January 2025

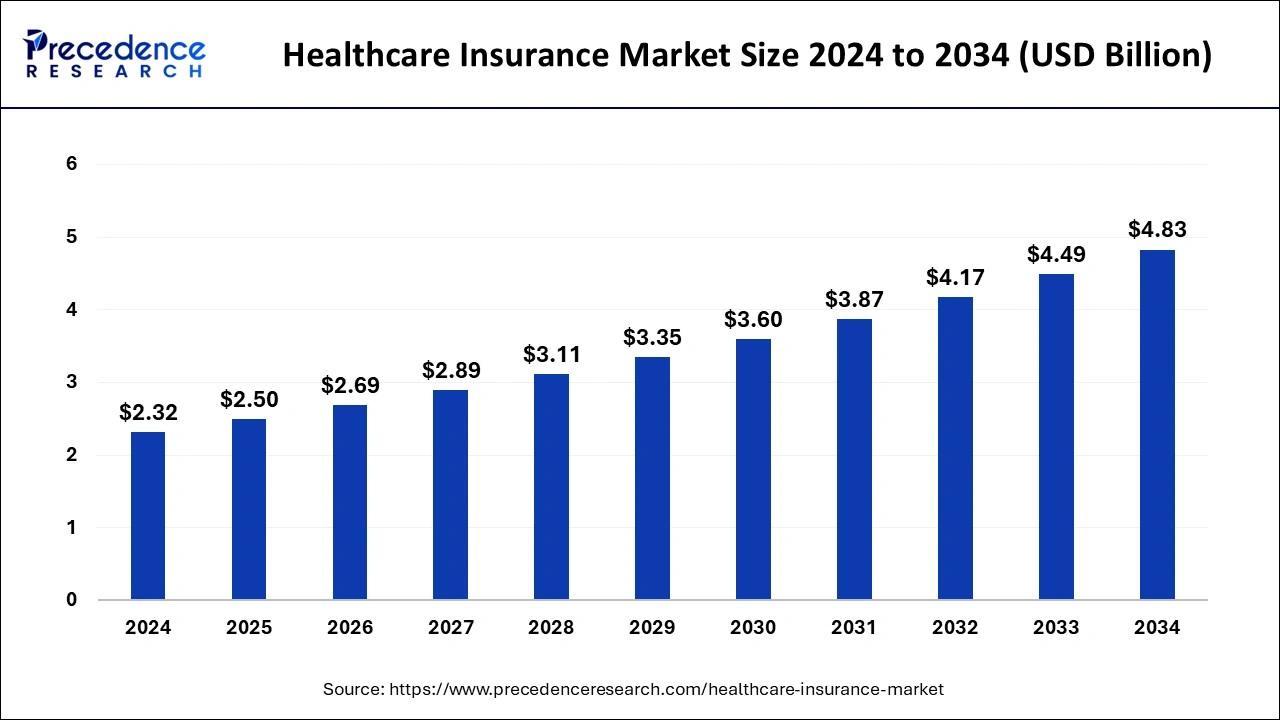

The global healthcare insurance market size is accounted at USD 2.50 billion in 2025 and is forecasted to hit around USD 4.83 billion by 2034, representing a CAGR of 7.60% from 2025 to 2034. The North America market size was estimated at USD 970 million in 2024 and is expanding at a CAGR of 7.77% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare insurance market size accounted for USD 2.32 billion in 2024 and is expected to exceed around USD 4.83 billion by 2034, growing at a CAGR of 7.60% from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop healthcare insurances which is estimated to drive the global healthcare insuarance market over the forecast period.

Artificial intelligence integration has the potential to transform the healthcare insurance industry by improving customer experiences, enhancing efficiency, and reducing costs. AI can analyze historical data to assess risk more accurately and customize premiums for individuals or groups. AI integration helps to improve risk assessment and underwriting. Machine learning models evaluate health records, lifestyle habits, and genetic data to predict potential health issues.

AI can identify patterns of fraudulent claims using anomaly detection algorithms. AI-driven systems can process claims faster by validating documents and determining eligibility without manual intervention. AI minimizes human errors in claims processing, improving accuracy and customer satisfaction.

