January 2025

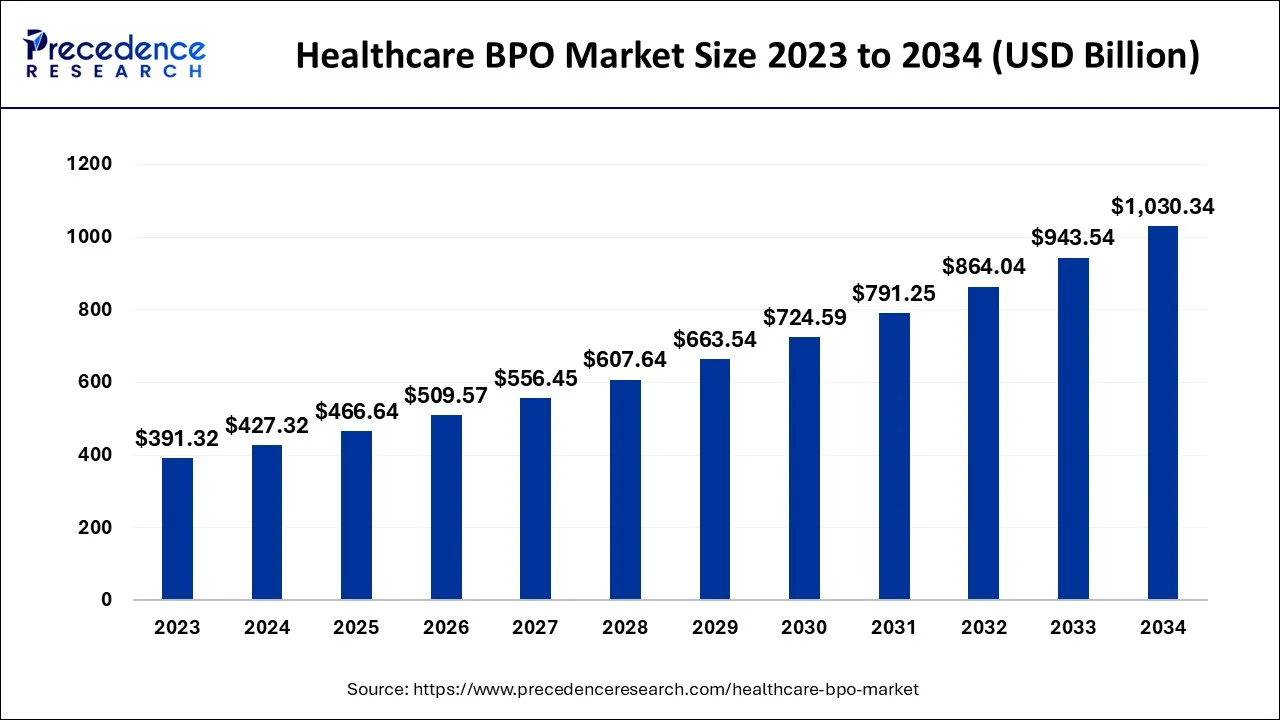

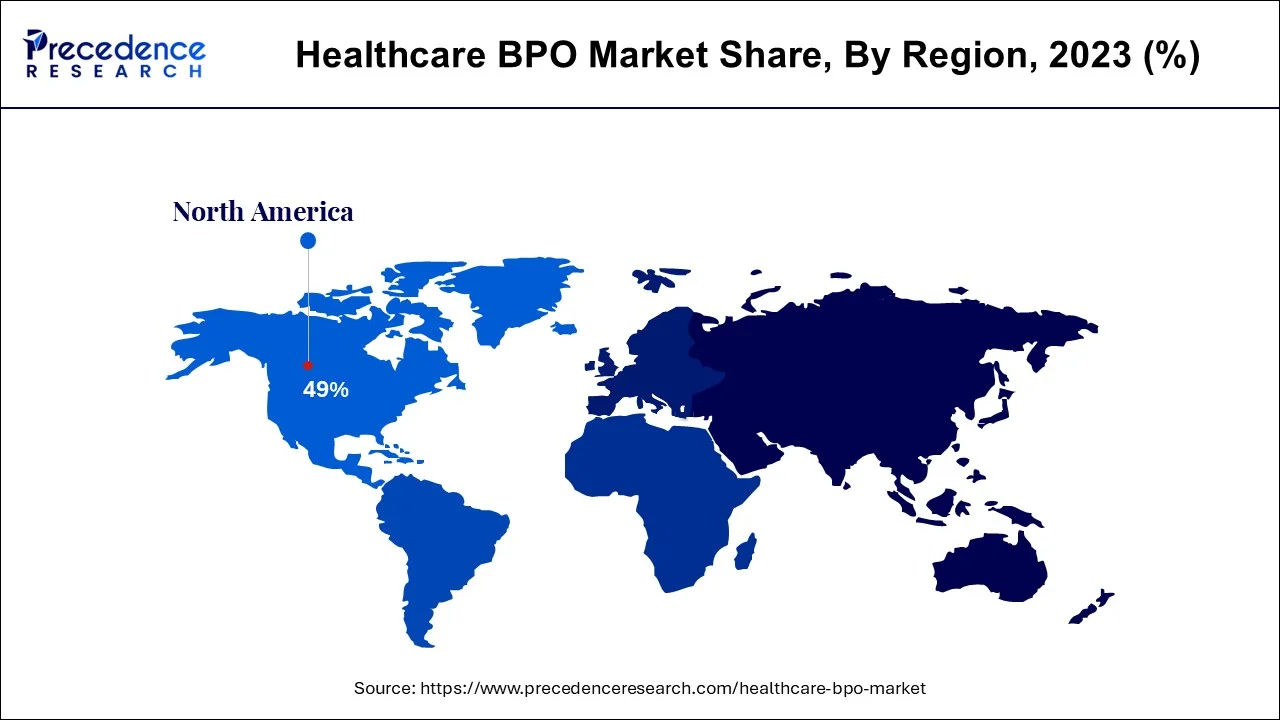

The global healthcare BPO market size accounted for USD 427.32 billion in 2024, grew to USD 466.64 billion in 2025 and is predicted to surpass around USD 1030.34 billion by 2034, representing a healthy CAGR of 9.20% between 2024 and 2034. The North America healthcare BPO market size is calculated at USD 209.39 billion in 2024 and is expected to grow at a fastest CAGR of 9.30% during the forecast year.

The global healthcare BPO market size is estimated at USD 427.32 billion in 2024 and is anticipated to reach around USD 1030.34 billion by 2034, expanding at a CAGR of 9.20% from 2024 to 2034.

