April 2024

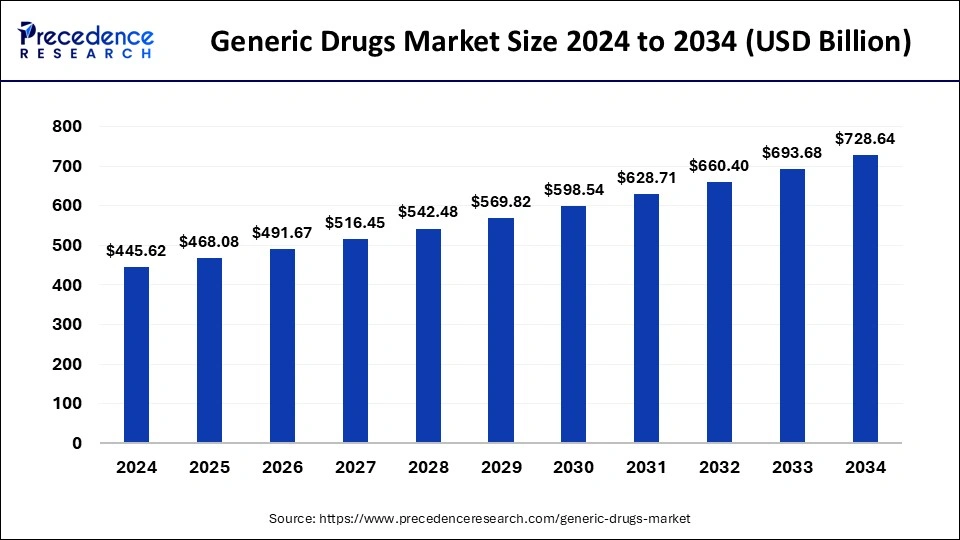

The global generic drugs market size accounted for USD 468.08 billion in 2025 and is forecasted to hit around USD 728.64 billion by 2034, representing a CAGR of 5.04% from 2025 to 2034. The North America market size was estimated at USD 173.79 billion in 2024 and is expanding at a CAGR of 5.17% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global generic drugs market size was calculated at USD 445.62 billion in 2024 and is predicted to increase from USD 468.08 billion in 2025 to approximately USD 728.64 billion by 2034, expanding at a CAGR of 5.04% from 2025 to 2034.

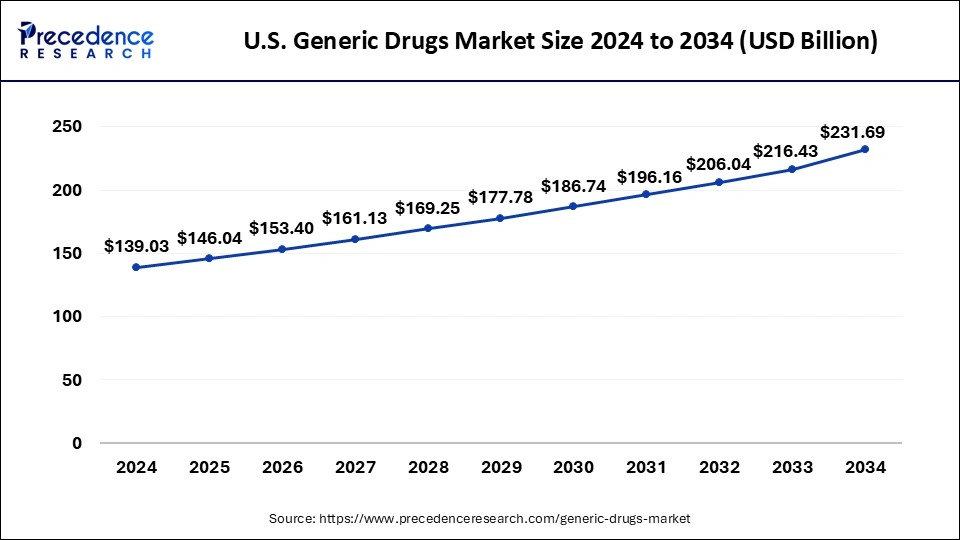

The U.S. generic drugs market size was exhibited at USD 139.03 billion in 2024 and is projected to be worth around USD 231.69 billion by 2034, growing at a CAGR of 5.24% from 2025 to 2034.

