December 2024

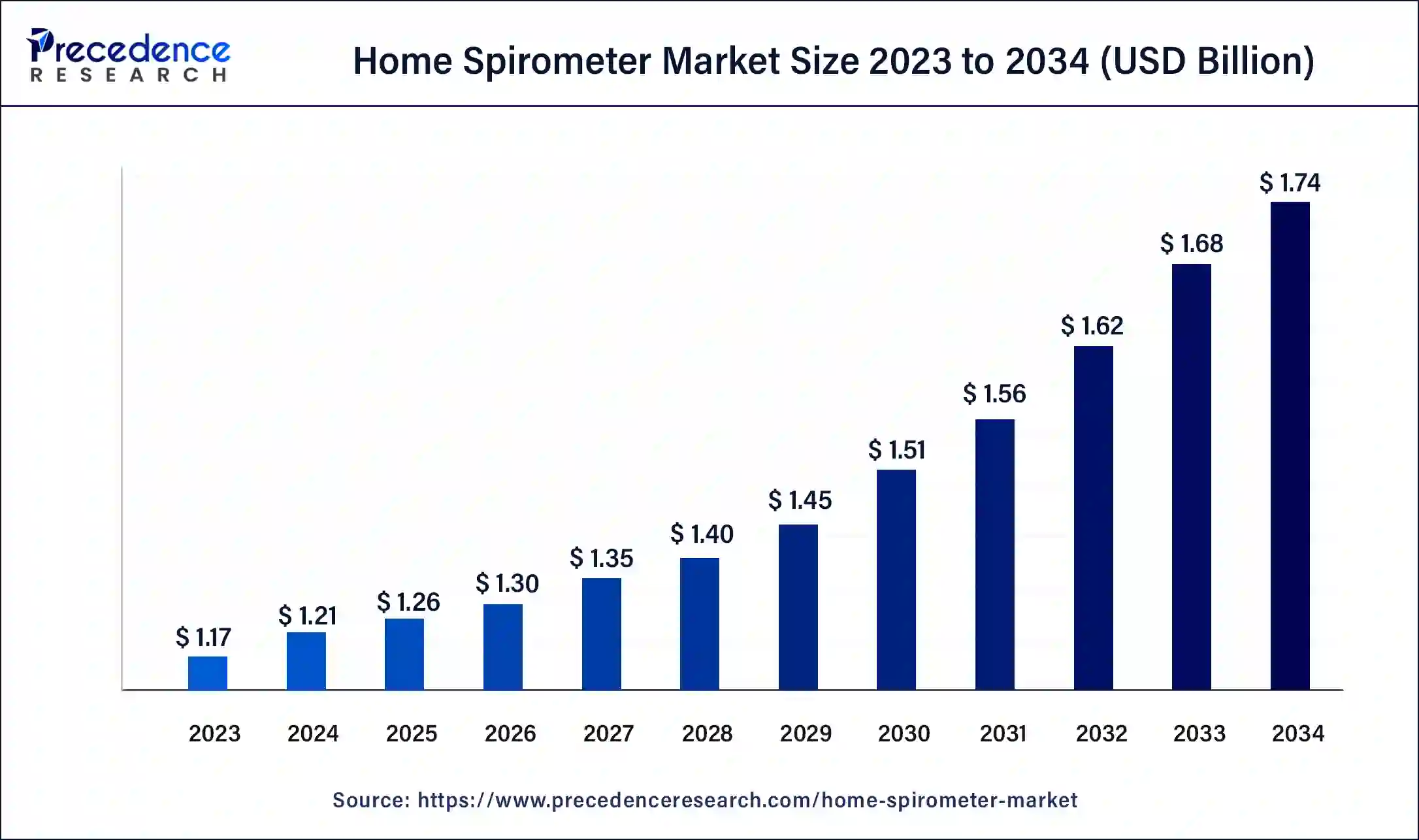

The global home spirometer market size was USD 1.17 billion in 2023, estimated at USD 1.21 billion in 2024 and is anticipated to reach around USD 1.74 billion by 2034, expanding at a CAGR of 3.70% from 2024 to 2034.

