May 2025

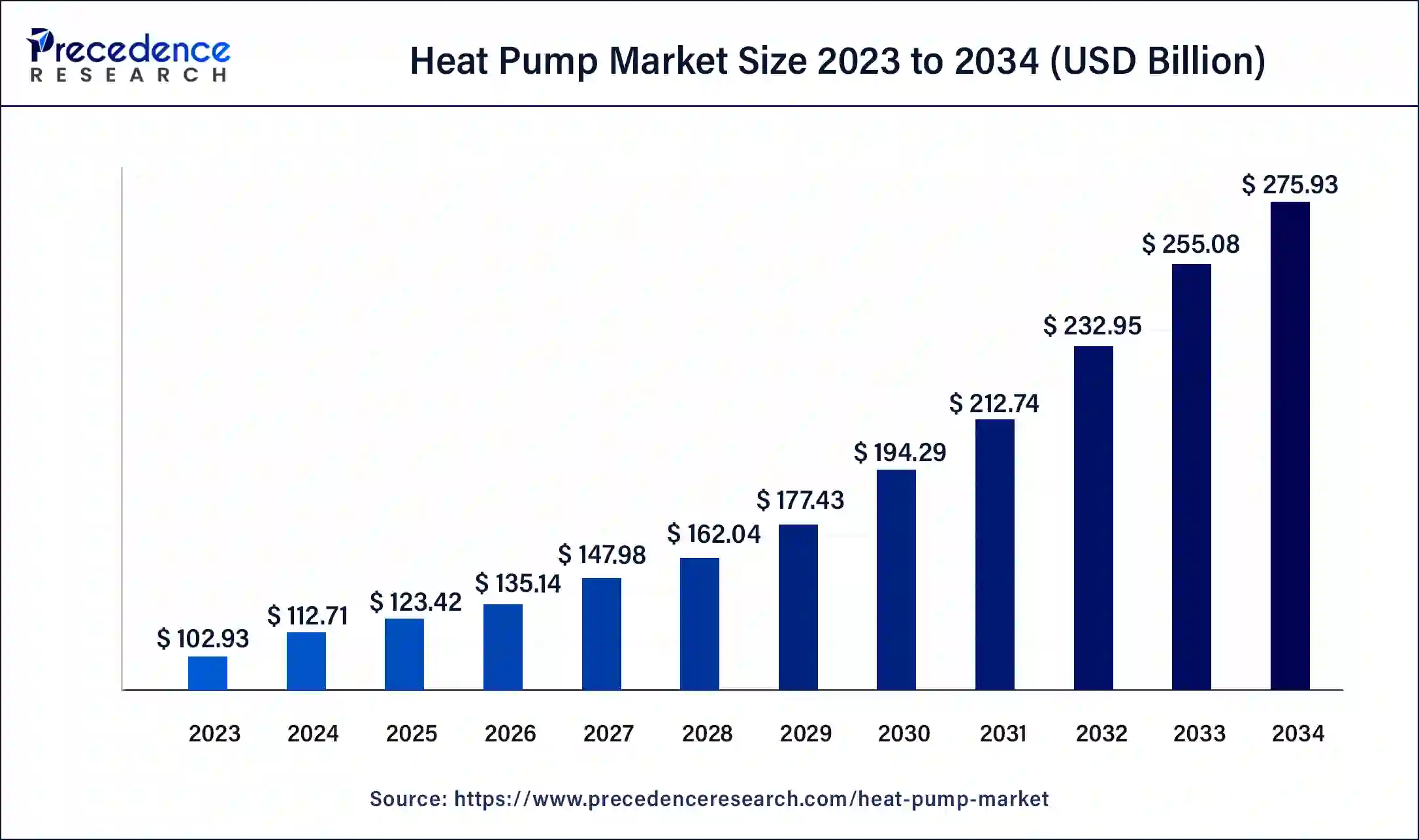

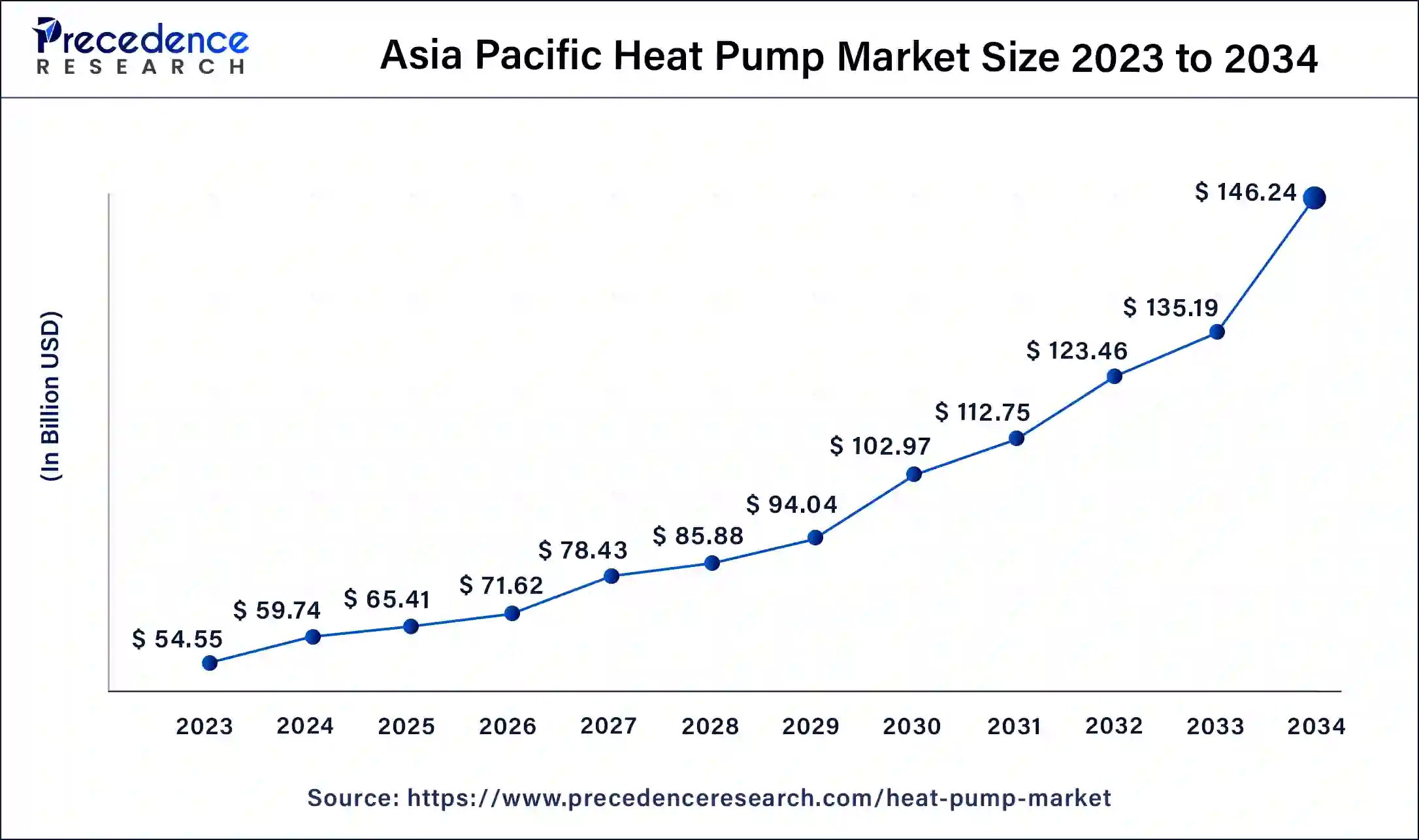

The global heat pump market size is estimated at USD 123.42 billion in 2025 and is anticipated to reach around USD 275.93 billion by 2034, accelerating at a CAGR of 9.37% from 2025 to 2034. The Asia Pacific heat pump market size accounted for USD 65.41 billion in 2025 and is expanding at a CAGR of 9.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global heat pump market size was valued at USD 112.71 billion in 2024 and is predicted to increase from USD 123.42 billion in 2025 to approximately USD 275.93 billion by 2034, expanding at a CAGR of 9.37% from 2025 to 2034. The global heat pump market is driven by the rising demand for renewable sources that is aligned with environmental concerns

The Asia Pacific heat pump market size was estimated at USD 59.74 billion in 2024 and is predicted to be worth around USD 147.62 billion by 2034, at a CAGR of 9.47% from 2025 to 2034.

