February 2025

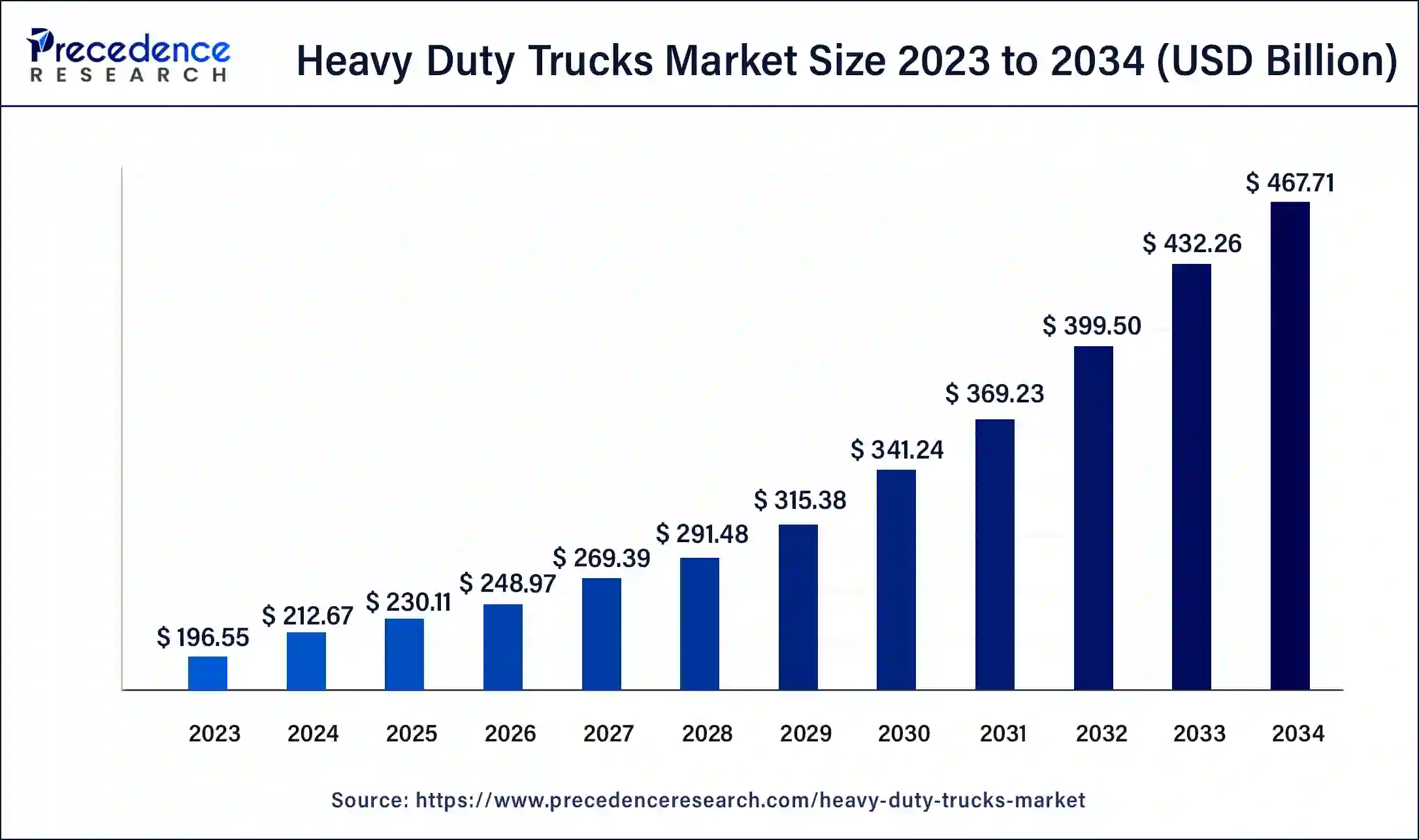

The global heavy duty trucks market size accounted for USD 230.11 billion in 2025, and is projected to surpass around USD 467.71 billion by 2034, representing a healthy CAGR of 8.20% between 2025 and 2034. The North America heavy duty trucks market size was calculated at USD 80.81 billion in 2024 and is expected to grow at the fastest CAGR of 8.34% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global heavy duty trucks market size was valued at USD 212.67 billion in 2024 and is anticipated to reach around USD 467.71 billion by 2034, expanding at a CAGR of 8.20% over the forecast period from 2025 to 2034.

