January 2025

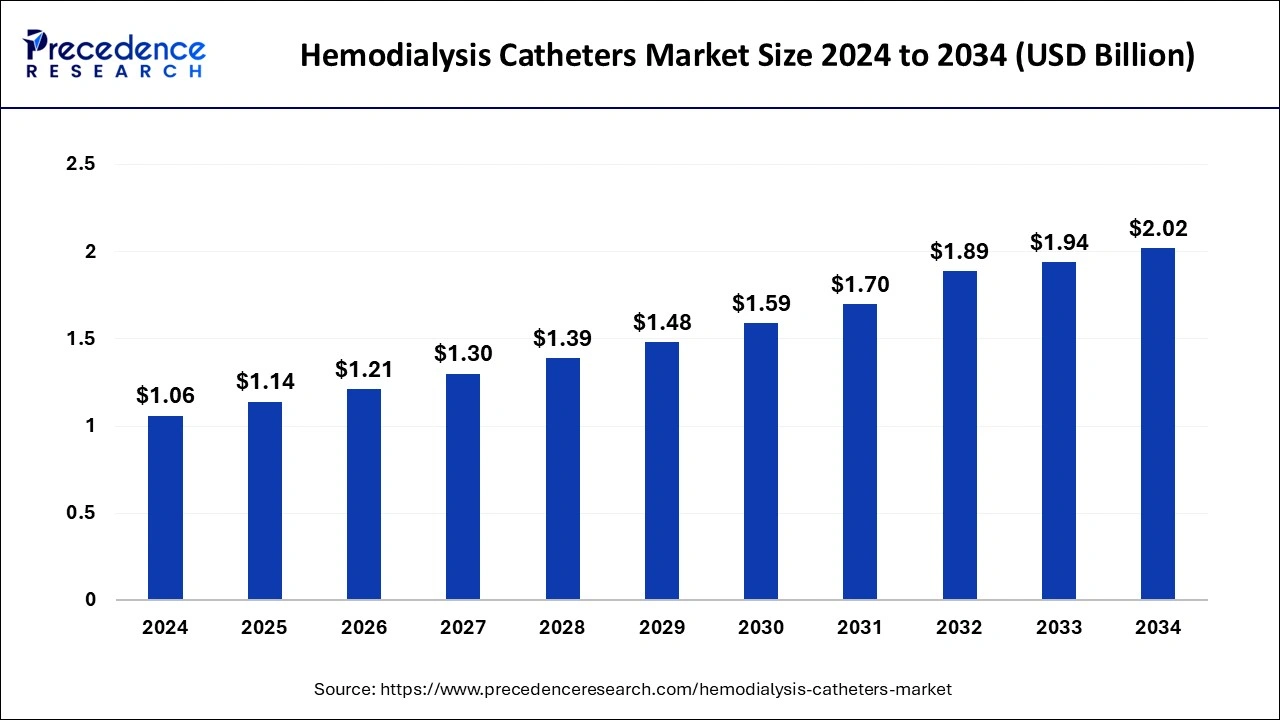

The global hemodialysis catheters market size is calculated at USD 1.14 billion in 2025 and is forecasted to reach around USD 2.02 billion by 2034, accelerating at a CAGR of 4.83% from 2025 to 2034. The North America hemodialysis catheters market size surpassed USD 550 million in 2024 and is expanding at a CAGR of 4.81% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hemodialysis catheters market size was estimated at USD 1.06 billion in 2024 and is predicted to increase from USD 1.14 billion in 2025 to approximately USD 2.02 billion by 2034, expanding at a CAGR of 4.83% from 2025 to 2034. The hemodialysis catheters market is driven by the rising prevalence of end-stage renal disease (ESRD) and chronic kidney disease (CKD).