The global home spirometer market size accounted for USD 1.21 billion in 2024 and is predicted to reach around USD 1.74 billion by 2034, growing at a CAGR of 3.70% from 2024 to 2034.

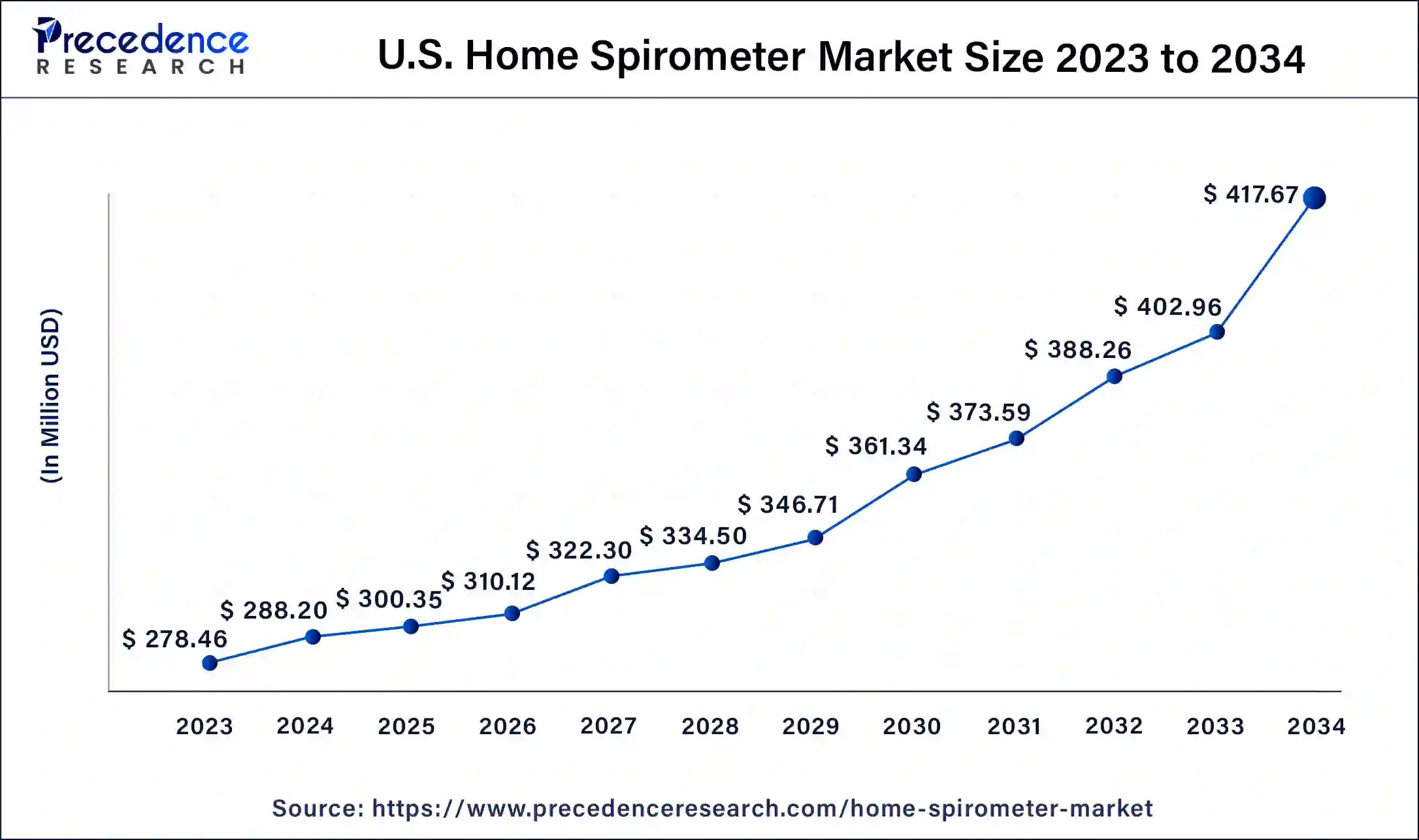

The U.S. home spirometer market size was valued at USD 278.46 million in 2023 and is expected to be worth around USD 417.67 million by 2034, at a CAGR of 3.78% from 2024 to 2034.

