November 2024

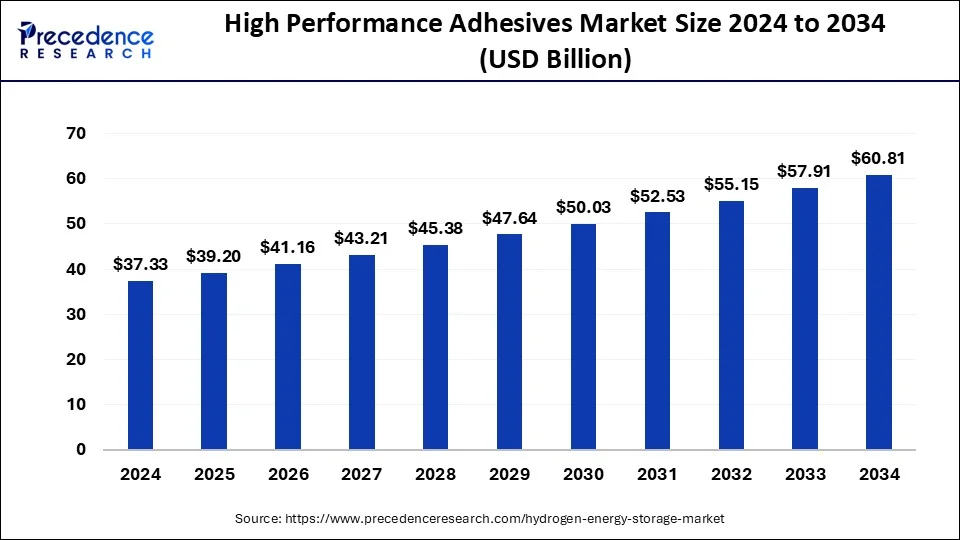

The global high performance adhesives market size is calculated at USD 39.20 billion in 2025 and is forecasted to reach around USD 60.81 billion by 2034, accelerating at a CAGR of 5.00% from 2025 to 2034. The Asia Pacific market size surpassed USD 16.43 billion in 2024. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global high performance adhesives market size was estimated at USD 37.33 billion in 2024 and is predicted to increase from USD 39.20 billion in 2025 to approximately USD 60.81 billion by 2034, expanding at a CAGR of 5.00% from 2025 to 2034.

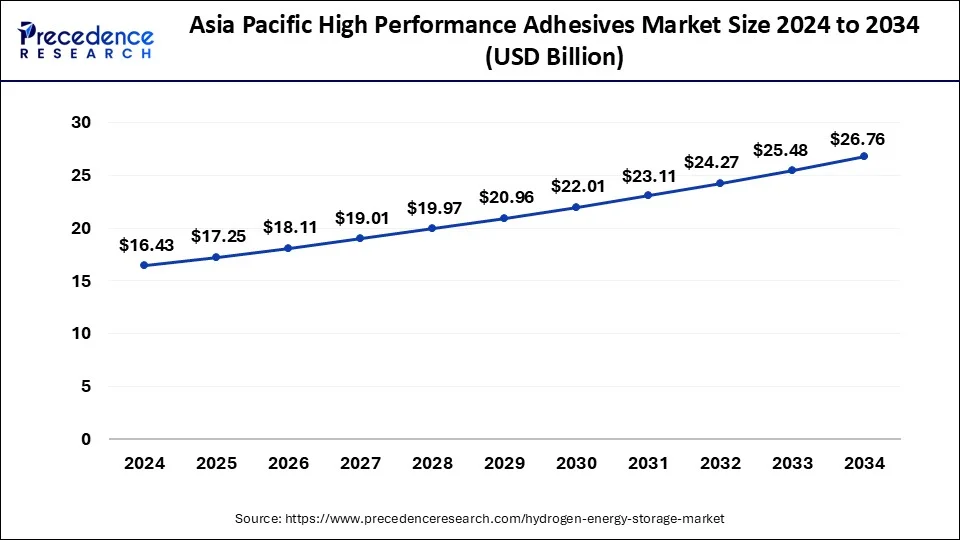

The Asia Pacific high-performance adhesives market size was estimated at USD 16.43 billion in 2024 and is predicted to be worth around USD 26.76 billion by 2034, at a CAGR of 5.00% % from 2024 to 2034.

