November 2024

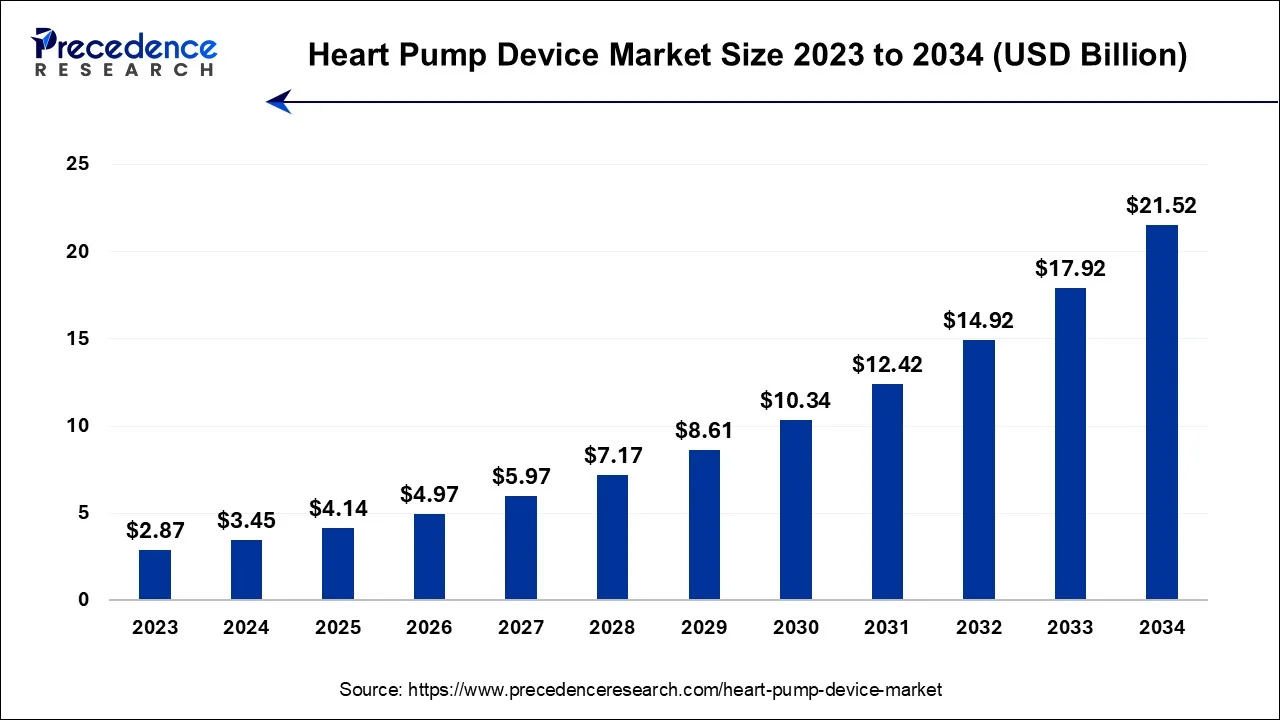

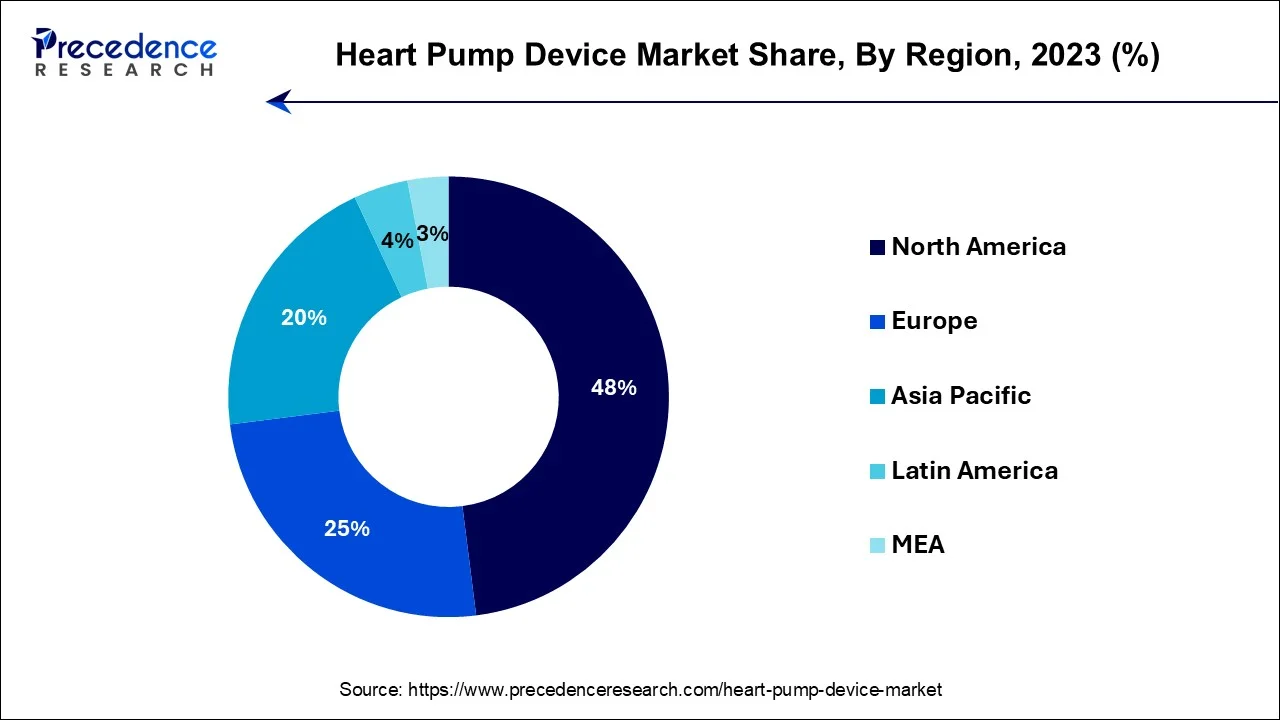

The global heart pump device market size is calculated at USD 3.45 billion in 2024, grew to USD 4.14billion in 2025 and is predicted to hit around USD 21.52 billion by 2034, expanding at a CAGR of 20.10% between 2024 and 2034. The North America heart pump device market size accounted for USD 1.66 billion in 2024 and is representing a notable CAGR of 20.18% during the forecast period.

The global heart pump device market size is accounted for USD 3.45 billion in 2024 and is projected to reach around USD 21.52 billion by 2034, growing at a CAGR of 20.10% from 2024 to 2034.

