January 2025

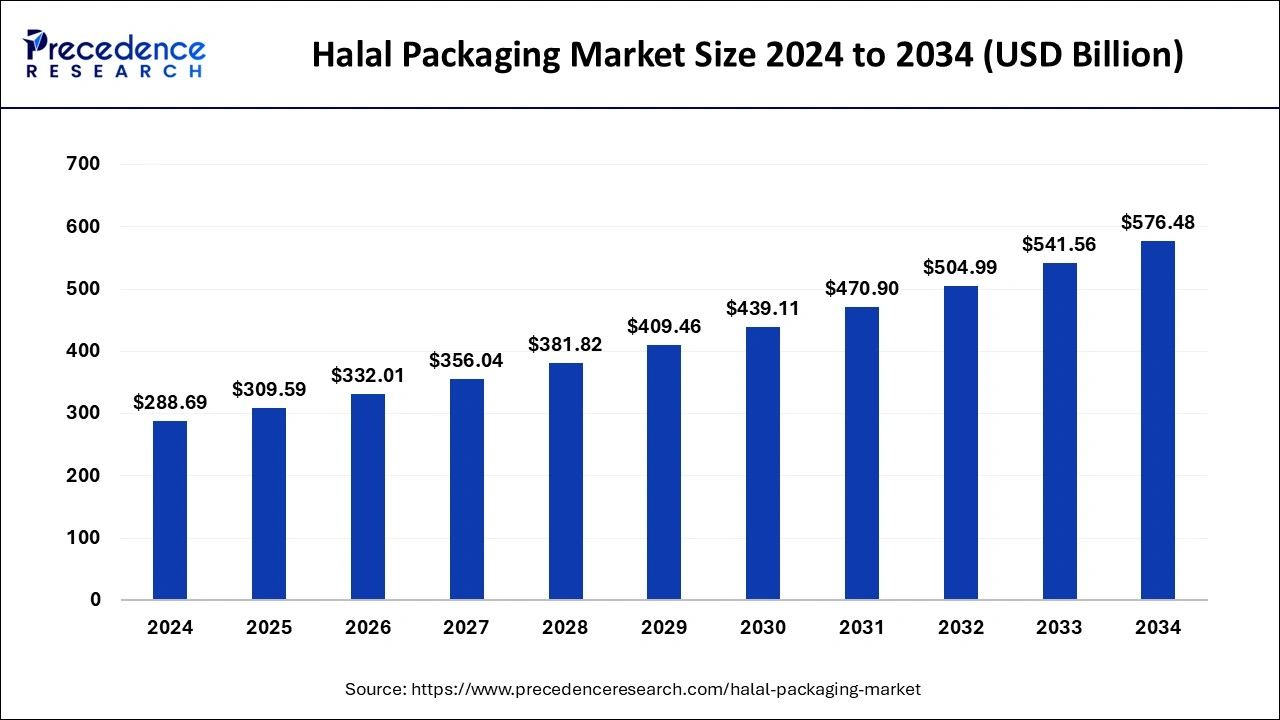

The global halal packaging market size is calculated at USD 309.59 billion in 2025 and is forecasted to reach around USD 576.48 billion by 2034, accelerating at a CAGR of 7.16% from 2025 to 2034. The Asia Pacific halal packaging market size surpassed USD 123.84 billion in 2025 and is expanding at a CAGR of 7.29% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global halal packaging market size was estimated at USD 288.69 billion in 2024 and is predicted to increase from USD 309.59 billion in 2025 to approximately USD 576.48 billion by 2034, expanding at a CAGR of 7.16% from 2025 to 2034.