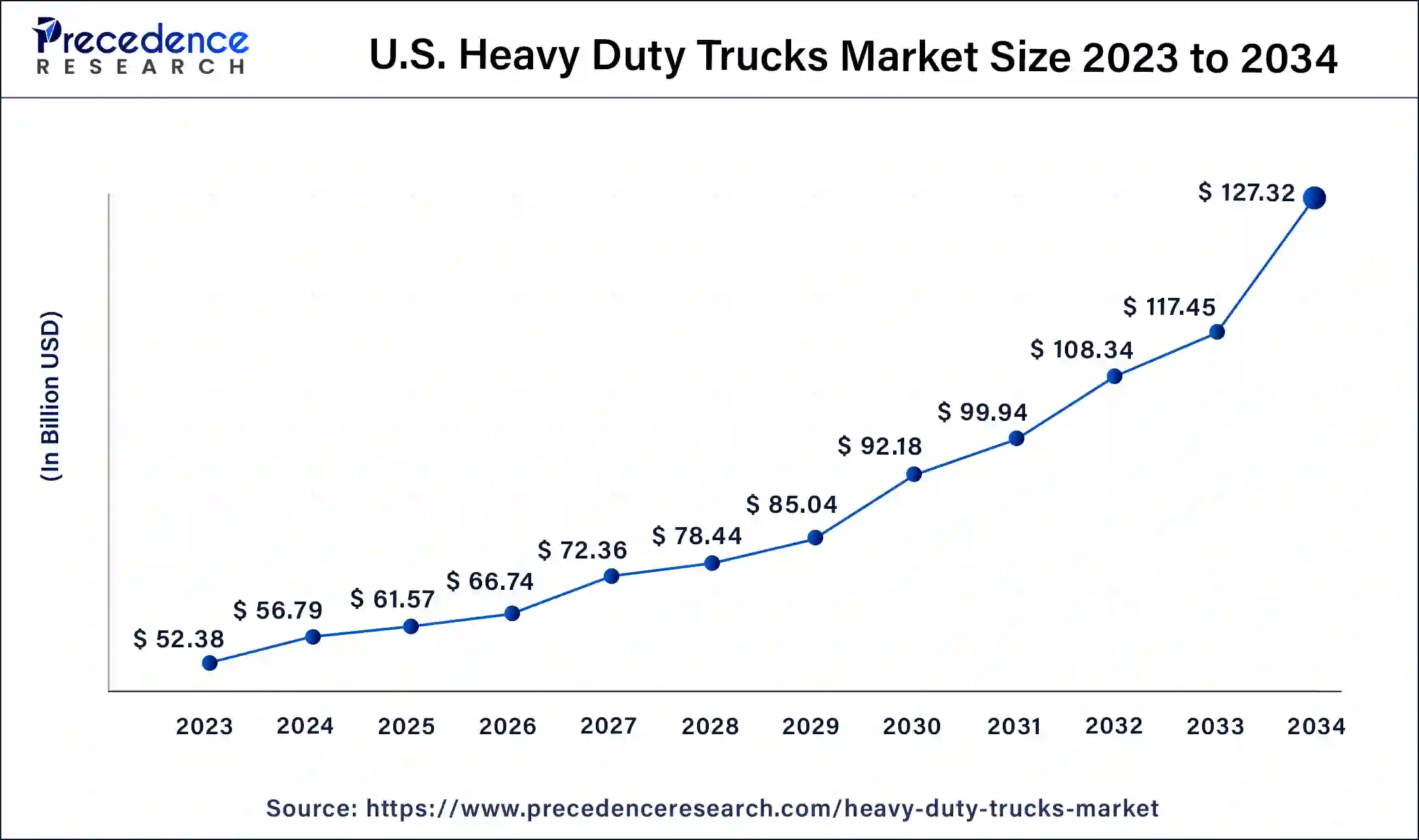

The U.S. heavy duty trucks market size was exhibited at USD 56.79 billion in 2024 and is projected to be worth around USD 127.32 billion by 2034, poised to grow at a CAGR of 8.41% from 2025 to 2034.

