January 2025

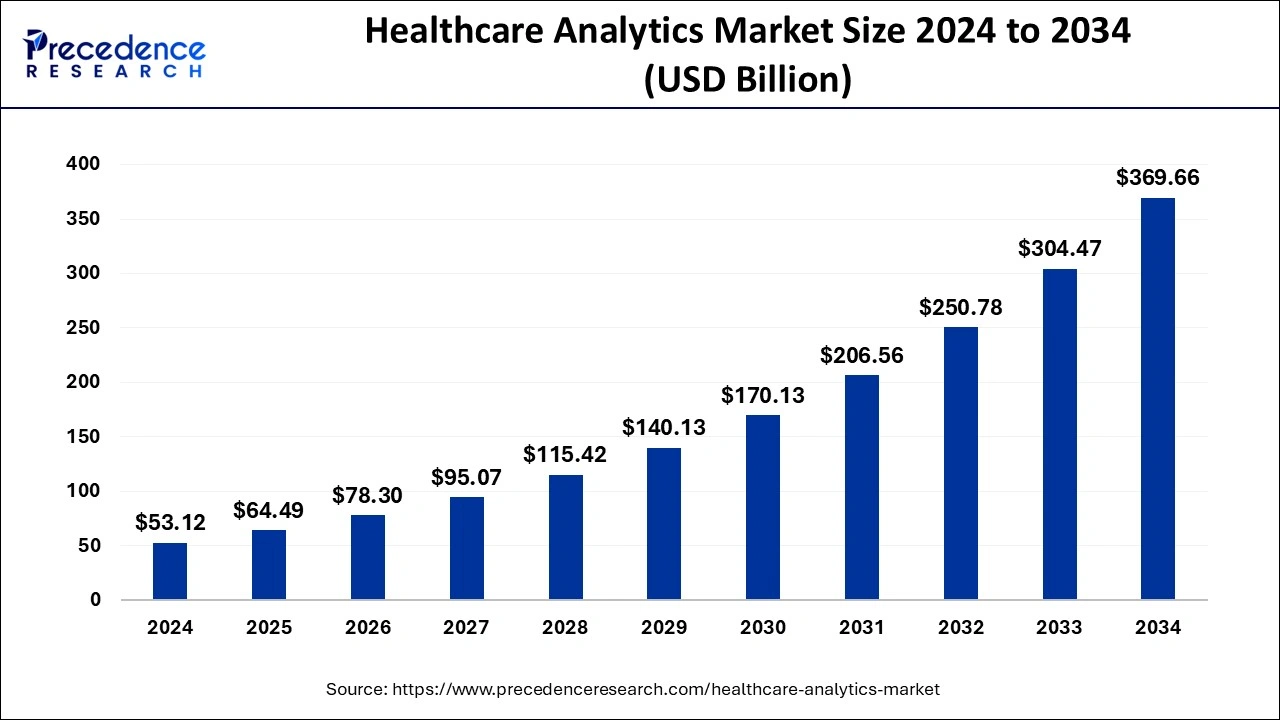

The global healthcare analytics market size was accounted for USD 53.12 billion in 2024, grew to USD 64.49 billion in 2025 and is predicted to surpass around USD 369.66 billion by 2034, representing a healthy CAGR of 21.41% between 2025 and 2034. The North America healthcare analytics market size was calculated at USD 25.83 billion in 2024 and is expected to grow at a fastest CAGR of 21.42% during the forecast year.

The global healthcare analytics market size was estimated at USD 53.12 billion in 2024 and is anticipated to reach around USD 369.66 billion by 2034, expanding at a CAGR of 21.41% from 2025 to 2034.

The development in AI technology is vital for the healthcare analytics market. The integration of AI in healthcare companies can help in accurate diagnoses of patients by analyzing medical images, scans, and electronic health records. Also, the rise in number of research activities associated with drug discovery can be enhanced using AI. Moreover, the advancements in AI can help in streamlining various healthcare operations consisting of administrative workload, patient engagement, predictive analytics, drug safety and some others. Thus, the integration of AI in healthcare analytics platforms is playing a crucial role in shaping the industry in a positive direction.