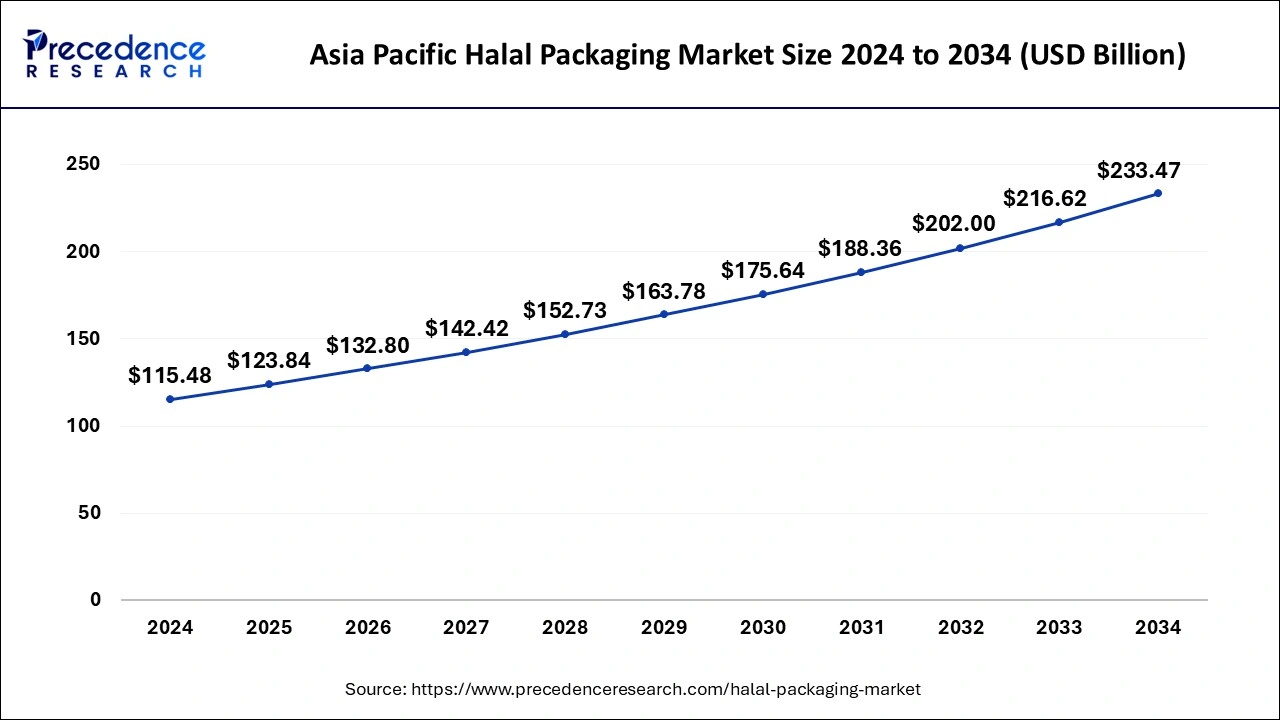

The Asia Pacific halal packaging market size was valued at USD 115.48 billion in 2024 and is anticipated to reach around USD 233.47 billion by 2034, poised to grow at a CAGR of 7.29% from 2025 to 2034.

