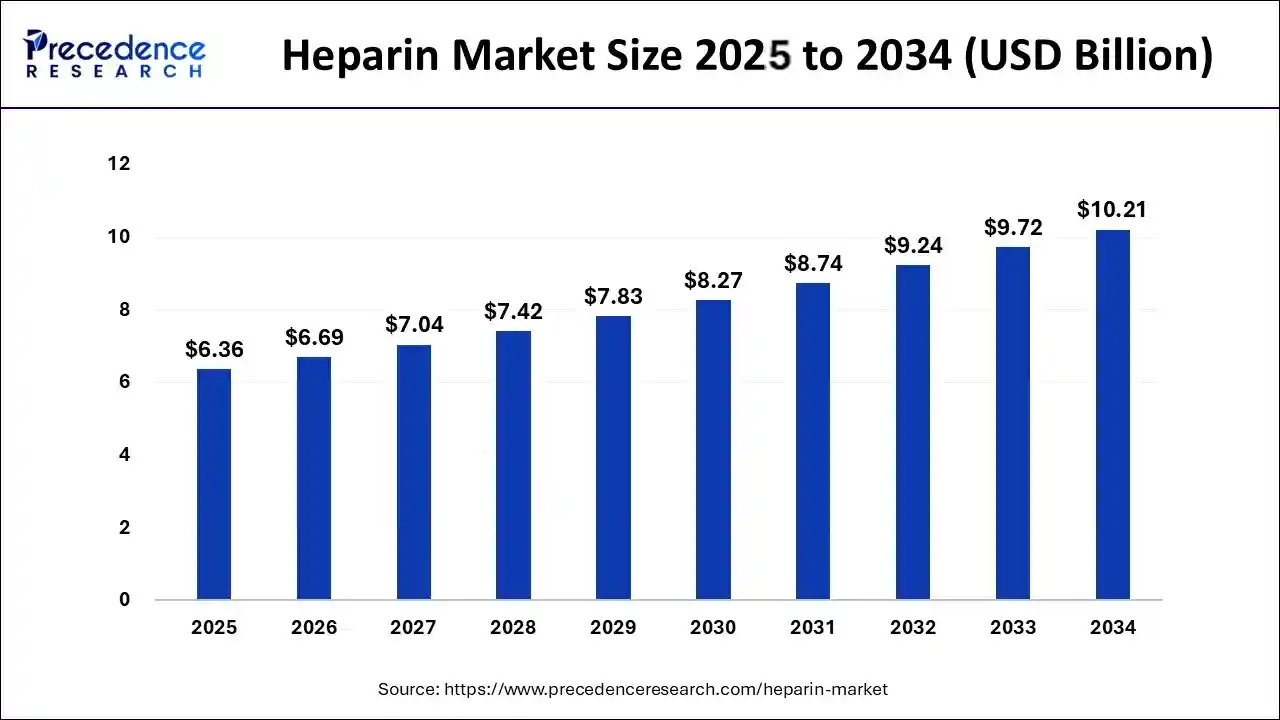

The global heparin market size is calculated at USD 6.36 billion in 2025 and is forecasted to reach around USD 10.21 billion by 2034, accelerating at a CAGR of 5.37% from 2025 to 2034. The North America market size surpassed USD 2.36 billion in 2024 and is expanding at a CAGR of 5.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global heparin market size accounted for USD 6.05 billion in 2024 and is expected to exceed around USD 10.21 billion by 2034, growing at a CAGR of 5.37% from 2025 to 2034.

