January 2025

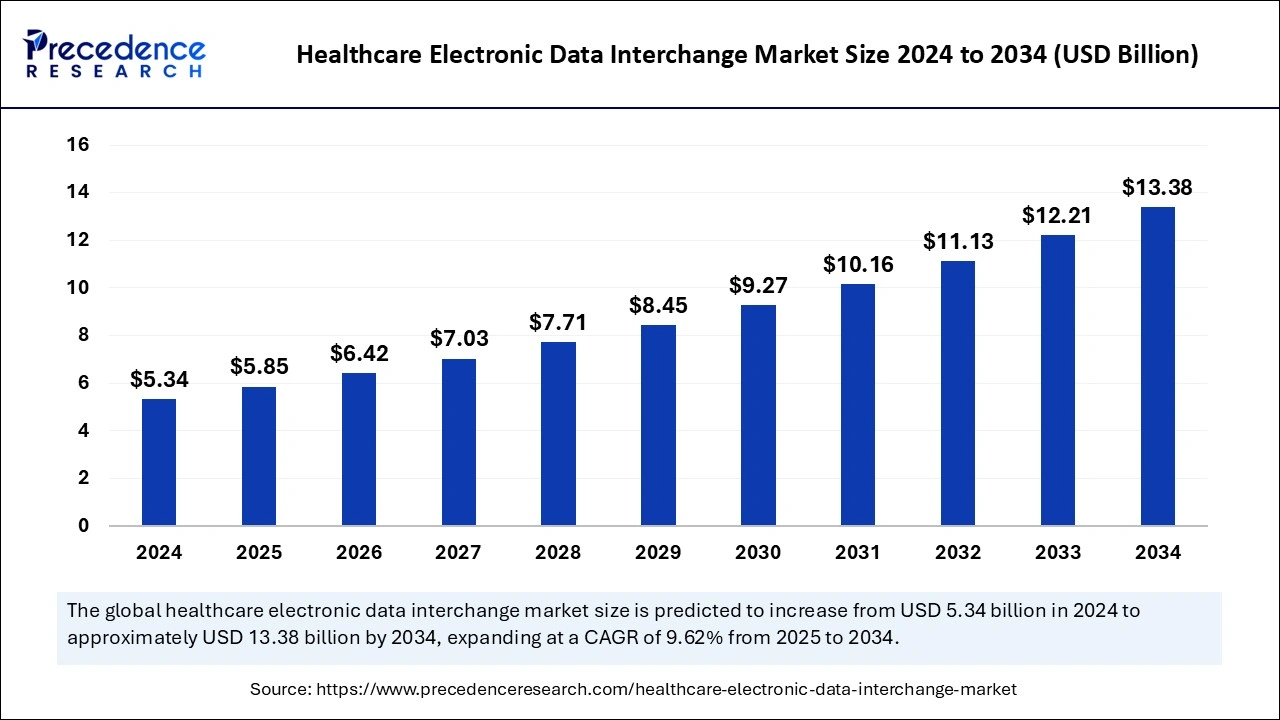

The global healthcare electronic data interchange market size is calculated at USD 5.85 billion in 2025 and is forecasted to reach around USD 13.38 billion by 2034, accelerating at a CAGR of 9.62% from 2025 to 2034. The North America market size surpassed USD 2.40 billion in 2024 and is expanding at a CAGR of 9.63% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare electronic data interchange market size accounted for USD 5.34 billion in 2024 and is expected to exceed around USD 13.38 billion by 2034, growing at a CAGR of 9.62% from 2025 to 2034. The expanding legal requirements for the interchange of electronic data drive the healthcare electronic data interchange market.

Compared to traditional EDI tools, Artificial Intelligence-driven systems can process vast volumes of healthcare data more quickly, cutting down on administrative delays. Machine learning algorithms can increase accuracy and lower expensive billing errors or rejections by identifying and fixing data processing flaws. By examining patient information and preferences, it can provide personalized billing communications, making the billing process more accessible to use. Natural language processing-powered automated chatbots can help patients comprehend their bills, enhancing the patient experience.

