What is the Health Insurance Market Size?

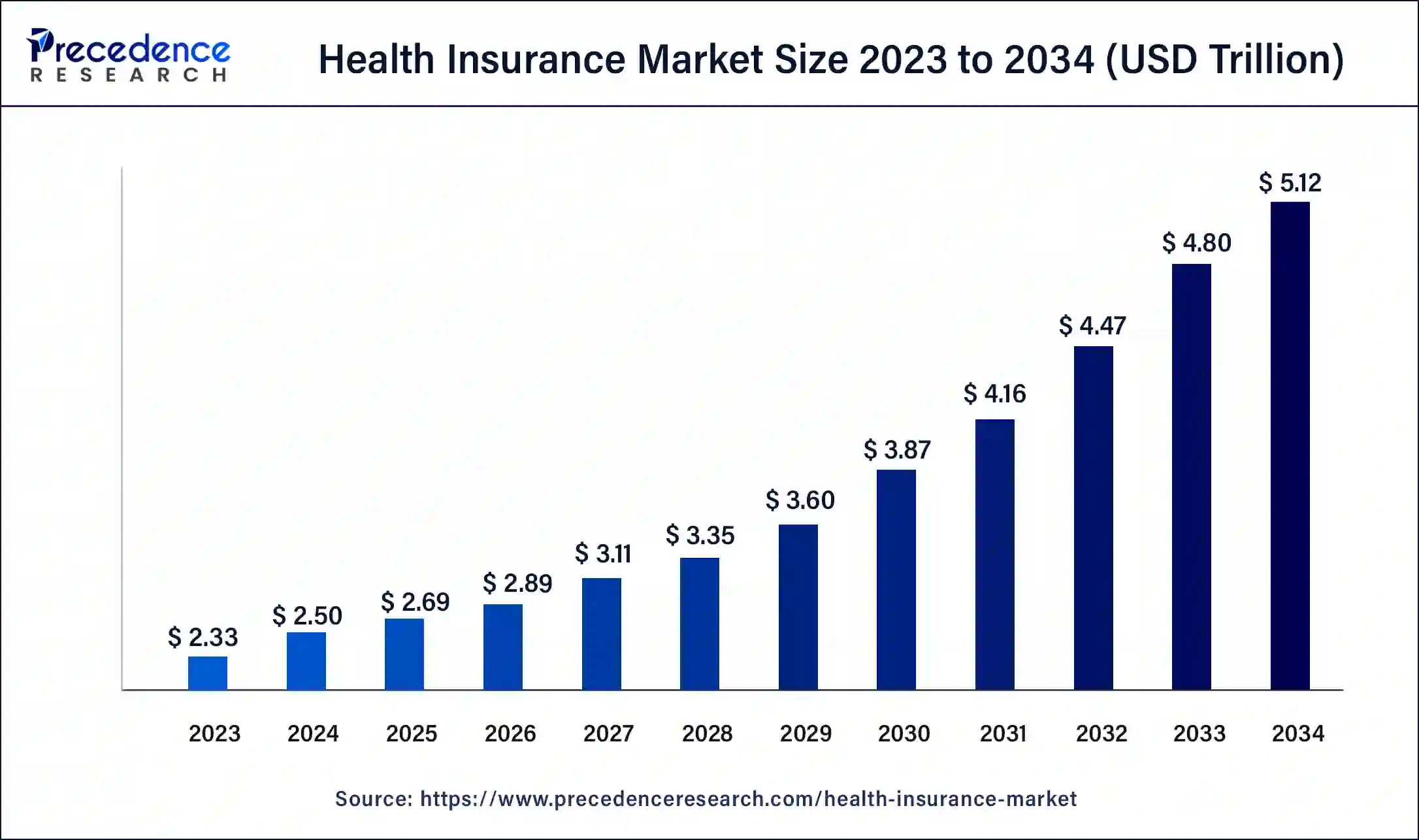

The global health insurance market size is estimated at USD 2.69 trillion in 2025 and is predicted to increase from USD 2.89 trillion in 2026 to approximately USD 5.45 trillion by 2035, expanding at a CAGR of 7.32% from 2026 to 2035.

