January 2025

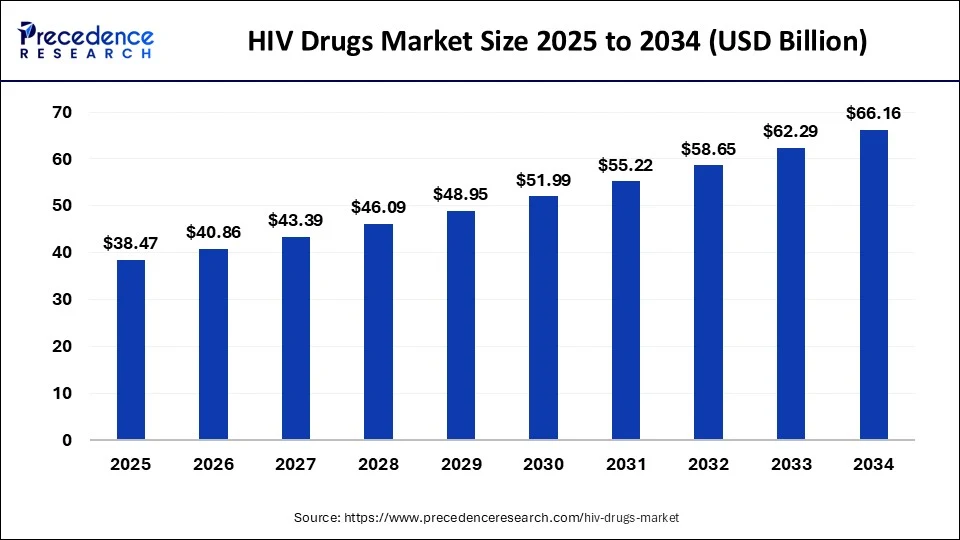

The global HIV drugs market size surpassed USD 34.10 billion in 2023 and is estimated to increase from USD 36.22 billion in 2024 to approximately USD 66.16 billion by 2034. It is projected to grow at a CAGR of 6.21% from 2024 to 2034.

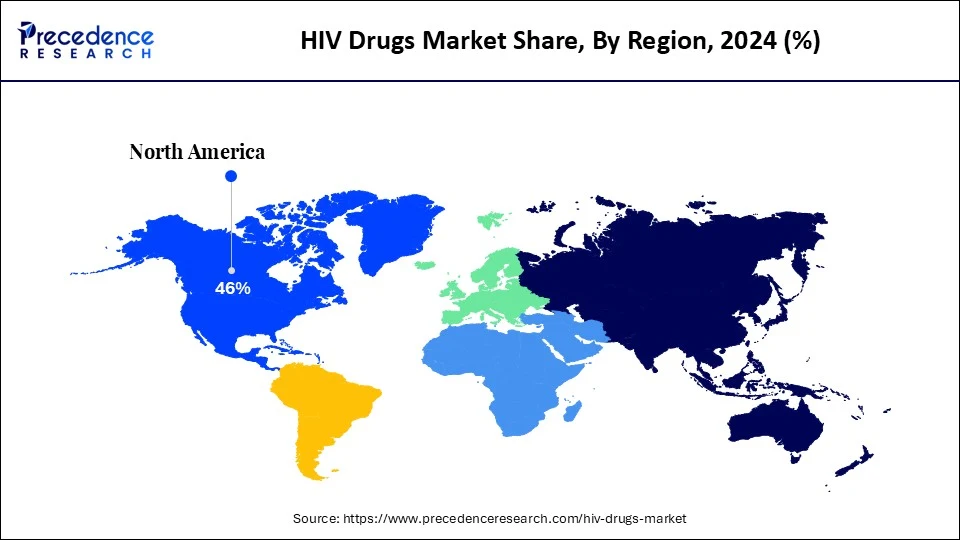

The global HIV Drugs market size is worth around USD 36.22 billion in 2024 and is anticipated to reach around USD 66.16 billion by 2034, growing at a CAGR of 6.21% over the forecast period 2024 to 2034. The North America HIV drugs market size reached USD 15.69 billion in 2023. The rising incidence of HIV cases and increasing resistance to existing therapies is pushing federal and private investment in the development of new therapies for HIV. These factors are driving growth in the HIV drugs market.