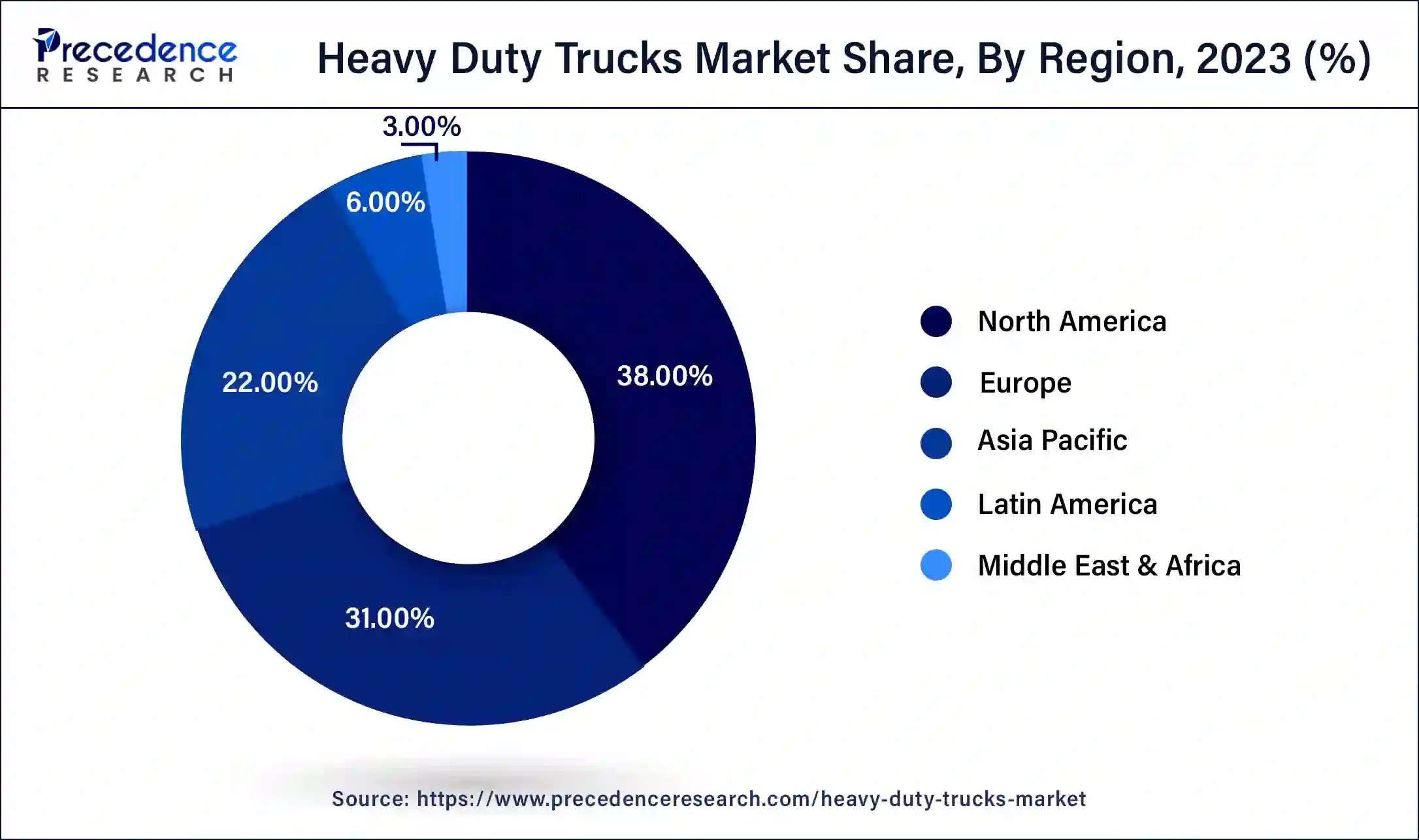

North America has held the largest revenue share 38% in 2024. In North America, the heavy duty trucks market is marked by a strong emphasis on sustainable and eco-friendly transportation solutions. Stringent emissions regulations have pushed manufacturers to innovate and invest in electric and hybrid heavy-duty trucks. Moreover, robust economic growth and a flourishing e-commerce industry continue to drive the demand for heavy-duty trucks, particularly for long-haul freight transportation.

North America is dominating the heavy-duty trucks market. The efficient logistics infrastructure and rising demand for freight are the major reasons for the growth of this market in the region. The popular manufacturers like Ford and Motors are ruling the market. Within the region, China’s industrialization and urbanization development are accelerating growth in the market.