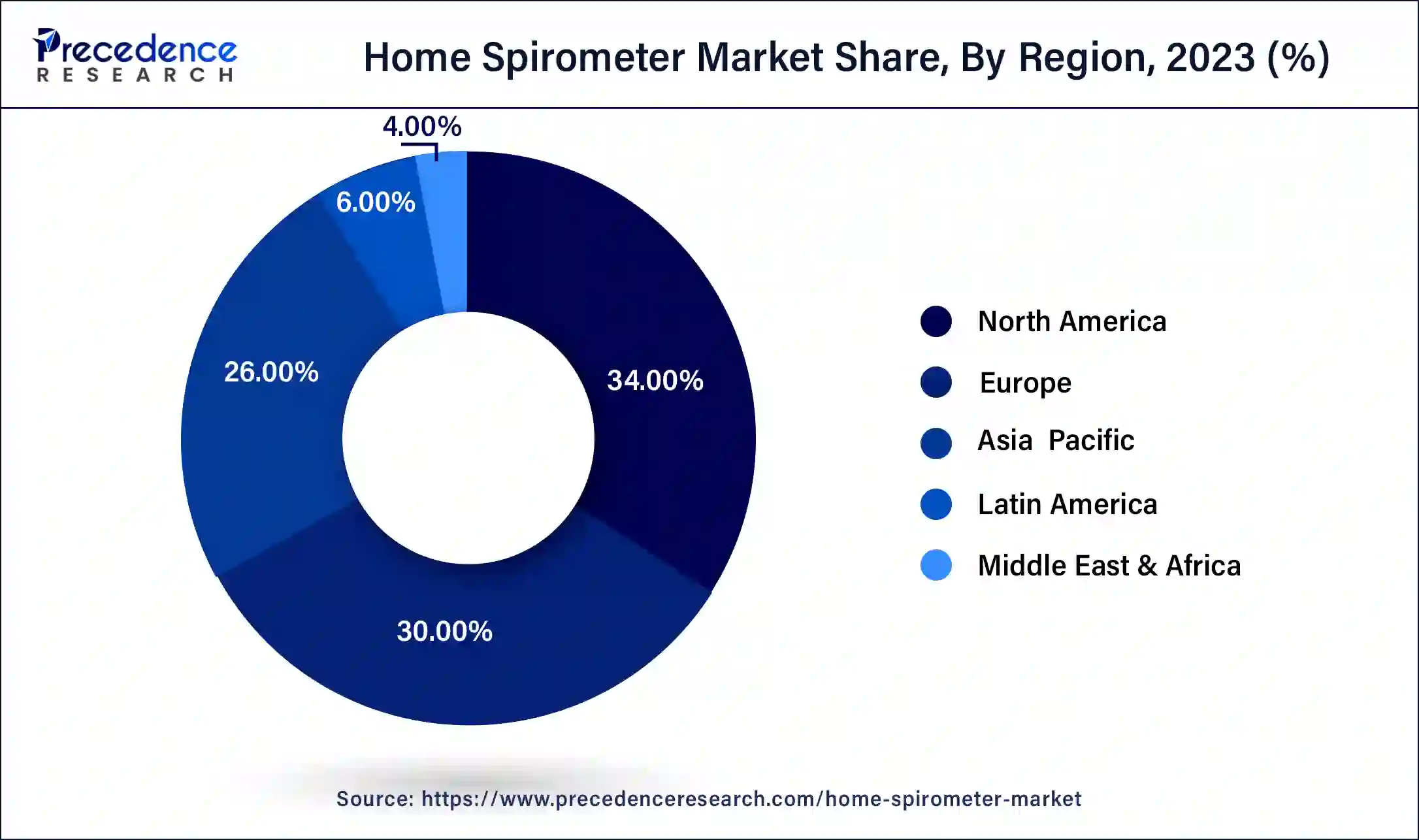

North America has held the largest revenue share of 34% in 2023. North America holds a major share in the home spirometer market due to several factors. The region has a well-established healthcare infrastructure, high healthcare expenditure, and a rapidly aging population. Additionally, there is a growing emphasis on remote patient monitoring, aligning with the prevalent use of telehealth services. The region's technological advancements, coupled with increasing awareness of respiratory health, contribute to the strong adoption of home spirometers. Favorable reimbursement policies and proactive government initiatives further support the market's growth in North America.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region commands a significant share in the home spirometer market due to a combination of factors. The region experiences a high prevalence of respiratory disorders, driving the demand for accessible monitoring tools. Additionally, increasing healthcare awareness, rising disposable income, and advancements in technology contribute to the adoption of home spirometers. The diverse and aging population in Asia-Pacific further fuels the need for convenient respiratory health solutions, positioning it as a key market for home spirometer growth.

A home spirometer is a compact medical device that allows individuals to check their lung function conveniently at home. It measures important respiratory indicators like forced vital capacity (FVC), forced expiratory volume in one second (FEV1), and peak expiratory flow rate (PEF). These metrics offer insights into lung health, aiding in the monitoring of conditions like asthma or chronic obstructive pulmonary disease (COPD).

The device, typically handheld with a mouthpiece and digital display, records breath volume and flow rate as users exhale forcefully. This data, tracked over time, helps individuals observe changes in their lung function. Healthcare professionals can then use this information to make well-informed decisions about personalized treatment plans. Home spirometers empower individuals to actively manage their respiratory health, offering a user-friendly and cost-efficient means of monitoring lung function and identifying potential issues early on.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.17 Billion |

| Market Size in 2024 | USD 1.21 Billion |

| Market Size by 2032 | USD 1.74 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.70% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Prevalence of respiratory disorders and telehealth expansion

The increasing prevalence of respiratory disorders, such as asthma and COPD, is a primary driver for the burgeoning demand in the home spirometer market. As respiratory conditions become more widespread, individuals are seeking proactive ways to manage their health. Home spirometers offer a convenient solution, allowing users to monitor their lung function regularly from the comfort of their homes. This rise in awareness and the need for continuous monitoring contribute significantly to the market's growth. Moreover, the expansion of telehealth services has become a catalyst for increased demand in the home spirometer market.