Market Highlights

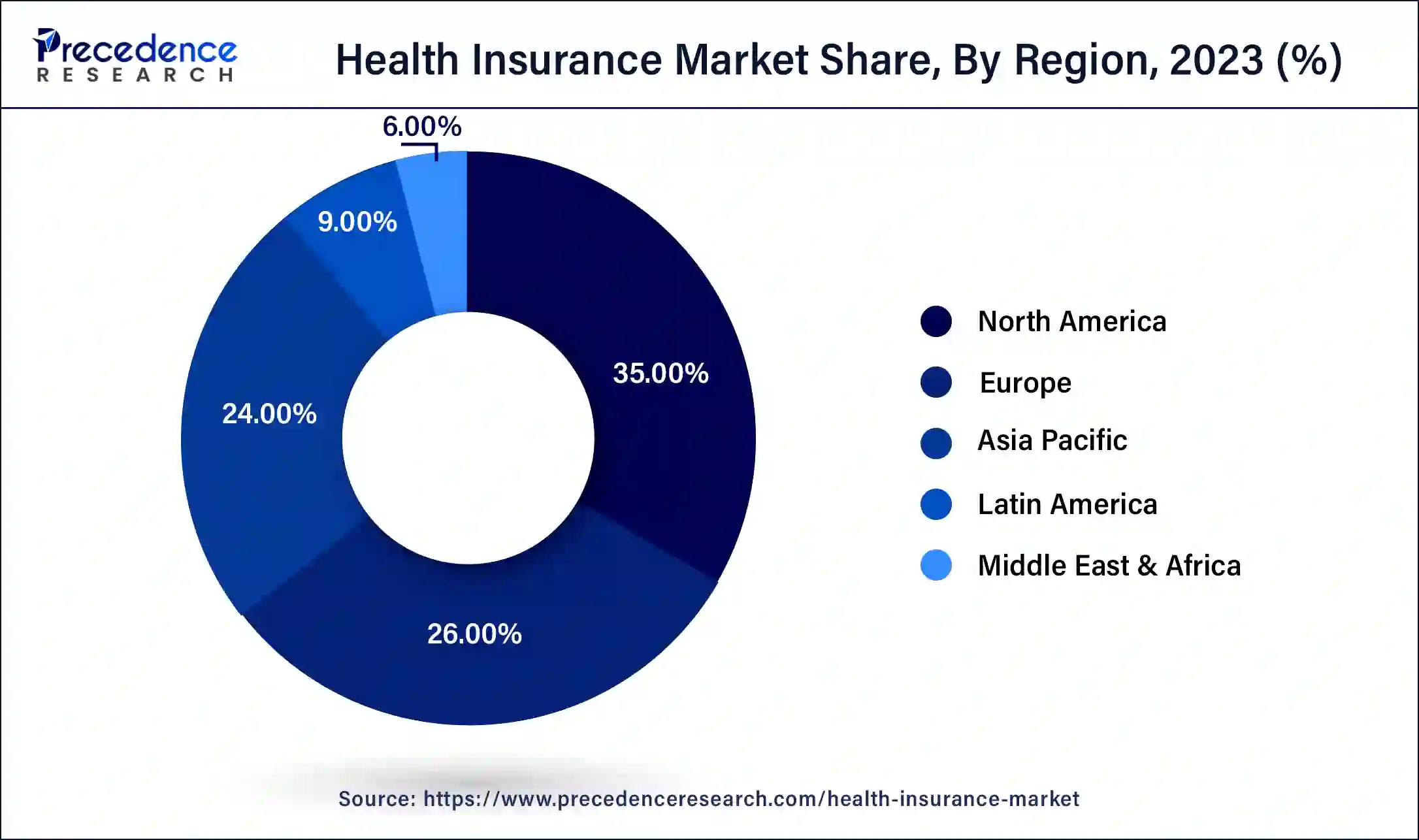

- North America dominated the global market with the largest market share of 39% in 2025.

- By coverage type, the life-time coverage segment held a 55% market share in 2025.

