October 2024

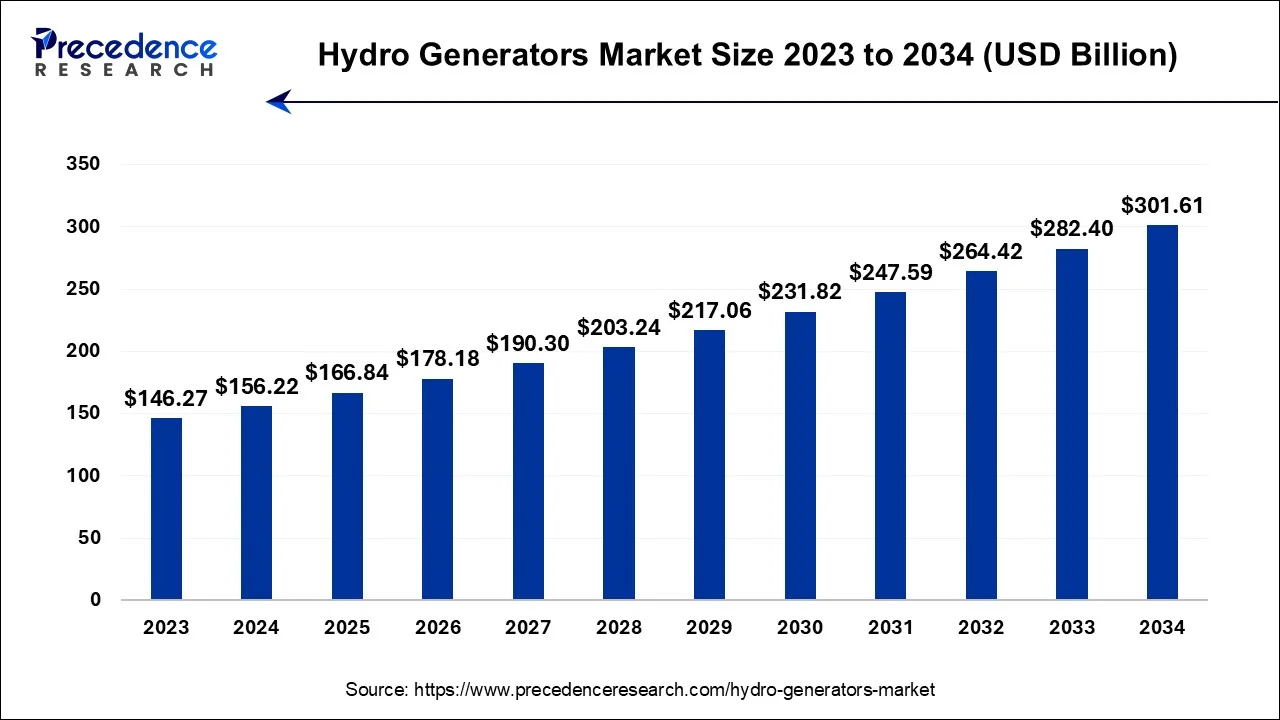

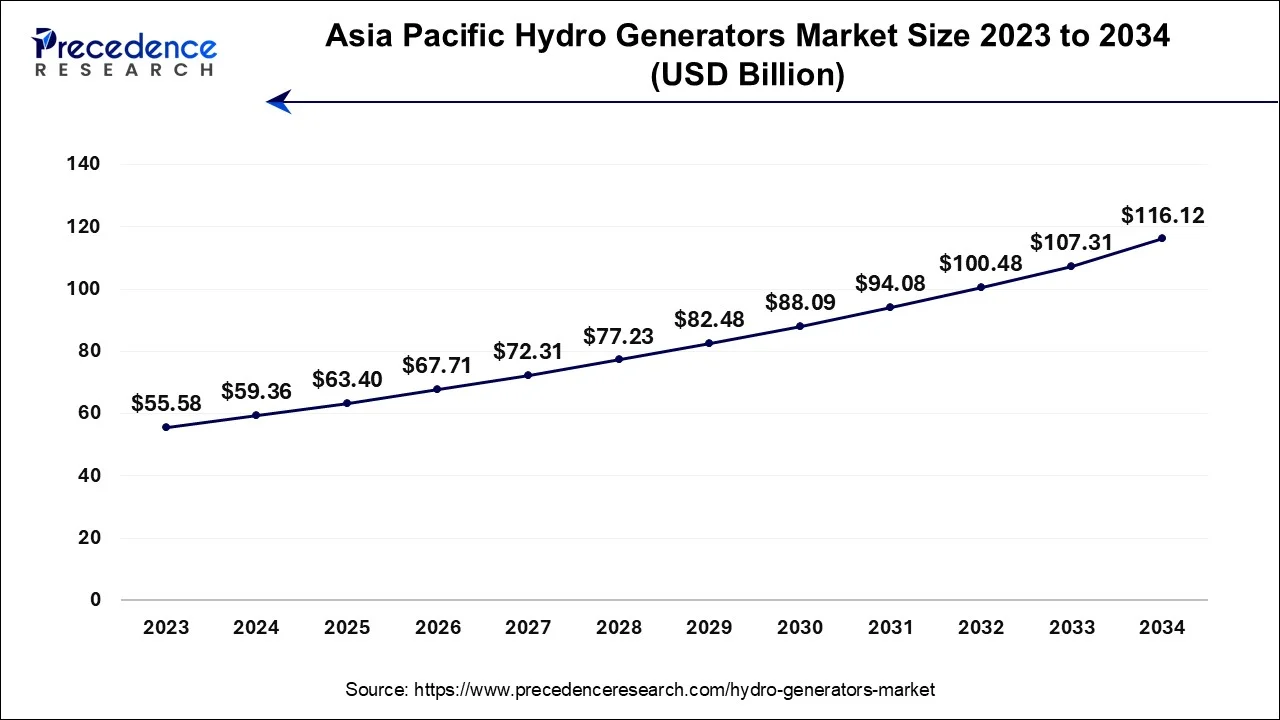

The global hydro generators market size is evaluated at USD 156.22 billion in 2024, grew to USD 166.84 billion in 2025 and is projected to reach around USD 301.61 billion by 2034. The market is expanding at a CAGR of 6.80% between 2024 and 2034. The Asia pacific hydro generators market size is predicted to increase from USD 59.36 billion in 2024 and is estimated to grow at a fastest CAGR of 6.94% during the forecast period.

The global hydro generators market size accounted for USD 156.22 billion in 2024 and is projected to surpass around USD 301.61 billion by 2034, expanding at a CAGR of 6.80% from 2024 to 2034.

The Asia Pacific hydro generators market size reached USD 59.36 billion in 2024 and is expected to grow around USD 116.12 billion by 2034, growing at a CAGR of 6.94% between 2024 and 2034.