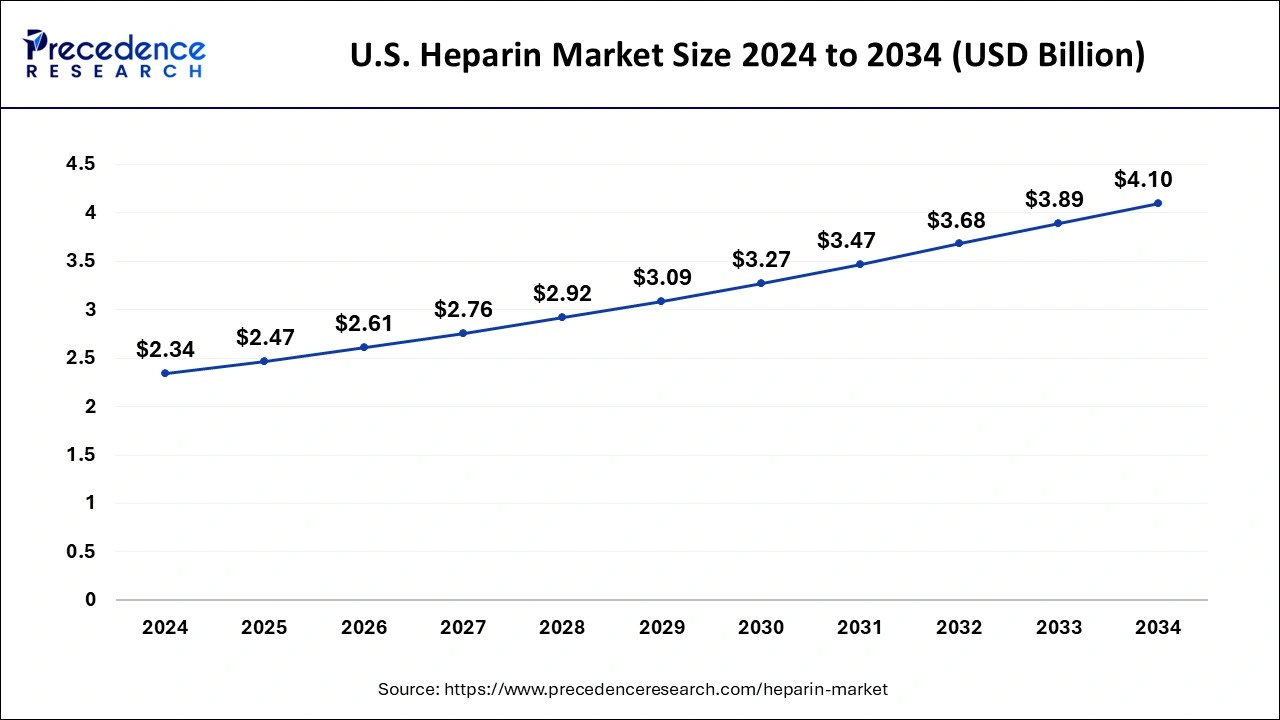

The U.S. heparin market size reached was exhibited at USD 2.34 billion in 2024 and is projected to be worth around USD 4.10 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034.

