January 2025

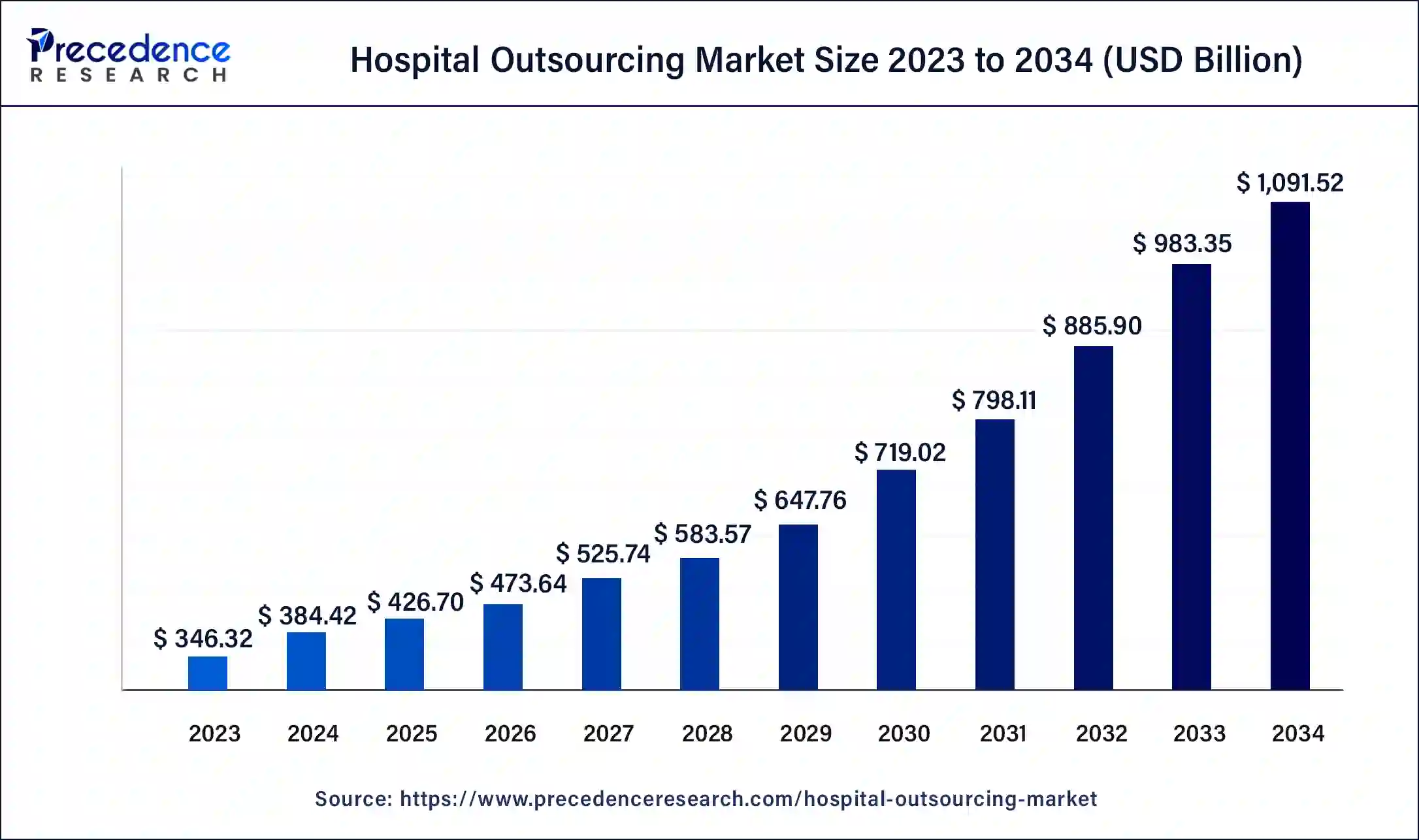

The global hospital outsourcing market size was USD 346.32 billion in 2023, calculated at USD 384.42 billion in 2024 and is projected to surpass around USD 1,091.52 billion by 2034, expanding at a CAGR of 11% from 2024 to 2034.

