January 2025

Healthcare Workforce Management System Market (By Solution: Software, Services; By Mode Of Delivery: Web & Cloud-based, On-premise; By End-use: Hospitals, Long-Term Care Centers, Nursing Homes Centers, Assisted Living Centers, Other Healthcare Institutions) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

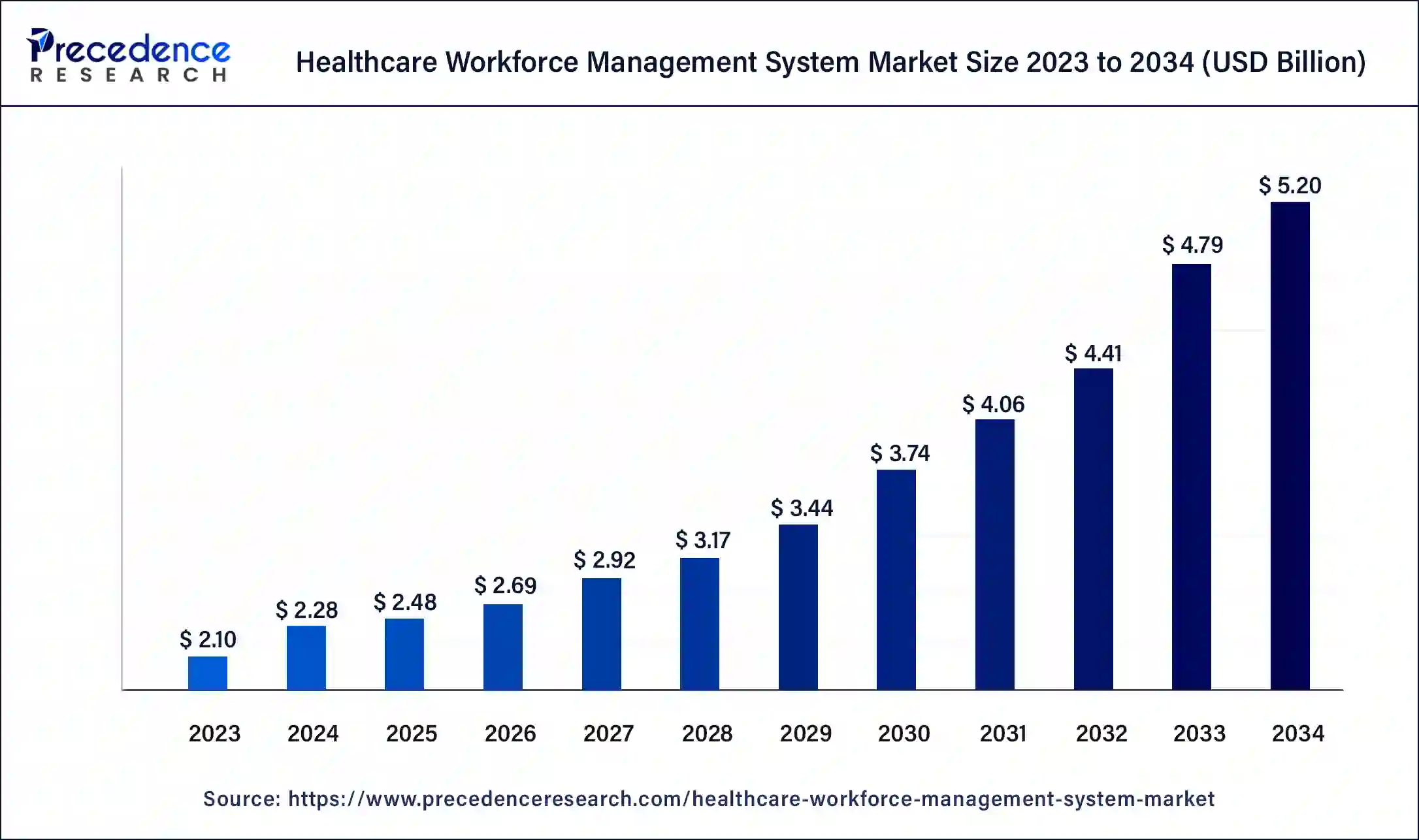

The global healthcare workforce management system market size was USD 2.10 billion in 2023, calculated at USD 2.28 billion in 2024 and is expected to reach around USD 5.20 billion by 2034, expanding at a CAGR of 8.59% from 2024 to 2034. The healthcare workforce management system market is expected to grow significantly, driven by the shift toward value-based reimbursements and the increasing adoption of telehealth technologies.

