April 2025

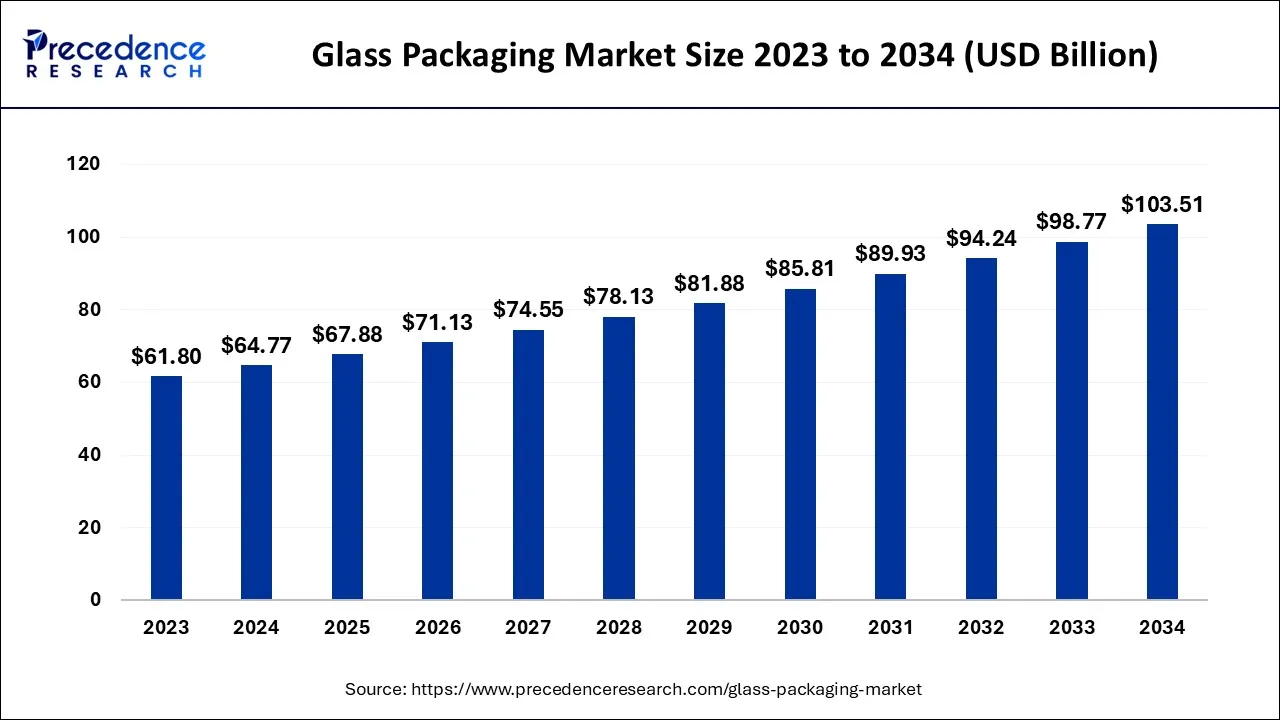

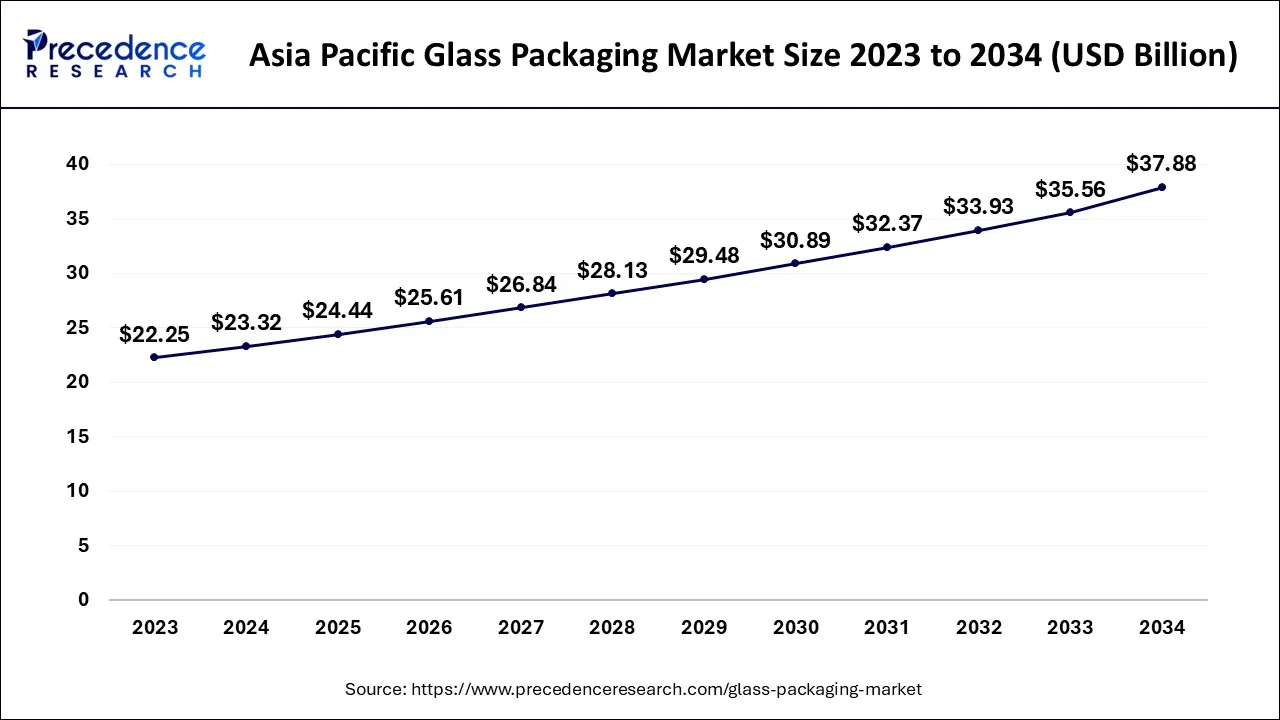

The global glass packaging market size accounted for USD 64.77 billion in 2024, grew to USD 67.88 billion in 2025, and is expected to be worth around USD 103.51 billion by 2034, poised to grow at a CAGR of 4.8% between 2024 and 2034. The Asia Pacific glass packaging market size is predicted to increase from USD 23.32 billion in 2024 and is estimated to grow at the fastest CAGR of 4.97% during the forecast year.

The global glass packaging market size is expected to be valued at USD 64.77 billion in 2024 and is anticipated to reach around USD 103.51 billion by 2034, expanding at a CAGR of 4.8% over the forecast period 2024 to 2034. The rising focus on sustainable solutions for packaging, especially in the food & beverages industry is observed to boost the growth of the glass packaging market.

The Asia Pacific glass packaging market size is exhibited at USD 23.32 billion in 2024 and is projected to beglass packaging market worth around USD 37.88 billion by 2034, growing at a CAGR of 4.97% from 2024 to 2034.