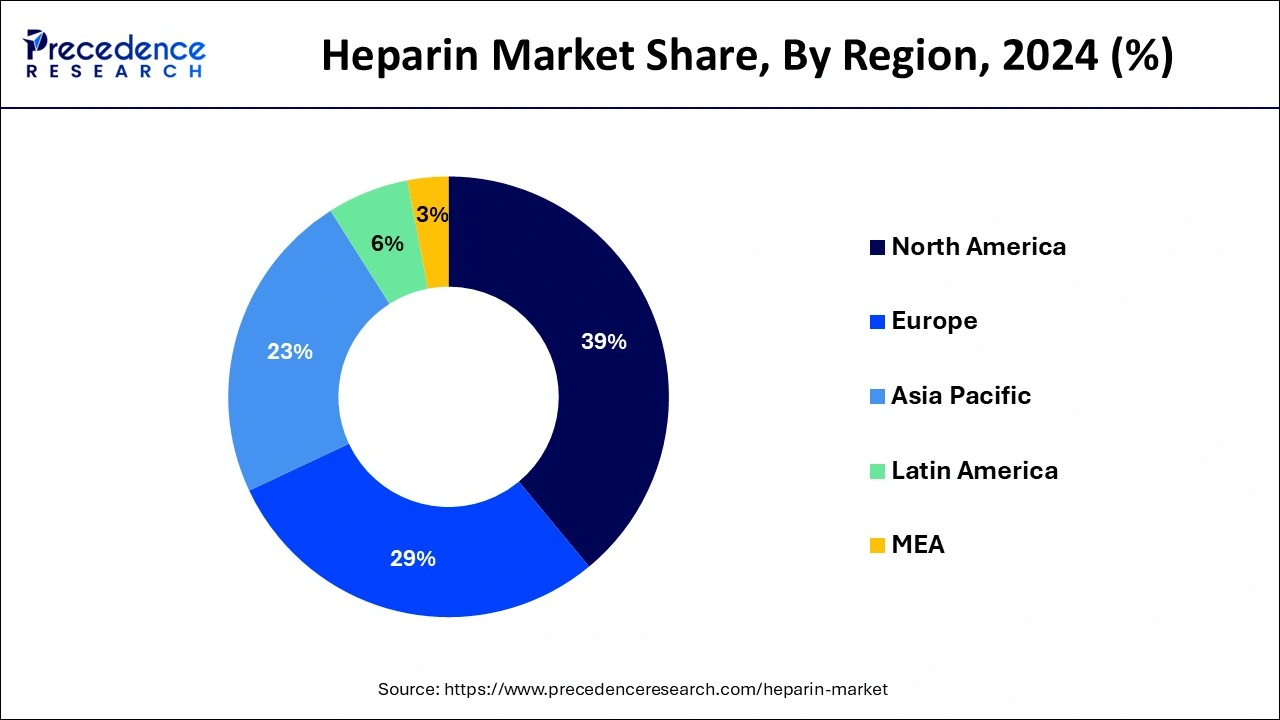

North America has garnered the largest share in 2024. The growth of the heparin market in the North America region is being driven by rising incidences of cardiovascular disorders. As per the Centers for Disease Control and Prevention, approximately 12.1 million people in the U.S. will have atrial fibrillation by 2034. In addition, growing healthcare expenditure as well as expansion of healthcare industry are also driving the North America heparin market. The North America region was valued at USD 2.6 billion in 2024.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. China and India dominated the heparin market in Asia-Pacific region. The Asia-Pacific heparin market growth is attributed to the expansion of healthcare infrastructure. The other factors such as adoption of technologically advanced products, growing initiatives by government, and rising patient population are contributing towards the growth of Asia-Pacific heparin market.

One of the significant factors driving the growth of global heparin market is rising incidences of cardiovascular and venous thromboembolism. Deep vein thrombosis and pulmonary embolism harm around 900,000 people in the U.S. each year, as per the data published by the Centers for Disease Control and Prevention in 2018. This is expected to drive demand for heparin in the global market.

Another factor boosting the growth of global heparin market is rising geriatric population. The geriatric population is more vulnerable to various disorders such as orthopedic disorders and arthritis. In 2021, for example, it was anticipated that more over 350 million individuals worldwide had arthritis. As a result, the growing number of senior people suffering from orthopedic diseases drives up demand for surgical treatment, propelling the industry forward. Thus, this factor is supporting the growing demand for heparin in the market over the forecast period.

The COVID-19 pandemic was said to have had a positive influence on the global heparin market, boosting upper income for number of major players operating in healthcare sector. Furthermore, as the number of people infected with COVID-19 grows, so does the demand for heparin, which helps to control the symptoms of respiratory infections while also thinning the blood.

The technologically sophisticated products, regulatory approvals, and the launch of new products, cooperation agreement, and acquisition with other market players are all priorities for key competitors in the worldwide heparin market. These methods are likely to propel the global heparin industry forward. The government all around the world are collaborating with major market players for the growth and development of global heparin market. In addition, the government is also heavily investing in the launch of new products, which is contributing towards the global heparin market.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.36 Billion |

| Market Size by 2034 | USD 10.21 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.37% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Route of Administration, Packaging, Container, Therapeutics, By Treatment, By Availability, By Application, By Source, By Ingredients, By Strength, By End Use, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

