What is Green Electronics Manufacturing Market Size?

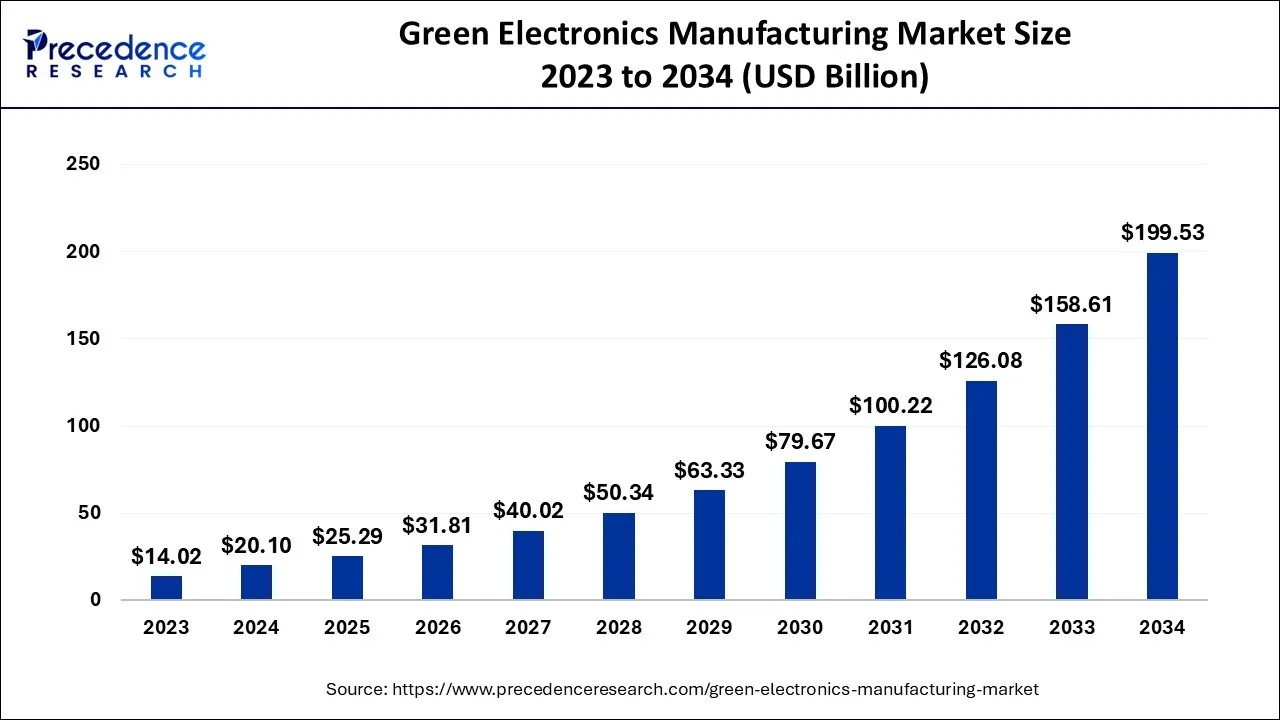

The global green electronics manufacturing market size is expected to be valued at USD 25.29 billion in 2025 and is anticipated to reach around USD 234.85 billion by 2035, expanding at a CAGR of 24.96% over the forecast period from 2026 to 2035.