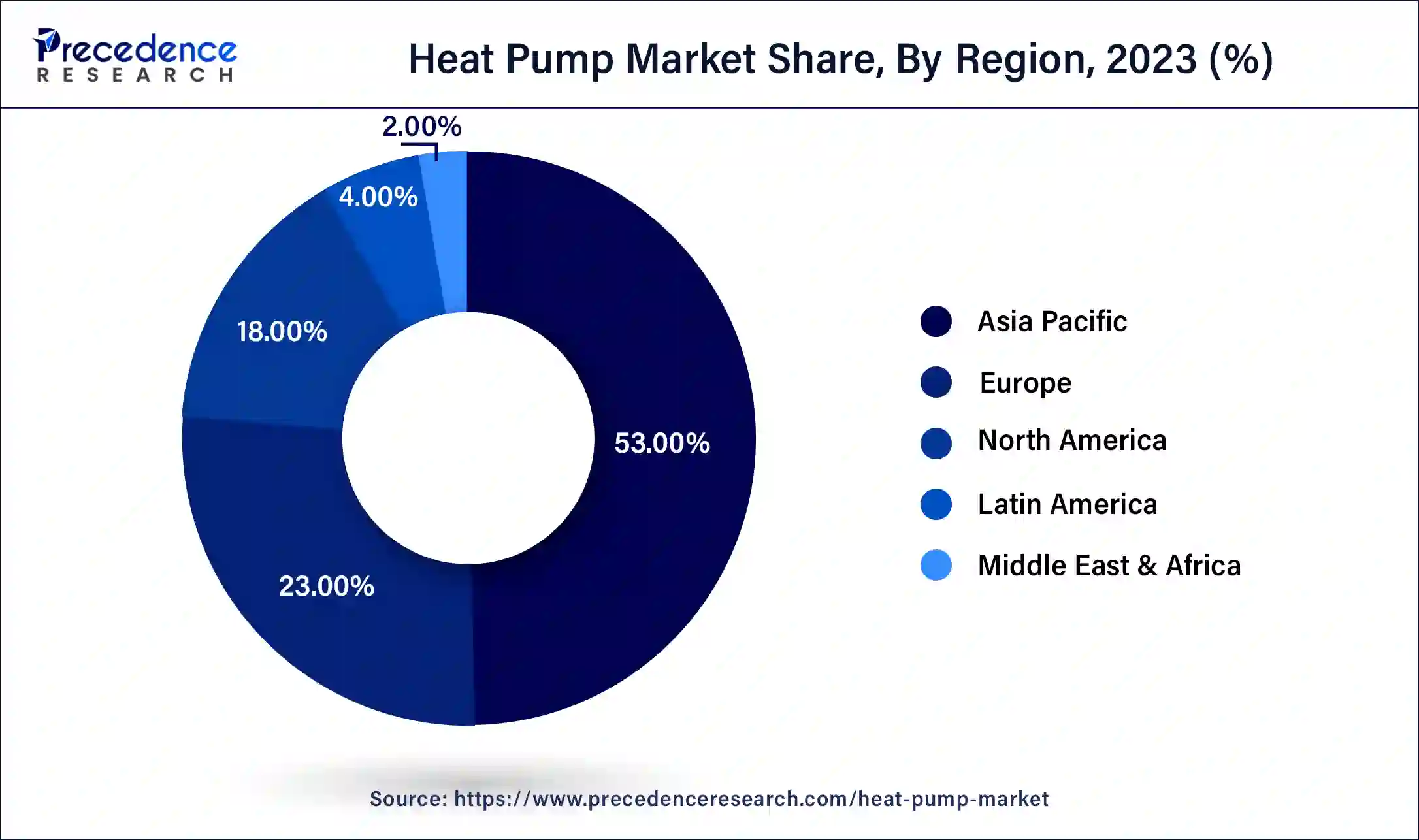

Asia-Pacific had the largest market share of 53% in the heat pump market in 2024. The Asia-Pacific region firmly leads the global heat pump market, primarily due to a blend of pivotal factors such as rapid urbanization, robust economic growth, rising disposable incomes, and an increasing focus on energy efficiency and sustainability. Governments in this region have enacted policies that strongly support renewable energy initiatives and environmental conservation, further amplifying the demand for heat pumps across both residential and commercial sectors.

The burgeoning populations and swift urban development in countries like China and India have resulted in a significant rise in residential construction projects, thereby intensifying the demand for energy-efficient heating and cooling solutions, with heat pumps at the forefront. These versatile systems are being widely adopted in residential buildings and various commercial facilities for essential functions such as heating, cooling, and providing hot water.

In North America, the heat pump market is witnessing dynamic growth fueled by several key factors, including a concentrated commitment to energy efficiency, proactive government initiatives that promote the adoption of sustainable heating technologies, and notable technological advancements particularly tailored for cold-climate applications. The region's dedication to diminishing carbon emissions, coupled with a rising demand for efficient heating and cooling systems, serves as the bedrock for this market's expansion. Furthermore, North America is focusing heavily on incorporating energy-efficient products like heat pumps to meet ambitious carbon reduction goals.

