Gas Turbine Market Size and Forecast 2025 to 2034

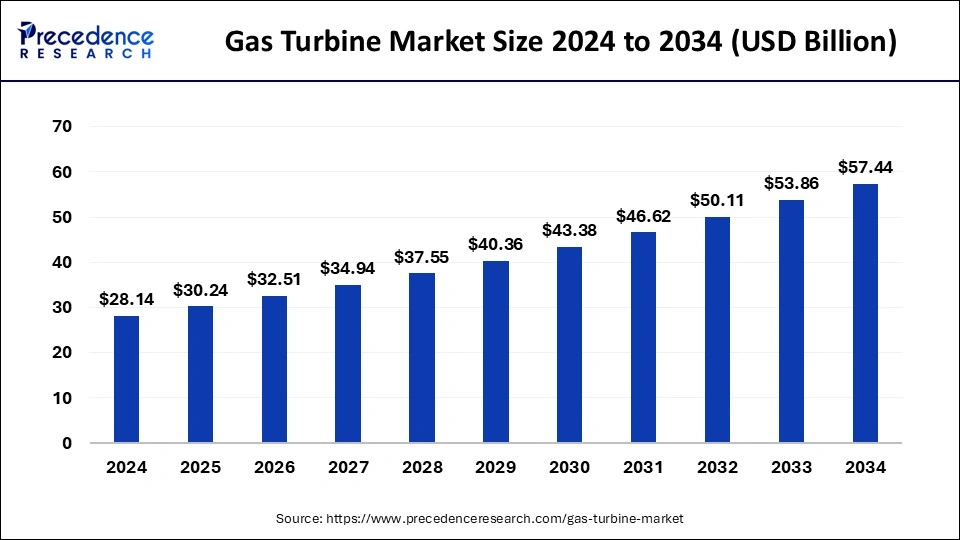

The global gas turbine market size is calculated at USD 30.24 billion in 2025 and is predicted to increase from USD 32.51 billion in 2026 to approximately USD 61.13 billion by 2035, expanding at a CAGR of 7.29% from 2026 to 2035.

Gas Turbine MarketKey Takeaways

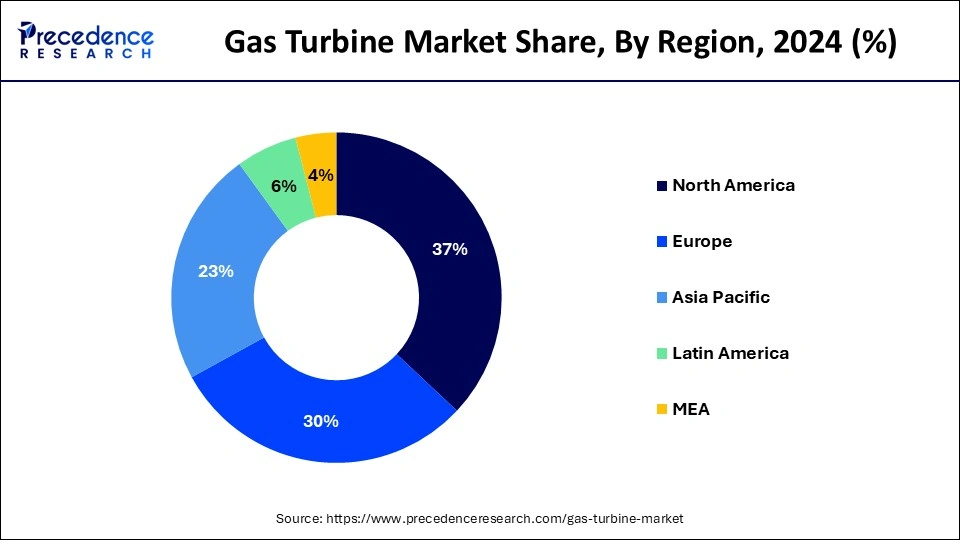

- Asia Pacific has held approximately 37% of the total revenue share in 2025.

- By capacity, the>200 MW segment had a significant revenue share of 66% in 2025.

- By technology, the combined cycle turbines sector has the highest revenue share 74% in 2025.

- By end use, the power & utility segment held a revenue share of over 82% in 2025.

