July 2024

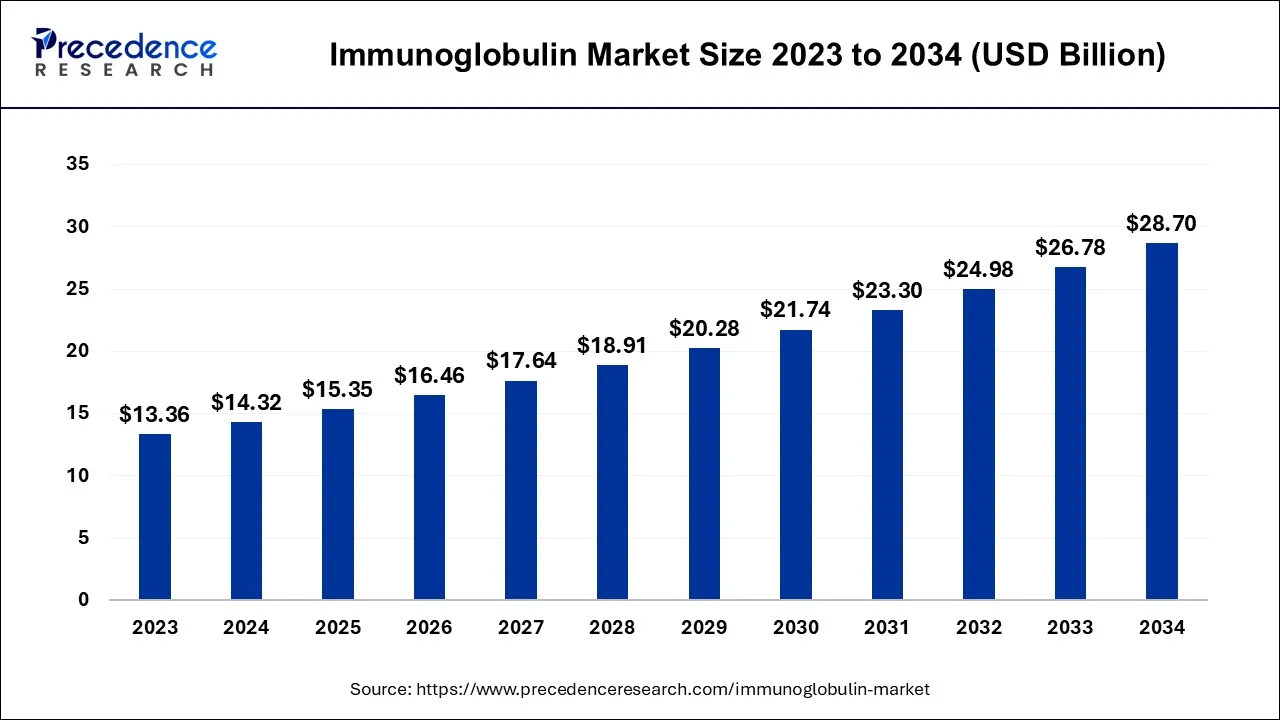

The global immunoglobulin market size accounted for USD 14.32 billion in 2024, grew to USD 15.35 billion in 2025, and is projected to surpass around USD 28.70 billion by 2034, representing a healthy CAGR of 7.2% between 2024 and 2034. The North America immunoglobulin market size is calculated at USD 6.59 billion in 2024 and is expected to grow at the fastest CAGR of 7.23%% during the forecast year.

The global immunoglobulin market size is expected to be valued at USD 14.32 billion in 2024 and is anticipated to reach around USD 28.70 billion by 2034, expanding at a CAGR of 7.2% over the forecast period 2024 to 2034.

