January 2025

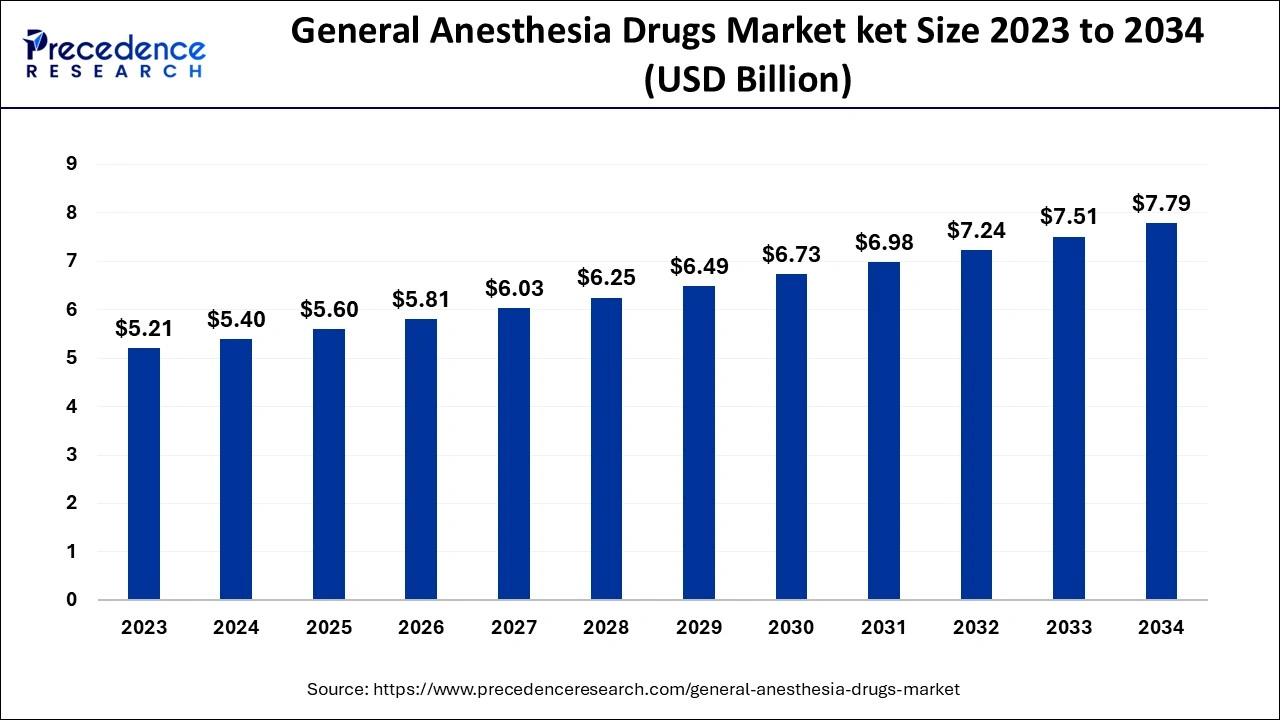

The global general anesthesia drugs market size accounted for USD 5.40 billion in 2024, grew to USD 5.60 billion in 2025 and is expected to be worth around USD 7.79 billion by 2034, registering a CAGR of 3.72% between 2024 and 2034. The North America general anesthesia drugs market size is evaluated at USD 2.00 billion in 2024 and is expected to grow at a CAGR of 3.83% during the forecast year.

The global general anesthesia drugs market size is calculated at USD 5.40 billion in 2024 and is predicted to reach around USD 7.79 billion by 2034, expanding at a CAGR of 3.72% from 2024 to 2034. The general anesthesia drugs market is driven by the rising prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer.