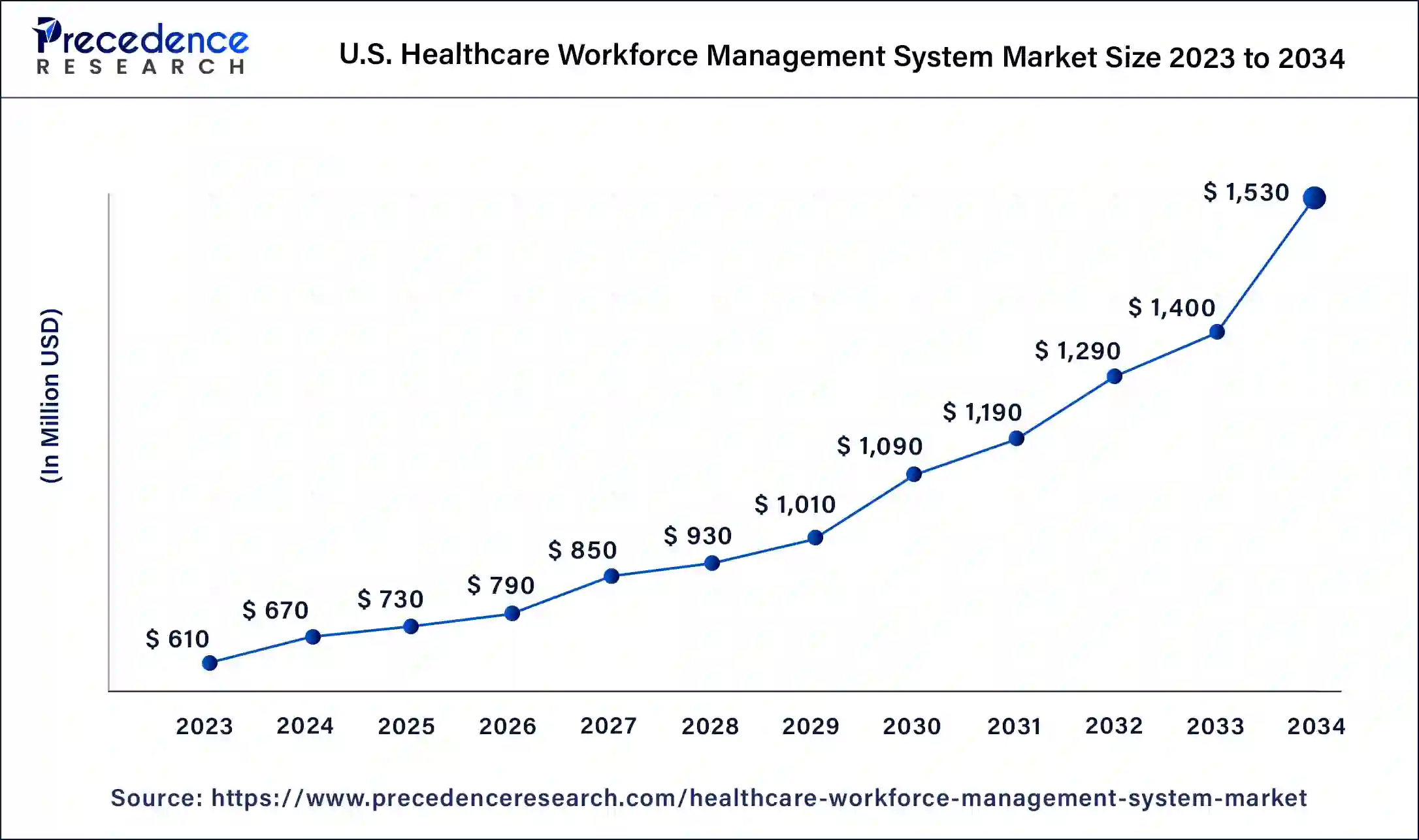

The U.S. healthcare workforce management system market size was exhibited at USD 610 million in 2023 and is projected to be worth around USD 1,530 million by 2034, poised to grow at a CAGR of 8.71% from 2024 to 2034.

