March 2025

High Voltage Battery Market (By Battery Capacity: 75 kWh–150 kWh, 151 kWh–225 kWh, 226 kWh–300 kWh, >300 kWh; By Battery Type: Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt Oxide, Lithium Nickel Cobalt Aluminium Oxide, Others; By Voltage: 400–600V, >600V; By Driving Range: 100–250 miles, 251–400 miles, 401–550 miles, >550 miles; By Applications: Passenger cars, Bus, Trucks, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

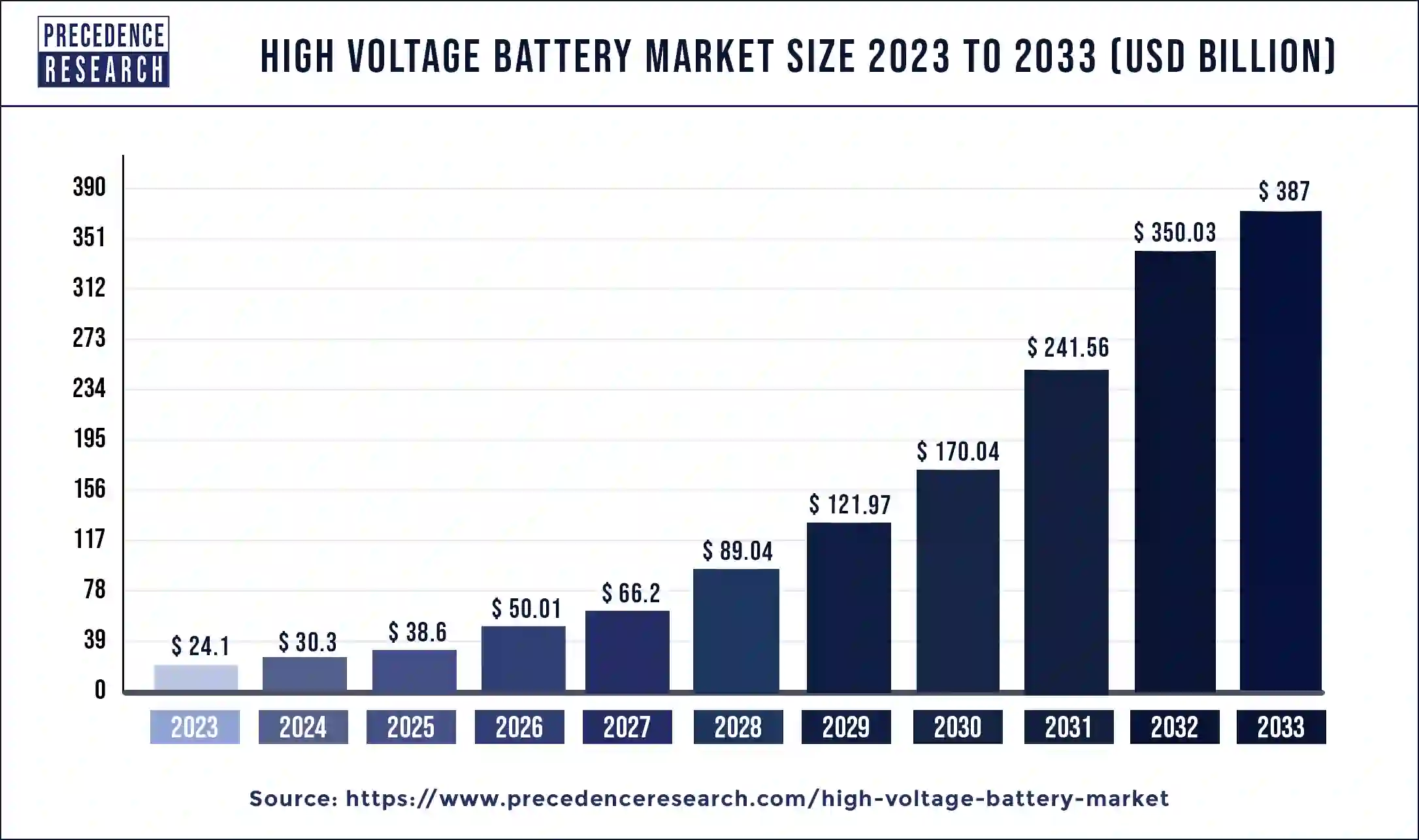

The global high voltage battery market size accounted for USD 24.1 billion in 2023 and is expected to hit around USD 387 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 31.99% from 2024 to 2033.

