September 2024

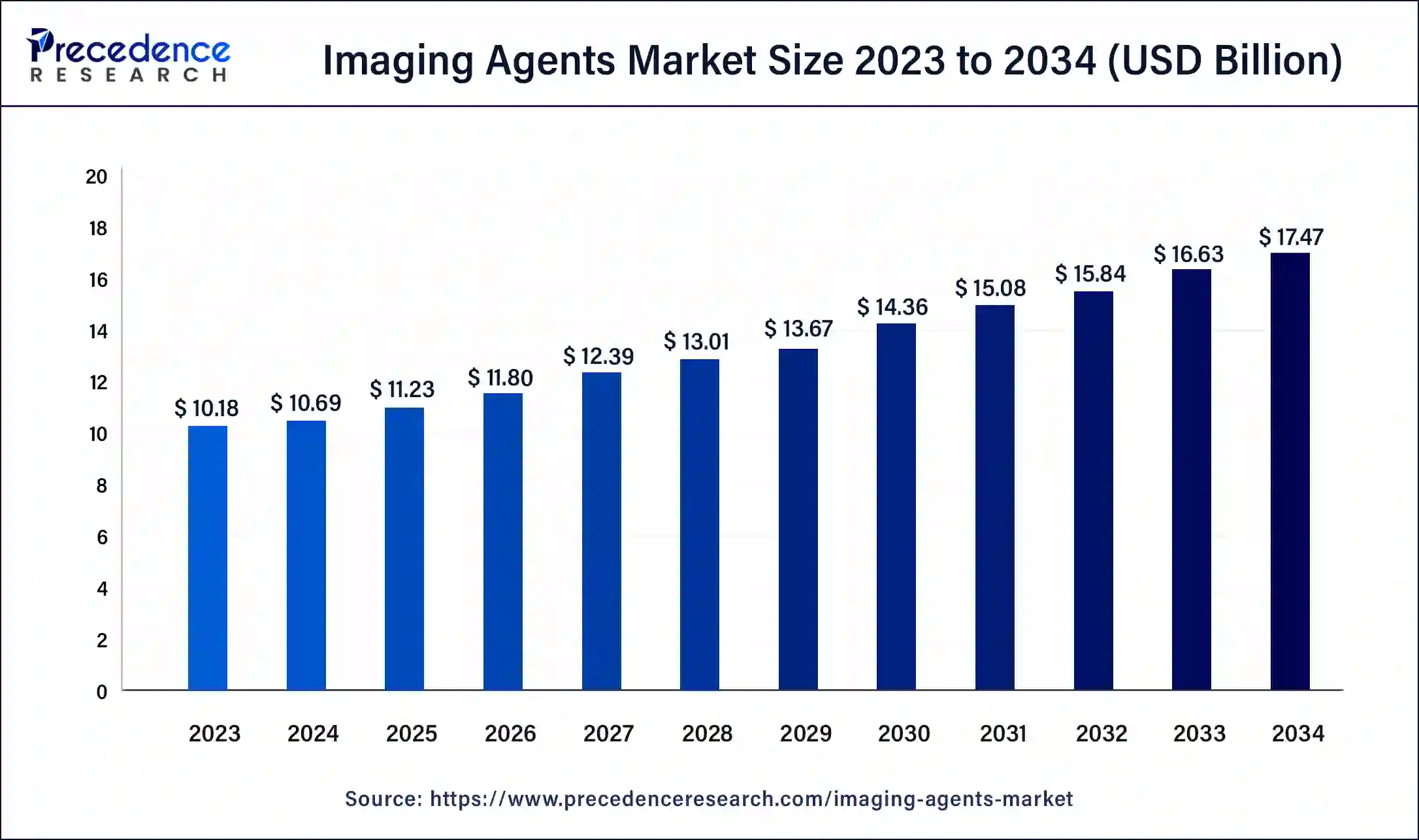

The global imaging agents market size surpassed USD 10.18 billion in 2023 and is estimated to increase from USD 10.69 billion in 2024 to approximately USD 17.47 billion by 2034. It is projected to grow at a CAGR of 5.03% from 2024 to 2034.

The global extruded plastics market size is worth around USD 10.69 billion in 2024 and is anticipated to reach around USD 17.47 billion by 2034, growing at CAGR of 5.03% over the forecast period 2024 to 2034. The imaging agents market growth is attributed to the development in providing information about structural or disease-related changes.

With the help of an imaging agent, users observe the anatomical structure and physiological process to diagnose the disease. The localization of disease and monitoring of disease progression or regression is crucial for preclinical research and clinical intervention. This calculates the suitable course of treatment and assesses the effectiveness of the ongoing treatment. To achieve an accurate diagnosis, a combination of imaging technology is required. Various imaging modalities pose different characteristics, strengths, and challenges regarding spatial resolution, sensitivity, or tissue penetration depth. In the last 20 years, the application of nanotechnology has improved the image quality in structural and biomolecular imaging and simultaneously reduced the toxicity of image-enhancing agents. The application is also noticed in the pharmaceutical industry for drug development and pharmacokinetic measurements, which guide dose selection.