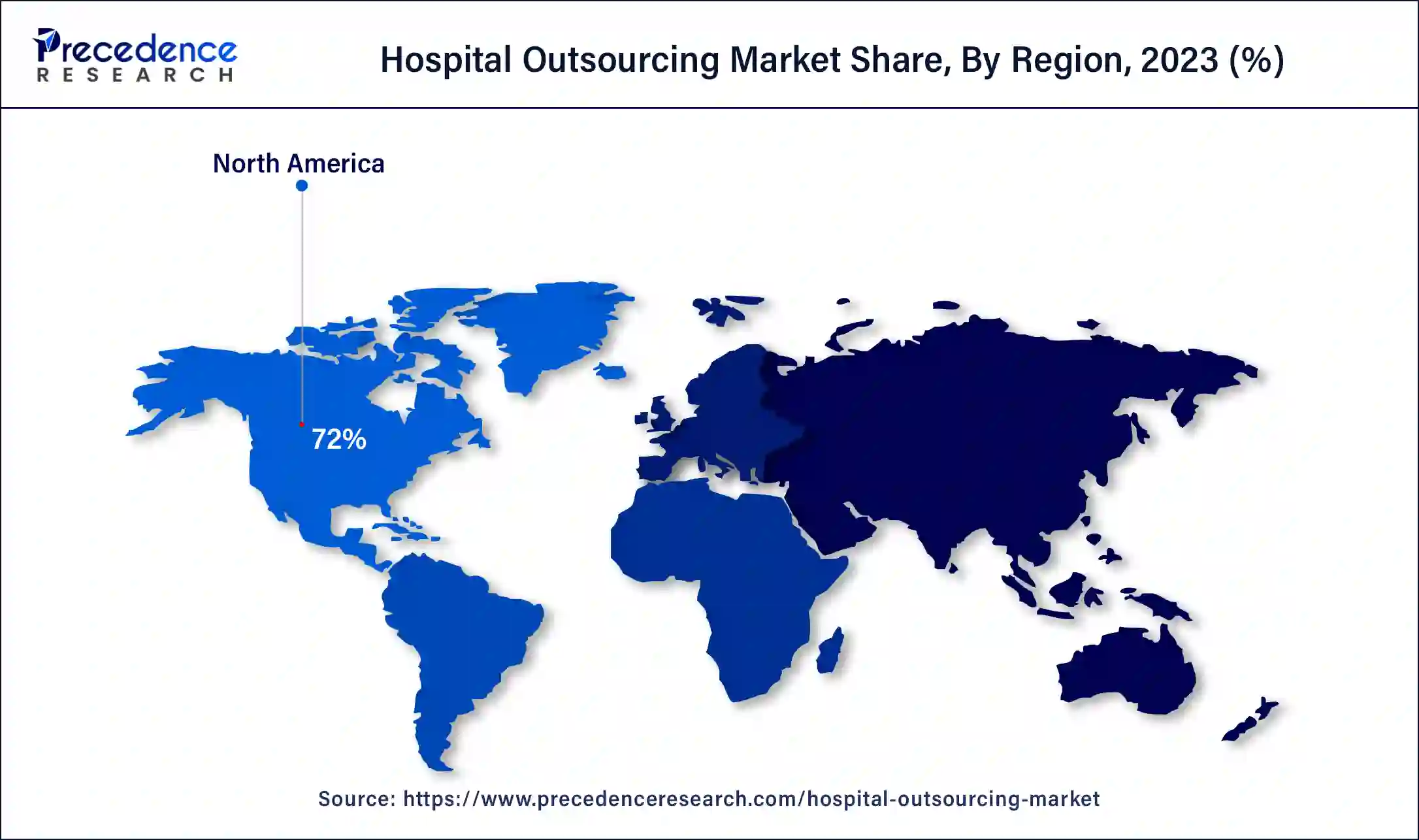

The global hospital outsourcing market size accounted for USD 384.42 billion in 2024 and is expected to be worth around USD 1,091.52 billion by 2034, at a CAGR of 11% from 2024 to 2034. The North America hospital outsourcing market size reached USD 249.35 billion in 2023.

