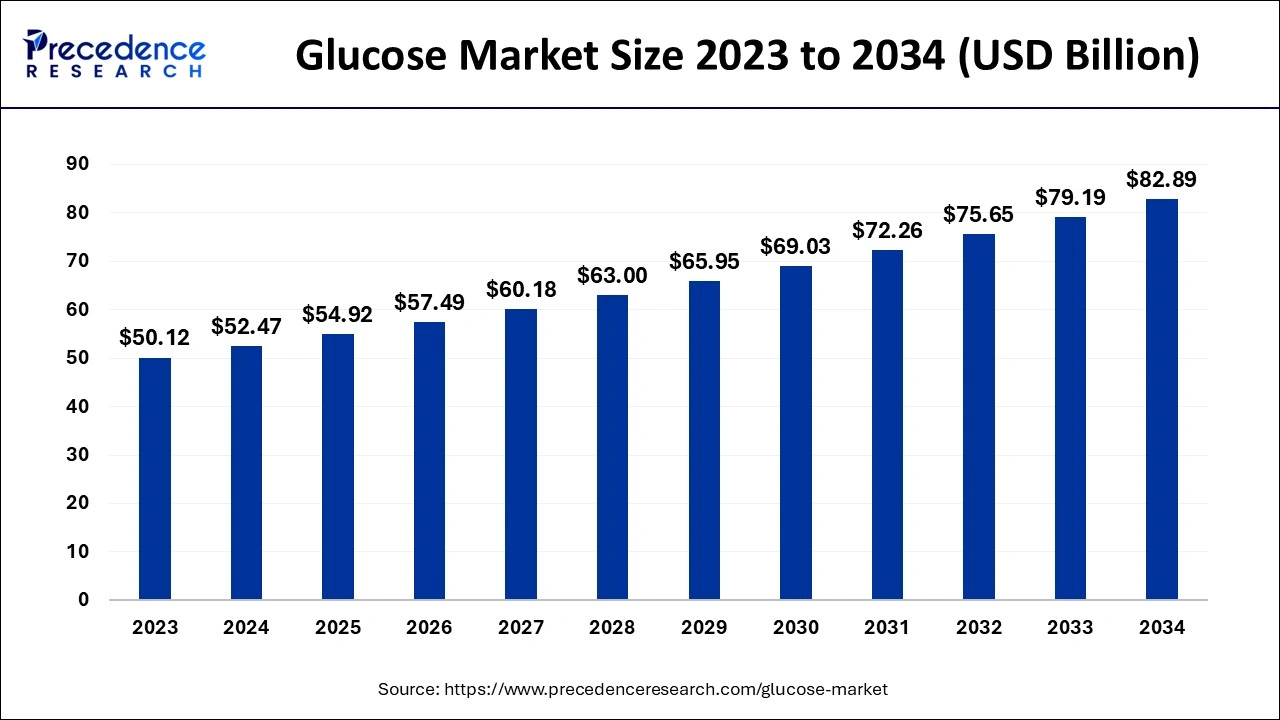

The global glucose market size accounted for USD 52.47 billion in 2024, grew to USD 54.92 billion in 2025 and is projected to surpass around USD 82.89 billion by 2034, representing a healthy CAGR of 4.68% between 2024 and 2034.

The global glucose market size is estimated at USD 52.47 billion in 2024 and is anticipated to reach around USD 82.89 billion by 2034, expanding at a CAGR of 4.68% between 2024 and 2034.