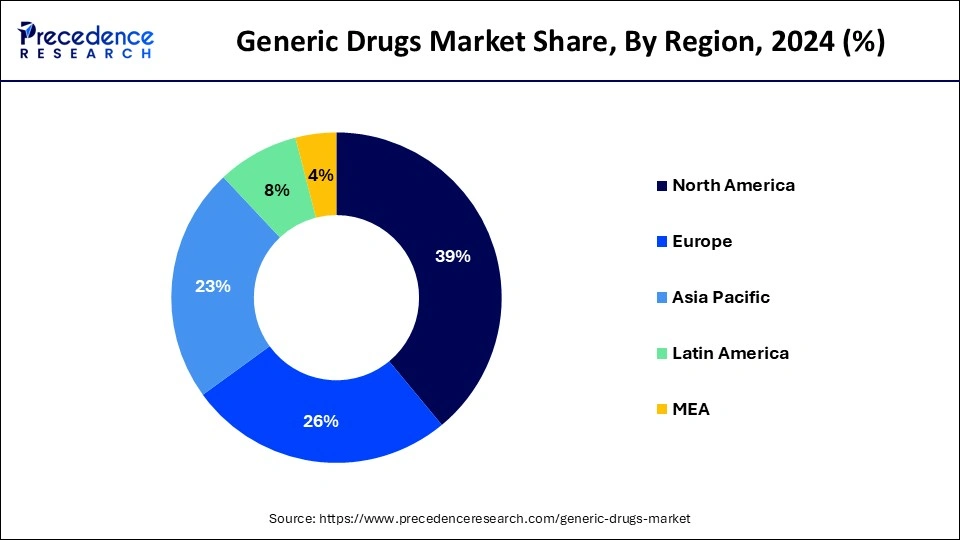

North America acquired the largest revenue share of 39% in the year 2024. U.S. recorded the highest sale in Generics Drugs Market in the year 2021. While the region’s primary healthcare emphasis remains on the pandemic as it moves through the 3rd year of its disruptive impacts and the death toll which approached to 1 million, other key dynamics are playing out with respect to health services utilization, the associated level of spending including patient costs out-of-pocket, and the use of prescription medicines. Understanding these factors of the health care system and how they may develop over the next few years remains critical to stakeholders and decision makers including patients. Spending and drivers for growth reflect the substantial differences in spending levels by stakeholders as rebates and discounts deforms these trends even as the most affecting driver has been the amount which is spent on COVID-19 therapeutics and vaccines.

The U.S. is a major player in the regional market, growth driven by the existence of robust pharmaceutical companies, the existence of key vendors, and government support. The U.S. is the hub for pharmaceutical innovation and development. The demand for generic drugs has increased in the country due to their affordability and regulatory standards. Increased number of geriatric patients, prevalence of chronic disease, and high availability of branded medication are supporting this demand. Additionally, U.S. collaboration with other leading countries is fostering the U.S. market. For example, the U.S. accounts for about 30% of India's total pharma exports.

The growth is attributed to speedy increase in the prevalence of chronic disease in the countries of APAC owing to changing lifestyle which is creating demand for the generic drugs. Additionally, growing demand for the generic drugs for the end users in LATAM and the countries of Middle East and Africa is anticipated to propel industry growth in the next 10 years.

Major Generic Drug Sales in the U.S in 2023

Global generic drugs market is expected to rise at substantial CAGR during the forecast era. The low cost of generics, as an alternative to branded drugs is major factor expected to fuel growth of the target industry in the near future. Additionally, increasing use of RPA to ensure regulatory and standards compliance can create lucrative growth opportunities for the key players operating in the global market.

The use of artificial intelligence (AI) technology to automate routine, rules-based processes is robotic process automation. Through this automation, key operating players in the target market are capable to devote more time, energy, and capitals to advanced value tasks. The use of RPA to ensure compliance with regulatory and standards is one of the major trends in the market for generic brands that will gain traction in the coming years. Company process automation systems such as RPA are commonly used by pharmaceutical firms to conduct high-volume R&D and production activities. RPA technology includes software that logs into programs, enters data, measures and completes the necessary activities, and logs out. It aims to ensure conformity with laws and requirements, to complete procedures at a faster speed and to reduce costs.

