January 2025

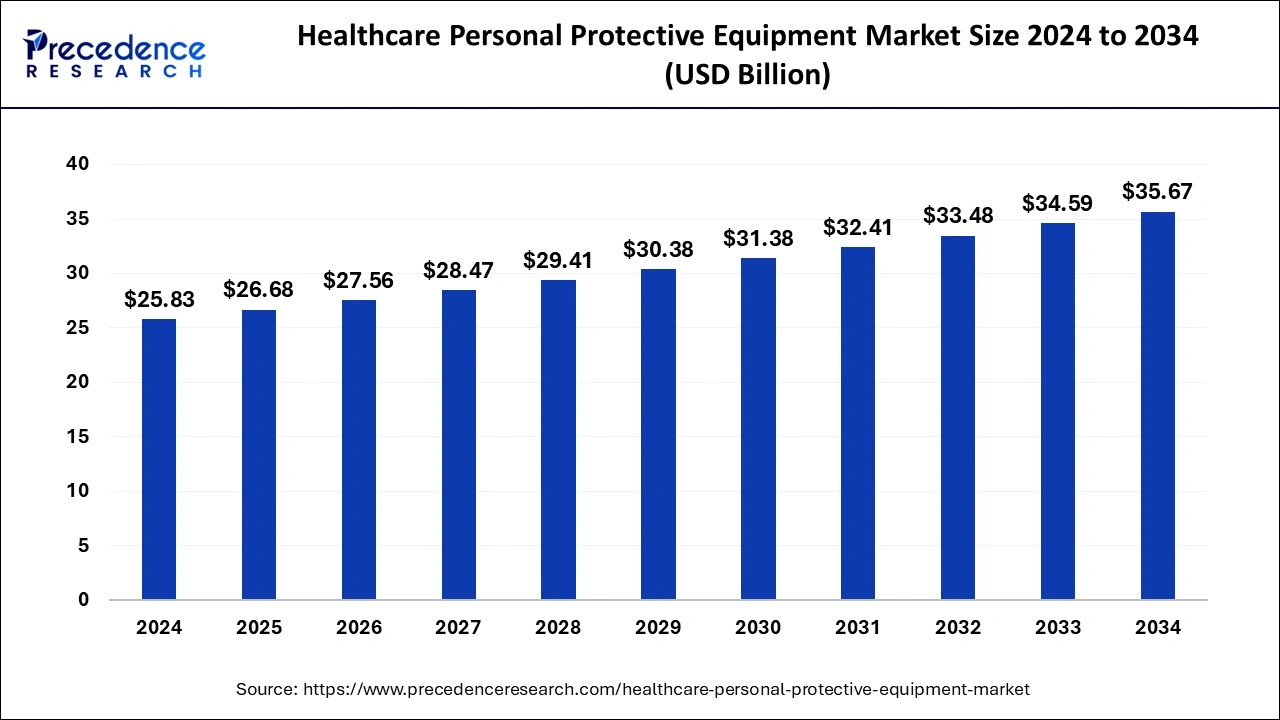

The global healthcare personal protective equipment market size is calculated at USD 26.68 billion in 2025 and is forecasted to reach around USD 35.67 billion by 2034, accelerating at a CAGR of 3.28% from 2025 to 2034. The North America market size surpassed USD 10.33 billion in 2024 and is expanding at a CAGR of 3.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare personal protective equipment market size was USD 25 billion in 2024, estimated at USD 25.83 billion in 2024 and is anticipated to reach around USD 35.67 billion by 2034, expanding at a CAGR of 3% from 2025 to 2034. The growth of the healthcare personal protective equipment market is driven by increasing number of infectious diseases. Furthermore, the rising awareness about the importance of PPE contributes to market expansion.

Artificial intelligence (AI) revolutionizes the market. AI accelerates the production process of healthcare PPE by automating various mundane tasks. This further enhances operational efficiency and production capability. AI plays a key role in personal protective equipment testing, ensuring that manufactured PPE meet quality standards, as even a small defect can deteriorate the quality of PPE. In addition, AI technologies help manufacturers optimize the supply chain by predicting future demand and managing inventory levels.