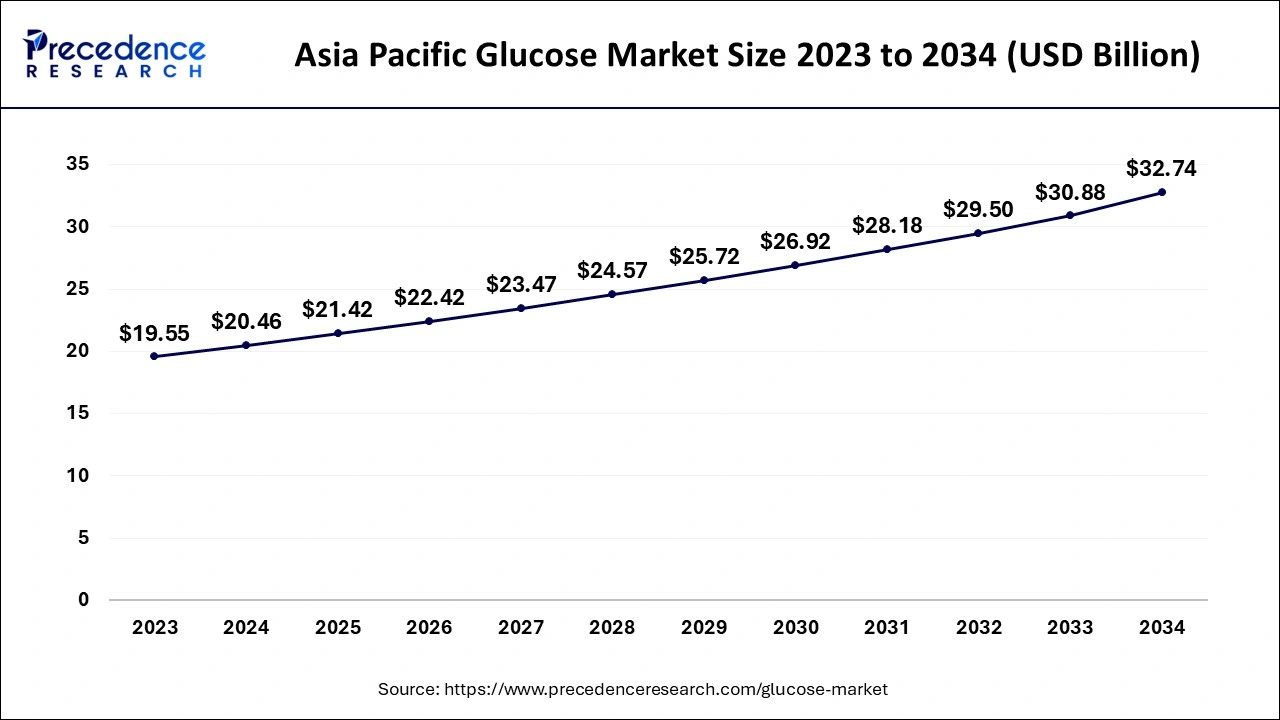

The Asia Pacific glucose market size accounted for USD 20.46 billion in 2024 and is expected to be worth around USD 32.74 billion by 2034, expanding at a CAGR of 4.80% between 2024 and 2034.