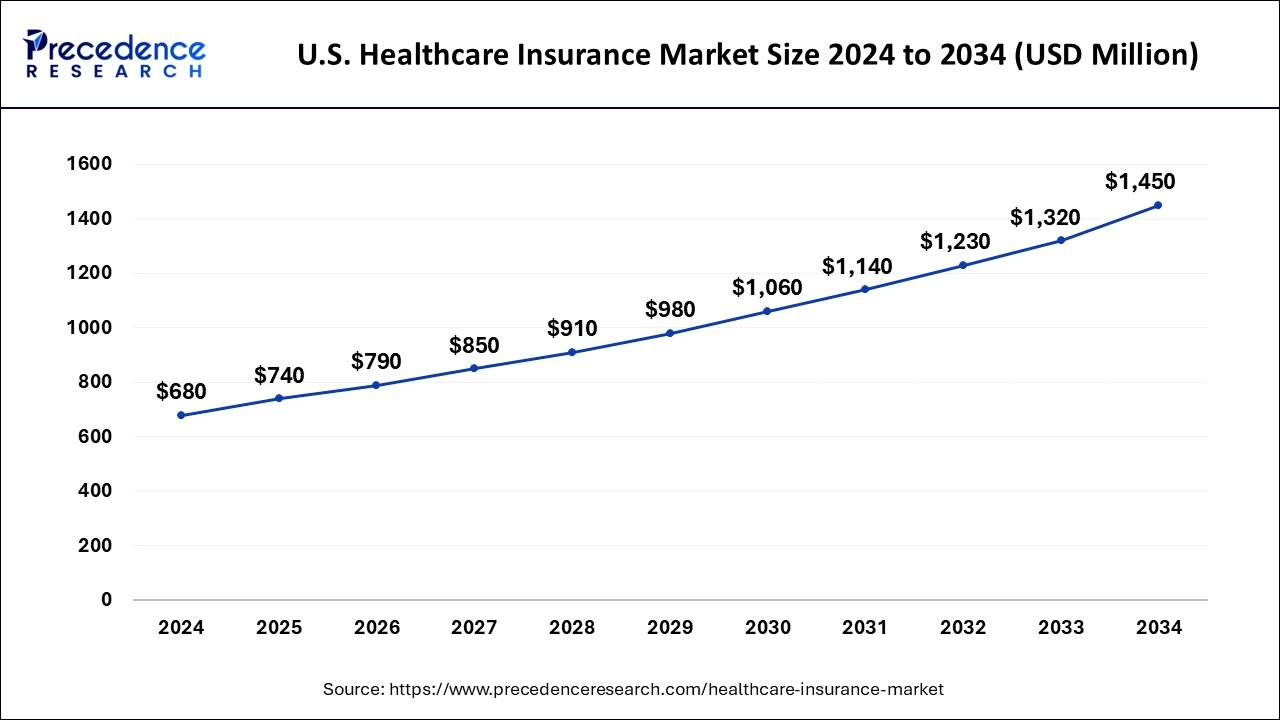

The U.S. healthcare insurance market size was exhibited at USD 680 million in 2024 and is projected to be worth around USD 1,450 million by 2034, growing at a CAGR of 7.87% from 2025 to 2034.