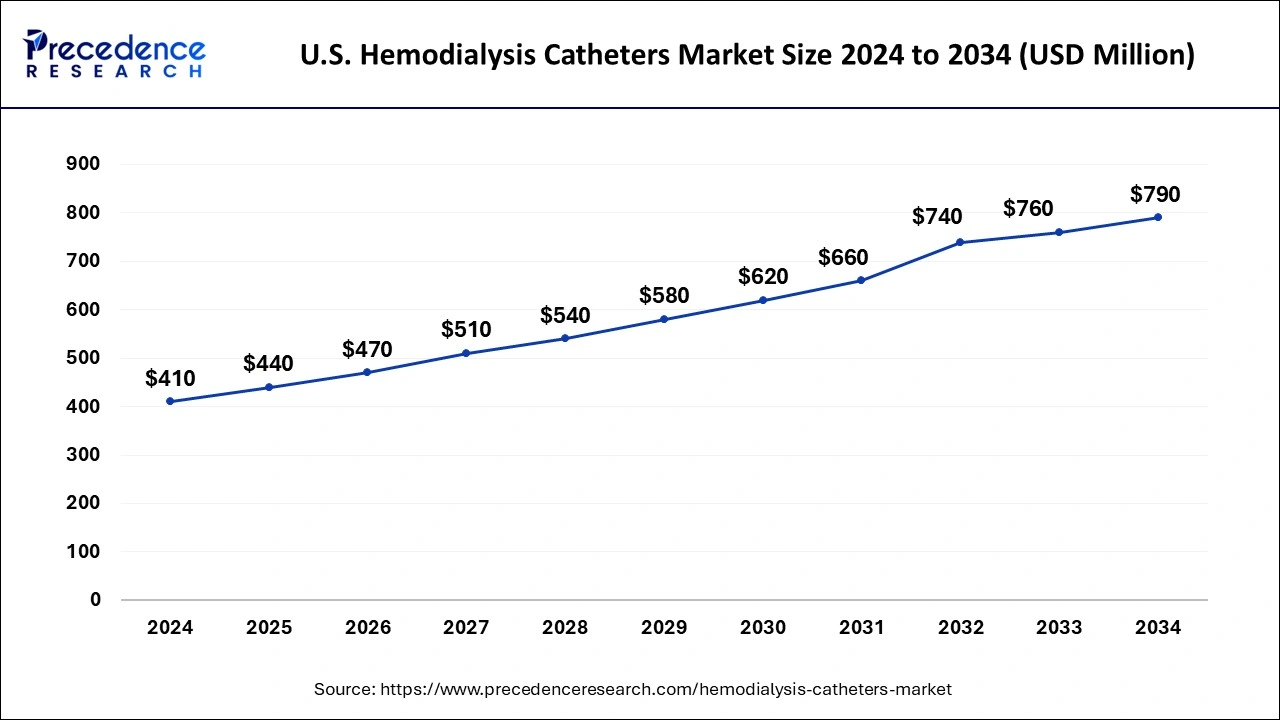

The U.S. hemodialysis catheters market size was valued at USD 410 million in 2024 and is expected to be worth around USD 790 million by 2034 with a CAGR of 4.87% from 2025 to 2034.

