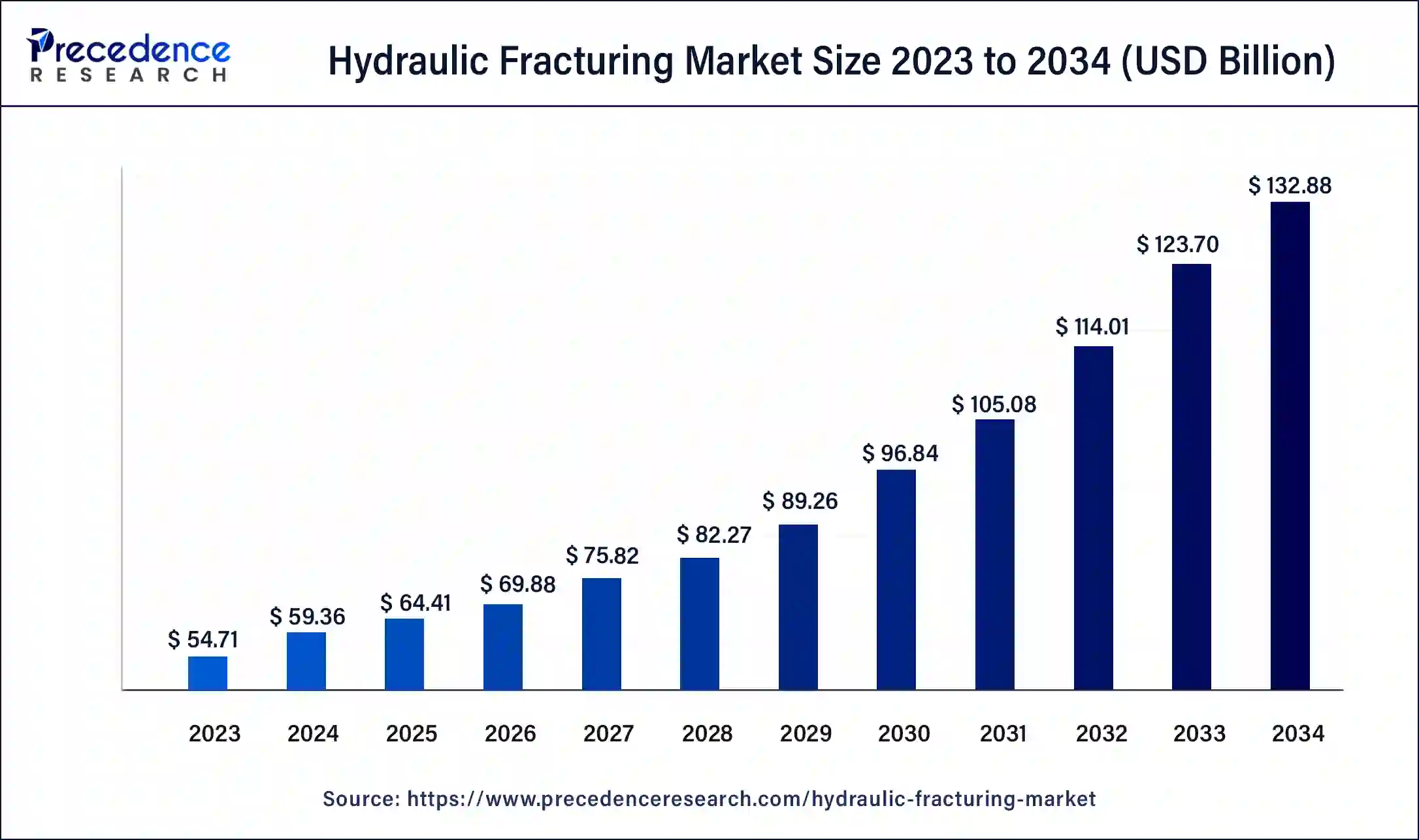

The global hydraulic fracturing market size was USD 54.71 billion in 2023, estimated at USD 59.36 billion in 2024 and is anticipated to reach around USD 132.88 billion by 2034, expanding at a CAGR of 8% from 2024 to 2034.

The global hydraulic fracturing market size accounted for USD 59.36 billion in 2024 and is predicted to reach around USD 132.88 billion by 2034, growing at a CAGR of 8% from 2024 to 2034.