- The aero-derivative segment is growing at 9% of CAGR from 2025 to 2035.

Major Trends in the Gas Turbine Market:

- Shift to Greener Energy Sources: Countries are decommissioning coal and nuclear plants in favour of gas turbines, which emit fewer pollutants and offer better energy efficiency.

- Escalating Power Demand: Industrial growth, urban expansion, and the surge in AI-driven data centres are significantly increasing electricityconsumption, prompting investments in dependable power generation like gas turbines.

- Cutting-edge Technologies: Breakthroughs in turbine materials, cooling systems, and combustion methods are enhancing operational efficiency and environmental performance.

- Synergy with Renewables: Gas turbines are being increasingly integrated with renewable energy systems to ensure a consistent power supply and reduce dependence on fossil fuels.

Market Outlook

- Market Overview: The gas turbine market is growing due to rising demand for reliable power generation, expansion of natural gas infrastructure, and the transition toward cleaner energy sources. Increasing use of gas turbines in combined-cycle power plants and industrial applications is further driving market growth.

- Major Investors: Major investors include power generation companies, oil and gas firms, and leading turbine manufacturers, who invest in R&D, capacity expansion, and high-efficiency turbine technologies. Their investments support the development of low-emission, high-performance turbines and the modernization of existing power infrastructure.

- Global Expansion: The market is expanding globally, supported by power sector upgrades in North America, Europe, and Asia Pacific. Emerging regions such as the Middle East, Africa, and Latin America offer strong opportunities due to growing electricity demand, industrialization, and investments in new power plants.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 30.24Billion |

| Market Size in 2026 | USD 32.51 Billion |

| Market Size by 2035 | USD 61.13Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.29% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Technology, Capacity, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for energy

According to the Energy Information Administration of the United States, the electricity consumption in the United States increased by 3% in 2022. Whereas according to the International Energy Agency, China's share in renewable generation will increase by 45% in the period 2023-2025. While the same report suggests that China's share for global electricity consumption will rise to one-third by 2025.

The increasing global demand for electricity and energy in general drives the demand for efficient and reliable power generation technologies, with gas turbines being one of them. Gas turbines are often used as backup or peaking power sources to complement intermittent renewable energy sources like solar and wind, providing grid stability when renewable generation fluctuates. Gas turbines are commonly fueled by natural gas, which is becoming more accessible and cost-effective due to advancements in extraction techniques like fracking. Fluctuations in natural gas prices can affect the attractiveness of gas turbines. The global population continues to increase, leading to more households and more people needing energy for daily activities, such as lighting, cooking, heating, and cooling. Thus, the rising demand for energy across the globe is observed as a driver for the gas turbine market.

Restraint

Environmental concerns

The emissions generated during the combustion process is observed to hamper the growth of the global gas turbine market. Gas turbines release greenhouse gases, nitrogen oxides and other particulate matter, which contribute to air pollution and climate change. Stricter environmental regulations and public pressure to reduce these emissions can lead to increased compliance costs and potential limitations on the use of gas turbines. This can impact the market's growth and attractiveness as more sustainable and cleaner energy alternatives are sought. Thus, environmental concerns are observed to restrain the market's growth.

Opportunity

Rising emphasis on hybrid power plants

In 2025, China aims to generate power with capacity of 2 billion kilowatt per hour under its largest project of hydro power which aims to generate electricity from photovoltaic and hydro powers. The country also aims to achieve carbon neutrality by 2060.

Similarly, multiple countries are focused on the integration of hybrid power plants for power generation. This element brings multiple opportunities for the market to grow. The development of hybrid power plants requires innovation in control systems, integration technologies, and energy storage solutions. Gas turbine manufacturers can invest in research and development to stay competitive in this evolving market and to refine the integration of various energy sources. Gas turbine manufacturers can expand their product offerings by incorporating hybrid solutions. This diversification allows them to cater to a wider range of customer needs, from those focused-on efficiency to those prioritizing sustainability and grid stability.

