September 2024

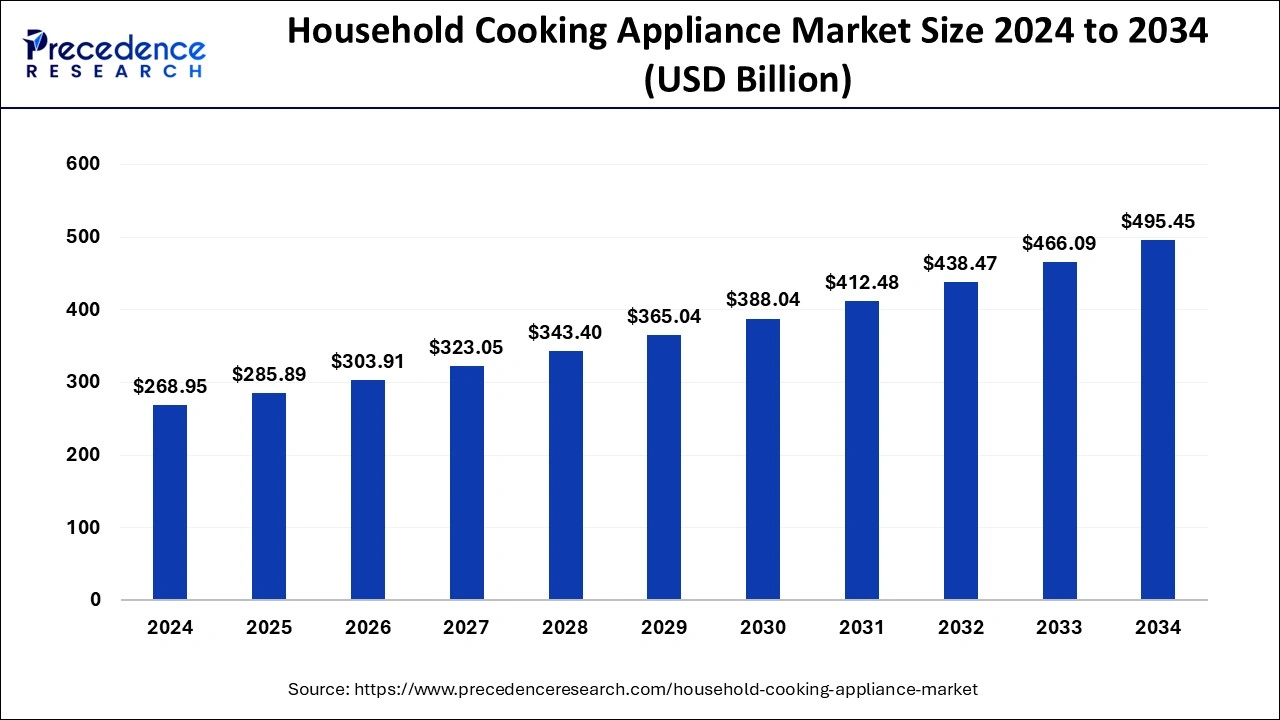

The global household cooking appliance market size is calculated at USD 285.89 billion in 2025 and is forecasted to reach around USD 495.45 billion by 2034, accelerating at a CAGR of 6.30% from 2025 to 2034. The North America household cooking appliance market size surpassed USD 103.92 billion in 2024 and is expanding at a CAGR of 6.31% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global household cooking appliance market size was estimated at USD 268.95 billion in 2024 and is anticipated to reach around USD 495.45 billion by 2034, expanding at a CAGR of 6.30% from 2025 to 2034. The growth of the household cooking appliance market is driven by the changing consumer preferences toward healthy cooking methods.

In today's Era, the conventional kitchen is transforming into a highly efficient and intelligent space due to the rise of smart home technologies. AI-powered kitchen tools are at the forefront of the smart kitchen revolution. Devices like smart ovens can learn the user's habits by gathering data on a daily basis, providing personalized cooking experiences. AI-enabled appliances come with advanced features like pre-programmed recipes, real-time assistance in cooking, and temperature control. Some models are even equipped with cameras, allowing users to monitor the cooking process remotely with the help of a smartphone app.