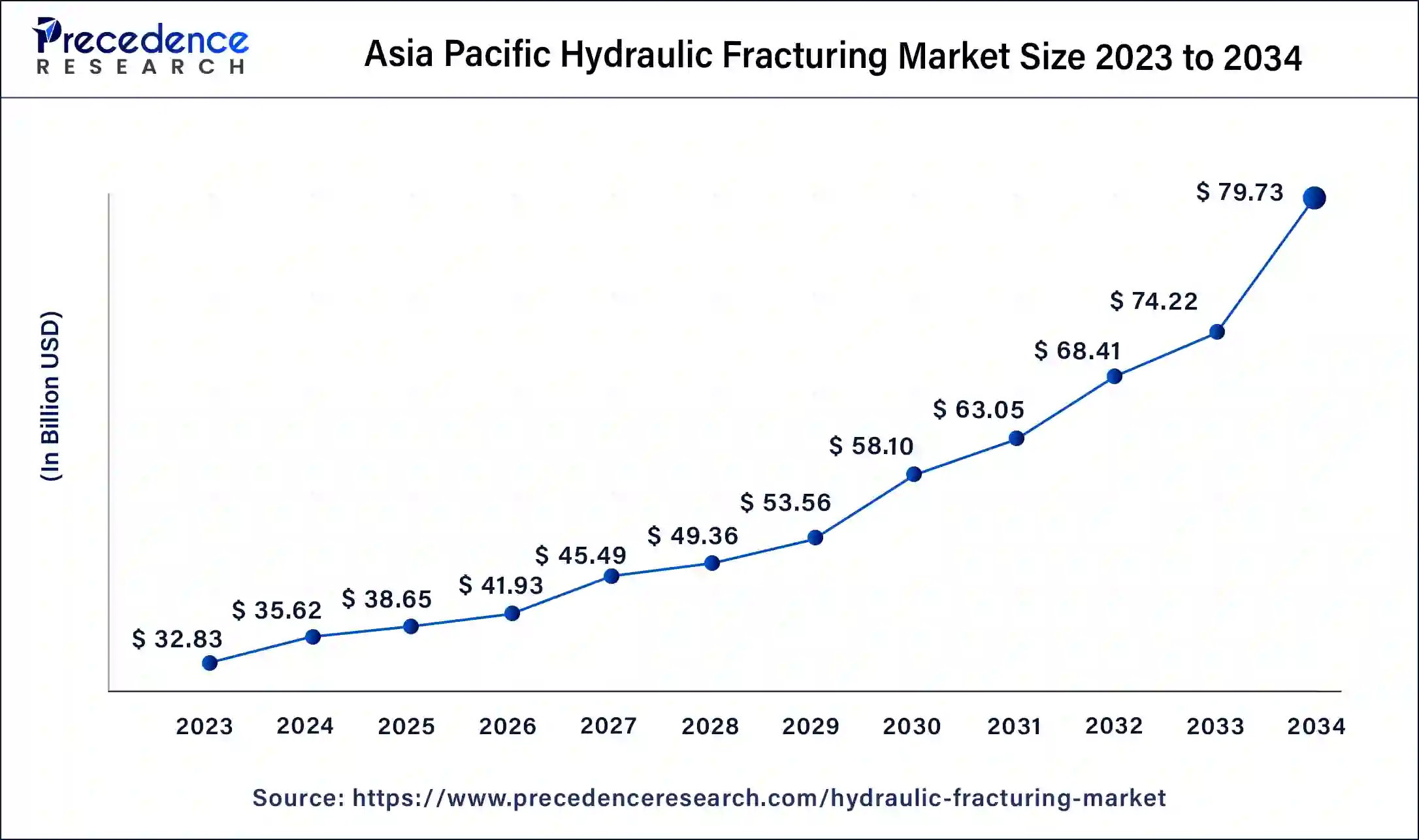

The Asia Pacific hydraulic fracturing market size was valued at USD 32.86 billion in 2023 and is expected to reach USD 69.04 billion by 2032, growing at a CAGR of 8.60% from 2023 to 2032.

