January 2025

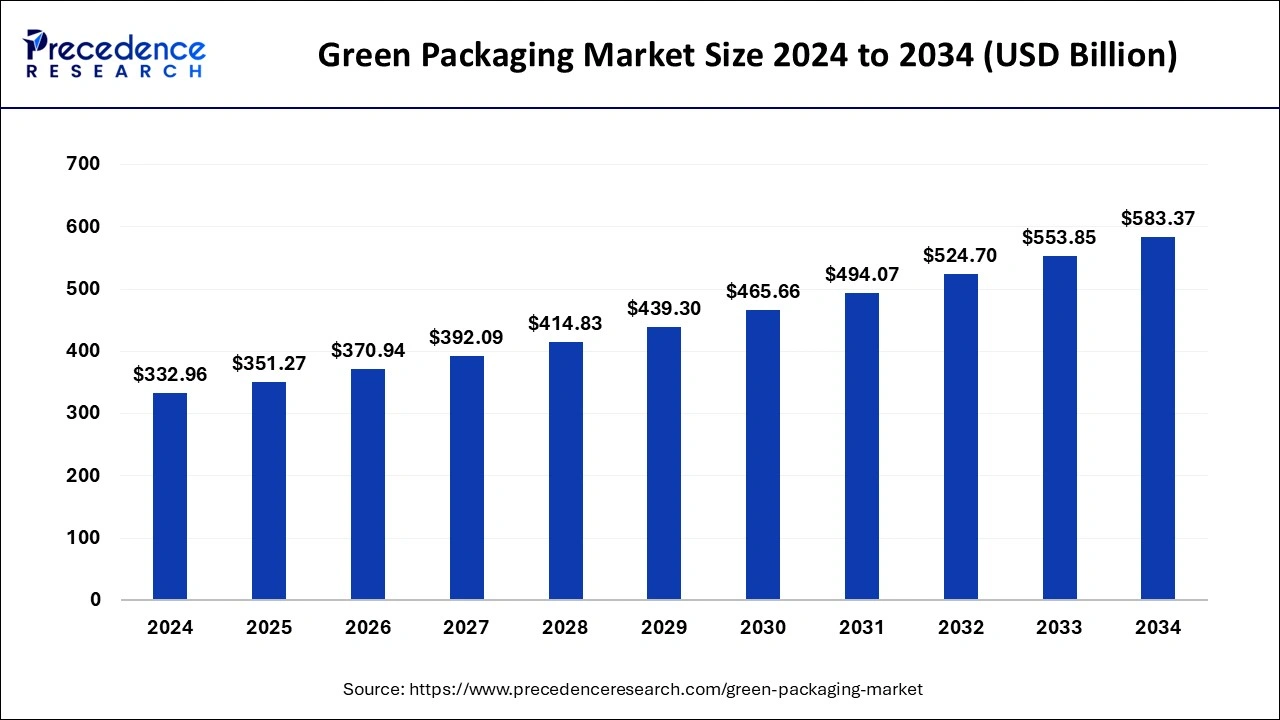

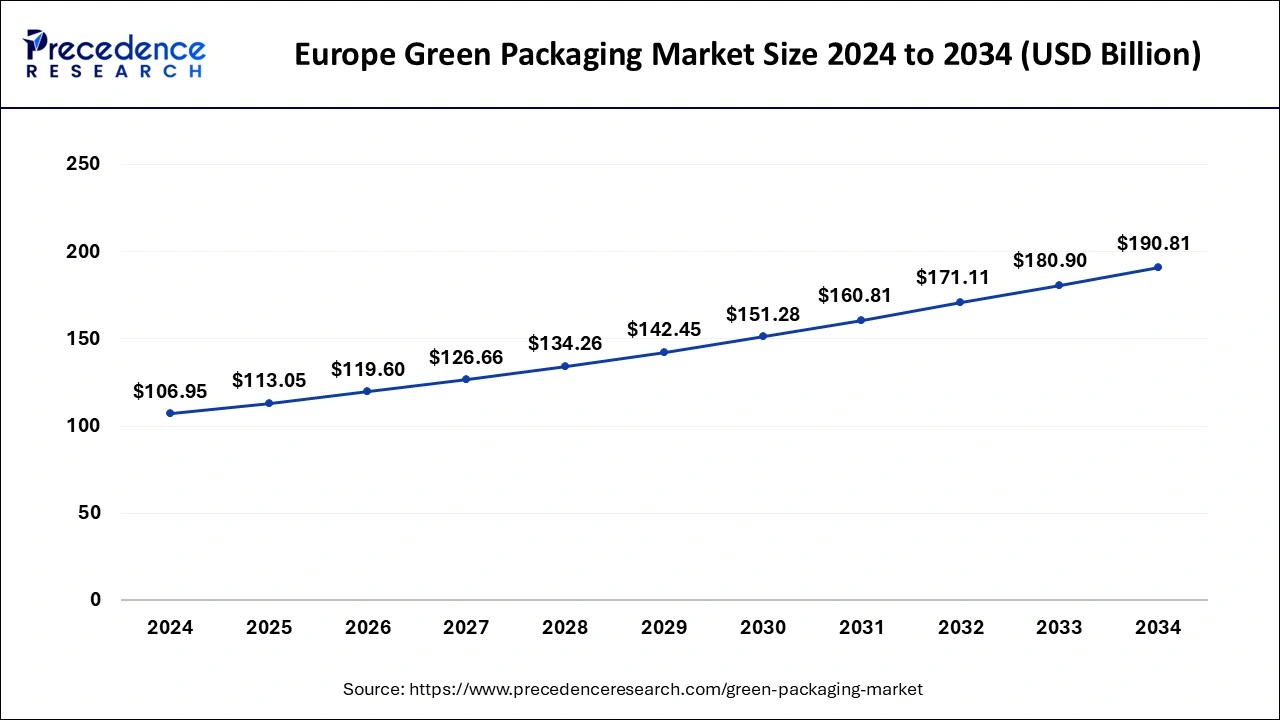

The global green packaging market size is calculated at USD 351.27 billion in 2025 and is forecasted to reach around USD 583.37 billion by 2034, accelerating at a CAGR of 5.77% from 2025 to 2034. The Europe green packaging market size surpassed USD 106.95 billion in 2024 and is expanding at a CAGR of 5.96% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global green packaging market size was valued at USD 332.96 billion in 2024 and is anticipated to reach around USD 583.37 billion by 2034, expanding at a CAGR of 5.77% from 2025 to 2034. The green packaging market is growing because it is an efficient and cost-effective alternative to single-use packaging.

With the use of machine learning algorithms, AI can create high-quality packaging that uses minimum materials without requiring any protection. AI can also try different scenarios to predict how volumes will counter different trends and avoid excessive volumes. Sustainable packaging manufacturers and retailers are using AI not only to create more sustainable packaging but also to predict the performance of each design. AI can analyze the environmental impact of different packaging materials, including biodegradability, recyclability, and carbon footprint. AI-powered material design and optimization enables the development of biodegradable, compostable, and renewable packaging materials that are comparable to traditional plastics while reducing environmental impact and leading to green packaging market.

The Europe green packaging market size was exhibited at USD 106.95 billion in 2024 and is projected to be worth around USD 190.81 billion by 2034, growing at a CAGR of 5.96% from 2025 to 2034.