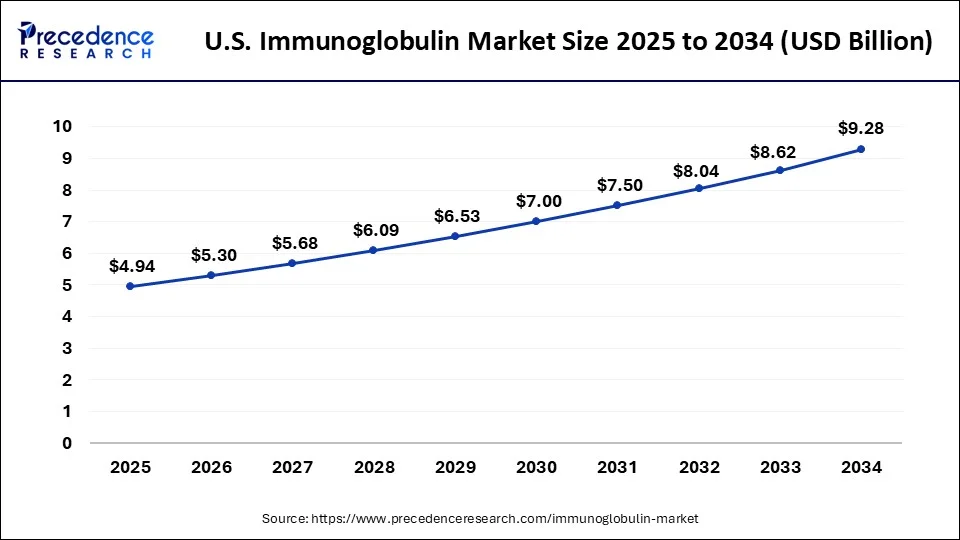

The U.S. immunoglobulin market size is calculated at USD 4.61 billion in 2024 and is projected to be worth around USD 9.28 billion by 2034, poised to grow at a CAGR of 7.24% from 2024 to 2034.