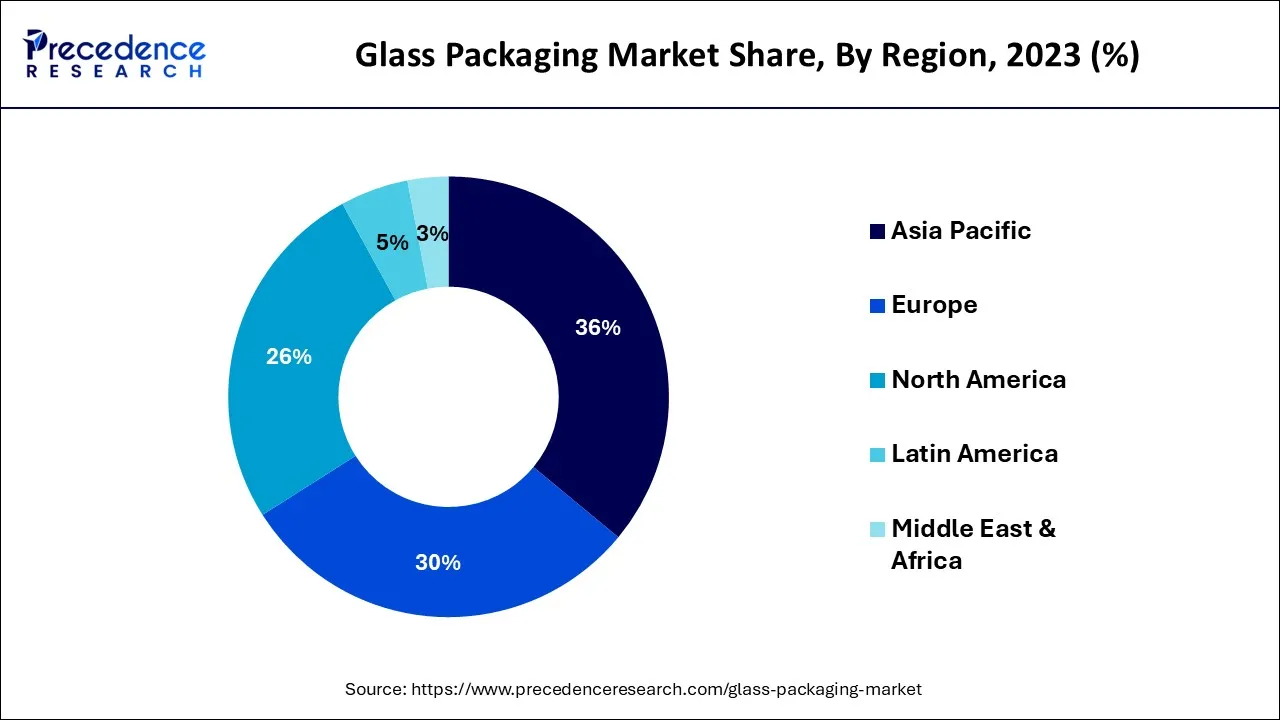

Asia Pacific holds the largest share of the global glass packaging market; the region is expected to maintain its dominance during the forecast period. The Asia Pacific region has a rapidly growing population, which is driving the demand for packaged goods, including food, beverages, and pharmaceuticals. The region is also experiencing rapid urbanization, which is leading to changes in consumer preferences and an increase in demand for high-quality and sustainable packaging solutions.

Glass manufacturers in Asia Pacific are investing in advanced glass production techniques, such as hot-end coating, to improve the quality and durability of glass containers. Advanced decoration techniques, such as digital printing, are used in Asia Pacific to create high-quality and eye-catching designs on glass packaging. Overall, the glass packaging industry in Asia Pacific is experiencing significant technological advancements, which are helping to improve the quality, efficiency, and sustainability of glass packaging solutions. These advancements are expected to continue to drive growth and innovation in the industry in the coming years.

North America is expected to register the fastest growth during the forecast period; the higher consumption of alcoholic beverages in the region is observed as a significant driving factor for the development of the glass packaging market in North America. Moreover, the rapid adoption of advanced technology for innovative glass packaging is another important factor for the market’s growth in the region.

In addition, the rising healthcare expenses in the region demand advanced hygienic devices or containers for healthcare center usage; this is fueling the growth of the glass packaging market in North America by expanding the prevalence of pharmaceutical end-user in the market.

The glass packaging market refers to the innovation, development, distribution, and utilization of glass packaging materials, including bottles, jars, and other materials for numerous end-users. Glass packaging is 100% recyclable, which makes it an attractive option for companies looking to reduce their carbon footprint.

The recyclability of glass packaging also helps to reduce waste and promote a circular economy. Several governments and private organizations are focused on promoting sustainability by implementing a number of initiatives, recycling of glass bottles, jars, and containers to develop new innovative glass products is one of the significant initiatives implemented by various governments. Such initiatives are even rapidly adopted by private companies/organizations. Such steps act as a fueling factor for the growth of the global glass packaging market.

In December 2022, Carlsberg Malaysia announced to work with Sabah Recycling Association to pilot test a three-year glass bottle recycling and community empowerment program. With this program, the company is aiming to fulfill its environmental, social, and governance agenda.

In October 2022, Grupo Petropolis and the National Confederation of Industry announced the launch of a project to improve and increase the utilization of glass throughout the supply chain. The project was launched through the National Service for Industrial Learning to solve the problem of the circularity of glass packaging chains, which focuses on reducing the generation of CO2 in the circular chain of glass, increasing the return the glass packaging, and promoting refillable packaging.

How does technological innovation impact the glass packaging market?

