December 2024

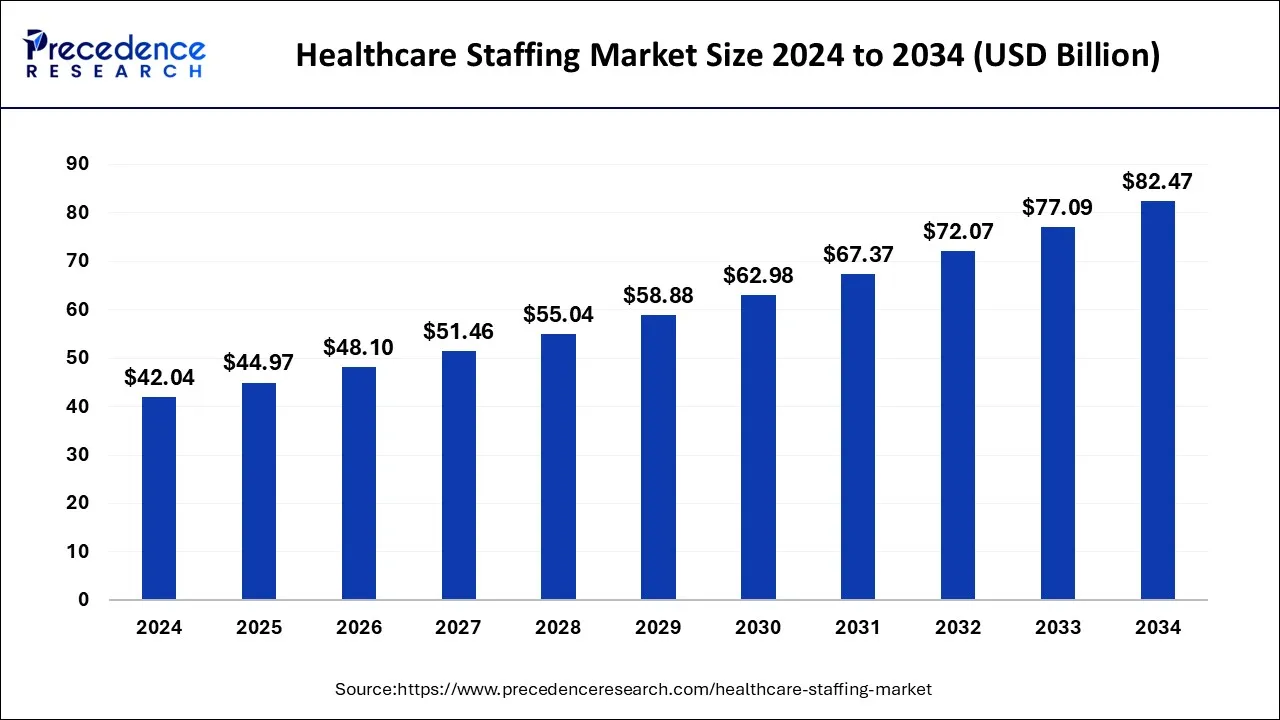

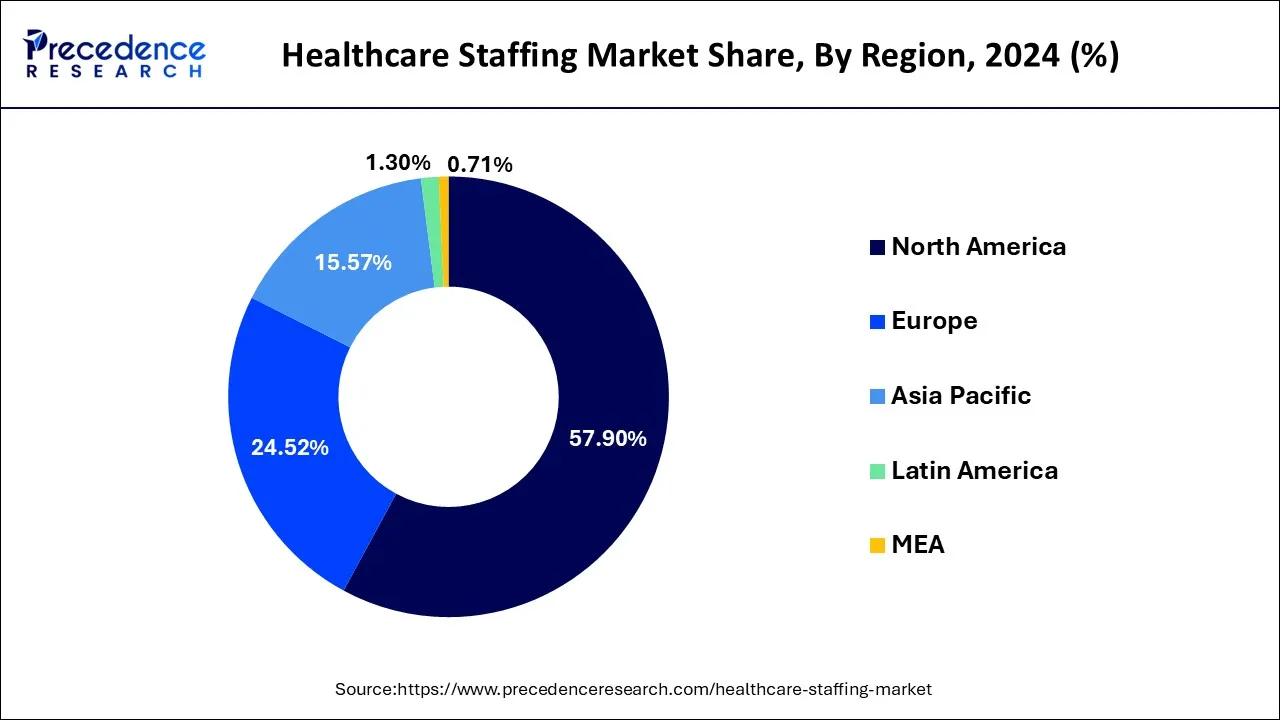

The global healthcare staffing market size is calculated at USD 44.97 billion in 2025 and is forecasted to reach around USD 82.47 billion by 2034, accelerating at a CAGR of 5.39% from 2025 to 2034. The North America healthcare staffing market size surpassed USD 24.34 billion in 2024 and is expanding at a CAGR of 5.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare staffing market size was worth around USD 42.04 billion in 2024 and is anticipated to reach around USD 82.47 billion by 2034, growing at a CAGR of 5.39% from 2025 to 2034.

