May 2024

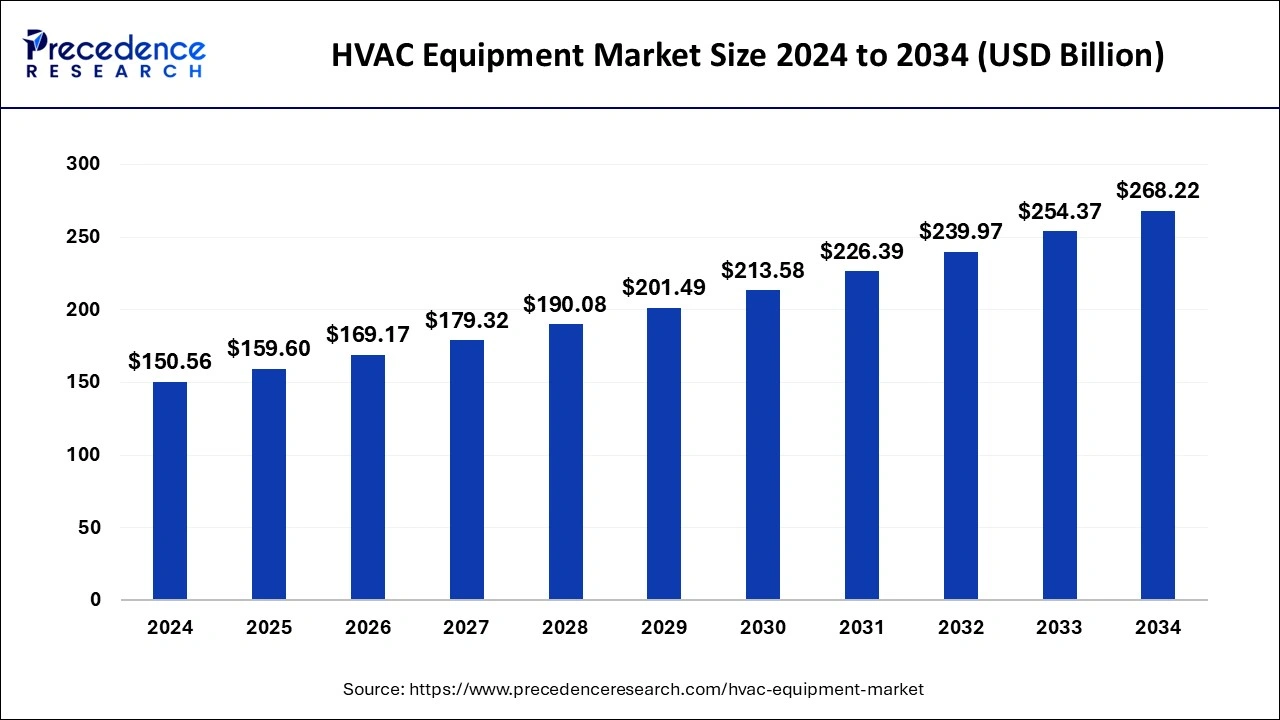

The global HVAC equipment market size is calculated at USD 159.6 billion in 2025 and is forecasted to reach around USD 268.22 billion by 2034, accelerating at a CAGR of 5.94% from 2025 to 2034. The Asia Pacific HVAC equipment market size surpassed USD 72.47 billion in 2025 and is expanding at a CAGR of 6.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global HVAC equipment market accounted for USD 150.56 billion in 2024 and is anticipated to reach around USD 268.22 billion by 2034, expanding at a CAGR of 5.94% from 2025 to 2034. The rising demand for the HVAC equipment market is due to the increasing need to maintain good indoor air quality through proper ventilation with filtration and provide thermal comfort.

The integration of artificial intelligence in HVAC has the potential to benefit the industry by improving system efficiency. Ai utilizes real-time data to adjust the heating and cooling system automatically which results in reducing energy wastage and lowering utility bills. AI-powered tools are built in with a predictive maintenance feature which is commonly applied in Building Management systems (BMS) which detects the presence of any abnormalities or inefficiency in the system, and sends an alert before a minor issue becomes a major problem. Additionally, AI has the ability to analyse HVAC system data from various sensors and maintain the optimal indoor atmosphere, adjusting to temperature, humidity and airflow in real-time.