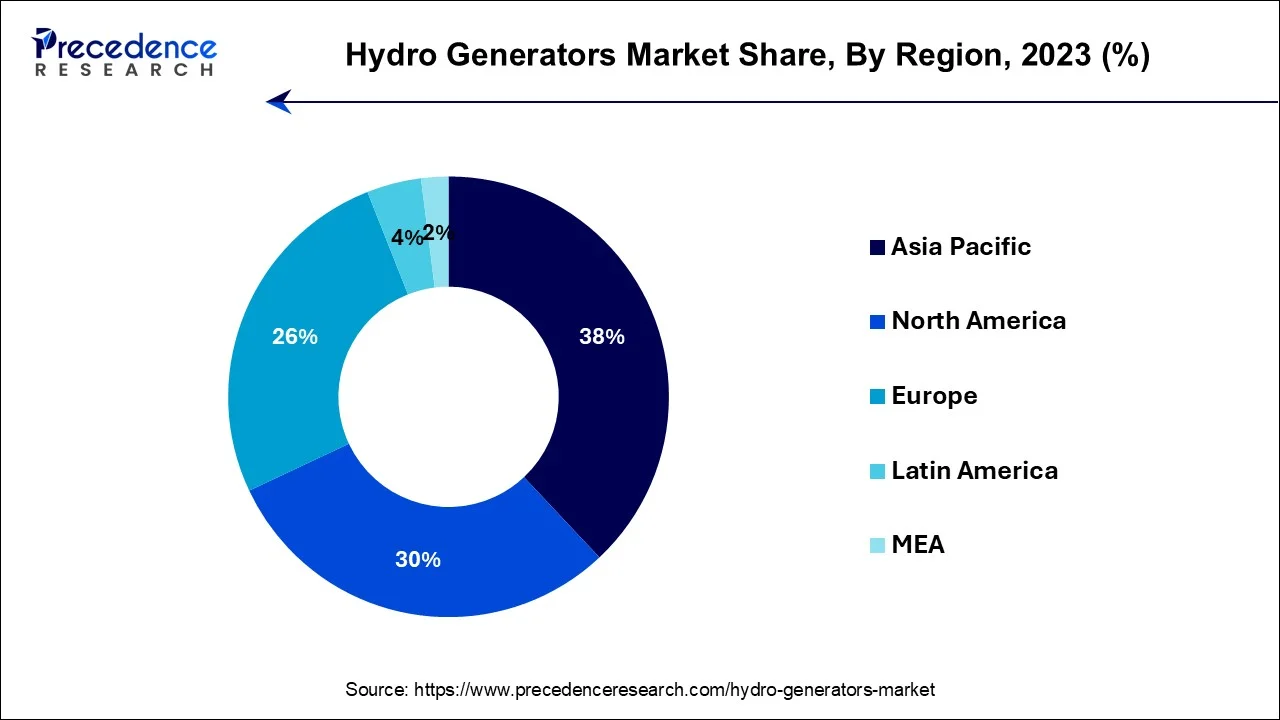

Asia-Pacific has held the largest revenue share 38% in 2023. In the Asia-Pacific region, the hydro generators market is witnessing robust growth. Countries like China, India, and Southeast Asian nations are investing heavily in hydropower projects to meet escalating energy demands sustainably. Small and micro hydropower installations are gaining popularity, catering to localized energy needs. Additionally, digitalization is on the rise, with the integration of real-time monitoring and control systems enhancing operational efficiency. The region's commitment to renewable energy and the potential of untapped hydropower resources continue to drive market trends.

Europe is estimated to observe the fastest expansion in Europe, the hydro generators market is experiencing a resurgence. This renewed focus has reignited interest in the sector, leading to a resurgence in investments and developments. Notably, offshore hydropower projects, especially in the North Sea region, are rapidly expanding. This expansion is driving an increased demand for specialized hydro generators, highlighting the region's dedication to harnessing the potential of clean and sustainable energy from hydropower sources. A shift towards high-efficiency generators and the incorporation of digital technologies for improved performance are prominent trends. Europe's emphasis on sustainability and grid integration remains a driving force, with countries actively modernizing and expanding their hydropower infrastructure to meet clean energy targets.

The hydro generators market in North America is on an upward trajectory. The United States and Canada are actively investing in upgrading existing hydropower facilities and exploring new projects. A focus on advanced turbine technology and grid integration solutions is evident. This region's commitment to clean energy sources continues to drive market growth and innovation in the hydro-generator industry.

Hydro generators are electromechanical devices used in hydropower plants to convert the kinetic energy of flowing water into electrical energy. They form a critical component of the hydroelectric power generation process. As water flows through a dam or penstock, it strikes the blades of the hydro generator's turbine, causing it to spin. This rotational motion is then transformed into electricity through electromagnetic induction. Hydro generators are available in various types, including synchronous, asynchronous, direct drive, and permanent magnet generators, catering to a wide range of hydropower applications, from large-scale hydroelectric plants to small, decentralized micro-hydropower systems, contributing to clean and sustainable energy production.

The hydro generators market is currently experiencing substantial growth driven by the global transition to renewable energy sources. Hydro generators, as integral components of hydropower plants, play a central role in this transition. Governments worldwide are increasingly advocating for cleaner and more sustainable energy solutions, with hydropower being a reliable and environmentally friendly option. Supportive policies and incentives further boost the market's expansion, encouraging the development of hydropower projects where hydro generators are pivotal. Key growth drivers for the hydro generators market include the global shift towards renewable energy, the need to expand hydropower capacity to meet escalating electricity demands, continuous technological advancements enhancing generator efficiency, and government initiatives such as financial incentives and regulations supporting hydropower projects.