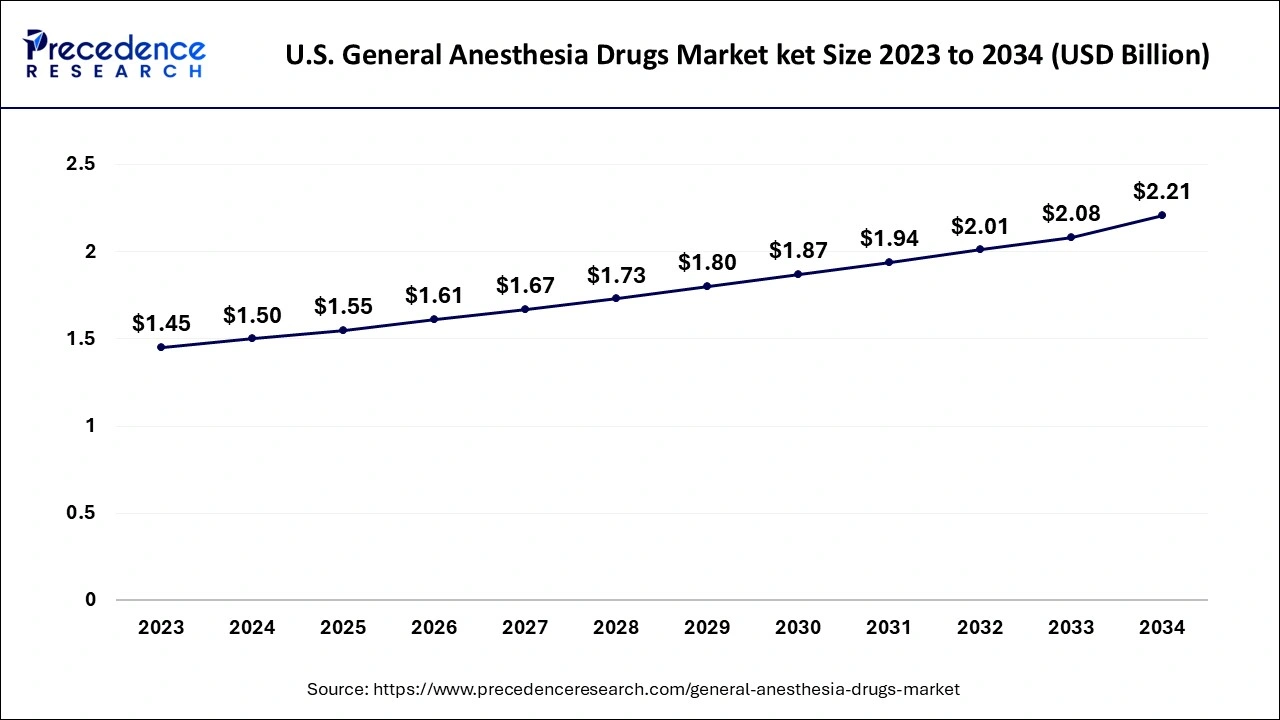

The U.S. general anesthesia drugs market size is exhibited at USD 1.50 billion in 2024 and is projected to surpass around USD 2.21 billion by 2034, growing at a CAGR of 3.90% from 2024 to 2034.