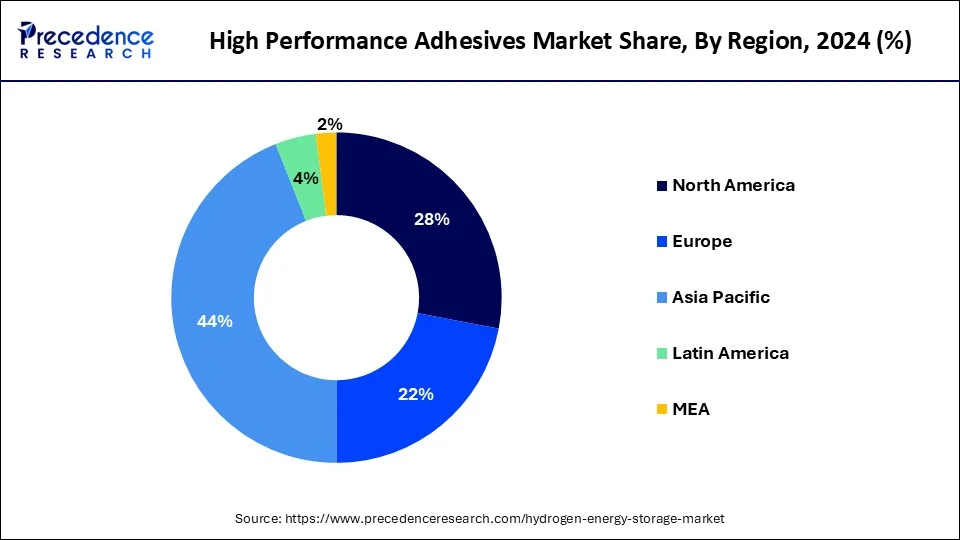

Globally, Asia Pacific appeared as leading and fastest-growing regional market for high-performance adhesives. Escalating application of high-performance adhesives in the construction, transportation, and medical sector is estimated to offer new appealing growth prospects to this market. Particular growth contributors of the market in this region include enormous economic growth, development in manufacturing activities, and accessibility of economical labor, budding end-use markets, and the worldwide shift of production services from established markets to evolving markets. Asia Pacific gathered prominent revenue share of the complete high-performance adhesives market on account of augmented infrastructural expansions, technological progressions and consumer responsiveness in this region. Further, research institutions plusmultiple manufacturers are undertaking different initiatives and offering huge funding to cultivate low-cost and long-lasting high-performance adhesives. They are also striving hard to advance the characteristics of high-performance adhesives for other end-use sectors.

High-performance adhesives North America is likely to take a foremost hit on account of COVID-19 epidemic in 2020. Nevertheless, steps undertaken by the federal government to release substantial amounts of fiscal stimulus including around USD 2 trillion packages is foreseen to deliberately reestablish the U.S. economy and substitute regional growth.

Robust requirement form the medical and aerospace industries is considered to be a foremost driving factor for the high-performance adhesives market growth across the globe. High-performance adhesives deliver exceptional mechanical and physical properties which make them appropriate for different high-end applications in the medical and aerospace and sector. Medical and aerospace end-user sector are expected to record firmest compound annual growth rate throughout the assessment period.

Additionally, emergent aged population, likelihood of additional unusual infectious sickness epidemic such as COVID-19 and upsurge in cardiovascular illnesses on account of unhealthy lifestyle is anticipated to trigger sizable funding by international and government institutions in healthcare industry. All these factors are together augmenting the demand for high-performance adhesives across the world.

| Report Highlights | Details |

| Market Size in 2024 | USD 60.81 Billion |

| Market Size in 2025 | USD 39.20 Billion |

| Market Size by 204 | USD 37.33 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.00% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Global high-performance adhesives market has been bifurcated depending upon different products into silicone, epoxy, acrylic and polyurethane. Out of these, epoxy product type emerged as prevalent segment on account to of its widespread application compared with other segments. This product type is projected to endure its stronghold during the prediction period on account of great temperature resistance of epoxy adhesives and its compatibility with different substrates employed in a diversity of end-user sectors.

Numerous kinds of formulation technology employed in the high-performance adhesives industry are water-based, UV-curable, solvent-based and hot melt. Among these technologies, solvent-based technology emerged as prevalent segment and accounted for prominent revenue stake of the market. However, this growth is declining gradually on account of hazardous impacts VOCs included by these solvent-based. On the other hand, the water-based technology segment is predictable to gain popularityat significant pace during years to come.

High performance adhesives based water-based technology offer outstanding adhesion to polar substrates and also deliver great resistance to extreme ecological circumstances. The main applications of this technology are construction and the packaging sectors among others.

Plentiful end-use industries of high-performance adhesives include electrical & electronics, packaging, medical, transportation, construction and others. Out of these end-users, medical sector has emerged as fastest-growing application sector for the global high-performance adhesives market in the assessment period. The snowballing elderly population and progressions in medical devices will linger to trigger the application of cyanoacrylic and UV curable high-performance adhesives in different types of medical devices and accessories. This will comprise hearing aids, IV syringes, delivery systems, catheters, and silicone rubber components and others. Further, improvements and advancements in the medical sector are likely to reinforce the demand of the high-performance adhesives market in this sector during forthcoming years.

Adhesives apparently also show enormous latent for usage in the automotive industry for the purpose of car digitization. They can be utilized to insulate cameras and sensors, safeguard wiring components in vehicles and manage the temperature of processor. Further, high-performance adhesives find extensive application in footwear applications on account of their light weight and bond strength characteristics. The footwear application is conquered by thermoplastic polyurethane-based adhesives.

By Technology

By Product

By End-User

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2024

July 2024

October 2024