In addition to these drivers, industry trends encompass the development of small and micro hydropower projects tailored to localized energy requirements and the integration of digital technologies for real-time monitoring and control, which enhances operational efficiency and reliability.

However, The hydro generator industry encounters significant challenges, primarily centered around mitigating the environmental impact of hydropower projects and navigating intricate and time-consuming regulatory approval processes. Environmental concerns, particularly related to aquatic ecosystems and local communities, necessitate rigorous planning and mitigation measures. Moreover, obtaining the necessary approvals can be a complex endeavor.

Despite these challenges, the industry presents substantial business opportunities. One notable opportunity lies in global expansion, particularly in emerging markets with untapped hydropower potential. Generator manufacturers have the chance to tap into these regions and contribute to their sustainable energy development. Additionally, there is a growing market for retrofitting existing hydropower facilities with modern generators and providing comprehensive maintenance services. Ensuring the efficient operation and longevity of these facilities aligns with the industry's commitment to sustainability and presents a lucrative avenue for growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 301.61 Billion |

| Market Size in 2024 | USD 156.22 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.80% |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Capacity, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global transition to renewable energy and hydropower capacity expansion

The pressing need to expand hydropower capacity is another force propelling market demand. Among these sources, hydropower stands out as both reliable and sustainable. Hydro generators play a pivotal role in harnessing the kinetic energy of flowing water to generate clean and environmentally friendly electricity, cementing their crucial position within the renewable energy landscape. In this context, hydro generators emerge as indispensable components, ensuring the efficient conversion of water's kinetic energy into clean electrical power.

Moreover, the need to expand hydropower capacity is driving the market further. Growing electricity demands necessitate the development of new hydropower projects, both large and small. Governments and utilities are actively investing in these projects to secure a stable energy supply. Hydro generators are the heart of these installations, ensuring efficient energy conversion from water to electricity. In essence, the hydro generators market is thriving as it aligns with global environmental goals and addresses the pressing need for expanded hydropower capacity in the quest for a sustainable energy future.

Environmental impact and regulatory approvals

The hydro generators market faces notable restraints in the form of environmental impact concerns and complex regulatory approval processes. which includes the environmental impact of hydropower projects presents a significant challenge. Hydropower, while a clean and renewable energy source, can have adverse effects on aquatic ecosystems, including alterations in water flow, temperature, and habitat disruption. These environmental concerns require meticulous planning and mitigation measures, which can increase project costs and timelines.

Furthermore, navigating the complex web of regulatory approvals is a formidable obstacle. Developing hydropower projects often involves lengthy and intricate permitting processes, varying from region to region. These hurdles can delay project commencement and increase overall investment risks. The need to satisfy environmental impact assessments, stakeholder consultations, and compliance with numerous regulations demand substantial resources and expertise. As a result, these restraints can hinder market growth by deterring potential investors and developers from engaging in hydropower projects, despite the industry's undeniable potential for clean and sustainable energy production.

Retrofitting existing facilities and comprehensive maintenance services

Retrofitting existing hydropower facilities and offering comprehensive maintenance services play a vital role in surging the market demand for the hydro generators market. As aging hydropower plants require upgrades to maintain efficiency and comply with modern environmental standards, the demand for retrofitting services has risen significantly. Upgrading these facilities with modern, efficient hydro generators improves overall power generation and extends the lifespan of the plant, ensuring its continued contribution to the energy grid.

Furthermore, the market for comprehensive maintenance services is expanding as the reliability and performance of hydropower facilities become paramount. Preventive maintenance and timely repairs ensure uninterrupted power generation and reduce downtime, saving costs and enhancing the long-term viability of these plants. As hydropower continues to be a key component of renewable energy strategies, retrofitting and maintenance services are pivotal in optimizing existing infrastructure and driving the Hydro Generators Market's growth, supporting a more sustainable and reliable energy future.

