January 2025

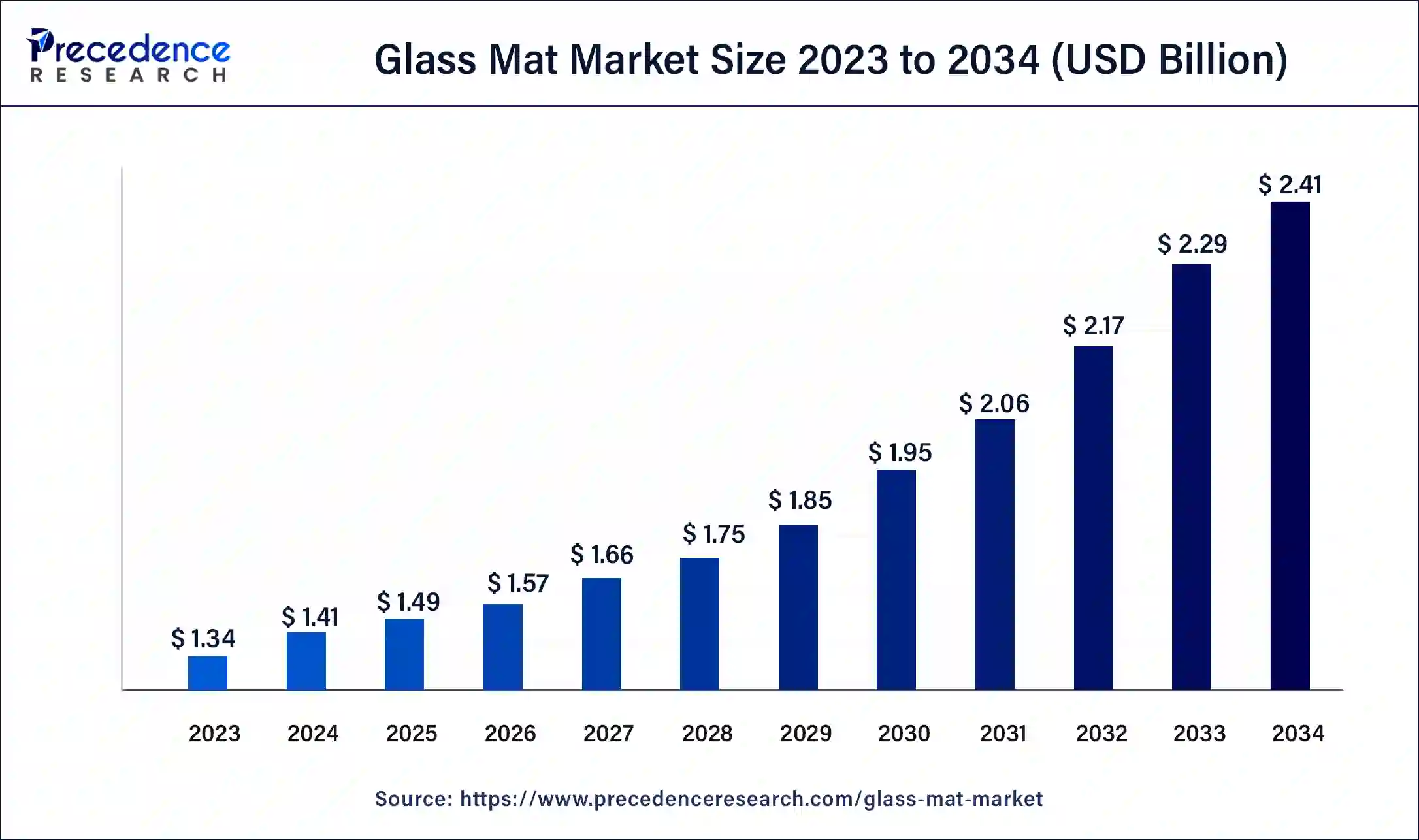

The global glass mat market size was USD 1.34 billion in 2023, calculated at USD 1.41 billion in 2024 and is expected to reach around USD 2.41 billion by 2034, expanding at a CAGR of 5.5% from 2024 to 2034.

The global glass mat market size accounted for USD 1.41 billion in 2024 and is expected to reach around USD 2.41 billion by 2034, expanding at a CAGR of 5.5% from 2024 to 2034. The growth in construction and infrastructural activities in regions is driving the market.

