January 2025

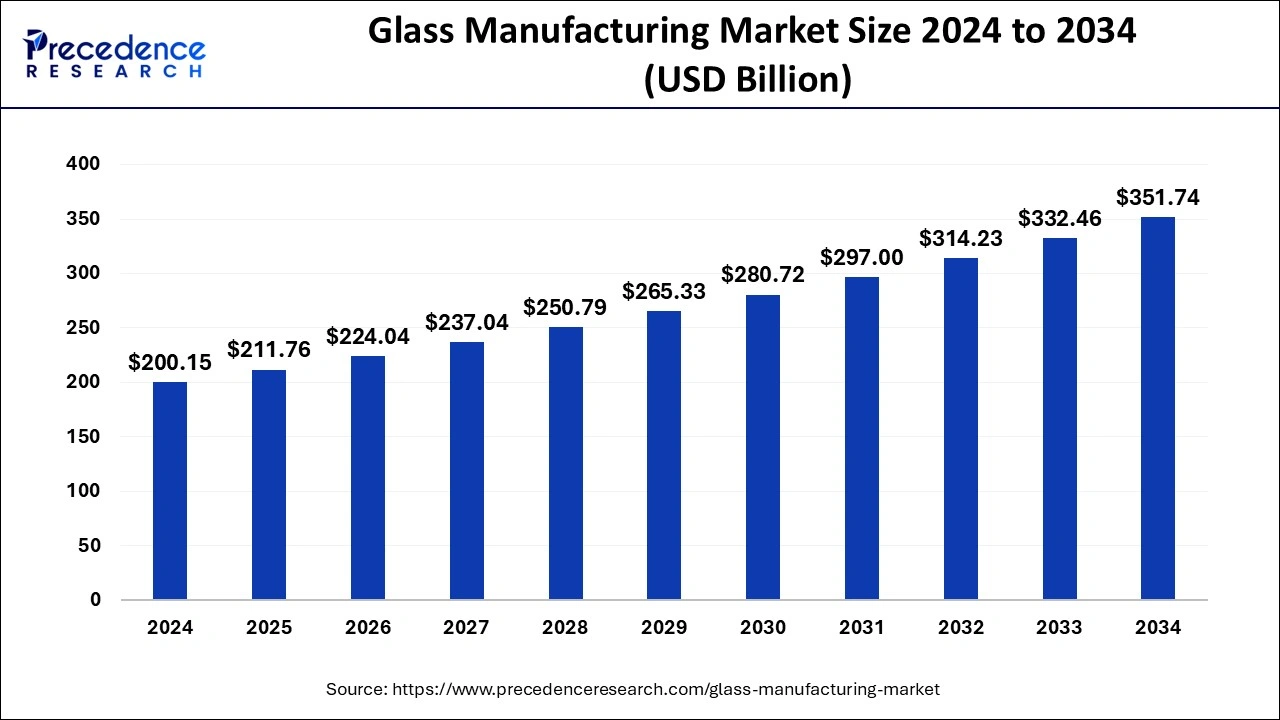

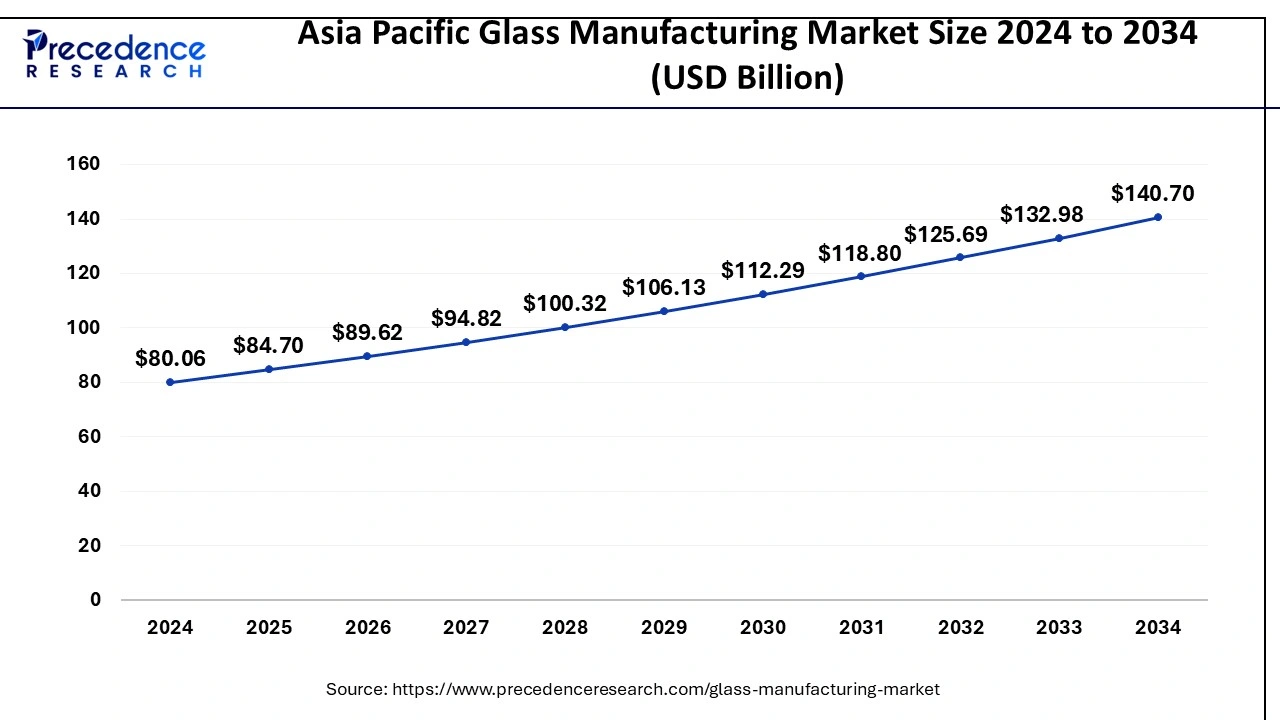

The global glass manufacturing market size is calculated at USD 211.76 billion in 2025 and is projected to surpass around USD 351.74 billion by 2034, expanding at a CAGR of 5.8% from 2025 to 2034. The Asia Pacific glass manufacturing market size was calculated at USD 84.70 billion in 2025 and is expanding at a CAGR of 6% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global glass manufacturing market size accounted for USD 200.15 billion in 2024 and is expected to be worth around USD 351.74 billion by 2034, at a CAGR of 5.8% from 2025 to 2034.

The Asia Pacific glass manufacturing market size was estimated at USD 80.06 billion in 2024 and is predicted to be worth around USD 140.70 billion by 2034, at a CAGR of 6% from 2025 to 2034.