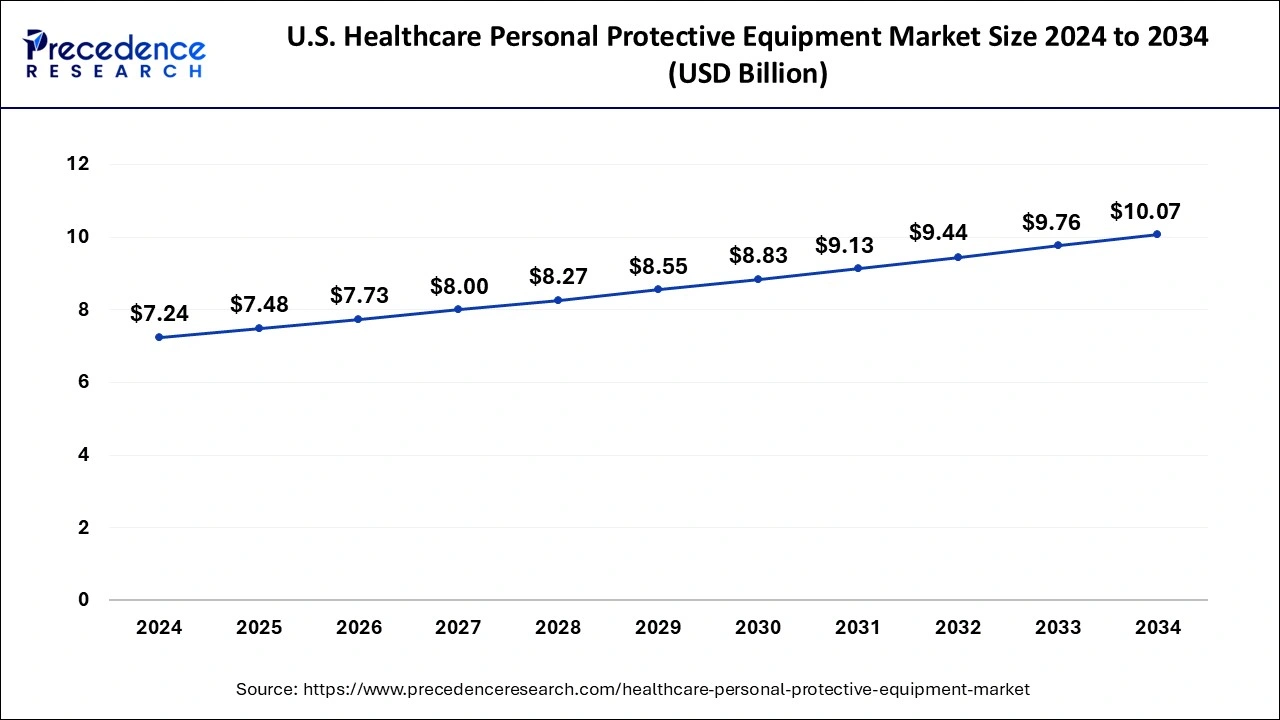

The U.S. healthcare personal protective equipment market size was estimated at USD 7.24 billion in 2024 and is expected to be worth around USD 10.07 billion by 2034, at a CAGR of 3.35% from 2025 to 2034.