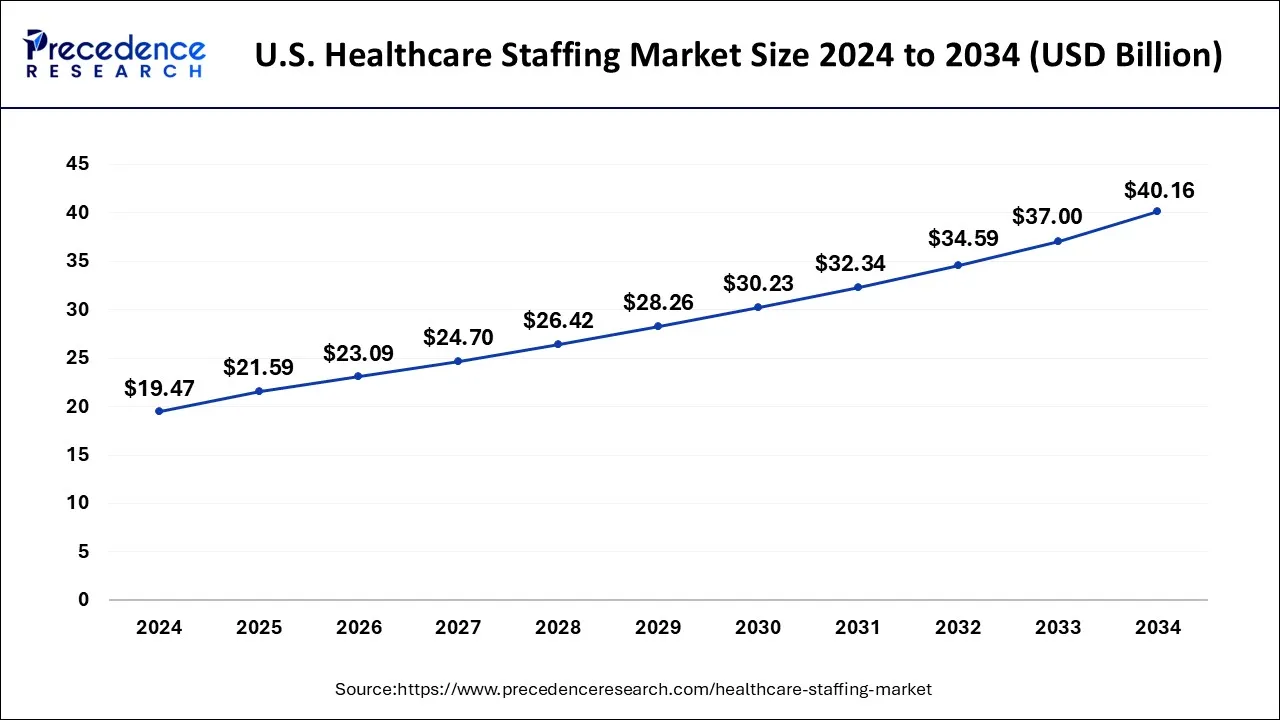

The U.S. healthcare staffing market size was evaluated at USD 19.47 billion in 2024 and is predicted to be worth around USD 40.16 billion by 2034, rising at a CAGR of 5.68% from 2025 to 2034.

The market share for healthcare staffing worldwide is anticipated to be dominated by North America. A lack of nurses and other medical professionals is caused by the growing elderly population, which drives up demand for healthcare services. In the upcoming years, the market is projected to be driven by temporary staffing's cost-effectiveness.

The fastest-growing region in North America is the United States. Over the next few years, approximately 500,000 physicians will depart, as per the Bureau of Labor Statistics (BLS). The Association of American Medical Colleges predicts that by 2032, there will be a deficit of between 21,000 and 55,200 primary care physicians. The physician shortage will probably drive the market in the upcoming years. It is also anticipated that the demand for a workforce in-home care, including nutritionists, dieticians, nurses, home care aides, and therapists, will increase.

A significant expansion in government and non-government hospitals, long-term care facilities, acute care centers, and other medical institutions is also predicted to influence market expansion considerably. The number of hospitals in this area is rising due to rising public health investment and better medical infrastructure.

Asia Pacific is estimated to register the highest growth during the forecast period on account of increasing demand for contract staffing. In addition, contract staffing comprises no liabilities which are generally associated with permanent staffing. The afore-mentioned factors are gaining traction in developing countries, thereby expected to fuel the regional market growth in the forthcoming years.

The substantial growth of the geriatric population is a major factor to drive the healthcare staffing market growth. In addition, rising awareness about benefits offered by job related perks, and temporary staffing is another factor expected to further boost the market growth over the forecast period. Healthcare firms are coming across the different challenges such as meet high turnover rates and increasing patient satisfaction rates. Approach for searching competent staff is developing to address the requirements of a new generation of nurses. Further, restructuring the hiring method from the time of application to recognition, to on-boarding is vital in this competitive environment. Though some of the organizations have figured out few short-term fix for dealing different compliance demands, most of the firms still find shortage of long-term resolutions that may scale with business. A centralized repository comprising credential data, plus availability and reflectiveness into expiration dates and credential statuses are critical for long-standing success.

As financial margins constrict, technology resolutions are being expected to advance diagnostic approach, progress connectivity, communication and streamline workflows. Nursing professionals are confronted with remaining on topmost of the modern technologies at the same time upholding their place as the face of patient care.

In recent years, the healthcare industry is facing challenges including a lack of skilled practitioners across the globe. According to the World Health Organization (WHO), there was a shortage of around 7.2 million healthcare staff globally, in 2013 and is expected to reach 12.9 million by the end of 2035. The survey conducted by Avant Healthcare Professionals reported that in the U.S. around 50% of hospitals reported temporary hiring if nurses, as more than 60% of the hospitals were expected nurses’ retirement in 2019. The shortage registered for nurses is expected to open new opportunities for market growth in the near future.