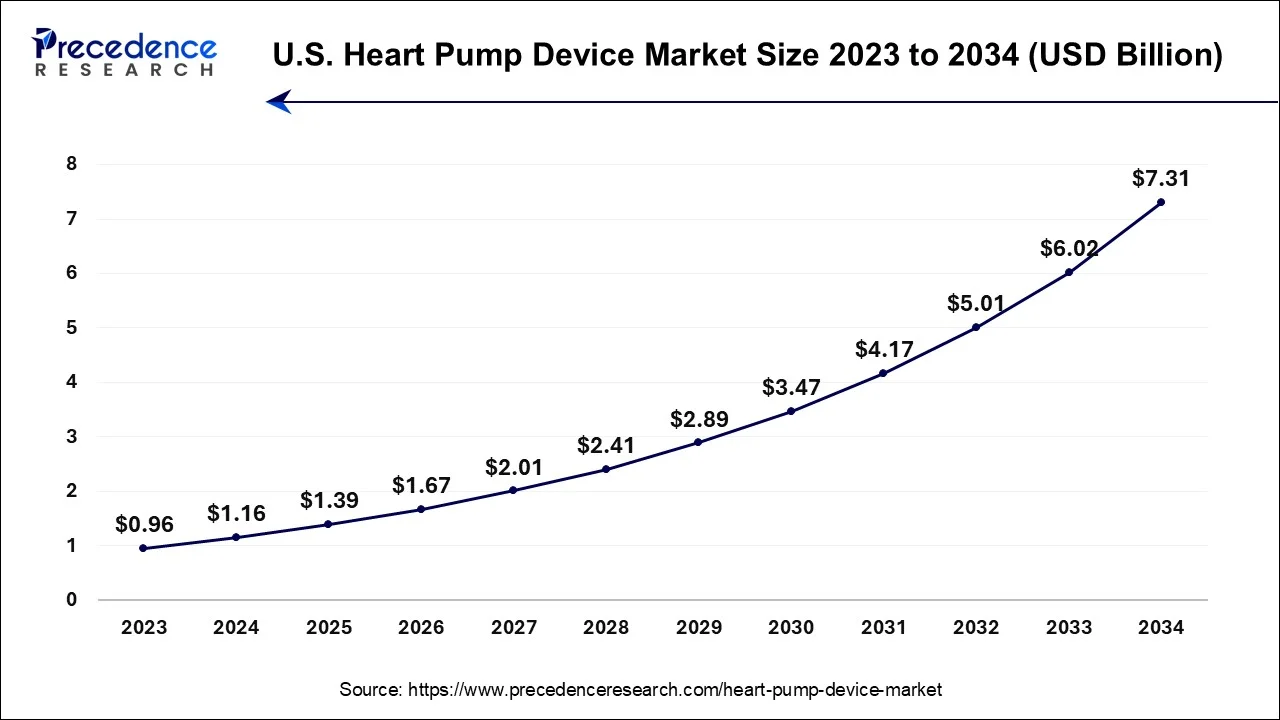

The U.S. heart pump device market size was exhibited at USD 1.16 billion in 2024 and is projected to be worth around USD 7.31 billion by 2034, poised to grow at a CAGR of 20.21% from 2024 to 2034.

North America dominated the heart pump device market in 2023. The U.S. dominated the North American heart pump device market followed by Canada and Mexico. Cardiovascular disease (also known as heart disease) is the leading cause of death in the U.S. Considering the presence of nations with high spending capacity, early adoption of the latest medical technologies, and rising prevalence of heart disease, the heart pump device market is forecast to grow significantly in the North American region during the study period.

Europe is observed to exhibit the fastest rate of growth in heart pump device market during the forecast period. The European heart pump device market is segmented into Germany, the United Kingdom (UK), Italy, Spain, France, and the Rest of Europe. Considering the well-developed healthcare infrastructure, Germany is expected to hold a higher share of the European heart pump device market during the forecast period.

Whereas Asia Pacific is expected to witness a notable rate of growth throughout the forecast period. China is predicted to continue its dominance in the Asia Pacific (APAC) heart pump device market followed by Japan and India. As per the Indian College of Cardiology (ICC), 1st time heart attack-related mortality is around 15-20% in India (120,000 to 200,000 deaths). The high occurrence of heart attacks is expected to drive the adoption of Intra-Aortic Balloon Pumps (IABPs) in the APAC region.

The global heart pump device market refers to the industry that designs medical devices to replace or assist the pumping function of the heart. These devices are typically used for patients with heart failure or other serious heart conditions. The global market for heart pump devices includes various manufacturers and models of heart pump devices and it is influenced by factors such as medical advancements, regulatory approvals and patient demand.

With the growing count of individuals suffering from cardiovascular diseases (CVDs), an increasing number of product approvals, and a promising product pipeline, the heart pump devices market is expected to grow promisingly in the coming years.

