November 2024

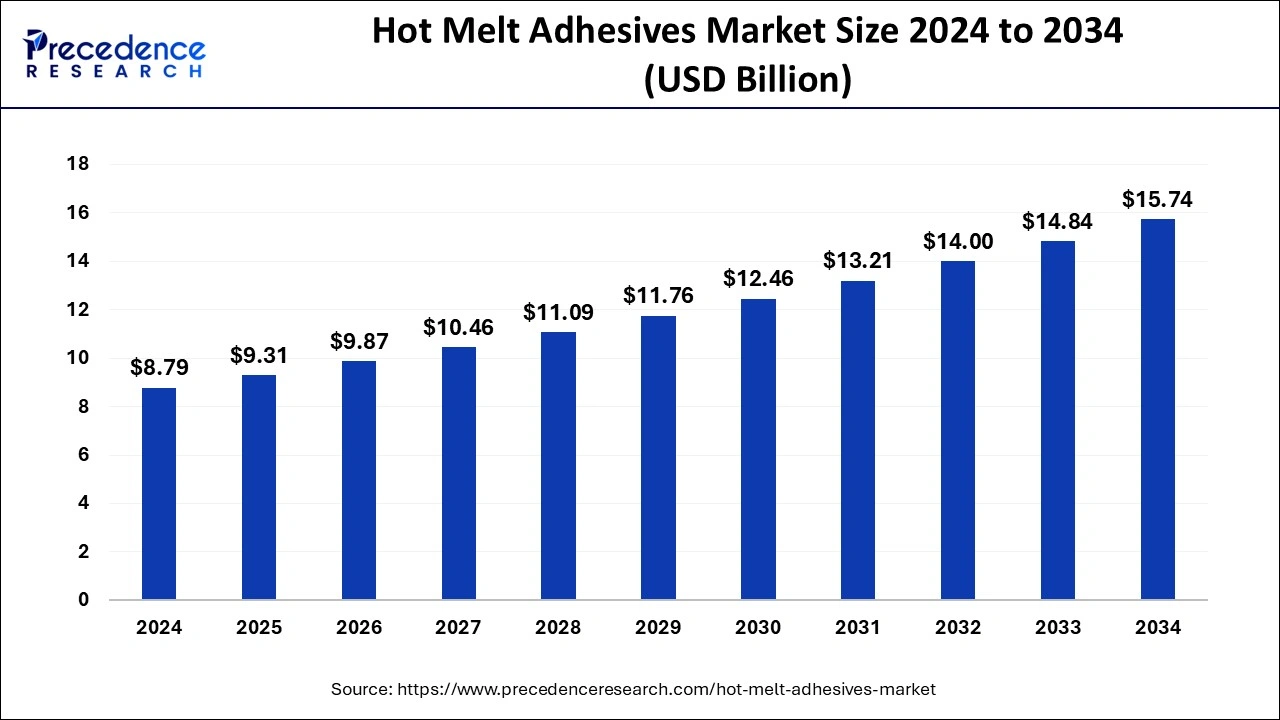

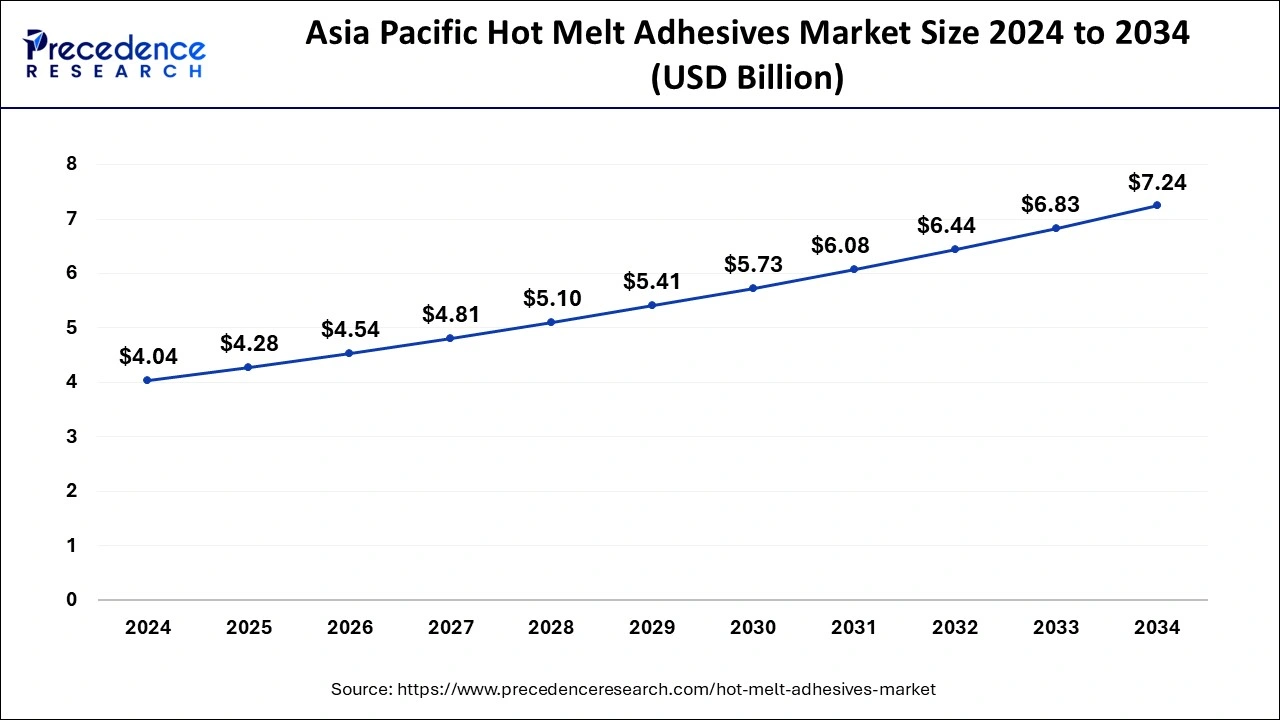

The global hot melt adhesives market size is calculated at USD 9.31 billion in 2025 and is projected to surpass around USD 15.74 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034. The Asia Pacific hot melt adhesives market size was estimated at USD 4.28 billion in 2025 and is expanding at a CAGR of 6.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hot melt adhesives market size accounted for USD 8.79 billion in 2024 and is expected to be worth around USD 15.74 billion by 2034, at a CAGR of 6% from 2025 to 2034.

The Asia Pacific hot melt adhesives market size was estimated at USD 4.04 billion in 2024 and is predicted to be worth around USD 7.24 billion by 2034, at a CAGR of 6.20% from 2025 to 2034.