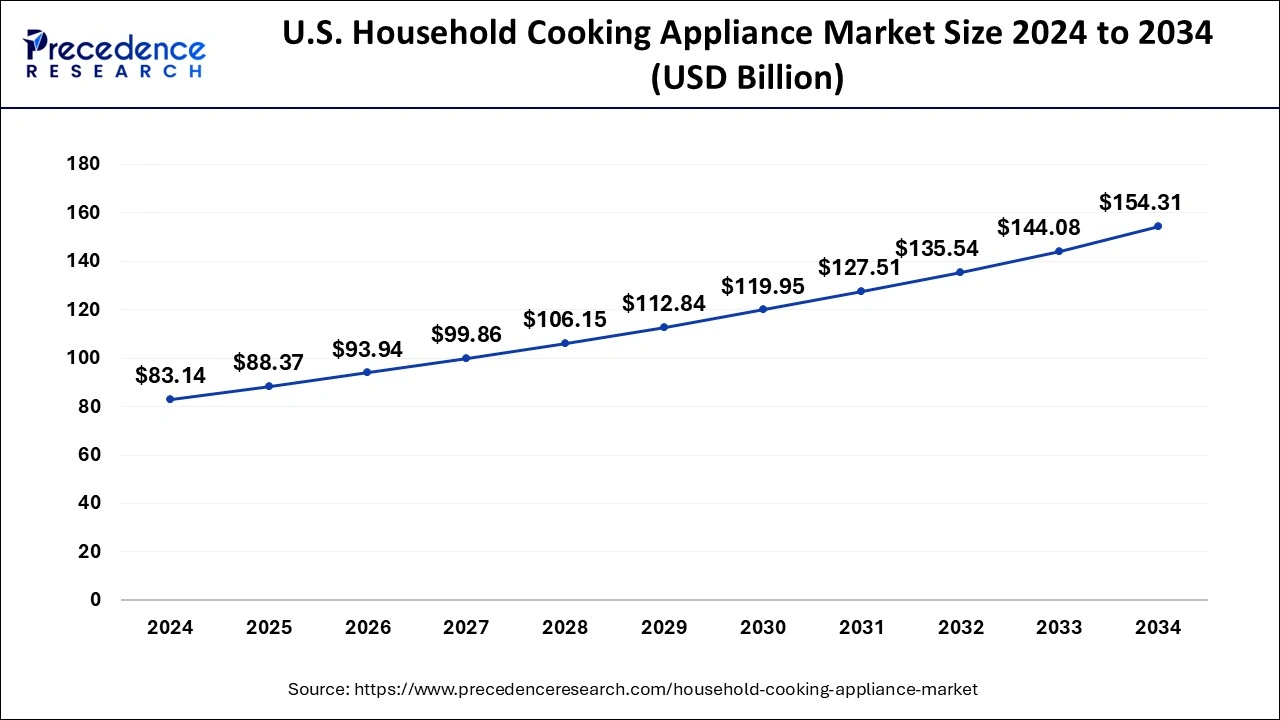

The U.S. household cooking appliance market size was evaluated at USD 83.14 billion in 2024 and is predicted to be worth around USD 154.31 billion by 2034, rising at a CAGR of 6.37% from 2025 to 2034.