Asia Pacific is estimated to observe the fastest expansion. The region showcases a burgeoning market for heavy duty trucks. Rapid urbanization, expanding infrastructure projects, and the need for efficient logistics are propelling the demand. Additionally, government initiatives to modernize and upgrade transportation networks are stimulating the market, while the growing e-commerce sector is boosting the need for heavy-duty trucks for last-mile delivery.

The heavy duty trucks market encompasses the global manufacturing, sales, and use of large, powerful vehicles designed for transporting heavy cargo and goods. The heavy duty trucks market involves the global production and use of large, powerful vehicles designed for heavy-duty cargo and goods transportation. These trucks, typically with a gross vehicle weight rating (GVWR) exceeding 26,000 pounds, are vital in industries like logistics, construction, and mining, where robust transportation is essential.

Market drivers include rising freight demand, economic expansion, infrastructure projects, and the adoption of eco-friendly and efficient technologies in the heavy-duty truck sector. Additionally, the industry is influenced by emissions reduction regulations and safety standards. Additionally, regulations aimed at reducing emissions and enhancing safety standards are shaping industry trends.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.2% |

| Market Size in 2024 | USD 212.67 Billion |

| Market Size in 2025 | USD 230.11 Billion |

| Market Size by 2034 | USD 467.71 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Tonnage Type, By Class, By Fuel Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing freight transportation demand and infrastructure development

Rising freight transportation demands driven by global trade and e-commerce are pivotal, spurring growth in the heavy-duty truck market as logistics becomes increasingly critical for efficient goods delivery. Heavy-duty trucks, with their substantial cargo capacity and long-haul capabilities, are essential in meeting this demand. As consumer expectations for timely deliveries continue to increase, businesses seek to expand their fleets of heavy-duty trucks to keep up with the freight requirements. This rise in transportation needs is a driving force for the market, spurring manufacturers to produce more trucks and logistics companies to invest in modern fleets.

Technological innovations have revolutionized the heavy duty trucks market. Advanced features such as telematics, connectivity, safety systems, and fuel efficiency improvements are attracting customers who value enhanced performance, safety, and operational efficiency. Telematics and connectivity solutions enable fleet managers to monitor vehicles, driver behavior, and route optimization, enhancing overall efficiency. Innovations in safety features reduce accidents and protect drivers and cargo. Additionally, fuel efficiency improvements align with environmental concerns, making modern heavy-duty trucks more attractive to companies aiming to reduce emissions and operating costs. As technological advancements continue, heavy-duty trucks become smarter, safer, and more environmentally friendly, driving market demand.

Stringent emission regulations and high initial costs

Global regulations to reduce greenhouse gas emissions from heavy-duty trucks, although essential for environmental protection, act as a market constraint by necessitating costly emission-reduction technologies. Compliance with these stringent rules necessitates significant investments in cleaner technologies, which can increase manufacturing costs and the purchase price of heavy-duty trucks. Manufacturers are compelled to develop and adopt emission-reduction technologies, such as cleaner-burning engines and exhaust after treatment systems. As a result, the high development and compliance costs are transferred to the customers, making new heavy-duty trucks more expensive.

Heavy-duty trucks with advanced features and technologies, such as electric and alternative-fuel vehicles, often come with higher initial purchase costs compared to their traditional diesel counterparts. Electric trucks, for instance, require expensive battery systems and charging infrastructure investments. While these advanced trucks offer long-term operational cost savings through reduced fuel consumption and maintenance expenses, the high upfront costs can deter potential buyers, particularly small and medium-sized enterprises with budget constraints. As a result, the substantial initial investment becomes a significant restraint on the adoption of cleaner and more technologically advanced heavy-duty trucks, limiting market growth, despite their long-term environmental and economic benefits.

Autonomous trucks and electrification

The adoption of autonomous heavy-duty trucks is on the rise, offering significant potential to revolutionize the industry. These vehicles can operate with increased efficiency and reduced labor costs, making them highly attractive for logistics and transportation companies. Autonomous trucks also promise improved safety by reducing the risk of accidents caused by driver fatigue or human error. Businesses are increasingly exploring this technology to optimize supply chains and reduce operational costs, driving the demand for heavy-duty autonomous trucks.