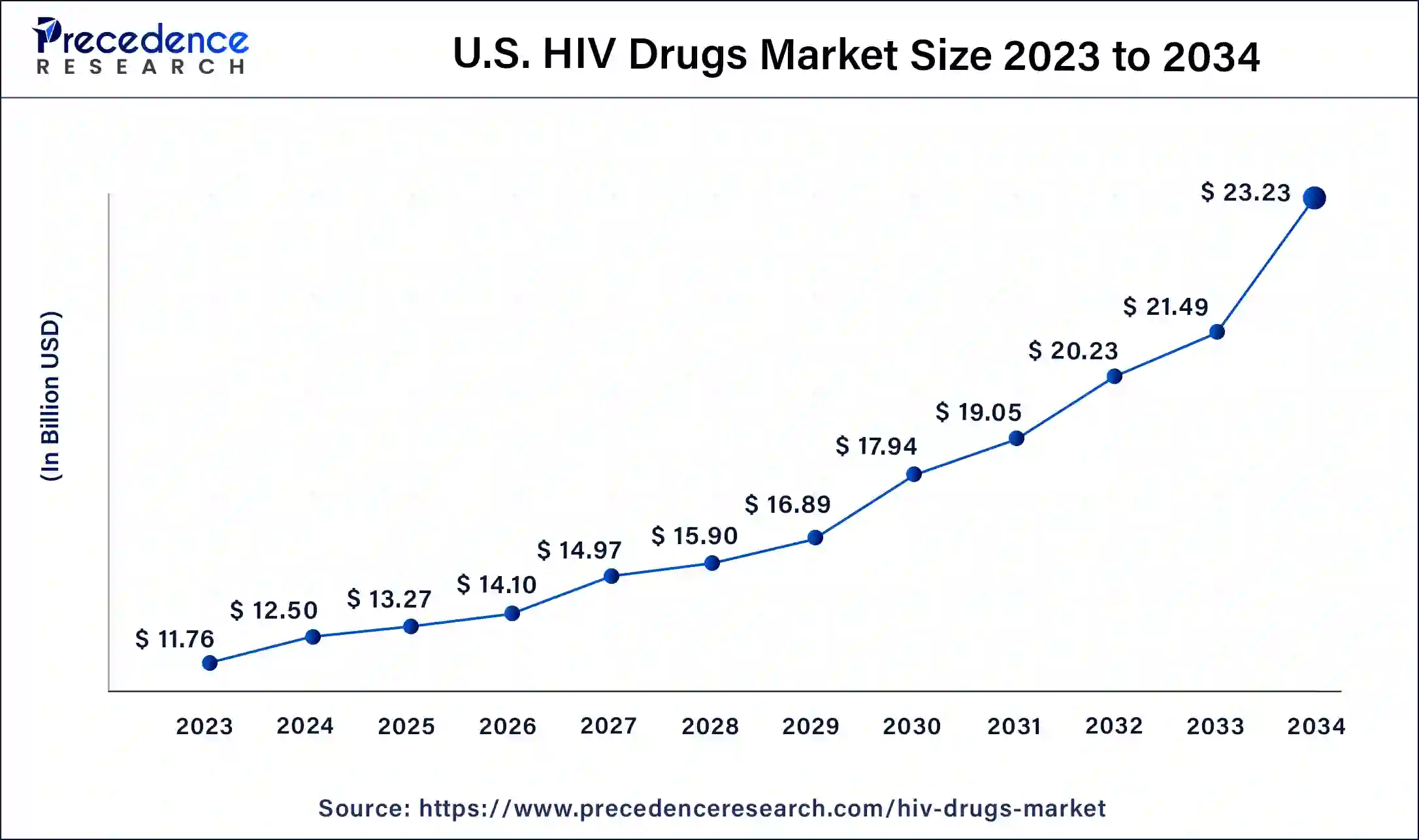

The U.S. HIV drugs market size was exhibited at USD 11.76 billion in 2023 and is projected to be worth around USD 23.23 billion by 2034, poised to grow at a CAGR of 6.38% from 2024 to 2034.

North America dominated the HIV drugs market in 2023. The prevalence of HIV in the region, combined with the presence of large pharmaceutical companies investing in the research and development of HIV medication, is driving growth in the region. North America also has a robust healthcare infrastructure and a strong regulatory framework for the expedient testing of new HIV treatment regimens.

Asia Pacific is expected to witness the fastest compound annual growth rate in the HIV drugs market in the forecast period from 2024 to 2033 due to the growing incidence of HIV infections in the region. Public awareness campaigns run by several governments in the region have increased awareness around HIV along with the frequency of testing.

Human immunodeficiency virus (HIV) is a pathogen that attacks the body’s immune system, resulting in the development of Acquired immunodeficiency syndrome (AIDS). The virus destroys CD4 T lymphocytes, also known as Helper T cells, required for most of the body’s immune responses. This makes the patient highly susceptible to other infections, including hepatic diseases, renal disease, and respiratory diseases such as pneumonia. HIV is spread through the bodily fluids of an infected person, such as blood, breast milk, and semen. The disease has no cure, but AIDS is preventable and is treated with antiretroviral therapy.

Despite an improved understanding of HIV and advanced treatments, the accessibility of treatments and awareness is lacking in emerging economies. Social stigma around the disease still discourages regular testing and prevents affected individuals from seeking treatment. Breakthroughs in the development of new drug therapies for HIV and the development of a therapeutic HIV vaccine provide opportunities for growth in the HIV drugs market.

The growing incidence of HIV due to the prevalence of unprotected sexual intercourse, the use of contaminated needles, and a lack of awareness around the transmission of the virus has led to a push for developing treatments. Government and private investment in the research and development of disease testing and management protocols drives growth in the HIV drugs market. Africa holds a notable share of the HIV drugs market. The large presence of HIV in the region has led to continued research and development efforts since the advent of the disease.

How is AI Transforming the HIV Drugs Market?