Market Highlights

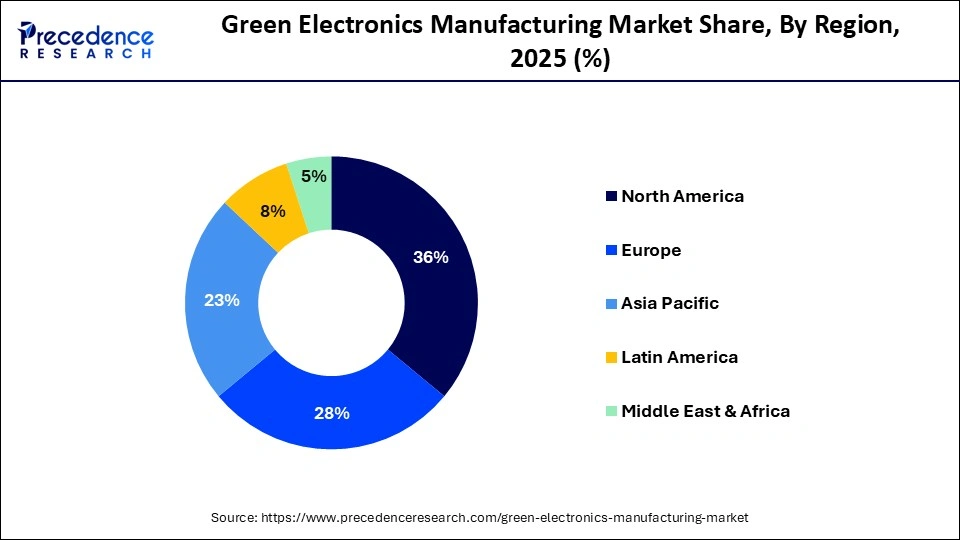

- North America led the global market with the highest market share of 36% in 2025

- By Technology, the lead-free technology segment captured for the maximum market share in 2025.

- By Application, the Portable segment contributed for the largest market share in 2025.

Market Overview

Electronics manufacturers are now investing in renewable energy solutions such as solar, wind, and hydropower to reduce their reliance on fossil fuels and lower their carbon footprint. This is driven by environmental concerns and the desire to reduce energy costs, as renewable energy sources often are more cost-effective in the long run.

Moreover, the green electronics manufacturing market increasingly focuses on circular economy principles that involve designing products and processes that minimize waste and maximize the use of resources, such as through recycling, remanufacturing, and refurbishment. Manufacturers are also exploring ways to incorporate recycled materials into their products, which can help reduce their environmental impact.

Growth Factors

The rising adoption of smart electronic devices is a key factor boosting the market's growth during the forecast period.

- Rising consumer preferences for eco-friendly and sustainable products are projected to create lucrative opportunities in the market.

- Major electronics manufacturers are increasingly investing in recycling and producing eco-friendly products and implementing several business ideas to promote sustainable practices.

- Rising awareness about green electronics manufacturing further fuels the market growth. Green electronics manufacturing can be a cost savings for manufacturers.

- Governments worldwide are imposing stringent environmental regulations and policies to lessen environmental impact, contributing to the growth of the green electronics manufacturing market in the coming years.

How are technological advancements impacting the growth of the green electronics manufacturing market?

Rapid technological advancements are flourishing the growth of the green electronics manufacturing market. Technological innovation enables the development of energy-efficient components, which assists manufacturers in producing green electronic devices. Integrating artificial intelligence (AI) and blockchain technologies paves the way for green electronics manufacturing. AI-powered predictive maintenance and optimization algorithms lead to enhanced energy efficiency and reduced waste. Blockchain facilitates transparent and traceable supply chains that ensure the responsible sourcing of materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.29 Billion |

| Market Size in 2026 | USD 31.81 Billion |

| Market Size by 2035 | USD 234.85 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 24.96% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing environmental concerns

Over the past few decades, there has been a growing awareness of the environmental impact of electronic waste, which has led to an increased demand for sustainable and eco-friendly electronic products. The electronics industry significantly contributes to environmental degradation, as electronic products often contain hazardous materials such as lead, cadmium, and mercury. When electronic products are not disposed of properly, these hazardous materials can end up in landfills, where they can contaminate soil and groundwater. Electronic waste can also release greenhouse gases when incinerated, contributing to climate change.Consumers increasingly seek sustainable and eco-friendly products as they become more aware of their purchases' environmental impact. This has created a market for green electronics manufacturing, where companies can differentiate themselves by producing more environmentally friendly products.

In response to this demand, many electronics companies are adopting sustainable practices, such as using recycled materials in their products, reducing the energy consumption of their manufacturing processes, and designing products that are easier to recycle or repair. Some companies even partner with environmental organizations to develop more sustainable practices and technologies.

Governments worldwide are also imposing regulations on the electronics industry to reduce its environmental impact. For instance, the EU RoHS directive restricts using certain hazardous substances in electronic products.

The EU WEEE directive requires electronics manufacturers to take responsibility for collecting and recycling their products. Therefore, growing environmental concerns drive the green electronics manufacturing market by creating demand for more sustainable and eco-friendly products and pushing electronics companies to adopt more sustainable practices.

Restraint

High costs associated with implementing sustainable practices and technologies in the manufacturing process

While green manufacturing has many benefits, such as reduced environmental impact, increased efficiency, and improved brand reputation, the initial costs of adopting these practices can be a significant barrier for many companies. There are several reasons why implementing sustainable practices can be expensive: Upfront Costs: Many green technologies and practices require substantial investment in new equipment, facilities, and infrastructure.