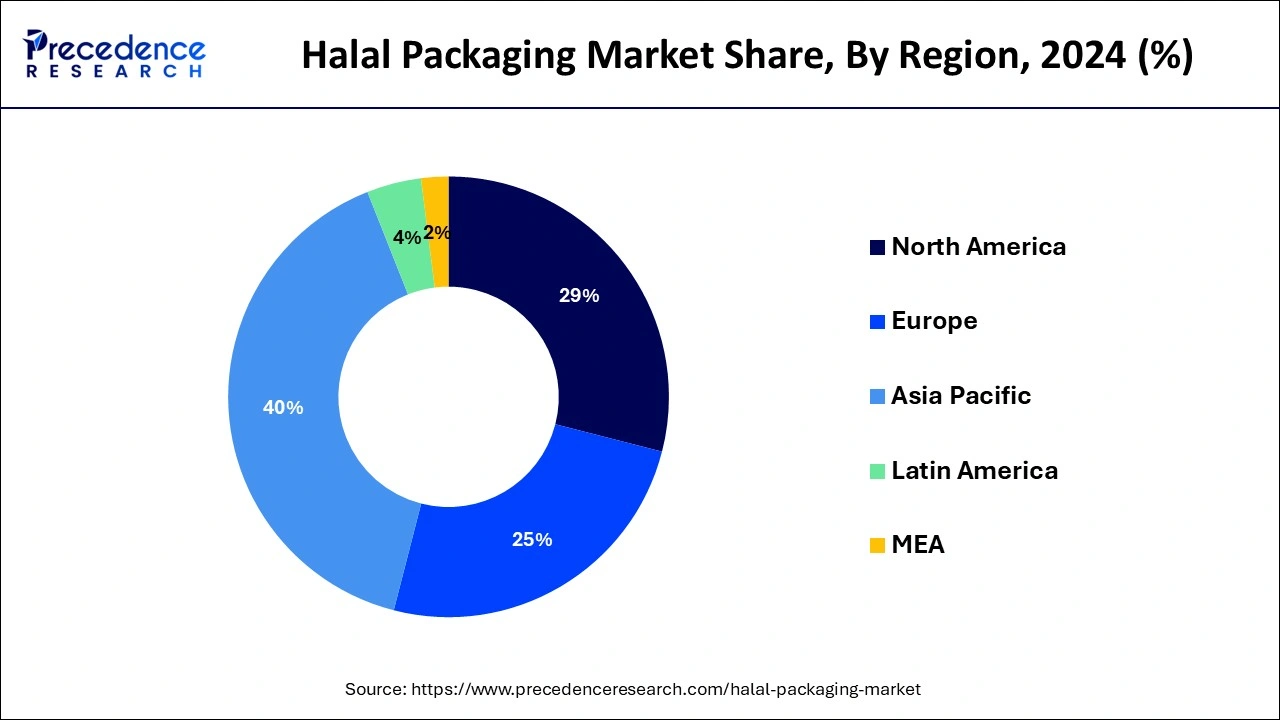

The Asia-Pacific dominated the halal packaging market in 2024 because a number of the region's nations, notably Indonesia, Malaysia, Singapore, and Thailand, have set up governmental organizations or halal certification authorities to supervise and control halal goods, including packaging. Halal certification is necessary for packaging makers to guarantee that their products fulfil the requirements. For instance, through its Halal Certification Program, the Islamic Religious Council of Singapore (MUIS) is in charge of regulating, certifying, and giving rules for halal items, including packaging. The region's halal packaging industry is expanding as a result of the regulatory agencies' proactive stance.

In the Asia Pacific area, Indonesia is a major player in the halal packaging business. This is a result of the Indonesian government enforcing stringent laws and rules, such as the 2019 introduction of the halal product Law. This regulation mandates that all consumer goods entering the nation must be certified as halal before they can be sold or distributed; otherwise, the items risk being banned and facing legal action.

For instance, the Korean instant noodle brand Samyang entered the Indonesian market without disclosing on the container that it contained non halal ingredients. As a result, to win back the faith of the nation's customers, the product was taken off the market until it received the required halal certification and included the halal label on its packaging. Thus, this is expected to drive the halal packaging market in the region.

The Middle East and Africa (MEA) is observed to continue to grow with a significant share in the halal packaging market during the forecast period. Several countries in the MEA region have implemented regulations and standards to govern the halal industry and ensure compliance with halal requirements. Government initiatives to promote halal certification and standardization contribute to the growth of the halal packaging market by creating a conducive regulatory environment for manufacturers and suppliers. Halal certification bodies and accreditation agencies also play a crucial role in verifying the authenticity of halal packaging and products, enhancing consumer trust and confidence.

The MEA region serves as a hub for halal products and exports, supplying halal-certified goods to markets worldwide. Halal packaging plays a crucial role in facilitating the export of halal products by ensuring compliance with international halal standards and regulations. Manufacturers and exporters in the region prioritize halal packaging to access global halal markets and capitalize on the growing demand for halal-certified products among Muslim and non-Muslim consumers alike.

Halal products hold cultural and religious significance for Muslims, who follow strict dietary guidelines based on Islamic teachings. Halal packaging ensures that products are manufactured, processed, and handled in accordance with these guidelines, providing consumers with confidence in the authenticity and integrity of the products they consume. As a result, there is a growing preference for halal-certified packaging among Muslim consumers in the MEA region.