Telehealth's growing prominence enables remote patient monitoring, making it easier for healthcare providers to assess and manage respiratory conditions without the necessity of in-person visits. This trend aligns with the broader shift towards digital healthcare solutions, fostering the integration of home spirometers into telehealth platforms and driving up their demand as essential tools for remote respiratory health management.

Limited accuracy in certain conditions and user compliance challenges

The market for home spirometers faces constraints due to limited accuracy in certain conditions and user compliance challenges. The accuracy of home spirometers may be compromised in specific medical situations or when compared to professional-grade equipment. This limitation raises concerns about the reliability of results, potentially impacting the device's effectiveness in monitoring respiratory health. Users, especially those with limited understanding of proper usage techniques, may inadvertently introduce errors, leading to inaccurate readings. This user-dependent nature poses a challenge to the device's overall reliability and may deter potential users who seek precise and consistent respiratory monitoring.

Moreover, user compliance challenges pose a significant restraint. Ensuring consistent and correct usage of home spirometers is crucial for obtaining reliable data. However, issues such as forgetfulness, lack of motivation, or misunderstanding of usage instructions can compromise the device's intended benefits. Overcoming these challenges requires not only technological improvements but also effective user education and engagement strategies to maximize the utility of home spirometers and enhance their role in managing respiratory health.

Remote patient monitoring expansion and increasing health consciousness

The expansion of remote patient monitoring and the growing emphasis on health consciousness are creating significant opportunities in the home spirometer market. The trend towards remote healthcare services has provided a platform for home spirometers to play a pivotal role in respiratory health management. With telehealth gaining prominence, individuals are increasingly seeking convenient and accessible tools like home spirometers for remote monitoring, presenting a substantial market opportunity. These devices offer real-time data collection, aligning well with the preferences of health-conscious individuals who seek accessible and user-friendly solutions.

Furthermore, the increasing recognition of the importance of preventive healthcare encourages individuals to proactively manage their overall health, including respiratory wellness. In this landscape, home spirometers emerge as user-friendly instruments, allowing individuals to monitor their lung function regularly. This cultural shift towards personal health responsibility positions home spirometers as valuable assets, presenting opportunities for market expansion among a population increasingly dedicated to enhancing their well-being.