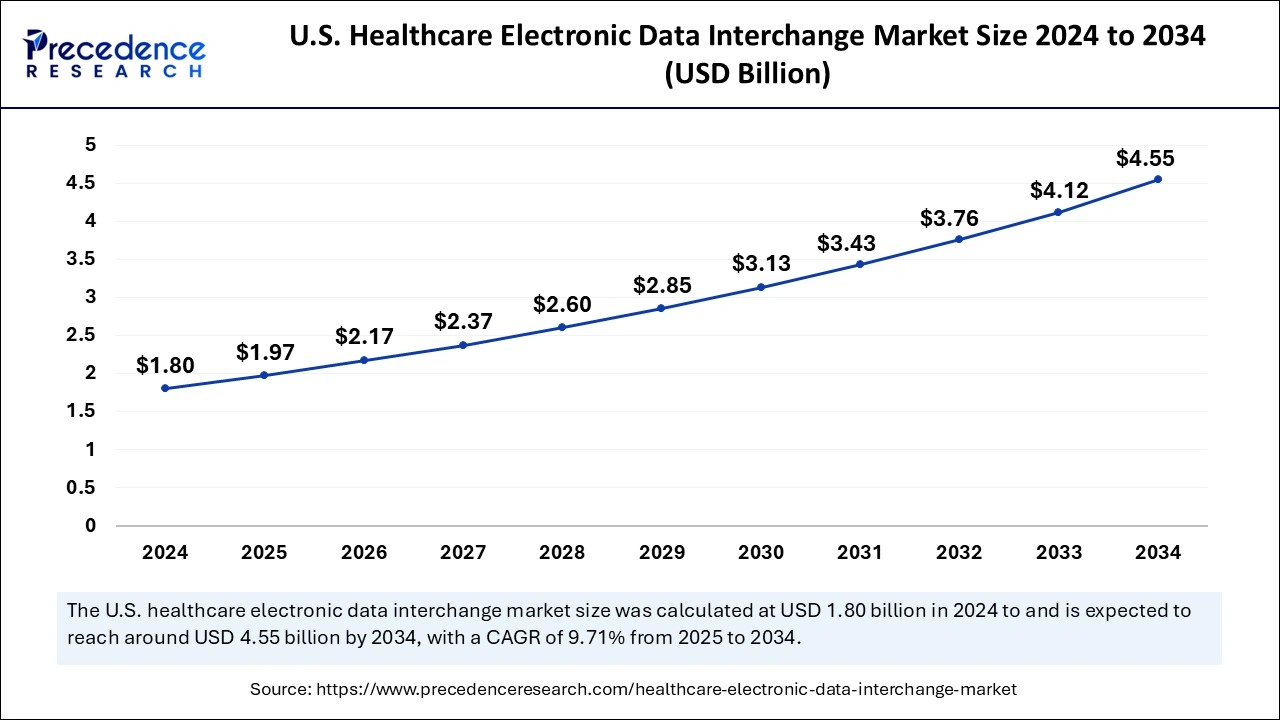

The U.S. healthcare electronic data interchange market size was exhibited at USD 1.80 billion in 2024 and is projected to be worth around USD 4.55 billion by 2034, growing at a CAGR of 9.71% from 2025 to 2034.