Halal packaging refers to the packaging of products by Islamic dietary laws, which are known as halal. halal is an Arabic term that translates to "permissible" or "lawful" in English. In the context of food and consumer products, it specifically refers to items that are permissible for Muslims to consume or use according to Islamic principles. Halal packaging involves ensuring that the materials used for packaging, as well as the processes involved in packaging, comply with Islamic guidelines. This includes avoiding contact with materials or substances that are considered Haram (forbidden) in Islam, such as pork and its derivatives, alcohol, and certain other ingredients.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.16% |

| Market Size in 2025 | USD 309.59 Billion |

| Market Size by 2034 | USD 576.48 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Product, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness for halal-certified products

One major factor propelling the halal packaging market is the exponential rise in the Muslim population worldwide. Along with that, the awareness about halal-certified products across the globe is creating a driving factor for the halal packaging market. The need for halal-certified goods is growing along with the Muslim population. It is anticipated that the number of Muslims worldwide will increase by about 50% by 2050, to 2.76 billion people. This change in the population closely correlates with an increase in the demand for halal cuisine in several different geographical areas, including both Muslim-majority nations and those with sizeable Muslim minorities.

Additionally, the general public, including non-Muslims, is becoming more aware of the halal dietary rules. People want high-quality, ethically sourced products and are growing more aware of what they eat. They also want openness in the food manufacturing processes. Since halal-certified food items conform to strict ethical and quality requirements, consumers' affinity for them has risen as a result of this awareness.

Cost and fragmented certification standards

Implementing halal packaging practices may involve additional costs for companies, including obtaining certification, using specific materials, and adjusting production processes. Some businesses may be hesitant to incur these additional expenses. Moreover, the existence of multiple halal certification standards and varying interpretations of halal requirements can create confusion in the market. This fragmentation might make it challenging for businesses to navigate the certification process and comply with different standards. Thus, this is expected to hamper the halal packaging market over the forecast period.

Globalization and multiculturalism

Globalization and the multiculturalism phenomena have made halal food items more widely available and easily accessible. The food markets of many non-Muslim-majority nations are changing to accommodate a range of dietary choices as they embrace diversity. In response to the needs of a varied customer base, conventional supermarkets, eateries, and food manufacturers are now offering a greater selection of halal products. Thus, this is expected to offer a lucrative opportunity for the halal packaging market over the forecast period.

The rigid segment dominated the halal packaging market in 2024. The choice of rigid packaging materials is crucial in halal packaging. Manufacturers must ensure that the materials used are free from prohibited substances (Haram) and comply with halal requirements. For example, plastic resins, coatings, and inks should be carefully selected to meet these standards. In addition, ongoing innovations in rigid packaging technologies, including barrier coatings, anti-counterfeiting features, and smart packaging, can be relevant to the halal packaging market.

Besides, the flexible segment is expected to grow at the highest CAGR during the forecast period because of its qualities that make it lightweight, portable, and easy to handle. Lower production and shipping expenses are sometimes achieved by using flexible packaging, which uses less material and space during transit. The flexible halal packaging industry is seeing growth due in part to the cost-effectiveness that appeals to both manufacturers and consumers.

The bottles & jars segment held the largest share of the halal packaging market in 2024. This is explained by the wide range of end-use sectors in which they are used, such as food and beverage, personal care, and halal pharmaceutical goods. By providing halal-certified packaging materials and making investments in cutting-edge designs, package producers are concentrating on satisfying the changing needs of customers looking for halal-compliant products. To meet the increasing demand from consumers for halal cosmetic packaging solutions, Albéa Services S.A.S., a provider of packaging solutions for cosmetics and personal care, offers jars and bottles that have received halal certification.

The bags and pouches segment is expected to grow at the highest CAGR during the forecast period. The market for bags and pouches is fueled by extra features including handles, spouts, rip notches, and resealable zippers that improve user friendliness and product safety. The integrity of items certified as halal is guaranteed by these qualities, which also offer convenience. For the food and beverage and pharmaceutical industries, halal bags and pouches are provided by several businesses, such as Rootree, and Core Pax (M) Sdn. Bhd., and Nsix Industry Sdn. Bhd. Modest fashion, or clothing that falls under that category, can be packaged in halal-certified bags.