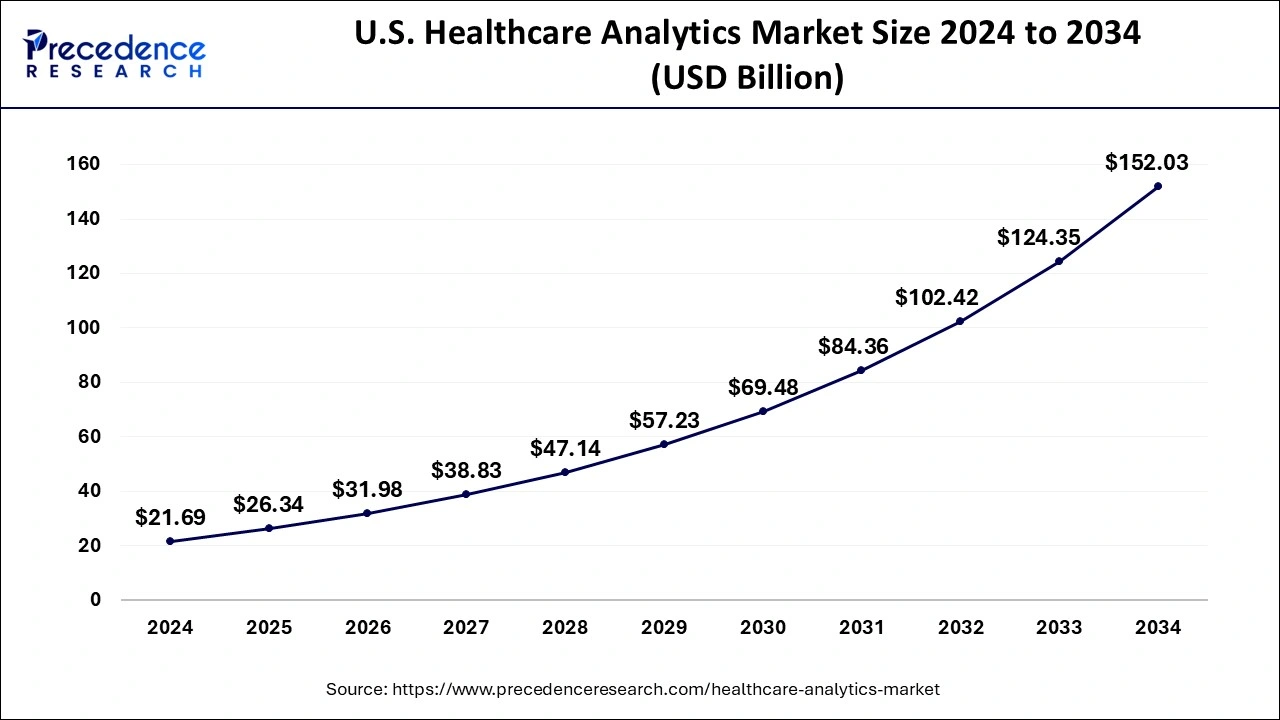

The U.S. healthcare analytics market size is evaluated at USD 21.79 billion in 2024 and was predicted to be worth around USD 152.03 billion by 2034, rising at a CAGR of 21.49% from 2025 to 2034.

