January 2025

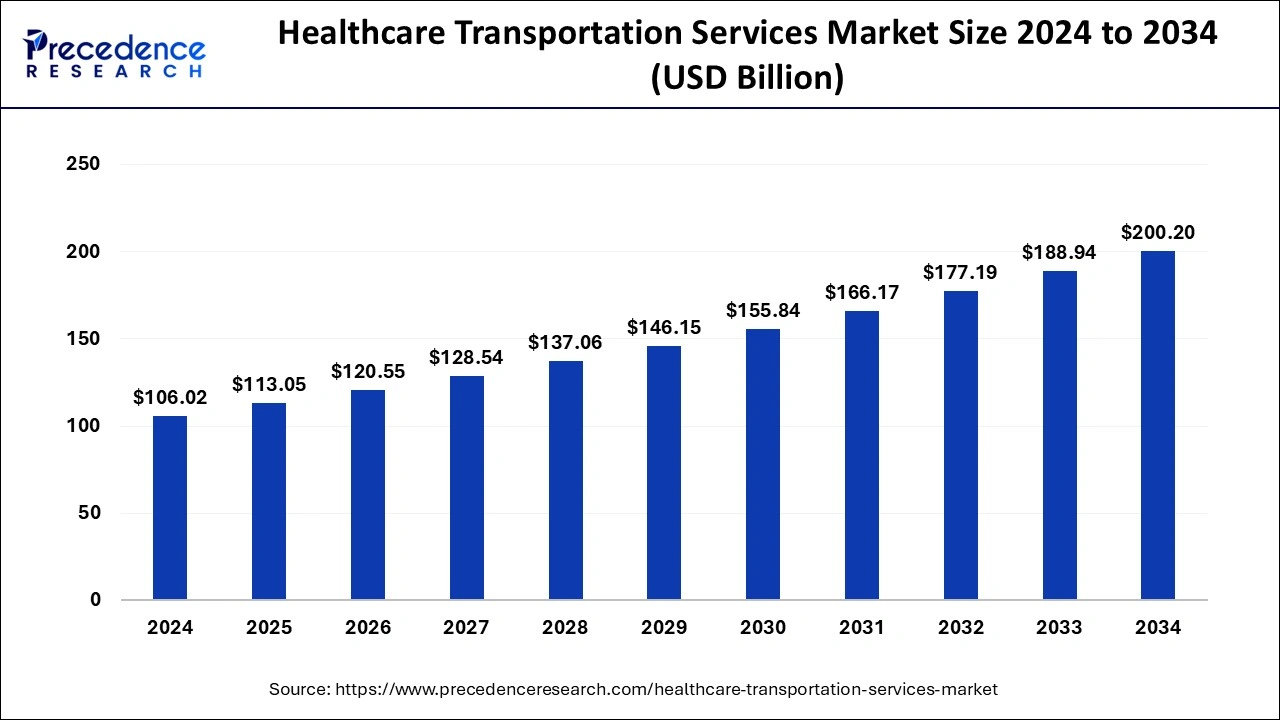

The global healthcare transportation services market size is calculated at USD 113.05 billion in 2025 and is forecasted to reach around USD 200.20 billion by 2034, accelerating at a CAGR of 6.56% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare transportation services market size was estimated at USD 106.02 billion in 2024 and is predicted to increase from USD 113.05 billion in 2025 to approximately USD 200.20 billion by 2034, expanding at a CAGR of 6.56% from 2025 to 2034. Increasing prevalence of the orthopaedic conditions such as fractures, osteoarthritis, osteoporosis and sports injuries etc. are rising the demand for the healthcare transportation services which is expected to drive the growth of the market over the forecast period.

Healthcare transportation services provide the timely patient service. It provides convenient transportation services of drugs or medicines, healthcare equipment, samples, and biological specimens, etc. from one place to other. For people who live in rural or underserved areas and healthcare professionals to connect, transportation is essential. Transport systems greatly enhance patients' access to healthcare services that might otherwise be inaccessible by facilitating their access to hospitals, clinics, or specialized care centers. For patients in need of urgent care, prompt and dependable transportation is essential to guaranteeing they reach the closest medical facility on time.

By avoiding the hazards associated with delayed emergency responses, effective ambulance services with paramedics in training and state-of-the-art medical equipment can save lives. A vital link in the healthcare supply chain, transportation guarantees the prompt delivery of medical supplies, pharmaceuticals, and other necessities to healthcare facilities. An efficiently managed transportation system guarantees that healthcare providers have access to the resources they need to provide high-quality care, including life-saving drugs and vaccines. Transport networks also assist the safe shipment of blood and organs needed for transplants. Given the delicate nature of these products, well-organized transport networks are crucial in reducing delays and ensuring their viability.

| Report Coverage | Details |

| Market Size in 2025 | USD 113.05 Billion |

| Market Size by 2034 | USD 200.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.56% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Launch of the healthcare transportation services

Increasing launch of the new healthcare transportation service by the key players in the market is estimated to fuel the healthcare transportation services market’s growth over the forecast period. For instance, in May 2024, Babyscripts, tele-maternal health company and comprehensive maternity care service providing company revealed the launch of the new program to provide transportation to maternal hospitals. The company offers travelling facilities for people who are pregnant and face difficulty in transportation.