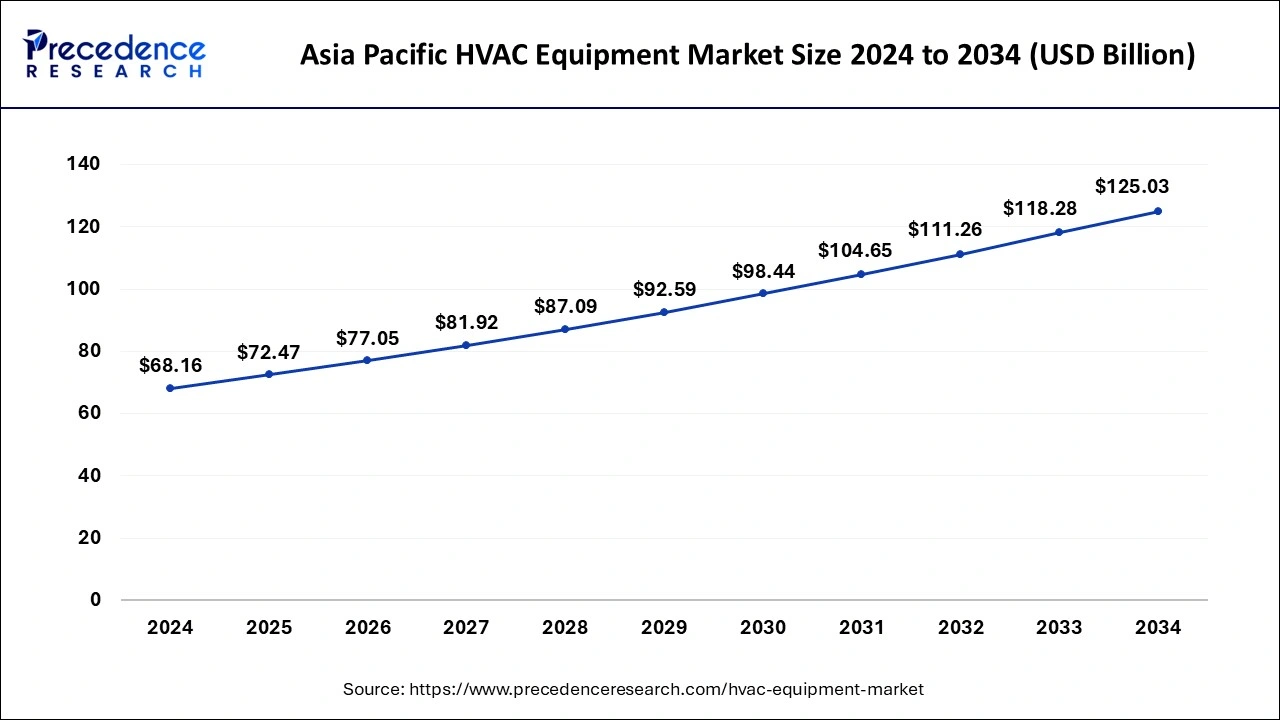

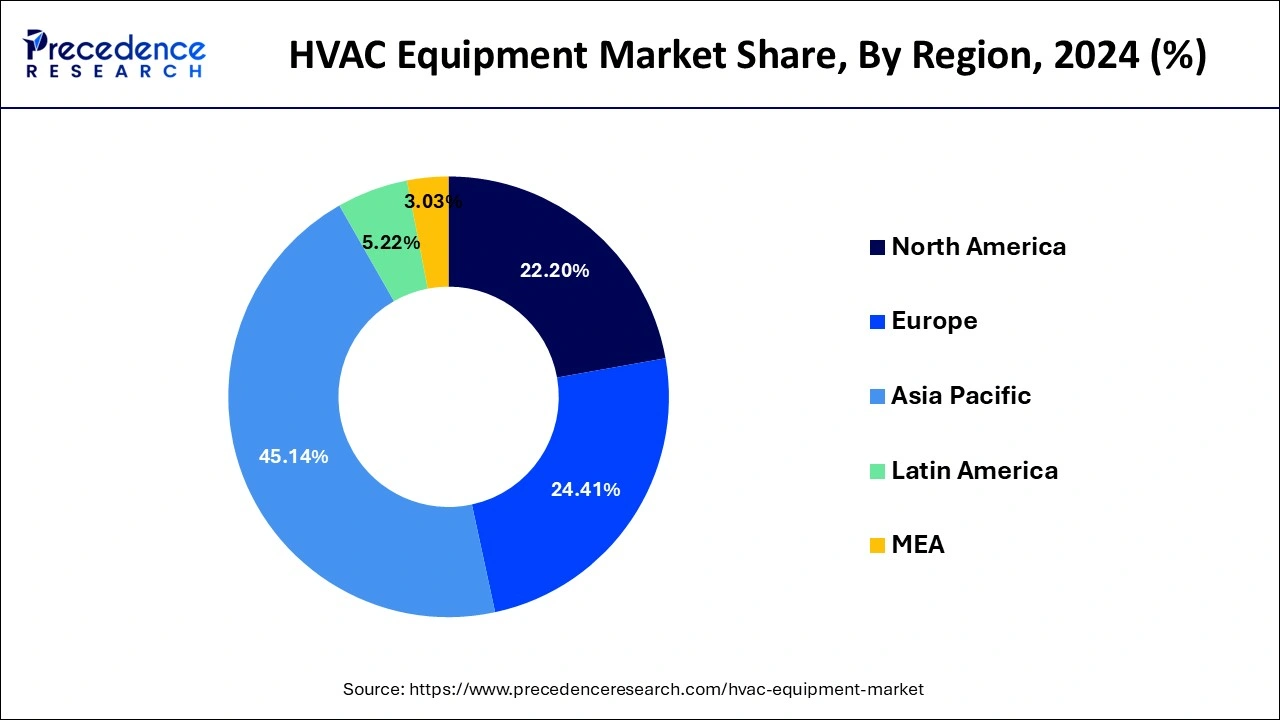

The Asia Pacific HVAC equipment market size was estimated at USD 68.16 billion in 2024 and is predicted to be worth around USD 125.03 billion by 2034, at a CAGR of 6.25% from 2025 to 2034.