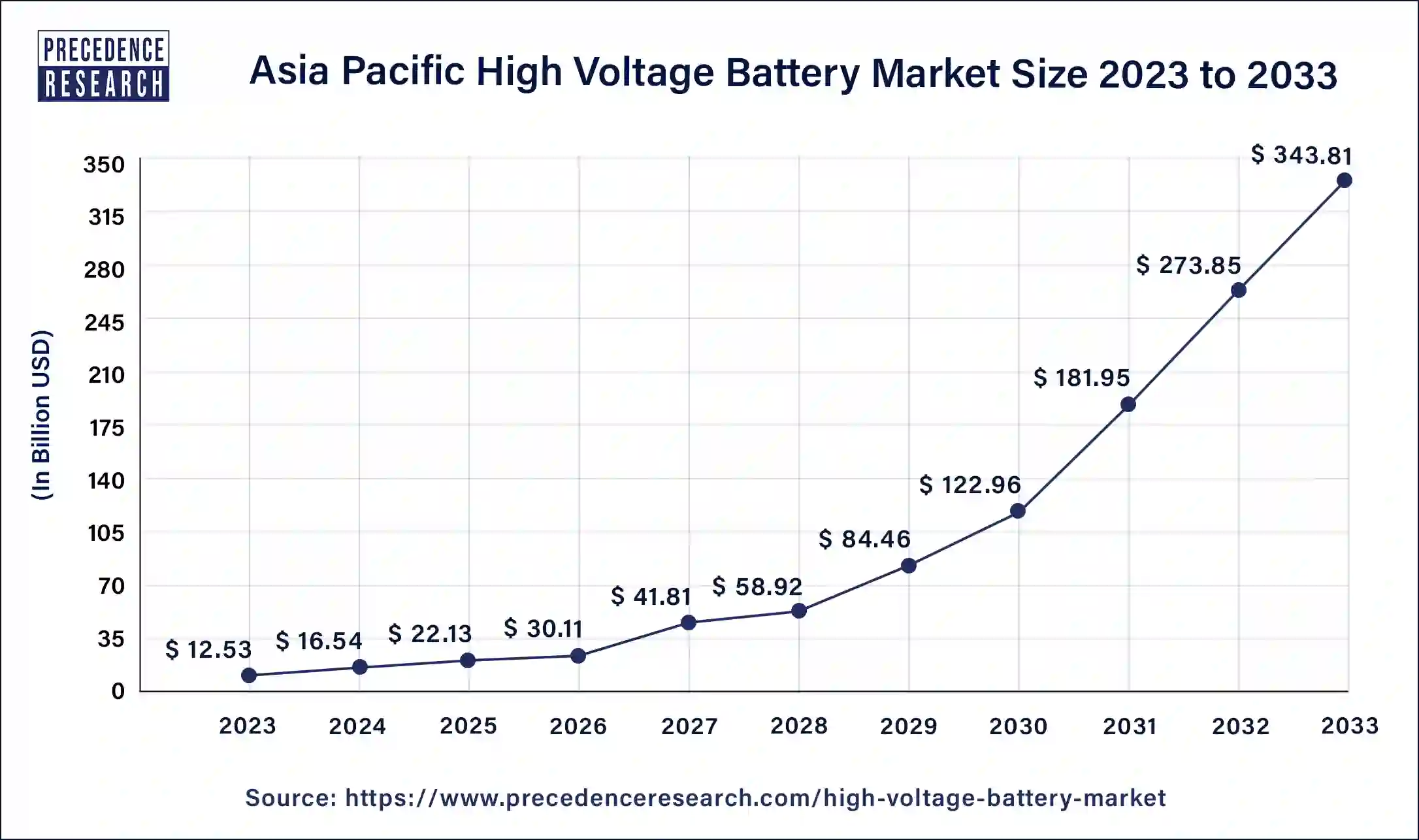

The Asia Pacific high voltage battery market size was valued at USD 12.53 billion in 2023 and is estimated to reach around USD 343.81 billion by 2033, growing at a CAGR of 39.26% from 2024 to 2033.

