pandemic also highlighted the importance of reliable electrical grids for remote work and essential services, potentially driving future demand for GIS systems. Moreover, the crisis prompted a renewed focus on digitalization and remote monitoring, which could accelerate the adoption of smart GIS solutions in the post-pandemic landscape.

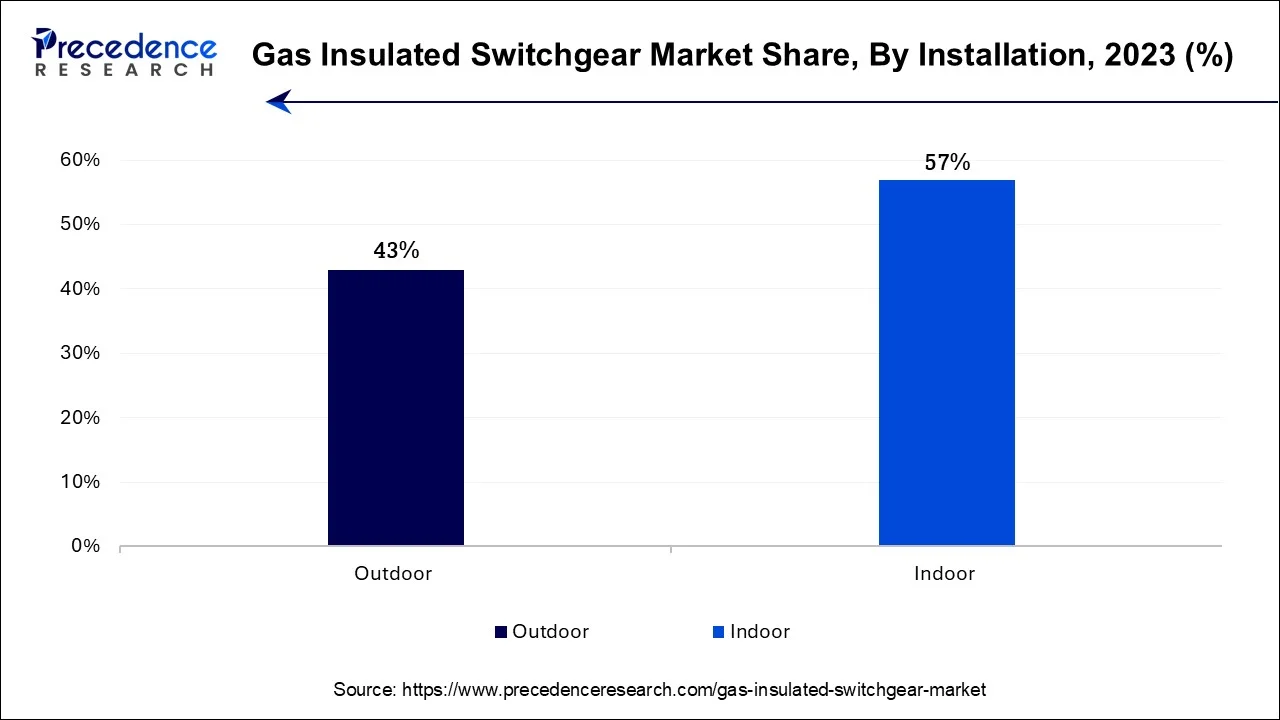

According to the installation, the outdoor sector has held 43% revenue share in 2023. The outdoor segment holds a major share in the gas insulated switchgear (GIS) market due to several factors. Firstly, outdoor GIS systems are widely used in high-voltage applications, such as substations and power transmission, where their robust construction and insulation capabilities are essential. Additionally, they offer cost-effective solutions for expanding electrical infrastructure in open spaces, making them preferable for utility companies. Furthermore, outdoor GIS systems are often chosen for their ability to withstand harsh weather conditions, ensuring reliable power distribution in various environments. This combination of factors contributes to the outdoor segment's significant market share.

The indoor sector is anticipated to expand at a significantly CAGR of 8.7% during the projected period. Indoor GIS systems offer enhanced safety and protection against environmental factors, making them ideal for densely populated urban areas and critical infrastructure. Their compact design makes efficient use of limited indoor space. Additionally, indoor GIS systems are easier to maintain and service. As urbanization continues and space constraints persist, the demand for indoor GIS solutions remains high, especially in areas where reliability, safety, and efficient space utilization are paramount.

In 2023, the 170 kV - 550 kV segment had the highest market share of 36% on the basis of the Voltage. The 170 kV to 550 kV segment holds a significant share in the gas insulated switchgear (GIS) market due to its critical role in high-voltage electrical transmission and distribution networks. This voltage range is commonly used in large-scale power infrastructure, substations, and grid interconnections. The need for efficient and compact solutions in these high-voltage applications drives the demand for GIS systems, which offer space-saving designs, enhanced reliability, and reduced transmission losses. As power demand grows and grid modernization continues, the 170 kV to 550 kV segment remains essential, ensuring a reliable and stable electricity supply for industrial, commercial, and residential users.

The above 550 kV is anticipated to expand at the fastest rate over the projected period. The above 550 kV segment holds a major growth in the gas insulated switchgear (GIS) market due to its critical role in transmitting large volumes of electricity over long distances with minimal losses. High-voltage GIS systems are indispensable in interconnecting power grids, supporting renewable energy transmission, and ensuring grid stability. As global electricity demand grows, particularly in megacities and industrial hubs, the need for reliable, high-capacity electrical infrastructure increases, making the above 550 kV GIS segment a preferred choice. These systems offer enhanced efficiency, reduced land requirements, and environmental benefits, further solidifying their growth in the market.

The utility segment held the largest revenue share of 30% in 2023. The utility segment holds a major share in the gas insulated switchgear (GIS) market due to its critical role in electrical power distribution. Utilities are responsible for supplying reliable electricity to homes, industries, and commercial establishments. GIS systems offer compact, high-performance solutions that meet the stringent reliability and efficiency demands of utility companies. They are vital for enhancing grid stability, reducing transmission losses, and accommodating renewable energy integration, all of which are essential in the evolving energy landscape. As utilities continually invest in infrastructure upgrades and grid modernization, the GIS market continues to thrive in response to their specific needs.

The retail and consumer goods sector is anticipated to grow at a significantly faster rate, registering a CAGR of 15.9% over the predicted period. The industrial segment holds a substantial growth in the gas insulated switchgear (GIS) market due to its critical need for efficient and reliable electrical distribution solutions. Industries require uninterrupted power supply to maintain production processes, and GIS systems offer compact, dependable, and space-saving solutions. They are well-suited for industrial applications where space constraints are prevalent. Additionally, the increasing integration of renewable energy sources and the need for grid modernization in industrial areas further boost the demand for GIS systems, making the industrial segment a major contributor to the market's growth.

Segments Covered in the Report

By Installation

By Voltage

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025