The global hard seltzer market size is calculated at USD 21.89 billion in 2025 and is forecasted to reach around USD 74.93 billion by 2034, accelerating at a CAGR of 15% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hard seltzer market size reached USD 19.03 billion in 2024, and is anticipated to reach around USD 74.93 billion by 2034, expanding at a CAGR of 15% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year. The hard seltzer market is growing due to growing demand amongst youngsters.

Artificial intelligence (AI) is being used by beverage alcohol brand owners as a research tool and to help develop new products, but the technology also has the ability to improve other aspects of business operations, like as manufacturing efficiency and revenue management. Personalized product recommendations and taste profiling are two of the most important ways AI is changing the alcohol sector. AI plays a critical role in supply chain and operations management to improve sustainability and efficiency.

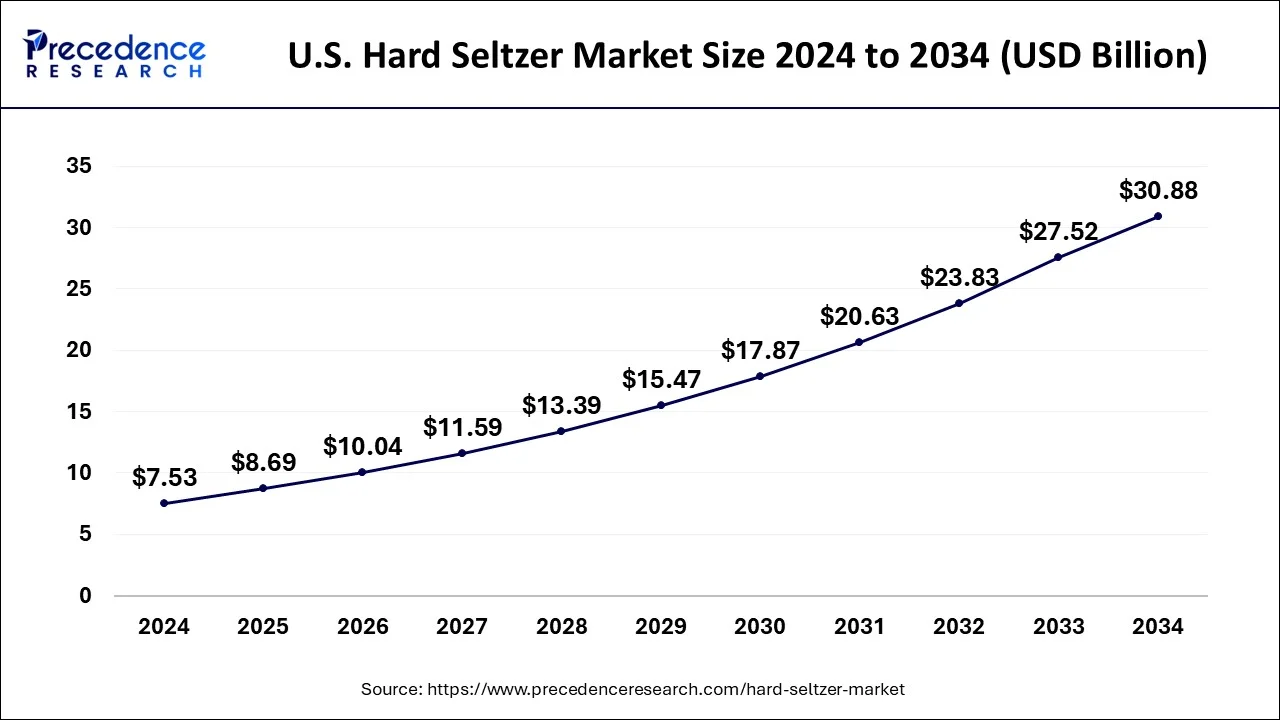

The U.S. hard seltzer market size was estimated at USD 7.53 billion in 2024 and is predicted to be worth around USD 30.88 billion by 2034, at a CAGR of 15.5% from 2025 to 2034.