How is AI changing the imaging agents market?

AI is widely used in medical imaging. It is used to identify complicated patterns in imaging data, provide a quantitative evaluation of radiographic traits, and detect image modalities at various treatment stages. The incorporation of AI analysis into medical imaging supports healthcare professionals in identifying problematic areas. For instance, AI-based medical imaging technology is used to diagnose cardiovascular abnormalities, which helps to identify left atrial enlargement and cardiac problems. AI-powered medical imaging tools utilize powerful algorithms and massive computing power to provide physicians with decision support quickly. AI and machines are beneficial for tracking the patient’s condition and detecting even the slightest change in vast amounts of information.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.47 Billion |

| Market Size in 2024 | USD 10.69 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.03% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Modality, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Forecasting and prevention

Medical imaging allows doctors or medical professionals to identify the underlying problem with any intervention with the internal body, such as tendons, muscles, joints, vessels, and organs. This also results in the patient's early recovery. Imaging procedures such as CT scans and radiation therapy technologies use medical radiation (such as ionizing radiation, gamma rays, and x-rays) to diagnose and treat a wide range of diseases, including stroke, heart disease, cancer, and appendicitis. Medical Imaging & Technology Alliance (MITA) states that manufacturers have introduced new products, system innovations, and patient care initiatives that reduce radiation doses by up to 75 percent, along with improving the ability of physicians to diagnose and treat their patients.

Patient awareness

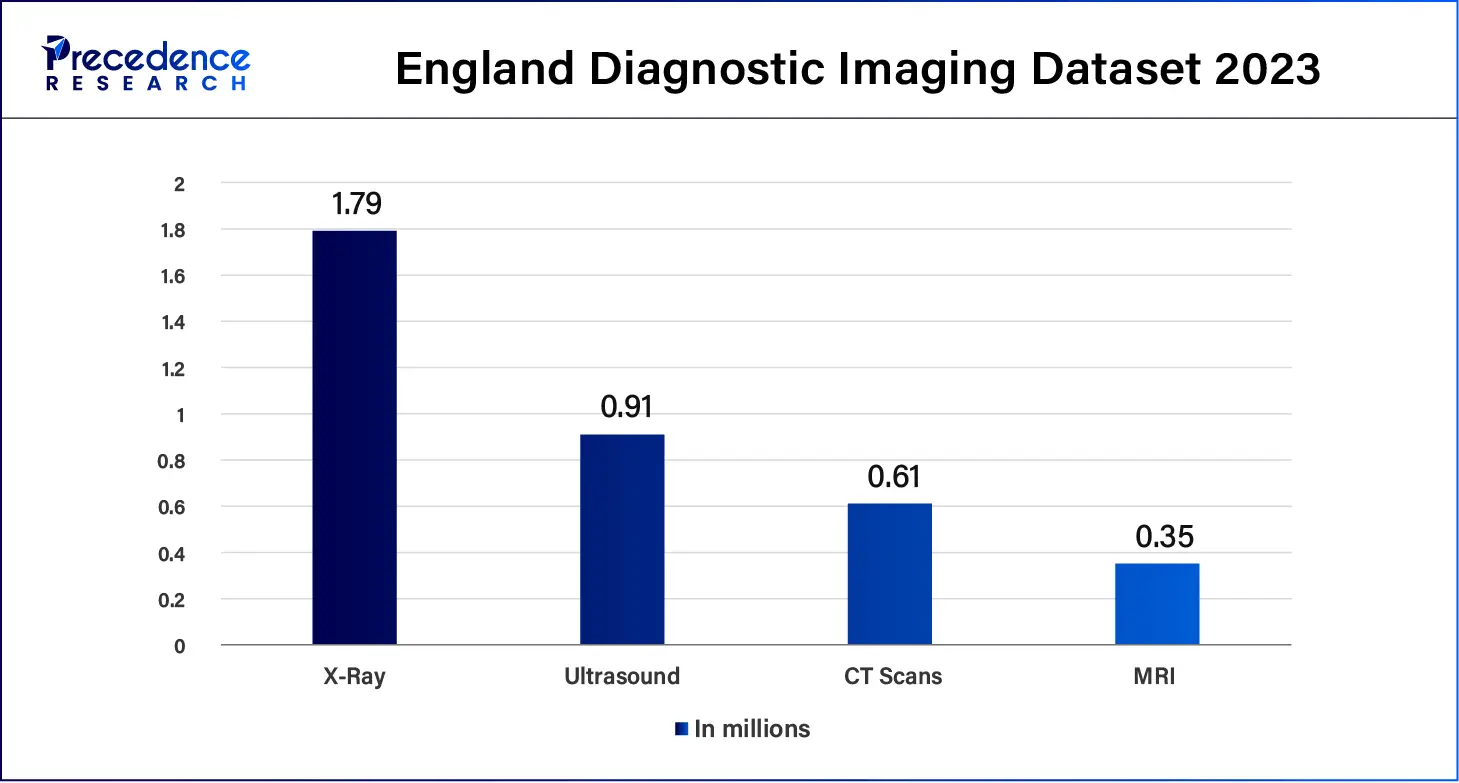

An increase in patient awareness for those who undergo frequent medical imaging is observed. It is essential to reduce radiation-related risk while simultaneously progressing the diagnosis. In a meeting held by The International Atomic Energy Agency (IAEA) under the Department of Nuclear Safety and Security, the participants discussed the impacts and strong action needed to improve guidelines for patient protection and technological solutions to monitor patient radiation exposure. Geographically, Japan has the record for most diagnostic devices in the world. In England, 45.9 million imaging tests were proclaimed in the year 2023.