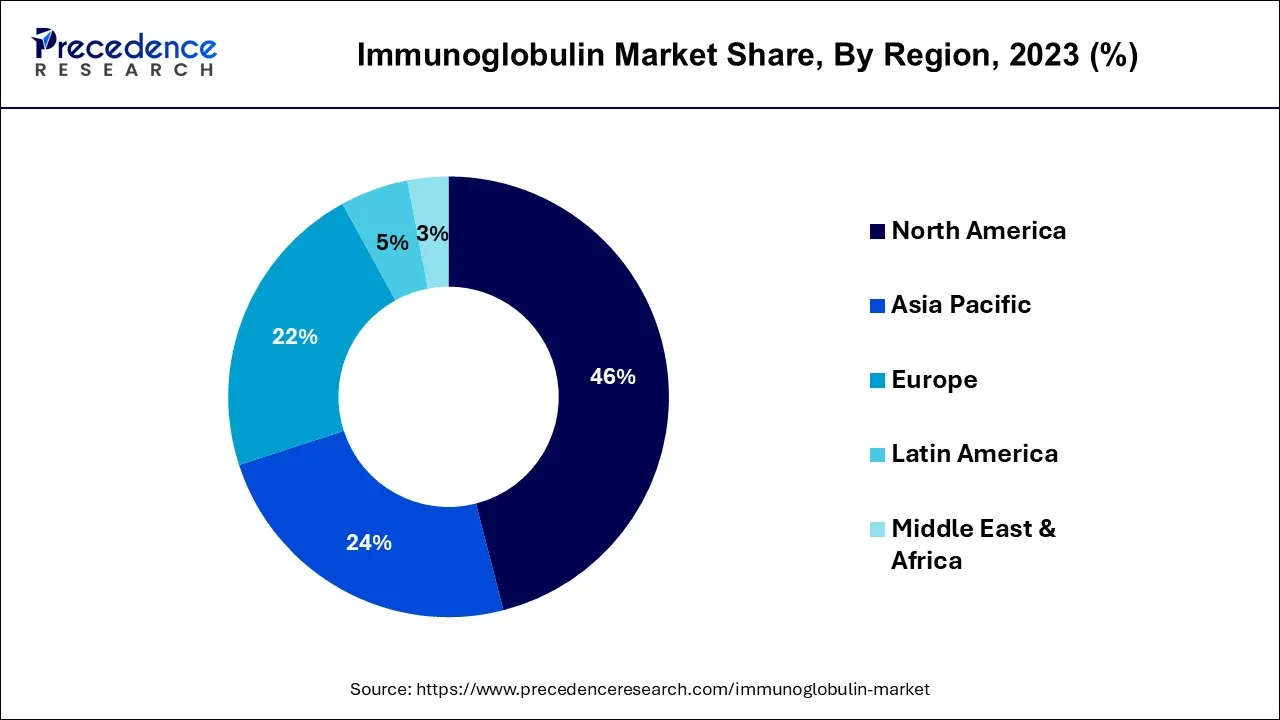

North America has held the largest revenue share 46% in 2023. In North America, the immunoglobulin market reflects a robust demand driven by advanced healthcare infrastructure and a high prevalence of immunological disorders. The region witnesses a growing emphasis on subcutaneous immunoglobulin administration, aligning with patient preferences for at-home treatments. Ongoing research into expanding therapeutic applications and strategic collaborations further shapes the market landscape, with regulatory support ensuring the safety and efficacy of immunoglobulin products.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific experiences dynamic trends in the immunoglobulin market, fueled by increasing healthcare awareness and a rising incidence of autoimmune diseases. The region sees a notable expansion in therapeutic applications, particularly in neurology and hematology. Accessibility to immunoglobulin therapies is enhanced by technological advancements and partnerships for localized manufacturing. Growing government initiatives for healthcare infrastructure development and immunization programs contribute to the market's steady growth in Asia-Pacific.

In the European immunoglobulin market, advanced healthcare systems drive trends, emphasizing the development of subcutaneous immunoglobulin for patient convenience. The region experiences an expanding therapeutic landscape, incorporating immunoglobulin therapies in neurology and hematology. Collaborative research initiatives and stringent regulatory standards characterize Europe's commitment to immunoglobulin advancements, ensuring the safety and efficacy of treatments in addressing a spectrum of immunological disorders.

The immunoglobulin market centers on the production, distribution, and utilization of immunoglobulin products, also known as antibodies. These proteins play a crucial role in the immune system, offering passive immunity against various diseases. The market is driven by the rising prevalence of immunodeficiency disorders, autoimmune diseases, and neurological conditions. Key players focus on developing and commercializing immunoglobulin therapies, including intravenous and subcutaneous formulations. Growing awareness, technological advancements, and an aging population contribute to the market's expansion, with immunoglobulin products serving as vital therapeutic options in addressing a spectrum of medical conditions.

The immunoglobulin market witnesses continuous growth due to advancements in plasma collection techniques and purification processes. Increasing research and development activities, along with expanding applications in areas such as neurology and hematology, further propel market dynamics.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.2% |

| Market Size in 2024 | USD 14.32 Billion |

| Market Size by 2034 | USD 28.70 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Application, By Product, and By Mode of Delivery |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of immunodeficiency disorders and autoimmune diseases and aging population

The immunoglobulin market experiences heightened demand due to the increasing prevalence of immunodeficiency disorders and autoimmune diseases globally. Broadening therapeutic applications of immunoglobulin propels market growth by expanding their utility beyond traditional uses. Ongoing research identifies novel applications in diverse medical specialties, such as neurology and hematology, creating new avenues for immunoglobulin therapies. This diversification not only addresses a wider range of medical conditions but also attracts increased demand, contributing to the market's sustained expansion.

The aging population further amplifies market demand, as older individuals are more susceptible to various health issues requiring immunoglobulin interventions. With aging often associated with a decline in immune function, immunoglobulin therapies become crucial for addressing age-related health challenges. As the world witnesses a demographic shift toward an older population, the immunoglobulin market is expected to meet the escalating healthcare needs associated with immunodeficiency disorders, autoimmune diseases, and age-related health conditions.