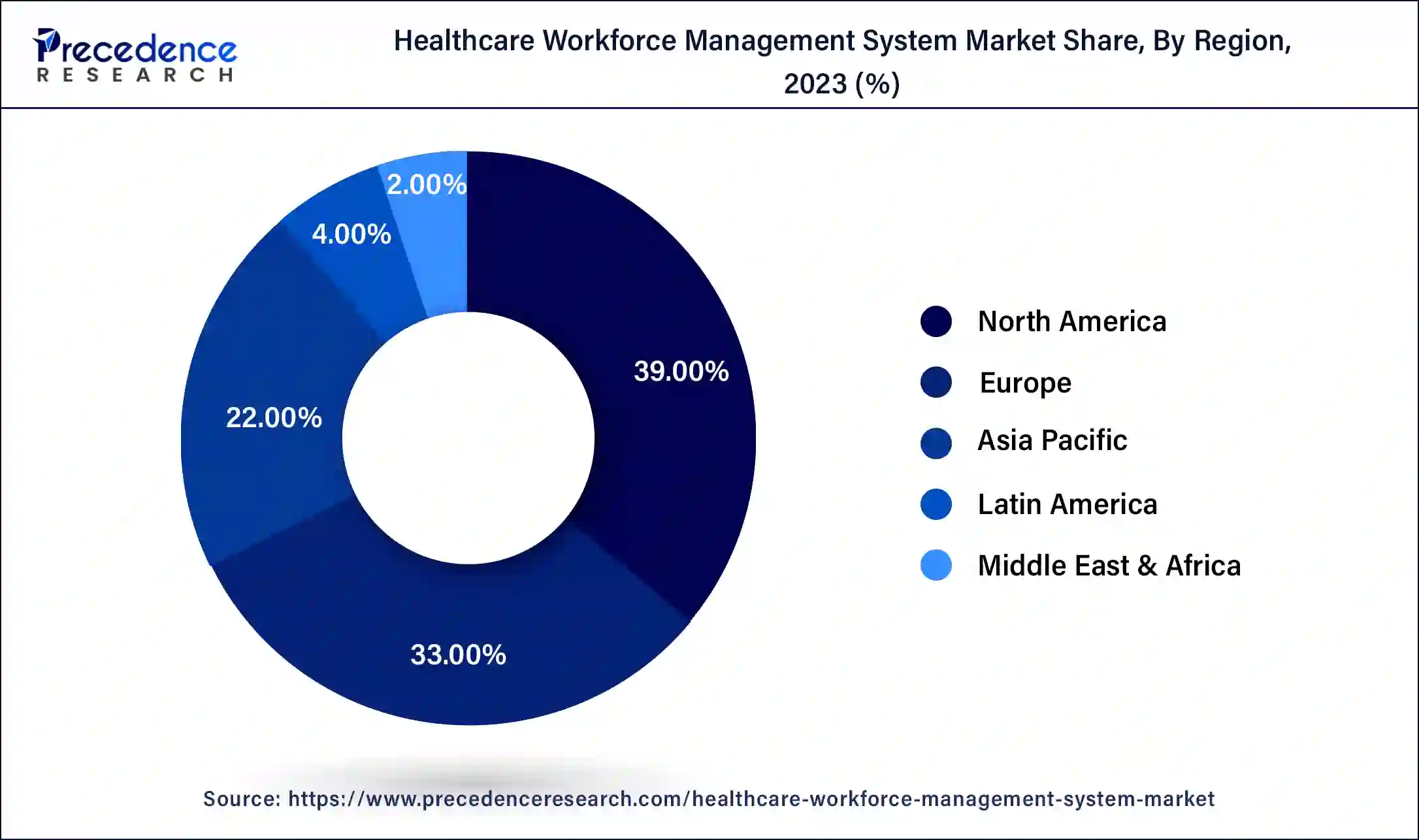

North America dominate the healthcare workforce management system market in 2023. North America has established itself as the leading region in the global healthcare workforce management system market due to increasing awareness of effective labor management strategies in the healthcare sector. The region is expected to continue its growth trajectory throughout the forecast period, driven by robust technological advancements and expansion.