Lack of skilled professionals

Even though there is a high demand for healthcare transportation services, factors like a shortage of qualified healthcare professionals, the high cost of maintenance and emergency care services, and limited awareness about healthcare services, particularly in some developing nations are anticipated to somewhat impede the growth of the healthcare transportation services market as a whole over the course of the forecast period. A severe healthcare professional shortage is now plaguing the healthcare sector, a problem made worse by the COVID-19 epidemic and its aftermath. For instance, in June 2023, according to data published by the Employment and Social Development Canada, non-profit organization of government of Canada, it was published that since there is a severe lack of skilled healthcare workers in Canada, especially Medical Laboratory Technologists (MLTs), MLTs are essential to the country's healthcare systems.

Increasing government initiatives and funding

In February 2023, according to the data published by the Medical Council of Canada, in order to enhance Canadians' access to health care, the Canadian government announced plans to invest about $200 billion over ten years, including US$46.2 billion in new financing for provinces and territories. These investments, on top of the substantial funding already in place, will contribute to giving Canadians access to a health care system that includes the following: timely, equitable, and high-quality mental health, substance use, and addictions services to support their well-being; access to their personalized electronic health information; and access to high-quality family health services when required including in rural and remote areas and for underserved communities. Hence, increasing government initiatives and funding provided by the government is estimated to create lucrative opportunities to fuel up the growth of the healthcare transportation services market over the forecast period.

The patient transport segment held the dominating share of the healthcare transportation services market in 2024 on account of factors such as increasing geriatric population and rise in the number of patient pool. Patient transport services are used for emergency cases like transporting elderly patients, accidental cases, airport emergency patients and mentally as well as physically disabled patients to medical centers for regular checkups. For instance, in January 2024, according to the article published by the Centers for Disease Control and Prevention (CDC), it was estimated that more than 14 million older adults in the U.S. fall each year accidentally and even found to be the primary cause of death in geriatric population. Furthermore, in March 2023, according to the data published by the World Health Organization, it was estimated that adults aged 65 and older experienced more than 3,000 fatal falls every month, resulting in 40,923 fatal fall injuries in 2022.

The hospitals segment held the largest share of the healthcare transportation services market in 2024. Increasing prevalence of chronic diseases and need for emergency admission of patient in hospital is expected to drive the hospital segment growth over the forecast period. For instance, in January 2024, according to the data published by the American Heart Association, it was reported that 300,000 to 450,000 deaths occurred due the cardiac arrest in the U.S. in 2023. Over 356,000 out-of-hospital cardiac arrests (OHCA) occur in the United States each year, with approximately 90% of them ending in death. According to the same source, cardiovascular diseases (CVDs) account for 17.9 million deaths annually, making them the leading cause of death. Medical equipment and supplies are mostly transported to hospitals using healthcare transport services in addition to patient transportation to hospital. Hence, the rising number of chronic diseases is expected to foster the growth of the hospital segment during the forecast period.

North America dominated the healthcare transportation services market with the largest share in 2024. The rise in the number of chronic diseases as well as after the Covid-19 pandemic the demand for the emergency patient transport service to hospital found to be increased in North America. Increasing funding by the government for the healthcare transport projects is expected to drive the growth of the market in the U.S.

Furthermore, in November 2023, Federal Transit Administration stated that US$4.7 million in competitive granted funding for Fiscal Year 2023 was made available for initiatives that enhance low-income communities' and older individuals' and people with disabilities' access to essential services. In Canada the government initiatives and funding for developing the healthcare facility and the skilled healthcare professional is expected to drive the growth of the market over the forecast period. For instance, in November 2023, the Medical Council of Canada, an organization charged with the partial assessment and evaluation of medical graduates received US$ 28.8 million from government of Canada for their project Modernizing Mandatory Physician Activities to enable safe patient care. The project intends to improve patient care through the creation of a National Registry of Physicians, a competency evaluation framework for foreign medical graduates, and an updated licensure verification examination procedure.

Asia Pacific is expected to witness the fastest growth over the forecast period owing to the increasing initiatives by the government to provide topline healthcare services for patients suffering with chronic diseases in the Asia Pacific region. For instance, February 2024, according to the data published by the World Health Organization it was reported that India has developed a multisectoral National Pandemic Preparedness Plan for Respiratory Viruses, a major step in the country's efforts to be ready for future respiratory pandemics.

The WHO's South-East Asia Regional Office arranged a regional workshop on the Preparedness and Resilience for Emerging Threats (PRET) project on October 12–13, 2023, which preceded this national endeavour. The goal of the workshop was to increase the effectiveness of pandemic preparedness for the nations in the region, acknowledging that similar skills and abilities can be utilized and implemented for different groupings of viruses according to their manner of transmission.

By Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024