High cost of immunoglobulin therapies, side effects and adverse reactions

The high cost of immunoglobulin therapies acts as a significant restraint on market demand. These therapies involve complex manufacturing processes and stringent quality standards, contributing to elevated production costs. As a result, patients, healthcare providers, and healthcare systems face financial challenges in accessing and affording these essential treatments. The cost factor limits the widespread adoption of immunoglobulin therapies, particularly in regions with limited healthcare budgets and resources.

Moreover, the presence of potential side effects and adverse reactions restrains market demand by impacting patient confidence and adherence. Immunoglobulin therapies can lead to adverse events, ranging from mild reactions to severe complications. Concerns about safety and potential adverse effects may deter both physicians and patients from opting for these therapies, hindering the overall growth and acceptance of immunoglobulin products in the healthcare landscape. Addressing these challenges is crucial for ensuring broader accessibility and sustained market growth.

Development of subcutaneous immunoglobulin and expansion of therapeutic applications

The development of subcutaneous immunoglobulin (SCIG) is a significant driver propelling the immunoglobulin market, offering patients a more convenient and patient-friendly administration option. This innovation enhances treatment accessibility, as SCIG allows individuals to self-administer immunoglobulin therapies outside of traditional healthcare settings. This shift towards subcutaneous delivery meets patient preferences, thereby increasing treatment adherence and expanding the overall market demand.

Furthermore, the expansion of therapeutic applications plays a crucial role in surging market demand. Immunoglobulin, once primarily associated with immunodeficiency disorders, now finds diverse applications in areas such as neurology, hematology, and autoimmune diseases. As research uncovers new therapeutic benefits, the versatility of immunoglobulin treatments grows, attracting a broader range of healthcare professionals and patients, and consequently, driving increased demand in the immunoglobulin market.

According to the application, the hypogammaglobulinemia segment has held 38% market share in 2023. Hypogammaglobulinemia refers to a condition characterized by lower-than-normal levels of immunoglobulin in the blood, leading to weakened immune function. In the immunoglobulin market, the treatment landscape for hypogammaglobulinemia has evolved with an increasing demand for immunoglobulin therapies. Advances in purification techniques and a growing patient pool contribute to a rising trend in the development and usage of immunoglobulin products tailored to address the specific needs of individuals with hypogammaglobulinemia.

The immunodeficiency disease segment is anticipated to expand at a significantly CAGR of 9.1% during the projected period. Immunodeficiency diseases involve a compromised immune system, leaving individuals susceptible to infections. Within the immunoglobulin market, the application of immunoglobulin therapies for immunodeficiency diseases is pivotal. Trends indicate a continuous expansion in therapeutic applications, as these therapies prove effective in managing and preventing infections in individuals with various forms of immunodeficiency diseases. Growing research and technological advancements contribute to the evolving landscape of immunoglobulin treatments for immunodeficiency diseases.

Based on the product, the IgA segment held the largest market share of 41% in 2023. Immunoglobulin A (IgA) is an antibody class playing a crucial role in mucosal immunity, primarily found in bodily secretions like saliva, tears, and mucous membranes. In the immunoglobulin market, the demand for IgA is driven by its significance in providing defense against infections at mucosal surfaces. Trends indicate a growing interest in research to harness IgA's potential therapeutic applications, particularly in addressing mucosal infections and immune deficiencies associated with mucosal immunity.

On the other hand, the IgG segment is projected to grow at the fastest rate over the projected period. Immunoglobulin G (IgG), the most abundant antibody in the blood, is central to systemic immune responses. In the immunoglobulin market, IgG holds a dominant position due to its versatility in targeting a wide range of pathogens. Trends highlight an increasing demand for specific IgG formulations tailored for various therapeutic applications, including autoimmune disorders and neurology. The market sees ongoing developments to enhance IgG therapies, ensuring optimized treatment outcomes across diverse medical specialties.