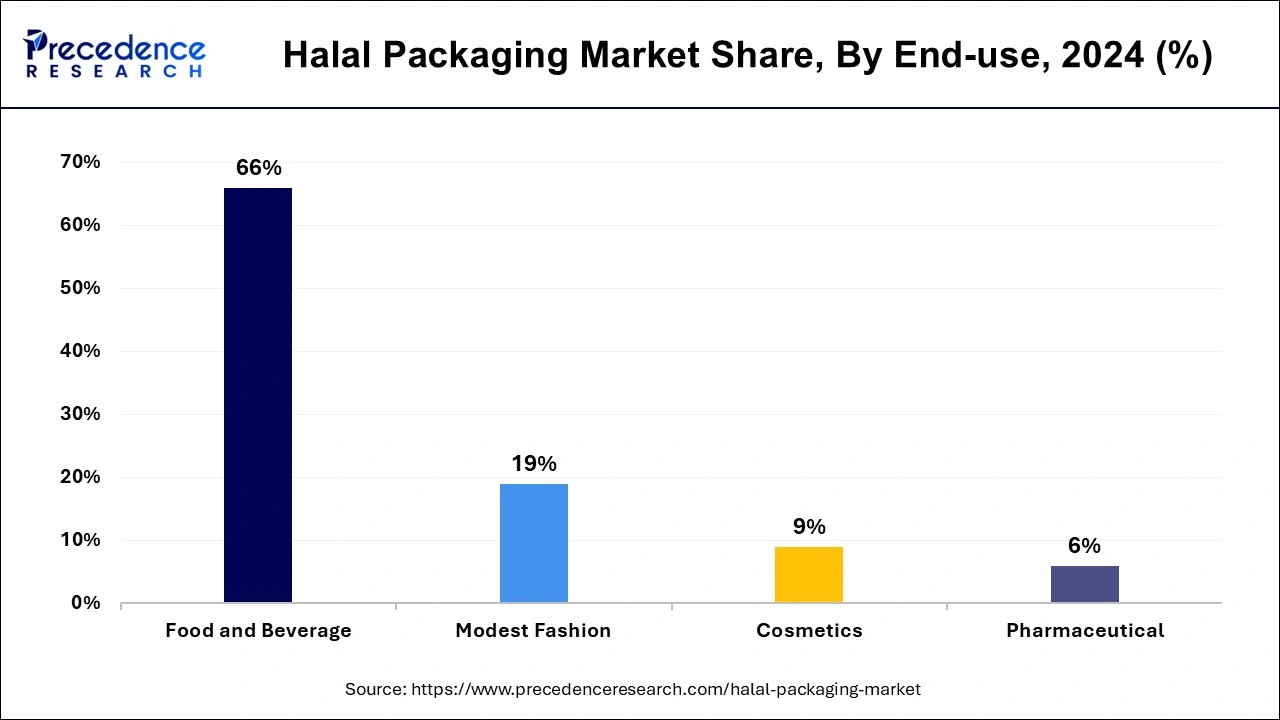

The food & beverage segment held the largest market share of 65% in 2024 due to the growing inclination of Muslim customers towards halal food and beverages. The need for halal-certified food packaging solutions has changed as a result of consumers becoming more aware of the possibility that packaging adhesives contain animal fats. As a result, food packaging producers are actively working to get halal certifications to satisfy the demands of a sizable consumer base interested in halal food and drink.

The pharmaceutical packaging segment is experiencing the highest growth over the projected period in the halal packaging market. Since they aid in ensuring the integrity and authenticity of halal-certified products across the supply chain, serialization and track-and-trace technologies are becoming more and more popular in the halal pharmaceutical packaging industry. Manufacturers may boost product safety, build customer trust, and support the expansion of the halal packaging industry by incorporating these technologies into their halal packaging.

Besides, the cosmetics segment is observed to witness a notable rate of growth during the forecast period. Many consumers, both Muslim and non-Muslim, are increasingly concerned about the ethical and cultural aspects of the products they use. Halal cosmetics appeal to consumers seeking products that align with their values, beliefs, and lifestyle choices. By using halal-certified packaging, cosmetic brands demonstrate their commitment to ethical sourcing, transparency, and inclusivity, appealing to a broader customer base.

The demand for halal cosmetics extends beyond Muslim-majority countries to diverse markets worldwide. With increasing globalization and cross-cultural exchange, halal cosmetics are gaining popularity among consumers of various backgrounds, religions, and ethnicities. Cosmetic brands recognize the potential of tapping into the lucrative halal market segment and are investing in halal-certified products and packaging to cater to diverse consumer preferences.

By Type

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025