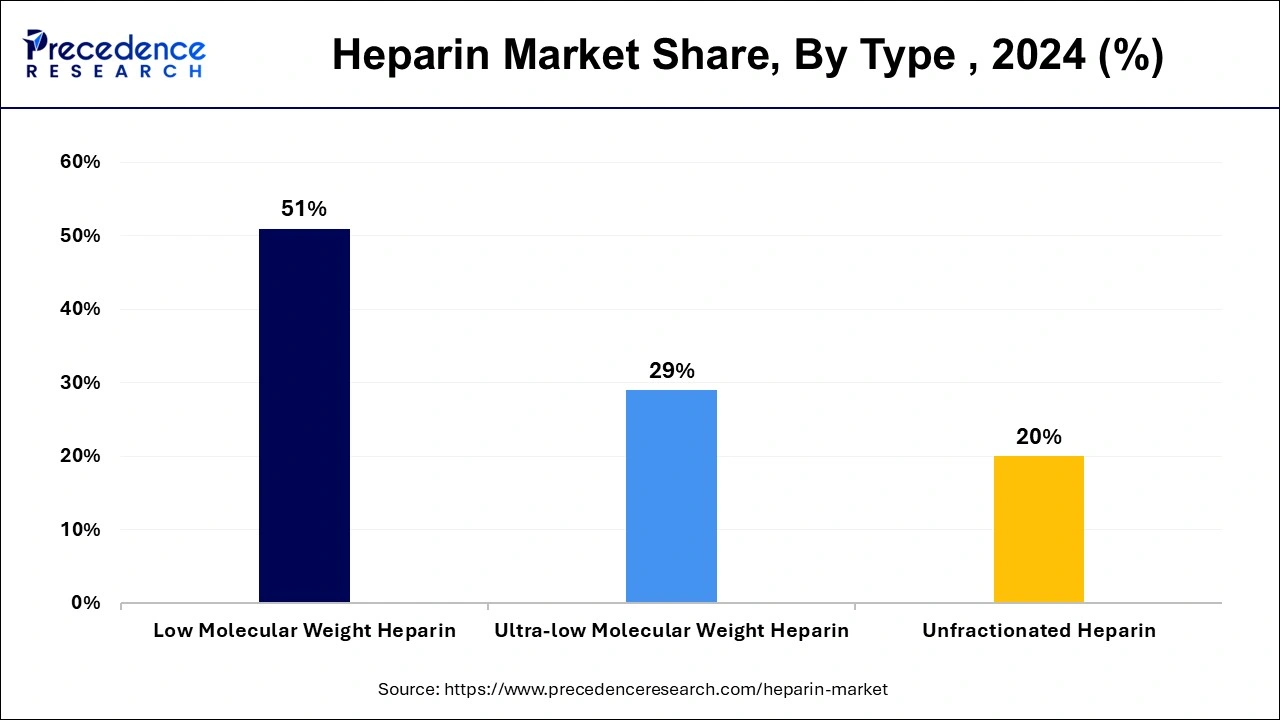

The low molecular weight segment accounted largest revenue share in 2023. The growth of the low molecular weight segment is being driven by growing adoption of this kind of products globally. In addition, the rising product launch by market players is driving the growth of segment. The introduction of low molecular weight heparin products to the global heparin market. For example, Valeo Pharma Inc., reported in November 2019 that they had submitted a new drug submission for a low molecular weight heparin biosimilar to Health Canada, which had been accepted for review.

The ultra-low molecular weight segment is fastest growing segment from 2024 to 2033. The growth of the ultra-low molecular weight is attributed to the launch of products with increased pharmacological properties.