Due to the rapid spreading of COVID-19, hospitals are becoming overwhelmed in various countries including China, U.S., Italy, and India. These countries are facing severe nursing shortages which may have an adverse effect on patient’s health during the outbreak of COVID-19. The Bureau of Labor Statistics’ reported that registered nursing staff is expected to grow around 3.4 million, in 2019 which is increased by 15% from 2016. Factors such as an increase in patients infected with the coronavirus and a rise in nurse retirements are majorly responsible for the nursing shortage. In several nations, frontline staff in the hospitals have been infected and placed into quarantine. Therefore, hospital leaders are taking several important initiatives to overcome this shortage which is expected to propel the market growth.

| Report Highlights | Details |

| Market Size in 2025 | USD 44.97 Billion |

| Market Size by 2034 | USD 82.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.39% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service, By End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Healthcare Staffing Platforms

Through early 2022, there has been a significant need for healthcare staffing services due to severe labour supply and demand instabilities, enhanced healthcare usage, and increased clinician turnover. Hospitals continue to face severe staffing shortages even as the impacts of COVID-19 and its derivatives fade. Significantly, according to Quartz, 24% of American hospitals experienced a severe labour shortfall in January, indicating the demand for a quick expansion of the healthcare labour market.

Additionally, the strain of caring for patients throughout the epidemic and the general increase in workload have made it difficult for healthcare professionals to retain staff. According to a recent survey from Cross Country Healthcare and Florida Atlantic University's College of Nursing, employee tiredness has increased open positions, with 37% of surveyed healthcare providers indicating that they are overworked.

Leading staffing companies have experienced significant growth due to the high need for healthcare experts, which has fueled higher labour volumes and bill rates. Hospitals have relied heavily on travel nurse professionals to bridge labour gaps. Since talent is in short supply and demand is outpacing supply, healthcare providers increasingly turn to staff companies to provide nursing solutions. Thus, as mentioned earlier, these factors propel the healthcare staffing market growth.

Lack of Remuneration

Many healthcare professionals feel underpaid, especially considering the time they invest in their jobs. Over the years, the Bureau of Labor Statistics has documented a consistent rise in pay, but many workers do not consider these figures higher. Nurses can earn up to $43 per hour, and other medical assistants can earn between $12 and $21, according to PayScale. Given the profession's requirements, this frequently does not result in fair compensation. Therefore, the professionals' low remuneration may hamper the growth of the healthcare staffing industry.

Increase in the Geriatric Population

The main factor influencing the target market in recent years is the massive increase in older adults. The global population of individuals 60 and above was 1 billion in 2020. This number is expected to rise to 1.4 billion by 2030, according to the World Health Organization statistics report on Aging and Health, issued in October 2021. As a result, illnesses and infections that require prolonged hospitalization are more likely to affect the elderly population. Thus, there will be a rise in outsourcing healthcare personnel, contributing to market expansion. The sector is expanding due to several causes, including employment-related incentives, increased public knowledge of the advantages of temporary work, and the opportunities available globally.