The United States dominates the market, benefiting from its advanced healthcare infrastructure, high adoption of technology, and strict regulatory compliance requirements. The healthcare workforce management system market in the U.S. is projected to expand significantly, fueled by the rising number of surgical procedures.

Asia Pacific is expected to grow at the fastest rate in the healthcare workforce management system market over the period studied. This is attributed to the region's economic expansion, notable IT sector growth, and advancements in healthcare IT. The region is poised for significant growth, driven by rising healthcare expenditures, increased awareness of workforce management solutions, and government efforts to improve healthcare infrastructure. Furthermore, the healthcare workforce management system market in Japan is projected to grow substantially over the forecast period. Japan's market leadership is supported by major manufacturers and a strong demand for healthcare workforce management systems.

Healthcare workforce management systems are specialized software solutions designed for the healthcare industry to enhance the efficiency and effectiveness of workforce operations. These systems are tailored for large hospitals and healthcare facilities, which offer capabilities to streamline employee management, including scheduling, leave management, payroll processing, and handling emergencies and shift changes.

In addition to these core functions, the healthcare workforce management system market plays a pivotal role in managing payroll operations, filling vacant positions promptly, and monitoring workforce performance to optimize productivity. The inclusion of features such as biometric time clocks, web-based interfaces, and mobile applications ensure accurate tracking of clock-in and clock-out times, which is essential for maintaining operational efficiency within healthcare settings.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.20 Billion |

| Market Size in 2023 | USD 2.10 Billion |

| Market Size in 2024 | USD 2.28 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.59% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Solution, Mode Of Delivery, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Demand for effective human resource management

The healthcare workforce management system market is poised for growth driven by the adoption of advanced human resource management strategies leveraging modern technology. Enterprise workforce management software simplifies hiring processes, record-keeping, and performance monitoring across healthcare facilities. These efficiencies lay the groundwork for future market expansion, supported by the rising adoption of cloud-based solutions. Moreover, the proliferation of affordable mobile technologies and the demand among small and mid-sized organizations for cost-effective technological solutions further drive this trend.

Limited interoperability

Interoperability challenges among various healthcare workforce management systems and other healthcare applications create obstacles to seamless data sharing and integration. This fragmentation can result in disjointed data and hinder a unified view of workforce management across diverse departments and facilities. Meeting regulatory standards with a healthcare workforce management system creates complexities and demands considerable time and effort for implementation. Thus hampering the growth of the healthcare workforce management system market.

Growing adoption in developing regions

Healthcare infrastructure development is booming in developing regions, leading to a heightened demand for effective workforce management. Adoption of the healthcare workforce management system market in these areas is anticipated to rise substantially shortly. Furthermore, Major players in the global healthcare workforce management systems market are concentrating on introducing technologically advanced solutions, which is expected to open lucrative growth opportunities for the market worldwide.