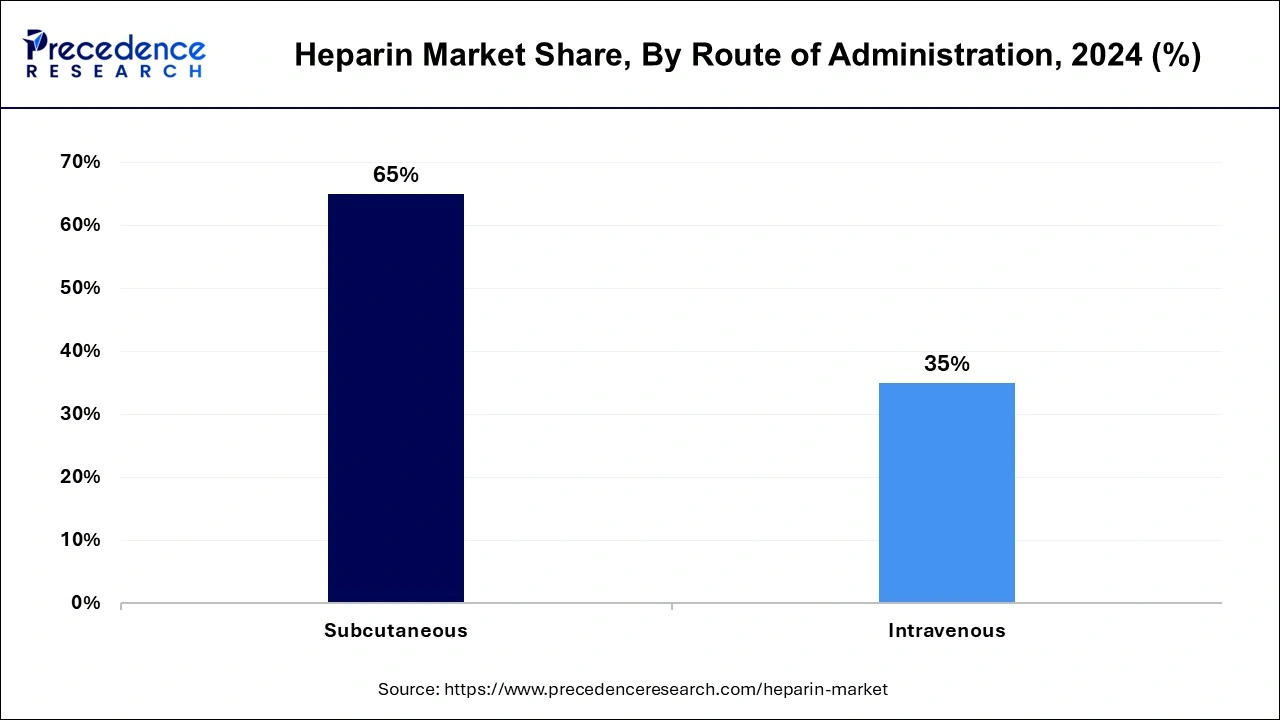

The subcutaneous segment dominated the heparin market in 2023. The growth of the subcutaneous segment is being driven by the growing adoption of low molecular weight heparin. The subcutaneous route of administration is a low-cost process that is carried out in hospitals.

The intravenous segment is fastest growing segment over the forecast period. It comprises a few of unfractioned heparin’s most well-known intravenous product lines. The intravenous route of administration is widely adopted by healthcare practitioners.

The coronary artery disease segment has garnered highest market share in 2023. The growth of the segment is attributed to the rising prevalence of heart disorders. As per the American Heart Association, around 92.1 million American adults suffered from cardiovascular disease in 2018. Furthermore, cardiovascular disease is responsible for around one in every three deaths in the U.S., responsible for roughly 2,300 deaths per day.

The venous thromboembolism segment is expected to hit strong growth from 2024 to 2033. One of the key elements driving the growth of segment is increased awareness of thrombosis. The International Society on Thrombosis and Haemostasias, Inc. for example, has launched an online portal to raise thrombosis awareness among patients.

The hospitals & ambulatory surgical centers segment dominated the heparin market in 2023. This is mostly due to an increased reliance on health care experts for product prescriptions and proper administration, particularly via intravenous infusion. In addition, growing hospital visits is also driving the growth of the segment.

Theclinics segment is fastest growing segment of the heparin market in 2023. Due to many of these medications are provided at dialysis clinics, among other places, the clinics category is predicted to account for highest market share in the global heparin market over the projected period.

By Type

By Route of Administration

By Packaging

By Container

By Therapeutics

By Treatment

By Availability

By Application

By Source

By Ingredients

By Strength

By End Use

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client