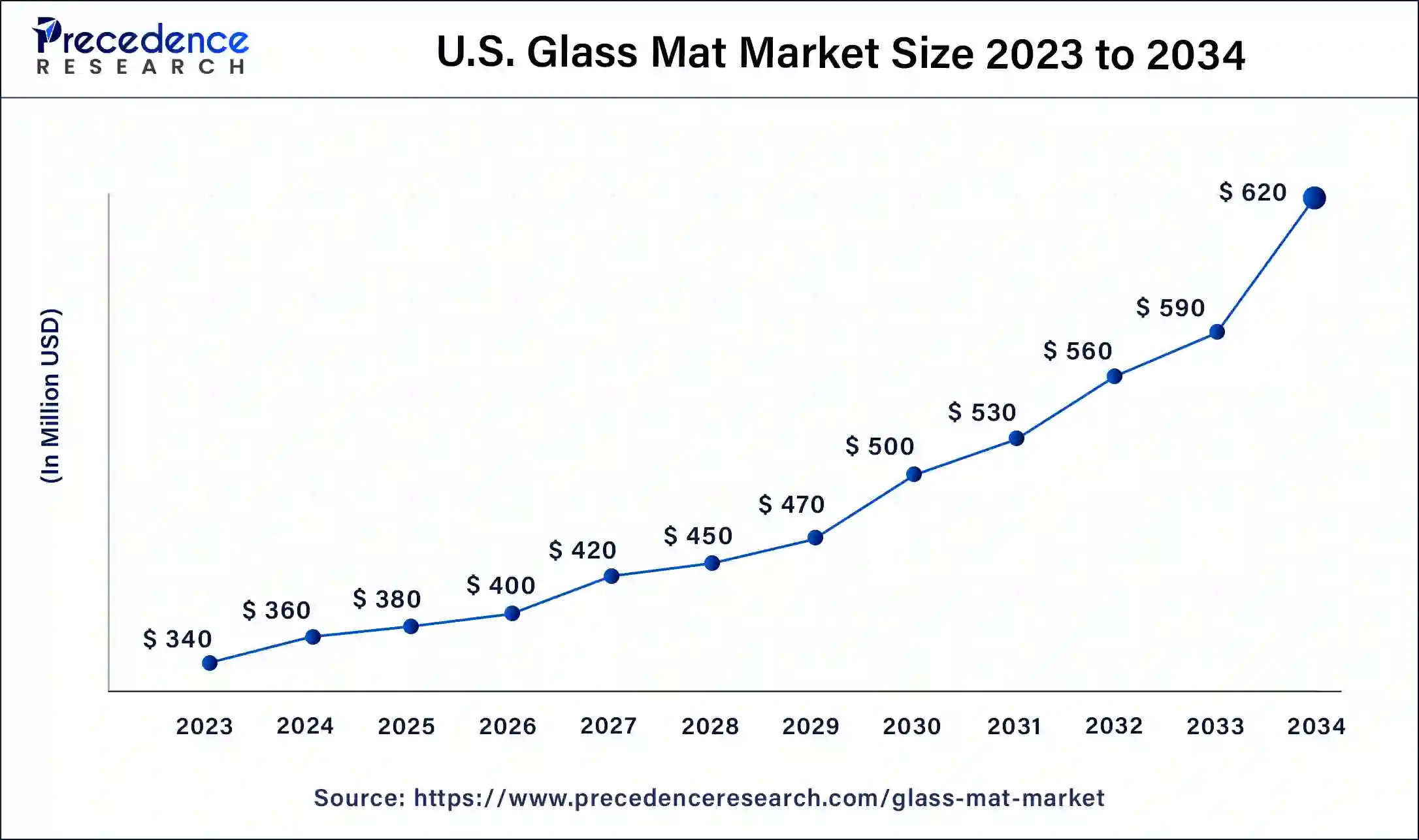

The U.S. glass mat market size was estimated at USD 340 million in 2023 and is predicted to be worth around USD 620 million by 2034, at a CAGR of 5.6% from 2024 to 2034.