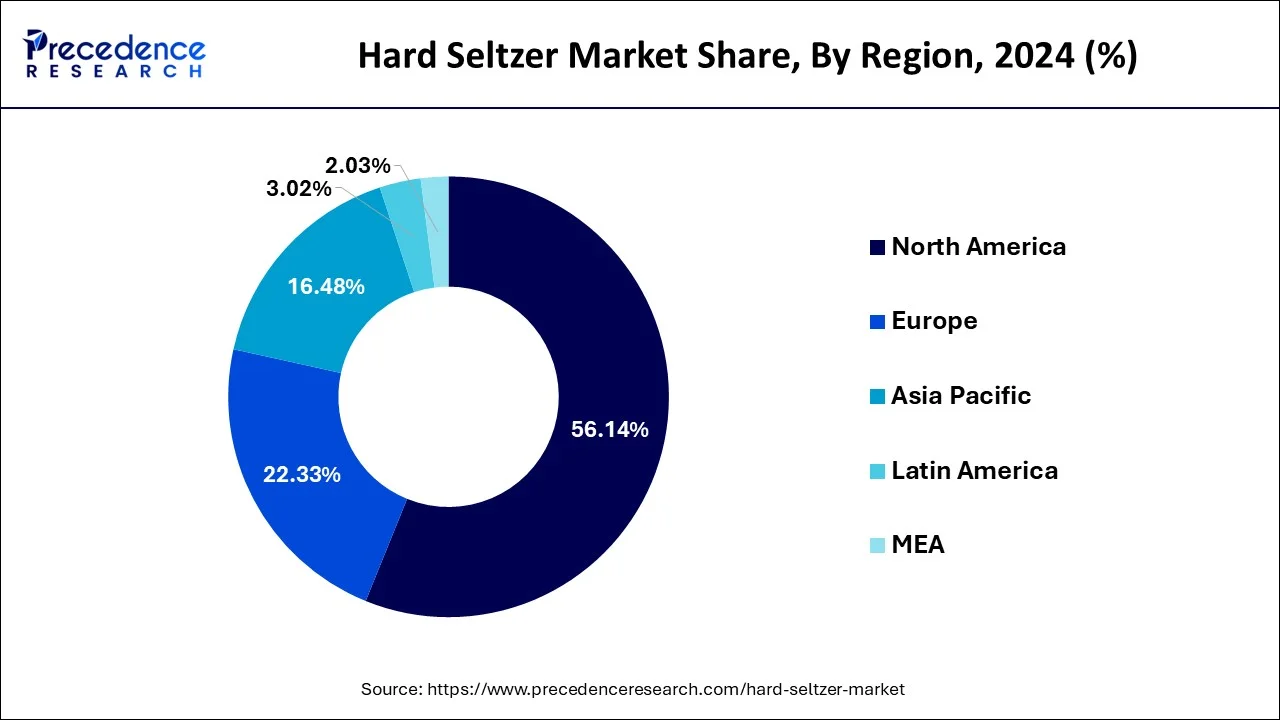

North America had the highest share of approximately 56.14% in 2024. The region noticed an increased demand, particularly from youth. Key players are encouraging the products they produce with novel techniques. Furthermore, the demand for these drinks made them appropriate to consumers, which is anticipated to increase hard seltzer consumption during the forecast period.

79.1% of those aged 12 and older, or 224.3 million individuals, reported drinking alcohol at some point in their lives, according to the 2023 National Survey on Drug Use and Health (NSDUH). Twenty-six percent of the children aged 12 to 17 (5.6 million) said they had consumed alcohol at some time in their lives. The control and sale of alcohol generated $15.5 billion (+2.5%) for the federal and provincial governments ($13.6 billion, +0.1%) in the fiscal year that ended in March 2023. Alcoholic drinks were sold for a total of $26.3 billion by liquor authorities and other retail establishments.

The European hard seltzer industry is anticipated to grow fastest CAGR In the next few years, lifestyle changes and consumer preferences are expected to fuel the expansion of the seltzer market. The demand for the seltzer industry is propelled as people become health-conscious and enhance their consumption of carbonated beverages. Seltzer is low in calories, gluten-free, and high in nutritional value. Seltzers are provided with alternative alcohol bases to meet various consumer needs.

The growing demand for low-alcohol and low-calorie beverages is driving up demand for seltzer in Europe, as it contains fewer carbohydrates and calories than other beers and mixed drinks.

The estimated amount of Alcohol Duty revenues in the UK from August to October 2024 is £3,060 million, or £181 million (6%). Alcohol Duty revenues from wine and other fermented goods are estimated to reach £1,153 million, or £83 million, during August and October of 2024.