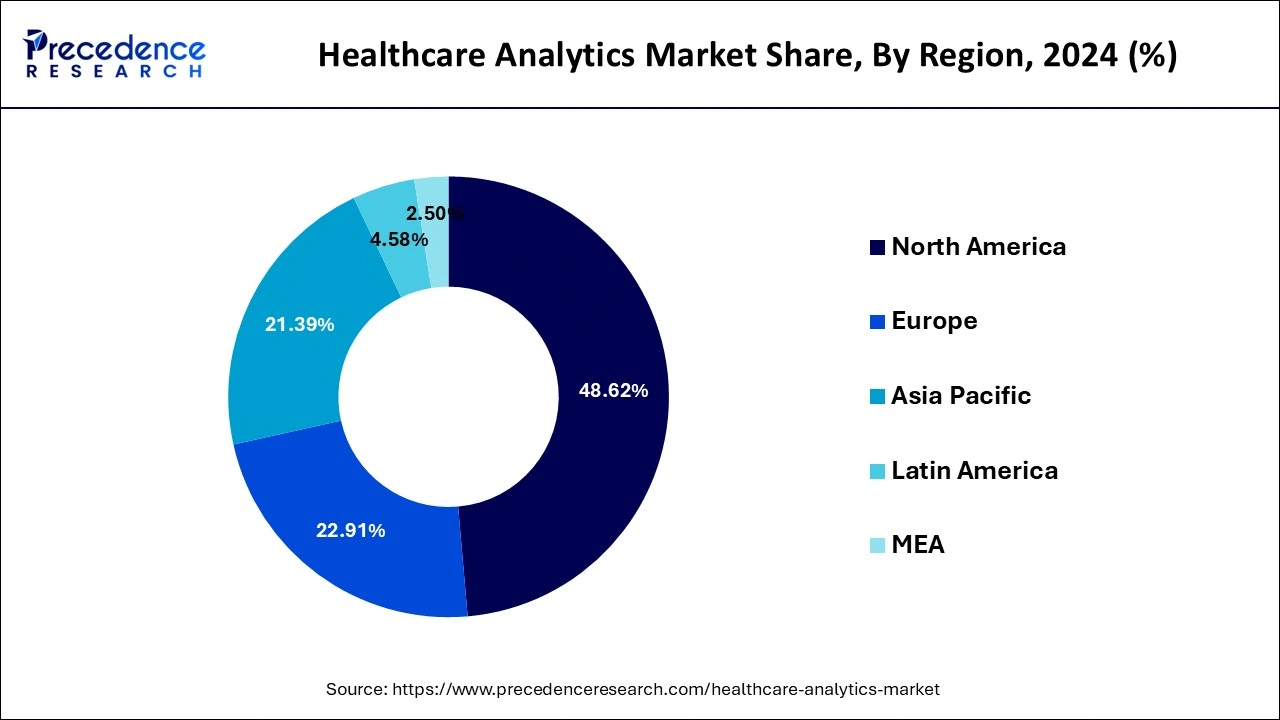

North America dominated the healthcare analytics market with the largest market share of 48.62% in 2024. It is primarily due to the development and evolution of healthcare facilities, the rising prevalence of chronic diseases, the growing geriatric population, technological advancements along with the growing adoption of analytical solutions. In addition, the majority of hospitals in the North America region have deployed electronic health record systems, as well as healthcare analytics software and tools, in order to cut costs and manage large volumes of patient data. Furthermore, the presence of significant healthcare analytics market players such as Cardinal Health, AlayaCare, Oracle and some others in this region boosts the market growth.

In North America, Canada and the U.S. are the main contributors in the market. In Canada, the healthcare analytics market is driven by several government initiatives to mandate analytics platforms in healthcare sector. In U.S., this market is generally driven by presence of numerous companies such as IBM, McKesson Corporation, Oracle Health and some others.

Asia Pacific is expected to expand at a double digit CAGR of 23.2% during the forecast period. The increased healthcare expenditures, infrastructure improvements, the formation of start-ups, and the use of advanced analytical solutions are all contributing to the healthcare analytics market’s growth during the forecast period. The technological advancements in healthcare sectors in countries such as India, China, Japan, South Korea and some others is further contributing to the industrial expansion. Moreover, several government initiatives to aimed at adopting analytics in healthcare sector along with rising incidences of cancers and CVDs has boosted the market growth. Additionally, presence of several companies such as HealthifyMe, CitiusTech, Indohealth Software Solutions Pvt. Ltd and some others has driven the growth of the healthcare analytics market.

The players in the healthcare analytics market are constantly inventing and developing improved analytical solutions, as well as extending their product offerings. To help healthcare organizations implement data analysis solutions, combat the pandemic, and preserve competitive advantage in the healthcare analytics market, the companies are focused on their alliances, technology collaborations, and product launch strategies.

Healthcare analytics enables experts in the field to identify opportunities to improve care delivery, clinical outcomes, operations, and patient engagement. Healthcare data analytics integrates real time and historical data to forecast trends, increase medical care, expose actionable insights, and fuel long term growth. Furthermore, healthcare analytics systems make use of massive volumes of data to present enterprises with useful information.

The growth of the healthcare analytics market is being fueled by a surge in government initiatives as well as an increase in the use of big data in healthcare organizations, which encourage the use of electronic health records by healthcare organizations. Moreover, the need for healthcare organizations to cut unnecessary costs has a positive impact on the global healthcare analytics market’s growth during the forecast period.

| Report Coverage | Details |

| Market Size in 2024 | USD 53.12 Billion |

| Market Size in 2025 | USD 64.49 Billion |

| Market Size by 2034 | USD 369.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 121.41% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, Delivery Mode, End Use, Region |

The government of several countries have started mandating EHR platforms for streamlining several medical operations. The integration of these platforms in healthcare sector helps in better collaboration among healthcare professionals and patients. Also, the numerous governments have started developing analytics solutions for healthcare industry to ease complex tasks. Moreover, the government of countries such as India and U.S have launched several smartphone apps for accessing electronic health records (EHRs). Thus, the above-mentioned factors are expected to drive the growth of the Healthcare Analytics Market.

The healthcare analytics industry encounters various problems in their day-to-day operations. Firstly, the rise in number of cyber attacks related crimes has created a security concern for adopting healthcare analytics. Secondly, the cost of developing advanced analytics platforms has increased rapidly due to the growing rates of software developers and companies. Thus, these factors are anticipated to restrain the growth of the healthcare analytics market.

Integration of Blockchain Technology

The advancement in blockchain technology is crucial for the healthcare analytics industry. The integration of blockchain in healthcare analytics helps in analyzing trends and predict future events along with securely storing and sharing patient data. Also, the rising adoption of blockchain-based analytics platform in healthcare sector helps in detecting fraud and ensuring interoperability and accessibility. Thus, the integration of blockchain technology in healthcare analytics platform is likely to create numerous opportunities for the market players in the future

The services segment dominated the market with largest revenue share in 2024. As they lack the skills and resources to deploy analytics, life science, and healthcare organizations outsource these services to other premier analytical solutions companies. Furthermore, the services category is predicted to increase at the rapid pace in near future.

The software segment is fastest growing segment of the healthcare analytics market in 2024. The healthcare industry is experiencing a surge in demand for analytical solutions as a result of the increased workload. For handling patient records, healthcare infrastructure is evolving and incorporating artificial intelligence and analytical based technologies.

The descriptive analysis segment accounted largest revenue share in 2024. This is due to an increase in the demand for descriptive analysis based on historical patterns in order to obtain data-enriched insights that will help organizations better comprehend the current situation. The major market players forecast future market outcomes using data mining technologies on descriptive data warehouses.

The predictive analysis segment, on the other hand, is predicted to develop at a rapid rate over the projection period. The healthcare analytics market players can create appropriate plans due to the growing use of advanced analytical solutions in anticipating future market dynamics and results. The market players can coordinate their plans and decision making based on healthcare analytics market performance using predictive analysis.

The On-premises segment contributed the highest market share of 48% in 2024. This is due to better accessibility from remote regions, as well as lower operation and maintenance costs. On-premise deployment entails putting systems and solutions on company computers.The hospitals have started deploying on-premises analytical solutions for enhancing several medical applications, thereby driving the industrial growth.