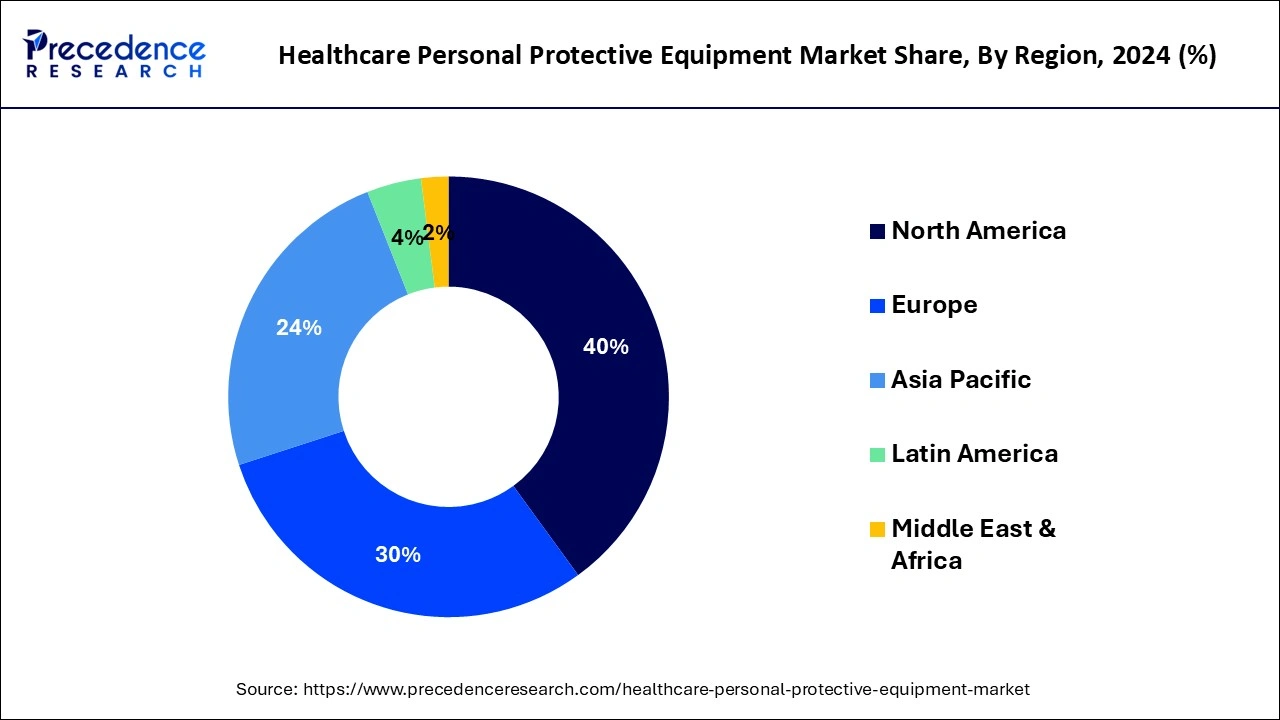

North America led the healthcare personal protective equipment market in 2024. The United States and Canada are observed to be the largest contributors to the market. The robust growth rate of GDP which is observed to support the sales of medical products across these countries creates a potential factor for the market to grow. Regulatory bodies like the Food and Drug Administration (FDA) in the U.S. play a critical role in ensuring the safety and efficacy of PPE, which has helped maintain a high standard of products in the market. The region’s focus on innovation and research has led to the adoption of advanced PPE technologies, such as respirators with enhanced filtration, smart PPE, and reusable protective gear.

Asia Pacific is observed to be the fastest growing area in the healthcare personal protective equipment market throughout the forecast period. Asia-Pacific is home to several major PPE manufacturing countries, including China, India, and Malaysia. China, in particular, is one of the world's largest producers of medical-grade PPE, including masks, gloves, gowns, and face shields. The region's extensive manufacturing infrastructure allowed it to ramp up production quickly during the COVID-19 pandemic.

Governments in Asia-Pacific countries provided strong support to the healthcare PPE industry through subsidies, incentives, and streamlined regulations to boost production and supply. This was especially evident during the COVID-19 pandemic, where governments prioritized the local production and export of PPE.

Healthcare personal protective equipment (PPE) has gained immense popularity since the outbreak of COVID-19. PPE includes respiratory protection, face protection, eye protection, hand protection, head protection, and protective clothing. Each type serves specific purpose. These equipment play a crucial role in limiting direct contact with infectious agents. The healthcare personal protective equipment market is experiencing significant growth due to the rising need for protective gear in healthcare organizations. In addition, the increasing infection control measures influence the market.

| Report Highlights | Details |

| Market Size in 2025 | USD 26.68 Billion |

| Market Size by 2034 | USD 35.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.28% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regulatory Mandates

Several healthcare regulatory bodies have mandated the use of personal protective equipment (PPE) for healthcare workers due to the growing concerns about workers' health and safety and the rising prevalence of hospital-acquired infections. According to the World Health Organization (WHO), around 1 in 10 patients is affected by hospital-associated infection. PPE, when used correctly in conjunction with other protective measures, reduces the risk of infection and disease transmission. PPE must meet strict regulations and approved standards to provide adequate protection for medical purposes. As part of a comprehensive infection prevention strategy, hospitals and clinics increasingly use essential items such as face masks, N95 masks, medical gloves, and gowns to protect healthcare workers as well as patients. These items play an important role in protecting healthcare workers from infectious diseases. Moreover, with the increasing awareness about health and wellness, there is a significant increase in healthcare expenditure, driving market growth.

Skin Issues

Wearing personal protective equipment for a longer period of time can cause dryness, itching, or retain moisture in body parts. According to a survey by the National Institutes of Health (NIH), dryness and itching are the most common problems related to the use of gloves. The lack of adequate training and knowledge regarding the proper use of PPE can reduce their usage. In specialties such as ophthalmology, the additional examination time required for PPE use can cause problems for medical personnel and patients, affecting the efficiency of the medical processes. Furthermore, concerns about the uncertainty regarding the effectiveness of PPE can lead to the rejection of routine use of PPE. These factors reduce the adoption rate of PPE, posing challenges to the healthcare industry.