The ongoing innovations in heat pump technology have led to the development of remarkably efficient systems, even in challenging cold climates. This increasing necessity for effective heating and cooling solutions within both residential and commercial environments is propelling the growth trajectory of the heat pump market in North America.

The market for heat pumps has expanded significantly in recent years due to the growing focus on sustainable heating solutions and energy efficiency. Heat pumps are becoming increasingly well-liked as adaptable and environmentally responsible replacements for conventional heating systems. Heat pumps draw heat from the air, earth, or water. The market is growing due to factors such as increasing public awareness of environmental issues, government subsidies encouraging the use of renewable energy, and developments in heat pump technology. With an emphasis on lowering carbon footprints, the market for heat pumps is expected to grow further because it is essential to shift to more sustainable and environmentally friendly heating options.

Numerous reasons have contributed to the notable expansion of the heat pump market. The growing emphasis on sustainability and energy efficiency is one important factor. Heat pumps are a more energy-efficient option to conventional heating systems for individuals and governments looking for ecologically friendly heating and cooling solutions. Technological developments are also a significant factor in the expansion of the heat pump industry. Consumer interest in heat pump systems has increased due to ongoing research and development efforts producing more dependable and efficient models.

The market for heat pumps has increased even further thanks to government policies and incentives that support the use of renewable energy sources. Financial incentives, tax credits, and rebates are frequently provided to promote the use of heat pump systems and lower their cost to consumers.