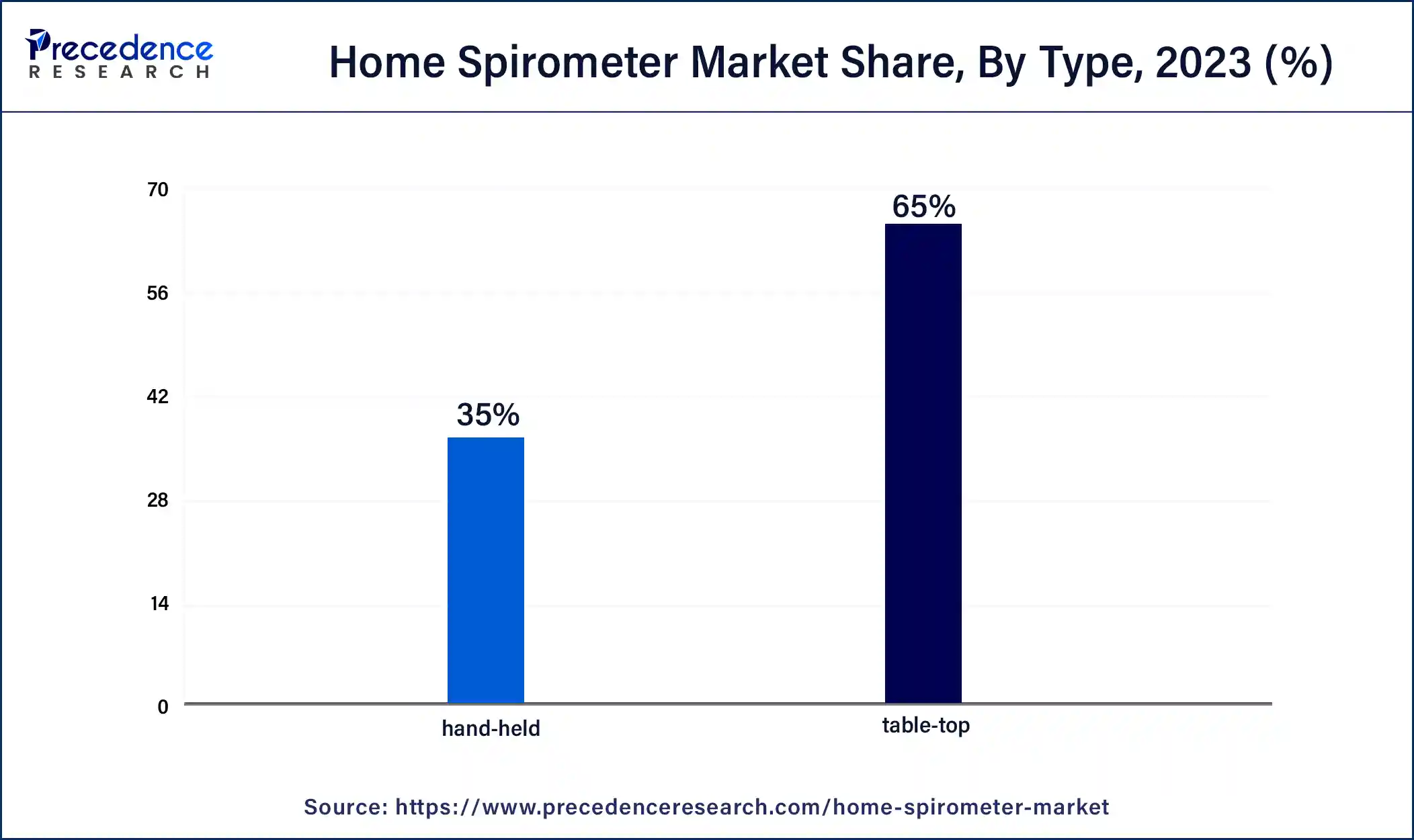

In 2023, the table-top segment had the highest market share of 65% based on the type. The table-top segment in the home spirometer market refers to spirometers designed for use on a stable surface, providing a convenient and accessible option for users. These spirometers typically feature a compact design suitable for placement on tables or countertops, offering ease of use and storage. A notable trend in this segment involves continuous efforts to enhance portability and user-friendly interfaces, ensuring that table-top home spirometers remain versatile and efficient tools for individuals monitoring their respiratory health in a home setting.

