May 2024

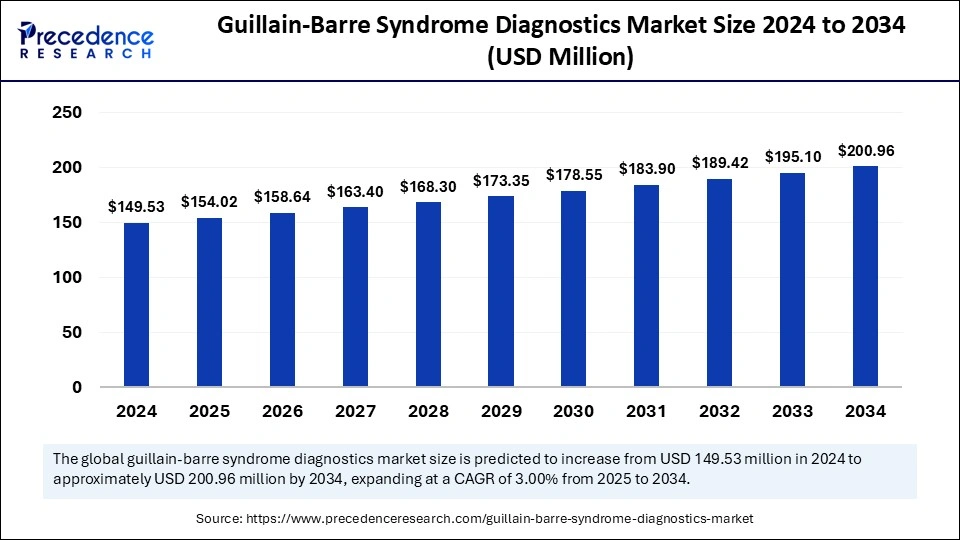

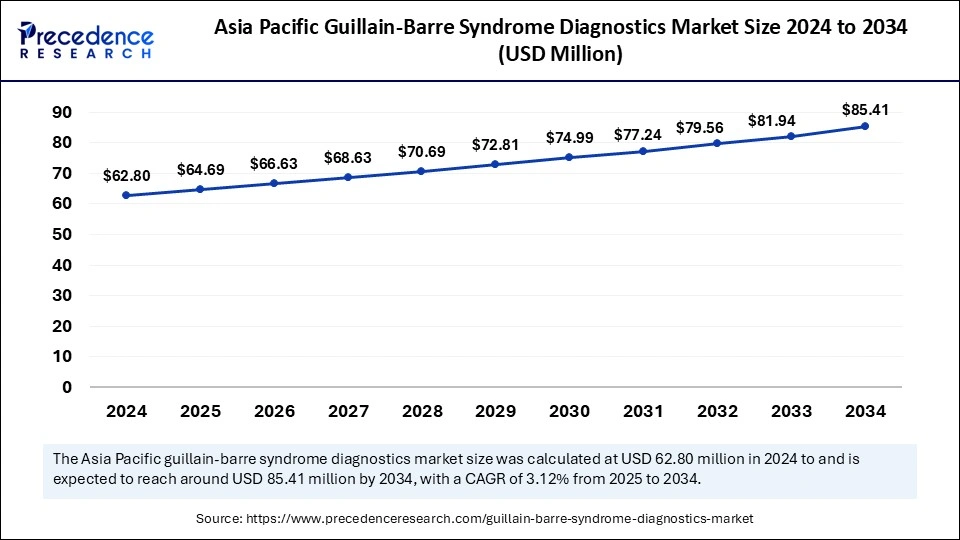

The global guillain barre syndrome diagnostics market size is accounted at USD 154.02 million in 2025 and is forecasted to hit around USD 200.96 million by 2034, representing a CAGR of 3.00% from 2025 to 2034. Asia Pacific market size was estimated at USD 62.80 million in 2024 and is expanding at a CAGR of 3.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global guillain-barre syndrome diagnostics market size was estimated at USD 149.53 million in 2024 and is predicted to increase from USD 154.02 million in 2025 to approximately USD 200.96 million by 2034, expanding at a CAGR of 3.00% from 2025 to 2034. The increasing incidence of guillain-barre syndrome (GBS), the increasing elderly population, growing awareness regarding early screening, rising approval and surge in the launch of new products, and technological advancements in diagnostic techniques are among several factors expected to drive the growth of the guillain-barre syndrome diagnostics market throughout the projected period.