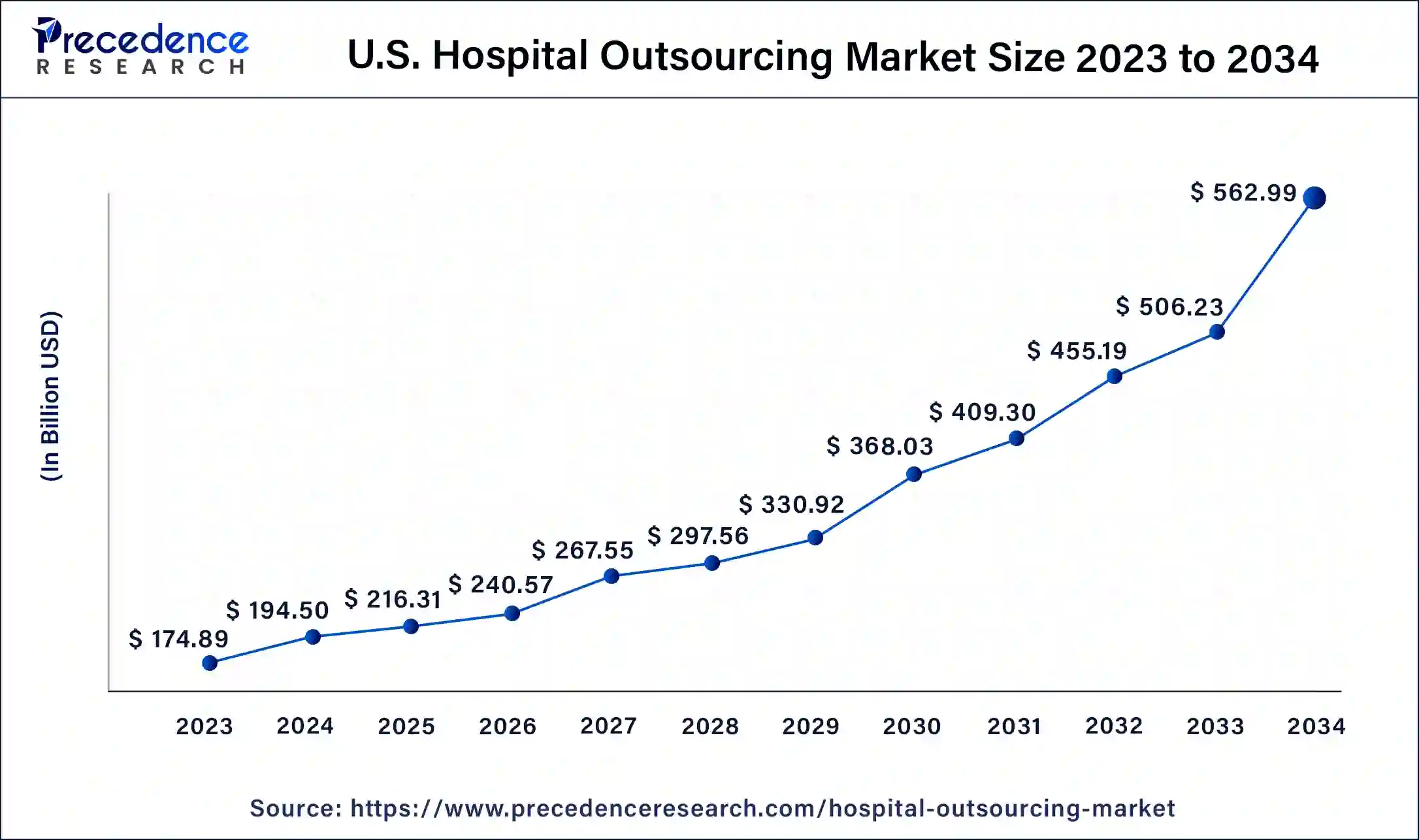

The U.S. hospital outsourcing market size was estimated at USD 174.89 billion in 2023 and is predicted to be worth around USD 562.99 billion by 2034, at a CAGR of 11.2% from 2024 to 2034.