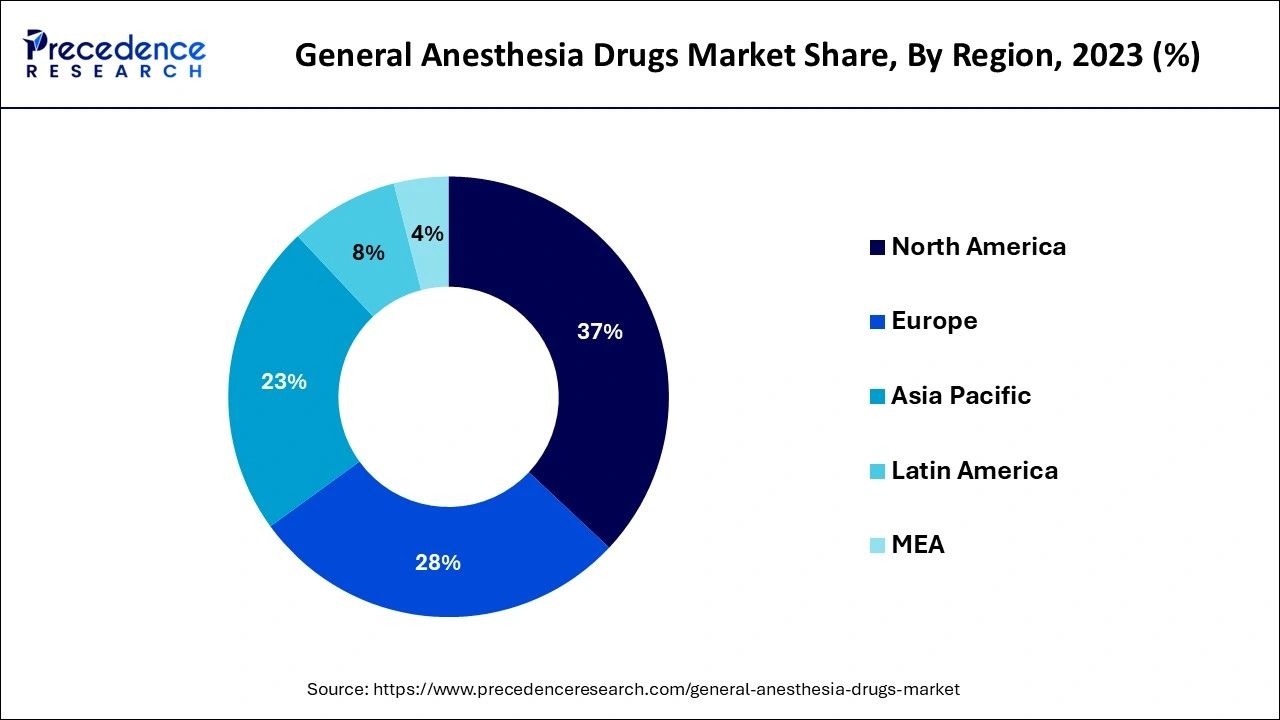

North America dominated the general anesthesia drugs market in 2023. The healthcare system in North America, especially in the U.S. and Canada, is very advanced. This comprises ambulatory surgical centers (ASCs), well-equipped hospitals, and specialty clinics that can perform a variety of anesthesia-related surgeries. Furthermore, the safety and effectiveness of anesthetic medications are guaranteed by strictly regulated drug approval procedures, such as those supervised by the U.S. Food and Drug Administration (FDA), which enhances confidence in using these medications in healthcare institutions.

Asia Pacific is observed to host the fastest-growing general anesthesia drugs market during the forecast period. More modern lives result from the growth of metropolitan areas and the expanding middle class. Because they are more exposed to international beauty trends and have easier access to stores that provide a variety of personal care items, urban inhabitants are more prone to develop new grooming habits. Customers in the area are growing increasingly aware of the value of skincare, hygiene, and personal grooming. Women are incorporating face razors into their grooming regimens due to increasing knowledge of the advantages of skincare, mainly because they provide a less harsh and more efficient hair removal option than conventional techniques.

Drugs used for general anesthesia are essential for performing procedures. They guarantee that patients are operated on without discomfort, consciousness, or motion, which is necessary for simple and intricate procedures. This keeps patients comfortable while surgeons concentrate on complex procedures. General anesthesia administered effectively and safely lowers hospital stays, surgical complications, and overall medical expenses. Anesthesia medications are vital to upholding high standards of care in surgical settings since patient safety is still a significant concern.

How is AI Helping the Growth of the General Anesthesia Drugs Market?