In today’s digital era, healthcare digitalization through artificial intelligence has brought a transformative impact on the guillain-barre syndrome diagnostics market and has shown promising results in diagnosing guillain-barre syndrome (GBS). Harnessing the power of AI, particularly in tools like computer-aided diagnosis, holds great potential to revolutionize the approach to diagnosing and treating guillain-barre syndrome. The AI integration in guillain-barre syndrome diagnosis facilitates more accurate diagnoses, early prediction of complications, and personalized therapies to improve patient outcomes. AI-powered models can predict respiratory and neurological complications in GBS patients, assisting healthcare professionals in making early interventions and allocating resources more efficiently. Therefore, AI has gained significant attention in improving patients' quality of life and reducing mortality rates.

Asia Pacific guillain-barre syndrome diagnostics market size was exhibited at USD 62.80 million in 2024 and is projected to be worth around USD 85.41 million by 2034, growing at a CAGR of 3.12% from 2025 to 2034.

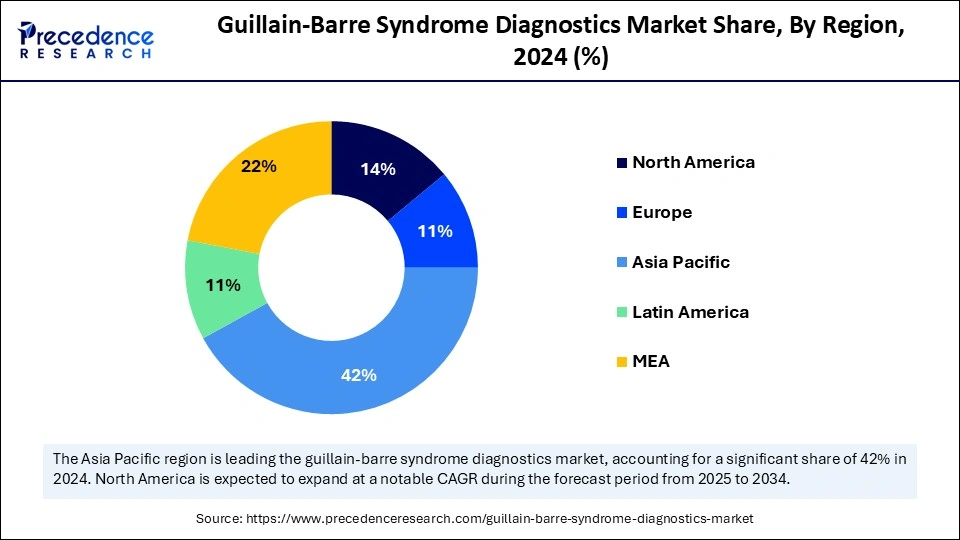

Asia Pacific dominated the guillain-barre syndrome diagnostics market by holding the largest share in 2024. This is mainly due to the increased awareness about early detection of GBS, which propelled the demand for advanced diagnostics tests. Governments around the region invest heavily in R&D to develop novel therapeutics. Moreover, there is a strong emphasis on improving healthcare infrastructure and diagnostic facilities, which bolstered the market in the region.

Europe is expected to witness rapid growth in the market during the forecast period. European countries such as Germany, the UK, and France are experiencing high demand for tech-driven diagnostic solutions. The region boasts advanced diagnostic facilities, coupled with skilled professionals and treatment options, allowing the development of personalized treatment plans that cater to each patient's unique needs. Favorable government initiatives, increasing cases of GBS, rising R&D activities, and increasing awareness of early diagnosis are also expected to propel the demand for advanced diagnostic techniques, supporting the growth of the market in the region.

North America held a considerable share of the guillain-barre syndrome diagnostics market in 2024 and is expected to witness notable growth in the foreseeable future. The growth of the market in the region is attributed to the presence of sophisticated diagnostic techniques, rising incidence of GBS, increasing aging population, rising government investments to support R&D activities, and increasing awareness regarding early screening of diseases. The U.S. and Canada are major contributors to the market due to well-established healthcare facilities and improved diagnostic solutions. In addition, the increasing launch of novel diagnostic tests and approvals from the U.S. FDA are anticipated to promote market growth in the region.

According to the CDC, GBS occurs in about 1 or 2 out of every 100,000 people in the U.S. each year.

Guillain-Barre syndrome (GBS) is a rare immune-mediated disorder affecting the peripheral nervous system. This disorder often leads to muscle weakness, numbness, and, in some critical cases, paralysis. Some of the common symptoms of Guillain-Barre Syndrome include weakness in the legs, difficulty in breathing, restricted eye or facial movements, and low or high blood pressure. Guillain-barre syndromes (GBS), such as acute motor axonal neuropathy (AMAN), acute inflammatory demyelinating polyneuropathy (AIDP), and acute motor-sensory axonal neuropathy (AMSAN), are primarily differentiated based on nerve conduction studies.