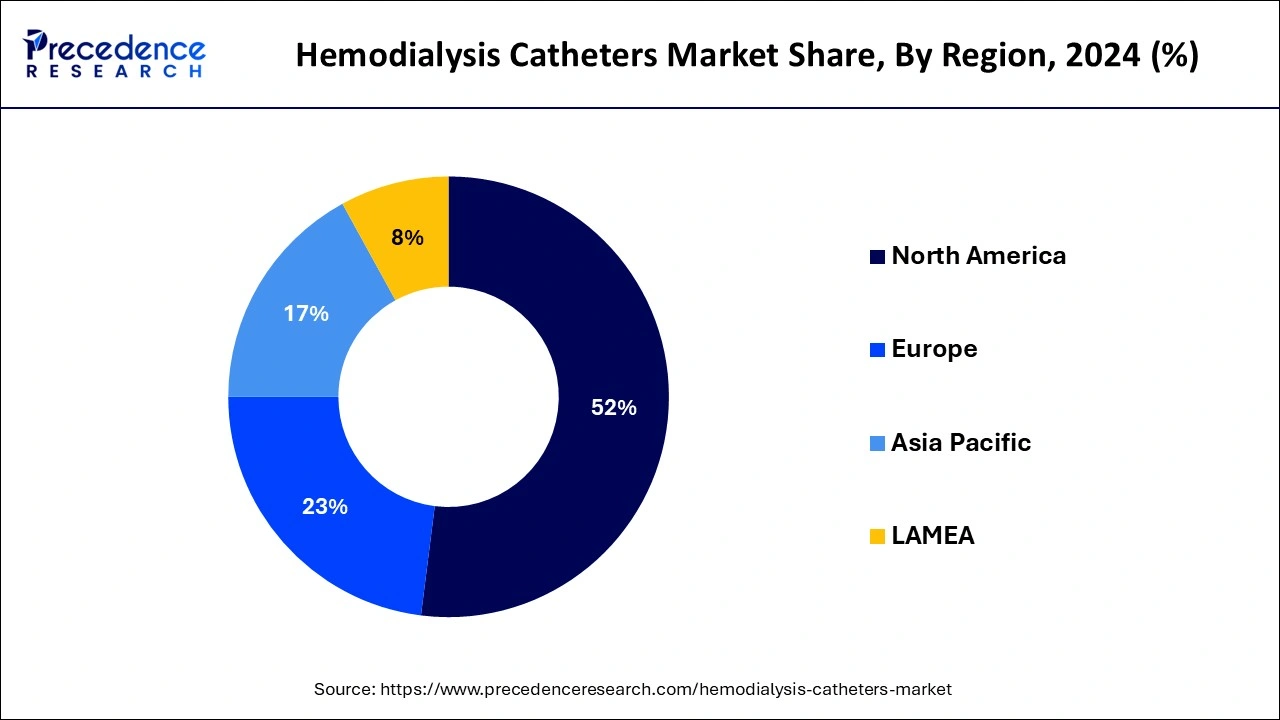

North America had dominated in the hemodialysis catheters market in 2024. Hemodialysis catheters must pass a stringent approval process administered by the Food and Drug Administration (FDA) of the United States. This guarantees that the products offered are the safest and best caliber. Hemodialysis care is held to a high standard thanks partly to the FDA's strict standards. Promising reimbursement rules in the United States and Canada facilitate the uptake of sophisticated hemodialysis treatments. Patients can receive therapy more easily because Medicare and commercial insurers frequently cover large amounts of the expenditures.

Asia-Pacific is the fastest growing in the hemodialysis catheters market during the forecast period. Hemodialysis is becoming more widely available due to large expenditures in healthcare infrastructure, such as brand-new hospitals and dialysis facilities. Implementing cutting-edge medical technologies, such as upgraded hemodialysis catheters, improves patient outcomes and treatment efficacy.

The expansion of regional producers of medical equipment in nations such as China and India lower expenses and increases the accessibility of hemodialysis catheters. Global medical device manufacturers are expanding their investments in Asia and introducing cutting-edge goods and innovations.

A flexible tube used for dialysis treatment is called a hemodialysis catheter. It is threaded to the right side of the heart and inserted into a blood artery in the upper chest or neck. Within the catheter are two tubes: one for returning blood to the patient and the other for transporting blood to the dialysis machine. Hemodialysis is a therapy that removes water and waste from the blood like healthy kidneys do. It aids in blood pressure regulation and the proper balance of vital minerals, including calcium, salt, and potassium. Hemodialysis catheters, or HDCs, are a crucial component of renal replacement medicine.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.06 Billion |

| Market Size by 2034 | USD 1.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.83% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Catheter Type, Product, Material, Tip Configuration, lumen, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of chronic kidney disorders

Renal replacement treatments (RRTs), like hemodialysis, are in high demand as the prevalence of chronic kidney illnesses rises. For patients with end-stage renal disease (ESRD), hemodialysis is an essential therapeutic option, and catheters are critical to making the process easier. Considerable technological progress has been made in the hemodialysis catheter market to improve catheter materials, design, and performance. Catheter tip designs, tunneled catheters, and antimicrobial coatings are innovations that have enhanced patient comfort, decreased infection rates, and improved outcomes. The hemodialysis catheter market is growing due to these developments. This drives the hemodialysis catheters market growth.

Increasing number of renal replacement therapy

When hemodialysis patients require vascular access, hemodialysis catheters are frequently preferred. This is particularly true in acute situations or when arteriovenous fistulas (AVFs) or arteriovenous grafts (AVGs) are not an option or have not worked well. Catheters are suitable for both short-term and long-term use, providing instant access and easy insertion. Hemodialysis catheters are in greater demand as hemodialysis operations increase in number.

Low awareness about kidney-related disorders

People might not take preventive actions to safeguard their kidneys if they are unaware of the risks to their kidneys. Kidney illness can arise because of lifestyle choices like smoking, eating poorly, and not exercising. Lack of knowledge may hinder individuals from adopting healthy habits that could stop or slow the development of kidney diseases, which would lessen the need for hemodialysis catheters. People who live in areas with poor access to healthcare facilities or a lack of suitable healthcare infrastructure may not be diagnosed with renal problems or receive treatment promptly.

