August 2025

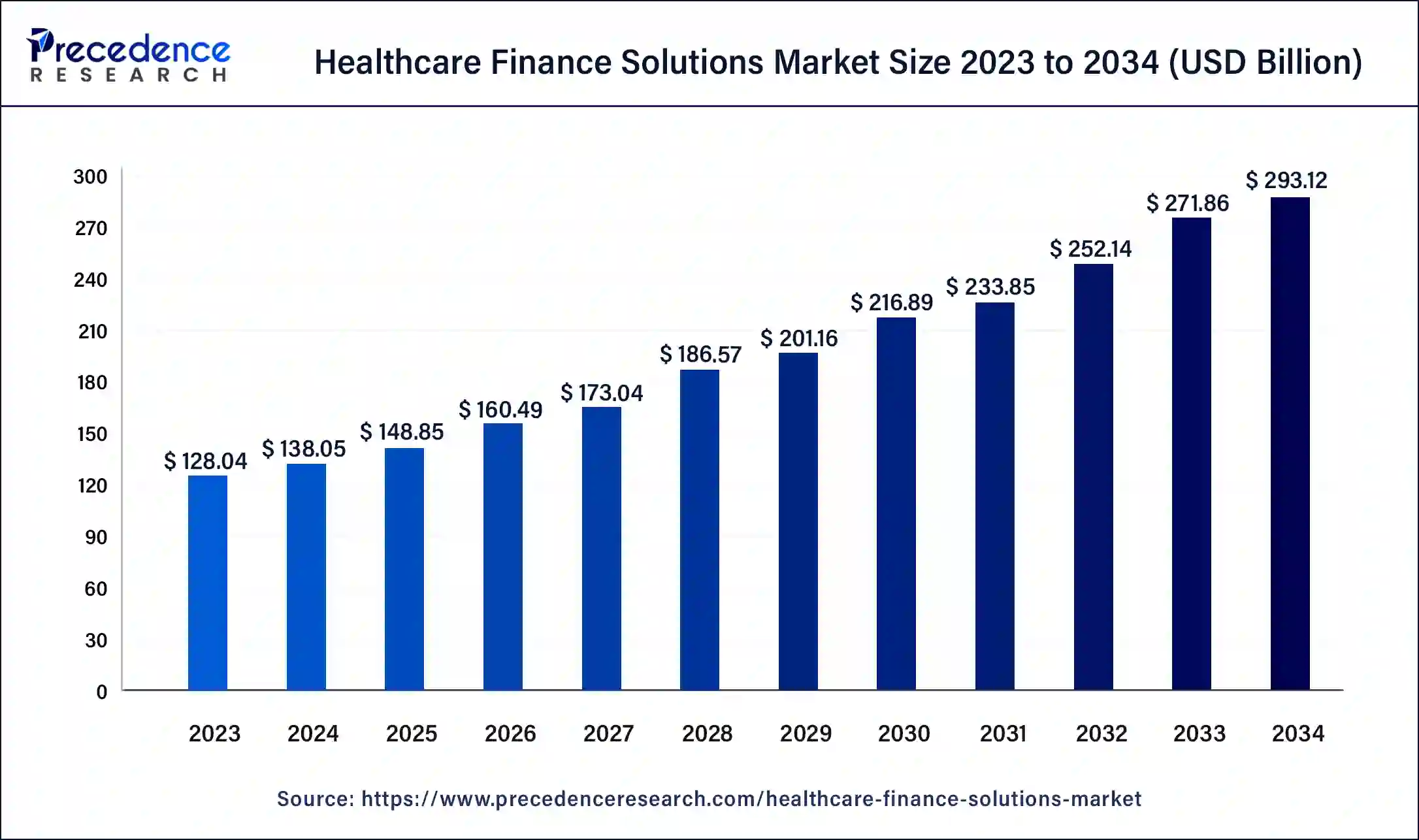

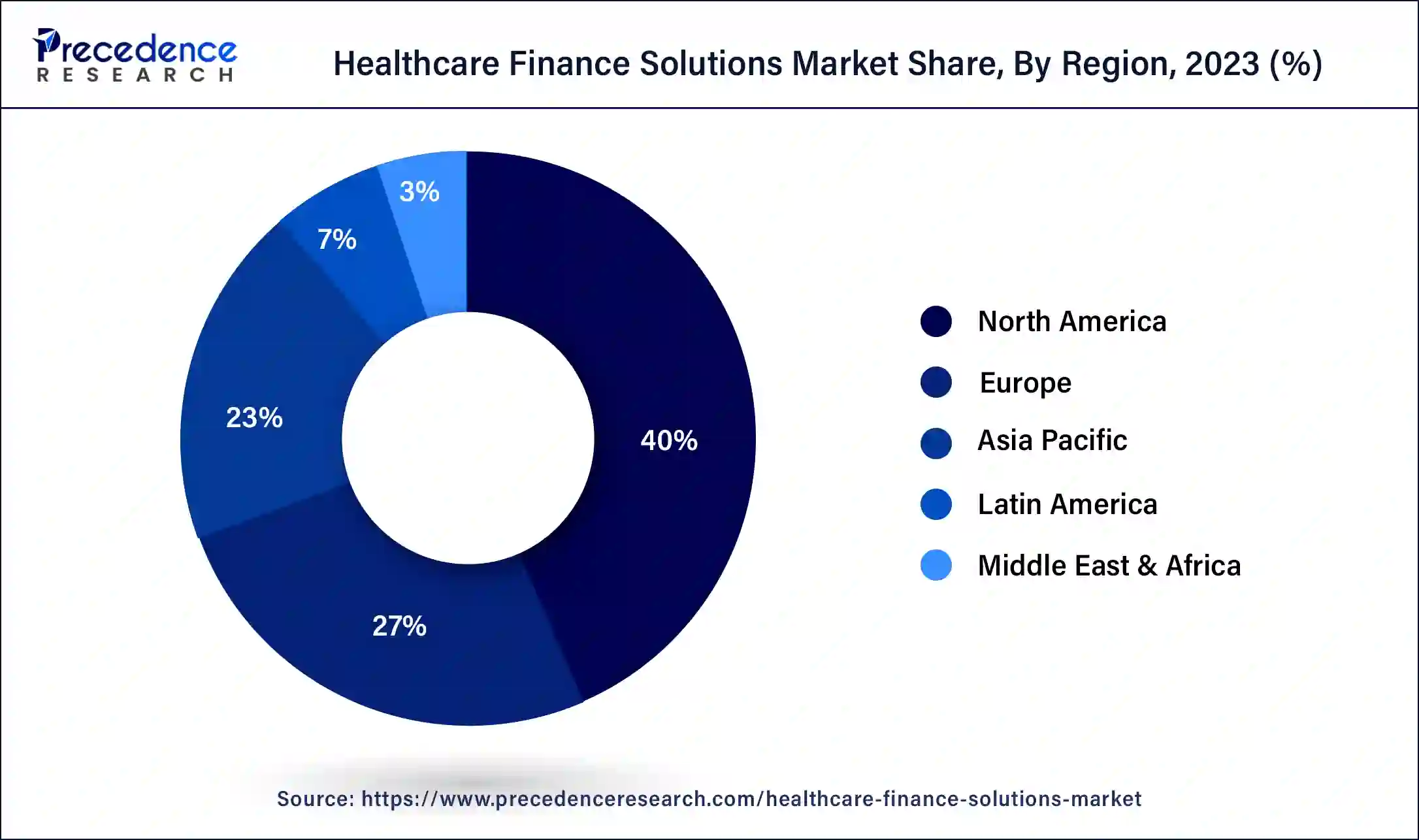

The global healthcare finance solutions market size was USD 138.05 billion in 2024, calculated at USD 148.85 billion in 2025 and is expected to reach around USD 293.12 billion by 2034, expanding at a CAGR of 7.82% from 2025 to 2034. The North America healthcare finance solutions market size reached USD 51.22 billion in 2023. The continuous need to improve processes and performance and the requirement for hi-tech equipment and technology are some of the factors driving the healthcare finance solutions market growth.