For example, companies may need to invest in new machinery or reconfigure their existing facilities to reduce energy consumption, switch to renewable energy sources, or incorporate recycled materials. Limited availability of materials: Sustainable materials can also be challenging and more expensive than traditional materials. For example, some sustainable materials used in electronics manufacturing, such as bioplastics, are still in the early stages of development and may not yet be widely available at a reasonable cost. Training and education: Companies may also need to invest in employee training and education to ensure staff members are familiar with new equipment and processes. This can be costly and time-consuming and may require hiring new staff or partnering with outside consultants.

As a result of these challenges, some companies may be hesitant to adopt sustainable practices or may delay their implementation. This limits the growth of the green electronics manufacturing market and slows the transition to a more sustainable economy. However, as sustainable technologies become more widely adopted and competition increases, costs will likely come down, making green manufacturing more accessible to a wider range of companies.

Opportunity

Adoption of circular economy and closed-loop manufacturing

Adopting a circular economy and closed-loop manufacturing approach in the electronics industry has several benefits. Firstly, it helps to reduce the environmental impact of manufacturing by minimizing waste generation and resource consumption. This is particularly important in an industry that generates significant waste, such as electronic waste. Secondly, adopting a circular economy approach helps manufacturers to reduce costs and improve efficiency by promoting resource efficiency and reducing the need for new raw materials.

This can help to increase profitability while reducing the environmental impact of manufacturing. Thirdly, adopting a circular economy and closed-loop manufacturing approach helps increase product lifespan and promote a more sustainable consumer consumption pattern. By designing products that are easy to disassemble, repair, and recycle, manufacturers can extend the lifespan of products and reduce the amount of waste generated.

To take advantage of this opportunity, manufacturers in the electronics industry will need to invest in research and development to develop new products and production processes that promote the efficient use of resources and the reduction of waste. This may involve working closely with suppliers and other stakeholders to develop new materials and production techniques that are more sustainable.

In addition, manufacturers must work closely with regulators and policymakers to ensure that their products and production processes comply with environmental regulations and standards. This may involve obtaining certifications, such as the ISO 14001 environmental management standard, and participating in collaborative initiatives that promote sustainable manufacturing practices.

In conclusion, adopting a circular economy and closed-loop manufacturing approach provide significant opportunities for manufacturers in the green electronics manufacturing market. By promoting resource efficiency, reducing waste, and increasing product lifespan, manufacturers can improve profitability while reducing their environmental impact. However, taking advantage of this opportunity will require investment in research and development, collaboration with stakeholders, and a commitment to sustainability.

Segment Insights

Technology Insights

The lead-free segment dominated the market with the largest share in 2023. This is partly due to the introduction of the EU's Restriction of Hazardous Substances (RoHS) directive, which restricts the use of certain hazardous substances, including lead, in electronic products sold in the European Union. As a result, many manufacturers have shifted towards lead-free technology to comply with this directive. Moreover, lead-free technology has potential health benefits for workers involved in electronic manufacturing, as lead exposure can cause serious health problems. By using lead-free technology, manufacturers can reduce the risk of lead exposure for their workers and provide a safer working environment. Therefore, the adoption of lead-free technology in the green electronics manufacturing market is driven by environmental regulations, health benefits, consumer demand, industry standards, and technological advancements. By using lead-free technology, manufacturers can improve the sustainability of their products and meet the growing demand for more sustainable electronics.

The halogen-free segment is expected to grow significantly during the forecast period. Halogen-free technology means that the halogen content in materials or products is within statutory limits and poses no hazard to users. Halogen-free technology plays an important role in electronics manufacturing, particularly in manufacturing wires, cables, and other electronic components. In halogen-free materials, the fire risk is reduced, and the exposure to potentially harmful chemicals is minimized.

Application Insights

Based on application, the green electronics manufacturing market is segmented into electronics, portable electronics, Industrial, Automotive and Others. In 2025, the Portable segment accounted for the highest market share. This is due to the increasing demand for portable and energy-efficient electronic devices such as smartphones, laptops, and tablets. Consumers are increasingly seeking eco-friendly and energy-efficient options, and manufacturers are responding by developing more sustainable products and manufacturing processes. Many manufacturers in the portable electronics segment have also started implementing take-back and recycling programs to reduce electronic waste and encourage responsible disposal of old devices.