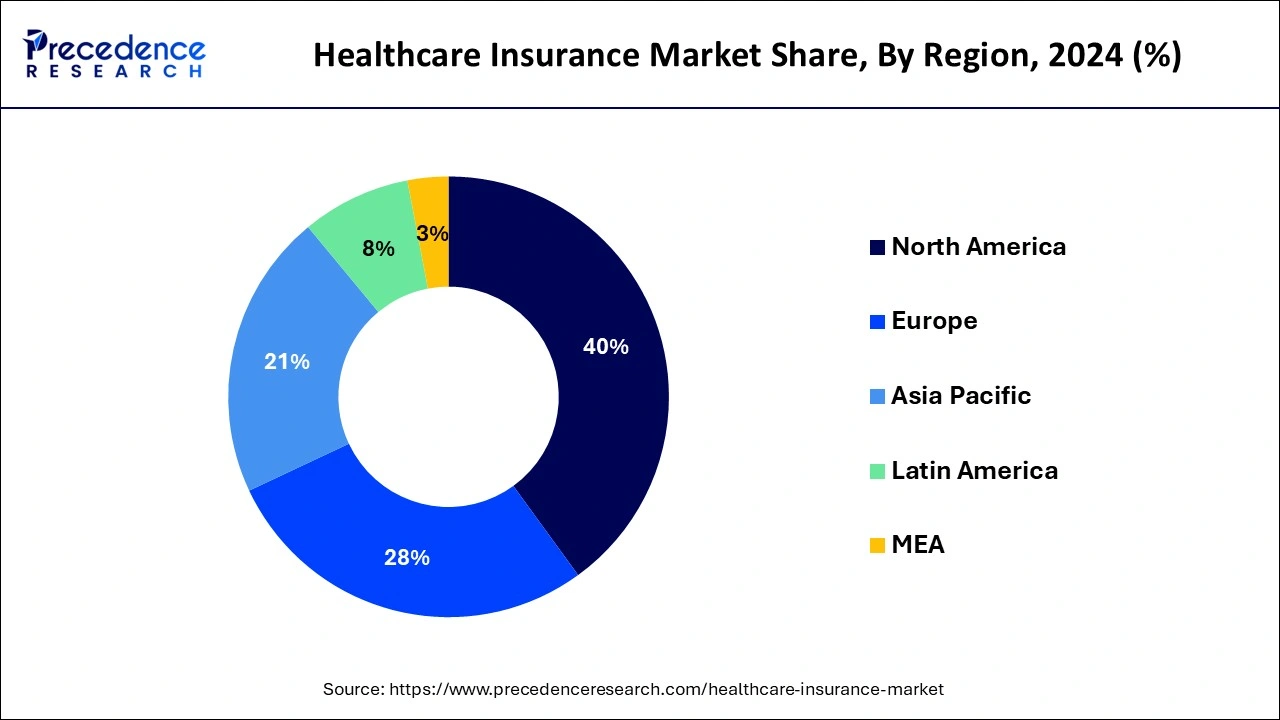

North America accounted for 40% of revenue share in 2024 and is estimated to sustain its dominance during the forecast period. North America is characterized by increased awareness regarding the benefits of healthcare insurance, increased disposable income, increased prevalence of diseases, growing geriatric population, increased demand for the latest surgeries and drugs, and increased expenditure on healthcare. All these factors has augmented the growth of the market in this region.

Asia Pacific is anticipated to grow at the fastest rate in the healthcare insurance market during the forecast period. The Asia Pacific region is the home to the world’s largest population. The rapid urbanization and growing penetration of the insurance companies is fueling the market growth. The changing lifestyle of the consumers, unhealthy eating habits, and rising obesity are the major factors behind the growing prevalence of chronic diseases in the region. The rising disposable income, improving access to the internet, rising literacy rates, increasing investments on the development of advanced healthcare infrastructure, and rising awareness regarding the health insurances among the population are the most prominent factors that are expected to drive the growth of the Asia Pacific health insurance market in the forthcoming years. Increasing government initiatives in Asia Pacific region for people over age 70 has driven the market over forecast period.

| Report Highlights | Details |

| Market Size in 2025 | USD 2.50 Billion |

| Market Size in 2034 | USD 4.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.60% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Provider, Coverage Type, Network Provider, Plan Type, Level of Coverage, Age Group, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Employment Growth & Growing Government Subsidies

Employer-sponsored health insurance plans increase with rising employment levels. Subsidized health insurance plans make coverage accessible to lower-income groups. Subsidies reduce the financial burden of purchasing health insurance, making it affordable for low- and middle-income individuals. This increases enrollment in health insurance plans, expanding the customer base for insurers. Subsidized health insurance programs often include incentives, such as tax benefits or premium discounts, encouraging more people to opt in. Governments may fund programs for specific groups, like children, the elderly, or low-income families, directly increasing coverage rates. Subsidies enable collaboration between governments and private insurers, where private companies administer subsidized plans, growing their market share. Subsidies can make advanced insurance plans affordable, increasing demand for policies with broader coverage and value-added services.

Based on the provider, the public segment accounted 56% revenue share in 2024 and is estimated to sustain its dominance during the forecast period. This is attributed to the increased public confidence and trust because the government itself acts as the main insurer and the provider of the services relating to healthcare. For instance, LIC Corporation in India and Medicare of the Federal government in US. Furthermore, public health insurance companies offers safety and operates at low cost.

On the other hand, the private segment is estimated to be the most opportunistic segment during the forecast period. The private players are coming up with improved healthcare services and premium options for the customers. Moreover, certain inefficiencies associated with the public sector healthcare insurance companies are overcome by the private market players, and hence is gaining more attention in the market. Moreover, they offer higher benefits as compared to that of the public segment.

Based on coverage type, the life-time coverage segment accounted for more than 52% of the market share. People chooses a life insurance policy as an investment option that also has huge tax-saving benefits. Moreover, the availability of wider variations of life insurance policies offered by the various market players serves the wider range of customers with different needs.

On the other hand, the term insurance segment is expected to show highest CAGR during the forecast period. This is attributed to the availability of huge benefits at low cost to the customers. It includes healthcare insurance plans that mainly covers the treatment costs at healthcare units. Therefore, rising prevalence of various chronic disease is the major driver of this segment. This also provides safety and helps the customers to safeguard their medical expenses.

The silver segment held a dominant presence in the healthcare insurance market in 2024. In the federal marketplace and state exchanges, silver plans are the most popular, with 70.0% of stock buyers selecting them. Those with one or two minor medical issues who need some medicine are typically the ones who use them.

The gold plans segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. This could be explained by the rising incidence of chronic illnesses, which necessitate frequent medical visits and costly prescription drugs that are unaffordable out of pocket.

The adult segment registered its dominance over the global healthcare insurance market in 2024. The adult population has a significant prevalence of lifestyle diseases that can raise future health risks. Heart disease and other conditions that necessitate hospitalization are more common in the population. Additionally, in 2023, about 59.0% of Americans carried life insurance, which accelerated market expansion.

The senior citizen segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. People over 65 are included because they are more prone to chronic illnesses, which raises the hospitalization rate. Senior health insurance plans are more essential, particularly when it comes to retirement. Additionally, it offers a number of benefits, including lifelong renewability, coverage of the outpatient department, and no medical screening prior to purchasing plans. It also offers the benefit of annual exams at no cost.

By Provider

By Coverage Type

By Network Provider

By Plan Type

By Level of Coverage

By Age Group

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024