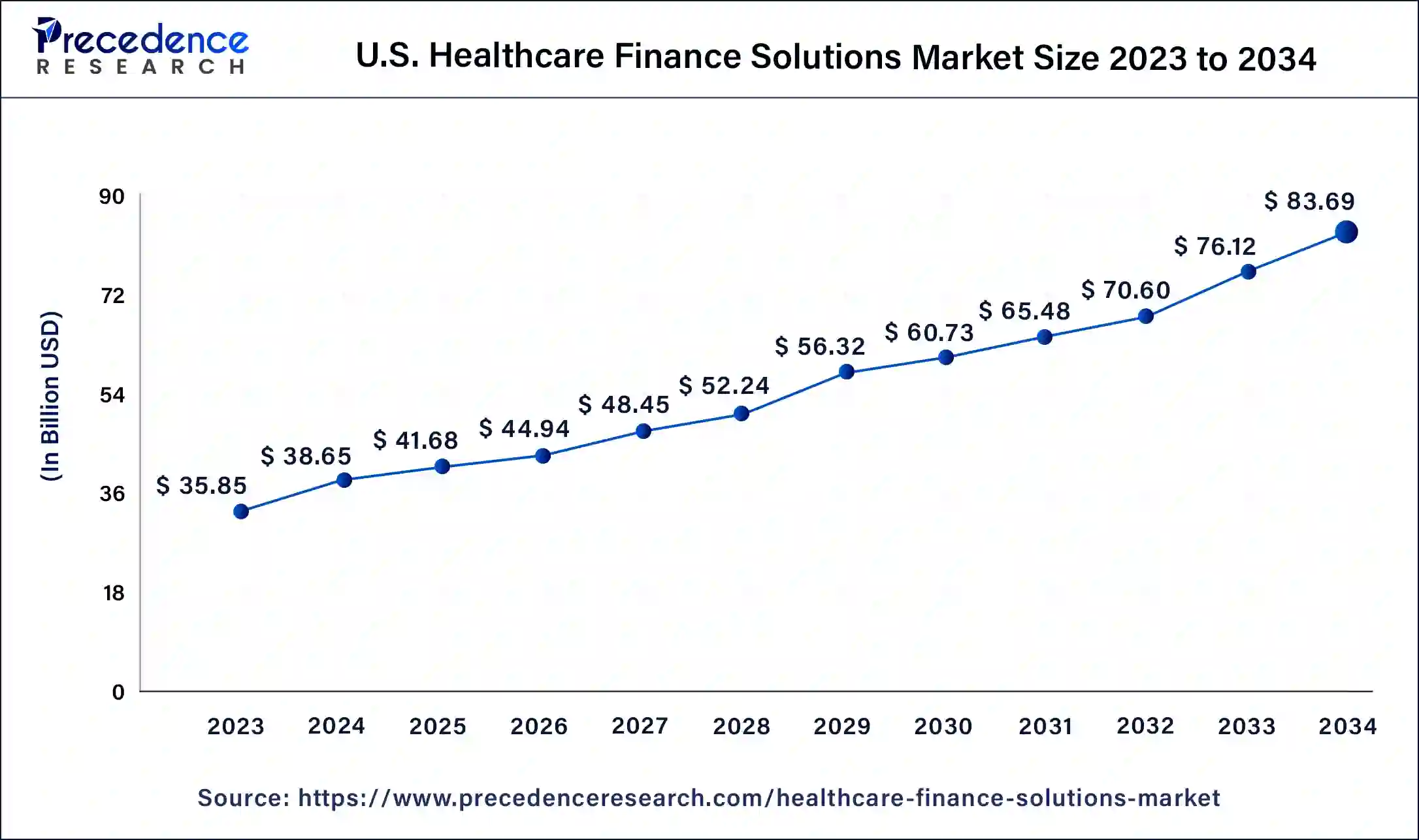

The U.S. healthcare finance solutions market size was exhibited at USD 35.85 billion in 2023 and is projected to be worth around USD 83.69 billion by 2034, poised to grow at a CAGR of 8.01% from 2025 to 2034.

North America dominated the global healthcare finance solutions market in 2023. The region's well-established healthcare infrastructure, which emphasizes technological advancements and effective financial management practices, contributes to its growth. North America's mature healthcare providers, insurance companies, and robust regulatory frameworks drive the adoption of finance solutions to efficiently manage complex financial processes. The United States stands out as a leading country in the production and development of advanced healthcare products, leading to higher healthcare costs for patients. Therefore, this directly increases the financial burden on patients.

Country wise healthcare spending

| Country | Change in Per Capita Health Spending (2021-2022) |

| United States | Increase of 2.9% |

| Australia's | Increase of 2.4% |

| Canada's | Increase of 0.7% |

| United Kingdom | Increase of 0.5% |

| Belgium's | Increase of 9.6% |

Asia Pacific is estimated to grow at the fastest rate in the healthcare finance solutions market throughout the forecast period. This growth is propelled by a significant patient base and increasing healthcare expenditure across the region. Additionally, as countries in the region witness rising healthcare demands and improved access to quality medical services, the need for efficient financial management to support this growth is also rising. The growing number of healthcare providers and insurers in the region is expected to drive the demand for healthcare finance solutions.

The healthcare finance solutions market encompass tools and strategies employed by healthcare organizations like hospitals and clinics to effectively manage their financial processes. These solutions streamline billing and payment procedures and ensure accurate billing for patients and insurance companies. They also aid in navigating intricate insurance reimbursement models and guaranteeing fair and timely payments.