Deep Learning and Machine Learning

Imaging agents involving deep learning and machine learning technologies are expected to be incorporated into medical imaging as hand interpretation of reports after observing the medical image leads to delay and errors; this issue can be avoided in the future. In the field of medical image processing, deep learning models are having a profound effect. Convolutional neural networks (CNNs), artificial neural networks used for image and pattern recognition, and other deep learning techniques have made it practically possible to automate the processing of medical images and improve diagnostic and treatment accuracy. This is widely applicable in radiology.

The iodinated contrast media segment dominated the imaging agents market in 2023 and is expected to expand in the field. Iodinated contrast media is a chemical contrast agent that contains iodine atoms for x-ray-based imaging modalities such as computed tomography (CT) and angiography. It is known to improve imaging resolution between tissues and improve blood vessel visualization. According to Immunology and Allergy Clinics of North America 2022, ICM is operated worldwide approximately 75 million times per year.

The gadolinium contrast media segment is expected to grow at a significant rate in the imaging agents market during the forecast period of 2024-2034. Contrast agents are pharmaceutical drugs that increase the information of diagnostic images. It improves the sensitivity and specificity of diagnostic images by changing the natural properties of tissues, which make an impact on the fundamental mechanisms. Gadolinium contrast media is also known as MRI contrast media, agents, or dyes. The use is widely noticed in magnetic resonance imaging (MRI) scans. This contrast media is injected into the body before the MRI scan to enhance and improve the quality of the MRI images. This provides an accurate anatomical and physiological report of the body, which helps the radiologist diagnose it.

The cardiology segment dominated the imaging agents market in 2023. Cardiac imaging consists of several types of examination that capture pictures of your heart and surrounding structures. With the help of diagnostic imaging, doctors detect heart conditions such as heart disease, leakage in heart valves, and defects in the size and shape of the heart. Cardiac (heart) imaging procedures include CT Coronary Angiography (CTCA), Coronary Artery Calcium Scoring, and MRI Heart (Cardiac MRI). Cardiovascular imaging is a safer procedure that is non-invasive or minimally invasive. Seldom people get allergic reactions because of the dye used in cardiac imaging tests.

The oncology segment is estimated to grow at the fastest rate in the imaging agents market during the forecast period. Cancer is a difficult disease to detect, but with the help of imaging techniques, early detection of many cancers is possible. Additionally, imaging techniques determine how developed the cancer is or the cancer stage, and they detect the precise location of uncontrollable growth of body cells, which directs the surgery to treat the cancer.

The computed tomography (CT) segment dominated the global imaging agents market in 2023. Computed tomography (CT) is a 3D X-ray that is constructed by taking X-ray shots of the same structures from different angles. Later, these X-rays undergo a computer process, yielding a 3D image. compared with other noninvasive imaging modalities, the CT scan is the fastest and provides high resolution, making it one of the most widely used diagnostic imaging techniques, particularly in oncology and cardiology. The majority of clinically used CT contrast agents are iodinated small molecules, as iodine efficiently reduces X-ray photons. The high energy emitted by X-ray leads to ionization, which means the radiation changes the atomic structure of the tissue, causing a potential risk for the development of cancer. It also damages the DNA. Contributing to the CT segment is more demanding in the imaging agents market.

The diagnostic & Imaging Centers segment accounted for the biggest share of the imaging agents market in 2023, as healthcare practitioners refer patients to engage with diagnostic imaging centers, which produce medical images with the help of a variety of machines and techniques, including radiography (X-rays), magnetic resonance imaging (MRI), computed tomography (CT), fluoroscopy, ultrasound, echocardiography, and nuclear medicine, such as PET. Moreover, the affordable factor for both patients and healthcare professionals contributes to the rising demand for diagnostic & imaging center segments in the market.

North America dominated the imaging agents market in 2023 due to the increasing demand for radiology imaging, which has experienced significant advancements over the past few years in North America. This region has constantly grown and strengthened its healthcare industry infrastructure. These advancements are witnessed in technology, application, and accessibility of the services. The United States is known to have the best medical imaging facilities and the world’s top radiology department, which focuses on thorough patient care. Moreover, investment in research and development is fueling the growth of imaging agents markets.

Asia Pacific is anticipated to grow at the fastest rate in the imaging agents market during the forecast period. The Asia Pacific region is expanding in the market due to the rising number of cancers, heart disease, and gastrointestinal cases. Japan and South Korea are at the forefront of these technological innovations. Recently, robotic radiology has been incorporated into this region.

Segments Covered in the Report

By Product

By Application

By Modality

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025