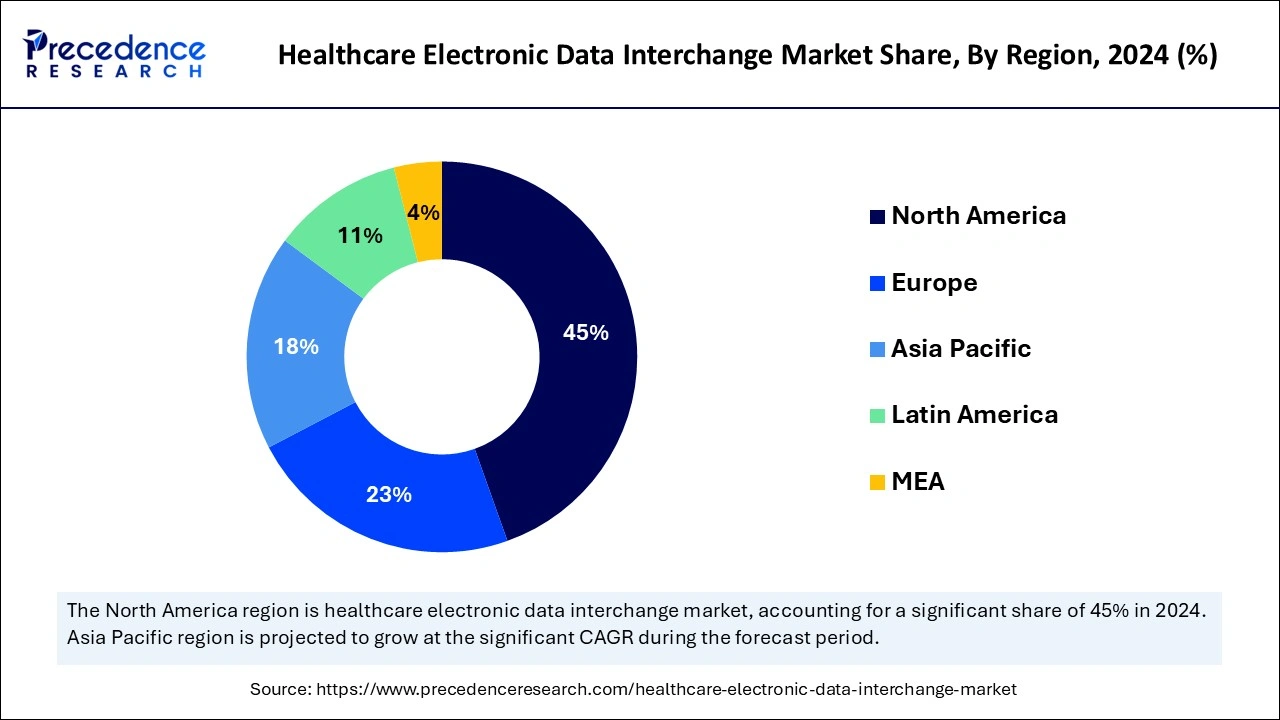

North America dominated the healthcare electronic data interchange market in 2024. The use of electronic health records (EHRs), which seamlessly interact with EDI systems, is among the highest in North America. Integrating EDI with EHR systems makes faster and more accurate cross-platform data interchange possible. Major North American clearing houses, insurance companies, and hospitals have made significant investments in EDI to automate processes, increase billing accuracy, and save operating costs. EDI has established industry standards and is supported by major companies such as Anthem, UnitedHealth Group, and other insurers.

Asia-Pacific is observed to be the fastest growing in the healthcare electronic data interchange market during the forecast period. Many healthcare providers in Asia-Pacific are implementing automated systems, and digital patient records to improve operational efficiency. This trend supports the expansion of EDI solutions, which enable safe and easy data transfers between different healthcare organizations. Efficient solutions that can securely and swiftly handle massive amounts of patient data are becoming increasingly necessary as healthcare needs rise, particularly during COVID-19. Efficient management of healthcare data, lower administrative expenses, and fewer data exchange errors are all made possible via EDI.

In the healthcare industry, electronic data exchange refers to a safe method of sending information between patients, insurers, and healthcare facilities using pre-established communication formats and standards. Because of this, implementing EDI is essential to providing high-quality medical treatment. It makes the smooth data flow between patients, payers, and healthcare providers possible.