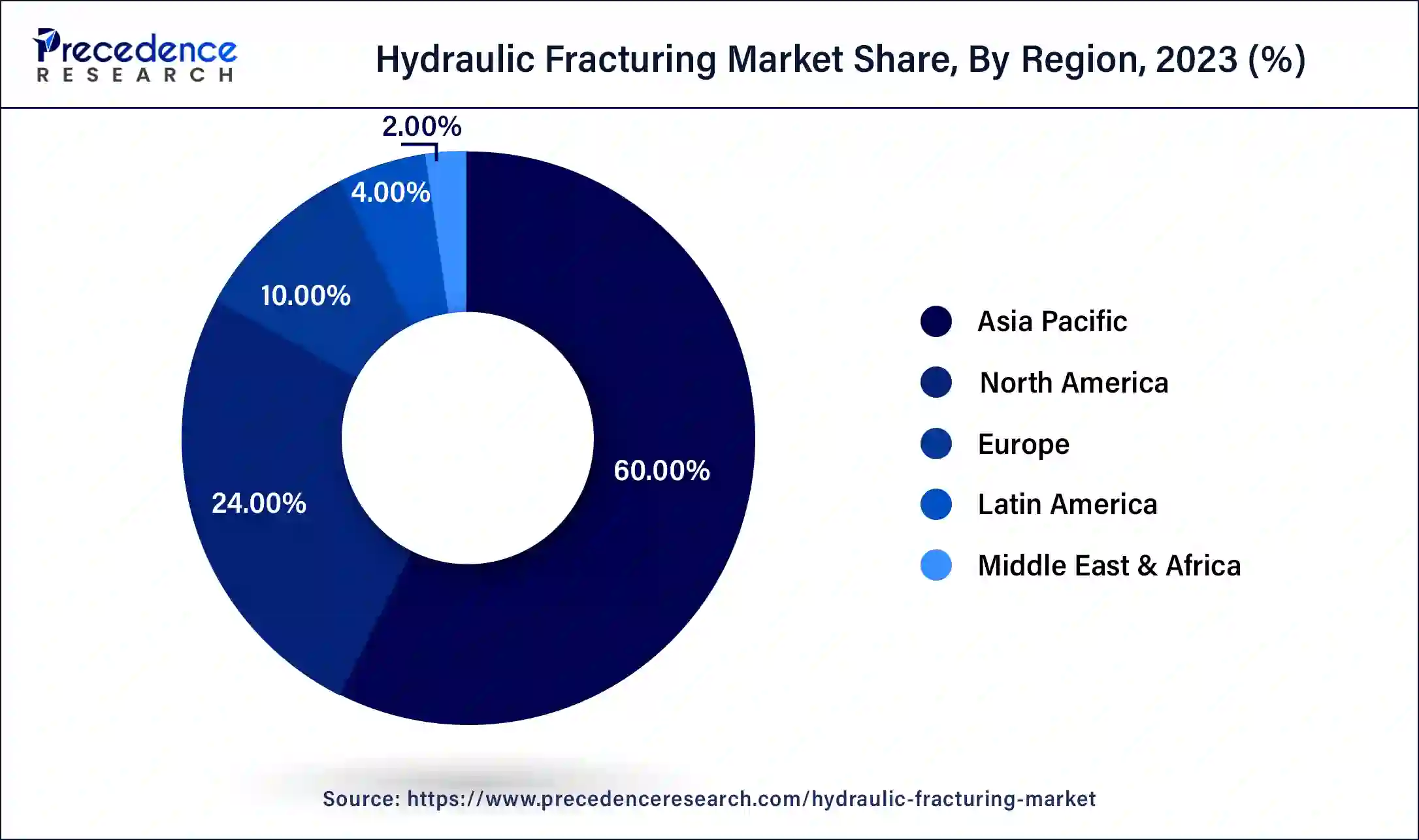

Asia Pacific was the leading hydraulic fracturing market that garnered a market share of more than 60% in 2023. Asia Pacific is the home to more than half of the global population which provides a huge consumer base. The rapid urbanization, rising disposable income, busy and hectic lifestyle, rising penetration of the internet, and the increasing adoption of the smartphones are some of the significant macroeconomic factors that drives the growth of the hydraulic fracturing market in Asia Pacific. Moreover, the presence of huge youth population and the rising demand for food along with the rising population is supplementing the market growth. The countries like China and India are showing promising growth opportunities for the market players owing to the strong economic growth in the region. The rising demand for the international cuisines and rising preferences for the food delivery over dine-in is supplementing the growth of the Asia Pacific hydraulic fracturing market. For this, the Asia Pacific is also estimated to be the fastest-growing market.

North America is estimated to grow at a considerable pace during the forecast period. Increasing buying power, improved access to the digital technologies, higher penetration of internet, and increased adoption of the smart devices are some of the major factors that has propelled the growth of the North America hydraulic fracturing market. The high demand for the fast foods coupled with the busy and hectic schedules of the consumers is boosting the demand for the hydraulic fracturing services owing to the conveniences associated with it.

Hydraulic fracturing is known as a technology in which the fluids are drove into the well at a high level of injection in order to breakdown the reservoirs of oil. This fluid comprise of chemicals, water, and sand. In addition, in the production of oil and gas, it is in general used to increase the production of oil & gas reservoirs in order to keep the well sticky in nature and also fracturing fluids are utilized in this technique for creating a fracture of better width. This technique of hydraulic fracturing is father known as fracking and it is utilized to generate gas and oil from the well. Also, this technique of fracking is provided by variouscompanies of oils & natural gas and it is also utilized in various applications such as tight oil, crude oil, shale oil and many others.