The hand-held segment is anticipated to expand at a significant CAGR of 4.2% during the projected period. The hand-held segment in the home spirometer market refers to portable devices designed for ease of use, allowing individuals to monitor their lung function conveniently. These spirometers are compact, often featuring a handheld design with a user-friendly interface. A notable trend in this segment involves continuous advancements in technology, enhancing portability, and ensuring accurate readings. The hand-held devices are gaining popularity due to their convenience, making them a preferred choice for users seeking a portable and accessible solution for monitoring their respiratory health from the comfort of home.

According to the technology, the flow measurement segment has held 61% revenue share in 2023. In the home spirometer market, the flow measurement segment involves the technology used to assess the rate and volume of air expelled during a user's forced exhalation. Traditional flow measurement methods have evolved to include advanced sensors and digital interfaces, enhancing accuracy and user experience. Recent trends in this segment emphasize the integration of smart technology, allowing for real-time data transmission to mobile devices. This technological evolution enhances the overall functionality of home spirometers, catering to a tech-savvy consumer base and contributing to the market's dynamic growth.

The volume measurement segment is anticipated to expand fastest over the projected period. In the home spirometer market, the volume measurement segment involves technology that accurately measures the volume of air exhaled by an individual during respiratory tests. This technology enables precise assessments of lung capacity, aiding in the early detection and management of respiratory conditions. Recent trends in this segment focus on the integration of advanced sensors and digital interfaces, offering users a more seamless and user-friendly experience. The incorporation of smart technology and real-time data tracking enhances the accuracy and accessibility of volume measurement in home spirometers, driving market growth.

According to the application, the COPD segment has held 45% revenue share in 2023. In the home spirometer market, the chronic obstructive pulmonary disease (COPD) segment refers to the monitoring of lung function in individuals diagnosed with this progressive respiratory condition. As a notable trend, there is a growing emphasis on home spirometers for COPD management. These devices enable COPD patients to track their lung health regularly, facilitating early detection of exacerbations and supporting personalized treatment plans. The COPD segment in the home spirometer market reflects a shift towards empowering individuals with chronic respiratory conditions to actively participate in their health management from the comfort of their homes.

The asthma segment is anticipated to expand fastest over the projected period. In the home spirometer market, the asthma segment focuses on devices designed for monitoring lung function in individuals with asthma. These spirometers enable users to track key respiratory metrics, helping manage and control asthma symptoms. A notable trend in this segment involves the integration of user-friendly interfaces and wireless connectivity, enhancing accessibility for asthma patients. The shift towards personalized asthma management, coupled with technological advancements, positions home spirometers as essential tools for asthmatic individuals to proactively monitor their lung health and optimize their treatment plans.

According to the end user, the hospitals and clinics segment has held a 41% revenue share in 2023. The hospitals and clinics segment in the home spirometer market refers to the end users who deploy these devices within healthcare institutions. A notable trend in this segment involves the increasing integration of home spirometers into hospital and clinic settings for remote patient monitoring. Healthcare providers leverage these devices to extend respiratory care beyond traditional appointments, enabling continuous monitoring and timely intervention. This trend aligns with the broader adoption of telehealth solutions, enhancing the efficiency of respiratory health management within hospital and clinic environments.

The home healthcare segment is anticipated to expand fastest over the projected period. The home healthcare segment in the home spirometer market refers to individuals using spirometers for respiratory monitoring within the comfort of their homes. A notable trend in this segment is the increasing preference for home-based healthcare solutions. With advancements in technology and a growing awareness of preventive care, more individuals are adopting home spirometers. This shift signifies a move towards proactive respiratory health management, empowering users to monitor their lung function regularly without the need for frequent clinic visits.

Segments Covered in the Report

By Type

By Technology

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

February 2025

January 2025