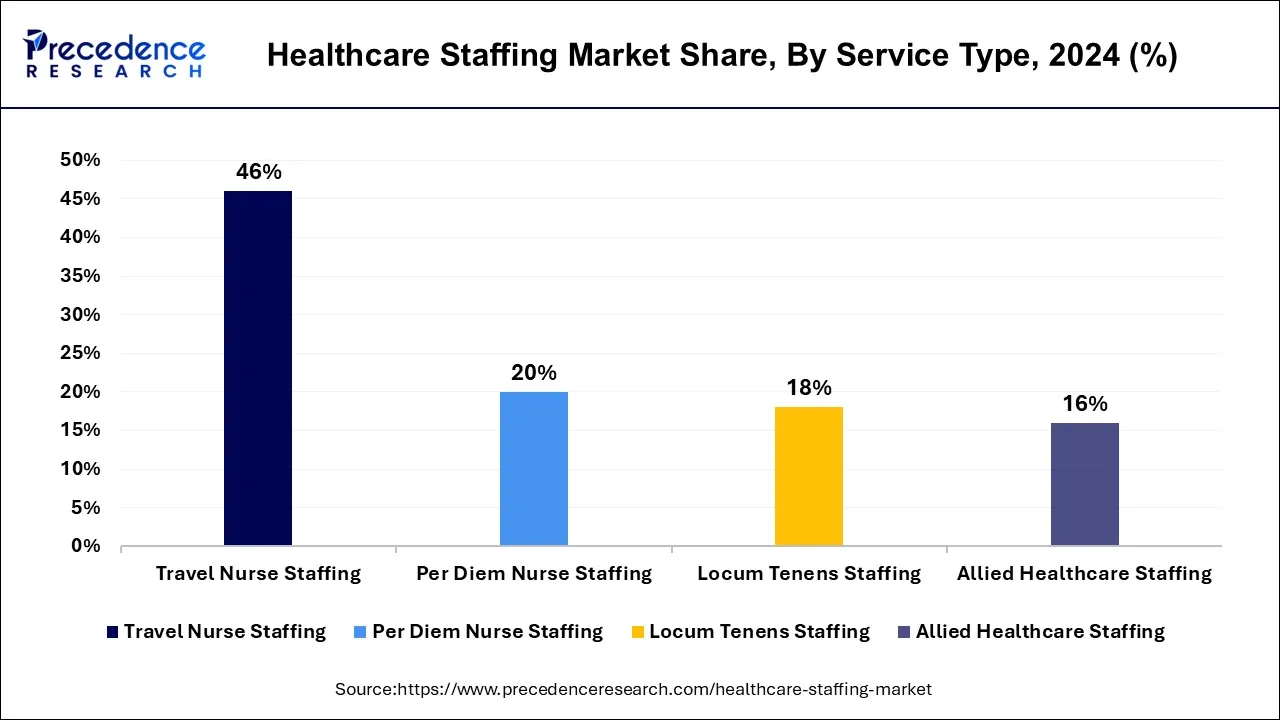

Based on services, the healthcare services market is classified into locum tenens, travel nurse, per diem nurse, and allied healthcare. The travel nurse segment accounted for the largest market share, in 2021. Due to growing healthcare costs, hospitals are enforced to reduce their working staff, wherein travel nurses play an important role in available when workload increased.

On the other hand, the locum tenens service segment is projected to exhibit with the fastest CAGR from 2025 to 2034. Several benefits such as cost efficiency and high preference of physicians to work as locum tenens are anticipated to augment the segment growth in the next few years.

The travel nurse staffing service is the market leader in these categories. Registered nurses (RNs) can operate in several healthcare areas and locations across the United States and abroad through travel nursing services. These programs allow individuals to accept temporary jobs, travel, gain clinical experience in various settings and set their hours. The sector is expanding because of escalating public awareness of the advantages of short-term work and the benefits related to specialized jobs.

In addition, hospitals had to reduce their staff due to increased healthcare costs. To guarantee that nurses are available as workloads increase, healthcare service providers are resorting to "staffing" firms. The utilization of travel nurses increased by 35%, according to an October 2021 AMN Healthcare poll. The study results indicate that this tendency is likely to persist soon. Therefore, such variables are anticipated to benefit the segment's growth during the projection period.

As hospitals with high patient volumes need a lot of qualified healthcare professionals, the hospital segment is anticipated to dominate the market. It is expected that a significant increase in the number of government and private hospitals will significantly accelerate market expansion. Since public health spending is being increased and the healthcare structure is being improved, there are more hospitals. New rules are expected to give associated employees, especially nurses, the power to act as the patient's primary advocates by launching health plans to facilitate improved care. These rules maintain and promote the right of individuals to make wise health decisions.

Additionally, most hospitals are expanding their employment according to the rules set forth by the government. Hospitals must adhere to standards for the standard health care professional ratio that various government agencies have established. Hospital staffing levels are rising due to legislation and regulations that put patients first.

Key Companies & Market Share Insights

The key market players are implementing some marketing strategies such as partnerships, mergers, and acquisitions in order to expand their service portfolio and geographical presence. For example, in 2018, TeamHealth announced the acquisition of an emergency medical staff provider, Emergency Medicine Consultants (EMC). This acquisition will help the former to add 330 physicians and 80 advanced practice clinicians.

Growing a large number of healthcare staff providers and the rising influence of newly established service providers through mergers and acquisitions are projected to propel the market growth in the next few years. For example, in 2017, Novation Companies, Inc. acquired a provider of healthcare Healthcare Staffing, Inc. (HCS). This acquisition is expected to help Novation Companies, Inc. to expand its geographical reach and service portfolio.

Segments Covered in the Report

By Service Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

April 2024

January 2025