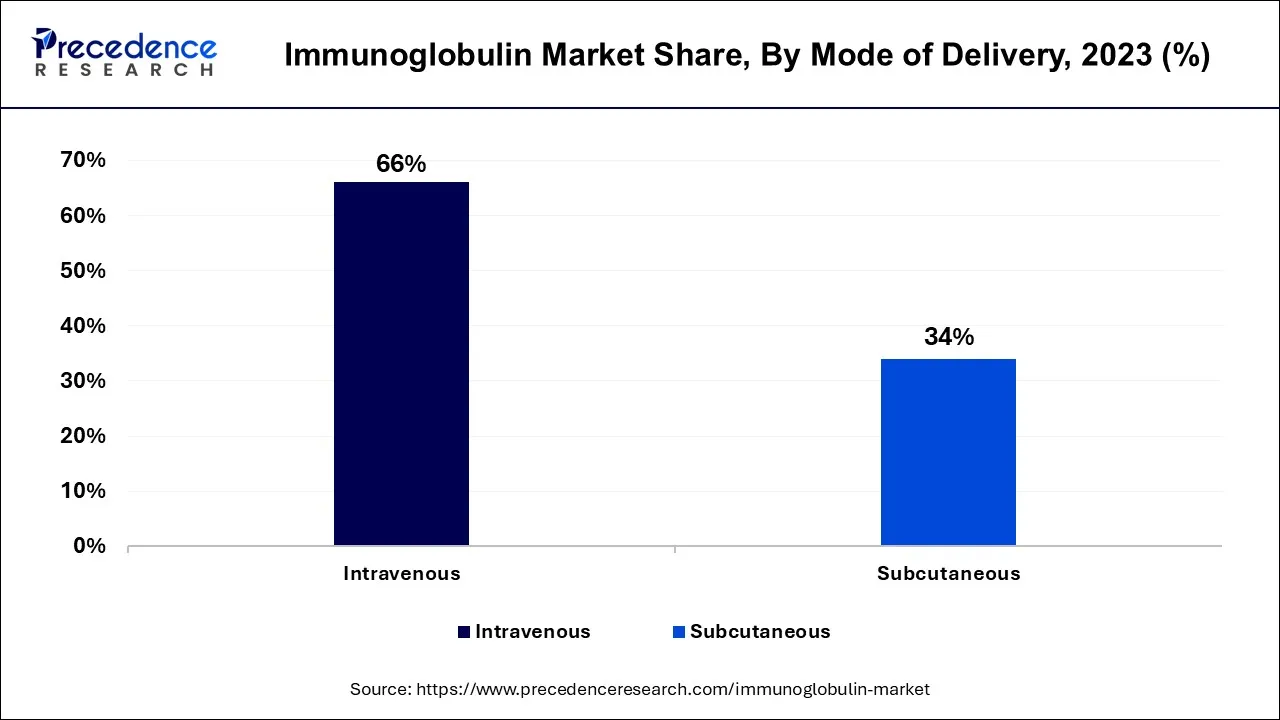

The intravenous segment held the highest market share of 66% in 2023. Intravenous immunoglobulin involves the administration of immunoglobulin products directly into the bloodstream through a vein. This mode of delivery is characterized by its systemic and rapid distribution throughout the body. Trends in the immunoglobulin market show a historical preference for IVIG, particularly in critical conditions. However, advancements in technology and patient-centric care have prompted a shift towards alternative delivery methods, spurring innovation in the form of subcutaneous immunoglobulin (SCIG).

The subcutaneous segment is anticipated to expand at the fastest rate over the projected period. Subcutaneous immunoglobulin entails the injection of immunoglobulin under the skin, providing a slower, sustained release into the bloodstream. SCIG has gained prominence due to its convenience, allowing patients to self-administer at home. Trends indicate a growing acceptance of SCIG, driven by improved patient experience, reduced healthcare burden, and increased treatment adherence. The immunoglobulin market witnesses a trend towards personalized medicine, with SCIG offering a tailored and patient-friendly approach to immunoglobulin therapy.

Segments Covered in the Report

By Application

By Product

By Mode of Delivery

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

February 2025

April 2024

February 2024