Owing to the growing prevalence of heart attacks and other heart conditions, the requirement for heart pump devices is expected to grow notably. With the rising adoption of the latest medical technologies, competition among major players is anticipated to rise in the heart pump device market.

| Report Coverage | Details |

| Market Size by 2034 | USD 21.52 Billion |

| Market Size in 2024 | USD 3.45 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 20.10% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Product, Therapy, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High prevalence of heart failure

Heart pump devices have high utility in treating heart failures. The ventricular assist device can pull oxygen-rich blood in one side of the pump and propel it out of the other side, into the aorta. As per the Journal of Cardiac Failure, nearly 6.7 million Americans above 20 years of age have heart failure (HF), and the prevalence is estimated to increase to 8.5 million Americans by 2030.

As per the British Heart Foundation Fact Sheet 2023, it is found that over 900,000 people have heart failure in the United Kingdom. Also, about 200,000 new diagnoses of heart failure are observed each year in the UK. As per an article shared by the National Library of Medicine, over 8 million Americans will be living with heart failure by 2030. The growing prevalence of heart failure is driving the heart pump device market growth remarkably.

High cost of heart pumps

As per a study result shared by Healthline Media UK Ltd., after the introduction of Impella heart pumps, the cost of treating heart patients with mechanical devices grew from $47,000 to $51,000 per patient. A total artificial heart (TAH) replaces the 2 lower chambers of the heart that may be not functioning due to end-stage heart failure. India Cardiac Surgery Site states that the average cost of artificial heart transplant in India ranges from about $54,000 (₹45,00,000) to $98,000 (₹80,00,000). Many patients are not able to afford such expensive heart pump devices. The higher costs associated with heart pump devices is restraining the market growth to a considerable extent.

Development of new heart pump devices

CorWave recently exhibited an unprecedented study on the performance of its implantable heart pump at the 41st Annual Meeting of the International Society for Heart and Lung Transplantation (ISHLT). CorWave unveiled the 1st study demonstrating sensorless synchronization of a pericardial pump with the native heart for over 30 days. In January 2022, The School of Medical Research and Technology (SMRT) of IIT Kanpur announced the launch of Hridyantra, a challenge-based program for developing an advanced artificial heart.

The new advanced artificial heart also known as the Left Ventricular Assist device (LVAD) is being developed for patients with end-stage heart failure. After receiving over $3 million from the National Heart, Lung, and Blood Institute in April 2022, Penn State College of Medicine started developing an implantable artificial heart that functions wirelessly and reliably for 10 years. The rising development of innovative heart pump devices is creating promising opportunities for market growth.

The implanted heart pump devices segment held the dominating share of the heart pump device market in 2023. Implanted heart pump devices are becoming very popular among patients who suffer from heart failure (HF) and are not eligible for a heart transplant. Improved quality life offered by implanted heart pump devices has forced the adoption of such devices in the healthcare industry.

The extracorporeal heart pump devices segment is predicted to grow at a significant rate during the study period. These heart pump devices are temporarily support for the functioning of the heart by pumping blood out and returning it to the circulatory system. As per the American Heart Association, there are nearly 750,000 fatalities every year in the U.S. The rising prevalence of heart disease is contributing to the extracorporeal heart pump device segment growth.

The ventricular assist devices (VADs) segment dominated the global heart pump device market in 2023. Continuous advancements in ventricular assist devices technology have led to improved device reliability, reduced complications and enhanced patient outcomes. Heart failures is a prevalent cardiovascular condition, and its incidence is on the rise due to factors like aging population and lifestyle-related health issues. This factor has increased the demand for heart pump devices, with ventricular assist devices being a primary choice.

The bridge-to-transplant (BTT) segment accounted for the largest share of the heart pump device market. clinical studies and real-world evidence have demonstrated the positive impact of bridge-to-transplant therapy of patients, solidifying its role as the standard of care for many transplant candidates. This therapy usually involves the use of ventricular assist devices or other mechanical circulatory support the failing heart until a suitable donor becomes available.

Segments Covered in the Report

By Type

By Product

By Therapy

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

October 2024

December 2024

January 2025