The demand for the product is driven by the younger generation's growing preference for low-alcohol beverages. Furthermore, the low-alcoholic drinks requirement has increased as consumers attempt to decrease their alcohol intake or become sober-curious.

Furthermore, due to stay-at-home orders from around the world, the revenue share of products increased drastically over e-commerce networks throughout the pandemic. Furthermore, hard seltzers meet the demand for new flavors and cocktail combinations, and insta-friendly sustainable cans provide easy installation.

| Report Coverage | Details |

| Market Size in 2024 | USD 19.03 Billion |

| Market Size by 2034 | USD 74.93 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 15% |

| Base Year | 2024 |

| Largest Market | North America |

| Forecast Period | 2025 to 2034 |

| Segments Covered | ABV Content, Packaging, Distribution Channel, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surge in urbanization

The market expanded significantly due to emerging economic growth, the tourism and travel industry, increased online liquor sales, and cafe and bar outlets. The growing influence of modernization on individuals, changing buyer perceptions of alcoholic beverage consumption, rapidly growing urbanization, and altering consumer preferences in emerging regions is predicted to drive the development of the global seltzer industry.

The rising trend of alcoholic beverage consumption among the young generation owing to changing user choices, rising disposable income, and consumer peer influence are the essential components expected to propel the demand for the global alcoholic beverage segment.

Adverse health effects, as well as alcohol poisoning

Hard seltzer misuse occurs when a female consumes more than 12 ounces of hard seltzer per day or a male consumes more than 24 ounces of hard seltzer in a day, according to National Institute on Alcohol Abuse and Alcoholism (NIAAA). Hard seltzer abuse can progress to hard seltzer addiction over time. Even if one wants to, this disorder makes them unable to quit drinking seltzer. Tolerance and physical dependence are also signs of addiction to hard seltzer. Tolerance means more extensive or frequent drinks to achieve the desired effect.

Physical dependence occurs when the body requires hard seltzer to function. For instance, Conigliaro warned that binge drinking makes people more likely to engage in risky sexual behavior, get into fights, or drive while intoxicated. Additionally, they run a higher risk of developing alcohol poisoning, a severe and possibly fatal side effect of consuming too much alcohol quickly.

Rising adoption of new flavors among consumers

The flavor profiles vary by brand and range from primary flavors like black cherry, lime, and ruby grapefruit to much more elevated flavors like melon basil, lemon agave hibiscus, and cucumber peach. As a result of changes in consumer preferences and the influence of peers among consumers, there is an increasing trend of alcohol consumption among the older and younger generations.

According to the National Family Health Survey-4 (NFHS-4), alcohol consumption is widespread throughout India across all states and union territories (UT), with a projected 160 million people consuming alcohol, including 29.2 % of men and 1.2% of women. Since hard seltzer drinks have improved in taste and variety for health-conscious consumers, the global hard seltzer market has seen a considerable increase in sales and demand.

The global hard seltzer industry is segmented on ABV content into 1.0% to 4.9%, 5.0% to 6.9%, and others. 5.0% to 6.9% ABV hard seltzers accounted for over 52% of the revenues generated in 2024. The concept of moderation is a rising trend, particularly in the US, driving this segment's growth. Many alcohol industry players have been developing their product lines of low-alcohol drinks.

1.0% to 4.9% ABV hard seltzer sales are anticipated to grow approximately at a 24% CAGR between 2025 and 2034. Due to the rise in awareness regarding general well-being, individuals of all age groups are attempting to reduce alcohol consumption. A significant boost in online forums about minimizing drinking over the last two years and a notable reduction in discussions about casual and high drinking events have been implemented. San Juan Spiked, Funky Buddha Premium, Corona, BON Viv Spiked, Crook & Marker Spiked Seltzer, Smirnoff, Night Shift Hoot, Willie's Superbrew, Coors Hard Seltzer are some of the key players in the market space.

The market is divided into two categories: metal cans and bottles. Cans made of metal have a larger market share as they have many benefits, like durability, printing of multi-color, convenience, and sustainability. Additionally, beverages in metal cans do not need additives and maintain their original taste for a prolonged period.

The canned form of hard seltzer with striking design and color enhances the premium look and appeal of the product; due to this, companies are focusing on introducing the product in the given format.

Since bottles provide a better handling and user experience than cans, the bottle segment is estimated to dominate the market during the predicted period. The primary factor in consumers' high preference for bottles is their transparency, allowing the inside substance to be displayed.