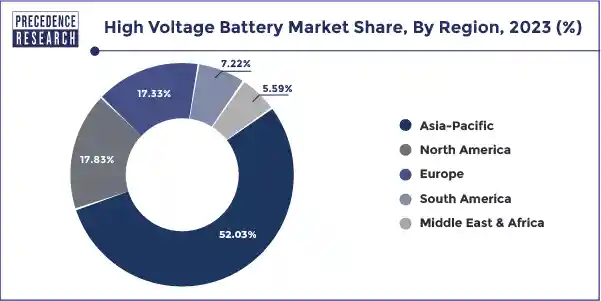

Among the various regions like Asia Pacific, Europe, North America and the RoW. The Asia Pacific is expected to hold the largest market share. Various factors like the domination of Chinese Industry in terms of Electric vehicle sector, strong economic growth, rising focus towards smart cities and favorable government interference have appreciated the demand of high voltage battery in this region. Among the region China accounts for highest market share of about 78.8% in the global high voltage market which are the results of growing electric busses in the country. China and South Korea are also the biggest manufactures of high voltage battery which also highly contribute to the supply chain industry of high voltage battery. Enormous opportunities lie in the country like China where Tesla is planning to produce 500,00 cars in China and many more such developments are expected to help Asia Pacific to gain the largest market share.

The high voltage battery is the type battery that allows for higher-than-normal voltage. It has higher energy density than standard lithium–ion polymer batteries. High Voltage battery system are rated around 400V and are able to get charged and discharged faster than low voltage batteries. They do not need large conductors as their voltage is too high. The lithium high voltage battery is more energy intensive as compared to traditional LiPo batteries. They are made up of Lithium cobalt oxide, lithium iron phosphate, lithium manganese oxide, lithium nickel manganese cobalt oxide (NMC).

The high voltage lithium polymer batteries having the nominal voltage over 3.7 V are having the ability to retain more power as compared to ordinary batteries. They are quickly chargeable and provide high output. These batteries have high application in hybrid and electric industries like boat motors, drones etc. They are quite expensive and have complications regarding the recycling of batteries, due to the presence of toxic and hazardous metal content requiring extra attention. The enhanced technology of high voltage batteries and matured safety ratings will help the particular market to grow in the upcoming years.