The growing emphasis on electrification in the heavy-duty truck market is propelled by mounting environmental concerns and intensified regulatory pressure to curtail emissions. Electric heavy-duty trucks present several compelling advantages, such as reduced operational costs, decreased emissions, and quieter operation, making them a favored choice. As governments worldwide impose more stringent emissions standards and businesses strive to fulfill sustainability targets, the demand for electric heavy-duty trucks is witnessing a substantial upswing. This trend harmonizes with the global drive for eco-friendly transportation solutions, ushering in fresh opportunities for manufacturers and bolstering the expansion of the heavy-duty trucks market.

Technological advancements in the heavy-duty trucks market feature electrification, digitalization, and connectivity. Digitalization and connectivity consist of a telematics system and OTA updates. The telematics system monitors fuel consumption and vehicle performance. Over-the-air updates are used to upgrade software, enabling security and improvement of truck performance. Electrification projects battery-electric trucks and charging infrastructure. Most of the companies are introducing battery-electric trucks and improving charging infrastructure by initiating fast charging stations for heavy-duty trucks. Additionally, the advanced technology has discovered platooning. Travel in a platoon will reduce the dragging of the huge containers. The advancement and enhancement are an opportunity for new businesses to enter the market.

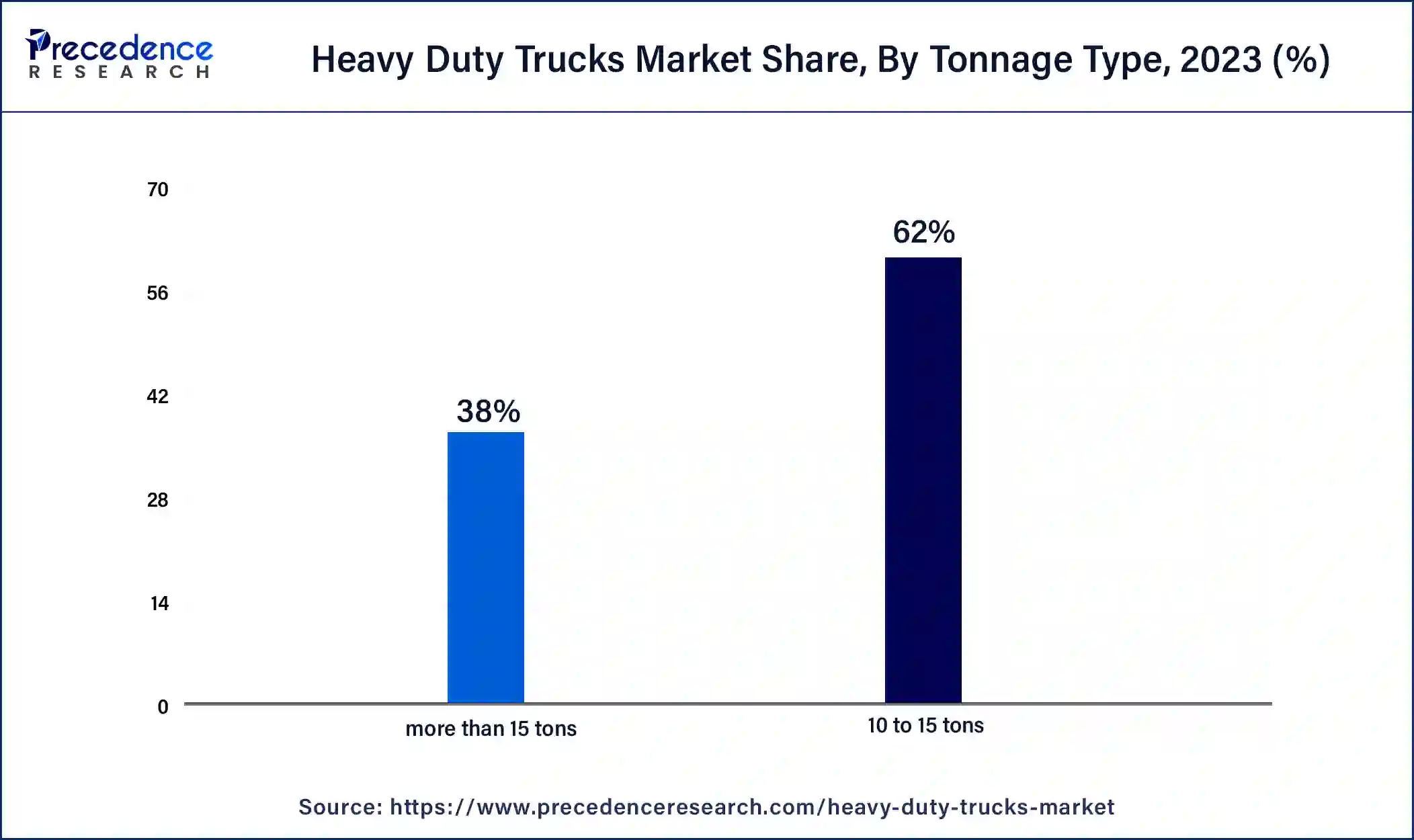

According to the tonnage type, the 10 to 15 tons segment has held 62% revenue share in 2024. In the heavy duty trucks market, the 10 to 15 tons category encompasses a segment known for versatility and adaptability. These trucks are favored for regional and urban logistics, as well as construction projects. The trend in this segment is marked by a surge in demand driven by the growth of e-commerce and last-mile delivery services, requiring trucks capable of maneuvering through city streets efficiently.

The more than 15 tons segment is anticipated to expand at a significantly CAGR of 12.8% during the projected period. The more than 15 tons category comprises heavy-duty trucks with substantial load-bearing capacity, often used in long-haul transportation and industries requiring bulk material transport. A noticeable trend is the shift towards improved fuel efficiency and lower emissions, as regulations become more stringent, and businesses seek cost-effective and environmentally friendly transport solutions. Additionally, the adoption of advanced safety features and autonomous technologies is on the rise in this category, enhancing both driver safety and overall operational efficiency.

Based on the class, the class 6 segment held the largest market share of 41% in 2024. Class 6 heavy-duty trucks typically have a gross vehicle weight rating (GVWR) ranging from 19,501 to 26,000 pounds. These trucks are commonly used for regional and local deliveries, making them crucial in urban settings. An emerging trend in the Class 6 segment is the adoption of alternative fuel options, including natural gas and electric powertrains. With the increasing focus on reducing emissions and operating costs, many fleet operators are considering these eco-friendly alternatives.