AI-powered algorithms in the general anesthesia drugs market can forecast potential interactions between novel chemical compounds and biological systems, which helps in developing safer and more potent anesthetic medications. This reduces the time and expense of developing new drugs using conventional trial-and-error techniques. Drug development procedures become quicker and more economical when AI estimates drug success rates, finds the best patient demographics for trials, and enhances trial designs. Artificial intelligence (AI) systems may analyze data from various monitoring devices, such as heart rate, oxygen levels, and brain activity, and give anesthesiologists real-time insights to help them make better surgical decisions.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.79 Billion |

| Market Size in 2024 | USD 5.40 Billion |

| Market Size in 2025 | USD 5.60 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Drug, Route of Administration, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increase in surgical procedures

Chronic diseases are more common as the world's population ages, which raises the need for surgical procedures. General anesthesia is usually required for procedures involving orthopedic problems, cardiovascular disorders, and cancer therapies, all of which are common in elderly people. More people are seeking surgical procedures due to greater patient awareness of their surgical alternatives. Advances in patient education, marketing, and communication have supported this trend.

Increasing awareness of pain management

Healthcare systems are moving toward patient-centered treatment, focusing on how vital it is to manage pain during and after surgery. Effective anesthetic solutions are in greater demand as patients become more knowledgeable about their treatment options. Governments and health organizations are funding more research to enhance pain management techniques, which will create more potent general anesthetic medications.

High cost of anesthesia drugs

Surgical treatments require anesthesia, and the high cost of general anesthesia drugs market products can drive up the total surgery cost. This could ultimately impact patient access to essential treatment by causing hospitals and surgical centers to raise service costs or reduce the number of procedures they conduct. Not all anesthetic agents have generic substitutes, even though generic versions of anesthetic medications can save money. Because there are no generic alternatives, manufacturers of name-brand medications can continue to charge higher prices.

Advancements in anesthesia technology

The efficiency of inhalational anesthetics has increased due to developments in inhalation delivery systems, such as low-flow methods. Creating sophisticated vaporization technologies that use less anesthetic volume may decrease drug expenses and waste. New anesthetic products that show improved safety and efficacy are gaining favor with regulatory agencies. Faster market entrance for novel medications may promote competition and market expansion for general anesthetic medications.

The propofol segment dominated the general anesthesia drugs market in 2023. Propofol, a drug generally used for general anesthesia, derails the brain’s average balance between stability and excitability. In contrast to other anesthetics, such as inhaled drugs like halothane or sevoflurane, propofol offers a smooth induction without the unpleasant side effects of nausea, vomiting, or delirium. Since patients prefer shorter hospital stays and ambulatory or outpatient surgeries are more cost-effective, propofol's ability to guarantee speedy recovery makes it perfect for these procedures.