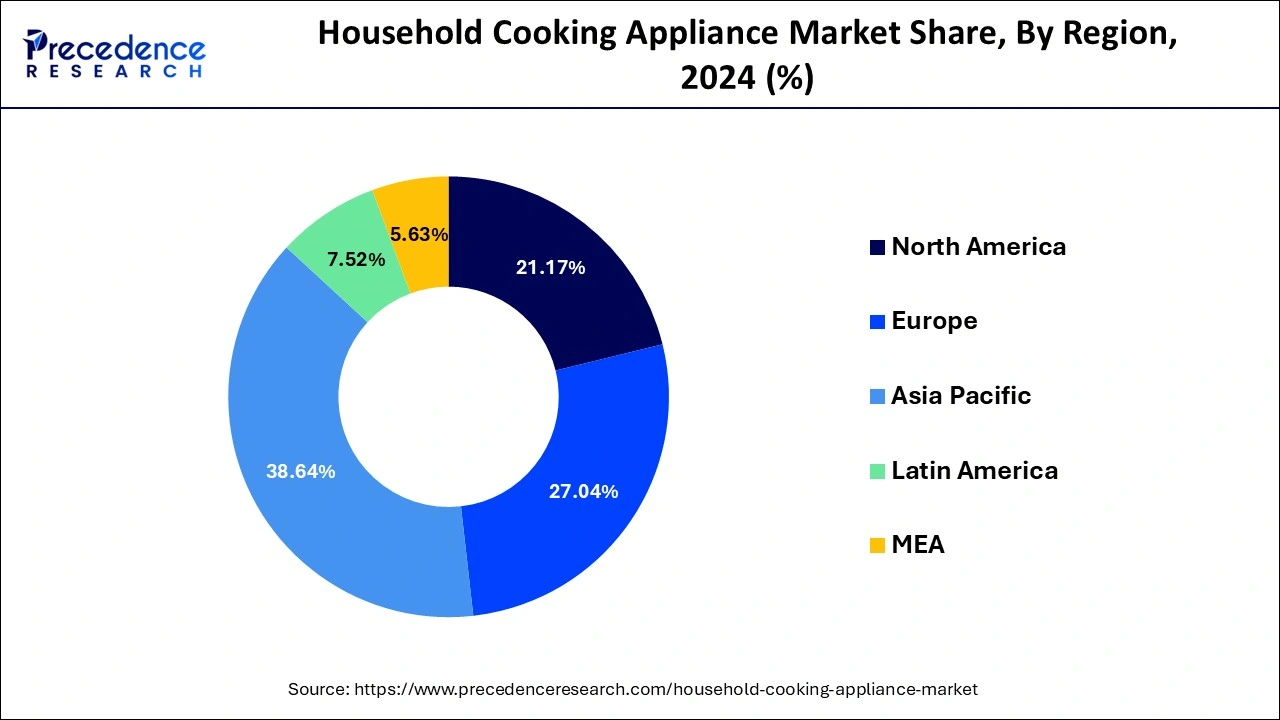

Asia Pacific region accounted for over 38.64% of the market share in 2024. This can be attributed to the presence of huge population, huge number of households, rising disposable income of the consumers, rising demand for the home improvement products, and the presence of top electronic manufacturers in the region. The world’s top electronic manufacturers are present in the nations like China, India, and South Korea and the various developmental strategies adopted by them significantly influences the markets across the globe. The availability of cheap factors of production in the region is another factor that makes the region the manufacturing hub of the world.

On the other hand, the Middle East and Africa is expected to be the most opportunistic market during the forecast period, owing to the rising penetration of the home improvement products, rising disposable income, and improving quality of life. The changing spending pattern of the consumers and changing lifestyle are the major drivers of the market in this region.

The household cooking appliance market is experiencing significant growth due to the increasing disposable income in many emerging countries. High disposable income significantly improves the living standards of consumers, allowing them to invest in home improvement. This, in turn, boosts the demand for household cooking appliances. Moreover, the rise of e-commerce significantly contributes to market expansion. Due to the expansion of e-commerce platforms, accessibility to household cooking appliances has increased.

| Report Coverage | Details |

| Market Size In 2024 | USD 268.95 Billion |

| Market Size In 2025 | USD 285.89 Billion |

| Market Size by 2034 | USD 495.45 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.30% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Structure, Distribution |

| Regions Covered | Asia Pacific, Middle East and Africa |

Changing Consumer Preferences

With the changing lifestyle, consumer preferences also change with time. Consumers are increasingly shifting from conventional cooking appliances to automated cooking appliances to reduce human efforts. These appliances allow people with busy schedules to complete cooking chores without hassle, thereby saving time. There is a high demand for energy-efficient cooking appliances, which further contributes to market expansion. Additionally, consumers are becoming more health conscious and looking for appliances, such as air fryers and multi-cookers, to support their healthy eating habits and cooking methods with less time.

High Cost

Despite the number of benefits provided by automated household cooking appliances, factors like the high cost of these appliances and the large amount of electricity needed to work properly hinder the market growth. These appliances are equipped with sensors and monitors, making them more costly than traditional household kitchen appliances. This high cost creates a barrier and discourages low-income consumers from investing in them. Moreover, these appliances require regular maintenance, increasing operational costs.

Rise of Smart Appliances

Technological advancements led to the development of smart cooking appliances, creating immense opportunities in the household cooking appliance market. Smart appliances can connect with Wi-Fi and Bluetooth, which enhances the cooking experience. Moreover, the rising demand for energy-efficient cooking appliances is likely to propel the growth of the market during the forecast period. Market players are actively developing innovative solutions to meet the growing demand for energy-efficient and smart appliances.

The cooktops & cooking ranges segment accounted for more than 47% of the market share in 2024. The rising adoption of modular kitchens coupled with availability of cooking appliances in varied sizes, easy to install feature, and easy to uses features are the significant drivers of the cooktops & cooking ranges. These appliances can be operated using gas and electricity. The induction cooktops gained immense traction among the consumers in the past especially in the regions like North America and Europe.

On the other hand, the oven segment is estimated to be the most opportunistic segment during the forecast period. The oven facilitates the households to cook restaurant like dishes. Moreover, the availability of various types of ovens such as microwave and combination ovens is another factor that serves the different needs of the consumers. Technological advancements in the oven segment is expected to boost its adoption among the consumers across the globe.