This may be caused by a lack of healthcare personnel, financial difficulties, or geographic barriers. Even if someone is aware of their kidney illness, they cannot undergo essential interventions, such as hemodialysis, if they do not have access to healthcare services.

Complications associated with hemodialysis catheters

Reduced blood return can result from central vein stenosis brought on by long-term hemodialysis catheter use. Severe morbidity from central vein stenosis may necessitate intricate procedures like surgery or angioplasty. The demand for hemodialysis catheters is impacted by the limited long-term usage of these devices due to the danger of serious vascular problems. This limits the hemodialysis catheters market growth.

Technological innovations in catheter design

Patients receiving hemodialysis should be very concerned about infections. Antimicrobial coatings used in new catheter designs drastically lower the risk of infection. These coatings release antimicrobial chemicals that increase patient outcomes and catheter usage by preventing bacteria from growing on the catheter's surface. Better maneuverability and positioning of the catheter within the patient's vascular system are made possible by using shape memory alloys, such as nitinol, in their manufacturing. These materials provide easy insertion and ideal positioning since they can alter their shape in response to temperature variations.

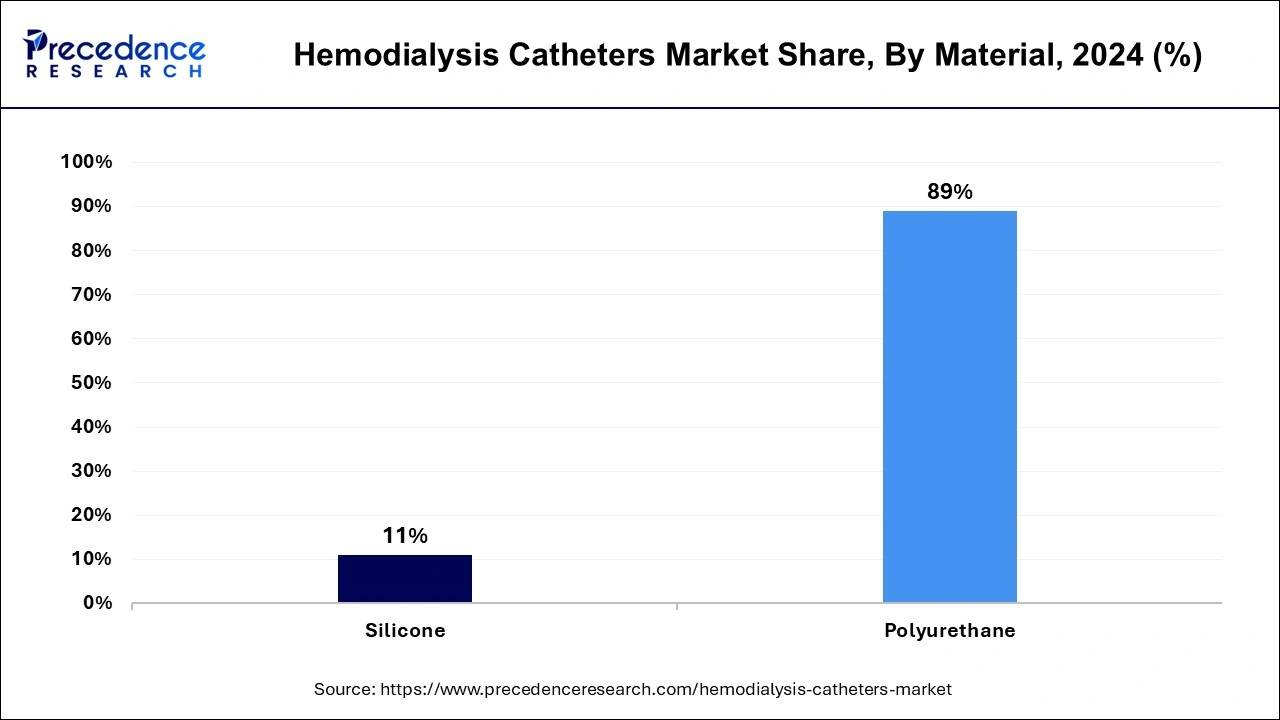

The short-term hemodialysis catheters segment dominated in 2024 in the hemodialysis catheters market. Catheters intended for short-term use are introduced over a guidewire, tapered, and stiff. They are typically utilized in an inpatient scenario when fluoroscopy is not necessary because they may be positioned at the bedside using the Seldinger technique. Interestingly, silicone or polyurethane is typically used to make these catheters. One feature that reduces the likelihood of vascular injury is the stiffness of polyurethane non-tunneled HDCs at room temperature, which becomes less stiff after installation as they approach body temperature.