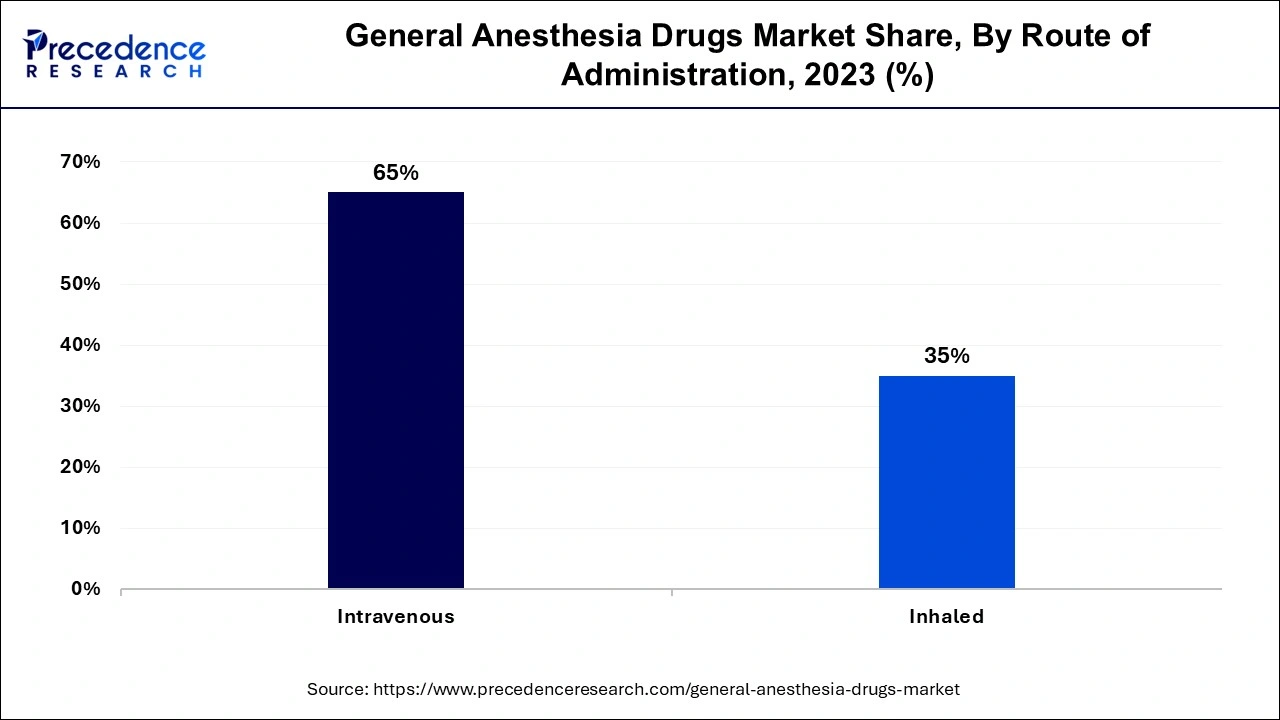

The intravenous (IV) segment dominated the general anesthesia drugs market in 2023. Compared to other techniques, such as inhalation, the onset of anesthesia is accelerated when anesthetic medicines are administered intravenously. Drugs are delivered to the brain quickly when they are given intravenously because they enter the bloodstream immediately. This makes it possible to induce drowsiness and anesthesia more quickly, which is essential for urgent surgeries or situations requiring anesthesia immediately. Compared to inhalation anesthetics, intravenous anesthetics typically result in fewer postoperative nausea and vomiting episodes, which enhances patient comfort and recovery, especially during ambulatory procedures.

The knee & hip replacement segment dominated the general anesthesia drugs market in 2023. Among the most popular orthopedic operations are knee and hip replacement surgeries, particularly for patients with rheumatoid arthritis or osteoarthritis and in older populations. The large number of these surgeries directly fuels the demand for general anesthetic medications. Complete muscular relaxation is necessary for joint replacement procedures so that the surgeon may precisely manipulate bones and position implants. For these surgeries, general anesthesia is the recommended option because it provides greater control over muscle relaxation than regional or local anesthetic.

The cancer segment is observed to be the fastest-growing in the general anesthesia drugs market during the forecast period. Radiation therapy, chemotherapy, and surgery are frequently used in conjunction to treat cancer. Many solid tumors are treated primarily with surgery. To guarantee patient comfort and immobility during invasive treatments, general anesthesia is usually required for procedures including tumor resection, biopsies, and surgeries connected to metastases. The need for anesthetic medications is being fueled by this growth in surgeries related to cancer. Furthermore, the requirement for anesthetic support has grown as less invasive surgical techniques (such as laparoscopic and robotic-assisted operations) have become more popular and sophisticated. Demand in this market is further driven by the fact that anesthesia is necessary even for minimally invasive surgeries to reduce pain and anxiety.