Generic companies are finding it more difficult to launch new medications as originator products that have gone off-patent become more difficult to develop, produce, and market. When comparing the status of generic firms to that of industrial or communications companies, it is clear that generic companies have a larger and more diverse range of options to pick from. Over $217 billion in original patents are set to expire shortly, and they cover everything from biologics to oral solids, injectable, and inhalers to over-the-counter (OTC) drugs.

By 2024, industry analysts predict that generics will have the luxury of generating $60 billion in net growth. Now is the moment for businesses to carefully consider where they should invest before deciding on their next product. As shown below, opportunities and obstacles differ substantially from one product category to the next.

One of the major restraints limiting the growth of generic drugs is stringent regulations, as the FDA examines the accuracy, side effects and other ingredients used in generic drugs. If the manufacturers fails to follow the regulatory guidelines, the drugs are usually recalled. Emerging economies such as India and China hold immense potential for the market growth due to the cost effectiveness of the generic drug in these countries. Purity, potency, stability, and drug release are the crucial factors that determine the quality of generic medications, and these should be controlled within a suitable limit, range, or distribution to achieve the required drug quality. Therefore, approval required for generic drugs due to the stringent governmental regulations, which is expected to obstruct market growth.

Major companies of the global industry including Abbott Laboratories and Teva Pharmaceutical Industries Ltd. are pointing towards commercial growth by adopting strategies like mergers and acquisitions, heavy investments in the manufacturing facilities that is predictable to flourish the global market growth in next few years. This trend is probable to continue and will augment growth of the target industry in the near future.

| Report Highlights | Details |

| Market Size in 2024 | USD 445.62 billion |

| Market Size in 2025 | USD 468.08 Billion |

| Market Size by 2034 | USD 728.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.04% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug, Brand, Route of Drug Administration, Therapeutic Application, Distribution Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Rising cases of cancer

Cancer treatment can be prohibitively expensive, especially with the rising costs of branded cancer medications. Generic drugs offer a more affordable alternative to branded counterparts, allowing patients to access essential cancer treatments at lower costs. As the number of cancer cases increases, the demand for cost-effective treatment options also rises, driving the growth of the generic drugs market. Many branded cancer drugs face patent expirations, allowing generic pharmaceutical companies to introduce bioequivalent versions of these medications into the market. Generic versions of cancer drugs can be approved more quickly and at a lower cost compared to the development of new branded drugs. Patent expirations create opportunities for generic manufacturers to enter the market and offer affordable alternatives to branded cancer treatments.

Regulatory hurdles

Generic drug manufacturers often face stringent regulatory requirements and lengthy approval processes before they can bring their products to market. Compliance with regulatory standards imposed by agencies such as the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA) can be costly and time-consuming, delaying market entry for generic drugs.

Patent protection granted to branded drugs can pose a significant barrier to the entry of generic competitors. Pharmaceutical companies invest heavily in research and development to develop new drugs, and patents provide them with exclusive rights to manufacture and sell these drugs for a specified period. Generic manufacturers must wait for patents to expire or challenge them through legal means, which can delay market entry and increase litigation costs.

Government support for the production of generic medicines

Governments prioritize public health initiatives aimed at improving healthcare access and outcomes for their populations. Generic drugs play a crucial role in addressing public health challenges by providing affordable treatments for chronic conditions, infectious diseases, and other healthcare needs. Government support for generic drugs aligns with public health goals of promoting medication adherence, reducing disease burden, and improving overall health outcomes. Governments establish regulations and approval processes for generic drugs, creating a pathway for their entry into the market. Regulatory agencies, such as the Food and Drug Administration (FDA) in the United States, assess the safety, efficacy, and quality of generic medications, ensuring they meet stringent standards before approval. Government support in the form of clear regulatory guidelines expedites the approval process for generic drugs, facilitating their availability to patients.

The pure generics segment accounted largest revenue share 52.57% in 2023. Emerging markets can be challenging for pharmaceutical companies that are more accustomed to operating in developed markets, but understanding the unique problems these markets present may distinguish winners from losers, especially as the competitive battlefield becomes more global. Emerging markets are home to more than 70% of the world's population, cover 46% of the planet's surface, and generate 31% of global GDP. As a result, they are the industry's next great growth engine.