The HVAC equipment market in China dominated the Asia Pacific region in 2024. The dominance of this country is due to the increasing consumer demand for energy-efficient, smart home technology which is extensively being adopted by homeowners. China has set ambitious climate goals, to reduce carbon emissions by incorporating HVAC systems. The primary driver of this market in China is the increasing building construction and strict regulation regarding energy efficiency. The Chinese HVAC equipments are generally affordable compared to the global market due to lower manufacturing costs and economies of scale.

North America contributed significantly amounting for the second-highest revenue share in 2024 and is expected to grow remarkably over the forecast period owing to the promotions by the Government in this region for the use of energy-efficient systems by providing subsidies and tax benefits. For instance, On 22nd September 2021, In North America, Carrier Corporation has introduced a new Toshiba Carrier touch screen controller for variable refrigerant flow (VRF) systems that can connect up to 128 indoor units to one simple interface. This controller enables building managers to access their complete VRF system from a single location, removing the need to monitor individual units. The European region is also estimated to grow significantly owing to the growing tourism sector and real estate industry in the region.

United States

The United States held a substantial HVAC equipment market share in 2024. The HVAC industry in the United States is currently facing a significant shortage of HVAC engineers and technicians. This shortage concerns the consumers and increases the demand for energy-efficient and sustainable HVAC solutions. According to a survey, in 2023, there were approximately 145,142 HVAC companies in the United States and 659,906 HVAC professionals employed in the HVAC industry.

| Report Coverage | Details |

| HVAC Equipment Market Size in 2025 | USD 159.6 Billion |

| HVAC Equipment Market Size by 2034 | USD 268.22 Billion |

| Growth Rate From 2024 to 2033 | CAGR 5.94% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global climatic changes leading to health risks

The global increase in greenhouse gas emissions and rising health concerns due to higher air quality indexes (AQIs) is creating the demand for efficient and clean air providing solutions such as advanced HVAC in both commercial and residential sectors. Furthermore, the rising disposable incomes are promoting the adoption of HVAC systems in various settings such as homes, offices and public places to maintain indoor air quality and safety.

High installation and maintenance costs

Although HVAC systems prove to be a potent solution for rising air pollution levels, the installation and maintenance costs associated with HVAC equipments is restraining their market growth. Furthermore, the complex process for installation needing expert technicians and requirement of large spaces with time-to-time maintenance of these systems can pose challenges for the adoption of HVAC systems ultimately impacting the market stability.

Technological advancements in developing energy efficient HVAC systems

The rising government support, increasing investments and technological advancements in developing energy efficient solutions and sustainable equipments for HVAC systems is creating opportunities for market growth. Moreover, the increased focus on automation of systems across multiple industries serves a potential to boost the integration of advanced technologies in the industry.

Based on the product, the cooling product segment is expected to witness the highest growth accounting for more than 54% of revenue share in 2024. It is also expected to grow significantly during the projection period. The cooling segment consists of air conditioning units that include unitary air conditioners, room air conditioners, split & packaged systems, cooling towers and portable units. With the evolution of technology in HVAC systems, valuable features such as IoT-integrated HVAC systems, remote operations, and small units are now possible, allowing for cost savings and improved energy efficiency and comfort. The HVAC Equipment Market is expected to increase as a result of all of these factors. Furthermore, rapidly changing climate conditions in the Middle East and Asia Pacific are expected to increase cooling unit demand.

Heating units, such as furnaces, boilers and heat pumps, are extensively used in residential, commercial, and industrial applications. Some of the major applications of heating equipment includes molding, floor & wall heating, space heating, steam generation, vaporization, and drying. As a result, regions with extremely cold climates and sectors that require heating are the primary drivers of the heating product segment's growth. Ventilation units are also becoming more popular around the world as air pollution levels grow and people become more conscious of the necessity of maintaining a healthy and safe atmosphere. The spike in demand for air purifiers and other ventilation equipment that lowers air contamination is expected to drive the market forward significantly.

The residential end use segment is expected to witness a significant revenue share during the forecast period amounting for more than 40% of the global share. It is also anticipated to grow remarkably during the forecast period. As the Residential HVAC units are compact and easy to install as compared to commercial or industrial units. The residential segment consists of HVAC units installed in small places such as houses, small stores and restaurants. Furthermore, the change in lifestyle and rising disposable incomes of the consumers are expected to fuel the market growth.

The commercial segment is also estimated to witness the fastest CAGR over the forecast period owing to increase in infrastructure development and surge in urbanization across major regions, generating demand for more office spaces. Commercial HVAC units require a huge amount of room to install, hence they are typically found on the rooftops of major restaurants, theatres, shopping malls, and other commercial spaces. In the commercial places, the HVAC systems are used continuously, and therefore require frequent maintenance. Therefore, retrofitting and replacement demand of these units is the major factor that is anticipated to drive the growth of the market.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

January 2025

January 2025

February 2025