Diagnosing GBS involves a combination of clinical evaluation, medical history of the patient, and multiple diagnostic tests to confirm the presence of the disease. Healthcare professionals often face difficulties diagnosing GBS in its earliest stages. Its symptoms are similar to those of other conditions and may vary from person to person.

| Report Coverage | Details |

| Market Size by 2034 | USD 200.96 Million |

| Market Size in 2025 | USD 154.02 Million |

| Market Size in 2024 | USD 149.53 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.00% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surge in Guillain-Barre Syndrome (GBS) Cases

The increasing number of cases of GBS, particularly in regions with high rates of infectious diseases, is driving the growth of the guillain-barre syndrome diagnostics market. For instance, according to the National Organization for Rare Disorders, GBS affects about one or two people each year in every 100,000 population. Guillain-barre syndrome (GBS) is a rare autoimmune disorder, a rapidly progressive disease due to inflammation of the nerves.

Healthcare professionals often recommend a spinal tap, also known as a lumbar puncture, electromyography, and nerve conduction studies to confirm the presence of GBS. The exact cause of GBS remains unknown. However, it is often followed by viral or bacterial illnesses, gastrointestinal infections, or respiratory infections. The diagnosis heavily depends on clinical impressions obtained from history and examination, while electrodiagnostic testing and cerebrospinal fluid analysis typically offer supportive evidence for the diagnosis. Therefore, the rising cases of guillain-barre syndrome substantially increase the demand for efficient and accurate diagnostics.

High Cost of Diagnostic and Lack of Awareness

The lack of awareness regarding symptoms of a disease is anticipated to hamper the market's growth. In addition, the high cost associated with diagnostic tests creates challenges in the market. The absence of skilled professionals and inadequate healthcare facilities in middle- and lower-income countries further limit the growth of the global guillain-barre syndrome diagnostics market.

Technological Advancements

Technological innovations led to improvements in diagnostic techniques, which are projected to create lucrative opportunities in the guillain-barre syndrome diagnostics market during the forecast period. Several market leaders are developing new and innovative diagnostic techniques and tests to improve the speed, precision, and accuracy of GBS diagnosis. Innovations in diagnostic techniques, including electromyography, nerve conduction studies, and biomarker-based tests, enable healthcare professionals to make early interventions and initiate personalized treatments to improve outcomes. Such technological advancements enhance patient outcomes and contribute significantly to the expansion of the market.

The lumbar puncture segment led the guillain-barre syndrome diagnostics market with the largest share in 2024. This is mainly due to the rise in the prevalence of GBS, particularly in areas with high rates of infectious diseases. Lumbar puncture, also known as a spinal tap, is recommended to identify protein levels and detect the characteristics of GBS. This test is gaining immense traction due to its minimally invasive nature.

The nerve conduction segment is expected to witness the fastest growth during the forecast period. The segmental growth is attributed to the increasing incidence of GBS and the rising demand for early and accurate diagnosis. NCS serves as a crucial diagnostic tool in detecting GBS. NCS uses electrical impulses to assess nerve damage. Nerve conduction studies facilitate accurate electrodiagnosis of GBS subtypes, which has both therapeutic and prognostic implications. Additionally, technological advancements have resulted in the development of more precise and advanced NCS equipment, improving diagnostic efficiency.

The hospitals & clinics segment held the largest share of the market in 2024, driven by the rising integration of advanced diagnostic tools and improved patient treatment outcomes. Hospitals and clinics increasingly invest in diagnostic technologies, such as nerve conduction studies (NGS) and lumbar puncture techniques, to enable healthcare specialists to early and precisely detect GBS. Additionally, the increase in the prevalence of GBS and a strong focus on early detection and personalized treatment plans for better treatment outcomes have bolstered the growth of the segment.

The diagnostic laboratories segment is projected to grow rapidly over the forecast period. These laboratories have cutting-edge equipment and diagnostic tests, including lumbar puncture, nerve conduction studies, and cerebrospinal fluid analysis, improving the detection of GBS. Moreover, rising investment in R&D activities and increasing awareness of GBS have encouraged diagnostic laboratories to integrate innovative diagnostic techniques and expand their testing capabilities, contributing to the segment’s growth.

From January 31 to February 3, the civic body conducted a large-scale health survey, covered 43,793 households, and tested over 1,31,175 residents.

By Test

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

March 2024

December 2024

December 2024