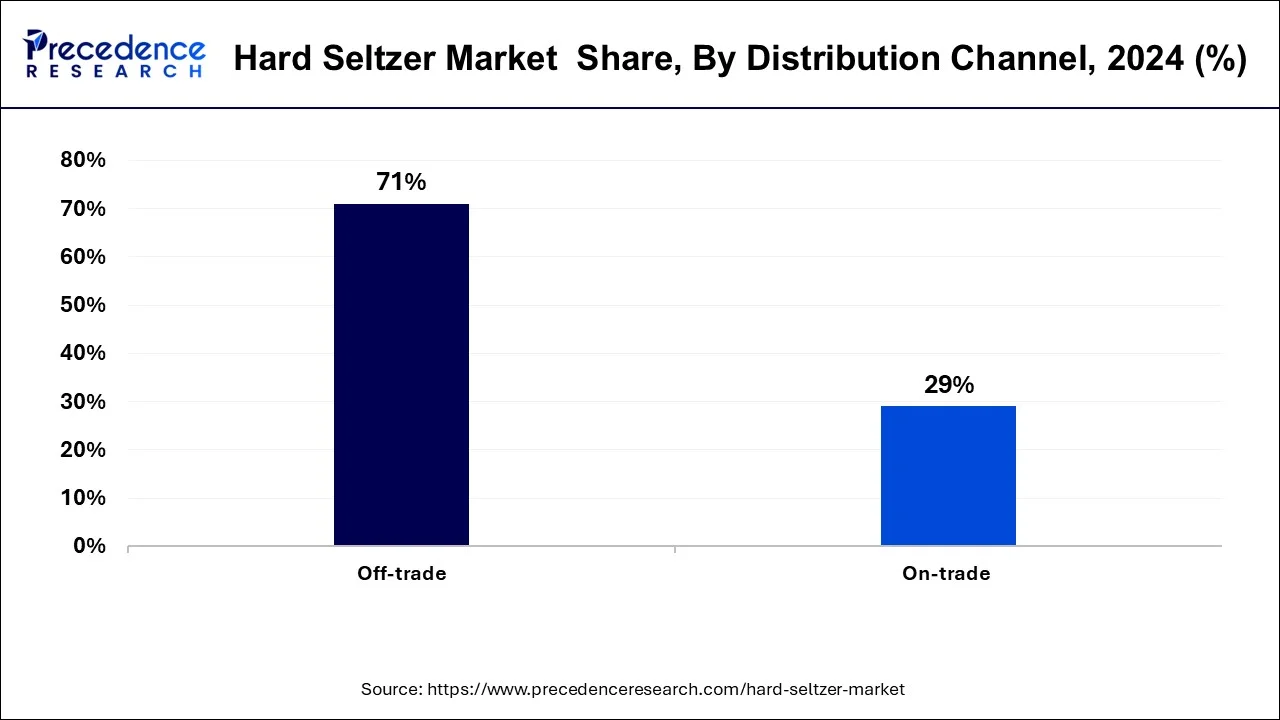

The market is segmented into on-trade and off-trade distribution channels. The off-trade segment was the highest distribution channel, accounting for approximately 71% of revenue in 2024. All retail stores, for instance, convenience stores, supermarkets, wine and spirit shops, and mini markets, are included in this segment. People often prefer these shops because they provide substantial discounts and promotions.

Furthermore, most brands introduce their goods through big supermarket chains, including Target and Walmart, to achieve a broader consumer base. Rising urbanization and rapid retail sector growth are anticipated to propel the off-trade channel of the hard seltzer market.

The on-trade channel is projected to grow at the fastest rate of approximately 24.10% from 2025 to 2034. Outlets which include bars, hotels, clubs, and lounges, are examples of on-trade distribution channels. However, product sales through on-trade channels increase with relaxed rules and individuals focusing on get-togethers, socializing, and parties.

‘We regard Spyk as a market leader and disruptor in the hard seltzer category,’ says Vamsi Krishna, CMO and co-founder of Spyk Hard Seltzer. Further he added, ‘our goal is to reinvent social drinking by creating a beverage that suits everyone's lifestyle preferences and is associated with people who work and play hard. We at Spyk are sure that we can emerge as the thrilling substitute to combat the heat.

By ABV Content

By Packaging

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client