The long-term hemodialysis catheters segment shows a significant growth in the hemodialysis catheters market during the forecast period. Tunneled catheters provide vascular access until long-term dialysis access is developed or matured, such as an arteriovenous fistula (AVF) or arteriovenous graft (AVG). Patients who have used up all their access choices for long-term dialysis access are also treated with them. They end in the right atrium and are optimally positioned into the jugular vein under fluoroscopic assistance. Flexible materials like silicone or polyurethane-polycarbonate copolymer make tunneled catheters to reduce catheter disintegration, vascular injury, and catheter-related problems. Copolymers of polycarbonate and polyurethane are consistently biocompatible.

The tunneled catheters segment dominated in 2024 in the hemodialysis catheters market. Tunneled catheters may decrease healthcare costs despite their potentially greater initial cost due to their longer lifespan and lower rate of complications. When infections and consequences are reduced, hospital stays, and medical procedures also decrease. By lowering the need for frequent catheter changes and handling issues related to non-tunneled catheters, tunneled catheters can simplify operations for healthcare practitioners.

In comparison, non-tunneled catheters are meant to be used temporarily. The tunneling procedure, in which the catheter is placed beneath the skin and then enters a big vein, decreases the danger of infection. By acting as a barrier against bacteria, the subcutaneous tunnel reduces the risk of bloodstream infections associated with catheter use.

The polyurethane segment dominated in 2024 in the hemodialysis catheters market. Due to its exceptional softness and flexibility, polyurethane is comforting for patients. Vascular injury and inflammation are less likely with polyurethane than with more stiff materials. Because polyurethane is so biocompatible, people are less likely to experience unpleasant reactions or immunological responses. This is especially important for materials close to tissues and blood.

Although polyurethane is flexible, it is also strong and long-lasting. Without losing structural integrity, it can endure the physical strains of frequent use and the pressures applied during hemodialysis.

The silicone segment shows a significant growth in the hemodialysis catheters market during the forecast period. Since silicone is well known for being highly biocompatible, using it in medical devices like hemodialysis catheters lowers the possibility of adverse reactions. Patients who need to utilize catheters for an extended period must have this feature. When compared to other materials, silicone catheters are softer and more flexible. Because of its flexibility, silicone is the material of choice for chronic dialysis patients since it improves patient comfort, particularly during extended use.

The smooth surface of silicone lessens the possibility of biofilm formation and bacterial adherence, which are frequent causes of catheter-related illnesses. This trait improves patient outcomes and dramatically reduces infection rates.

The step-tip catheters segment dominated in 2024 in the hemodialysis catheters market. Step-tip catheters are made with a gradual decrease in diameter in mind, which makes insertion easier and lowers the chance of vascular injury. Because of the exact design, there is little chance of kinking and dislodgment, providing stable and dependable access to dialysis treatments. Ideal blood flow rates are necessary for dialysis sessions to effectively remove waste materials and toxins from the blood. The step-tip design makes this possible. Higher flow rates correlate with better dialysis adequacy and patient outcomes.

The split-tip catheters segment is the fastest growing in the hemodialysis catheters market during the forecast period. Split-tip catheters are becoming increasingly popular because of their design, intended to enhance clinical results. These catheters usually offer higher blood flow rates and reduced recirculation than conventional catheters. This increase in performance results in more effective hemodialysis treatments, which shorten patients' total treatment duration and enhance their quality of life. Hemodialysis treatments are in greater demand due to the expanding global prevalence of end-stage renal disease (ESRD) and chronic kidney disease (CKD).

Due to the increase in demand, dependable and effective catheters are required. In response to this expanding requirement, split-tip catheters are becoming increasingly well-liked due to their greater performance and safety features.

The double-lumen segment dominated in 2024 in the hemodialysis catheters market. Treatment sessions run more smoothly when healthcare professionals can easily handle and utilize double-lumen catheters. Medical professionals may need less training time because these catheters are simple. Because they need fewer insertions and adjustments, these catheters are typically more comfortable for patients. This may result in better patient compliance and general happiness with their dialysis therapy.

By Catheter Type

By Product

By Material

By Tip Configuration

By lumen

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

March 2025