Additionally, there is a growing trend toward designing products that can be easily upgraded or repaired, extending their lifespan and reducing the need for frequent replacements. Thus, the portable electronics segment is expected to grow in the coming years, driven by technological innovations and increasing demand for mobile and energy-efficient devices. Manufacturers who prioritize sustainability in their product development and manufacturing processes are likely to be at an advantage in this rapidly evolving market.

Regional Insights

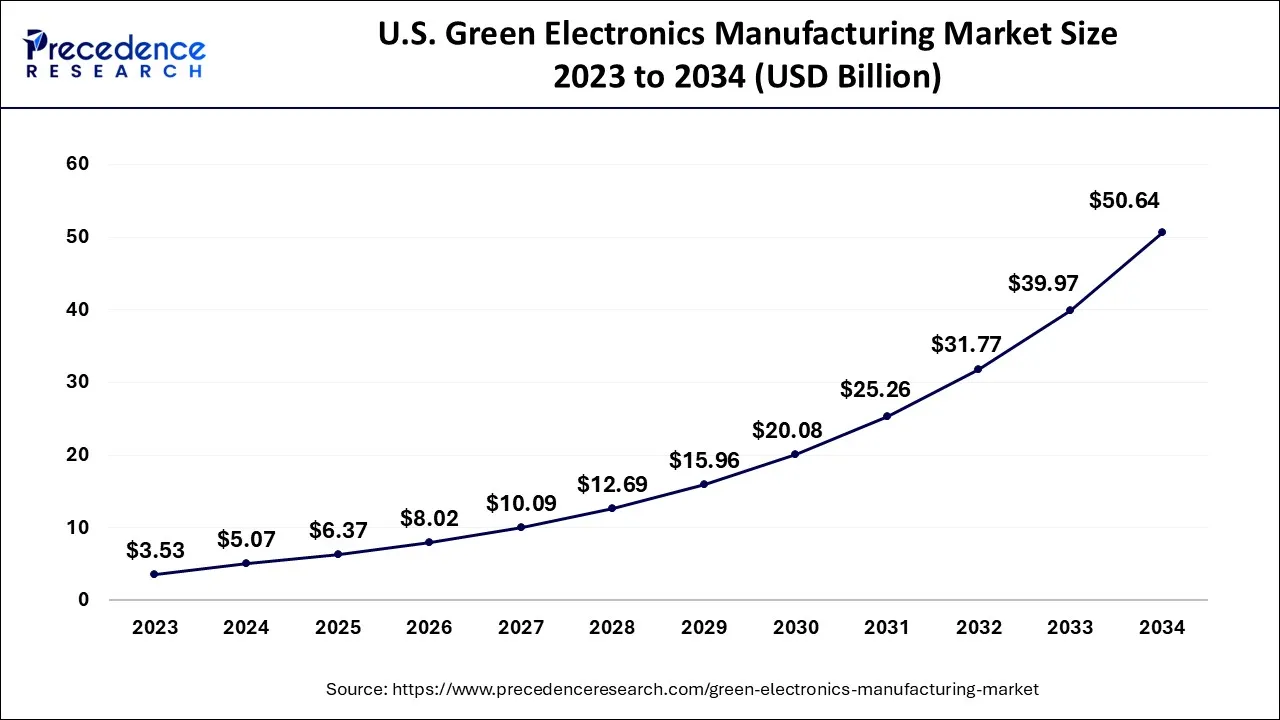

U.S. Green Electronics Manufacturing Market Size and Growth 2026 to 2035

The U.S. green electronics manufacturing market size is exhibited at USD 6.37 billion in 2025 and is projected to be worth around USD 59.66 billion by 2035, growing at a CAGR of 25.07% from 2026 to 2035

U.S. Green Electronics Manufacturing Market Analysis

The U.S. market for green electronics manufacturing is driven by federal funding for R&D, compliance with regulatory standards, and material innovation. The electronics manufacturers and the companies stay updated with the environmental regulations that help them maintain compliance. Government initiatives, incentives for clean manufacturing, and corporate sustainability commitments are further accelerating the adoption of green technologies. Rising consumer demand for environmentally responsible electronics is also shaping product design and supply chain strategies.

How did the Asia Pacific Region dominate the Green Electronics Manufacturing Market in 2025?