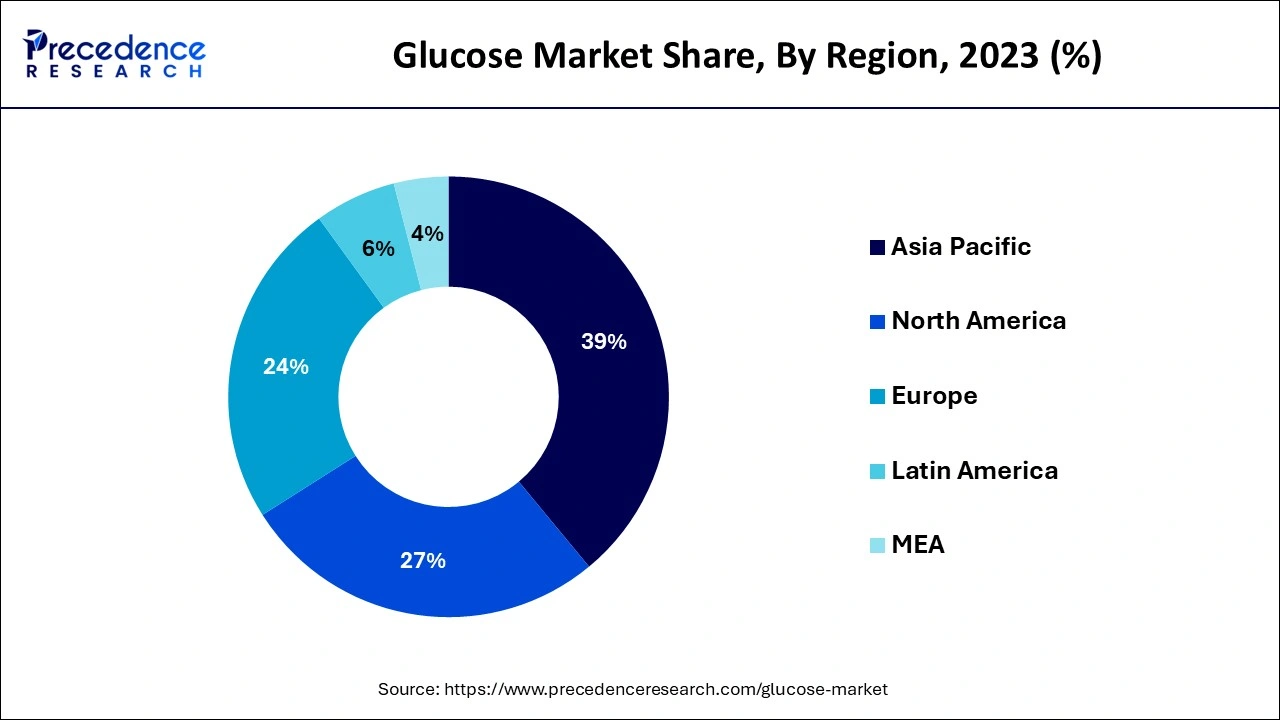

Asia Pacific led the glucose market in 2023 and generated for more than 39% of total revenue. The region is expected to maintain its dominance during the predicted period of 2024 to 2034. The existence of large customer support is the most important factor in determining the highest regional industry value. The region's major economies, including China and India, contribute significantly to revenue. The region's market is being driven by the rising need for food and beverage products in these countries as a result of large customers and prompt economic development.

Europe is gaining momentum due to its significant economies, which include the United Kingdom, Italy, and Germany. Organic, natural, and clean-label products are currently important factors driving demand in European industry. Due to the aging population's emphasis on health, European customers are opting for healthy options like fresh, artisanal, ethnic, and organic food products. As it has been manufactured in the region for over a century, glucose syrup dominates over solid form.

Rising sales of soft drinks, confectionery, as well as bakery products are boosting the glucose market. Glucose is utilized in a variety of industries, including pharmaceuticals, food and beverages, pulp and paper, and cosmetics and personal care. Apart from imparting sweetness, glucose functions as a stabilizer, flavor enhancer, texture enhancer, adjunct, humectant, coating & bulking agent, and preservative. One of the most significant benefits of glucose is that it inhibits sugar from crystallizing in sweets.

Glucose is primarily obtained from corn starch. Glucose is used in cosmetics and personal care for various product formulations, such as hair care and skin care products, cleaning products, makeup products, and bath products. It works as a humectant and skin-conditioning agent. The rising demand from the pharmaceutical industry boosts the market. Pharmaceutical companies are now selling medicines and supplements containing glucose, dextrose, and maltodextrin, which are beneficial to treat a variety of health problems.

| Report Coverage | Details |

| Market Size in 2024 | USD 52.47 Billion |

| Market Size by 2034 | USD 82.89 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.68% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Form and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing use in the bakery and confectionery industry

The increasing use in the bakery and confectionery industry is driving the growth of the market during the forecast period. Glucose is generally produced commercially by the enzymatic hydrolysis of starch. The starch is obtained from a wide variety of plants such as rice, wheat, potato, cassava, corn, arrowroot, and others. In the United States, corn starch is the most common source of glucose. It is commonly used to manufacture homogeneous confectionery items such as chewing gum and chocolates. Dextrose monohydrate is being used as an alternative to sucrose by confectionery manufacturers all over the world. Glucose or dextrose also serves as a flavour enhancer and texture-creating agent. It prevents sugar crystallization, a desirable feature in confectionery products, which increases its use in the confectionery industry significantly. Moreover, several food and beverage companies used these ingredients owing to the several benefits associated with them, including their use as sweeteners, binders, emulsifiers, and thickening agents.

Diabetes is a significant impediment to market growth.

Many doctors believe fructose is better for people with diabetes than sugar, but glucose is absorbed by every cell in the body. The liver, on the other hand, is in control of fructose metabolism. Diabetes has been linked to the intake of high fructose corn syrup, which includes an abundance of free-floating fructose. In comparison to fruit, which contains fructose, fiber, and nutrients to aid digestion, glucose syrup has little nutritional value. There are only calories and sugar.

Increased R&D activity.

Rising R&D activities in a variety of industries, including pharmaceuticals, food and beverage, and others, as well as a strategy to track the untapped market, are expected to open up new opportunities for manufacturers in the glucose, dextrose, and maltodextrin markets.

The launch of low-sugar syrup has become a significant trend in the glucose industry, gaining popularity. To meet consumer demand and strengthen their position, significant players in the glucose industry are focusing on the launch of low-sugar syrups. For example, the ingredion launched a stable sweet low-sugar syrup in November 2020. It is produced with the support of corn.

The company intended to market these stable sweet low, sugar-glucose syrups in a variety of forms, including lollipops, chewy sweets, hard-boiled candy, gummies, and jellies. This reduces sugar recrystallization and stickiness in the finished product while improving shelf-life and color stability.