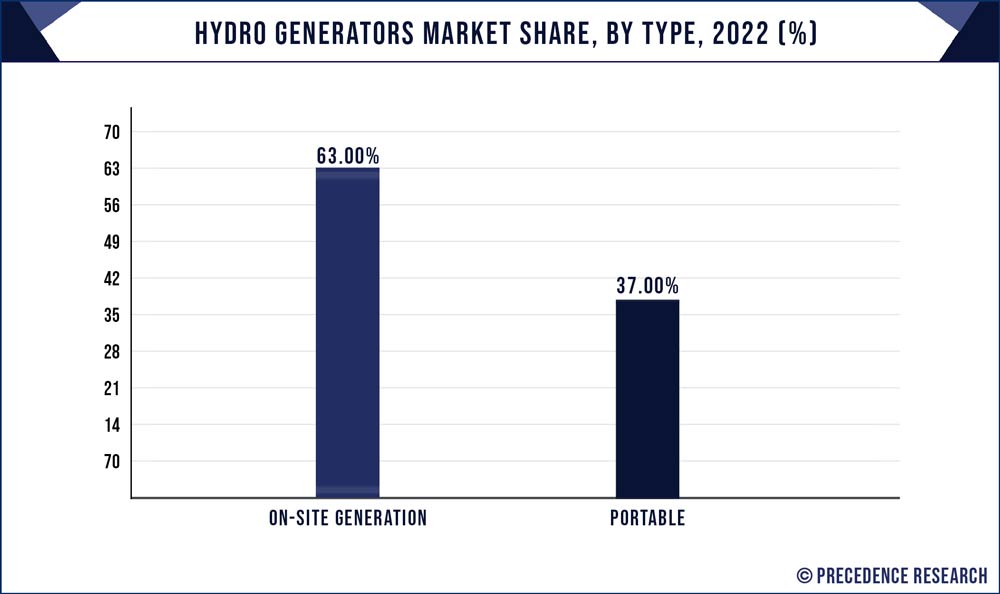

The On-Site Generation has held 63% revenue share in 2023. On-site generation hydro generators are stationary installations integral to hydroelectric power plants. They directly convert the kinetic energy of flowing water into electricity. These generators are engineered for continuous, high-capacity power production, primarily utilized in large-scale hydropower facilities. In the hydro generators market, on-site generation hydro generators maintain their dominance, bolstered by the global proliferation of grid-connected hydropower projects.

The current trends focus on elevating their efficiency and longevity through technological advancements and innovative materials. Moreover, the industry places growing importance on environmental sustainability, prompting initiatives to mitigate the ecological impact of on-site generation projects. This includes the development of fish-friendly turbine designs and more effective water management practices, aligning with the industry's commitment to eco-conscious practices and minimizing environmental disruption.

The Portable segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. Portable hydro generators are compact, versatile units designed for mobility and ease of deployment. They can be transported to various locations to harness energy from natural water sources, making them suitable for off-grid or remote areas. The portable hydro generator segment is witnessing growth due to its suitability for decentralized energy generation in remote regions. A notable trend is the development of more lightweight and efficient portable generators, making them easier to transport and install. These generators cater to the demand for small and micro hydropower projects and emergency power generation solutions in off-grid locations. Additionally, advancements in energy storage technologies are complementing portable hydro generators, ensuring a continuous power supply even when water flow is intermittent.

The 101 to 250W segment held the largest market share of 39% in 2023. Hydro generators with a capacity of 101 to 250 watts are considered small-scale units, typically employed in micro-hydropower projects or remote off-grid applications. These generators cater to localized energy needs, such as powering rural communities, small industries, or remote agricultural operations. In recent years, the trend for these generators involves increased efficiency and reliability, making them suitable for off-grid electrification initiatives in developing regions and eco-friendly energy solutions in environmentally sensitive areas.

On the other hand, the 501 to 750W segment is projected to grow at the fastest rate over the projected period. Hydro generators within the 501 to 750-watt capacity range are commonly utilized in small to medium-sized hydropower installations. These generators are versatile and adaptable, serving a variety of applications, including decentralized energy generation, rural electrification, and industrial operations. The trend in this capacity segment encompasses enhanced automation and digitalization, allowing for real-time monitoring and control. This trend not only improves operational efficiency but also aligns with the broader industry shift towards smart grid integration, optimizing the utilization of hydropower resources within a modern energy landscape.

Segments Covered in the Report

By Type

By Capacity

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

July 2024