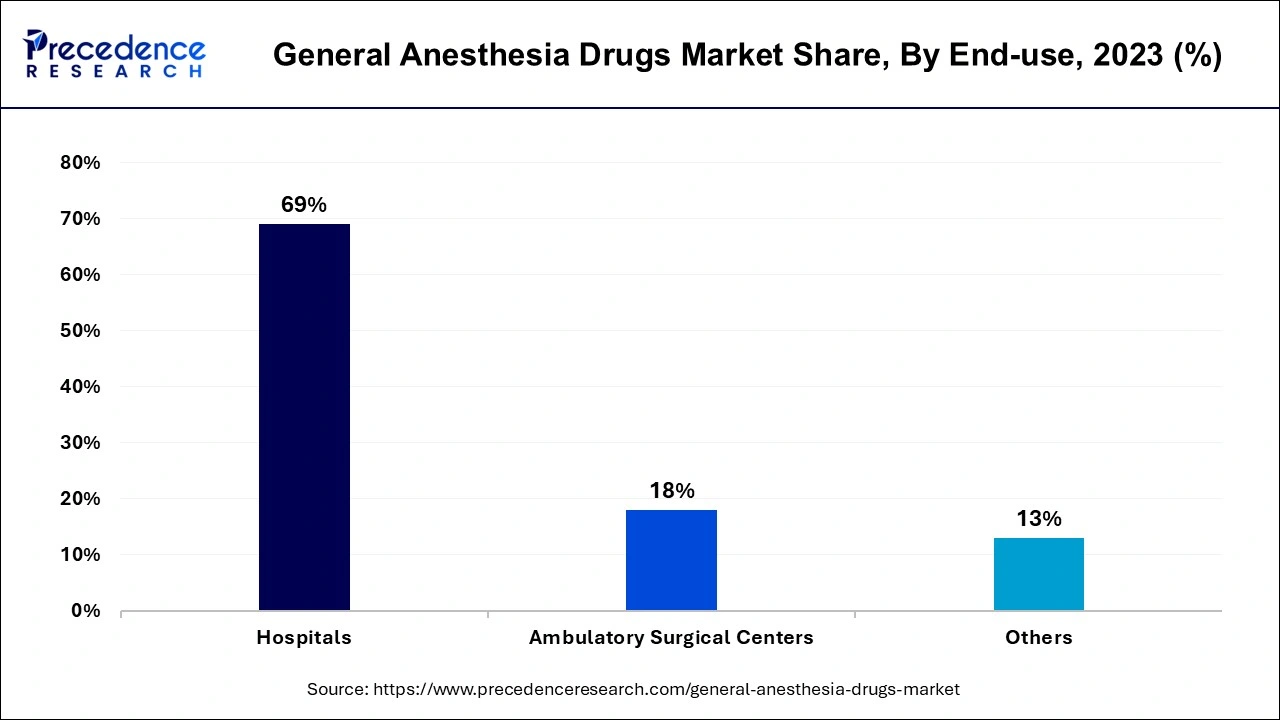

The hospital segment dominated the general anesthesia drugs market in 2023. Hospitals are outfitted with cutting-edge medical equipment, such as operating rooms, critical care units that need specific anesthetic medications, and complex monitoring systems. Hospitals continue to be a significant customer of general anesthetic medications due to their capacity to execute intricate procedures and state-of-the-art post-operative care facilities. Government healthcare programs and comprehensive insurance policies are more likely to cover hospital operations. These payment plans frequently cover the delivery of anesthesia and associated medications, making hospitals a financially attractive choice for both patients and healthcare professionals. This leads to an increase in the use of anesthesia medications.

The ambulatory surgical center's segment is observed to at the fastest rate in the general anesthesia drugs market during the forecast period. Ambulatory surgical centers are preferred by patients looking for convenience and affordability because they perform surgeries that don't require hospitalization. Many treatments that once needed inpatient care can now be safely completed in an outpatient setting due to improved anesthetic and surgical techniques. The number of procedures performed in ASCs has increased due to this change, increasing the demand for medications used in general anesthesia.

Segments Covered in the Report

By Drug

By Route of Administration

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

January 2025