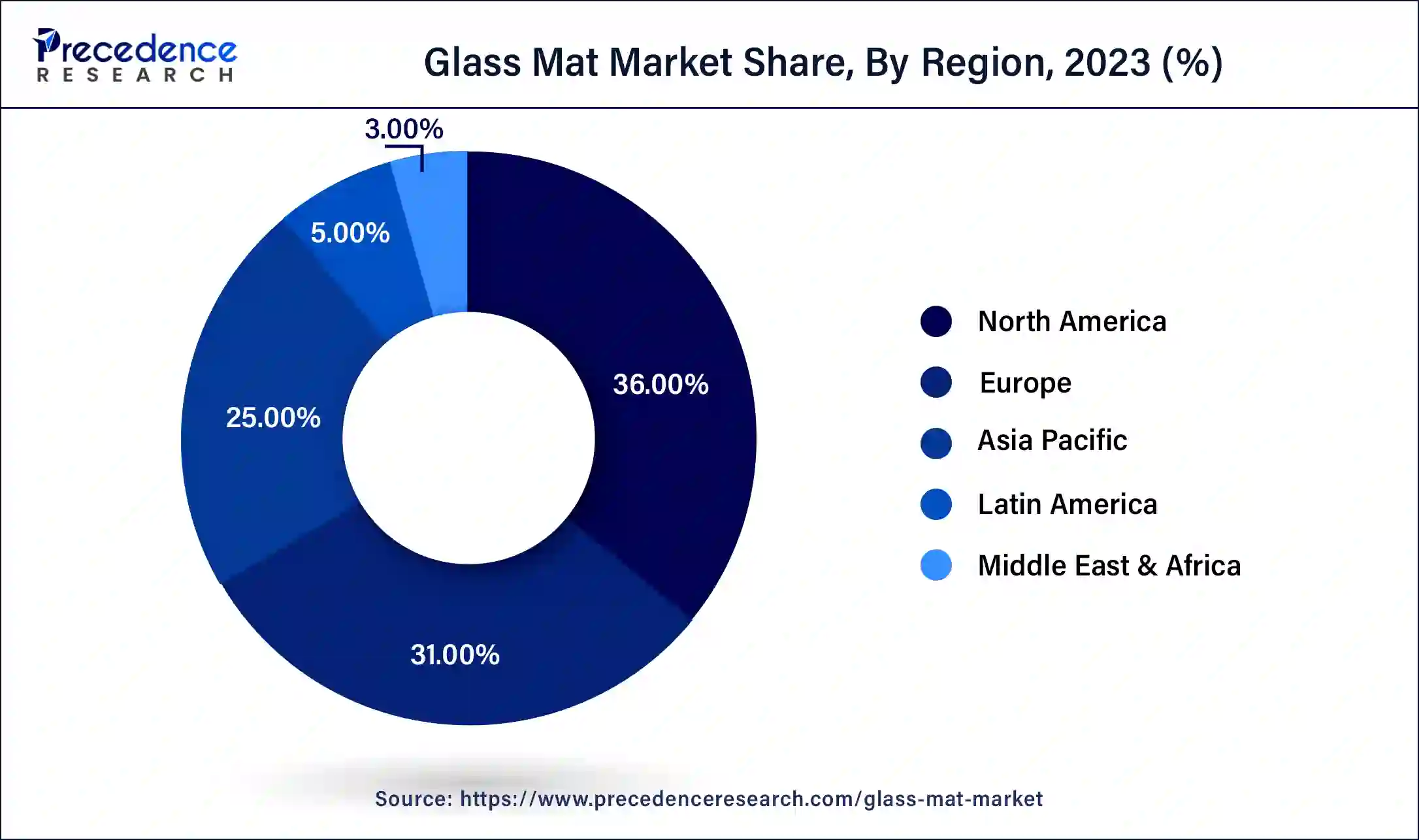

North America dominated the glass mat market in 2023, fueled by well-established industries in construction, automotive, and aerospace. The United States played a key role in the market due to its rising construction and automotive sectors. Moreover, the market players' focus on innovation and technological advancements further contributes to the market expansion in the region.

Asia-Pacific is predicted to be the fastest-growing region in the glass mat market over the forecast period. This is because there's a lot of demand for glass mats in this region, especially in building and construction, automotive, and other industries, as the area is experiencing rapid industrialization and growth.

The construction sector in Asia Pacific is booming due to more infrastructure projects, new architectural ideas, a push for eco-friendly buildings, and a high demand for modern construction methods. As construction keeps growing and expanding, the need for glass mats for things like floors, ceilings, walls, and other uses is expected to keep rising. That's why glass mats are expected to stay dominant in the region in the coming years.