Rise of Smart Personal Protective Equipment (PPE)

Advancements in technology have paved the way for the development of smart personal protective equipment. Smart PPE includes innovations such as helmets with built-in cameras that provide real-time information to improve worker safety and prevent accidents, gloves that can measure movement, and wearable devices that monitor vital signs. From Internet of Things (IoT) helmets that can detect falls to smart glasses that provide augmented reality, these exciting devices can help healthcare workers stay more protected while doing their jobs. Smart PPE can also automate equipment inspections and maintenance via smartphones, ensuring compliance with safety standards and reducing the risk of equipment failure. Instant updates on equipment, when needed, improve operational efficiency and help prevent non-compliance, further fueling the growth of the healthcare personal protective equipment market.

Personal protective equipment find extensive application in averting different infectious diseases comprise gloves, medical masks, face shield, gowns, goggles, protective clothing or apron, and respirators like FFP2 and N95 standard/comparable. The workforces engaged in the distribution and management of personal protective equipment, public health specialists, healthcare setting, and other crucial services are need to use personal protective equipment to evade contamination from COVID-19.

The sale for isolation gowns utilized by healthcare professionals during treatment of COVID-19 infected patients is estimated to record significant CAGR in the U.S. market on account of its benefits such as impermeable properties and fluid-resistance.

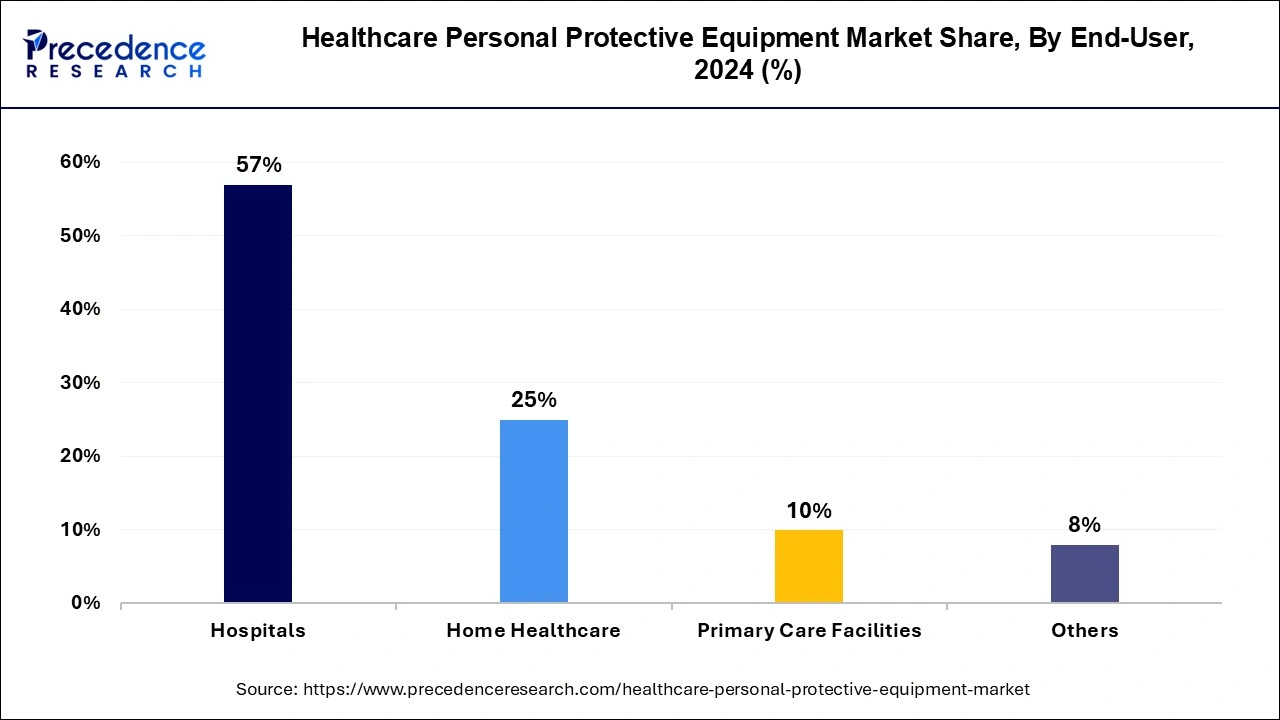

The proliferation of personal protective equipment in hospitals segment is projected to observe substantial growth due to escalating occurrence of hospital-acquired contaminations and rising elderly populace across the world. Besides, the introduction of encouraging activities and improvements endorsing the usage of personal protective equipment in hospitals of government setting is predictable to motivate the progress of healthcare personal protective equipment market growth in the next few years.

By Product

By End-use

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

April 2024

January 2025