The healthcare finance solutions market provides financial analysis and reporting by offering insights into the organization's financial performance. Some solutions incorporate advanced technologies, such as artificial intelligence, to facilitate data-driven financial decisions. Hence, these solutions help healthcare providers to maintain financial stability, deliver quality patient care, and comply with regulatory requirements.

| Report Coverage | Details |

| Market Size by 2034 | USD 293.12 Billion |

| Market Size in 2025 | USD 148.85 Billion |

| Market Size in 2024 | USD 138.05 Billion |

| Market Growth Rate from 20254 to 2034 | CAGR of 7.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment Type, Healthcare Facility Type, Service, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing need for efficient revenue cycle management

The healthcare finance solutions market is transitioning from a volume-based to a value-based care model, focusing on improving patient outcomes and engagement. Traditional fee-for-service models, which are dependent on volume-based care, do not guarantee successful patient outcomes. Regardless of the necessity or effectiveness of a service, healthcare providers are compensated for each service provided. Moreover, the primary objective of the value-based care delivery model is to enhance healthcare outcomes while controlling costs. In this framework, payers can designate a primary provider responsible for budget allocation to secondary healthcare providers, thus moving away from direct payments to individual providers.

Stringent regulations and lack of cost-effectiveness

The expansion of healthcare finance solutions will be hindered by high costs and unfavorable government policies. Furthermore, intense competition among market participants will impede the growth of healthcare finance solutions. Also, a lack of awareness among most of the population will serve as a restraint, which can slow the market's growth rate.

Artificial intelligence (AI) integration

AI integration is transforming the healthcare finance solutions market, giving substantial growth opportunities. By utilizing AI technologies, healthcare providers can streamline financial processes, boost efficiency, and enhance patient care. AI-driven algorithms analyze large volumes of patient data, accurately forecasting payment behaviors and optimizing billing processes. This leads to fewer claim denials, faster reimbursements, and improved cash flow for healthcare institutions. Additionally, advanced algorithms monitor transactions in real time, identifying suspicious activities and potentially fraudulent claims that can drive market growth further.

The decontamination equipment segment dominated the healthcare finance solutions market in 2023 by equipment type. Surgical devices are only deemed safe for reuse after undergoing decontamination. Surgical devices are only deemed safe for reuse after undergoing decontamination. Decontamination equipment is essential for patient care. With more patients exposed to infections and the growing urgency to eliminate these infections, the decontamination equipment segment is expected to expand. Furthermore, the rising demand for optimal care and desired outcomes will likely increase the need for advanced equipment to support market growth.

The specialist beds segment is expected to grow at the fastest rate in the healthcare finance solutions market over the forecast period. The growth in this sector is attributed to the rising demand for advanced beds in healthcare facilities. Moreover, supportive government initiatives aimed at improving healthcare infrastructure are expected to drive industry expansion. Specialist beds, including standing beds, legacy beds, and turning beds, are designed to effectively address various medical conditions. These beds are specifically made to treat severe injuries, such as back and spinal injuries.

The hospital & health systems segment led the global healthcare finance solutions market in 2023. Given the constantly changing regulations, the expansion of healthcare access, and increasing patient demands, hospitals need financial support. Healthcare facilities are expected to provide patients with both optimal care and desired outcomes. As a result, significant growth is anticipated for hospital and health system facilities over the forecast period.

The outpatient surgery centers segment is expected to show the fastest growth in the healthcare finance solutions market during the forecast period. As more patients choose outpatient procedures, the need for efficient financial management to handle billing, reimbursements, and revenue cycles in these centers is expected to rise rapidly during the forecast period. The growing popularity of outpatient procedures, fueled by cost-effectiveness and advancements in medical technology, has significantly boosted the demand for financial solutions in these centers. It can drive the segment's accelerated expansion.

The equipment & technology finance segment accounted for the largest healthcare finance solutions market share of the market in 2023. The need for substantial capital investment for setup and expensive healthcare equipment requires financial support. Digital technology has the potential to transform the patient's experience by providing real-time access to medical services and related assistance. Furthermore, upgrading to this level would involve installing equipment capable of seamlessly handling and managing these tasks. As technology progresses and the demand for advanced healthcare grows, the cost of these devices will become a crucial factor for healthcare providers. The expense of such devices will significantly influence the industry's growth.

The corporate lending segment is anticipated to grow at the fastest rate in the healthcare finance solutions market during the projected period. The accelerated growth is driven by the increasing presence of private financial institutions that offer adaptable corporate lending solutions. These institutions are gaining popularity in both developed and developing economies due to their capability to deliver flexible financial solutions tailored to the specific needs of corporate clients.

Segments Covered in the Report

By Equipment Type

By Healthcare Facility Type

By Service

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2025

August 2025

February 2025

July 2025