AI: Reshaping the Global Health Insurance Landscape

The digital transformation of artificial intelligence has been augmenting the health insurance sector in terms of efficiency, personalization, and precision. AI-aided predictive analytics have even helped develop more precise risk-assessment algorithms so that companies might present the consumer with fair price rates and coverage plans customized to their needs. Claims processing held up by automation leads to delays and errors, while uplifting customer satisfaction and reducing admin costs. Fraud detection systems managed with machine learning keep both insurers and honest customers safe from false claims. Giving a human touch, artificial intelligence-powered chatbots and virtual agents render customer service to customer. Alongside this, artificial intelligence supports proactive wellness management, which helps to minimize the long-term medical costs. By streamlining the back-office processes of health insurance, AI makes better coverage and better health outcomes accessible to everyone.

Health Insurance Market Growth Factors

The health insurance market is anticipated to witness rapid growth owing to the rising burden of diseases and growing geriatric population across the globe. The prevalence of various chronic diseases such as cardiovascular diseases, respiratory diseases, neurological diseases, cancer, musculoskeletal diseases, and diabetes is rising at a significant pace across the globe. The growing awareness among the population regarding the financial benefits of having health insurance is expected to drive the growth of the global health insurance market.

According to the GLOBOCAN report by the International Agency for Research on Cancer, around 19.3 million new cancer cases and around 10 million cancer related deaths were reported in the year 2020, across the globe. Cardiovascular diseases are the leading cause of deaths across the globe that accounted for 32% of the global death, as per the World Health Organization.

The rising obesity, physical inactivity, increased consumption of tobacco and sugar, increasing prevalence of smoking, and unhealthy food habits are the major causes behind the surging burden of chronic diseases across the globe. The cost of treatment is expensive and it can drain all the savings of an individual. Therefore, the rising financial literacy among the modern people and the easy availability of various types of health insurance providers are the significant factors behind the burgeoning demand for the health insurance.

- Under the federal government subsidies (United States), the amount of health insurance for people under age 65 is projected to be $1.6 trillion in 2032. Whereas the medicine and the children health insurance program is expected to account for about 42% of the total subsidies during the period of 2022-2032

- Vitality, Bupa and Aviva, top leading health insurance companies added 480,000 new consumers since the beginning of 2022 in the United Kingdom. Vitality Health Insurance has witnessed an overall increase of 20% in consumers in 2022 as compared to 2021.

- In between January- June 2022, approximately 61.4% people (all ages) in the United States had private health insurance coverage. Whereas 39.2% of people (all ages) had public health insurance coverage.

- According to the Commonwealth Fund, approximately 43% of working adults in the United States were insured in 2022. Which means, more than two in every five working adults had health insurance in 2022.

- Reliance Nippon Life Insurance, India had 2,396,976 policies in force as of 2022. The company's overall profit increased by 30% in 2022.

- Cigna Healthcare, one of the leading healthcare insurance providers stated that its overall consumer relationship grew by 2% at the end of 2022 and reached 189.7 million which was 185.6 in the year 2021.

- An increasing prevalence of chronic diseases and lifestyle disorders is alarming demand for full health coverage.

- The aging population worldwide has been facilitated in its increased reliance on health insurance.

- Increasing awareness and financial literacy for insurance-related benefits promotes its broader adoption.

- Increasing accessibility through private and public insurance providers gives a stronger boost to the market.

- High treatment costs for unplanned occurrences motivate increased financial protection.

Health Insurance Market Outlook

- Industry Growth Overview: The health insurance market is set for robust growth between 2025 and 2034, primarily driven by soaring healthcare costs, the rising prevalence of chronic and lifestyle diseases, an aging population, and heightened consumer awareness of the need for financial protection. High-growth segments include critical illness policies, specialized plans for seniors, and outpatient care coverage.

- Global Expansion:Leading players are expanding their geographical footprint, particularly into high-growth emerging markets in Asia-Pacific and Latin America, driven by rising disposable incomes, rapid urbanization, and supportive government initiatives to provide universal health coverage. North America remains a dominant market due to its established infrastructure and high healthcare spending.