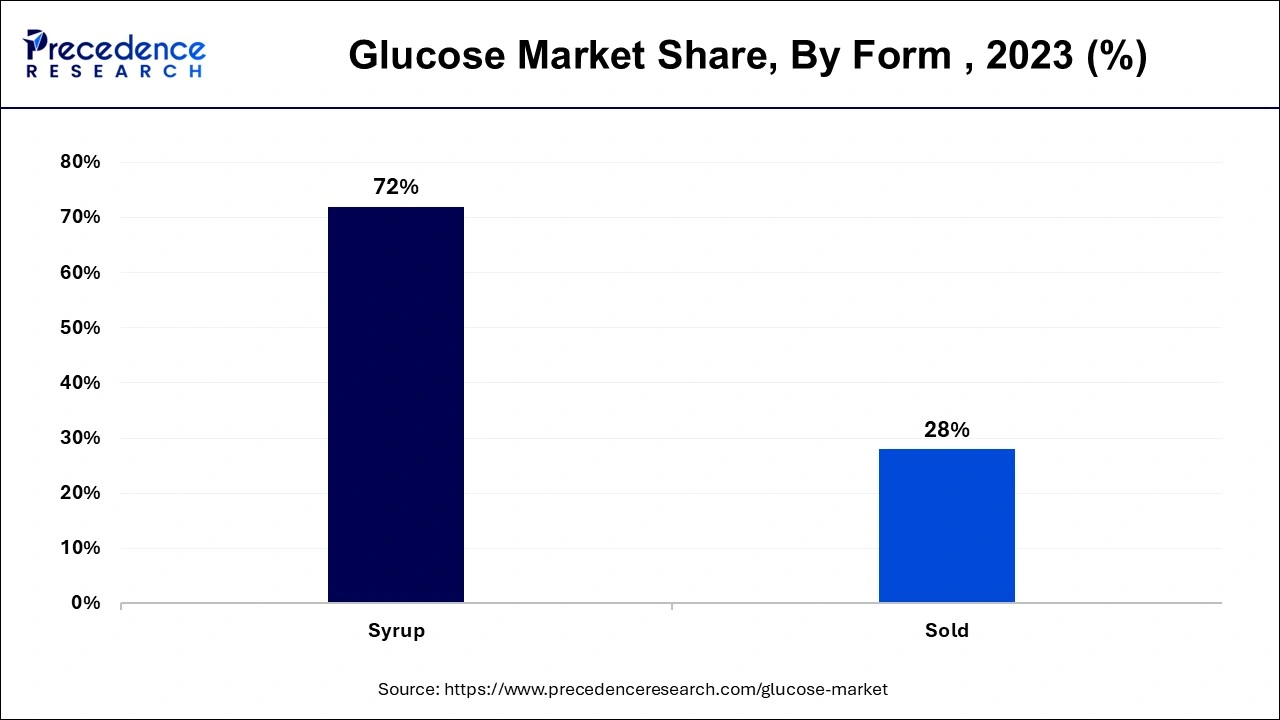

The syrup segment accounted for the largest share in 2023 due to its high usage in various for & beverages. Syrup is liquid glucose commonly derived from corn as well as cereal grains such as wheat, barley, rice, cassava, and potato. For instance, various glucose syrup was provided by AGRANA under the label AGENABON. Most of them are produced from wheat and corn. According to the culture of the region, it is generally used in the manufacture of a diverse range of beverages and food products.

The rising demand for convenience foods, as well as the increased use of such syrups in bakery products such as desserts, are the factors propelling the segmental growth. Furthermore, as the demand for sugar substitutes increases, such syrups are used in the production of chewing gum, ice cream, canned meals, and chocolates.

Non-GMO, organic, vegan, and low-sugar syrups are among the current developments in the market. AGENABON, for example, aids in the reduction of microbiological decay during storage as well as the decrease of syneresis. AGENABON organic syrup is a preferred ingredient for non-GMO and organic products like spices, ice cream, meat products, ketchup, barbecue sauces, and liqueurs.

The solid segment is expected to expand at the fastest rate in the coming years. Glucose powder, or solid form, is widely used in food and beverages due to its adaptability. The rising demand for natural glucose powder is projected to contribute to segmental growth. Moreover, the longer shelf life of powder glucose contributes to its increased demand.

The food & beverages segment held the largest segment of the glucose market in 2023. This is mainly due to the rising demand for sweeteners in various food items. Glucose is mainly used in confectionery products like chocolates and chewing gum. Due to changing diet habits and urbanization, the demand for bakery products has increased. The application of glucose in baked goods has advantages; it's simply fermentable, promotes browning in buns and bread making, and avoids syrup crystallization. This makes it a suitable component in bakery goods.

The cosmetic & personal care segment is expected to grow rapidly during the forecast period. In cosmetics and personal care products, glucose is widely used in the formulation of bath products, eye makeup, cleansing products, skincare products, and hair care products. The demand for cosmetics and personal care products is increasing due to the growing awareness about hygiene, contributing to segmental growth.

Segments Covered in the Report:

By Form

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client