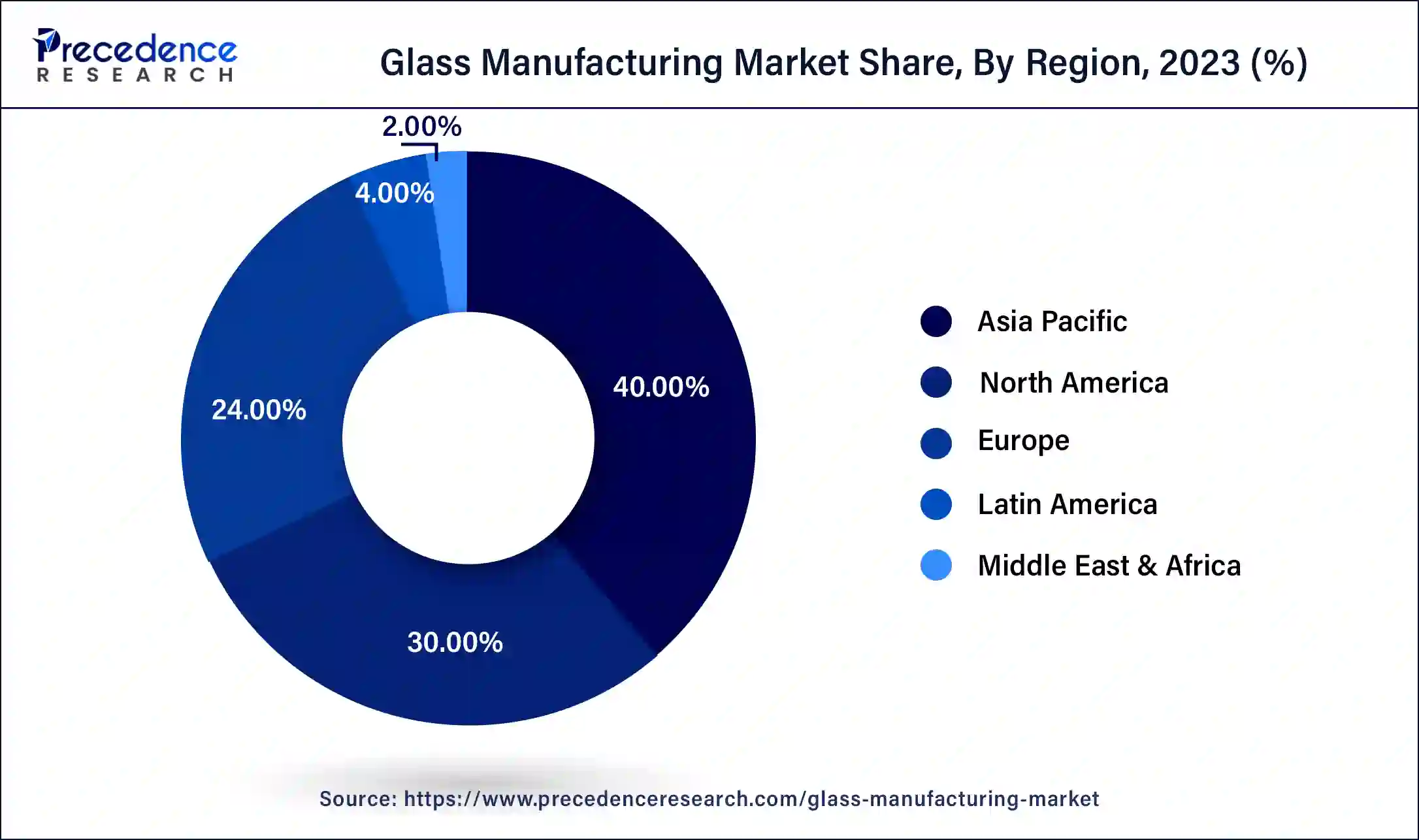

The Asia Pacific encountered as the largest market for the glass manufacturing accounting for approximately half of the volume share in 2024. This is attributed to the significant presence of consumer base for numerous applications of glass such as automotive, kitchen utensils, packaging, consumer electronics, and many other applications.

North America emerged as the third largest market in terms of volume in the year 2024. Though packaging industry accounts for the largest share in the market, demand for jumbo coated architectural flat glass registered significant growth since the past few years. The trend expected to continue for notable time period.

An escalating growth in the demand for consumer electronics products owing to increasing penetration of Artificial Intelligence (AI) in consumer and business applications, proliferation in the production of smartphones, and declining prices of consumer electronic devices are some of the major factors that drive the market growth.

Other than this, profound increase rise in the infrastructure development along with construction activities projected to propel the demand for glasses over the upcoming timeframe. For instance, in January 2019, the government of Saudi Arabia announced to invest more than USD 426 Billion in infrastructure projects by 2030 primarily for the development in key areas for example technology, hospitality, and mobility.

Additionally, increasing concern among government of various regions to avoid the non-degradable substances for packaging and other applications have spur the demand for glass as an alternative source. Glasses are the most preferred materials over non-degradable and wood products owing to environmental protection concern and preventing the fast depletion rate of natural resources. The above mentioned factors expected to prosper the market growth over the forthcoming years.

| Report Highlights | Details |

| Market Size in 2024 | USD 200.15 Billion |

| Market Size in 2025 | USD 211.76 Billion |

| Market Size by 2034 | USD 351.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Container glass captured the maximum market share in terms of volume and accounting for around 50% in the year 2024. This is mainly attributed to the rapid growth of beer industry along with significant demand of alcoholic beverages especially in Eastern Europe and the Asia Pacific regions. Furthermore, shifting consumer preference from plastic container towards glass container because of its attractive properties in the kitchen storage materials sector predicted to spur the growth of the segment over the analysis period.