- Major Investors: Private equity and venture capital firms are actively investing in the sector, drawn by its defensive growth characteristics and integration with health tech. Strategic investors, including major tech companies like Microsoft and Nvidia, are also entering the space. Noteworthy investments include those from KKR, Carlyle Group, and Blackstone in related healthcare sectors.

- Startup Ecosystem: The startup ecosystem is flourishing, especially in areas leveraging technology for improved accessibility and efficiency. Innovations focus on digital-first platforms, AI-driven risk assessments, telemedicine integration, and RaaS models for healthcare delivery, offering solutions such as on-demand micro-insurance and simplified, transparent policy management.

Trends Enabling Growth in the Health Insurance Market:

- The trend of personalized and wellness-integrated insurance continues to be a growing preference among consumers. Increasingly, these customized insurance solutions based on individual needs (including chronic health conditions), behaviours (such as lifestyle choices), and preventive health incentives have become the new standard for insurance plans. Wellness rewards and trade area are available in customized plans today.

- The growth of cashless and value-based care continues to increase as a way for insurers to increase accessibility and reduce upfront financial barriers for customers by expanding the use of cashless reimbursements, value-based insurance design, and Medicaid health savings plans.

- An increase in awareness and disposable income in urban and semi-urban areas is contributing to growth in the middle-class population. Increasing access to health insurance among urban populations in emerging markets will continue to increase as accessible, fast, and affordable solutions are developed through emerging technologies.

Government Initiatives Towards the Health Insurance Market:

- Governments are expanding the number of individuals who qualify for public health insurance programs to increase access to healthcare. These programs will especially provide coverage to people who are in need, including the poor and residents of rural areas where access to healthcare is typically more difficult for many people.

- Assisting those with low-income families, senior citizens, and disabled individuals through the provision of subsidies and other financial assistance to make it more affordable for these individuals to have health insurance is necessary to improve the level of penetration of health insurance within society.

- Strengthening policyholder protections through the establishment of more standardized disclosures, fair claims processes, and simplification of policy terms through legislative action to build trust among consumers that purchasing health insurance is an investment that should be pursued.

- Without having to pay cash up front at a hospital that is included within a government-approved cashless provider network. Health insurance is being linked to digital health networks using various electronic platforms (e-health id's, electronic medical records) that allow for better organization and control of policies, faster processing of claims, and increased accuracy of data.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.69 Trillion |

| Market Size in 2026 | USD 2.89 Trillion |

| Market Size by 2035 | USD 5.45 Trillion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.32% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Provider, Coverage Type, Network Provider, Plan Type,Age Group, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segments Insights

Provider Insights

The public provider was the leading segment in the global health insurance market in 2025. In case of the public provider, the government act as the major insurance provider and the increased public trust and confidence on the government bodies regarding their funds is a prominent driver of the public provider segment. For instance, MEDICARE and MEDICAID services of the US Federal government and the Life Insurance Corporation of India are the well-known public providers of health insurance. Moreover, the regulatory changes regarding the reimbursement policies pertaining to the services acquired from the telehealth platforms is expected to foster the growth of the public provider segment in the forthcoming future.

The private provider is anticipated to exhibit the highest CAGR during the forecast period. The global health insurance market is flooded by the presence of numerous top global and domestic players. The aggressive marketing strategies and lucrative offers provided by them is gaining consumer attention rapidly. Furthermore, the rising adoption of digital technologies and adoption of hassle-free settlement procedures are the major factors that are expected to have a significant impact on the growth of the private providers segment. Moreover, the inefficiencies and delays in procedures associated with the public providers in solved in the private providers, which are fueling the growth of this segment.

Coverage Type Insights

Depending on the coverage type, the lifetime coverage was the dominant segment in the global health insurance market, accounting for over 55% of the market share in 2025. The lifetime coverage health insurance is more popular among the customers owing to the tax benefits associated with it.

The term insurance is anticipated to be the fastest-growing segment during the forecast period. The low cost and a wider range of benefits associated with the term insurances is fueling the adoption of the term health insurances among the consumers across the globe. Moreover, the regular product launches with addition of new benefits gains the consumer attraction and hence this segment is expected to be the fastest-growing.