Faster and more transparent billing procedures, speedier claims processing, and accurate medical records are all made possible via EDI, which enhances the patient's experience. Patients gain from shorter wait times and less trouble when interacting with insurance and medical professionals.

| Report Coverage | Details |

| Market Size by 2024 | USD 5.34 Billion |

| Market Size in 2025 | USD 5.85 Billion |

| Market Size in 2034 | USD 13.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.62% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Delivery Mode, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased data accuracy

Better clinical decision-making is facilitated by accurate data. To offer adequate care, healthcare professionals depend on accurate information regarding patient histories, diagnoses, and treatment plans. Rapid and precise transmission of patient data via EDI systems lowers the possibility of mistakes that can result in ineffective therapies. Accountability is enhanced by the audit trails that EDI systems frequently offer. A clear record of transactions is ensured by accurate data, which makes it simpler for businesses to prove compliance in audits.

High implementation costs

To effectively use the new EDI system, healthcare staff must get training. This training may require substantial time and expense commitment, particularly in larger firms. It can be difficult to precisely measure the expected advantages (such as increased communication, fewer errors, and higher productivity) against the implementation expenses.

Adoption of cloud technologies

Large volumes of data can be safely stored and accessed by healthcare companies at any time and from any location due to cloud technologies. This functionality makes sharing health information more accessible for payers, consumers, and providers. By offering a centralized communication hub, cloud-based EDI platforms improve provider collaboration. It is easier for various healthcare providers to collaborate on patient care plans. Errors in data transmission and interpretation are reduced when communication is improved.

The services segment dominated the healthcare electronic data interchange market in 2024. Instead of keeping in-house solutions, many healthcare organizations and providers would outsource EDI activities to specialist service providers. This enables companies to benefit from the experience of outside suppliers knowledgeable about data security, regulatory standards, and compliance procedures like HIPAA in the United States. Healthcare companies can lessen the workload on their internal IT teams and concentrate more on patient care by outsourcing EDI.

The solutions segment is observed to be the fastest growing in the healthcare electronic data interchange market during the forecast period. Providers and payers must exchange patient data across many platforms and systems as the healthcare sector grows more integrated. To solve this, EDI solutions standardize communication protocols and data formats, facilitating smooth system integration. This is particularly important in complicated healthcare networks where real-time access to reliable patient data enhances clinical decision-making and operational efficiency. EDI solutions are rapidly incorporating AI and ML technology to improve predictive capabilities, automate data processing, and improve data analytics.

The web and cloud-based EDI segment dominated the healthcare electronic data interchange market in 2024. Web-based EDI is a cutting-edge solution that uses contemporary technology to automate the sharing of information and business documents between trading partners. When using cloud-based EDI, the EDI platform is accessible online and housed in the cloud. Numerous advantages come with this, including reduced expenses, simplicity in setup and upkeep, automatic upgrades, and scalability. The EDI requires healthcare businesses to increase their size. Cloud-based EDI can readily accommodate larger data quantities and more complicated procedures, enabling firms to modify their usage according to their requirements. Data and transaction volumes might fluctuate significantly in the healthcare industry, so this flexibility is essential for managing these variations.

The mobile EDI segment is observed to be the fastest growing in the healthcare electronic data interchange market during the forecast period. Mobile EDI sends and receives EDI messages in a client-specific format via a mobile phone application. It enhances productivity and customer satisfaction by enabling companies to share electronic data interchange (EDI) documents on mobile devices. By facilitating safe communication between insurance companies, healthcare providers, and other stakeholders, mobile EDI improves data exchange process efficiency and minimizes the paperwork and delays of more conventional approaches. Healthcare providers can process claims and other transactions more rapidly and precisely with the help of mobile EDI systems, which lessen administrative constraints. This effectiveness speeds up reimbursements, lessens human entry, and lowers the likelihood of error, all of which add up to decreased operating expenses.