The glass mat market comprises the industry involved in producing and distributing fiberglass mats. These mats are made from randomly spread glass fibers bonded together with a binder. Due to their high strength, durability, and resistance to chemicals and moisture, they find extensive use across various sectors. Glass mats are commonly used in composite materials to reinforce finished products, providing them with added strength and rigidity. They also serve as thermal and acoustic insulators in applications such as building construction and automotive components. In infiltration systems, glass mats effectively filter particulates from liquids or gases, offering protection against corrosion, chemicals, and moisture.

Glass mats improve acoustics and noise reduction in automotive and architectural settings. The appeal of glass mats lies in their endurance and long-lasting performance, thanks to their exceptional tensile strength and dimensional stability.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.5% |

| Global Market Size in 2023 | USD 1.34 Billion |

| Global Market Size in 2024 | USD 1.41 Billion |

| Global Market Size by 2034 | USD 2.41 Billion |

| U.S. Market Size in 2023 | USD 360 Million |

| U.S. Market Size by 2034 | USD 620 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Binder Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid urbanization in developing countries

Developing countries like India are witnessing rapid urbanization coupled with increasing housing demand. It is projected that the Indian real estate market will grow exponentially with cost-effective housing. The Indian government is also supporting several innovative building technologies to address this issue with traditional construction, such as sustainability, labor recruiting, productivity, and safety. Moreover, government advancements in the construction industry across the globe can also boost the glass mat market during the forecast period.

High cost of glass mat

The cost of high-quality glass mats is quite high, and because there are cheaper alternatives like glass fibers available, the market growth for glass mats might be limited in the future. Also, in developing countries, there's a shift from using glass mats to other products like glass cloth and glass wicks because they're easier to use with automated processes and newer mold applications. This change is making it harder for the glass mat market to grow.

Rise in construction and infrastructure projects

The increase in construction and infrastructure projects worldwide is driving up the demand for glass mats. These mats are tough and durable, preventing leaks and lasting a long time. They're flexible, can withstand heat and moisture, won't catch fire easily, and are resistant to water damage and mold. Because of these qualities, they're being used more in flooring, roofing, insulation, and vehicles. This rising demand from industries like construction, chemicals, and automotive is expected to boost the glass mat market revenue in the future.

Utilizations of glass mat in various industries

The electrical and electronics industry uses glass mats because they're great at insulating against both heat and electricity. This creates various opportunities in the glass mat market. They're used in things like appliances, transformers, and circuit boards to keep them safe and working well. In the marine industry, glass mats are handy for boat parts like hulls and decks because they resist corrosion, repel water, and last a long time in tough conditions. Furthermore, glass mats are also used to make wind turbine blades and aerospace parts because they're light but strong, which is important for those applications.

The chopped strand glass mats segment dominated the market share in 2023 and is expected to maintain its position throughout the forecast period. This is especially due to its demand in the construction and automotive sectors and its affordable nature. Chopped strand mat is extensively used in mold making and to produce low-cost GRP moldings like panels and small boat hulls.

The continuous filament mats segment is expected to be at a significant pace over the foreseen period. A continuous filament mat (CFM) has better mechanical properties than a chopped strand mat (CSM), as it is stronger, stiffer, and more stable in shape. Because of this, CFM is preferred for things that need to be strong and stiff, like wind turbine blades, aerospace parts, and car components. It's also lighter than materials like metal or concrete, which is great for making things like airplanes and wind turbine blades that need to be lightweight. People want composites more because they're strong, stiff, and light. CFM is a big part of composites, so it's boosting the glass mat market.