In terms of revenue, fiberglass anticipated to witness the fastest growth rate of more than 4% between the years 2025 and 2034. Extensive application of fiberglass in automobile industry owing to its high strength and lightweight properties attributed as the key factor that drives the growth of the segment. Further, increasing usage of fiberglass in construction & building sector especially for insulation and composite applications likely to propel the growth of the segment over the analysis period.

Flat glass is the other most significant product segment that exhibits prominent growth over the forthcoming years. Solar application expected to be the crucial factor in driving the demand of the flat glass in the years to come. With numerous benefits of renewable energy over conventional sources propel the installation of solar power plants across the globe. Furthermore, environmental concerns, advancements in solar technology, depletion of non-renewable resources, and reductions in the cost of solar installations are the other significant factors that contribute towards the growth of flat glasses in the near future.

Packaging application dominated the global market and accounted for a value share of roughly 45% in the year 2024. Glass is more hygienic compared to other materials and have superior flavor retention capability that makes it ideal in food packaging application. Other than this, extensive demand of glass materials for packaged consumer goods because of increasing consumer disposable income especially in developing economies of the Asia Pacific and Middle East &Africa.

Electronics application projected to register the fastest growth of over 5.0% in terms of value over the forecast timeframe. The growth of the segment can be attributed to the rapid expansion and rising innovation in the production of consumer electronic devices. Further, increasing penetration of scratch-resistant glasses particularly in smartphones and tablets expected to boost the growth of the segment over the coming years.

The global glass manufacturing industry seeks intense competition among the market players owing to rising penetration of major players in same application segment. For instance, several players in the industry are focusing towards particular product segment. Ardagh; Owens Illinois Inc.; and Vetropack dominated the container glass market whereas Saint Gobain; AGC Inc.; and Guardian Industries are the key players in flat glass sector. The Asia Pacific is considered as the potential market due to significant economic growth of the region within past few years. In June 2018, ÅžiÅŸecam Group acquired 49.8% stake in HNG Float Glass Limited to strengthen its position in the India market.

By Product

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2025

October 2024