As consumers become more conscious of the environmental effects of traditional HVAC systems, such as those that run on fossil fuels, their tastes are shifting in favor of more environmentally friendly options like heat pumps. Customers prioritize eco-friendly products, fueling market expansion due to the increased environmental consciousness. Furthermore, the growing building sector, particularly in areas with severe weather, fuels the need for more effective heating and cooling options, which boosts the market for heat pumps. Heat pumps are incredibly versatile since they can both cool and heat subjects.

| Report Coverage | Details |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.37% |

| Market Size by 2034 | USD 275.93 Billion |

| Market Size in2025 | USD 123.42 Billion |

| Market Size in 2024 | USD 112.71 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Rated Capacity, Refrigerant, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for heat pumps is surging, mainly due to the increased focus on increased safety and environmental friendliness. When heat pumps are used instead of conventional heating systems, they drastically lower greenhouse gas emissions. Their effectiveness in removing heat from the ground, the air, or water sources helps reduce energy use, which aligns with international efforts to mitigate climate change. Enhanced safety features primarily drive the adoption of heat pumps. Unlike combustion-based heating systems, heat pumps function without open flames, which lowers the possibility of mishaps involving gas leaks or combustion-related catastrophes. This addresses the issues of indoor air quality and fire threats, making them a safer solution for both commercial and residential applications.

Furthermore, technical developments have resulted in the creation of intelligent and automated heat pump control systems, which improve safety by including functions like automatic shutdown in the event of a malfunction or unusual operating circumstances. This keeps the equipment safer for longer and extends its lifespan. Manufacturers must create heat pumps with the least amount of environmental impact possible as environmental regulations throughout the world become stricter. This covers the use of refrigerants that adhere to stringent efficiency criteria and have a lower global warming potential (GWP). As more people become aware of the long-term advantages of purchasing environmentally friendly heating solutions, the market for heat pumps is expanding.

For various reasons, higher installation costs are a significant barrier in the heat pump business. First off, installing heat pump systems typically calls for specific knowledge, which raises labor expenses. The overall cost of installation is further increased by the requirement for qualified specialists to evaluate the location, make the required adjustments, and guarantee correct sizing. Additionally, heat pumps can require particular infrastructure changes, such as ductwork or electrical upgrades, which would raise the installation cost. Potential customers may be turned off by the difficulty of integrating heat pump technology with current HVAC systems, which can increase costs.

Permit requirements and adhering to building rules may occasionally result in more extended installation periods and higher expenses. Potential consumers are discouraged from implementing heat pump solutions because of this and the need for high-quality components and sophisticated controls, which raises the total cost of ownership. The increased initial installation costs ultimately deter consumers and businesses from switching to heat pumps, which hinders the general uptake of this energy-saving innovation.

Heat pumps with built-in humidity control features create a more comfortable interior atmosphere by controlling moisture levels, which is especially helpful in areas with different humidity levels. Effective humidity management lessens the heat pump's workload, increasing energy efficiency. Users will benefit from decreased energy use and operating expenses as a result.

Ventilation can be added to advanced heat pump systems to bring fresh outdoor air. Better air quality is maintained, and indoor contaminants are lessened. Certain heat pump types have advanced air filtration systems capable of removing pollutants, dust, and allergies, creating a better living environment and enhancing indoor air quality.

In 2024, the air-source technology segment held the dominating share of 83% in the heat pump market. Many significant benefits are causing air source heat pump technology to become more and more dominant in the market. First, it is more affordable than other options like ground source heat pumps. Because air source heat pumps typically have cheaper installation and operating costs, they are desirable for residential and commercial applications. Furthermore, the fact that air source heat pumps don't need significant drilling or ground excavation makes them more straightforward to install and less expensive overall. They are, therefore, a sensible option for adding heating systems to older buildings.

Another reason for the widespread use of air-source heat pumps is their adaptability. They can function well in various weather conditions, even in colder areas. Due to technological developments, they now work better even in cold weather, making them appropriate for multiple climates. Furthermore, air-source heat pumps are more space-efficient because they require less installation area than ground-source heat pumps. Because of this, they are a better choice in confined urban spaces.