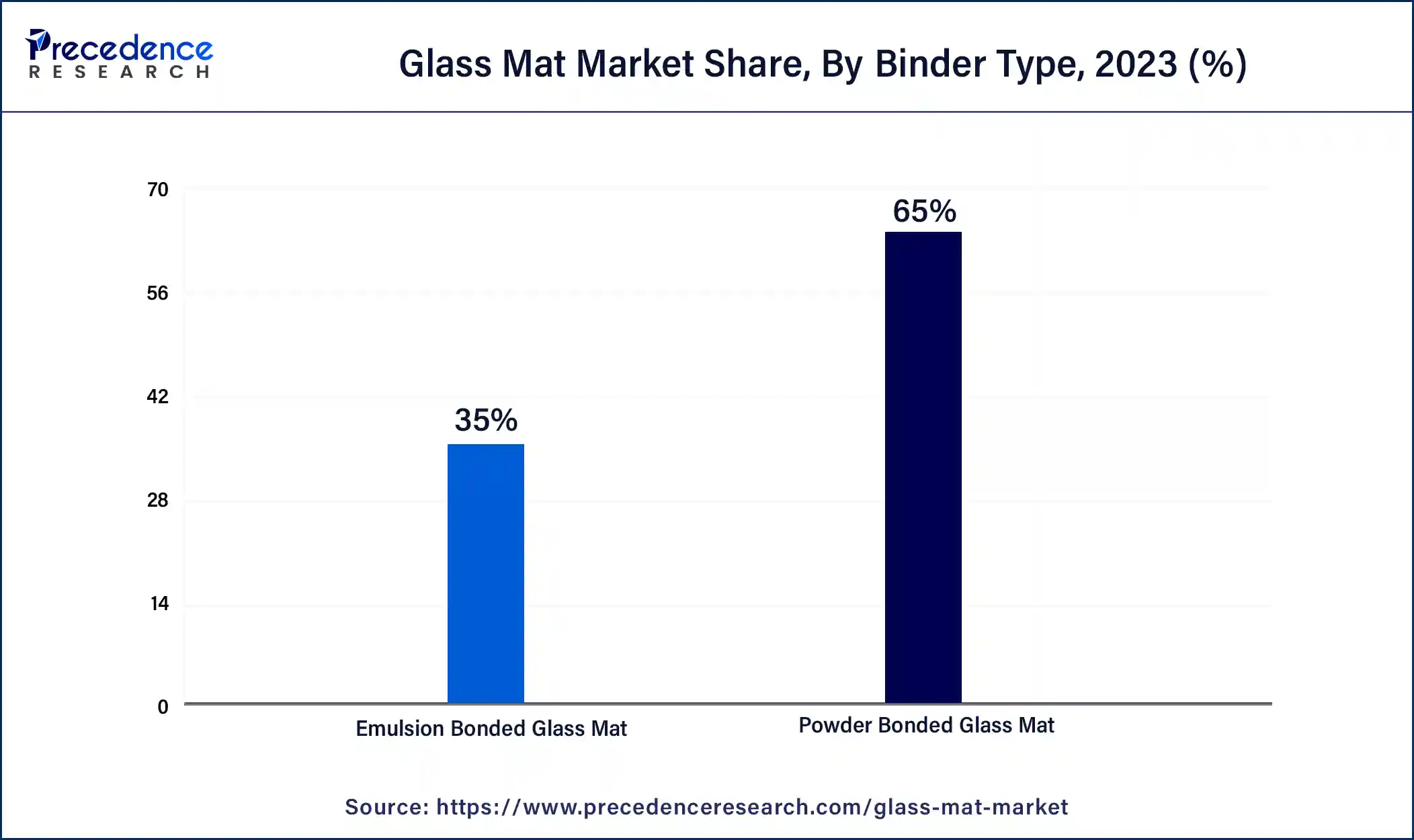

The powder bonded segment held the largest share in the glass mat market in 2023. This is attributed to its cost-effectiveness and convenient application in various sectors. Additionally, the growing demand for eco-friendly coating solutions will drive the segment's growth over the projected period.

The emulsion segment is expected to grow significantly over the forecast period. Emulsion-bonded glass mats are popular in the vehicle industry because people want lighter cars and use less fuel. Using these glass mats can make vehicles lighter, which means they can go further on less fuel. Emulsion-bonded glass mats are better than powder-bonded ones because they're more flexible, easier to work with, and stick better. This makes them stronger and longer lasting in whatever they're used for.

The construction & infrastructure segment held a significant share of the glass mat market in 2023 and is expected to grow substantially during the forecast period. Construction is booming all over the world because cities are growing fast, the population is increasing, and there's a lot of new infrastructure being built. Glass mats are used a lot in construction for things like roofs, walls, floors, and insulation. Because there's so much construction happening, there's a big demand for glass mats. They're great because they're strong, last a long time, resist moisture, and don't catch fire easily, which makes them perfect for building stuff. As more people learn about how good glass mats are, the demand for them in construction keeps going up.

Segments Covered in the Report

By Type

By Binder Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

April 2025

January 2025