Technological advancements have a significant impact on the glass packaging market, leading to improved manufacturing processes. Advancements in the glass packaging process further lead to reduced energy consumption and waste. Smart inspection systems further improve the entire production process. These systems use computer vision and ML algorithms to detect flaws accurately in glass bottles, such as bubbles, cracks, and irregular shapes. Smart inspection automatically identifies damaged bottles, which ensures that only high-quality products move on to packaging and reduces the risk of defective bottles reaching customers. Furthermore, innovations like NFC integration enhance consumer experiences by providing them with additional information about the product.

| Report Coverage | Details |

| Market Size in 2024 | USD 64.77 Billion |

| Market Size by 2034 | USD 103.51 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.8% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The enormous demand for premium packaging

Consumers are willingly showing interest in buying a premium range of products, especially from the personal care and cosmetics end; this is observed as a significant driver for the market’s growth. Glass packaging has a high-end and luxurious image that can enhance the appeal of premium products, such as high-end spirits, wines, and cosmetic products. As consumers increasingly associate glass packaging with premium quality, businesses can leverage this association to enhance their products' perceived value and drive sales.

Premium products often require high levels of protection during shipping and handling. Glass packaging is a durable and reliable option that can protect products from damage, ensuring they arrive at their destination in excellent condition. Glass packaging provides ample opportunities for branding, as it can be easily branded with logos and other marketing messages.

The fragile nature of glass packaging can make it more expensive to transport and handle compared to other materials. Glass packaging requires special handling and packaging to avoid breakage during transit, which can add to the overall cost of shipping. The fragility factor may not be suitable for use in specific applications, such as for products that require a high degree of impact resistance or flexibility. Due to the risk of breakage during shipping, handling, and use, there may be a higher rate of product waste associated with glass packaging compared to other materials.

This can result in additional costs for businesses and reduce the appeal of glass packaging for some consumers. Overall, the fragility of glass packaging can present challenges and additional costs that may limit its appeal for some businesses and consumers, which could potentially restrain the growth of the glass packaging market.

Innovation in glass material for packaging

As glass packaging becomes more innovative, it can be used for a broader range of products, expanding the market beyond traditional products such as beverages and food. Innovative glass packaging can be used for products such as pharmaceuticals, electronics, and beauty and personal care items. Innovations in glass packaging can improve its functionality, making it more convenient and practical for consumers to use.

Innovations in glass packaging can also improve its sustainability, such as by reducing the amount of material used, creating packaging that is lighter and more compact, or using recycled materials. Sustainable packaging solutions are becoming increasingly important to consumers and businesses, which can create new opportunities for glass packaging manufacturers.

The bottles segment dominated the global glass packaging market in 2023; the segment will maintain its dominance during the forecast period. The versatility and durability of bottles have supported the segment’s growth. Along with this, the rising demand for recyclable materials from the food and beverage industries is observed to maintain the development of the bottles segment during the forecast period.

Rising disposable income is another factor considered for the growth of the bottle segment; as disposable income increases, consumers are more likely to purchase premium products that are often packaged in glass bottles, such as high-end wine, spirits, and cosmetics.

The jars and containers segment is anticipated to register the fastest growth during the forecast period; the growth of the jars and containers segment is attributed to the rising demand for reusable packaging for personal care and cosmetics products. As consumer preferences shift towards sustainable and eco-friendly products, the demand for glass jars and containers is expected to continue to rise, providing ample opportunities for growth and expansion in the market. Moreover, the product safety, convenience, and aesthetic appeal offered by jar and container products are observed to boost the segment’s growth.

The food & beverage segment held the largest market share in 2023; the segment is predicted to maintain its dominance during the forecast period owing to the rising consumption of glass packaging for alcoholic beverages. Companies are focused on utilizing glass materials to maintain the aesthetics of bottles. In recent years, glass packaging has become a popular choice by multiple companies for packing wine, beer, spirits, and juices, as excessive light exposure can degrade the flavor, aroma, and appearance of many beverages, especially those that are sensitive to light. Dark-colored glass, such as amber or green, is often used to provide additional protection from sunlight.

On the other hand, the personal care and cosmetics segment is expected to register the fastest growth during the forecast period. As consumers are becoming more aware about environmental issues, the demand for refillable packaging options for personal care and cosmetics products is predicted to grow.

According to an article published by Beauty Packaging in August 2022, key beauty brands are gradually taking up new challenges to curb the beauty industry’s waste issues. The same report stated that in January 2022, Chanel, a luxury brand launched its new range of cosmetics products by eliminating all plastic components while opting for glass packaging including jars and containers.

The pharmaceuticals segment will remain the most attractive segment throughout the projected timeframe, factors such as protection offered for liquid dosage, the non-reactive nature of glass material, and increased regulations on pharmaceutical companies to shift towards more sustainable ways of packaging, are observed to boost the utilization of glass packaging in the pharmaceutical industry.

Segments Covered in the Report

By Product

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

March 2025