Asia Pacific held the largest share of the green electronics manufacturing market in 2023. The region is home to some of the major electronics manufacturers and is characterized by rapidly growing economies, creating significant growth opportunities in the green electronics manufacturing market. In addition, the region is witnessing significant increase in demand for eco-friendly products and sustainable manufacturing practices. China, Japan, and South Korea are the leading countries in the regional green electronics manufacturing market, driven by government initiatives and policies promoting sustainable practices and renewable energy.

- According to the IBEF, India is considered a popular manufacturing hub and has grown its domestic electronics production from US$ 29 billion in 2014-15 to US$ 101 billion in 2022-23. India's electronics sector contributes around 3.4% of the country's gross domestic product (GDP).

Why is North America the Fastest-Growing Region in the Green Electronics Manufacturing Market?

On the other hand, North America is anticipated to grow at the fastest rate in the market during the forecast period. This is mainly due to the rising acceptance of sustainable manufacturing practices and the increasing demand for green electronics. Regional electronic manufacturers are investing in R&D and focusing on developing green electronics, contributing to regional market growth. Moreover, governments around North America provide incentives to companies or businesses to adopt sustainable manufacturing practices. These incentives can be in the form of research funding, tax breaks, and grants.

Additionally, the region is experiencing increasing demand for eco-friendly products and sustainable manufacturing practices. China, Japan, and South Korea are the leading countries in the Asia Pacific region for green electronics manufacturing, driven by government initiatives and policies promoting sustainable practices and renewable energy. China is the region's largest green electronics manufacturing market, driven by the country's focus on reducing carbon emissions and promoting sustainability.

How is the Notable Growth of Europe in the Green Electronics Manufacturing Market?

Europe is expected to grow at a notable rate in the market during the studied period due to the regulation of sustainable products, material recycling, and regulatory frameworks. The electronics working group of the European Union coordinates research projects and drives the green economy. Manufacturers are increasingly adopting eco-design principles, recyclable materials, and energy-efficient production technologies to comply with EU directives such as RoHS and WEEE. Growing investments in renewable energy-powered manufacturing facilities and circular economy practices, including electronics recycling and reuse, are further shaping the market.

• In June 2025, the GENESIS project launched in Europe, which has driven the transition of Europe to sustainable semiconductor manufacturing. The projected aimed to reduce harmful gases and optimize waste treatment across the region.

What are the Major Factors Contributing to the Green Electronics Manufacturing Market within South America?

South America is expected to experience significant growth during the forecast period due to regulatory reforms, e-waste management, and the integration of renewable energy. The investment by Stellantis aims to support 40 new products, bring new business opportunities, and boost the production of decarbonization technologies. Manufacturers are adopting eco-friendly materials, energy-efficient manufacturing processes, and improved waste management to align with environmental regulations and corporate sustainability goals.

• In March 2024, Stellantis announced the investment of €5.6 billion in South America, which is the largest investment in the automotive industry of this region. This has been the biggest automotive investment in South American history.

What Opportunities Exist in the Middle East and Africa in the Green Electronics Manufacturing Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by the adoption of Industry 4.0. the national sustainability initiatives, the national strategic visions, and the integration of renewable energy. The major investors in the Middle East and African startups belong to companies across AI, fintech, robotics, and deep tech.

Government-led sustainability agendas, renewable energy investments, and regulations promoting lower carbon footprints are encouraging manufacturers to adopt cleaner technologies. In addition, growing demand for energy-efficient consumer electronics and industrial equipment is influencing production strategies.

Green Electronics Manufacturing Market Companies

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Dell Technologies Inc.

- Sony Corporation

- LG Electronics Inc.

- HP Inc.

- Panasonic Corporation

- Siemens AG

- Toshiba Corporation

- General Electric Company

Recent Developments

- In October 2024, researchers from the Queen Mary University have developed new nanocomposite films using starch instead of petroleum-based materials, marking a significant advancement in the field of green electronics.

- In July 2024, Foxlink, a global leader in electronics manufacturing, announced a major expansion to its green energy manufacturing footprint in the U.S. By investing approximately US$ 20 million in wholly owned subsidiary Foxlink Arizona, the company has created over 100 new jobs in the Phoenix area. Adding high-value jobs in green energy will also support the local economy and keep next-generation innovation in the U.S.

Segments Covered in the Report

By Technology

- Lead-Free

- Halogen-free

By Application

- Electronics

- Portable electronics

- Industrial

- Automotive

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344