The water-source technology segment shows significant growth in the heat pump market during the predicted period. Because water source technology is sustainable and efficient, its market share in the heat pump industry has increased significantly. The constant temperature of water sources, like lakes, rivers, or subterranean aquifers, is tapped into by heat pumps that use water as its source. Because water has a higher thermal conductivity than air, this technology uses this property to enable more effective heat exchange.

The increased emphasis on renewable energy solutions and the demand for environmentally friendly substitutes are significant factors propelling this expansion. By utilizing the inherent heat found in water bodies, water source heat pumps help reduce carbon footprints by lowering dependency on fossil fuels.

Water-source heat pumps are more efficient and have lower running costs and environmental advantages than air-source equivalents. Due to its affordability, businesses and consumers have noticed, creating a favorable market trend.

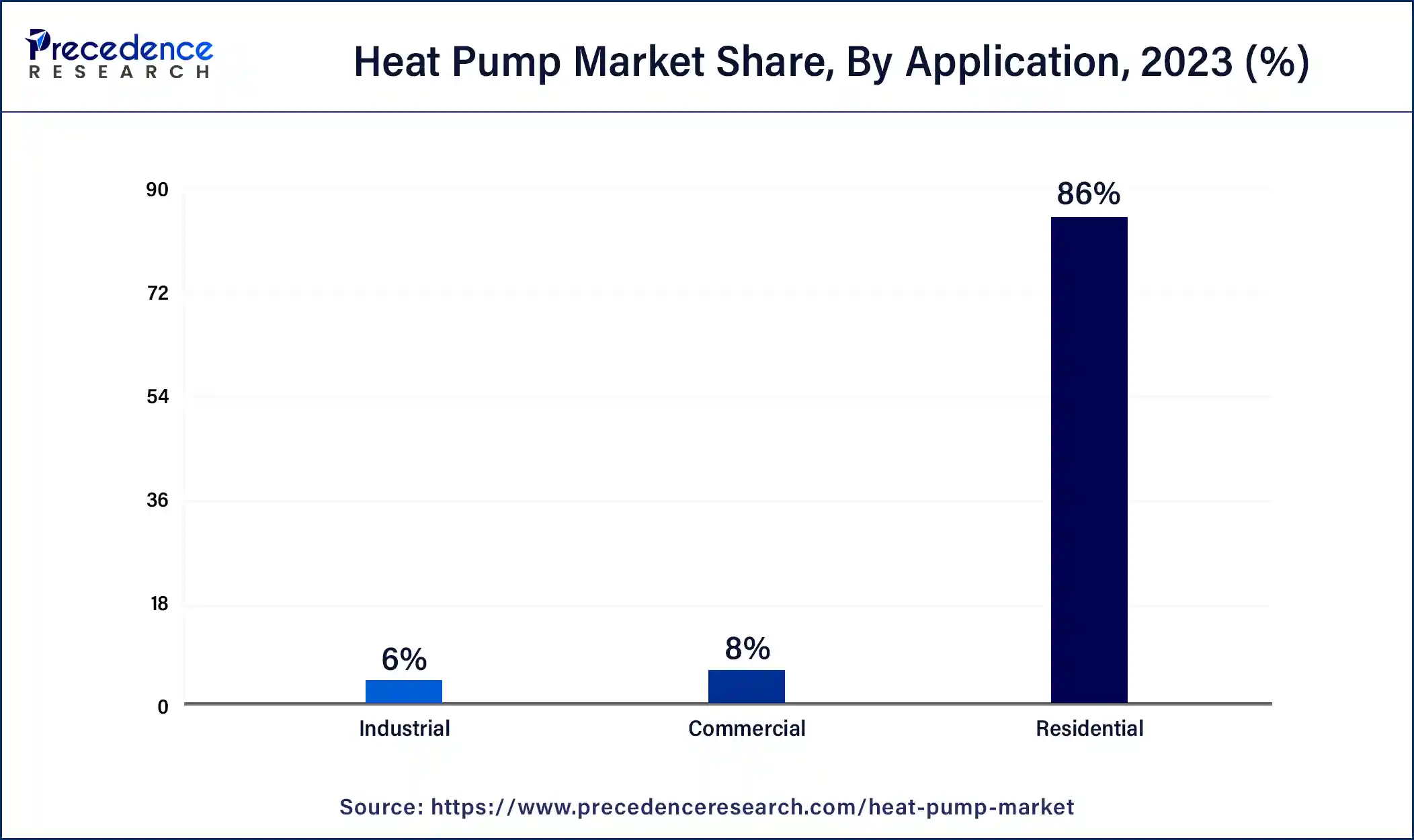

The residential segment held the largest share of 86% in 2024. Residential applications, for several reasons, dominate the market for heat pumps. First, households are looking for alternative heating and cooling options due to the increased focus on sustainability and energy efficiency, making heat pumps a desirable choice. These systems use the ground's temperature or the ambient air to heat and cool, which uses less energy overall.

Technological developments have also improved residential heat pumps' cost-effectiveness, dependability, and efficiency. Improved designs, variable-speed compressors, and smart controls make better efficiency and energy savings possible, which appeal to households looking for cost-effective and ecologically friendly options.

The industrial segment shows significant growth in the heat pump market during the forecast period. The industrial sector has witnessed substantial growth in the heat pump market due to several key factors. Firstly, the increasing global emphasis on sustainable and energy-efficient technologies has driven industries to adopt heat pumps as an eco-friendly alternative for heating, ventilation, and air conditioning (HVAC) systems. These pumps utilize renewable energy sources, such as air or water, to transfer heat, reducing carbon emissions and operating costs.