Challenge

Fluctuating fuel prices

Fluctuating fuel prices pose a challenge for the gas turbine market because gas turbines rely on fossil fuels like natural gas or diesel for operation. When fuel prices are volatile, it becomes challenging for businesses and industries to accurately predict and manage their operational costs. High fuel prices can lead to increased operating expenses and reduced profitability for gas turbine operators. Moreover, unpredictable fuel costs make it harder for investors to assess the long-term viability and return on investment of gas turbine projects, potentially affecting the willingness to invest in new installations or upgrades.

Segment Insights

Capacity Insights

Among different capacity segment of gas turbine market, 50 kW - 500 kW capacity is expected to observe an annual deployment of over 2 GW by 2034. Continuing progressions due to budding combustor technology, durability and operating range in line with extension of effective re-generative systems to endure high heat necessities may further accelerate the product penetration. Furthermore, rising preference toward combined cycle power generation plants due to high operational performance, reliability and high efficiency would further spur industry prospects.

Application Insights

Using locally available fuels to produce power is a crucial constraint in upstream oil operations, as services are regularly located in remote places. Gas turbines demonstrate economical and efficient solution of power distribution in plants. Demand in the power generation sector is anticipated to progress at significant rate over the estimate period.

Technology Insights

In 2024, combined cycle turbines technology segment accounted for more than to over 74% share of total revenue of the market. This technology segment is probable to observe the almost growth during years to come. These extremely effectual turbines need marginal consumption of fuel to yield the anticipated output and suggestively diminish transmission and distribution losses.

Regional Insights

Asia Pacific Gas Turbine Market Size and Growth 2026 To 2035

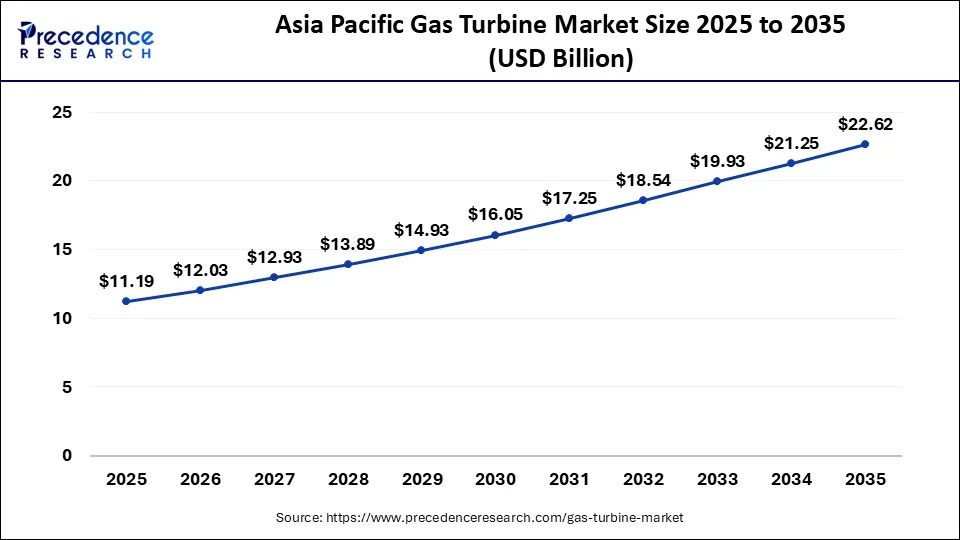

The Asia Pacific gas turbine market size is valued at USD 10.41billion in 2025 and is expected to be worth around USD 22.62 billion by 2035, growing at a CAGR of 7.29% from 2026 to 2035.

The gas turbine industry in Asia Pacific is predicted to surpass 10 GW annual installations by 2035. Easy approachability of raw material and constant incorporation of technologically advanced turbines are major factors rushing the product saturation. Escalating focus toward CCGT power technology plus upward applicability of gas-powered systems through drilling and extraction methods will promote product demand further. Middle East and Africa is projected to appear as another significant market in terms of capacity additions and orders. Cumulative demand can be credited to expanding inclination to gas-fired combined cycle plants in the local oil and gas sector.

The EU policymakers deliberate gas turbines more than a connecting technology to attain the 2034 targets till other technologies are developed. It is expected to propel the demand for gas turbines throughout the estimate period. Though, the release of methane and other harmful gases can pose a challenge to this growth in near future.