A significant increase in the offshore and onshore oil and gas explorationactivities is one of the major factors driving the market growth. Hydraulic fracturing is extensively used for the redevelopment of well base expansion, oil fields, and exploring new offshore projects for the extraction of crude oil and natural gas. In addition, the growing demand for energy across both emerging and developed nations is providing a growth impetus to the market. Hydraulic fracturing is widely used for the exploration of optimization of oil production and highly impermeable shale reservoirs. In line with this, the increasing adoption of prefundplug technology for horizontal and vertical wells is also contributing to the market growth. In addition, the growth of waterless and foam-based technologies of fracking is working as another growth factor. In addition, foam provides low liquid and high viscosity content that helps in decreasing water reducing and utilizing the impact on the environment. Furthermore, other key factors, comprise of the growth of lucrative fine sand of mesh frac, also with the application of sustainable development favorable policies, are anticipated to drive the market toward growth.

The outbreak of the COVID-19 epidemic in 2020 forced the government to shut down the market in an attempt to restrict the spread of the covid19 virus. Likewise, the lockdown rules and travelling restrictions were assessed across the globe. The propagation of the COVID-19 worldwide has braked down the growth of multitudinous diligence. Furthermore, epidemic has resulted in a substantial decline in affiliated conditioning and transportation, which has further impacted the customer demand for oil and gas. According to the report of International Energy Agency (IEA), the events of geopolitical has increased the low-priced oil supply to the global market of hydraulic fracturing, and during the same time, the demand also declined owing to the outburst of the epidemic, leading to a collapse in oil prices in March 2020. Moreover, these events altogether negatively impacted the global demand regardingoil and natural gas, along with the demand for hydraulic fracturing products & servicesand have integrated significant oil prices volatility.

| Report Coverage | Details |

| Market Size in 2023 | USD 54.71 Billion |

| Market Size in 2024 | USD 59.36 Billion |

| Market Size by 2034 | USD 132.88 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Well Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technological advancements

Technological advancements have played a crucial role in driving the Hydraulic Fracturing (fracking) market. Advancement in horizontal drilling techniques allows for greater access to hydrocarbon reservoirs. Technological innovations enable real-time monitoring of well performance and reservoir conditions. Data analytics help operators make informed decisions, optimize production, and troubleshoot issues promptly, improving overall efficiency and reducing downtime. Technologies like Enhanced Oil Recovery (EOR) methods, such as CO2 injection and chemical flooding, can be integrated with hydraulic fracturing to maximize hydrocarbon recovery.

Environmental concerns

Governments and regulatory bodies are increasingly scrutinizing the environmental impact of hydraulic fracturing. Stricter regulations, permit requirements, and environmental assessments can increase the operational costs and timelines for fracking projects. Fracking generates a significant amount of wastewater, often containing hazardous substances and heavy metals. Proper disposal and treatment of this wastewater pose challenges, and improper handling can lead to soil and water pollution.

Emergence of water management solutions

Increasing environmental regulations and public concern about water usage and contamination have put pressure on the hydraulic fracturing industry to adopt more sustainable and responsible practices. Water management solutions can help companies comply with regulations and demonstrate their commitment to environmental stewardship. Effective water management solutions can lead to cost reductions by optimizing water usage, recycling wastewater, and minimizing the need for freshwater inputs. Concerns about water scarcity and pollution have led to increased scrutiny of fracking operations by communities and stakeholders.

The horizontal well segment held the dominating share of the hydraulic fracturing market in 2023. Horizontal wells allow for a greater contact area with the reservoir rock compared to vertical wells. This extended contact enhances the recovery of hydrocarbons, especially in unconventional resources such as shale formations.

The horizontal well segments enable better access to the natural fractures within the reservoir, leading to increased production rates. By drilling horizontally through the productive zone, operators can tap into more natural fractures and maximize the flow of hydrocarbons.

Based on the application, the shale gas segment is expected to grow at the fastest rate during the forecast period. In addition, there are a myriad number of shale reserves around the world. Also, according to the EIA study, there exist 48 shale gas basins in 32 countries, which comprise of almost 70 shale gas foundations in total. Consequently, China has shale gas reserve which is technically recoverable of about 21.8 tcmand has proved shale gas reserve of 764.3 bcm, Sichuan basin based marine facies. Furthermore, the technically recoverable shale gas reserves of Argentinawhich is around 802 billion cubic feet, however Algeria comprise of the world’s third largest intact resources of shale gas with 20 tcm shale gas which is technically recoverable. Therefore, such myriad reserves are boosting the market growth of hydraulic fracturing.

Segments Covered in the Report

By Well Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client