January 2025

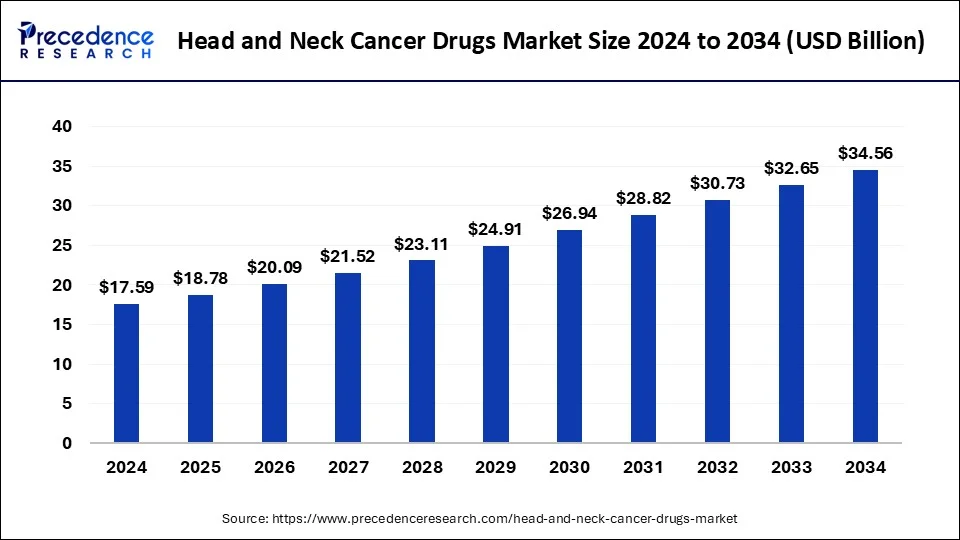

The global head and neck cancer drugs market size is calculated at USD 1.90 billion in 2024, grew to USD 2.05 billion in 2025, and is predicted to hit around USD 4.06 billion by 2034, expanding at a CAGR of 7.88% between 2024 and 2034.

The global head and neck cancer drugs market size is expected to be valued at USD 1.90 billion in 2024 and is anticipated to reach around USD 4.06 billion by 2034, expanding at a CAGR of 7.88% over the forecast period from 2024 to 2034.

Head and neck cancer drugs refer to therapeutic approaches that are used to treat different cancer tumors that develop in or around the mouth, larynx, sinuses, throat, and nose. Most neck and head cancers are squamous cell carcinomas. The increasing demand for effective and safe drugs, the growing burden of neck and head cancer, and the growing geriatric population are expected to boost the market growth in the coming years. Additionally, significant rises in clinical research to develop new therapies for treating malignancy and the rising technological advancements in screening procedures for diagnosis purposes are further expected to contribute to market expansion.

The increasing cases of malignant tumors that develop around the throat, mouth, salivary glands, nose, and larynx are likely to fuel the market. Chemotherapy, in addition to other therapies, is generally used for the treatment of head and neck cancer. Moreover, advancements in non-surgical therapies, such as immunotherapy and targeted therapy, are boosting the adoption of head and neck cancer drugs among patients across the globe. The availability of advanced diagnostic tools to diagnose various types of cancer and tumors is supplementing the market growth. The rising awareness among the population regarding the availability of effective and innovative drugs to treat cancer, coupled with increasing healthcare expenditure, is fueling the market. The rapidly growing biopharmaceutical industry and the rising penetration of online pharmacies are the major factors expected to augment the market's growth during the forecast period. Moreover, key players are using various business development strategies, such as partnerships, new product launches, and adoption of the latest technologies, to compete in the market.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.90 Billion |

| Market Size by 2034 | USD 4.06 Billion |

| Growth Rate from 2024 to 2034 | 7.88% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Treatment, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing instances of head and neck cancer