Network Provider Insights

Depending on the network provider, the preferred provider organization was the leading segment that accounted for a market share of more than 27% in 2025. The preferred provider organizations have a huge variety and wider range of health insurances products to offer to the customers. It also offers choices among the hospitals and doctors to the customers. Therefore, the availability of wider range of options with the preferred provider organizations has made it the most dominating segment in the global health insurance market.

The point of sale is anticipated to be the most lucrative segment during the forecast period. The mixed features of the point of sale organizations have made it a popular choice among the customers. It includes the features of both the preferred provider organization and the health maintenance organization.

Regional Insights

U.S. Health Insurance Market Size and Growth 2026 to 2035

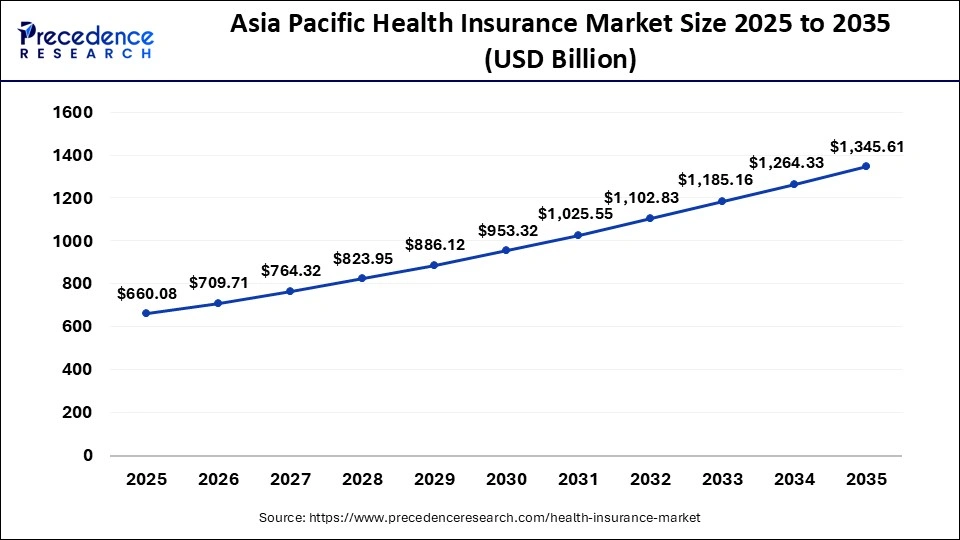

The U.S. health insurance market size is estimated at USD 660.08 billion in 2025 and is predicted to be worth around USD 1,345.61 billion by 2035, at a CAGR of 7.38% from 2026 to 2035.

North America led the global health insurance market in 2025. The market size of North America region was USD 800 billion in 2023. The higher penetration of the health insurance in North America has led to the growth of this segment. The healthcare costs and expenditure are very high in North America. In fact, most of the people depend on the reimbursements for receiving the treatments. Furthermore, the prevalence of chronic diseases is very high in the major market like U.S. It is estimated that approximately 60% of the U.S. population is suffering from one or more chronic conditions. The availability of advanced healthcare infrastructure and improved access to the advanced healthcare facilities are the major factors behind the high healthcare costs. The increased awareness among the population regarding the benefits of insurance policies and the high literacy rate in the region are the prominent factors behind the rapid growth of the health insurance market.

U.S. Market Trends

The U.S. plays a key role in the market, serving both as the direct insurer for over a third of the population through major public programs like Medicare, Medicaid, and military/veterans benefits, and as the main regulator for the leading private insurance sector. Through significant legislation such as the Affordable Care Act (ACA), the government sets consumer protections, mandates essential coverage, and provides substantial financial subsidies to promote employer-sponsored insurance.

What Factors are Boosting the Growth of the Health Insurance Market in Asia-Pacific?