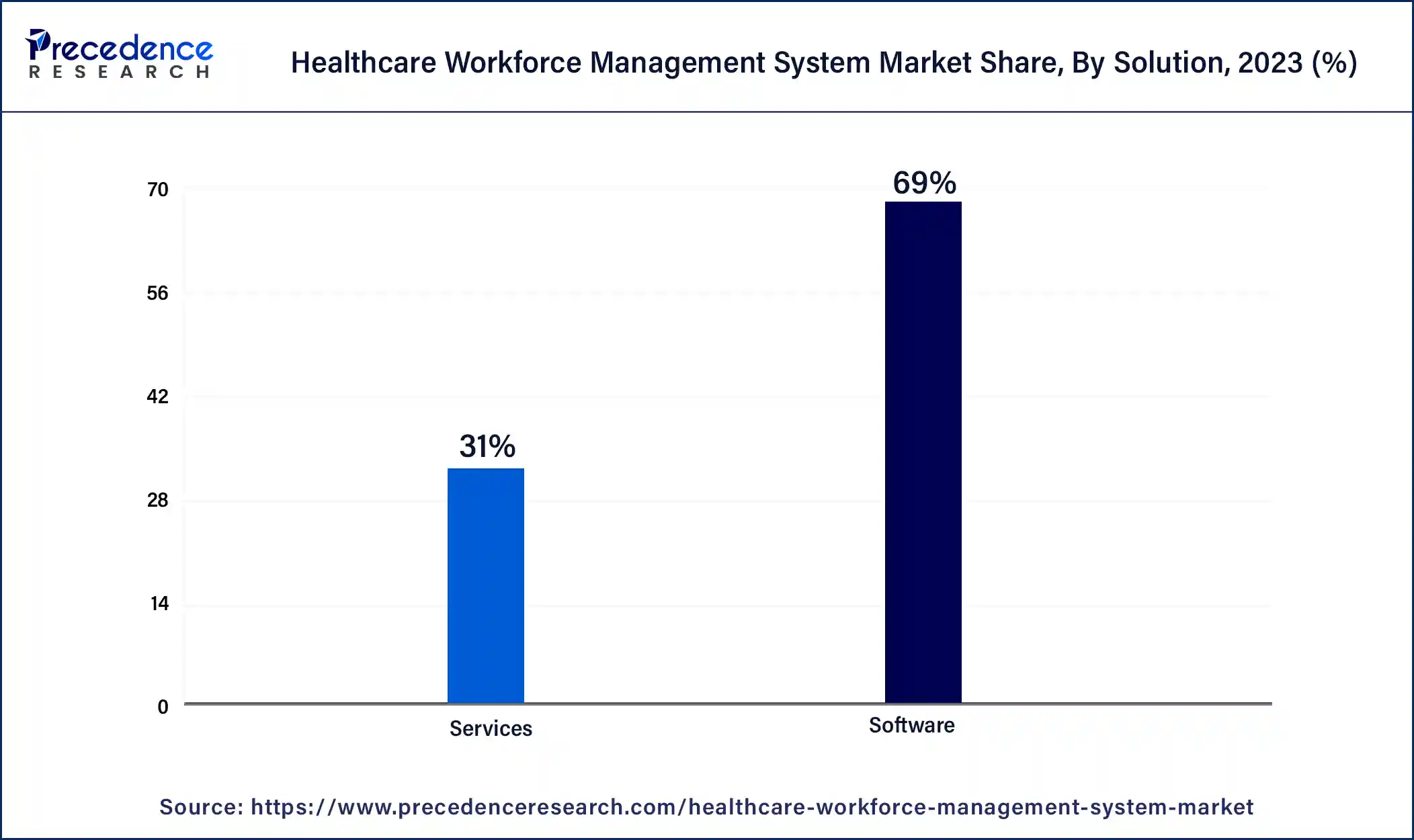

The software segment led the global healthcare workforce management system market in 2023. This segment is categorized into standalone and integrated software. Regarding standalone software, the time and attendance management segment held the largest revenue share in 2023. also, these systems typically rely on software applications that can be installed on a PC or accessed via the internet browser. They generally provide features such as scheduling, time and attendance tracking, payroll management, and reporting.

The reporting & analytics segment is expected to show the fastest growth in the healthcare workforce management system market over the forecast period. The adoption of reporting and analytics in workforce management has been significantly influenced by the rise of cloud computing and software-as-a-service (SaaS) solutions. Additionally, the incorporation of advanced technologies like cloud-based software, mobile applications, and artificial intelligence driven analytics is anticipated to further propel the growth of this segment.