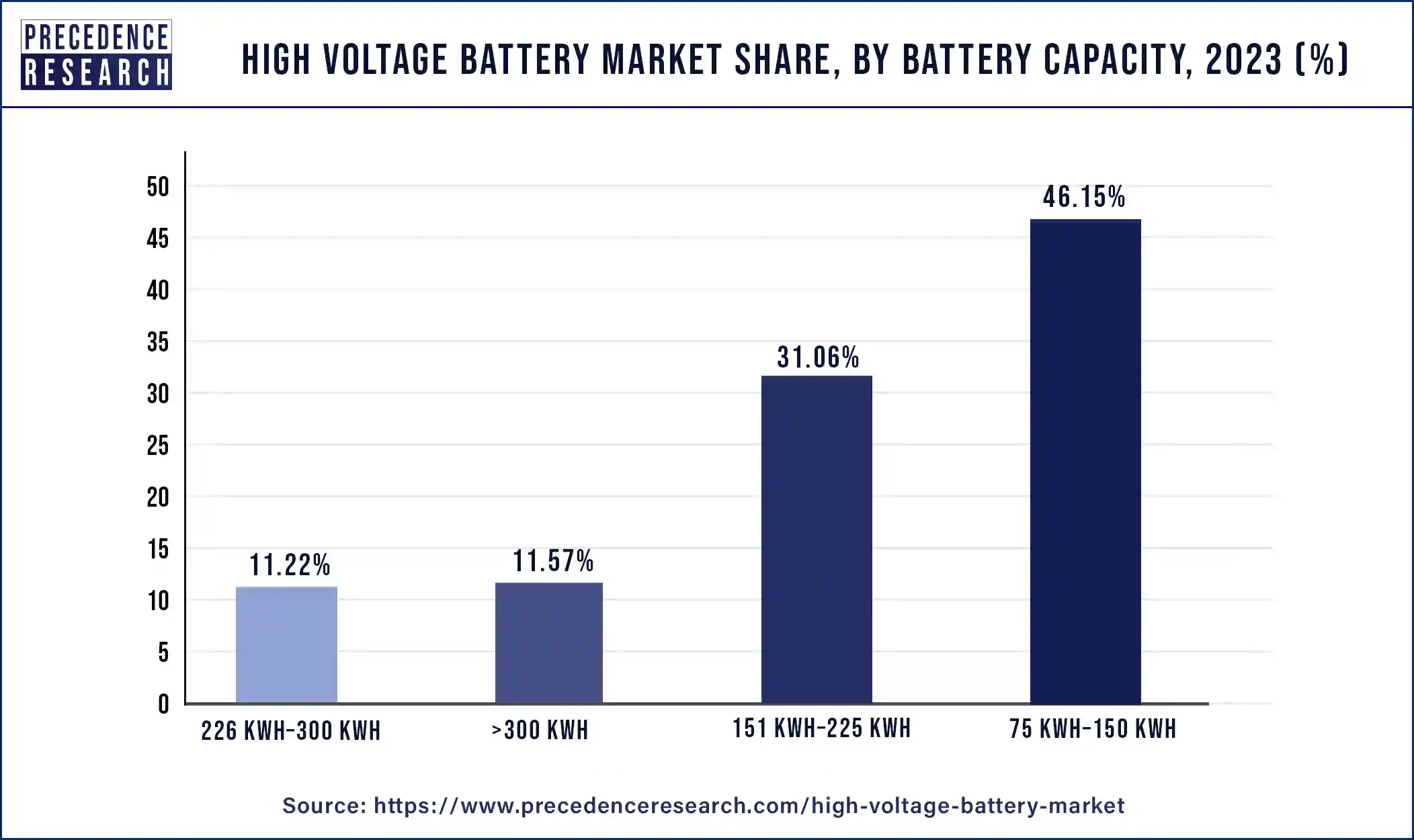

The increasing demand of high driving range vehicles, smart transportation and the advancement in batteries chemistry are the factors which are expected to play an important role in the growth of high voltage market. The battery capacity of > 300 kWh batteries is expected to be the reason for it being the largest contributor in the high voltage battery market. The growth of these type of batteries are generally driven by the dominance of electric bus industry in country like China. The electrification of public transport is driving the demand of electric buses and trucks which eventually has pushed the demand of high voltage batteries in the market.

The primary insights of various reports shows that Tesla semi’s battery pack will have the capacity of 800-1000 kWh, so it will be a game changer in the the industry of electric truck, as the majority of Tesla semi-trucks are pre ordered. About 90% of the electric buses falls into the category of high voltage batteries, and it is expected to dominate in the high voltage market in the forecasting period. Overall factors such as dominating EV industry, strong economic growth, introduction to smart cities, Gigafactory related development, and various government initiatives have pushed up the demand of high voltage batteries in the various regions.

In wake of COVID-19 the continuous rising demand for power supply from the critical infrastructure have driven the market of high voltage battery. The COVID- 19 situation has somewhat downsized the lithium ion battery market due to the hindrance in the supply of batteries as the result of supply chain disruptions.

| Report Coverage | Details |

| Market Size in 2023 | USD 24.1 Billion |

| Market Size by 2033 | USD 387 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 31.99% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Battery Capacity, Battery Type, Voltage, Driving Range, Applications, and Geography |

| Companies Mentioned | Tesla (US), BYD (China), LG Chem (South Korea), Samsung SDI (South Korea), and CATL (China) |

Key Market Trends

Drivers in High Voltage Battery Market

Challenges in High Voltage Battery Market

Based on battery capacity, the >300 kWh segment is observed to witness the fastest rate of expansion during the forecast period. The >300 kWh battery capacity has a potential of holding substantial amount of energy while applied for heavy vehicles such as buses and trucks. This factor plays a crucial role in the expansion of the segment. The rising adoption of energy efficient buses with the implementation of government policies creates a potential for the segment to grow. Electric buses with battery capacities of 300 kWh can achieve ranges varying from 214 to 300 km depending on factors like heating systems, driving behavior, and weather conditions. These variations highlight the importance of larger battery capacities to accommodate different operational scenarios and ensure reliable service.