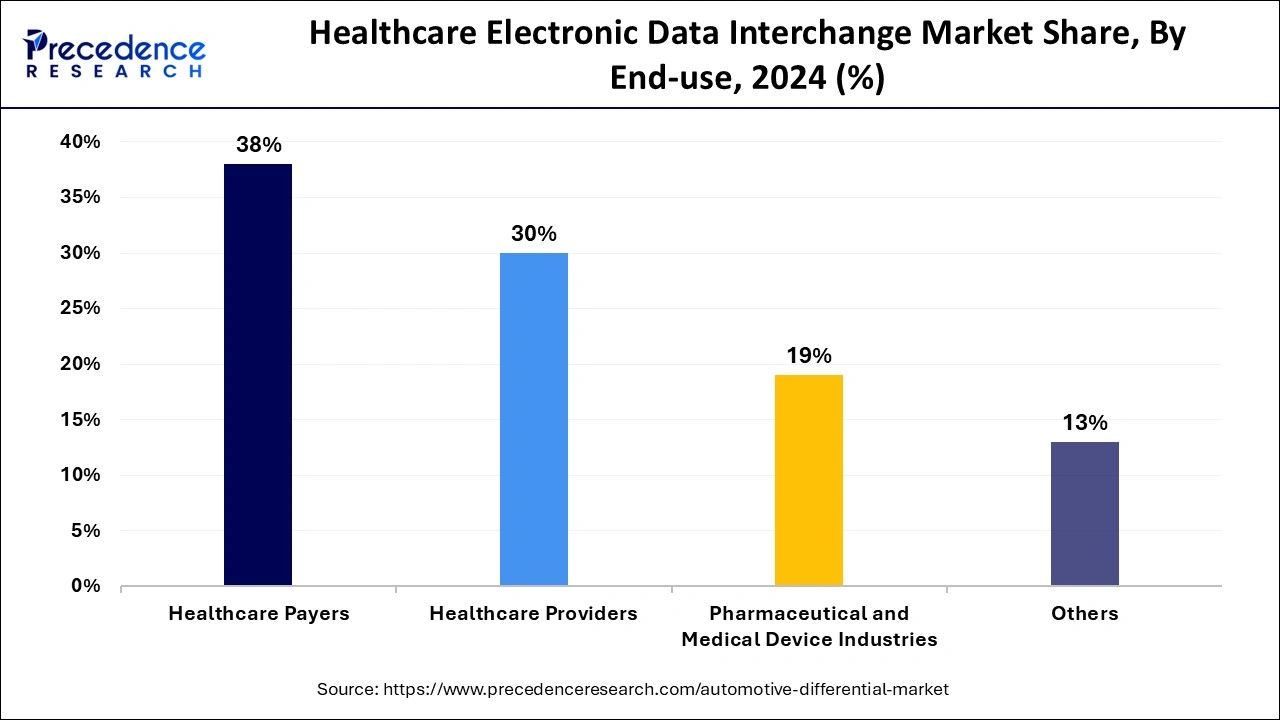

The healthcare payers segment dominated the healthcare electronic data interchange market in 2024. Processing claims from healthcare providers is a direct responsibility of healthcare payers, which include insurance companies, governmental organizations, and other third-party payers. These payers can automate claims processing through Electronic Data Interchange, which lowers administrative expenses, speeds up adjudication, and reduces errors.

Payers are positioned as essential consumers of EDI systems because of this efficiency, which is crucial for high claims volumes. Healthcare payers can increase operational efficiency, decrease manual intervention, and automate repetitive operations with EDI. By reducing the administrative burden, this technology enables payers to make significant cost reductions.

The healthcare providers segment is observed to be the fastest growing in the healthcare electronic data interchange market during the forecast period. The number of patients and the need for data management are growing exponentially for healthcare providers, such as hospitals and clinics. It offers a simplified method of handling this data, reducing the time and effort required for manual processing and allowing providers to send information effectively and securely. To minimize paper records and facilitate remote data sharing, the COVID-19 epidemic hastened the implementation of digital solutions in the healthcare industry, including electronic data interchange (EDI). The necessity of effective digital systems to improve responsiveness and resilience, especially in times of crisis, has been more widely acknowledged by healthcare professionals.

By Component

By Delivery Mode

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024