Asia Pacific is expected to exhibit the highest growth rate during the forecast period. The Asia Pacific region is the home to the world's largest population. The rapid urbanization and growing penetration of the insurance companies is fueling the market growth. The changing lifestyle of the consumers, unhealthy eating habits, and rising obesity are the major factors behind the growing prevalence of chronic diseases in the region. The rising disposable income, improving access to the internet, rising literacy rates, increasing investments on the development of advanced healthcare infrastructure, and rising awareness regarding the health insurances among the population are the most prominent factors that are expected to drive the growth of the Asia Pacific health insurance market in the forthcoming years.

China Health Insurance Market Trends

China is a major contributor to the Asia Pacific health insurance market due to its large population and rapidly growing middle class, which is increasingly seeking private healthcare coverage. The government's focus on expanding healthcare access and reforms aimed at improving insurance penetration further boost market growth. Rising awareness of health risks, coupled with increasing chronic disease prevalence, drives demand for comprehensive health insurance plans. Additionally, the presence of both domestic and international insurers offering innovative policies strengthens China's position as a key market in the region.

How is the Opportunistic Rise of Europe in the Health Insurance Market?

Europe is seeing significant growth in the health insurance market, marked by strong public universal healthcare systems and a sizable private insurance sector. The private market mainly grows from individuals seeking additional coverage to access more services, shorter wait times, and a wider choice of providers. Strict regulations protect consumers and ensure data privacy. There is also a focus on preventive healthcare, along with the integration of AI and data analytics for personalized policies and expanding digital health platforms.

Germany Health Insurance Market Trends

Germany is a major contributor to the European health insurance market due to its well-established statutory health insurance (SHI) system, which covers the majority of the population, alongside a competitive private health insurance (PHI) sector for high-income earners and professionals. The market's growth is driven by an aging population, rising healthcare costs, and a focus on improving claims processing and customer-centric services. Strong regulation and the presence of both public and private insurers ensure high market penetration and innovation in coverage options.

What Potentiates the Growth of the Latin America Health Insurance Market?

The health insurance market in Latin America is steadily expanding, driven by growing health awareness, increasing middle-class incomes, and the demand for better healthcare options beyond public systems. The region features a mix of public and private coverage, with a focus on private insurance to manage rising healthcare costs and improve access to better facilities. Key drivers include the adoption of digital health solutions like telemedicine, strategic partnerships between local and international insurers such as Bupa and MAPFRE, and government initiatives aimed at expanding coverage. Brazil holds the largest market share, but countries like Costa Rica and Peru are also showing significant growth potential.

Brazil Health Insurance Market Trends

Brazil's health insurance market is growing quickly. Many people try to avoid the long wait times and restrictions of the public healthcare system. The market's growth is fueled by economic expansion, rising disposable incomes, and regulatory changes that promote private-sector involvement. A key trend is the rising demand for supplemental health insurance and the fast adoption of digital healthcare solutions, including Bradesco Saúde, Amil, and Hapvida.

A New Era for Health Insurance in the Middle East and Africa

The MEA health insurance market is set for robust growth, driven by rising healthcare costs, a high prevalence of chronic diseases, and increased health awareness. Government-led initiatives and the implementation of mandatory health insurance policies in several countries, especially in the Gulf Cooperation Council (GCC) region, are key market drivers. The private sector plays a leading role, providing faster claims processing and a wider network of hospitals. A major trend is the adoption of digital health technologies.

Saudi Arabia Health Insurance Market Trends

Saudi Arabia has a large and tightly regulated health insurance market, managed by the Cooperative Health Insurance Council (CCHI). This council requires coverage for all expatriates, private-sector employees, and their dependents. The market is mainly led by the private sector, with major companies like Bupa Arabia and Tawuniya, due to increasing healthcare costs, the privatization of public health services, and efforts to achieve universal health coverage.

Value Cain Analysis

- R&D: At this stage, new drugs, therapies, and medical technologies are researched and developed.

Key Players: Merck & Co., Roche

- Clinical Trials and Regulatory Approvals: This stage involves testing new treatments on humans and getting approval from regulatory bodies such as the FDA before a product can be sold.

Key Players: IQVIA, ICON plc

- Formulation and Final Dosage Preparation: This phase involves the combination of active pharmaceutical ingredients with other components to prepare a stable, effective, and acceptable final drug product.