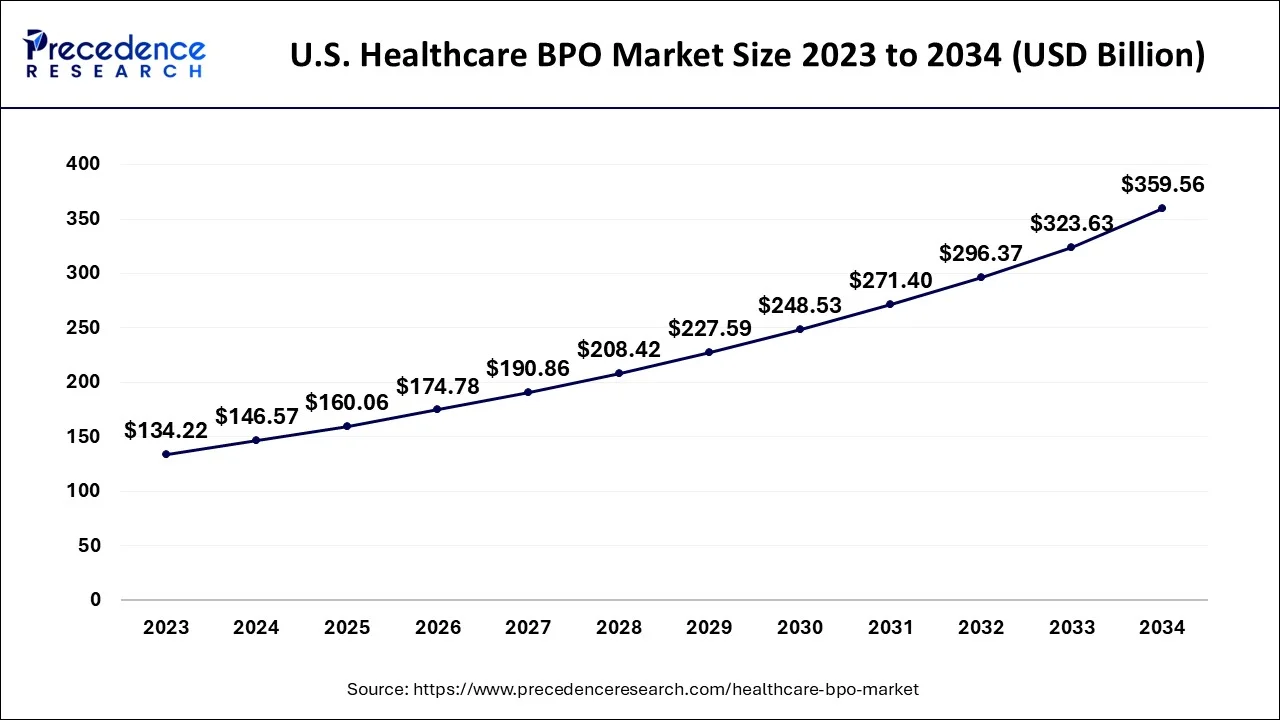

The U.S. healthcare BPO market size is evaluated at USD 146.57 billion in 2024 and is predicted to be worth around USD 359.56 billion by 2034, rising at a CAGR of 9.37% from 2024 to 2034.

The Medical BPO industry inside the Atlantic is being driven by considerably large care costs item, a very well platform, and the development of significant business participants. The industry for medical BPO is now dominated by the United States, and this dominance is anticipated to last for another few decades. The United States has the number one position. The medical sector in particular, which consists of pharmacists, medical equipment makers, pharmaceutical firms, and health providers, is expanding quickly. Individuals with specialized training who manage these processes are essential to these intricately developed markets.

The significant adoption adopted by major market participants in the market as well as the significant knowledge of the potential direction ns medical IT solutions is credited with the expansion of both the market sector. Due to a noticeable cost of health care expenditure, the existence of huge companies, as well as advancements, this nation came in second within the medical BPO industry. In terms of providing significant potential for growth, the medical BPO industry throughout this sector is expanding at the quickest rate worldwide.

In the countries in the US, nursing service processes offshore seem to have the smallest pricing power. Additionally, expanding federal programs in the nation is predicted to fuel industry expansion there. To promote medical accessibility and affordability for underrepresented people using remote treatment, the Ministry of Health Administration granted roughly USD 56 m to 29 Connection exists medical clinics in Feb 2022. Consumers have benefited greatly from telemedicine, particularly even during epidemics. As a result, growing demand in the nation is anticipated to be fueled by policy measures.

The Medical BPO research report provides a complete understanding of the industry and provides a snapshot of the industry. It contains the Covid 19 Research, market structure, an industry analysis, an industry analysis, product differentiation, a competitive environment, and important trend. It also enables investors to make investments in the Hospital BPO sector and allows them to thoroughly research the business before taking any actions.

The study identifies the main factors that are causing the health BPO industry to bloom and expand globally for a multitude of reasons, the majority of which encompass an increase in the number of individuals looking for insurance coverage and the guarantee of govt assistance. Furthermore, some limitations are insurmountable, such as the massive fees for system construction and repair and the swift shifts in market conditions.

The objective is to reach a point where there would be an expensive way to address the issue with no deceit or dishonesty throughout this industry to expand, however, the prospects are unlimited as practice goes. If organizations became a personality, there would be no opportunity for the company to work upon that offshore outsourcing and will have a substantial portion of customers who subcontract essential assigned jobs with the company. It would only enable little players to flourish alongside greater heavyweights. This study article analyses nursing service processes outsourced and analyses the prospects or difficulties. The effect of COVID 19 on the medical BPO sector is the subject of another phase of the report. The report also contains an estimate for growing markets and changes.

Its explosive growth of clinical pathways outsourced and also the decline in faults across noncritical operations including accounting, financing, and services to customers are driving the development of the segment hospital BPO sector. Additionally, the demand for protection, the need to reduce health care expenditures, and also the threat of patent peaks for the pharmaceutical industry is indeed the main drivers of the expansion of the medical BPO sector. This increases stress upon the delivery of healthcare services.

In terms of balancing the many facets of controlling operating costs, company bottom lines, and legislation directed to better outcomes, medical care has indeed been changing continuously. Fresh company concepts have emerged as a result of the ongoing need to improve patient and consumer services in the context of budgetary as well as bottom line restrictions. The persistent efforts to improve care coordination and create medical care better consumers are what fuel the growth of the construction BPO industry.

Operations are contracted to experienced personnel in done to avoid damages and lower the likelihood of crime. Healthcare and network operators will benefit by reducing the cost and time, while consumers will benefit by receiving high-quality care. We believe that such issues will spread throughout the industry. Furthermore, it is projected that the fear of a cyber-attack, the possibility of relinquishing power well over activities that are delegated, and concerns about customer satisfaction will impede market expansion. Since the primary organization is no longer in charge of the operation, there seems to be a dangerous chance that its influence through it will be lost.

The increased contribution of their solutions to enhancing patient treatment, enhancing population health, and assisting medical providers in cost-optimization has strengthened the financial model for nursing service activity key suppliers. Additionally, there would be a danger to information security. Contracting exposes a lot of private information to any third company, raising questions about information security. Furthermore, there are concerns about the level of service provided because a service provider may not even be as interested inside or worried about proposing alternatives or treatments to the agreed-upon parties as the main business is. It is envisaged that these elements will serve as growth inhibitors.

The medical BPO sector has an environment considered by companies. Using outsourcing, a wide range of moment jobs are usually transferred, which helps to reduce operating costs. manufacturing, Drug development, marketing, and statistics are just one of the important end customers. Clinical coder and accounting, expense reports, and information processing operations are increasingly demanded after healthcare process services in the hospital BPO sector.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.20% |

| Market Size in 2024 | USD 427.32 Billion |

| Market Size by 2034 | USD 1030.34 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Provider Service, Payer Service, Life Science Service, Geography |

Billing monitoring is a tool used by medical institutions to monitor all economic communication with customers, after their first consultation until the settlement of any outstanding recovery debt. All medical and management tasks that are needed to manage and recover care delivery payments collectively are referred to as the RCM. Therefore, it is anticipated that the growing demand for RCM products in hospitals will promote segment expansion.

In 2023, billing planning held the greatest customer base, and it is anticipated that it would continue to hold that position throughout the projected timeframe. The decrease in medical costs, expanding government attempts to integrate billing and coding technologies, and rising healthcare sector spending may all be contributing factors to the category expansion. This RCM provides the supplier with several advantages, including managing admin duties as well as invoicing and receivables. This cutting-edge system uses complex accounting, merchant services, and electronic medical record technologies to perform admin duties. According to Jul 2023 post "Billing Control in Medical," since many clinics manage to account for utilizing inefficient manual processes, human mistakes, such as mistakes in entering data, are the chief reason for payment problems.

Term supply chain administration is the collective name for the entire process of accepting revenues and managing returns. According to the previously cited source, RCM also efficiently and error-free blends payment details with aggregate records, insurer names, client private details, health findings, and medical classifications. As a result, RCM was once used quite regularly inside the medical industry, which is fueling product demand.

The Medical BPO region is based upon the services that the aid measures. Types of assistance provided by suppliers include customer onboarding, reimbursement policies, and quality experience. The clinical situation has improved the quality of medical improvements. The biggest market position for worldwide health Outsourcing is held by the claims processing category by 2023 and therefore is anticipated to keep this position throughout the forecast timeframe. Claiming management is a strategy that manages complaints while creating initiatives to minimize expenses and reduce theft while maintaining client satisfaction. The market is anticipated to witness a result.

During the projected timeframe, technological advancements are predicted to have the highest growth. The company's overall expansion could be attributed to rising expenditure for novel medications and vaccinations in response to an increase in COVID-19 patients. According to health system predictions, the business technology development sector is predicted to grow at a rapid pace since that is still a marketplace where consumers are not fully informed and because the COVID epidemic still seems to be active.

By Provider Service

By Payer Service

By Life Science Service

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024