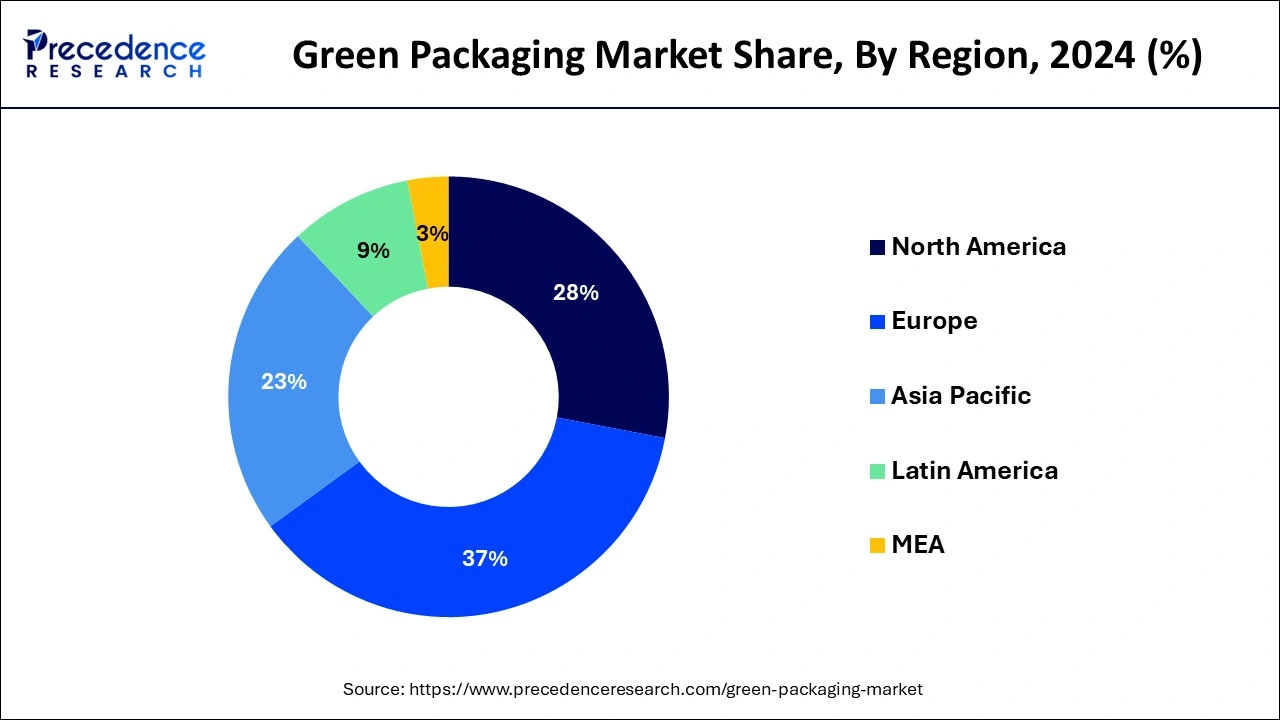

Europe was the leading green packaging market and it garnered a market share of around 37% in 2020. The stringent government regulations pertaining to the use of single-use plastics and increased awareness towards sustainability has fostered the demand for the green packaging across Europe. The government initiatives to promote the adoption of green packaging solutions are a major factor that has driven the growth of the Europe green packaging market.

Asia Pacific is expected to be the fastest-growing market during the forecast period. Asia Pacific is the manufacturing hub of the world. The low cost availability of plastic materials has fostered the adoption of the recycled plastic, recycled paper, and recycled glass packaging across various applications. Moreover, the surging growth of the food and beverages and the FMCG industry in the region is expected to be the most prominent driver of the green packaging market. Moreover, the government regulations regarding the plastic use is driving the adoption of the green packaging solution across Asia Pacific.

| Report Coverage | Details |

| Market Size in 2025 | USD 351.27 Billion |

| Market Size by 2034 | USD 583.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.77% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging Type, Application, Material, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Recycled content packaging segment dominated the global green packaging market in 2024. The extensive usage of materials such as plastic, glass, metal, and paper, which can be easily recycled, has propelled the growth of this segment. These materials are recycled by the manufacturers to produce a new packaging and hence the amount of wastage is drastically reduced. It has become the most popular and widely accepted type of green packaging.

Furthermore, the low cost of plastic and its high durability has made the use of recycled plastic popular across the globe. The low cost of the recycled plastic has gained rapid traction in the developing regions. Therefore, the surging adoption of the recycled plastic across various end use verticals has resulted in the dominance of this segment across the globe.

Green Packaging Market Revenue in USD Billion, by Type

| Type | 2019 | 2020 | 2021 |

| Recycled Content Packaging | 169.74 | 159.70 | 174.04 |

| Reusable Packaging | 42.34 | 39.75 | 43.23 |

| Degradable Packaging | 11.53 | 11.02 | 12.19 |

On the other hand, the reusable packaging is expected to be the most opportunistic segment during the forecast period. These are made from plastic materials that are intended to longer and multiple uses. For instance, the drums are popularly used for the transportation of the liquid goods. The plastic containers are gaining rapid popularity among the vegetable and fruit vendors as it offers easy packaging and transportation solutions.

The food and beverages segment dominated the market in 2024. The increasing adoption of the green packaging solutions in the restaurants, packaged foods, and fast food chains has boosted the growth of this segment. The surging adoption of the compostable and pulp packaging in the food and beverages industry is expected to drive the growth of this segment in the forthcoming period.

The healthcare is expected to be the fastest-growing segment during the forecast period. The surging number of manufacturing facilities of various medicines and medical devices coupled with the stringent government regulations pertaining to the packaging and safety of the medical consumables is expected to drive the growth of this segment in the forthcoming years. Glass packaging and aluminum foils are among the top packaging materials used in the pharmaceutical industry.

By Packaging Type

By Application

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025