Asia Pacific is still a budding market nonetheless forceful infrastructure expansion commenced by governments is anticipated to offer the market a momentous boost. India is also growing its focus on the utilization of cleaner resources. Further, China's reliance on coal is foreseen to decline over the upcoming years, alongside its energy mix principally preferring clean energy resources.

China: China leads the Asia-Pacific gas turbine market with a 38.1% share as of 2023. The shift from coal-fired plants to natural gas infrastructure is propelled by pollution concerns and green policy frameworks.

Japan: Japan continues to expand its natural gas capacity to reduce dependency on nuclear energy post-Fukushima. Gas turbines play a central role in its energy diversification strategy.

India: India is witnessing moderate growth in this segment, focusing on industrial and residential energy use through LNG imports. Though facing competition from steam turbines, its interest in hydrogen-compatible turbines is growing

Growing concerns for GHG emissions in accordance with severe government regulations for the implementation of gas fired turbines over conventional power generating units is expected to propel the growth of gas turbine market. Growing energy demand in emerging countries as well as constant acceptance of renewables than traditional fuels is predicted to further reinforce the product integration. Technology enhancement has led upsurge in the production of shale gas and plans of numerous nations to phase out coal-based power generation and substitute them with the gas-fired power plant, is expected to flourish the market growth during years to come. Nevertheless, growing renewable deployment on account of superior competence of renewable-based power generation may hamper growth of gas turbine market in the coming years.

It is anticipated that in the coming years, electricity demand may grow by closely one-third of the current demand. Main gas producing regions including the U.S., Middle East, and Russia are observing a foremost revamp in their electricity generation groundwork to rapidly follow gas-based power generation. Noteworthy installations are also observed in Latin America, Southeast Asia, and Africa. As a result of these advancements, demand for gas turbine may increase in these regions during forecast period.

United States: The U.S. is the dominant force in the region, accounting for over 80% of the North American gas turbine market. Natural gas-powered plants generate the country's electricity, underscoring the nation's reliance on gas turbines for energy security and emissions control.

Canada: Holding roughly of the regional market, Canada is transitioning from coal to cleaner gas-powered solutions, spurred by environmental policies and energy reforms.

What Potentiates the Gas Turbine Market in Europe?

Over the years, the gas turbine market in Europe has experienced significant growth, driven by rising demand for efficient power generation and improvements in electricity distribution and grid control systems across both Eastern and Western Europe. These advancements have helped better differentiate baseload and steady-state power requirements. Additionally, government initiatives, such as a recent survey in Spain highlighting reduced emissions, resource conservation, and improved energy efficiency, have supported the phase-out of older plants and reduced reliance on coal, further boosting gas turbine adoption in European power generation.

Germany: Germany dominates the European gas turbine market, primarily due to its high electricity generation capacity and ongoing efforts to modernize the power sector. Over the years, the country has implemented initiatives to phase out aging power plants and reduce coal-related emissions, while newer digital and automation technologies are increasingly being adopted. This transition is driving greater use of AI in energy operations, making it a vital component of Germany's evolving energy sector.

How is the Opportunistic Rise of the Middle East & Africa in the Gas Turbine Market?

The Middle East & Africa (MEA) is experiencing an opportunistic rise in the market, driven by the development and adoption of advanced, large-scale gas turbine technologies. These high-efficiency, low-emission turbines are being increasingly used in power generation and marine applications, supporting sustainability goals and enabling the region's transition toward cleaner energy systems.

Saudi Arabia: Saudi Arabia dominates the Middle East & Africa gas turbine market, driven by government initiatives to integrate gas turbines with renewable energy sources. Newly launched programs focus on hybrid systems and fast-response technologies, helping reduce carbon emissions and accelerate the transition toward cleaner energy.

What Opportunities Exist in Latin America?

Latin America offers significant opportunities for the gas turbine market, supported by rising electricity demand, expanding industrial activities, and the need for flexible power generation solutions. Countries across the region are increasingly adopting gas turbines to complement renewable energy sources such as wind and solar, ensuring grid stability and reliable peak-load power. Favorable government policies, investment in natural energy infrastructure, and the shift away from coal and oil-based generation further support the market growth.

Brazil: Brazil leads the Latin American gas turbine market, fueled by its large power generation capacity, growing natural gas availability, and increasing integration of gas-based plants with renewable energy projects.