Moreover, advancements in heat pump technology have enhanced their efficiency, making them more attractive to industries looking to optimize energy consumption. Heat pumps' ability to provide heating and cooling solutions adds versatility to their applications, addressing the diverse needs of industrial processes. Government incentives and regulations promoting energy efficiency and environmental responsibility have further incentivized industrial players to invest in heat pump systems. Financial benefits, such as tax credits or subsidies for adopting sustainable technologies, have encouraged industries to transition.

Additionally, industries are starting to see heat pumps as strategic investments due to a rising knowledge of the long-term financial benefits of lower operational costs and energy usage. This is especially important for industries like manufacturing and processing facilities with high energy requirements.

In 2024, the 10 – 20 kW segment held the largest share of over 23% in the heat pump market. Several causes are responsible for the rise of the 10-20kW segment in the heat pump market. First, this line fits nicely with the growing need for small-scale commercial and residential applications, where efficiency and capacity must be balanced. As energy efficiency gains traction, consumers choose heat pumps in this power range because they minimize energy use while providing necessary heating and cooling. Technological developments have also been crucial. Higher efficiency levels in the 10–20kW range result from improved compressors, heat exchange systems, and componentry, which appeals to consumers more. Manufacturers also create intelligent and networked products that enable customers to optimize energy using remote control and monitoring.

Enhanced awareness and education are further factors driving the market's expansion. The market for these systems is growing as more people become aware of the advantages of 10–20kW heat pumps, such as decreased energy costs and less of an impact on the environment. This positive feedback loop in the heat pump business drives the 10–20kW category to new heights through awareness, technological breakthroughs, and government backing.

TCL

In March 2025, TCL unveiled a groundbreaking propane heat pump designed specifically for residential applications, marking a significant innovation in the field.

Ariston

In May 2025, Ariston introduced the NUOS PLUS S2, a smart and energy-efficient heat pump water heater that aims to revolutionize energy consumption in households.

Mitsubishi Electric Trane HVAC US

In April 2025, Mitsubishi Electric Trane HVAC US launched a novel collection of low Global Warming Potential (GWP) all-electric heat pumps, optimized for performance across diverse climate conditions.

By Technology

By Application

By Rated Capacity

By Refrigerant

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

February 2025

February 2025