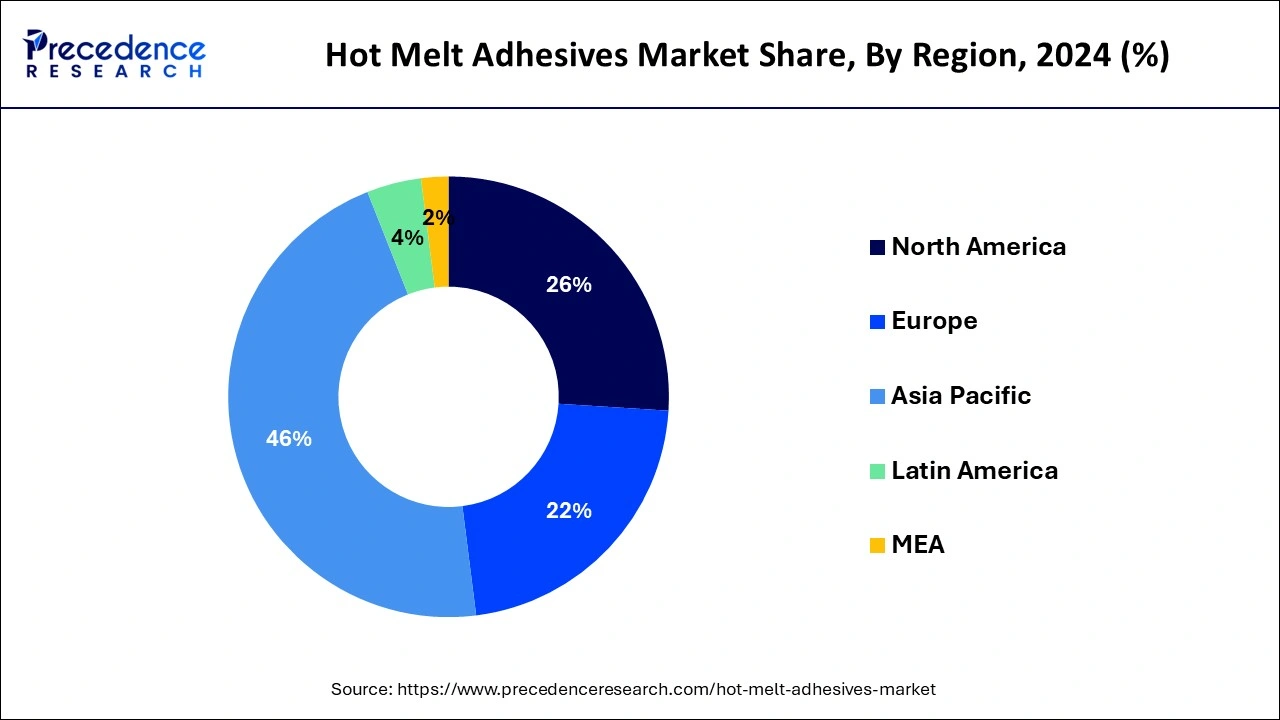

The Asia Pacific emerged as a dominating market and accounted for a revenue share of more than 46% in 2024. In addition, the region also registers the fastest growth rate of approximately 5.6%, in terms of value, during the forthcoming years. Significant expansion of manufacturing base for packaging industry along with rapid rise in demand for nonwoven products in the region accounted as the prominent factor that drives the market growth for hot melt adhesives over the forecast timeframe.

North America estimated to grow at a rate near to 4.4%, in terms of value, from the year 2024 to 2034. The region is a hub of some major packaging manufacturers that are International Paper, Ball Corporation, and Owens-Illinois packaging sector is the major factor that expected to be the crucial factor that drives the market growth for hot melt adhesives.

| Report Highlights | Details |

| Market Size in 2024 | USD 8.79 Billion |

| Market Size in 2025 | USD 9.31 Billion |

| Market Size by 2034 | USD 15.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Ethylene-Vinyl Acetate (EVA) dominated the global hot melt adhesives market accounting highest revenue share in the year 2024. EVA is highly versatile, durable, and holds strong adhesion properties because of which, it is broadly used in woodworking and packaging sectors.

On the other hand, rubber (styrene block copolymer) predicted to expand at the fastest rate of around 5.5%, in terms of value, during the analysis timeframe. The product is generally used in the manufacturing of pressure-sensitive products such as labels, tapes, and graphics. Increasing demand for labels and tapes especially from the packaging industry estimated to prosper the growth of the segment over the upcoming years.

Apart from above discussed segments, polyolefin hot melts is the other most widely used product categories. Excellent chemical resistance, low moisture permeability, and good barrier properties are some of the prime factors that contribute towards the significant growth of the segment. Additionally, the aforementioned properties of the polyolefin product are significantly used in the nonwoven product manufacturing as well as packaging industries.

Packaging application segment captured the major market share in 2024. Hot melt adhesives superior bonding, speed, and adhesion capabilities makes them an ideal packaging solution in corrugated cases, sealing bottles, and paper board cartons compared to other packaging products.

Besides this, nonwovens segment expected to exhibit the fastest growth rate during the forecast period ranging from 2024 to 2034. Increasing disposable income levels along with growing awareness among consumers related to personal hygiene are the major factors anticipated to boost the market demand for nonwoven products that includes diapers and other hygiene products mainly used by females that in turn expected to fuel the growth of the segment.

In woodworking, hot melt adhesives are largely used as a general-purpose adhesive material for bonding wooden substrates in furniture application. Increasing number of restoration and refurbishment projects across developed nations along with new construction projects in developing countries predicted to flourish the demand for hot melt adhesives in woodworking applications.

The global hot melt adhesives industry is highly consolidated in nature because of few market players capturing major market share. These industry players face stiff competition primarily on the basis of application characteristics and price of the product. Further, these players adopt strategies such as regional expansion and merger & acquisition to retain their competitive edge in the market.

By Product

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

April 2025

October 2024

August 2024