Mexico:Mexico closely follows, supported by robust cross-border natural gas trade, combined-cycle power plant installations, and rising industrial energy demand.

The Global Gas Turbine Sale Volume was pegged around 469 Units in 2025 generating a CGAR of 3.6% from 2026-2035

Global Gas Turbine Market - Company Market Share

| Company | Market Share (%) |

| GE Vernova | 28.1% |

| Siemens Energy | 24.1% |

| Mitsubishi Heavy Industries | 18.4% |

| Baker Hughes | 9.6% |

| Ansaldo Energia | 7.3% |

| Solar Turbines (Caterpillar) | 6.0% |

| Rolls-Royce (Power Systems) & Other Regional OEMs | 6.5% |

Key Insights of the Companies

Heavy-duty gas turbine manufacturers (conservative, backlog-driven)

GE Vernova

- Observed action: Targeted expansion of gas turbine manufacturing capacity through a large capital investment program, aimed at increasing annual heavy-duty turbine deliveries.

- Rationale: Strong multi-year backlog and long project execution cycles encourage selective capacity additions, focused on delivery assurance and margin protection rather than broad-based expansion.

Siemens Energy

- Observed action: Continued focus on execution of large utility-scale and combined-cycle projects, supported by selective supply-chain and manufacturinginvestments.

- Rationale: Heavy-duty turbine demand is project-based and capital intensive; expansion decisions are closely tied to secured orders and long-term visibility.

Mitsubishi Power

- Observed action: Ongoing fulfillment of large-frame turbine orders and selective investments linked to advanced and hydrogen-capable turbine platforms.

- Rationale: Emphasis on technology-led differentiation and backlog execution, rather than aggressive volume expansion.

Medium and aero-derivative gas turbine manufacturers

Solar Turbines (Caterpillar)

- Observed action: Expansion of service capabilities, customer collaborations, and integrated solution offerings, particularly for industrial, mechanical-drive, and data-center-related applications.

- Rationale: These markets are short-cycle and fast-moving, favoring service-led expansion over large manufacturing footprint increases.

Rolls-Royce (MTU)

- Observed action:Investments in new engine platforms, supplier partnerships, and production capacity aligned with emergency power and data center demand.

- Rationale:Growth is driven by distributed power and standby applications, requiring flexible production and faster response times.

Kawasaki Heavy Industries and select Asian OEMs

- Observed action: Targeted production and product development activity, including hydrogen-capable turbines and region-specific projects, particularly in Asia-Pacific.

- Rationale: Focus on regional demand capture and product innovation, rather than global-scale capacity expansion.

Gas Turbine Market Companies

- Wartsila

- BHEL

- Mitsubishi Hitachi Power Systems

- Harbin Electric International Company

- Siemens AG

- Man Diesel & Turbo

- General Electric

- NPO Saturn

- Kawasaki Heavy Industries

- Solar Turbines

- Capstone Turbine

- Vericor Power Systems

- Cryosta

- AnsaldoEnergia

- Opra Turbines

- Zorya-Mashproekt

Recent Development

- In April 2025, Spain's power company, Red Eléctrica, announced on April 16 a significant milestone: the generation of enough renewable energy to meet the nation's demand. “The ecological transition is moving forward,” the company stated with optimism. However, just under two weeks later, an 18-hour blackout affected Spain and Portugal, presenting challenges that disrupted daily life, including the closure of businesses and schools, as well as issues with trains and mobile networks. This incident highlights the importance of continued advancements in energy infrastructure as the transition to renewable sources progresses.

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further this research study calculates market revenue and its growth trend at global regional and country from 202 to 2035. This report includes market segmentation and its revenue estimation by classifying it on the basis of end-use and region as follows:

Segments Covered in the Report

By Capacity Type

- > 500 kW to 1 MW

- > 1 MW to 30 MW

- < 50 kW

- 50 kW to 500 kW

- > 70 MW to 200 MW

- >30 MW to 70 MW

- > 200 MW

By Product Type

- Heavy Duty

- Aero-Derivative

By Technology Type

- Combined Cycle

- Open Cycle

By Application Type

- Process Plants

- Power Plants

- Oil & Gas

- Aviation

- Marine

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting