February 2025

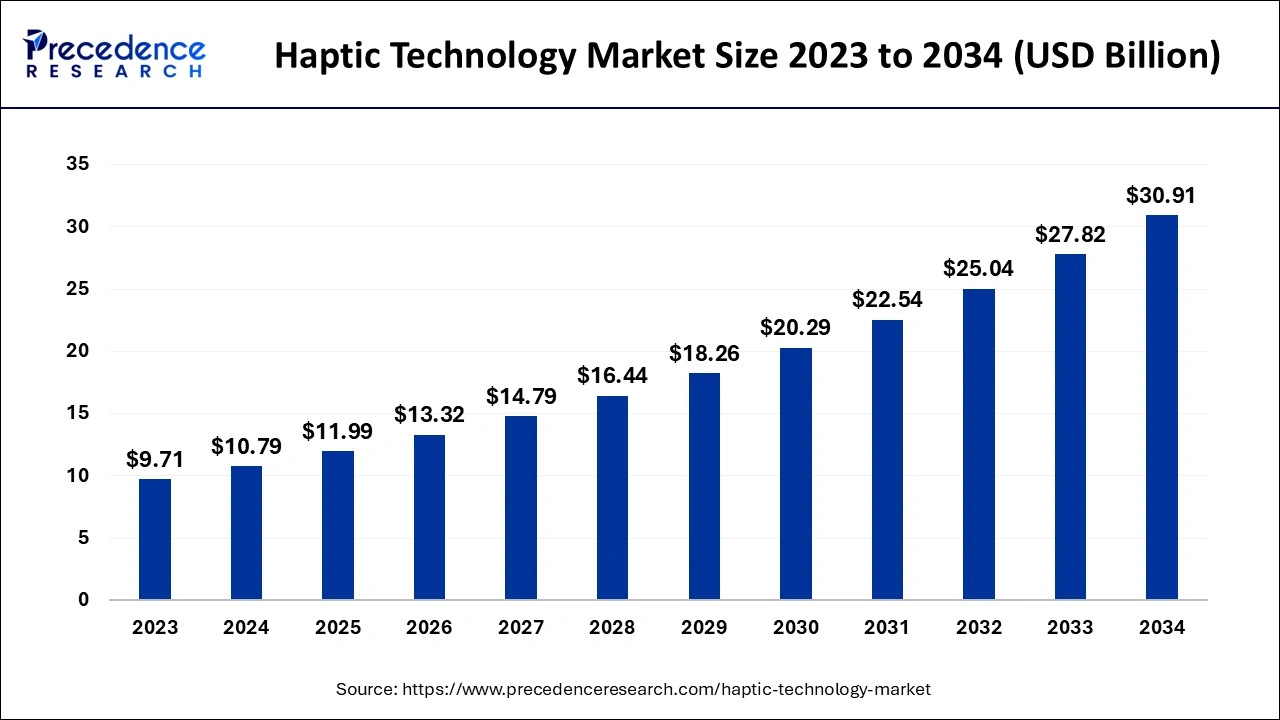

The global haptic technology market size accounted for USD 10.79 billion in 2024, grew to USD 11.99 billion in 2025 and is predicted to surpass around USD 30.91 billion by 2034, representing a healthy CAGR of 11.10% between 2024 and 2034. The North America haptic technology market size is calculated at USD 4.64 billion in 2024 and is expected to grow at a fastest CAGR of 11.21% during the forecast year.

The global haptic technology market size is estimated at USD 10.79 billion in 2024 and is anticipated to reach around USD 30.91 billion by 2034, expanding at a CAGR of 11.10% from 2024 to 2034.

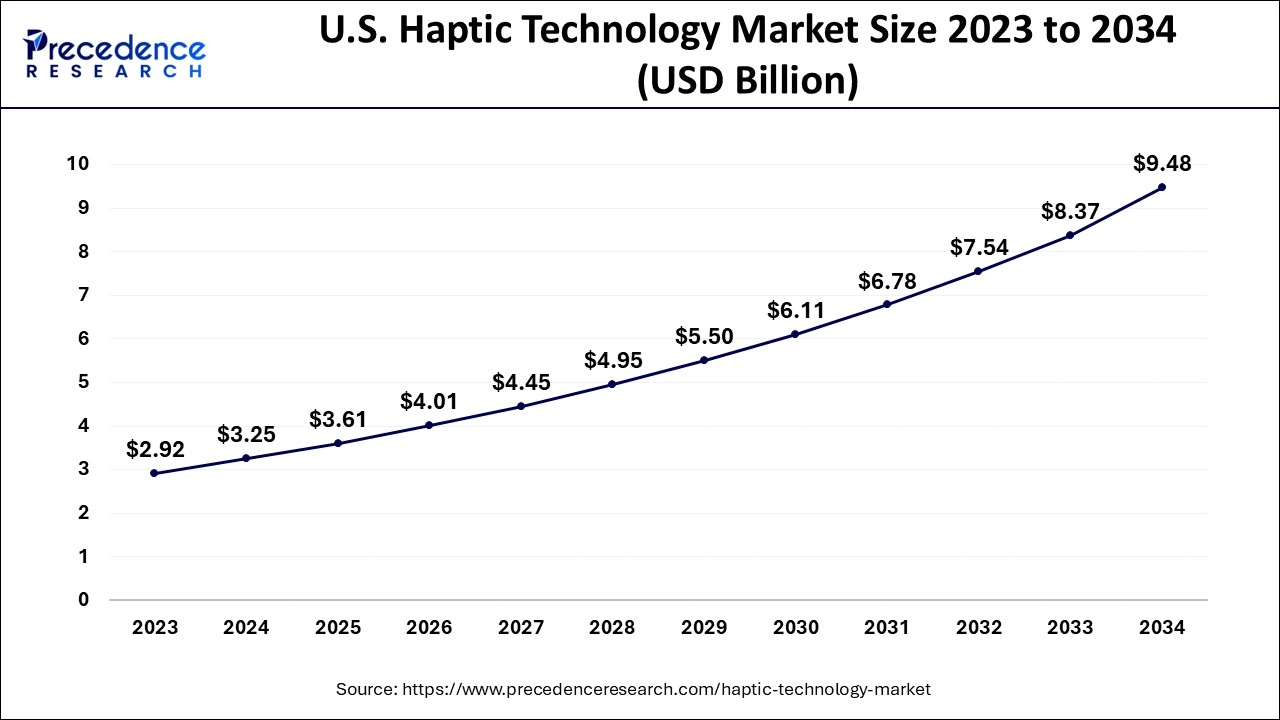

The U.S. haptic technology market size is evaluated at USD 3.25 billion in 2024 and is predicted to be worth around USD 9.47 billion by 2034, rising at a CAGR of 11.30% from 2024 to 2034.

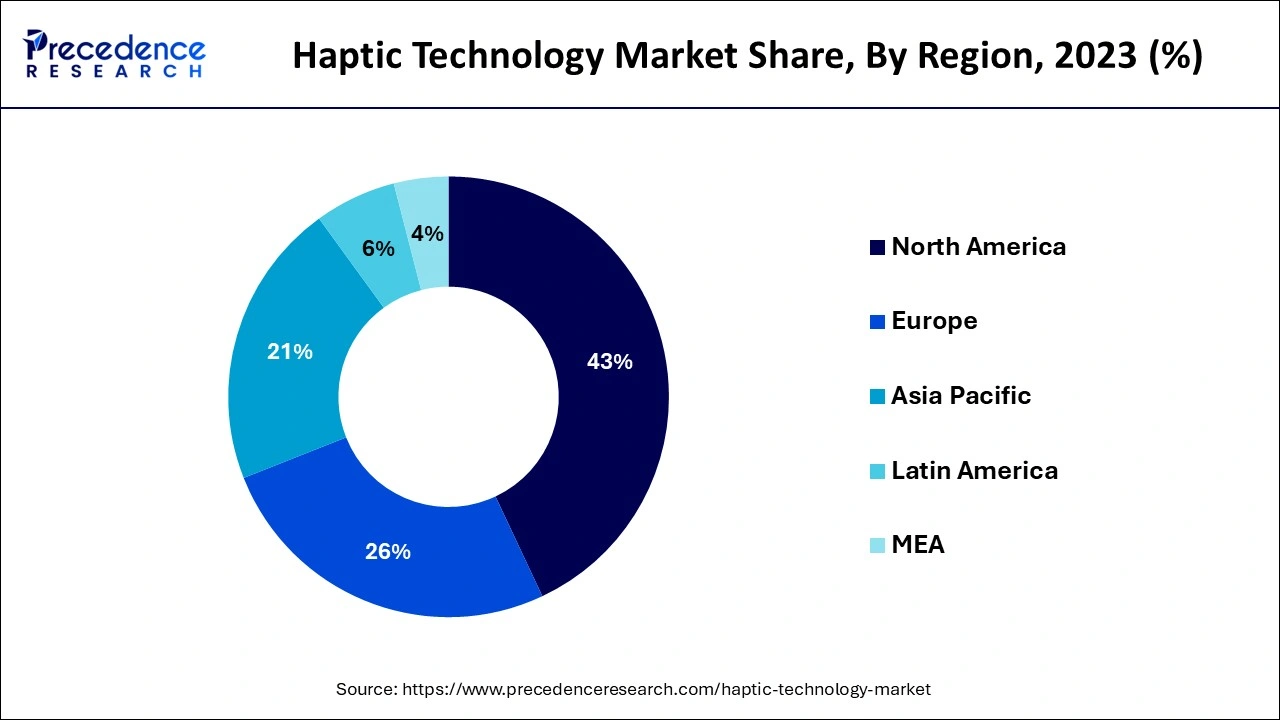

In the next years, North America is expected to account for a sizeable portion of the global haptic technology industry. This is a result of the region's widespread smartphone use. Additionally, according to data from GSMA Intelligence, 80% of the region's population already uses a smartphone, with that number rising to 91% by 2025.

The market for haptic technology in Europe is being driven by rising consumer expenditure on technologically sophisticated consumer electronic devices. Europe is demonstrating a huge need for touchscreen technology, particularly for applications in the automotive, consumer, and retail industries.

According to projections, Asia Pacific will experience significant development in the next years. This is a result of the presence of significant manufacturers in the area as well as growing nations like China and India. For instance, the Indian electronics market is predicted to develop at a rate of 41% by 2020 and reach a milestone of USD 400 billion, according to the Indian Brand Equity Foundation.

Through pressure, motion, or vibration, haptic technology creates sensory experiences for three-dimensional communication. This method may be applied to many other electrical tasks, such as building better control systems and creating virtual objects. Haptic technology is widely used in a variety of industries, including the automotive sector, wearables, game controllers, phones, and virtual reality. Increased technology integration into consumer electronics devices and touch-enabled household appliances has contributed to market growth. With the use of vibration feedback provided by haptic technology, users may improve touchscreen accuracy.

The market expansion of the haptic technology sector is being driven by the introduction of touch screens in products like music players and household appliances to give consumers with a favourable experience. As customers look for additional game to enhance their gaming experiences, the haptic technology market is also expected to expand. Since the word "haptic" is defined as "able to contact," technologies had a part in the evolution of touch. Haptic technology is being employed on large aeroplanes, and it is used to provide bad responses when it finds faults. Using haptic technology, the inaccuracy or danger was found. The haptic technology market is growing faster and has a greater range of uses. As a consequence of the growing trend of technological integration in augmented reality-enabled gadgets and gaming consoles, the industry for haptic technology is expected to expand. Game input devices such as joysticks and remote consoles utilize haptic technology to provide different vibration intensities that enhance the user experience. The ability of haptics to mechanically recreate a user's sense of touch is among the key factors fuelling market demand.

Due to disruptions in the manufacturing and supply chain, closures of the public and commercial sectors, lockdown and social distancing norms, and a scarcity of workers, the COVID-19 epidemic has slowed the growth of the haptic technology industry. This has caused a steep fall in the sales of touchscreen devices, consumer electronics, and the automotive sector, which has an impact on how haptic technology is made.

Industry drivers are the many elements that affect the development of the haptic technology market. The rising demand for loT devices is one of the key factors driving the haptic technology market. The need for haptic technology is rising as more people own smartphones, tablets, and other wearable gadgets. The need for haptic technology is being driven by the inclusion of haptic technology in smartphones and tablets to provide a positive touch experience. The market is expanding as a result of rising demand for wristbands, smartwatches, and other wearable technology. The expanding need for cutting-edge technologies in the automotive sector is another significant market driver. The market for haptic technology is growing as a result of the widespread usage of this technology in the automotive sector. The coronavirus epidemic has caused a dramatic decline in the market for haptic technologies. Lockdown restrictions resulted in continual supply chain disruptions, which reduced production and sales volume. When lockdown rules are tightened in some of these locations, it's predicted that manufacturing facilities used to make the product would start up again. Once things get back to normal, the product is expected to grow significantly since more people are purchasing technical items.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.79 Billion |

| Market Size by 2034 | USD 30.91 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Application, Feedback Type, and Geography |

Adoption of Haptic Technology in education

The haptic technology market will experience rapid expansion thanks to the growing demand for holographic displays, increased use of haptic technology in robotics and education, and other factors. Robots utilising haptic technology, such as gloves, are able to manipulate a robotic hand and other items with complete control. Thanks to haptic technology, the robots can easily control robotic arms. As 3D touchscreen displays are increasingly used in automotive and medical equipment, the industry is growing.

Rising integration of haptic technology in gaming applications for immersive user experience

Through 2030, the gaming industry is expected to experience considerable growth, driven by a rise in the popularity of mobile-based video games. Gamers have a better real-life experience when haptic technology is integrated into gaming consoles and smartphone devices. Gaming controllers with haptic capabilities give video game events like crashes and explosions a tangible feeling of reality, creating significant market development prospects. To meet the growing demand for cutting-edge consoles, a number of market participants in the virtual gaming sector are introducing new devices that use better haptic technology. With instance, Sony declared in April 2020 that their DualSense gaming controller with haptic feedback will be released for the next PlayStation 5. On the L2 and R2 buttons of the controller, DualSense has adjustable triggers that deliver powerful sensations and enhance player interaction.

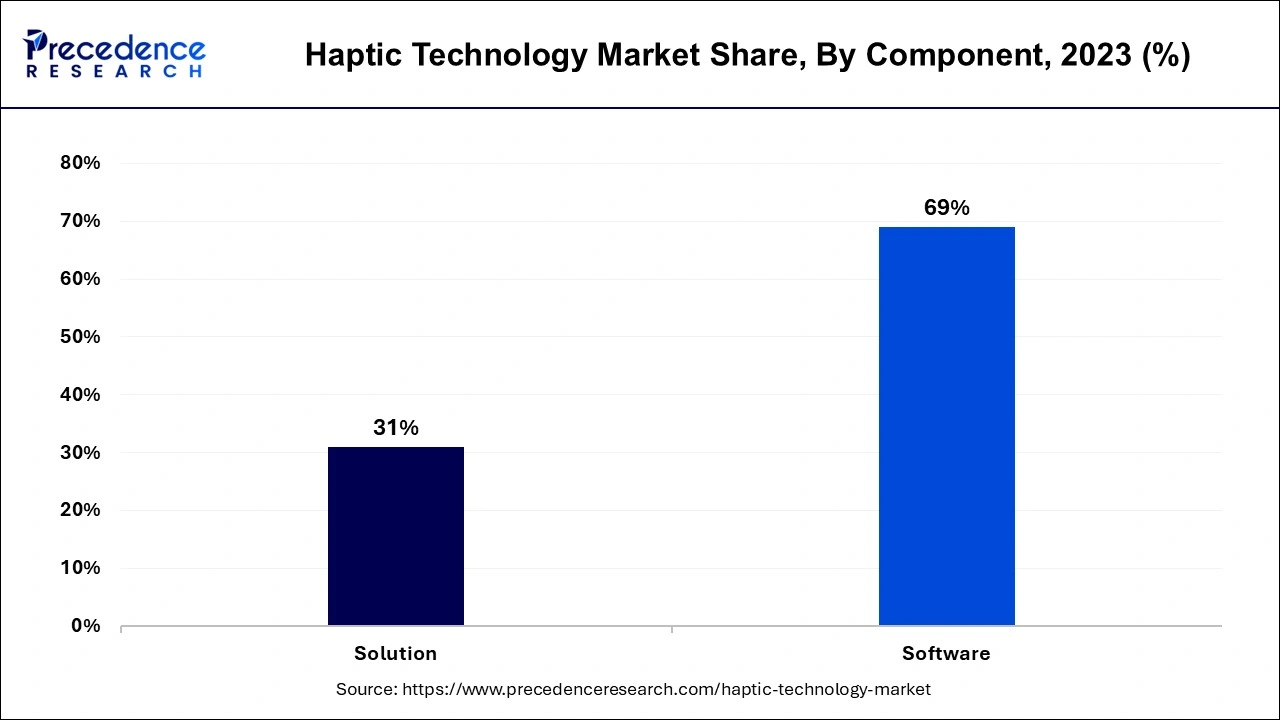

According to the component analysis, the software sector will be in demand and command the largest market share globally. Numerous advantages of haptic software include better accuracy, more user happiness, quicker response times, and improved gadget performance.

The rise of smartphones, widespread use of haptic-based devices across a variety of sectors, and high penetration of high-end consumer electronics are all driving the software market.

The market is broken down into categories including healthcare, automotive, transportation, consumer electronics, business & industrial, gaming, and military based on the application study. The automobile and transportation sector will have rapid growth and maintain the current trend between 2024 and 2034. The main driving forces behind this development are the advancements in the automotive industry, the rising demand for sophisticated electronic systems among electrical vehicles, the preference for luxury and safety vehicles, and the incorporation of haptics technology into in-car entertainment systems. The technology is employed in steering wheels, dashboards, climate control displays, and accelerator pedals. The top automakers, including BMW, Honda, Toyota, Benz, Tesla, and Audi, are incorporating haptic technology into their vehicles.

Because it allows users to customise their SMS alerts and other smartphone notifications, the tactile feedback category leads the worldwide haptic technology industry. This has a favourable influence on haptic technology. The market will rise as a result of rising consumer desire for a realistic smartphone experience and the introduction of Internet of Things (IoT)-enabled products like smart watches and wristbands, which will make it easier for people to monitor their health.

By Component

By Application

By Feedback Type

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

January 2025

October 2023