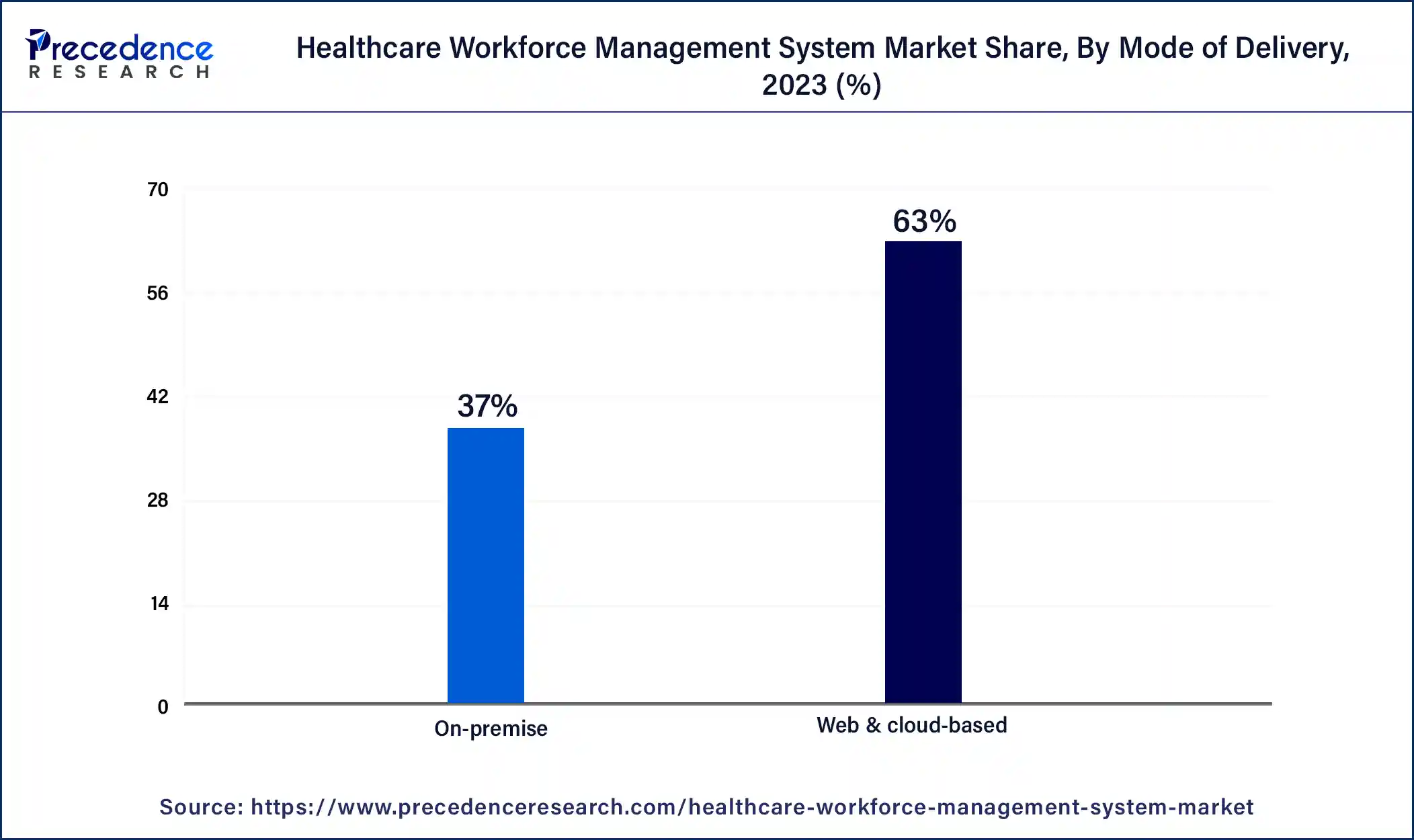

The web & cloud-based segment held the largest share of the healthcare workforce management system market in 2023. The significant advantages of cloud-based healthcare workforce management systems are the primary reasons for the segment's dominance in the base year. Cloud delivery in the healthcare industry offers benefits such as minimal setup costs, reduced IT maintenance expenses, no costs for software updates, and the added advantages of flexibility and adaptability in workforce management systems.

The on-premises segment is anticipated to grow at a substantial rate in the healthcare workforce management system market over the forecast period. On-premise solutions involve installing and maintaining software on the organization's servers. The delivery mode significantly influences the accessibility, scalability, and cost-effectiveness of the workforce management system, which is important for healthcare organizations aiming to optimize workforce operations. These benefits are key factors driving the growing demand for on-premises software in the healthcare sector.

The hospital segment led the healthcare workforce management system market in 2023. Healthcare workforce management systems are utilized in numerous hospitals to improve workforce productivity and efficiency. These systems offer multiple advantages, such as managing payroll efficiently, tracking employee shift timings, ensuring regulatory compliance, and handling human resources. Due to these significant benefits, their popularity is steadily increasing in hospitals.

The long-term care center segment is expected to witness the fastest growth in the healthcare workforce management system market during the projected period. Healthcare providers, especially long-term care facilities, are constantly looking for methods to enhance patient care. Implementation of a workforce management system can streamline operations, minimize paperwork, and optimize workforce management in care centers. Also, with an increasing emphasis on delivering superior and more efficient care, the demand for these systems in long-term care centers is anticipated to grow substantially, which can contribute to the progress of the healthcare industry.

Segments Covered in the Report

By Solution

By Mode Of Delivery

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024