On the other hand, the class 7 segment is projected to grow at the fastest rate over the projected period. Class 7 heavy-duty trucks, on the other hand, have a GVWR between 26,001 and 33,000 pounds. These vehicles are often used for heavier regional or interurban delivery applications. In the Class 7 segment, a significant trend is the integration of advanced safety features and driver assistance technologies. These enhancements enhance driver safety, reduce accidents, and contribute to lower insurance costs for fleet owners. With the ongoing emphasis on road safety and regulatory requirements, the adoption of such technologies in Class 7 trucks is on the rise.

In 2024, the diesel segment had the highest market share of 69% on the basis of the fuel type. Diesel-powered heavy-duty trucks have long been the workhorses of the industry, offering robust performance and range. However, they face challenges due to environmental concerns and stricter emissions regulations. Despite this, diesel engines continue to evolve with cleaner and more fuel-efficient technologies.

The electric segment is anticipated to expand at the fastest rate over the projected period. Electric heavy-duty trucks are emerging as a sustainable alternative. With advancements in battery technology and charging infrastructure, electric trucks are gaining traction. The drive towards electrification is fueled by environmental regulations and a growing emphasis on reducing carbon footprints, making electric heavy-duty trucks a promising trend in the industry.

In 2024, the construction and mining segment had the highest market share of 52% based on application. In the heavy-duty trucks market, the construction and mining sector involves the use of robust, high-capacity trucks designed to transport heavy equipment, construction materials, and minerals. A notable trend in this segment is the integration of advanced telematics and fleet management systems, enabling precise tracking and efficient management of construction and mining fleets. Additionally, there's a growing focus on enhancing the durability and off-road capabilities of these trucks to meet the demanding requirements of construction and mining operations.

The freight and logistics segment is anticipated to expand at the fastest rate over the projected period. The freight and logistics segment encompasses trucks dedicated to the transportation of goods and commodities over long distances. This sector is experiencing a surge in demand for autonomous and electric heavy-duty trucks to optimize long-haul transportation and reduce operational costs. Moreover, the increasing need for real-time tracking and tracing solutions is driving the adoption of advanced connectivity technologies, contributing to improved efficiency and safety in freight and logistics operations.

By Tonnage Type

By Class

By Fuel Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

May 2025

September 2024