The instances of throat cancer are rising worldwide, owing to factors such as excessive consumption of alcohol and smoking tobacco. As per the American Cancer Society, the lifetime risk of developing oropharyngeal cancer is about 1 in 139 for women and 1 in 59 for men. Neck and head cancer deals with various types of cancers that affect an individual’s throat, mouth, or other parts of the neck and head. Chemotherapy is the staple treatment for neck and head cancers that use potent drugs to attack cancer cells. Thus, with the increasing prevalence of head and neck cancer, the demand for novel drugs is expected to increase. There are various chemotherapy drugs available to treat conditions. For instance,

Adverse effects of drugs

Adverse effects associated with neck and head cancer drugs are one of the major factors restraining the market's growth. Chemotherapy medications target fast-growing cells, but if these drugs cannot differentiate between cancerous cells and healthy cells, their usage causes side effects. Neuropathy, hearing loss, fatigue, and appetite are the most common side effects of chemotherapy. However, a doctor may recommend support services, prescribe other medications, and adjust the dosage of the drugs to lessen the side effects of neck and head cancer drugs.

Rising focus on early detection and the demand for precision medicines

Neck and head cancer usually originate in the squamous cells that line the throat, nose, and mouth. Dental cone beam CT, Panorex, PET/CT, CT of the sinuses, head CT, and head MRI are the most commonly used to thoroughly examine head and neck areas that are more difficult to reach, determining if cancerous cells spread and confirm a cancer diagnosis. Early diagnosis of neck and head cancer may require less treatment and care, reduce mortality rate, and improve patient outcomes. Moreover, the rising demand for precision medicines encourage market players to invest heavily in the research and development of novel drugs, such as Atezolizumab, Afatinib, and Ipilimumab, thus contributing to the market growth.

The chemotherapy segment accounted for the largest market share in 2023. This is attributed to the increased adoption of chemotherapy along with radiation therapy and the rise in awareness regarding combination therapies to treat head and neck cancer. Several drugs, such as capecitabine, cetuximab, paclitaxel, bleomycin, hydroxyurea, and docetaxel, are approved for treating head and neck cancer across the globe. Therefore, the rising prevalence of head and neck cancer and increased usage of chemotherapy in combination with other therapies has fostered the growth of this segment in the past few years.

The immunotherapy segment is expected to expand at the fastest growth rate during the forecast period. The rising awareness among patients regarding the effectiveness and benefits of immunotherapy over chemotherapy is expected to boost the growth of this segment. The growing focus of the manufacturers and the active participation of authorities like the FDA and EMA in the approval of immunotherapy drugs is expected to augment the segment

The retail pharmacies segment led the market with the largest share in 2023. This is attributed to the increased penetration of retail pharmacies and various popular chains of pharmacies across the globe. Retail pharmacies are the traditional and most popular type of sales channel among the population for buying drugs. Therefore, the increased coverage of retail pharmacies from urban to rural areas across the globe has fostered the growth of this segment.

The online pharmacies segment is expected to lead the market during the forecast period. The rising penetration of the internet and the growing adoption of smartphones are the major factors that boost the growth of online pharmacies. Furthermore, the increasing popularity of online retail platforms propels the segment. Online pharmacies provide easy doorstep delivery and offer discounts on drugs. This convenience factor attracts wider consumers, thus boosting the segment.

North America dominated the head and neck cancer drugs market in 2023. According to the American Cancer Society, head and neck cancer accounts for around 4% of the total cancer cases in the U.S. Therefore, the rising prevalence of head and neck cancer in the region contributed to the regional market growth. Moreover, the presence of sophisticated healthcare infrastructure, increased healthcare expenditure, favorable reimbursement policies, and enhanced access to advanced diagnostic devices are the major factors that bolstered the market.

The market in Asia Pacific is anticipated to expand rapidly in the near future. This is attributed to the rising prevalence of head and neck cancer, owing to the high consumption of alcohol and tobacco, rising awareness regarding the availability of innovative drugs, and rising healthcare expenditure. Throat cancer is the most common type of cancer in India, accounting for almost 57% of all throat cancer patients. Rising consumer awareness about early diagnosis of cancer and rising demand for advanced therapeutics are significantly fostering market growth in this region.

Segments Covered in the Report

By Treatment Type

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

July 2024

August 2024