Branded generics, on the other hand, are given names to increase consumer recognition and loyalty. Cryselle, for example, is a brand-name generic contraceptive pill. To improve the possibility of patients requesting it by name, it is referred to as Cryselle rather than its generic name (norgestrel and ethinyl estradiol). To achieve cost savings, formulary administrators must examine the drugs on their formularies regularly. Branded generics, like generics, offer a cost-effective alternative to branded medications. When it comes to ways that PBMs avoid complete disclosure of their revenues, there is some friction between formulary managers and PBMs. Some pharmacy benefit consultants believe that one of the ways pharmacy benefit managements hide revenue is through branded generics.

Oral formulations account for around 65.33% of the global market share of all pharmaceutical formulations intended for human use, according to current estimates. Orally administered pharmaceuticals account for about 84 percent of the top-selling pharmaceuticals.

According to the World Health Organization, between 2 and 3 million cases of non-melanoma skin cancer and 132,000 cases of melanoma skin cancer are detected each year. Furthermore, the global prevalence of psoriasis ranges from 0.09 percent to 11.43%, making it a severe global disease affecting at least 100 million people. The market for sophisticated topical products is likely to rise in the coming years, as topical drug administration is the first line of treatment for the majority of skin illnesses.

On the basis of drug type simple generic drugs segment is dominant owing to its low cost over super generic drugs. These drugs also yield the same therapeutic effect and are prescribed in the same dosing, with the same quality, and same the way of consumption and usage. Super generics of drug type segment is expected to hold a share of more than 42.18% by 2030 in the global generic drugs market.

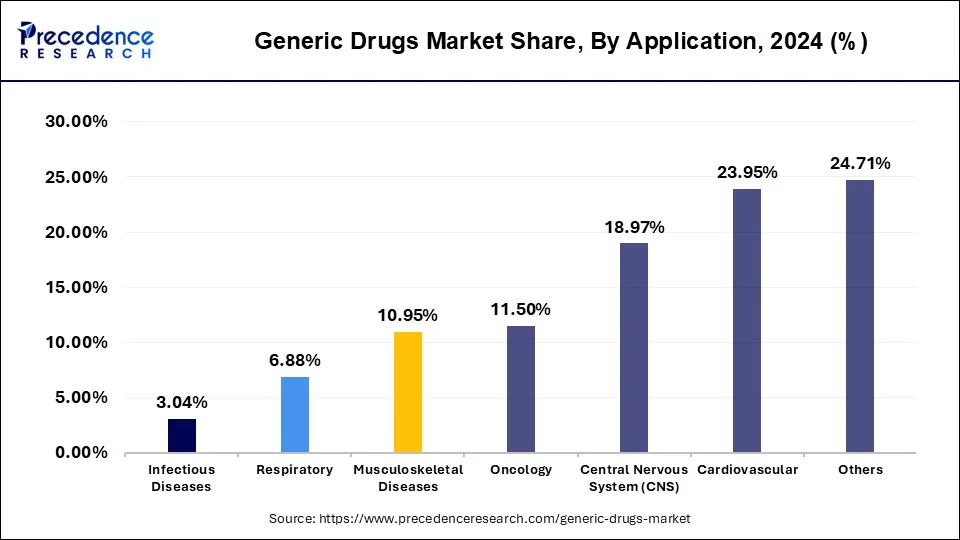

The oncology segment is observed to witness the fastest rate of expansion at a CAGR of 6.6% during the forecast period. Cancer is one of the leading causes of mortality globally, and the demand for effective cancer treatments continues to rise. Oncology drugs are essential for treating various types of cancer, including breast cancer, lung cancer, prostate cancer, leukemia, and lymphoma. As a result, the oncology segment represents a substantial portion of the pharmaceutical market.

The high cost of branded oncology drugs can pose significant financial burdens on healthcare systems, insurers, and patients. Generic oncology drugs offer a more cost-effective alternative, helping to reduce overall healthcare expenditures and improve affordability and access to cancer treatments. As a result, payers and healthcare providers often encourage the use of generic drugs to lower healthcare costs while maintaining treatment quality.

By Drug Type

By Brand

By Route of Drug Administration

By Therapeutic Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2024

January 2025

June 2025

February 2025