Among the high voltage battery market, the high voltage battery >75kWh battery capacity are used in electric passenger cars, electric trucks, and electric buses. The lithium ion batteries have dominance in the market as the various key market players are at the forefront of developing electric vehicles. Lithium-ion batteries are the mainstream battery cells for electric vehicles but only 3.6V per cell. The modules are connected in the series of 280V,360V, etc. The nickel-metal hydride, lead acid and ultracapacitors are also used in electric vehicle batteries. Among these the Lithium Iron Phosphate battery (LFP) have various applications in cars, bicycles and solar devices. These types of batteries are well suited for the applications which require high-load currents and endurance.

The lithium nickel-cobalt-Aluminum oxide have different applications such as power grid application, medical devices and electric cars. The market leader Tesla deploys NCA batteries in their electric vehicles system. The other NMC batteries can also use in same application like NCA batteries. The use of high voltage batteries is mostly in hybrid and electric industries.

| By Battery Capacity | 2020 | 2021 | 2022 | 2023 |

| 75 kWh–150 kWh | 5,372.7 | 6,855.6 | 8,656.7 | 11,117.1 |

| 151 kWh–225 kWh | 4,164.8 | 5,065.1 | 6,111.6 | 7,482.8 |

| 226 kWh–300 kWh | 1,608.8 | 1,914.0 | 2,260.5 | 2,704.1 |

| >300 kWh | 1,396.7 | 1,757.3 | 2,192.1 | 2,782.4 |

The high voltage batteries have increasing demand for sectors like high driving range vehicles and in smart transportation which are likely to drive the market in forecast period. The >300kWh batteries is mostly used in electric bus industry especially in China. The applications are mostly found in electric public transports like electric buses and trucks which in turn are expected to drive the high voltage battery market. In the present scenario most of the electric vehicles falls under the range of 251-400 miles and 401-550 miles driving range and are expected to move towards > 500 miles range which will coordinate with the advancement of high voltage battery.

The aerial survey drones use a standard 22.V or 44.4V battery and the energy of high voltage lithium battery increases its flight time under the same user environment. The attributes like high energy density, longer battery life, and high and stable discharge platforms have provided benefit in terms of gaining large scale in the battery market.

The buses segment is observed to sustain the dominance during the predicted timeframe. The rising adoption of electric buses for public transportation purposes to curb environmental concerns creates a significant potential for the segment to grow. Rapid urbanization has led to increased traffic congestion and air pollution in cities, prompting authorities to seek cleaner and more efficient public transportation solutions. Electric buses offer an environmentally friendly alternative to traditional diesel or gasoline-powered buses, with zero tailpipe emissions and reduced noise pollution.

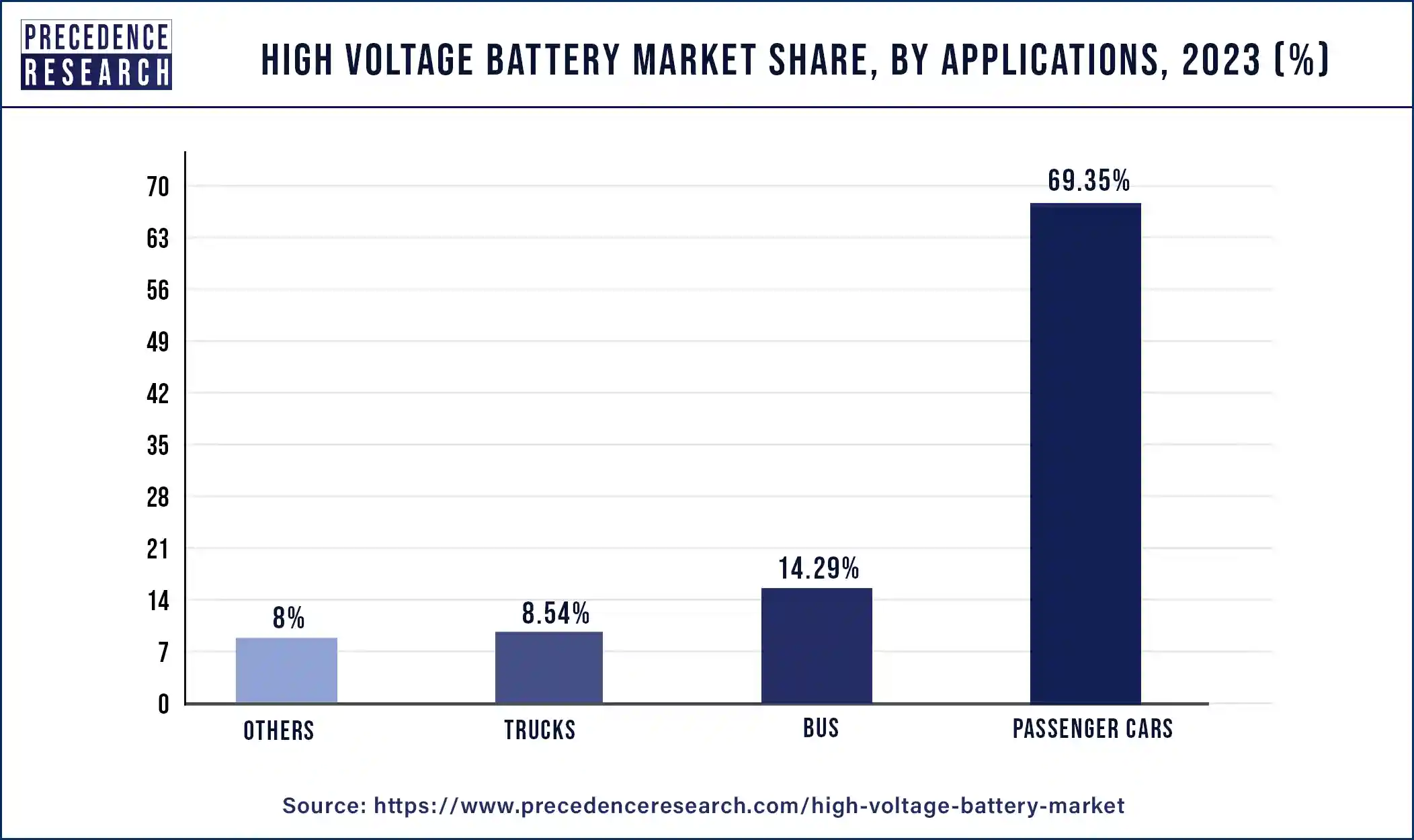

| By Application | 2020 | 2021 | 2022 | 2023 |

| Passenger Cars | 7,096.7 | 9,560.4 | 12,573.0 | 16,704.4 |

| Bus | 2,440.8 | 2,740.2 | 3,059.4 | 3,444.2 |

| Trucks | 1,608.8 | 1,747.7 | 1,890.8 | 2,057.3 |

| Others | 1,396.7 | 1,543.7 | 1,697.8 | 1,880.5 |

The lithium nickel manganese cobalt oxide segment was observed to have a significant share of the market in 2023. The segment is further expected to maintain its position during the forecast period. The cost-effectiveness offered by lithium nickel manganese cobalt oxide batteries, especially for electric vehicles. This factor promises a sustained rate of adoption of these batteries.

The lithium nickel manganese cobalt oxide batteries offer increased battery storage capacity with layered structure while allowing lithium ions to be stored. Moreover, the initial investment for such batteries is comparatively lower, despite the occurrence of global events of fluctuating prices.

The 400-600V segment held a notable share of the high voltage battery market in 2023. The 400-600V voltage range is widely considered optimal for high voltage battery applications in various industries, including electric vehicles (EVs), renewable energy storage systems, and grid stabilization solutions. Batteries operating within this voltage range strike a balance between power output, energy density, and safety considerations, making them suitable for a wide range of applications.

The >550 miles segment is observed to grow at the most significant rate during the forecast period. As consumers become more inclined towards electric vehicles, there is a growing demand for EVs with longer ranges that can meet the needs of daily commuting as well as long-distance travel. The >550 miles segment caters to this demand by offering batteries capable of supporting longer journeys without compromising on performance or convenience.

Segments covered in the report

By Battery Capacity

By Battery Type

By Voltage

By Driving Range

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

April 2025

November 2024

February 2025