Based on the region, in 2023 the North America region dominated the market with 72% in terms of revenue and is estimated to sustain its dominance during the forecast period. The presence of high number of private and public hospitals in North America and the mandatory government regulations for the hospitals to maintain various records related to patients is exponentially surging the growth of the market in the region. Further, the availability of numerous large and small service providers offers the hospital to acquire third party services at an optimum cost. The strict regulations imposed by the government to maintain electronic medical recordsin US has fostered the hospital outsourcing market in the past years.

On the other hand, the Middle East is expected to witness considerable growth in the upcoming years. The availability of low cost services and growing demand for advance technologies is propelling the market growth in the region.

The increased adoption of digital media in the management of hospital in-house services has opened the doors for the adoption and implementation of artificial intelligence technologies that will increase efficiency by eliminating errors.

However, data breaches and cybersecurity remains a major challenge for the hospital outsourcing industry that needs to be resolved as soon as possible. The cyberattacks may result in financial losses and may also put the patients’ health at risk.

The hospitals are rapidly adopting the outsourcing services for the management of internal activities such as IT services, medical billing, back office operations, and other activities. The third party service providers specializes in managing the hospital activities and offers time savings, cost reduction, savings on infrastructure and technology, and staffing flexibility to the hospitals. For this, the hospital outsourcing services are gaining immense traction. The lack of managerial efficiency, in-house experts, and limited budget are few of the primary difficulties faced by the private hospitals. The third party service providers helps in eliminating these difficulties by undertaking administration and managerial tasks of the hospital. There are other such issues such as lack of efficiency in managing revenue cycle, payroll, supply management, and other services. All these issues are taken care of by the contract service providers. Hence the hospitals are extensively opting for the specialized services by outsourcing the tasks, which propels the growth of the global hospital outsourcing market.

Over the past few years, hospitals are witnessing an upsurge in outsourcing in-house activities due to the mandatory federal guidelines of maintaining electronic medical records. Moreover, rising healthcare costs, rising patient flow, and increasing burden of processes like maintaining records of patients’ check-ins and check-outs and insurance related records are the various issues for which hospitals are increasingly outsourcing their in-house services. Therefore, the growing demand for the outsourcing services in hospitals is significantly contributing towards the growth of the global hospital outsourcing market.

| Report Coverage | Details |

| Market Size in 2023 | USD 346.32 Billion |

| Market Size in 2024 | USD 384.42 Billion |

| Market Size by 2034 | USD 1,091.52 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service, Type, Region |

| Segments Covered | Service, Type, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

By service, others segment led the market with a 40% revenue share in 2023 and is anticipated to retain its dominance throughout the forecast period. The others segment includes services such as laundry, food, cafeteria, security, and various other services. The presence of numerous small services together accounted for a large market share in this segment.

On the other hand, clinical services segment is anticipated to expand growth at a CAGR of 11.5% during the forecast period. Various services such as radiology, pathology, physiotherapy, microbiology, dialysis, and others together constitutes the clinical services segment. The growing penetration of diagnostic labs across the globe is a primary factor that is expected to fuel the market growth.

By type, the private segment led the market with 70% revenue share in 2023 and is anticipated to hit growth at a CAGR of 11.5% throughout the forecast period. This is attributed to the growing complexity in the in-house activities of the private hospitals coupled with the financial limitations. This is offering the opportunities for customer satisfaction due to experienced professionals.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedand efficient services. Moreover, they are also focusing on maintaining competitive pricing.

In June 2020, intraFusion, a healthcare management company in US, was acquired by McKesson Corporation. This acquisition helped McKesson in strengthening of its core business.

In March 2021, Omega Healthcare acquired Himagine Solutions, a medical coding company. Omega Healthcare is a service provider of revenue cycle management. This acquisition will extend the company’s services portfolio.

The various developmental strategies adopted by the key market players creates new opportunities and exponentially contribute towards the development of the market.

Segments Covered in the Report

By Service

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2024

January 2025

April 2025