The cloud-based segment is representing a solid CAGR of 24.43% during the forecast period. The increased accessibility of the internet and better ease-of-access from remote areas are driving the expansion of cloud computing and web-based applications. The rising number of cloud-platforms that provides unlimited storage for storing health-related information has boosted the market expansion.

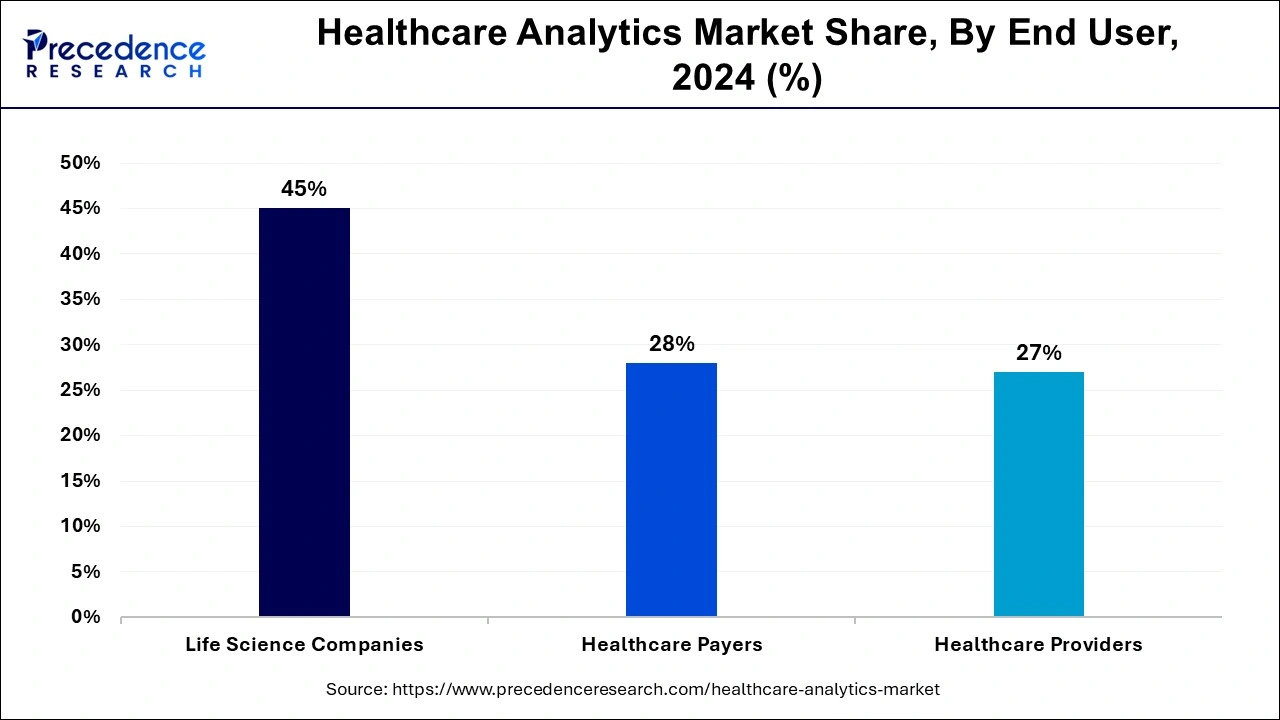

The life science companies segment contributed the biggest market share of 45% in 2024. This is due to life science firms’ increasing use of analytical solutions to improve product efficacy and accuracy. The growing focus of life science companies on developing novel medications along with rise in number of research activities associated with disease identification for developing effective drugs has boosted the market growth.

The healthcare providers segment is projected to grow at a solid CAGR of 25.83% during the forecast period, owing to hospitals and other care facilities’ increasing usage of analytical solutions. The integration of analytics solutions helps in enhancing several healthcare operations such as diagnostic analytics, predicting hospital visits, electronic health records, prescriptive analytics and some others has propelled the growth of the healthcare analytics market.

By Component

By Type

By Application

By Delivery Mode

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024