Artificial intelligence is making waves in the medical industry, demonstrating great potential in developing effective treatments for several prevalent diseases. In terms of treating AIDS, machine learning is being applied in HIV prevention intervention strategies. Artificial intelligence has sped up the development of automatic identification of individuals at risk, cluster detection, partner notification, and counseling. People can use pre-exposure prophylaxis when the risk of contracting HIV is high. Machine learning is being explored to identify persons who will benefit from pre-exposure prophylaxis more quickly using population health data, biomedical information, and informatics.

| Report Coverage | Details |

| Market Size by 2034 | USD 66.16 Billion |

| Market Size in 2023 | USD 34.10 Billion |

| Market Size in 2024 | USD 36.22 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Medication Class, Drug Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing prevalence of HIV/AIDS globally

The prevalence of HIV among the world’s population is due to a lack of knowledge about transmission risks and the prevalence of unprotected sexual intercourse across Africa, the Americas, and Southeast Asia. In the HIV drugs market, factors like the opioid epidemic in the United States have led to growing concern about how injection drug-related opioid use might fuel the transmission of infectious diseases. Significant investment in developing global HIV strategies, with organizations such as the WHO, the Global Fund, and UNAIDS focusing on sustainable development goal 3.3 of ending the HIV epidemic by 2030.

Development of new treatment protocols for HIV-affected individuals

The pharmaceutical industry has continued to invest in research and development for the HIV drugs market. The goal is to achieve HIV remission or a functional cure. The current treatment protocols for HIV involve antiretroviral therapy, which includes taking a combination of HIV medicines daily that keeps the viral load low. The expanded use of pre-exposure prophylaxis, such as long-acting injectable cabotegravir, a demand for antiretroviral drugs, and generic equivalents to branded, expensive medication, is driving growth in the HIV drug industry. Innovations in the field, such as the development of long-lasting injectables and implants, have enhanced the effectiveness of HIV therapeutics.

Slow regulatory approval and lack of awareness

Growth in the HIV drugs market is limited by a lack of awareness in emerging nations about the transmission methods of the virus. Lack of regular testing, especially among at-risk, leads to the risk of undetected transmission. According to the Joint United Nations Programme on HIV/AIDS (UNAIDS), about 5.4 million people did not know that they were living with HIV in 2023. The lack of proper infrastructure, limited facilities for screening, and social stigma around the disease in emerging economies are hindering proper treatment. The regulatory processes involved in the approval of HIV injections involve rigorous evaluations for safety and quality standards, slowing down the adoption of new treatments.

HIV drug resistance

The increased use of antiretroviral therapy over the past decade has saved the lives of millions. However, the widespread use of antiretroviral therapy has led to the emergence of HIV drug resistance. As treatments for HIV have evolved, so has the virus, with the emergence of resistance to Dolutegravir, a popular antiretroviral drug. HIV drug resistance occurs due to mutations in the genetic structure of HIV that affect its ability to replicate. HIV drug resistance needs to be countered with the development of new classes of antiretroviral drugs. Future growth in the HIV drugs market depends upon the unmet diagnostic and treatment needs present in African and Asian countries.

The multi-class combination drugs segment led the global HIV drugs market in 2023. Multi-class combination drugs combine different subtypes of HIV medication into one regimen based on the presentation of HIV, possible side effects, and ease of adherence to treatment plans. Treatment also varies depending on the type of HIV virus: wild-type virus (naturally occurring virus) or a drug-resistant one (mutated virus). These multi-class combinations combine various types of nucleoside reverse transcriptase inhibitors, non-nucleoside reverse transcriptase inhibitors, integrase strand transfer inhibitors, and more. The high comorbidity of HIV and Hepatitis and the common medication pool between the two diseases also contribute to the usage of multi-class combination drugs.

The nucleoside reverse transcriptase inhibitors segment is set to grow at the fastest rate in the HIV drugs market during the forecast period. Nucleoside reverse transcriptase inhibitors block an HIV enzyme called reverse transcriptase, preventing the conversion of its RNA into DNA and preventing the virus from replicating. According to a study published by the Creighton University School of Pharmacy & Health Professions, among various FDA-approved treatments, nucleoside/nucleotide reverse transcriptase inhibitors were most effective in limiting HIV-1 infection. Further research and development efforts into nucleoside reverse transcriptase inhibitors have led to the development of new medication in this subtype. The newer generation of reverse transcriptase inhibitors have longer half-lives, more favorable adverse effect profiles, and fewer drug interactions.

The hospital pharmacies segment dominated the HIV drugs market in 2023. The number of people currently receiving antiretroviral therapy in hospitals leads to high sales of HIV drugs in hospital pharmacies. In regions like Saharan Africa, people with HIV-related diseases occupy more than half of all hospital beds.

The online pharmacies segment is expected to grow at the fastest rate in the HIV drugs market over the forecast period between 2024 and 2033. The digitization of healthcare with telemedicine and the rise of medical e-commerce have spurred online sales of HIV drugs in high-income economies. Improvements in logistics and the rise of online payment platforms have improved accessibility in emerging economies where federal healthcare expenditure and disposable incomes continue to rise.

Segments Covered in the Report

By Medication Class

By Drug Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025