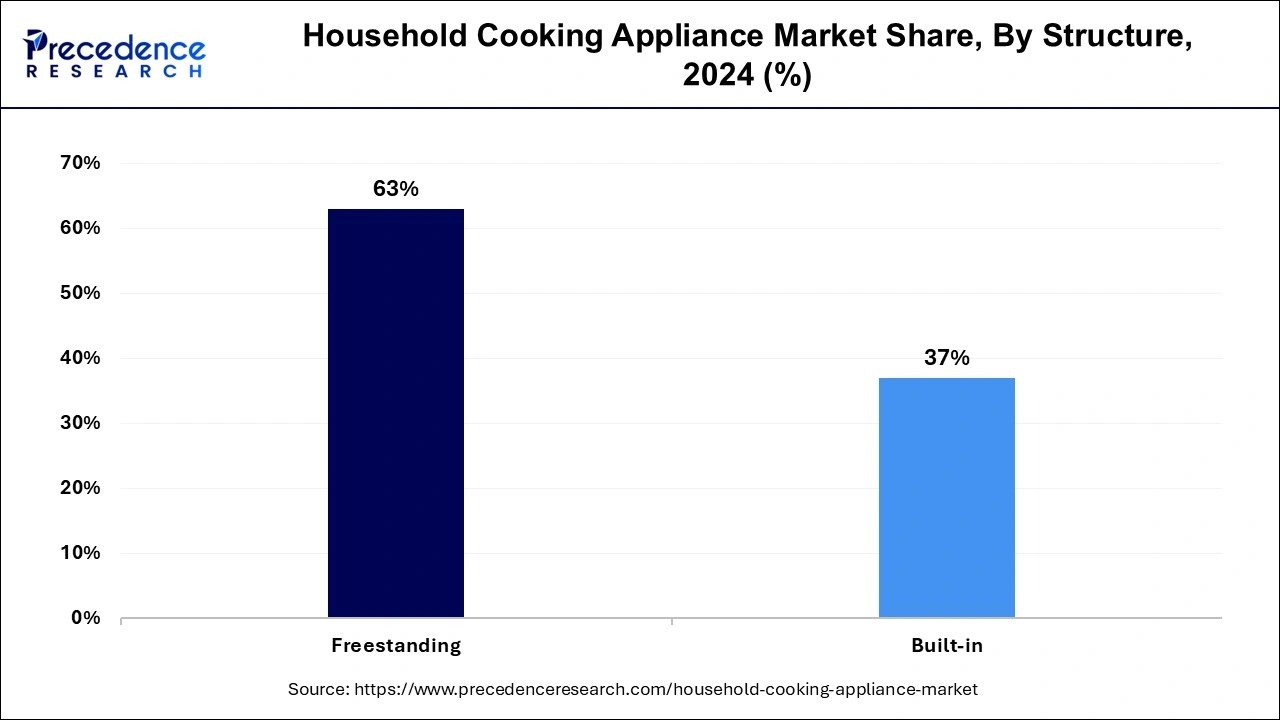

The freestanding segment accounted for over 63% of the market share in 2024. This is attributed to the easy availability, availability in different sizes, and easy maintenance of the freestanding cooking appliances. Moreover, the spare parts of the freestanding appliances are easily available. These appliances are require more spaces and are popular among the consumers.

On the other hand, the built-in segment is estimated to be the fastest-growing segment during the forecast period. This segment is gaining popularity as it serves the problem of space limitations of the household. The low and middle-income consumers having small kitchen spaces are increasingly adopting the built-in household cooking appliances and it perfectly serves the modular kitchen spaces. Hence, the segment is expected to grow at a significant rate.

The offline segment dominated the global household cooking appliance market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This can be attributed to the increased penetration of the supermarkets, hypermarkets, and specialty stores operating in the electronic household appliances. The huge popularity of these stores among the consumers made the offline segment a popular sales channel for the household cooking appliance across the globe.

On the other hand, the online segment is expected to be the most opportunistic segment during the forecast period. This is due to the rising penetration of internet, increasing adoption of smartphones, and growing number of internet users across the globe. According to the ITU, around 4 billion people were using internet by the end of 2019. Moreover, the rapidly growing online retail platforms such as Amazon, Flipkart, Wal-Mart, and eBay are contributing significantly towards the growth of the online sales channel across the globe.

By Product Type

By Structure

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

November 2024

March 2025