Key Players: Catalent, Lonza

- Packaging and Serialization: This process involves packaging drug products and labeling individual units with unique identifiers for tracking and tracing along the supply chain, hence novelty to counterfeiting and ensuring product authenticity.

Key Players: Gerresheimer AG, AptarGroup, Inc.

- Distribution to Hospitals, Pharmacies: The stage the logistical process of transporting approved drugs and other medical products to healthcare providers and pharmacies, thus allowing them for patient use.

Key Players: McKesson Corporation, Cardinal Health

- Patient Support and Services: The stage of activities meant to improve patient experience and treatment adherence, such as patient education, follow-up care, and loyalty programs.

Key Players: Star Health and Allied Insurance Co. Ltd., Care Health Insurance

Top Companies for the Health Insurance Market and Their Offerings

- United Healthcare Services, Inc.: Offers comprehensive health benefit programs for individuals, employers, Medicare, and Medicaid, complemented by health services through its Optum division (pharmacy, data, and care delivery).

- CVS Health Corporation: Provides health insurance plans for individuals, employers, Medicare, and Medicaid. It integrates these benefits with its extensive pharmacy network (CVS Pharmacy, Caremark) and retail health clinics (MinuteClinic).

- Cigna Corporation: A global health services company with two main segments: Cigna Healthcare (health, dental, behavioral health plans) and Evernorth Health Services (pharmacy benefits, specialty care).

- Centene Corporation: A multi-national healthcare enterprise focused on government-sponsored programs (Medicaid, Medicare) and the Health Insurance Marketplace. It emphasizes local service delivery for underserved and uninsured populations.

- Allianz SE: A global financial services and insurance giant offering a wide range of insurance products worldwide. In health, it specializes in international health plans for expatriates and local health products in numerous countries.

Health Insurance Market Companies

- WellCare Health Plans, Inc.

- National Insurance Company Limited

- Bupa Global

- Humana, Inc.

- AIA Group Limited

Recent Developments

- In March 2025, Battery X Metals Inc. an energy transition resource exploration and technology company, announced it has completed, effective acquisition of the remaining 51% of the common shares of Li-ion Battery Renewable Technologies Inc. under the exercise of its Call Right, as defined therein, from the LIBRT shareholders in consideration for 3,030,296 common shares of the Company.

- In February 2025, Blue Whale Materials, a leader in lithium-ion battery recycling, announced a strategic partnership with Call2Recycle, the leading battery stewardship organization in North America. As an output partnership, Blue Whale Materials' advance sorting and recycling facility in Bartlesville

- In May 2025, Solidion Technology, Inc., an advanced battery technology solutions provider, today announced that a series of key patents on solid-state batteries have been granted to Solidion, which have potential to transform the entire lithium battery industry.

- In June 2018, UniCreditentered into a partnership agreement with the Allianz Group in Europe. This agreement aimed at integrating the Allianz's insurance expertise with UniCredit's banking franchise in European market.

- In June 2021, Anthem, Inc. acquired the MMM Holdings, Inc., which allowed the company to serve the consumers in Puerto Rico with Medicaid and Medicare plans.

- In April 2021, Molina Healthcare, Inc. entered into an acquisition agreement with Cigna Corporation in which Molina Healthcare acquired Cigna's Medicare-Medicaid Plan and Texas Medicaid.

- The health insurance market is highly fragmented with the presence of numerous top players in the market. These market players are constantly engaged in various developmental strategies such as mergers, joint ventures, business expansion, acquisitions, partnerships, collaborations, and new product launches to strengthen their position and expand their market share.

Segments Covered in the Report

By Provider

- Public

- Private

By Coverage Type

- Term Insurance

- Life-time Coverage

By Network Provider

- Point of Service

- Preferred Provider Organizations

- Exclusive Provider Organizations

- Health Maintenance Organizations

By Plan Type

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

By Age Group

- Minor

- Adults

- Senior Citizen

By Distribution Channel

- Direst Sales

- Brokers/Agents

- Banks

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting